Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

February 11, 2010

Analysis and Signals

February 11, 2010

Fundamentals

The calendar of the previous week was a bit light and I want to note two basic events – consumer credit, payrolls results and yesterday’s B. Bernanke testimony text release. Outside worse than expected Non-manufacturing ISM index (that we’ve talked on a previous week), some growth in unemployment claims data and reducing on NFP for 20K, we see some positive signs. First, Consumer credit has contracted just 1.7B$ instead of -10B$. In spite of reducing NFP in January, unemployment fell to 9.7%, the trend in temporary hiring shows job growth – the number has risen in January for 52K and to 248 K since October. The household employment shows growth as well and the household numbers a bit ahead of NFP. So, all these movements are pointed towards the stable trend in recovery.

Ben Bernanke's testimony text was blurring a bit. As always the Fed has tried to be smooth and predictable in their decisions in order to not shake the markets, so they were very cautious in their rhetoric. The general idea was in line with systematic exit from emergency monetary program and taking course on a normal Fed Fund Rate. The Chairman noted the need for exit from temporary lending programs, stating that total credit outstanding under all programs had fallen from 1.5Trln$ at 2008 to just 100B$ in the most recent period. The main thing in all the testimony is that Fed will not use Fed fund rate tightening just yet, because the inflation pressure is still anemic and early tightening may hurt households and businesses. The Fed rate will be used in line with changing economic situation and the current regulation of liquidity will be made by reverse repos, raising discount rates and sale of securities held.

Concerning the situation in the EU… First, there existed two possible ways – bailout of a Greece from EU and support from financially strong Germany and France to resolve the problem. In general, the first way is simply impossible for many reasons – the Euro-Zone has invested much in Greece. Ireland and UK hold about 23% of total issuance, France – 11%, Italy and Benelux – 6% each. The default of Greece will lead to serious problems in banking sector in the EU. Second, the bailout of Greece (then possibly Spain and Portugal) will lead to destruction of Intra-Euro Zone trade and note that about 41% of German export is based on purchases by EU countries. This will reduce EU GDP much and cause heavy pressure on EUR. From the other side, Greece has not much space to regulate its huge deficit – they can’t reduce wages and rise taxes much, deflate the debt or debase the currency. So, it means that exit will be slow and gradually. But information about support from senior brothers such as France and Germany can calm down the situation in the short term and switch investor’s attention to other questions. Nevertheless situation will resolve slowly and this will press on the EUR in a long-term.

Résumé: Fundamentals have not changed much. The main risk for US is a stability of macro data. Problems in the EU are long-term and can’t be resolved fast; Japan's economy depends much on exports mostly to the USA and Europe, so it is unlikely that it will be able to gain momentum in front of the US economy. So, circumstances adjust probability in favor of the USD. I expect that the EU will support Greece – there will be no bailout decision. This can support the EUR in the short term but the slow resolution of the situation will press on EU currency in the long-term.

Technical

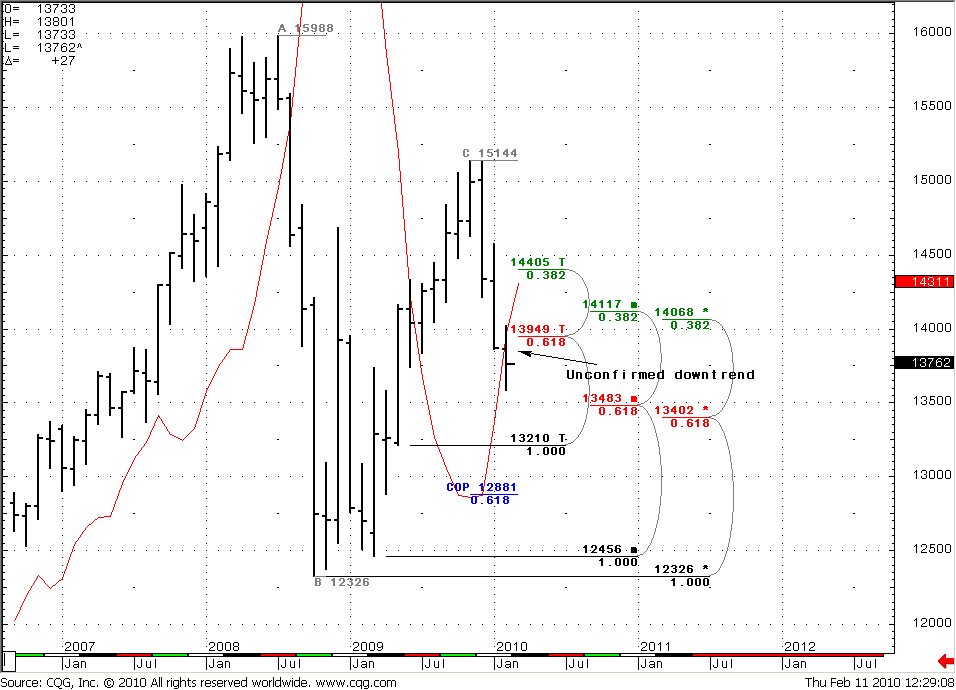

Monthly (EURO FX all sessions CME futures)

The most interesting thing on the monthly time frame is that unconfirmed trend turns bearish. The breakeven trend point is 1.3970 level. In the case of market closing below it we will receive confirmation. Prices broke through monthly support at 1.3950-1.4070 area. I’ve calculated monthly target for down move (if the trend will turn bearish) – COP=1.2881.

If February's bar will close higher than 1.3975 then we can expect movement at least to previous highs – 1.51-1.52 area.

Monthly

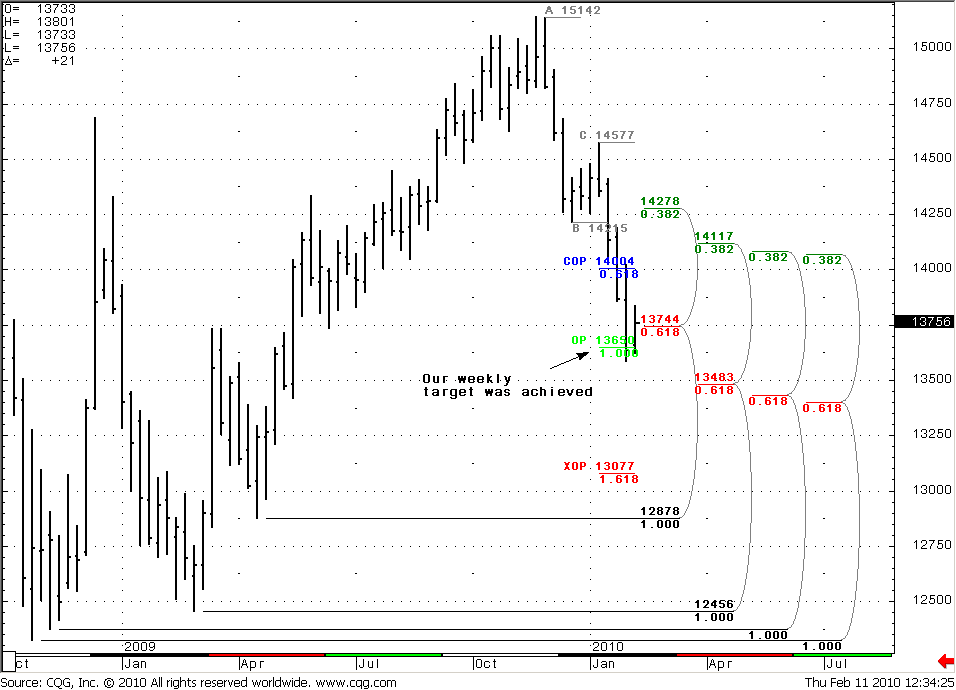

Weekly (EURO FX all sessions CME futures)

Our target OP=1.3650, pointed on previous week, was achieved. The market has started a retracement after OP was achieved and now prices are around 1.3744 weekly and monthly supports. The closing of the current week above 1.3744 level will increase probability of a retracement higher. (The targets in this case, we will estimate later, because this move not even started). The trend is still bearish, no oversold on weekly time frame.

Weekly

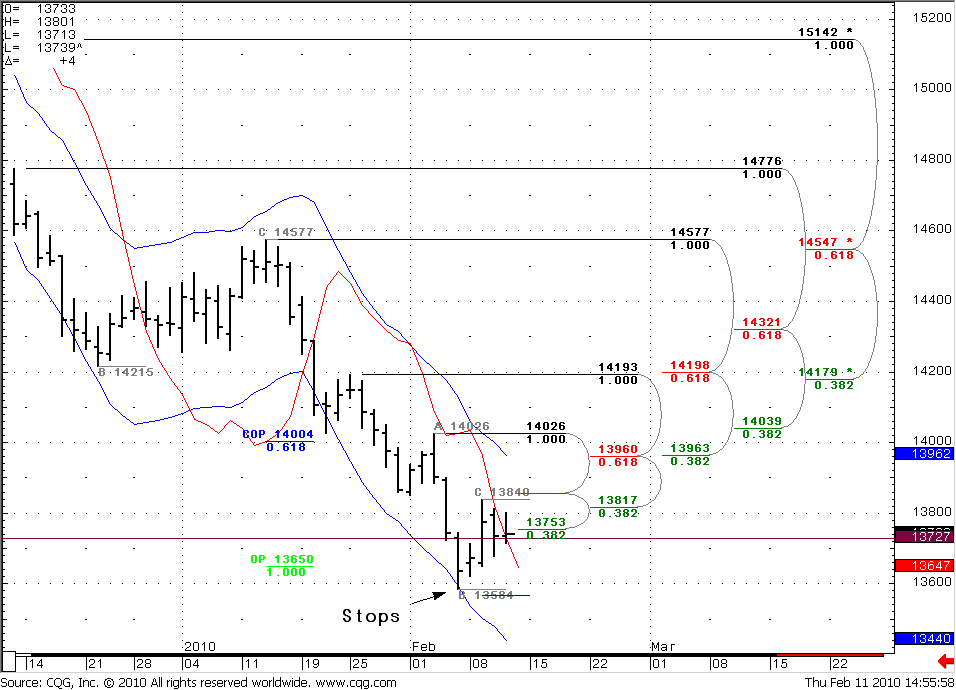

Daily (EURO FX all sessions CME futures)

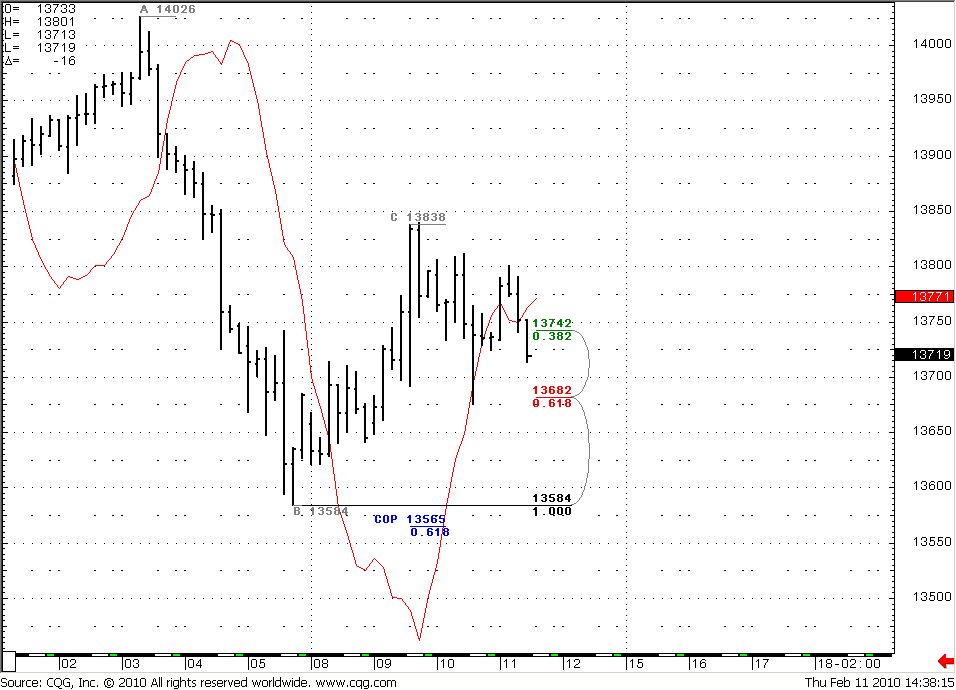

After reaching 1.3650 level and oversold condition market has entered consolidation. For now the trend is still bearish, but we have unconfirmed bullish trend as well. Today it is too difficult to talk about long-term perspective but if today's close will be below 1.3727 level, I’ll be searching for possibility to enter short with nearest target at 1.3560 area. The reasons are twofold. First, we will have a daily unconfirmed stop grabber situation (look my recent trade description to understand how this kind of signal works) and today’s close below 1.3727 is a confirmation. The nearest target is stops at previous minimum – 1.3580, if the market will touch them – we’ll reach COP=1.3565. Second – weekly close below 1.3740 will mean that downward move should continue and daily bear trend will hold.

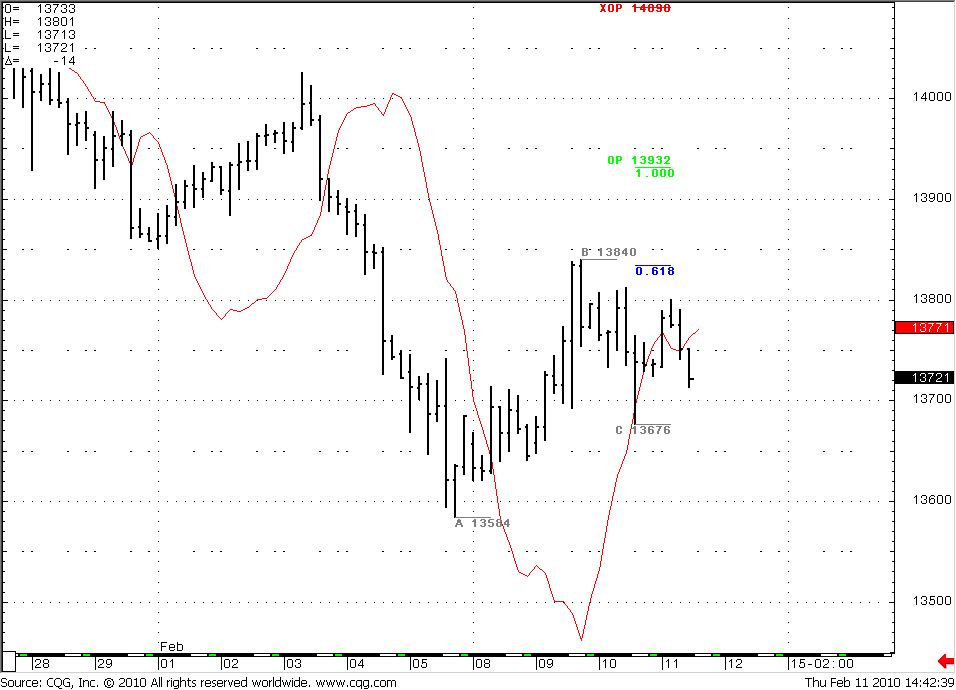

If daily trend turns bullish then the move to 1.3930-1.3960 area will be possible. First, OP=1.3932 from 4-hour chart, second 1.3960 – daily Confluence resistance and daily Overbought area (see daily and 4-hour #2 chart).

Daily EURUSD

4-hour EURUSD #1

4-hour EURUSD #2

Trade EUR/USD possibilities (1):

Monthly

February close above 1.3975 can lead to previous highs at 1.5150-1.52 area.

Weekly

We have down trend, no oversold conditions. The main thing is a close of current week. If it will be below 1.3740 then downtrend should continue. If not – then retracement higher is more probable at near term.

Daily

At daily timeframe we have potential signal for trading. If market will close today below 1.3727 it will mean that daily bullish trend will not confirmed - then I will be search possibility to enter short with 1.3565 target. If daily bullish trend will be confirmed – then retracement up is possible to 1.3930-1.3960 area.

Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.