Sive Morten

Special Consultant to the FPA

- Messages

- 18,630

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

November 5, 2009

Analysis and Signals

November 5, 2009

Fundamentals

Risk aversion is continuing. On the previous week we’ve seen only the first signs of this process, but during this week the process has accelerated even more. The point 6 of our “Basic macroeconomic issues” is underway. So, what do we have now? First and the most important is to watch the labor market. Numbers do not show any grow in momentum. Yes, we see some improvement, but the jobs numbers and employment are showing stabilization rather than growth. The trend in PMI numbers, which originally adopted a v-shaped pattern, is losing momentum also. Although we’ve seen a solid GDP growth – this is still due to Government programs – Bonds buyback, cash for clunkers auto program, tax back and tax credit programs, etc. From the other side we see bankruptcy of CIT, the divesting of ING, the EU Commission’s forecast that European banks could see between E200B and E400B more in losses and the announcement that RBS and Lloyds will need more capital.

As a result, I expect that Central Banks politics and macro data will be the most important till the next of the year. Investors are now trying to reassess the situation, because the first euphoria about world economy recovering and about the pace of this repair is not confirmed yet. So, it means that things are not as good as has been assumed. The additional headache is coming from the end of a fiscal year fact. This moment also can skew the real situation a bit.

The release of October Non-Farm payrolls will be paramount to perpetuating current EUR/USD move. A further deterioration in payrolls will be detrimental to sentiment and cause another wave of risk aversion. However as the market settles after the release and no new concerns over the financial system arise, the risk trade may resume to the detriment of the dollar. This questioning of the fundamental recovery could leave the trade quite choppy before it resumes a steadier trend.

My thought is in near-term this dollar’s strengthening can continue. For now it is a technical factor, it is just reassessment of expectations and economy condition. In the long-term, unfavorable fundamentals for the dollar didn’t disappear – the continued ambiguity and fiscal irresponsibility coming from Washington coupled with the poor interest rate differential and low LIBOR still make the dollar unattractive. Moreover, the global recovery is not over; it is just hitting a rough patch. Additionally, central banks are still diversifying reserves despite the setback in the economic repair. India just purchased 200 tons of gold from the IMF to facilitate this diversification. While 2010 may prove to be a better year for the dollar, it is possible this short term correction is just a hiccup in a bigger trend.

Basic macroeconomic issues:

1. Investors basically pay attention only to the nearest perspective. Since FED rate tightening is too blurring, we should not to expect meaningful USD strengthening until next year (or till first signs of a rate hike possibility);

2. USD will become stronger when investors see these signs, so the expectations concerning EUR/USD rates parity will change;

3. We can expect growth in the USD, if the possibility of second leg of recession will grow, and if investors will have large borrowing positions in USD;

4. EU economic recovery will have a time lag about 1-2 quarters compared to the US recovering;

5. When EU rate hike expectations will appear, the dollar will turn to weakeness;

6. We can see temporary USD strengthening from time to time due some technical movements (risk aversion, stocks buying etc) until the first signs of a rate hike possibility appear.

7. The primary US economic data that will be under scrutiny are personal credit, spending, wages and employment, inflation. This is a final segment in the chain, and it’s very important.

Technical

Monthly (EURO FX all sessions CME futures)

I do not show the monthly chart for the current week, because there is nothing new to say. All important information was in previous research. The main thing that I would like to remember – is that monthly trends are bullish, so the current down move on EUR/USD is just a retracement from the monthly scale view.

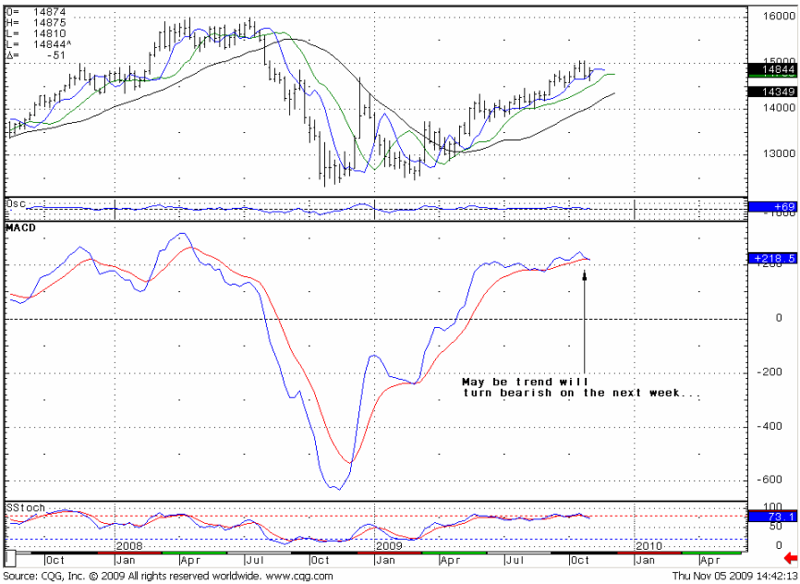

I place weekly chart lower. The most interesting movement – is a possibility of trends change to bearish in weekly term. It depends on EUR/USD movements till the end of the week. If it will happen, we can expect deeper down move from the peer.

Daily (EURO FX all sessions CME futures)

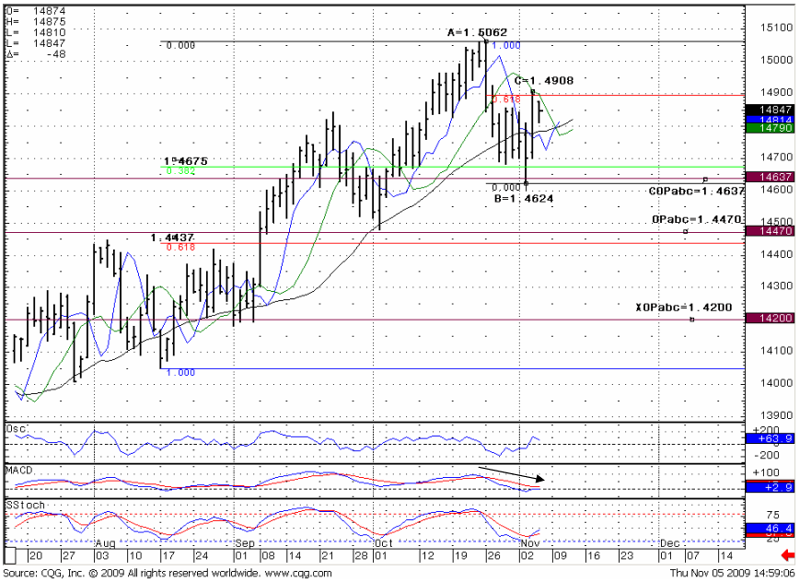

The daily trends are bearish; we have no oversold level, so technically nothing is blocking a possible down move. Look’s like up retracement is over (we take a close look at this movement on the hourly chart), and we have received our ABC points. So, what are the possible targets for Daily down move? COP=1.4637, OP=1.4470 that is most probable to reach. The most interesting thing is that both targets are very close to Fib support levels, that makes these levels stronger, although spread between targets and according them Fib levels a bit wide for daily chart.

Also I want to point out that up retracement had stopped precisely at 0.618 Fib resistance. It tells us that daily down trend is still working.

Hourly (EURO FX all sessions CME futures)

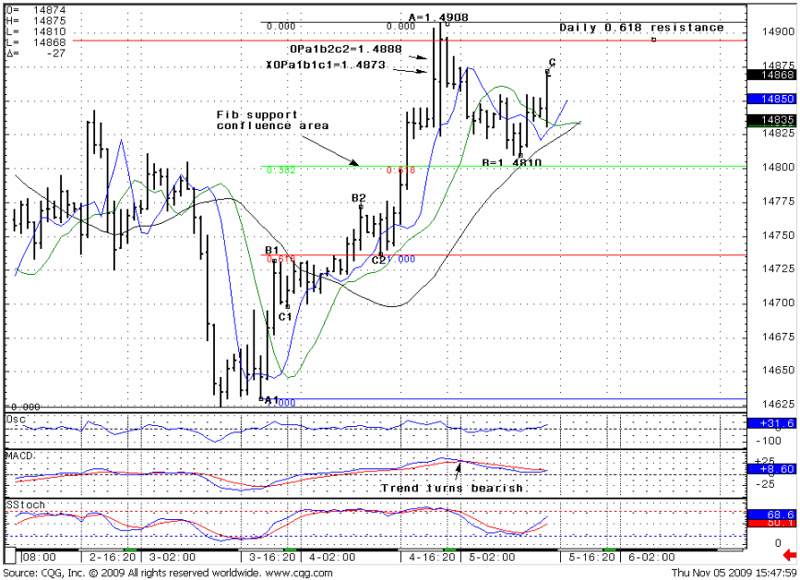

The context on the Hourly chart is bearish for now. First, the strong uptrend has finished precisely at 0.618 Fib daily resistance level. XOP target at 1.4873 and OP at 1.4888 were in agreement with this daily resistance level. We have no oversold yet, so can expect the solid down move. The up move is still holding on hourly chart, now it’s near Fib resistance at 1.4875. So we can’t estimate C point for target calculation just yet. We have just A and B points.

Trade EUR/USD possibilities (1):

Hourly:

Well, it still difficult to say will it be additional up move or not, but the context for trading is bearish. The most conservative stop is above of previous high – 1.4908. If market breaks it – a down move is under questions. We can’t estimate targets yet, an up move is still underway.

Daily:

The Daily trend is still bearish. It can break up, if the market goes higher than 1.4908 level. For now the situation is for short trading. The nearest target is 1.4637

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.