Sive Morten

Special Consultant to the FPA

- Messages

- 18,664

EUROPEAN FOREX PROFESSIONAL WEEKLY

August, 28,2009

August, 28,2009

Fundamentals:

The basic thought that is spread widely enough is that dollar must become weaker in the long term. The reasons are quite simple – The Federal Reserve and US Treasury have built a large quantitative program, which increase inflation risks in long-term. Europe has a more sustainable economic support program, so inflation expectations there are lower than in the US. When the economic recovery starts, investors will think what price they paid and will pay for the supporting programs that made huge inflows of cash in the economy for stimulating consumer spending, bank loans and support of the real estate market. Besides, policymakers will not be too hasty to become restrictive enough. So, the Federal Rate will be low for too long. That is obvious statement, and in general it is correct, but there are some additional points that we should pay attention to.

- Economy recovering starts in the USA earlier than in Europe. Usually the time lag is about 1 or 2 Q. The main perspective of such a situation is a growing demand for US assets (stocks, bonds, mutual fund inflows etc.). If demand for assets will grow – demand for US currency will grow also.

- When the US economy recovery starts – USD/EUR rate parity expectations must change. A well-known fact is that current exchange rate reflects currency rate parity. During the recovery phase of the economy, inflation (and it’s expectations) will grow. As a result, expectations of rising FFR rate also grow. The Federal Reserve will rise rates earlier than the ECB because of an earlier economic recovery than in Europe.

- If we take into consideration the previous 2 points, then we can assume that US Dollar become stronger first – rising economy, growing demand for US assets, expectations for rates rising and earlier start of recovery will change the rate parity expectations. Moreover, the USD can become stronger as early as macroeconomic statistics (Nonfarm payrolls, Housing starts, ISM Index, Consumer confidence index) will show stable improvement trends.

- I expect that USD will start to lose strength only after first rise of rates in Europe (or near to this point). So, I agree with weak dollar in long-term, but I believe that it will become a bit stronger first.

For the nearest week (31Aug – 4Sept):

The main triggers that definitely will influence on EUR/USD pair are:

Aug 31 – Chicago PMI, Consumer Confidence;

Sep1 – ISM Index;

Sep4 – Nonfarm payrolls.

Technical

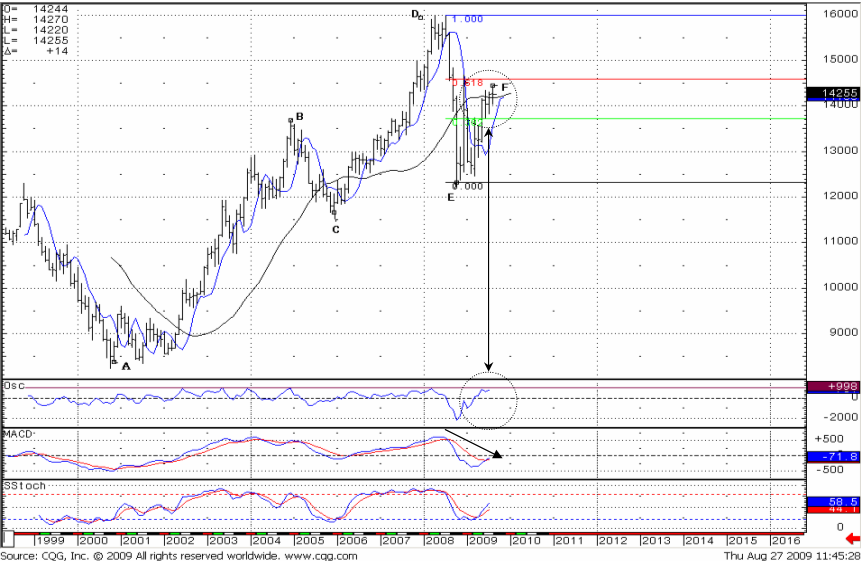

Monthly (EURO FX all sessions CME futures)

Let’s look at the recent monthly movements. First, point “D” is a perfect 0.618 Fibonacci extension form “ABC” movements:

A=0.8245;

B=1.3687; D=1.5024 (the real “D” is 1.5088).

C=1.1661.

Second, we see, that market has a record overbought level, according to the oscillator, since 1999. This overbought is just under 0.618 Fibonacci retracement that creates meaningful resistance to the market. The great overbought level near strong resistance is a potential bearish signal. Besides, if we look at MACD we’ll see, that it shows that the down trend is still holds. So, we can expect that this growth to near 1.45 level is just a correction from a down move. The main nearest target of potential bear movement is:

D=1.5988;

E=1.2326; =1.2126

F=1.4449.

Besides, some resistance to Fib 0.618 level adds 25-period MA that is 1.4183 currently (black line on chart).

As a result, it seems that monthly EUR/USD is more bearish than bullish.

But we have to find some more proof of that assumption in lower time scales charts.

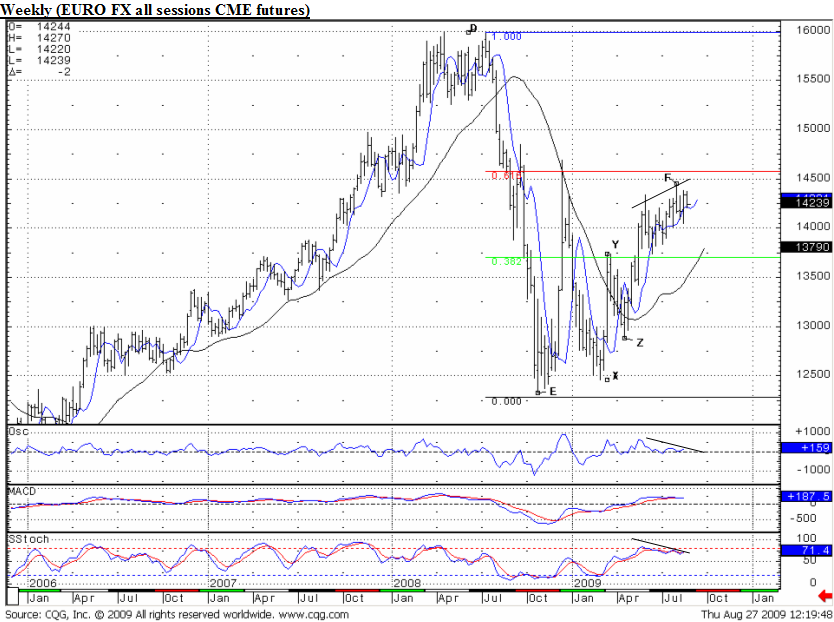

The main facts on weekly chart are growing volatility near 0.618 resistance level, MACD near crossing and bearish divergence with Oscillator and Stochastic. I do not believe in divergence too much and rare use this signal, but taking in the accounts all facts, it looks like it should working in this situation.

Besides, the target of XYZ movements (1.4159) is a bit lower than “F” point, and almost in confluence with 0.618 resistance level. This make this level - 1.4573 (CME FX Euro futures contract quote, but is almost the same as a FOREX quote) stronger. Also we have to pay our attention, that previous upside move has finished on that level – maximum was near 1.47, and the closing 1.3853.

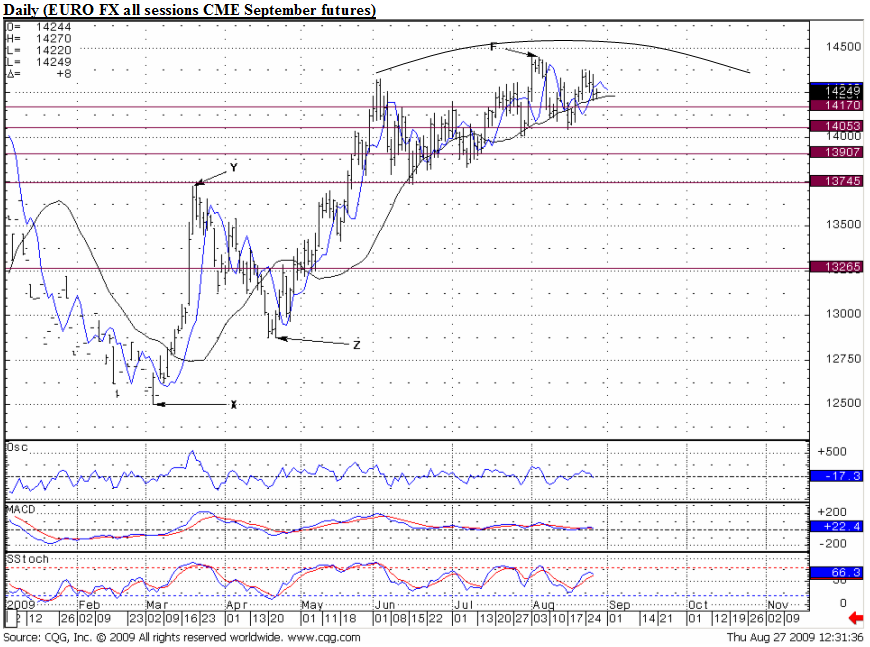

Daily graph does not adds much additional information. We can see the same rising volatility near resistance. I just added some important support levels. Also, it is possible, that downturn will be in the form of circle – round top.

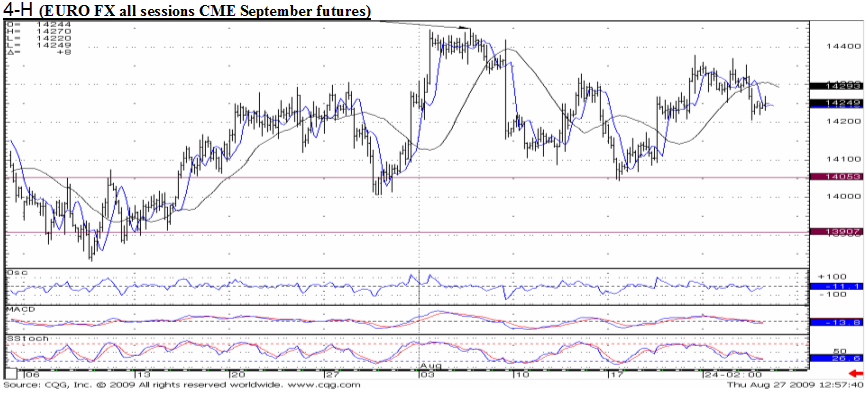

4-hours chart shows a downtrend with middle oversold level. It is possible, that market will not go higher than 1.44. But, the possibility to go short near 1.43 is real enough.

Trade EUR/USD possibilities:

Monthly - Bearish;

Weekly - Bearish;

Signal only on weekly basis. Sell EUR/USD near 1.43-43.50, stop 1.4720, nearest profit 1.3750. There is not much probability that the pair will go higher than 1.4550, but 1.4720 is a level that has technical basis.

Probably we can see 28 Aug, or during the next week more obvious signals to enter market on daily basis, but there are no valuable signals for now.

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments mentioned herein.

Last edited: