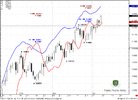

EUR/USD 4 hr

Dear Sive

Thanks for your analysis.

In the weekly research you had mentioned a 4hr butterfly sell from 1.4370 region. Is that not valid because as you mentioned wash and rinse of previous highs and with all the doom and gloom ahead is that not a possibility?

Thanks in advance.

Mili

Dear Sive

Thanks for your analysis.

In the weekly research you had mentioned a 4hr butterfly sell from 1.4370 region. Is that not valid because as you mentioned wash and rinse of previous highs and with all the doom and gloom ahead is that not a possibility?

Thanks in advance.

Mili