EUR/USD Daily Update, Thu 18, August 2011

Good morning,

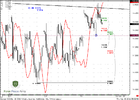

So, our idea with fake triangle breakout has worked, thanks to SNB intervention...

Now, if you will take a look at contracted daily chart again (as we show it in weekly research), you'll see that market has broken this triangle to the upside, and now stands in tight consolidation after breakout. This is bullish sign.

Second, on common daily chart market stands in the same tight consolidation right under neckline of H&S pattern. The fact that market does not move lower than 0.382 Fib support for me also look bullish. Trend is bullish also, btw.

On 4-hour chart there is one technical moment though, that could lead to some short-term downward move. See, how market acts with MACDP red line. Yesterday it has shown fast failure trend change - and that has led to clearing out previous lows. Now you see, that the same pattern appears again, since we can't exclude that lows at 1.4319 could be renewed by market...

On hourly chart we see that 1.618 target stands right below yesterday's lows, so market could take it today, besides - hourly and 4-hour trends are bearish.

So, if you want to enter long based on daily time frame scenario wait one of the two possible ways:

1. if you'll find some clear bullish pattern on hourly chart - for instance, butterfly "Buy" with the target that coincides with 1.618 AB-CD target.

2.If you will not, then wait when all three trends (daily, hourly and 4-hour) will turn bullish. Then you may use nearest Fib support on hourly time frame to enter long.

To enter short is very dangerous currently. Still you may - but be sure that your risk is small.