Sive Morten

Special Consultant to the FPA

- Messages

- 18,635

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

October 15, 2009

Analysis and Signals

October 15, 2009

Fundamentals

As we expected during the past week, earnings reports definitely have made the most impact on EUR/USD. Partially, because there wasn’t any serious macro data, partially – this should have shed some light on the real economy and health of the companies themselves. Nevertheless, retail sales also have played a part in dollar move.

Equities. In general, earnings reports were between mixed to good. Excellent reports were in the technology sector and banking. Industrial companies had published shyer numbers. The banking sector is of particular interest, because the Fed tracks the loan market’s health, and it will take it in consideration when this will begin to tighten. So, JP Morgan has shown good numbers (0.82$ per share instead of 0.55$ as expected), although the main earnings have been received from Investment banking and not from commercial and retail banking. But it is worth noting that the signs of stabilization in the credit card business are present. Till the end of this week will be earnings releases of Goldman Sachs (today), Citigroup, and Bank of America that will attract great attention. The strong impact on US equities has come from Asian markets that grew due to some macro data (see below “macro data”).

Upside momentum on stock markets will press on dollar in the near-term. Although there are some bearish risks, such as a healthcare reform, but this risks are too blurred yet. The risk-buying momentum can become stronger due low USD rates and unclear perspectives of Fed policy. The Fed is very undecided currently in many aspects, particularly on the MBS buyback program, tightening policy etc. This adds pressure on the USD, because markets see nothing besides rhetoric.

Macro data.

Chinese loan growth exceeded expectation as did the trade data. Exports contracted -15% Y/Y versus the - 21% expected. The trade balance narrowed due to a surge in imports. On a y/y basis imports jumped to -3.5% from -17% in August. Sequentially, imports rose $15B and the US and EU numbers showed a strong uptrend.

US data was mixed. The retail sales figure fell -1.5% though the number was estimated to fall -2.1% due to the fall back from cash for clunkers. The business inventory data and import price index were however sour. The import price data rose +.1%, falling below expectations of +.2%. In general, pace of Import prices is strongly correlated with CPI index. High expectations on Import prices mean that market tried to overestimate an inflation rate.

Macro data is positive for USD (although we should look at Initial and continuous claims today and Ind. Production). But in the near-term these data are not sufficient for strong reversing on USD. The market has caught some strong upside momentum and it is possible that USD can become a bit weaker during the next week, especially if we will get more strong earnings and continuing of growth on the equity markets. The macro data will take a back seat, until the upside momentum is worked out and investors will start to look for new information. (Now we can see realization of 1st point in our “Basic macroeconomic issuers”).

Basic macroeconomic issues:

1.Investors basically pay attention only to the nearest perspective. Since FED rate tightening is too blurring, we should not to expect meaningful USD strengthening untill next year (or untill first signs of a rate hike possibility);

2.USD will become stronger when investors will see these signs, so the expectations concerning EUR/USD rates parity will change;

3.We can expect growth in USD, if the possibility of second leg of recession will grow, and if investors will have large borrowing positions in USD;

4.EU economic recovery will have a time lag about 1-2 quarters compared to US recovery;

5.When the EU rate hike expectations will appear, the dollar will turn to weaken;

6.We can see temporary USD strengthening from time to time due some technical movements (risk aversion, stocks buying, etc.) till first signs of a rate hike possibility appear.

7.The primary US economic data that will be under scrutiny are personal credit, spending, wages and employment, and inflation. This is a final segment in the chain, and it’s very important.

Technical

Previous “trade possibilities(1)”:

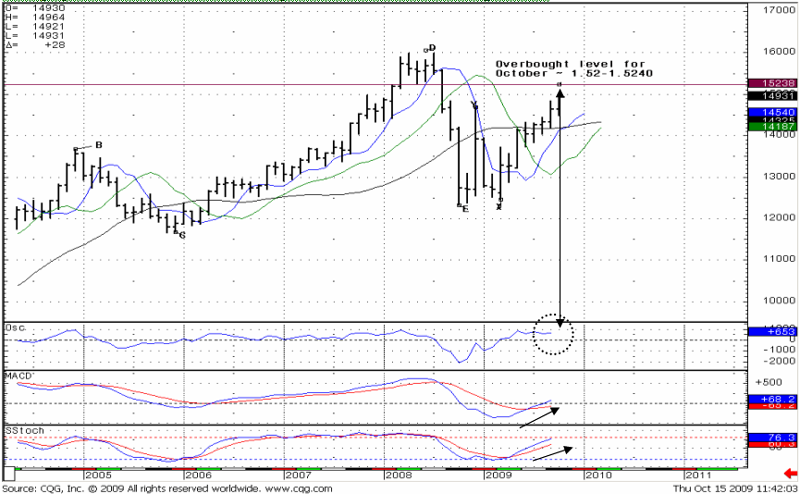

Monthly:

Pressure from the overbought level and reaching an important target will press on EUR/USD during the month, but there are no turnaround signs on weekly chart still. That’s why the extreme price for October is 1.52-1.5240 level. If we see a signs of a down move, I do not expect a deep retracement - 1,42-1.4350.

Daily

Today I can’t identify the trend. Deep upside retracement, after 1.4480 was reached, showing that the daily downtrend is not strong enough for now, so recommendations are twofold:

1.If downtrend holds and there will be signs to down move on 1H-4H charts, then nearest target is 1.4530-1.4540. Because of deep upper retracement there is a possibility that the market will not reach 1.4400.

2.If daily trend will turn bullish – looking for possibility enter long with 1.4840 nearest target. I expect that market will not go higher than 1.52-1.5240 in October.

Monthly (EURO FX all sessions CME futures)

The macro data had brought in definite amendments in my expectations. So, what we do see now? A strong upside trend and momentum is high, but not extreme, overbought level.

These circumstances allow moving market higher on monthly term. According to my calculation of overbought levels, I think that the market will be quite volatile, if it reaches 1.52 during October. It is difficult to say for now when we can see a downside retracement, but if it will happen, it shouldn’t be too deep – trends are still bullish. The maximum that I can extract from the monthly chart for now is a potential level of upside moving in October from which retracement can start – 1.52-1.5240.

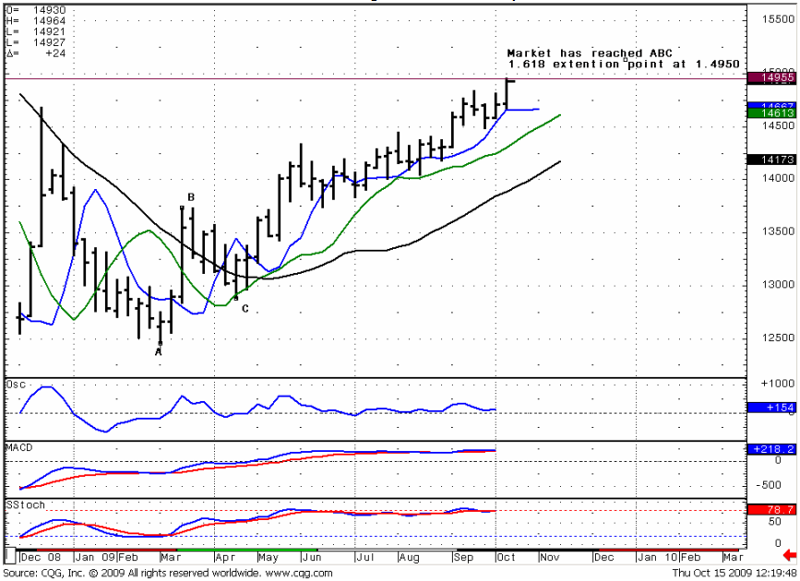

Weekly (EURO FX all sessions CME futures)

On the weekly chart, trends remain bullish for now. Market has touched the extension point at 1.4950 from ABC move. No overbought. If we assume that the weekly close will be at current level 1.4950, then OB level for next week will be around 1.5300. So, there are no signs for retracement yet.

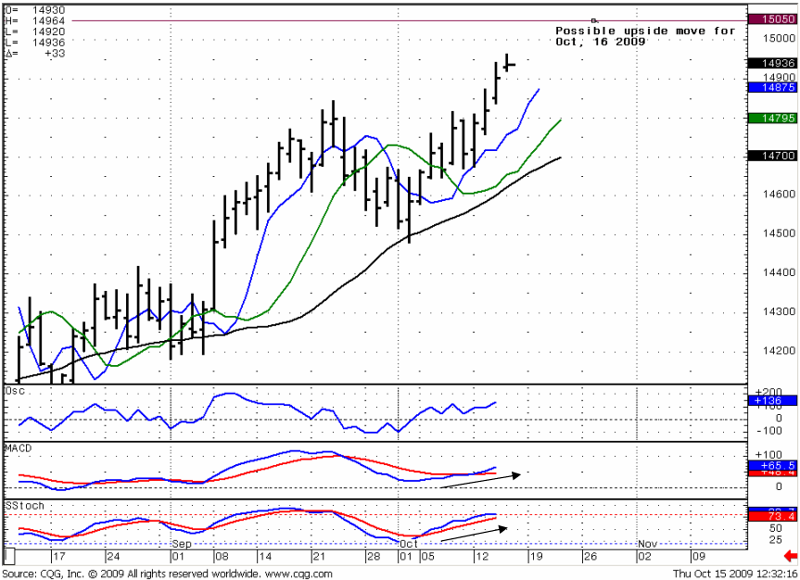

Daily (EURO FX all sessions CME futures)

During the week, trends turned bullish. We see no sign of extreme overbought levels yet. If the market will close today around 1.4930 then upside for tomorrow (Oct, 16 2009) 1.5050 level (Market will be overbought there), so it is possible some small back moves from there. I’ve checked for 1H and 4 H charts, so I do not see signs of reversion yet.

Trade EUR/USD possibilities(1):

The market information is a poor a bit for current week

Monthly:

Momentum is up; extreme price for October is 1.52-1.5240 level. Possibly it can be reached.

Weekly, Daily:

Still no signs of reversion or retracement. The most important thing – expansion at 1.4950 that market has reached on weekly chart. We have to check this important movement. Possibl,y we see some signs of retracement on next week. All the other factors have nothing to say – up trend, up momentum, no overbought levels.

I will post in forum topic, if signals for short-term short position or any signs of retracement will appear in nearest days.

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments mentioned herein.