Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

Today, guys, we take a look at GBP again instead of Gold market, mostly because on Gold market we have the same pack of driving factors as on EUR and we already discussed our technical trading plan. On GBP we have more specific driving factors as Boris Johnson has become a PM once again.

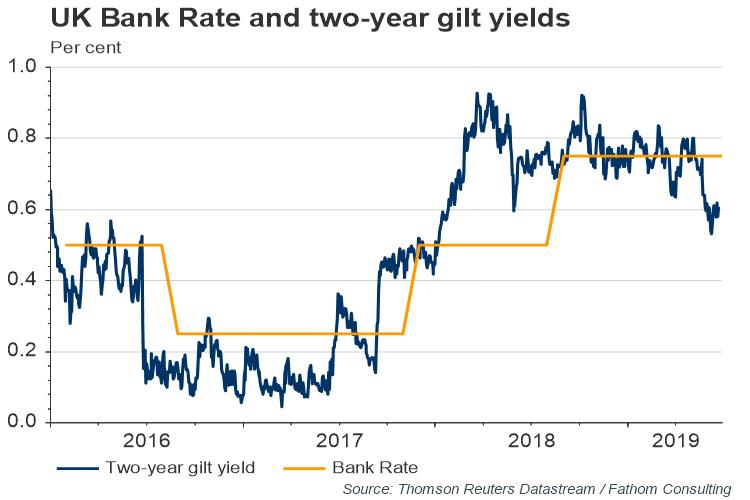

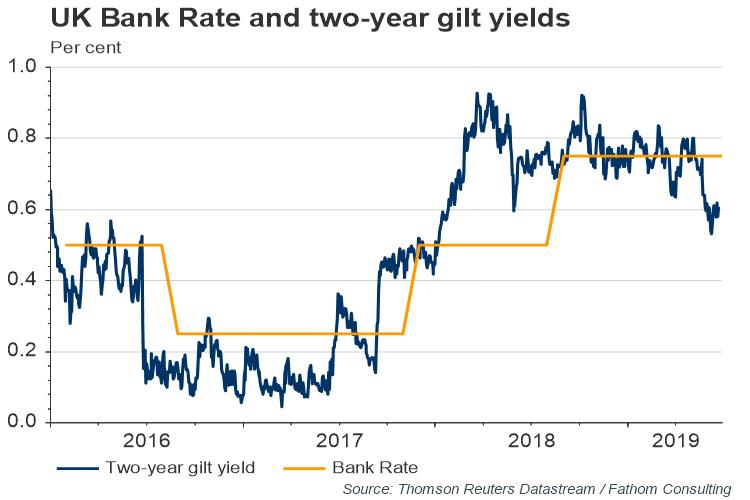

Besides recent statistics on UK tells that BoE has misleading view on economy situation which also is confirmed by market data. For example, BoE tells on more hawkish rate policy while interest rate futures and Guilt yields suggest the opposite. This divergence potentially creates long-term trading opportunities.

So, new Prime Minister Boris Johnson filled his cabinet with Brexiteers and promised he would take Britain out of the European Union on Oct. 31 with or without a transition deal.

Johnson met his Brexiteer-dominated team of senior ministers for the first time on Thursday to plan how to persuade the EU to agree to a new withdrawal deal.

He told parliament that the Irish border backstop would have to be struck out of the divorce agreement if there was to be an orderly exit with a deal.

Johnson’s victory in the Conservative Party leadership contest was largely priced into sterling.

“Sentiment towards the pound doesn’t seem to have improved – on the contrary, three-month risk reversals continue to decline, showing that people are getting increasingly negative on the currency,” said Marshall Gittler, a currencies analyst at ACLS Global.

“So I believe this is just a temporary respite and I remain long-term bearish on GBP.”

Attention now turns to whether Johnson will follow through on his rhetoric about trying to extract more concessions from the EU, and taking Britain out of the EU in October without a deal if he cannot achieve that.

The EU has so far repeatedly said it will not rewrite the withdrawal agreement, but it has said it could change a so- called political declaration on future ties. European Commission President Jean-Claude Juncker telling new British Prime Boris Johnson that a deal agreed forged by his predecessor was the best and the only Brexit agreement.

Juncker told Johnson on Thursday that the European Union would analyse any ideas put forward by Britain, provided they were compatible with the withdrawal agreement.

Just to remind you in two words - Irish border is a stumbling point, because splitting EU and GB by land means dividing Ireland in two parts and return to all nightmare of divided Ireland that was finished by big efforts two decades ago. While applying border by Irish see will split the GB economy space in two parts. This is the problem that has no compromise solution.

Hot news on this subject tells the following - the British government is working on the assumption that the European Union will not renegotiate its Brexit deal and is ramping up preparations to leave the bloc on Oct. 31 without an agreement, senior ministers said on Sunday.

Leading Brexit supporter Michael Gove, who Johnson has put in charge of ‘no deal’ preparations, wrote in the Sunday Times newspaper that the government would undertake “intensive efforts” to secure a better deal from the EU.

“We still hope they will change their minds, but we must operate on the assumption that they will not ... No deal is now a very real prospect and we must make sure that we are ready,” Gove wrote.

“Planning for no deal is now this government’s no. 1 priority,” he said, adding “every penny needed” for no deal preparations would be made available.

The Sunday Times also reported that Dominic Cummings, the mastermind behind the 2016 referendum campaign to leave the EU and now a senior aide to Johnson, told a meeting of the prime minister’s advisers that he had been tasked with delivering Brexit “by any means necessary”.

Ministers are preparing for a no-deal emergency budget in the week of Oct. 7, the newspaper added.

Writing in the Sunday Telegraph, new finance minister Sajid Javid said he had ordered no deal preparations in his Treasury department to be stepped up.

“In my first day in office ... I tasked officials to urgently identify where more money needs to be invested to get Britain fully ready to leave on October 31 – deal or no deal. And next week I will be announcing significant extra funding to do just that,” he said.

Javid, a former interior minister, said this would include funding for 500 new Border Force officers.

Johnson has said the Irish backstop, an insurance policy designed to prevent the return of a hard border between EU-member Ireland and the British province of Northern Ireland by provisionally keeping Britain in a customs union with the EU, must be removed from any Brexit deal.

“You can’t just reheat the dish that’s been sent back and expect that will make it more palatable,” Gove wrote. “We need a new approach and a different relationship. Critically, we need to abolish the backstop.”

Labour leader Jeremy Corbyn said on Sunday his party would do everything it could to prevent the country leaving the EU without a deal.

Although Johnson has been adamant he will not hold an election before Brexit, his Conservative Party does not have a majority in parliament, are divided over Brexit and under threat of a no-confidence vote when parliament returns in September.

Speculation of an early election to break the deadlock is likely to be fueled by a YouGov opinion poll in the Sunday Times, which showed the Conservatives had opened up a 10-point lead over Labour since Johnson took over. (Ordinary schedule suggests next elections in May 2020).

So, let's draw the line under political driving factor. Definitely it becomes the one that actively will be used for different speculations. It consists of two parts - speculation on early elections, which seems hardly possible before Brexit and this will be outstanding measure, only if B. Johnson couldn't push through Parliament his decision on Brexit.

Second political factor is Irish border negotiations. It is relatively easy to monitor - no new achievements and agreements with EU tells about higher chances on no deal Brexit, which will be bearish to GBP.

Now let's take a look at economy.

The Bank of England gives its monetary policy decision next Thursday. Few economists expect the bank to change rates from the current 0.75% but the focus will be on policymakers’ assessment of the current economic slowdown in Britain and whether it justifies a rate cut down the line.

In general, according to CME BoE watch tool, markets do not expect rate drop until November meeting, where chances on decrease to 0.5% level stands now around 36%.

At the same time, previously, we mentioned many times that economy assessment, provided by BoE and rate policy doesn't correspond to reality, based on statistics and interest rate market.

At the meeting that concluded on 20 June, the Bank of England’s Monetary Policy Committee revised down its projection for growth in Q2 from 0.2% to 0.0%. Nevertheless, members continue to warn of higher interest rates. With inflation on target in May, and set to fall through the second half of this year, reflecting the effects of weaker energy prices, investors have rightly taken a different view. A comparison of two-year gilt yields with current Bank Rate provides a simple metric of the direction of change of official interest rates judged likely by market participants. By late June, the two-year yield had dropped some 15 basis points below the policy rate — a clear sign that investors were expecting looser, rather than tighter policy.

Here is the view of Fathom consulting on current UK situation. We bring some extractions from this interesting article, which are interesting in context of our discussion.

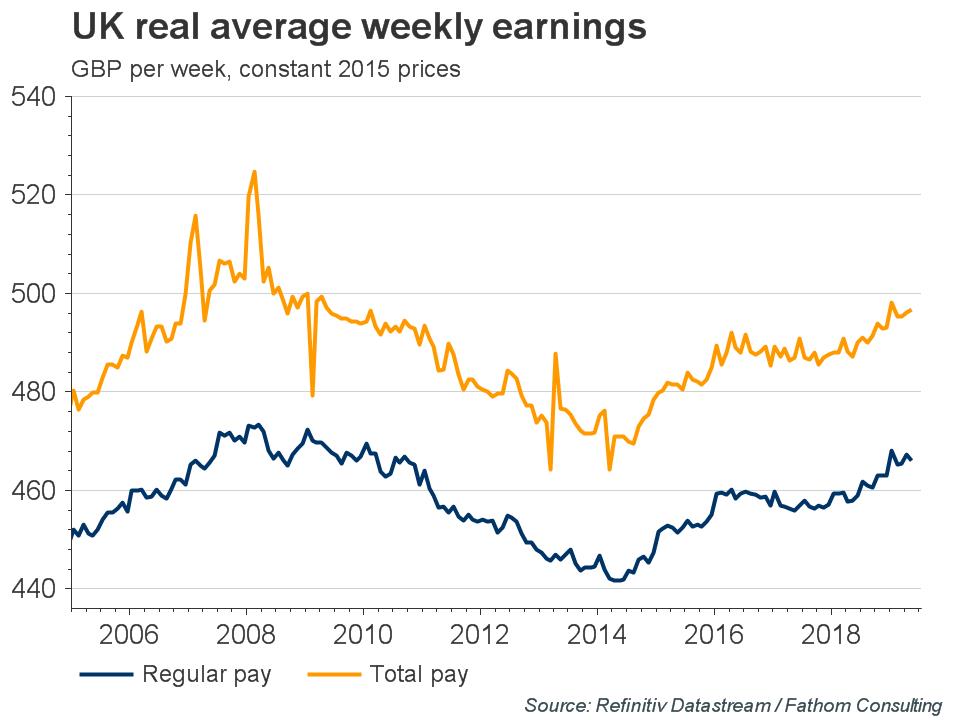

The UK’s next Prime Minister will inherit an economy that, Brexit aside, is in a vulnerable position. Near-stagnant labour productivity since the Global Financial Crisis of 2008/09 means that trend growth in the UK economy is now somewhere in the range 0.5%-1.0%. Actual growth has been much stronger than that, even since the EU referendum of 2016, driven by rapid growth in household spending.

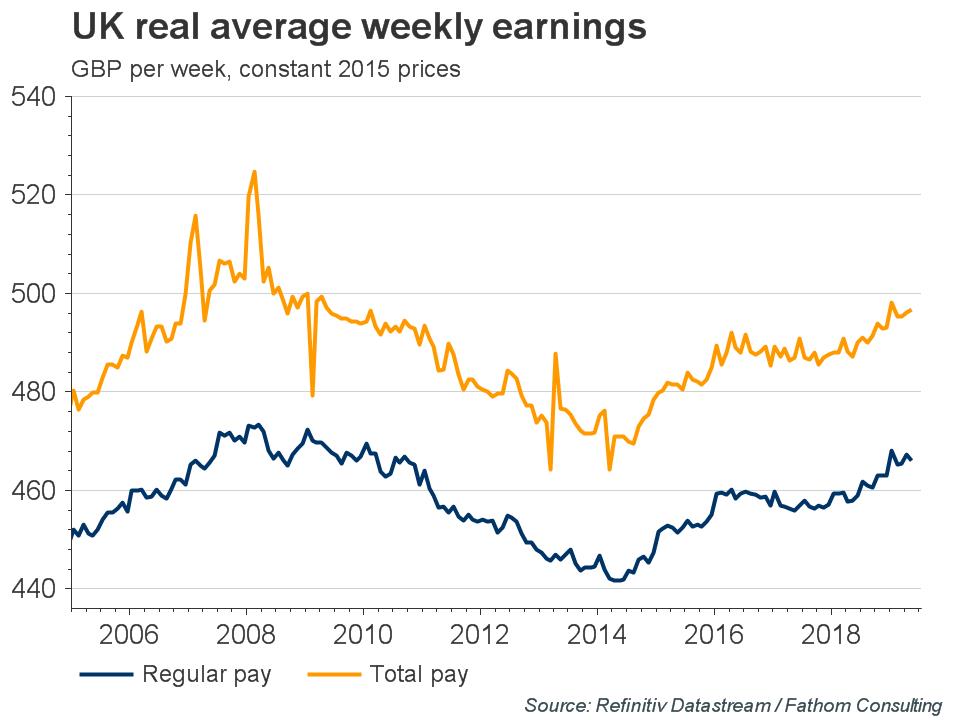

Growth in household spending has remained strong, even though real rates of pay have been largely stagnant for the past ten years, mirroring the trend in labour productivity. If real rates of pay are flat, real household spending can still rise if employment is rising, or if the saving ratio is falling. In fact, both these phenomena have been in place.

But neither a rising employment rate, nor a falling saving ratio can support consumption indefinitely of course. Indeed, there are signs that recent increases in employment have been driven by increases in the number of people describing themselves as self-employed, rather than by increases in the number of employees. And banks are coming under pressure from the Bank of England to reduce the availability of unsecured credit.

Absent a sustained increase in real wages, which would require a return to more normal rates of labour productivity growth, then there appears little scope for household spending to contribute as much as it has towards UK economic growth.

Leaving aside the public sector for a moment, these are net external demand, and business investment. With the global economy slowing, net external demand is unlikely to be a source of strength. What of business investment? Capital expenditure by UK corporates fell in every quarter of last year, held back by uncertainty over the nature and the timing of the UK’s departure from the EU. We estimate that, by 2019 Q1, Brexit-related uncertainty had reduced the level of UK business investment by around 10%.

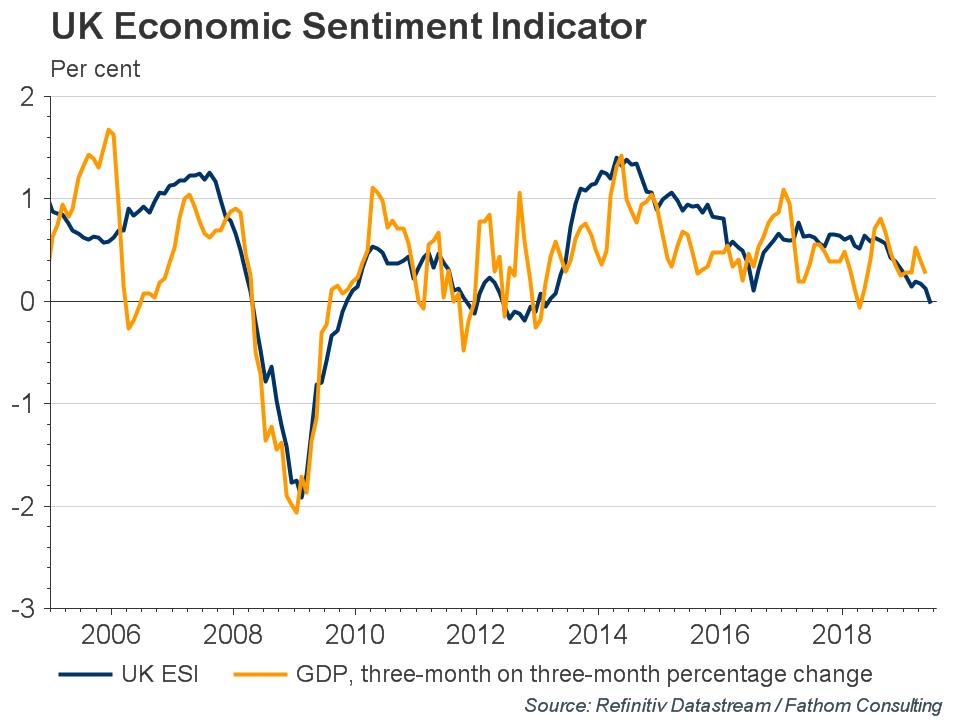

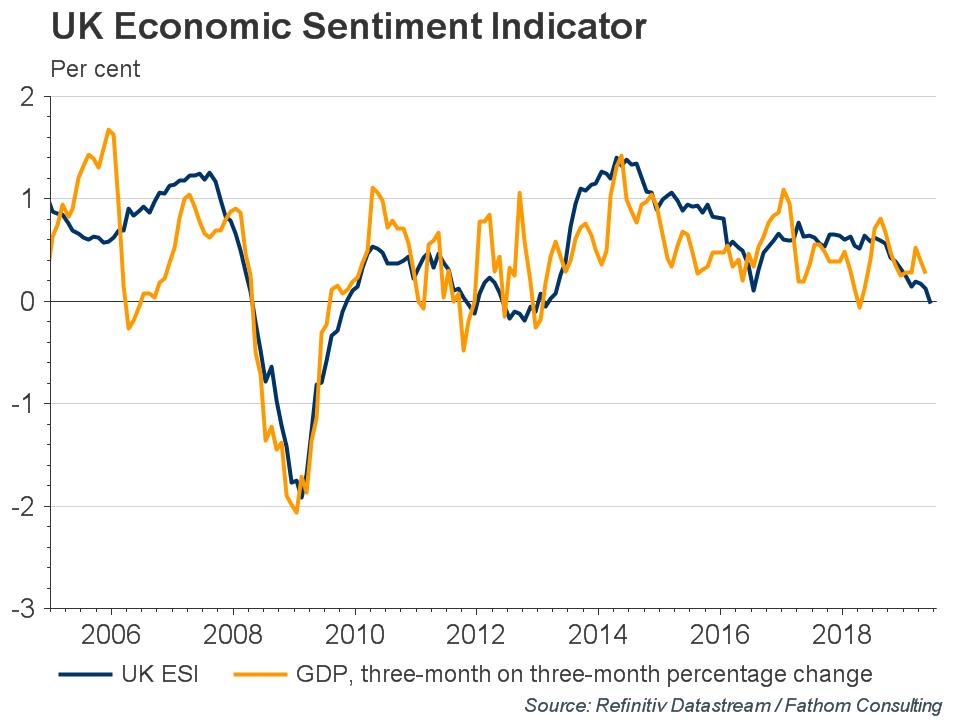

The outlook for investment, and with it the UK economy, will depend crucially on political developments between now and 31 October, when the UK is due to leave the EU. Fathom’s UK Economic Sentiment Indicator (ESI), which we treat as a useful guide to underlying economic momentum, slipped further in June and is now at its weakest in more than six years, consistent with broadly flat economic output. Despite the rhetoric of the favoured leadership candidate, it is of course conceivable that the UK leaves the EU on 31 October with a deal close to that currently on the table. We would give that around a 5% chance. To us, that is more or less the only scenario imaginable that would produce a meaningful near-term rebound in economic sentiment, and with it economic growth.

Much more likely than the UK leaving with a deal on the 31 October is the UK leaving with no deal on that date, or a further postponement of the UK’s departure from the EU following the dissolution of parliament in preparation for a general election. We would give these two options a combined weight of around 90%, split 3:1 in favour of a general election. Either of these outcomes is likely to lead, in the short term at least, to a further, and perhaps marked deterioration in our UK ESI. That is why we see a greater-than-evens chance of a technical recession in the UK within the next twelve months. Getting out of that will require substantially looser fiscal policy than is currently pencilled in by Chancellor Philip Hammond.

It seems that Fathom is not alone in this suggestion as CFTC data also shows rising of net short position. It stands not at historical lows (which are ~ -110K) and has some potential to decrease more, but here we're interested with trend - net short position is rising within 10+ weeks in a row:

Source: cftc.gov

Charting by Investing.com

Technicals

Monthly

Our long-term view mostly stands the same. Here you can see our major targets chain.

In July market has completed some targets here. First is our bearish grabber has reached minimal target as price has dropped below 1.24, second - market now is challenging YPS1. Breaking YPS1 will tell us that new part of long-term bear trend is started.

Now market stands with our all time AB-CD pattern. COP target and following retracement are done. Now it seems that CD leg continues and in long-term perspective, OP at 0.95 target could be completed. But this is too long-term perspective for us. We need something closer to use it as real target in day-by-day trading. First is, challenging of 1.20 lows again, next is suggest appearing of butterfly pattern, with first target around 1.1335.

Weekly

On weekly chart trend stands bearish, market is not at oversold. Here GBP has erased two potentially bullish patterns. First is Reversal week has been erased, second - as GBP continues downside action, potential H&S pattern has failed. This is actually what we've expected to get, based on fundamental background. Now market is well on the way to COP target at 1.2170. "B" lows have been broken already.

Daily

On daily chart we have two setups of different scale. If we suggest large butterfly "Buy" started XA swing, then its 1.27 target coincides mostly with weekly COP.

Second one is short-term setup that we've discussed in the beginning of the month. Our XOP target stands at 1.2340 and market gradually is coming to it. At the same time we see falling wedge pattern and bullish divergence with MACD pattern, which indicates that market could start retracement as soon as XOP will be reached. Coming Fed meeting also could become a reason for that.

Conversely, if Fed statement will be strongly dollar supportive, we could get fast downside breakout of the wedge pattern. Although not often, but sometimes this happens. Thus we mostly should prepare to upside retracement but keep in mind this scenario as well.

Intraday

4H chart shows that XOP will be finalized by butterfly pattern. Theoretically, if you want to buy GBP, you could use this butterfly, but risks are very high. In fact, GBP has no Fib levels below the market as all major Fib support levels already have been broken, including all time 5/8 Fib support. This makes task for bears much easier. In fact, skipping upside retracement and waiting suitable moment for re-enter short seems as better and safer tactics right now.

Conclusion:

Analysis of fundamental factors this week confirms existing of bearish sentiment and we keep our long-term bearish view on GBP. Political risks stand high, UK statistics gives signs of slowdown as inflation as overall performance which will exacerbated closer to October.

Coming Fed meeting definitely will make impact on the market, and depending on meeting results, downside action could be postponed by some retracement etc. Technically we see that GBP could show pullback as soon as 1.2340 target could be hit. But still, our position suggests that it would be better to not trade upside pullbacks but use them for short entry at better levels. It seems as safer tactics.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Today, guys, we take a look at GBP again instead of Gold market, mostly because on Gold market we have the same pack of driving factors as on EUR and we already discussed our technical trading plan. On GBP we have more specific driving factors as Boris Johnson has become a PM once again.

Besides recent statistics on UK tells that BoE has misleading view on economy situation which also is confirmed by market data. For example, BoE tells on more hawkish rate policy while interest rate futures and Guilt yields suggest the opposite. This divergence potentially creates long-term trading opportunities.

So, new Prime Minister Boris Johnson filled his cabinet with Brexiteers and promised he would take Britain out of the European Union on Oct. 31 with or without a transition deal.

Johnson met his Brexiteer-dominated team of senior ministers for the first time on Thursday to plan how to persuade the EU to agree to a new withdrawal deal.

He told parliament that the Irish border backstop would have to be struck out of the divorce agreement if there was to be an orderly exit with a deal.

Johnson’s victory in the Conservative Party leadership contest was largely priced into sterling.

“Sentiment towards the pound doesn’t seem to have improved – on the contrary, three-month risk reversals continue to decline, showing that people are getting increasingly negative on the currency,” said Marshall Gittler, a currencies analyst at ACLS Global.

“So I believe this is just a temporary respite and I remain long-term bearish on GBP.”

Attention now turns to whether Johnson will follow through on his rhetoric about trying to extract more concessions from the EU, and taking Britain out of the EU in October without a deal if he cannot achieve that.

The EU has so far repeatedly said it will not rewrite the withdrawal agreement, but it has said it could change a so- called political declaration on future ties. European Commission President Jean-Claude Juncker telling new British Prime Boris Johnson that a deal agreed forged by his predecessor was the best and the only Brexit agreement.

Juncker told Johnson on Thursday that the European Union would analyse any ideas put forward by Britain, provided they were compatible with the withdrawal agreement.

Just to remind you in two words - Irish border is a stumbling point, because splitting EU and GB by land means dividing Ireland in two parts and return to all nightmare of divided Ireland that was finished by big efforts two decades ago. While applying border by Irish see will split the GB economy space in two parts. This is the problem that has no compromise solution.

Hot news on this subject tells the following - the British government is working on the assumption that the European Union will not renegotiate its Brexit deal and is ramping up preparations to leave the bloc on Oct. 31 without an agreement, senior ministers said on Sunday.

Leading Brexit supporter Michael Gove, who Johnson has put in charge of ‘no deal’ preparations, wrote in the Sunday Times newspaper that the government would undertake “intensive efforts” to secure a better deal from the EU.

“We still hope they will change their minds, but we must operate on the assumption that they will not ... No deal is now a very real prospect and we must make sure that we are ready,” Gove wrote.

“Planning for no deal is now this government’s no. 1 priority,” he said, adding “every penny needed” for no deal preparations would be made available.

The Sunday Times also reported that Dominic Cummings, the mastermind behind the 2016 referendum campaign to leave the EU and now a senior aide to Johnson, told a meeting of the prime minister’s advisers that he had been tasked with delivering Brexit “by any means necessary”.

Ministers are preparing for a no-deal emergency budget in the week of Oct. 7, the newspaper added.

Writing in the Sunday Telegraph, new finance minister Sajid Javid said he had ordered no deal preparations in his Treasury department to be stepped up.

“In my first day in office ... I tasked officials to urgently identify where more money needs to be invested to get Britain fully ready to leave on October 31 – deal or no deal. And next week I will be announcing significant extra funding to do just that,” he said.

Javid, a former interior minister, said this would include funding for 500 new Border Force officers.

Johnson has said the Irish backstop, an insurance policy designed to prevent the return of a hard border between EU-member Ireland and the British province of Northern Ireland by provisionally keeping Britain in a customs union with the EU, must be removed from any Brexit deal.

“You can’t just reheat the dish that’s been sent back and expect that will make it more palatable,” Gove wrote. “We need a new approach and a different relationship. Critically, we need to abolish the backstop.”

Labour leader Jeremy Corbyn said on Sunday his party would do everything it could to prevent the country leaving the EU without a deal.

Although Johnson has been adamant he will not hold an election before Brexit, his Conservative Party does not have a majority in parliament, are divided over Brexit and under threat of a no-confidence vote when parliament returns in September.

Speculation of an early election to break the deadlock is likely to be fueled by a YouGov opinion poll in the Sunday Times, which showed the Conservatives had opened up a 10-point lead over Labour since Johnson took over. (Ordinary schedule suggests next elections in May 2020).

So, let's draw the line under political driving factor. Definitely it becomes the one that actively will be used for different speculations. It consists of two parts - speculation on early elections, which seems hardly possible before Brexit and this will be outstanding measure, only if B. Johnson couldn't push through Parliament his decision on Brexit.

Second political factor is Irish border negotiations. It is relatively easy to monitor - no new achievements and agreements with EU tells about higher chances on no deal Brexit, which will be bearish to GBP.

Now let's take a look at economy.

The Bank of England gives its monetary policy decision next Thursday. Few economists expect the bank to change rates from the current 0.75% but the focus will be on policymakers’ assessment of the current economic slowdown in Britain and whether it justifies a rate cut down the line.

In general, according to CME BoE watch tool, markets do not expect rate drop until November meeting, where chances on decrease to 0.5% level stands now around 36%.

At the same time, previously, we mentioned many times that economy assessment, provided by BoE and rate policy doesn't correspond to reality, based on statistics and interest rate market.

At the meeting that concluded on 20 June, the Bank of England’s Monetary Policy Committee revised down its projection for growth in Q2 from 0.2% to 0.0%. Nevertheless, members continue to warn of higher interest rates. With inflation on target in May, and set to fall through the second half of this year, reflecting the effects of weaker energy prices, investors have rightly taken a different view. A comparison of two-year gilt yields with current Bank Rate provides a simple metric of the direction of change of official interest rates judged likely by market participants. By late June, the two-year yield had dropped some 15 basis points below the policy rate — a clear sign that investors were expecting looser, rather than tighter policy.

Here is the view of Fathom consulting on current UK situation. We bring some extractions from this interesting article, which are interesting in context of our discussion.

The UK’s next Prime Minister will inherit an economy that, Brexit aside, is in a vulnerable position. Near-stagnant labour productivity since the Global Financial Crisis of 2008/09 means that trend growth in the UK economy is now somewhere in the range 0.5%-1.0%. Actual growth has been much stronger than that, even since the EU referendum of 2016, driven by rapid growth in household spending.

Growth in household spending has remained strong, even though real rates of pay have been largely stagnant for the past ten years, mirroring the trend in labour productivity. If real rates of pay are flat, real household spending can still rise if employment is rising, or if the saving ratio is falling. In fact, both these phenomena have been in place.

But neither a rising employment rate, nor a falling saving ratio can support consumption indefinitely of course. Indeed, there are signs that recent increases in employment have been driven by increases in the number of people describing themselves as self-employed, rather than by increases in the number of employees. And banks are coming under pressure from the Bank of England to reduce the availability of unsecured credit.

Absent a sustained increase in real wages, which would require a return to more normal rates of labour productivity growth, then there appears little scope for household spending to contribute as much as it has towards UK economic growth.

Leaving aside the public sector for a moment, these are net external demand, and business investment. With the global economy slowing, net external demand is unlikely to be a source of strength. What of business investment? Capital expenditure by UK corporates fell in every quarter of last year, held back by uncertainty over the nature and the timing of the UK’s departure from the EU. We estimate that, by 2019 Q1, Brexit-related uncertainty had reduced the level of UK business investment by around 10%.

The outlook for investment, and with it the UK economy, will depend crucially on political developments between now and 31 October, when the UK is due to leave the EU. Fathom’s UK Economic Sentiment Indicator (ESI), which we treat as a useful guide to underlying economic momentum, slipped further in June and is now at its weakest in more than six years, consistent with broadly flat economic output. Despite the rhetoric of the favoured leadership candidate, it is of course conceivable that the UK leaves the EU on 31 October with a deal close to that currently on the table. We would give that around a 5% chance. To us, that is more or less the only scenario imaginable that would produce a meaningful near-term rebound in economic sentiment, and with it economic growth.

Much more likely than the UK leaving with a deal on the 31 October is the UK leaving with no deal on that date, or a further postponement of the UK’s departure from the EU following the dissolution of parliament in preparation for a general election. We would give these two options a combined weight of around 90%, split 3:1 in favour of a general election. Either of these outcomes is likely to lead, in the short term at least, to a further, and perhaps marked deterioration in our UK ESI. That is why we see a greater-than-evens chance of a technical recession in the UK within the next twelve months. Getting out of that will require substantially looser fiscal policy than is currently pencilled in by Chancellor Philip Hammond.

It seems that Fathom is not alone in this suggestion as CFTC data also shows rising of net short position. It stands not at historical lows (which are ~ -110K) and has some potential to decrease more, but here we're interested with trend - net short position is rising within 10+ weeks in a row:

Source: cftc.gov

Charting by Investing.com

Technicals

Monthly

Our long-term view mostly stands the same. Here you can see our major targets chain.

In July market has completed some targets here. First is our bearish grabber has reached minimal target as price has dropped below 1.24, second - market now is challenging YPS1. Breaking YPS1 will tell us that new part of long-term bear trend is started.

Now market stands with our all time AB-CD pattern. COP target and following retracement are done. Now it seems that CD leg continues and in long-term perspective, OP at 0.95 target could be completed. But this is too long-term perspective for us. We need something closer to use it as real target in day-by-day trading. First is, challenging of 1.20 lows again, next is suggest appearing of butterfly pattern, with first target around 1.1335.

Weekly

On weekly chart trend stands bearish, market is not at oversold. Here GBP has erased two potentially bullish patterns. First is Reversal week has been erased, second - as GBP continues downside action, potential H&S pattern has failed. This is actually what we've expected to get, based on fundamental background. Now market is well on the way to COP target at 1.2170. "B" lows have been broken already.

Daily

On daily chart we have two setups of different scale. If we suggest large butterfly "Buy" started XA swing, then its 1.27 target coincides mostly with weekly COP.

Second one is short-term setup that we've discussed in the beginning of the month. Our XOP target stands at 1.2340 and market gradually is coming to it. At the same time we see falling wedge pattern and bullish divergence with MACD pattern, which indicates that market could start retracement as soon as XOP will be reached. Coming Fed meeting also could become a reason for that.

Conversely, if Fed statement will be strongly dollar supportive, we could get fast downside breakout of the wedge pattern. Although not often, but sometimes this happens. Thus we mostly should prepare to upside retracement but keep in mind this scenario as well.

Intraday

4H chart shows that XOP will be finalized by butterfly pattern. Theoretically, if you want to buy GBP, you could use this butterfly, but risks are very high. In fact, GBP has no Fib levels below the market as all major Fib support levels already have been broken, including all time 5/8 Fib support. This makes task for bears much easier. In fact, skipping upside retracement and waiting suitable moment for re-enter short seems as better and safer tactics right now.

Conclusion:

Analysis of fundamental factors this week confirms existing of bearish sentiment and we keep our long-term bearish view on GBP. Political risks stand high, UK statistics gives signs of slowdown as inflation as overall performance which will exacerbated closer to October.

Coming Fed meeting definitely will make impact on the market, and depending on meeting results, downside action could be postponed by some retracement etc. Technically we see that GBP could show pullback as soon as 1.2340 target could be hit. But still, our position suggests that it would be better to not trade upside pullbacks but use them for short entry at better levels. It seems as safer tactics.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.