Sive Morten

Special Consultant to the FPA

- Messages

- 18,644

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

April 21, 2010

Analysis and Signals

April 21, 2010

Fundamentals

The current week is very light on macro statistics and main attention was focused on financial events beyond US borders. Nevertheless some US events are also worth noting here. First, there is a rumor that the BOC (Bank of Canada) intends to hike rate for another 0.25% and forecasts GDP growth around 3.7% in 2010 and CPI about 2.0%. Taking into account the proximity of US and Canada, there are some thoughts that these BOC’s decision can make the Fed be more hawkish in nearest Fed rate rhetoric on 28th of April. But, it’s just a rumor…

The more important are SEC foreclosure to GS and earnings reports of US banking sector that is not favorable for USD. Although the SEC has lack of stability in their foreclosure (voting was 3 to 2) and looks like the SEC is over politicized (3 votes belong to Democrats and 2 votes to Republicans), but the precedent as it is not favorable for US Banking sector. It can lead to strong reassessing of the stability of the banking system, earnings revisions and fiscal penalties.

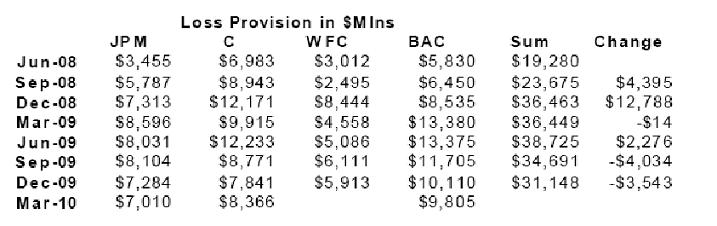

The second important thing is bank’s statement reports. Although earnings have extended significantly, loss provisions didn’t contract much. This means that banks have great reserves for assets that do not work still, and contraction of these assets has a very slow pace.

Third, the way of recovery during the current economic cycle is different from the previous ones. Usually, labor market recovery and the housing market has strong correlation. But now, we see some improvement in te labor market, but the housing market is still anemic. Logically, this should lead to either a drop in the labor market or a rise in the housing market. But anyway such kind of divergence is not a good sign.

So, the current recovery shows some problems, that makes the Fed be nervous and is a headwind to a possible rate hike. As a result this stuff presses on the USD and makes it lose its upside momentum. That was partially based on a possible earlier rate hike by Fed comparing to other Central Banks. I think that if the EU doesn’t have problems that it has now the EUR/USD pair has turned up already or move into wide consolidation. But, the problems in the EU press on the EUR and that makes the pair move lower. Another words, problems in the EU are heavier than in the US and overweight them.

As I have assumed a month ago, Greece’s financial crisis is like a Pandora’s Box and leads the EU to newer and newer negative surprises. It seemed only yesterday that all things is OK and that there is nothing more to look at there. Today we received new information that EU/IMF 30 Bln. is not enough and Greece needs at least 67 bln. Just Greece… But there are still such countries as Italy, Spain, Ireland and Portugal that also need money. Although Greece tries to restructure their debt and issue bonds (today by the way) there is a great probability that it will activate IMF money in nearest future. The market does not want this. The market does not want to see high yield on Greek’s debts also. But today the 10-year rate on Greek bonds is about 8%. Greece has a BBB+ rating, the same as a Russia, for example. But the rate is higher. The development of the EU debt crisis can lead to risk aversion and support USD in medium term.

A couple of words about the UK... Due to election euphoria, the GBP may rise if Lib party will start to dominate over Con. Anyway Cable behavior can be very choppy during these days, but I’m positive on GBP/USD and expect some appreciation. This can strongly press on EUR/GBP cross.

Résumé: Uncertainty in EU will press on EUR in near term. Although we can see some problems in the US banking sector, low inflation and lack of pace in housing market recovery, I think that EU negatives are much stronger and this will push EUR/USD rate lower. The nearest level that I expect is 1.28-1.30.

The election in UK and possible Lib’s win over Cons. will support GBP at least till 6th of May. Also this can press much on EUR/GBP cross.

Technical

Quarterly (EURO FX all sessions CME futures)

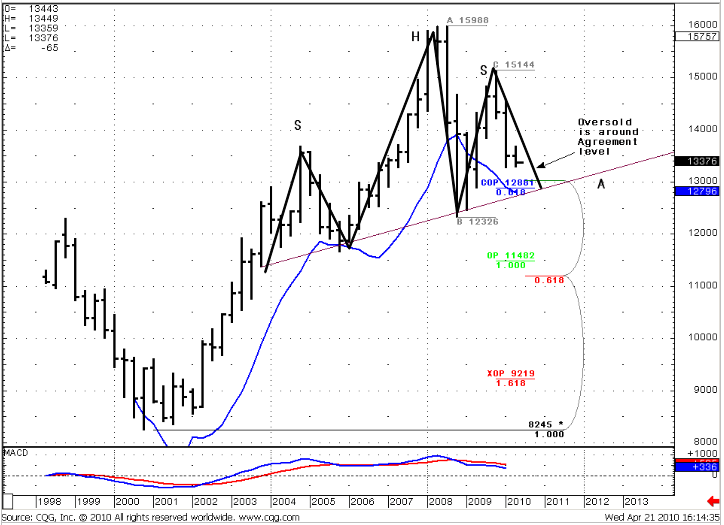

The quarterly situation still in place - we have a down trend. The blue line on the chart is the lower bound of Oscillator predictor that shows us an oversold level of the market. There is no oversold yet, but the market is close to this. Very important thing – Agreement support that includes COP target at 1.2881 and 0.382 major support level at 1.3030. If we add to this quarterly oversold condition then we get a very strong support at 1.28-1.30 level. Also I’ve marked possible H&S pattern – it skewed a bit, but possibly this is one. We have neck line precisely in the Agreement area. All this stuff makes me expect that we shouldn’t break the neck line on the first attempt. I expect retracement higher from the 1.28-1.30 area. Taking into consideration that this is a quartery chart, the market should stay above 1.28 till July 2010. In general, this is in a row with fundamental expectations –we see a down move in April, but the Fed still talks about softening the tightening policy and that can lead to consolidation in the second half of April and May. Although the market has penetrated 1.3030 support level – it didn’t close below it, so I think that it still works. By the way support of 25x5 MA (not shown) is also in the area between 1.28 and 1.30

Quarterly EUR/USD

Monthly (EURO FX all sessions CME futures)

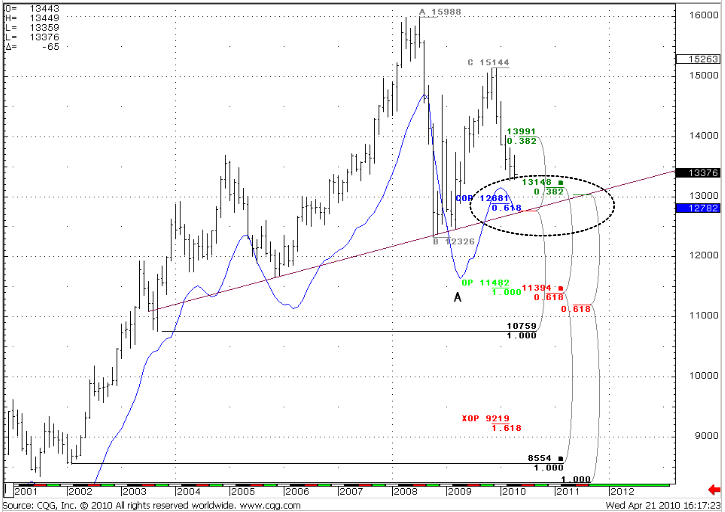

Monthly #1 chart shows some additional detail to the quarterly graph – additional 0.618 support at 1.2756. So, we have monthly Confluence (although it is a bit wide) and Agreement with COP=1.2881. Also we have April Oversold level there (1.2782) and a possible neck line of the H&S pattern. The result is the same - 1.28-1.30 is a very strong support, we have all rights to expect a pullback from this somewhere around May. The trend is bearish.

Monthly #2 chart shows another price swing. We have a down trend no oversold yet. In fact, just one support stays for this price swing – 0.618 major support at 1.3402. Price has moved below this level again but hasn’t closed yet.

Monthly #1 EUR/USD

Monthly #2 EUR/USD

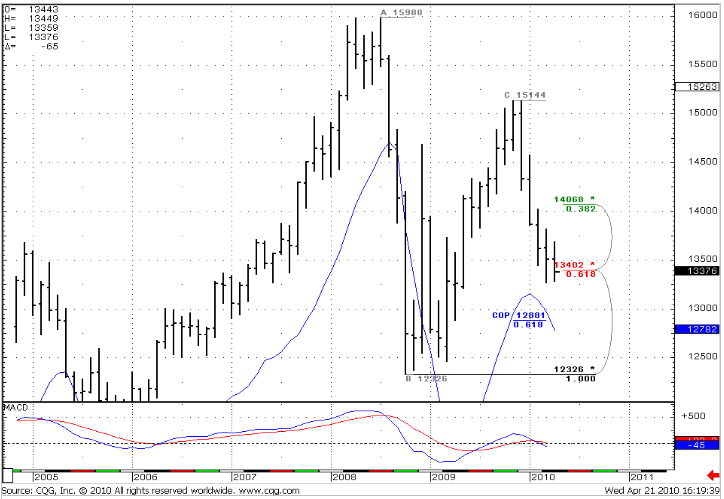

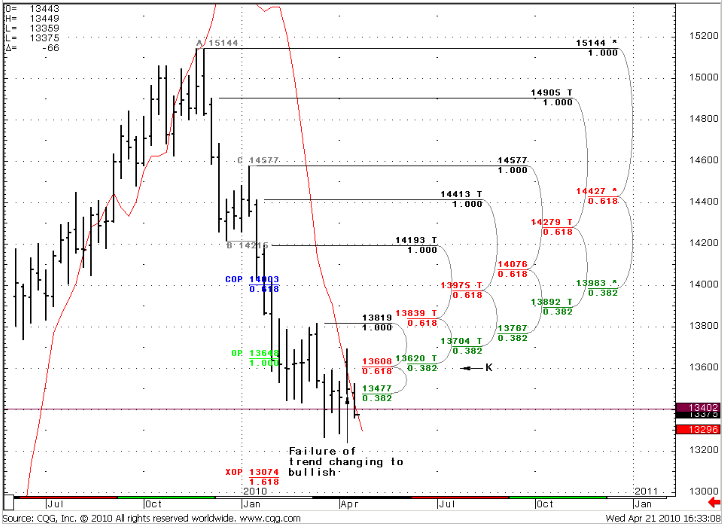

Weekly (EURO FX all sessions CME futures)

Our expectations were right, the market couldn’t break through strong resistance area and continues a down move. Also, I’ve pointed out that if trend changing hasn’t been confirmed, then probability of a down move will grow. It has not confirmed, and trend remains bearish. This situation can lead at least to the previous lows and 1.32 level. In general, I expect that we will reach XOP target at 1.3074

Weekly EUR/USD

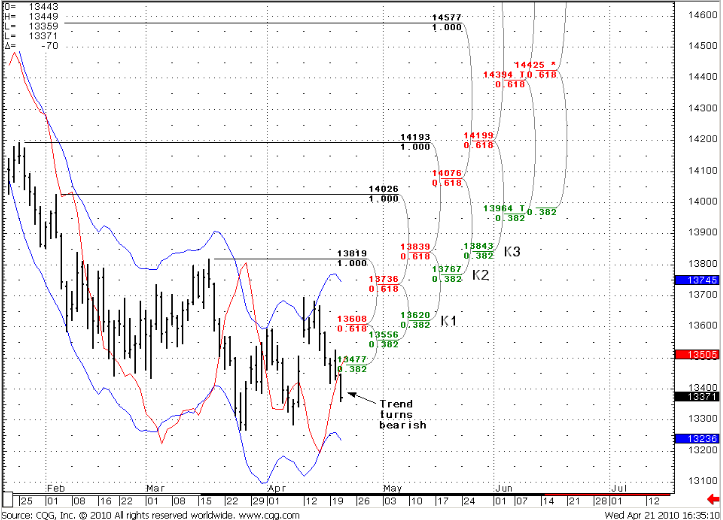

Daily (EURO FX all sessions CME futures)

The market has turned south and couldn’t break through resistance. The trade possibility for “Stretch” pattern that I’ve talked about in previous research has worked good, I’ve posted a description of this trade in the topic of previous research.

Today, the trend turns bearish, (although the day is not closed yet). So, we have all three trends in one direction – daily, weekly and monthly. We have a Trend changing failure on weekly also. There is no oversold on daily. Although there are no particular signals on the market right now, I think that it is possible to open trend short position on the upper retracement on the daily chart (selling the rallies) with target at least at 1.3200.

Daily EUR/USD

Trade possibilities (1):

Monthly

The nearest long-term target is COP=1.2880. I expect that we will see retracement higher from 1.28-1.30 area in IIQ.

Weekly

We have failing trend changing signal, so, I expect that market should reach at least 1.3200 level. Also, I think that we will reach XOP=1.3074 then.

Daily and Hourly

For now all trends are bearish, no oversold. So, there is possible to enter short on retracement (may be even from 1.3477 level) with target 1.3200.

Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.

Last edited: