Well, I think that my answer a bit late...

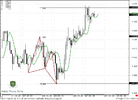

But in general - no. Daily trend is bullish, so you have no context to enter short, at least you do not trade some directional patterns that overrule trend. Or -

if you trade at lower time frames, say 5-min and use hourly trend as context.

Hi Sive

You never mentioned that some barrier option interests could be stronger driving factor for the moves we see, and as a rule they had been in discrepancy with indicator's prediction you use. Do not you think so?

Like today, we expected down move toward the WPP area, but maybe the target of the market makers for this up move is simply 1.4650.