Sive Morten

Special Consultant to the FPA

- Messages

- 18,630

Fundamentals

This week we've got a lot of information to think about. But the most amazing thing was, no doubts, the market reaction. It was very "special" I would say. First is, we've got the rally on relatively hawkish J. Powell comments, then we've got plunge as a result of strong employment data in the US. If latter is more or less understandable but the former is absolutely unexpected. One of the reasons could be the lack of confidence that markets could have to the Fed. As we've said in our daily updates, it seems that markets do not believe to the Fed. Because anybody who more or less tries to dig with statistics and fundamental data could see that Fed's ability to control situation now are limited. They are not almighty anymore. Recent data also rises a lot of questions and its reliability.

Market overview

All this stuff has started on Wed, when the dollar extended losses and fell to a nine-month low against a basket of currencies after Federal Reserve Chair Jerome Powell spoke of making progress in bringing down inflation pressures, even as the U.S. central bank warned of further monetary policy tightening. Powell, speaking in a news conference after the Fed announced that it had hiked rates by a widely expected 25 basis points, said he is not fully sure where the central bank will stop with its increases to borrowing costs as it presses forward with its efforts to cool inflation.

He also noted progress on disinflation, which he said is in its early stages, and said the Fed will continue to make decisions on a meeting-by-meeting basis.

The ADP National Employment report on Wednesday showed that U.S. private payrolls rose by 106,000 jobs last month, far less than expected in January, hinting at some cooling in the labor market. But NFP on Friday was absolutely stunning. The dollar jumped on Friday after data showed that U.S. employers added significantly more jobs in January than economists expected, potentially giving the Federal Reserve more leeway to keep hiking interest rates.

The Labor Department's closely watched employment report showed that nonfarm payrolls surged by 517,000 jobs last month. The department revised December data higher to show 260,000 jobs added instead of the previously reported 223,000. Average hourly earnings rose 0.3% after gaining 0.4% in December. That lowered the year-on-year increase in wages to 4.4% from 4.8% in December.

The surprisingly strong payrolls number reversed a move from Wednesday when traders raised bets that the U.S. central bank would stop hiking borrowing costs after a widely expected 25-basis-point increase in March.

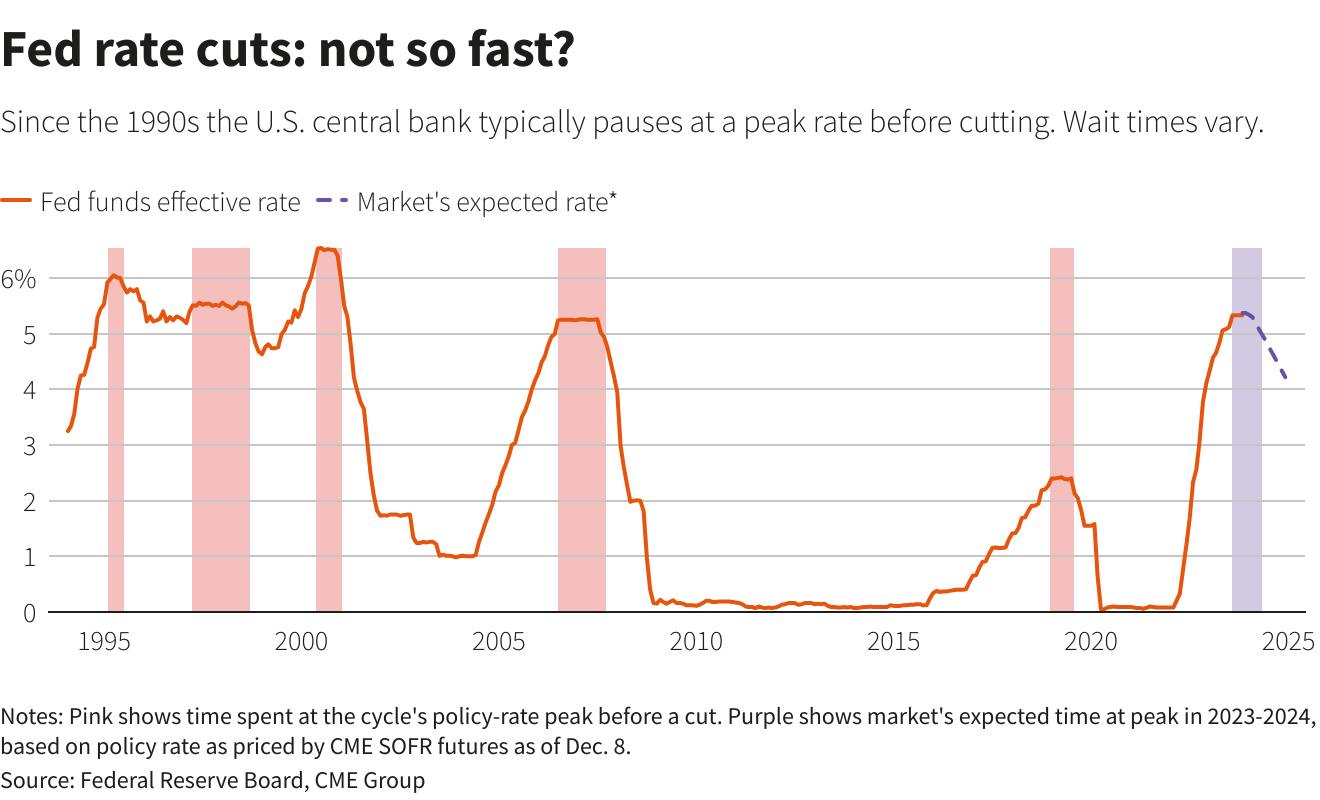

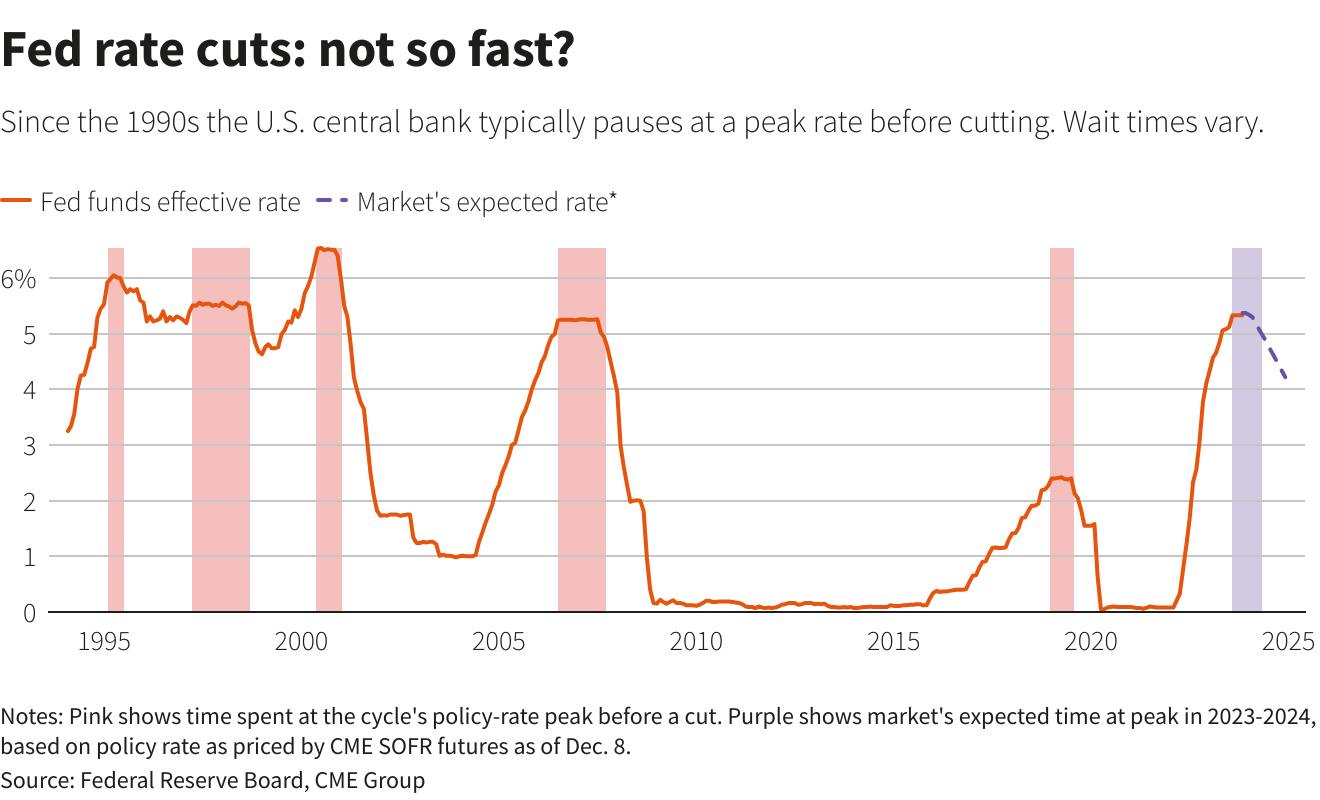

Fed officials in December said they expected to raise the central bank's benchmark overnight interest rate above 5% and they have stressed they will need to hold it in restrictive territory for a period of time in order to sustainably bring down inflation. Traders are now pricing in the Fed's policy rate to peak at 5.03% in June, up from 4.88% on Thursday afternoon.

As rate hike expectations increase, however, fears of a bigger economic downturn may also weigh on markets.

The next major U.S. economic release that may give further clues to Fed policy will be consumer price data for January due on Feb. 14.

While the Fed intention to rise rates above 5% was not a surprise and widely announced and not just once, for the markets recent NFP report has turned everything from top to bottom. Interest-rate futures traders, initially skeptical that with a disinflationary trend already underway the Fed would need more than a one further quarter point interest-rate increase in March, moved after Friday's job report to price a further increase in May.

That move would bring the policy rate to the 5%-5.25% range.

Traders also pushed out their expectations for eventual Fed rate cuts after the jobs report, pricing them to start in November versus in September previously.

Powell has said he does not expect inflation to fall fast enough to allow the Fed to cut rates at all this year.

So, what is in a dry residual?

Of course, we couldn't know that NFP report will be so strong, but we know other background and that's why we've said on Wed that market will regret on this rally very soon, because it absolutely doesn't correspond to the spirit of recent J.Powell speech, which was hawkish enough. What did he say? I see following major points:

If we take a deeper look at fundamentals we could find a lot of reasons why Fed should start searching reasons to stop tightening and turning to easing, but this is only in a case of deep analysis. On a surface - US economy shows good shape. Take a look - inflation is dropping, job market is strong, GDP is rising above 2%, why not to keep tight policy for longer?

Markets do not believe to the Fed

Investors ignored him, keeping bets on just one more rate hike ahead and piling further into bets that rates will be lower by year's end than they are now. It's not obvious which view will prove right: neither the Fed nor markets have a great predictive record since the central bank's current round of rate hikes began last March.

Markets have repeatedly had to scrap bets for a quick pivot, pushing those expectations out farther as the central bank charged ahead with the most aggressive policy tightening in 40 years.

It was on Fed Chair Burns' watch, in the 1970s, that the Fed repeatedly raised rates and then cut them to fight rising unemployment, only for prices to explode again and force more rate hikes. His successor Paul Volcker ended up jacking rates to almost 20% to finally quash the inflation that Burns had let get out of hand.

Financial conditions began to ease following the central bank's policy meeting last November and while Powell largely brushed off such concerns on Wednesday, the Fed can ill afford for them to ease further

US Government bond markets meanwhile continued to price in rate cuts by year-end as the economic cycle turns. Over in Europe, the European Central Bank delivered a hefty 50 bps hike on Thursday and promised more of the same for March and beyond. Euro zone markets also rallied.

Investors said that whatever central banks pledged now mattered less for markets already driven by a belief that inflation has peaked. Markets also anticipate the lagged effect of rate rises would slow the global economy, with both forcing rate hikes to be reversed later in the year. Traders expect the Fed to cut rates at least twice by year-end . Even as the ECB sounded hawkish, markets lowered expectations for where its key rate will end up to around 3.25% from 3.4% earlier on Thursday .

Markets also price a scenario where major economies cool down just enough to prompt central banks to quit hiking rates, without plunging into dreadful recessions.

Some investors believed markets are also underestimating the full impact of monetary tightening that operates with a time lag.

What the reasons are to "not believe in Fed"?

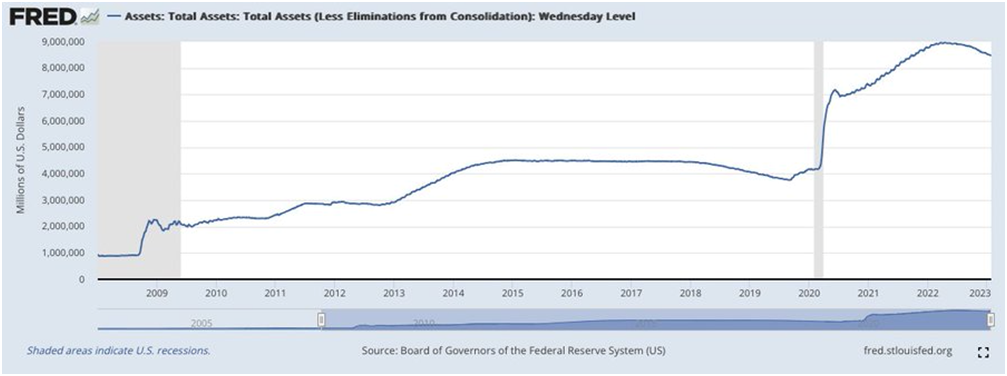

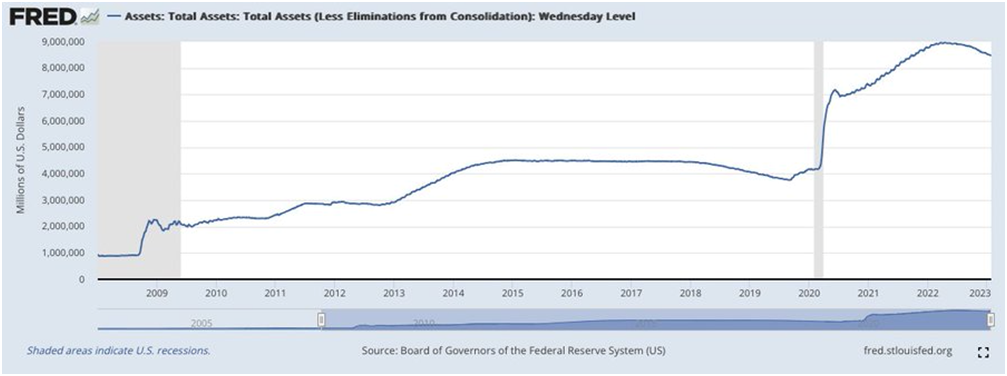

First is the Fed balance, of course - it is a big way to normalization still. Just 500 Bln was sold off the balance.

Second reason - J. Powell speech sounds a bit unconfident. Just he said that rate will not be cut any time soon, and immediately he tells that "If the data comes in the other direction, then we will certainly make decisions depending on the data (it is assumed to stop the increase or even decrease)". Thus, Powell "promised" not to cut rates this year, but immediately made a reservation that we are very flexible and will revise our plans if necessary. Markets feel that whole Powell's rhetoric was suggesting the desire to retreat. Powell actually is a natural "dovish person" through his carrier as he is the one among other creators of modern financial imbalances (including bubbles), who is trying to manipulate market expectations by portraying an aggressive hawk. It's a bluff. Markets feel it.

This circus continues until there are no visible signs of a crisis and until no one from the "too big to fall" segment cracks at the seams from overload. The measure of the Fed's aggressiveness is directly proportional to the degree of stability of the financial system. Any, even the most insignificant disruption – the rhetoric will change at lightning speed. In the hierarchy of priorities, the stability of the financial system is much higher than any attempt to combat inflation.

Potential capital flow out from the dollar means a decrease in the value of the dollar, i.e. a purely inflationary process. Inflation is the other side of the measure of confidence in the Fed's policy, as the monetary aspect of inflation. To reduce market nervousness and stabilize inflation expectations from about June last year to December, Powell portrayed an aggressive hawk.

In principle, a good double game. So far, it has been successful, the work is very difficult, but now another process has begun, more complex and structural – the transfer of high interest rates expenses to the economy. I wonder what is the margin of safety of an economy that has existed for 15 years in the illusion of endless and free money? No, the game is not over, everything is just beginning! The focus is on the transfer of interest costs to the economy. Who will be the first to stagger?

But definitely, there should be some more practical background beyond just psychology and suspicions. They are actually exist. Some economists suggest that calculation methods of major statistician indicators are built so to underestimate negative factors. Simple comparison of average indicator, such as CPI of GDP deflator with industry private indicators clearly show this.

There is a serious crisis in the USA. It's coming. It is structural in nature, it has nothing to do with the recession. In fact, the decline in US GDP in 2022 alone amounted to ~6-8% (see below). And since this decline anyway appears in the income of households, politicians must do something.

Both the main inflation indices, PPI and CPI, are currently more than 6% according to official data, in reality they are seriously underestimated. In terms of the current situation, it turned out about 3%. That is, only due to this parameter, it is necessary to increase the inflation figures to 9%, and the US GDP, respectively, to reduce by 3%.

And there are other indicators (for example, in recent years, only the methodology for calculating GDP has changed at least twice, and each time it increased GDP). In particular, the GDP began to include the growth of capitalization of various kinds of financial assets. It is not surprising that the real disposable incomes of households have become increasingly detached from the expenditures necessary for the formation of GDP.

The same is with EU's GDP deflator:

"It is known that inflation in Europe has been breaking all records, at least for the last 40 years, but does Eurostat transfer this inflation into the calculation of GDP? That's what it's worth checking out. Comparing the deflator on consumer spending and the CPI across the Eurozone, you can definitely notice a correlation (it can't be otherwise), since mid-2021, Eurostat has really started to translate price growth into a deflator, but it turns out that the conversion of price growth into a deflator is insufficient if estimated by the CPI.

For Q3 2022, the CPI increased by 9.3% YoY, and the deflator of consumer spending by only 7.4%, i.e. a gap of almost 2% in favor of prices, respectively, real consumer spending is highly likely to be overstated by 1.8-2.1%.

Is the error accumulating in the calculations of Eurostat? The accumulated CPI price growth from December 2019 to September 2022 was 12%, and the deflator price growth by 10%, i.e. this means that the 2% gap is not formed every year, but is spread over three years.

If we average the period 2009-2019, the CPI is usually higher than the deflator with a discrepancy of about 0.2 percentage points per year, and now 2% per year at once, i.e. they have clearly under-twisted about 1.7-1.8%, but the effect of imports is possible."

Since the methods, in general, are about the same, it can be assumed that in the United States, an underestimation of the deflator relative to the PPI and CPI indices also gives about 2%. Since these two understatements act independently, we can already talk about 5%. And if we add that hedonistic indices are far from exhausting ways to underestimate inflation, it turns out already somewhere 6-7%.

We do not know the exact indicators of various intra-industry indices and parameters, and therefore we cannot give accurate estimates. But these calculations show the scale of distortions, and it is safe to say that there are other factors that underestimate inflation. And any assessment of the economic situation should take this into account.

In other words, it is safe to say that the US GDP in 2022 fell by at least 2%, and with a high probability that this decline is approaching 6%. Of course the Fed knows this. Whether do other market participants know this? I'm not sure. Big whales do probably. This explains different comments and reaction. While individual investors are trying to catch up the market -

While big banks warn about durable high inflation time. We discussed this last week. Besides, the bulk of recent data, especially private PMI indexes and US regions data clearly show that "something is wrong in Dutch Kingdom." Last week we've mentioned Richmond and this week we've got data from Texas FRB and Chicago. As well as some other data:

Finally, Fed could meet technical problems to provide liquidity closer to the summer time. We already talked about it many times and keep an eye on US Treasury deposit. Now it stands around 500 Bln. But, with delay in debt ceil agreement, and knowing that February-March are the heaviest months in terms of budget deficit. (Last year in these months the deficit was 409 billion, from 2017 to 2020 an average of 380 billion.)

We could suggest that in February-March, the system will receive more from the Fed/US Treasury (350-450 billion) than it will withdraw (190 billion). But by June, the cache will exhaust and they will have to borrow actively – this will become a problem.

Conclusion:

Events of recent week shows us that everybody should be driven by own analysis and keep head in cold, not to succumb to panic/euphoria and use common sense, believe in numbers but not in emotions. That is what recent week teaches us. Currently it is very difficult to predict the perspective of dollar strength. Probably it lasts for some time, because EU policy is known until March - another 0.5% rate change and totally priced-in, while Fed policy is still unclear. Recent Fed comments together with strong data are powerful reasons to review market strategy in favor of stronger USD. But longer-term perspective is blur and hardly somebody could tell something definite, including the Fed probably. Particular speaking - everything depends on "signs of weakness", mentioned above. Until they come Fed should keep rates high. The same could happen in EU as well. They have slightly less interest rate now, but their economy looks weaker either. This is a kind of "war of attrition", depending who could keep tight policy longer. That's why we intend to go with our trading plan - moderate pullback in near term, but with some circumstances, dollar could rise significantly, so our 0.9 target is not cancelled yet totally.

This week we've got a lot of information to think about. But the most amazing thing was, no doubts, the market reaction. It was very "special" I would say. First is, we've got the rally on relatively hawkish J. Powell comments, then we've got plunge as a result of strong employment data in the US. If latter is more or less understandable but the former is absolutely unexpected. One of the reasons could be the lack of confidence that markets could have to the Fed. As we've said in our daily updates, it seems that markets do not believe to the Fed. Because anybody who more or less tries to dig with statistics and fundamental data could see that Fed's ability to control situation now are limited. They are not almighty anymore. Recent data also rises a lot of questions and its reliability.

Market overview

All this stuff has started on Wed, when the dollar extended losses and fell to a nine-month low against a basket of currencies after Federal Reserve Chair Jerome Powell spoke of making progress in bringing down inflation pressures, even as the U.S. central bank warned of further monetary policy tightening. Powell, speaking in a news conference after the Fed announced that it had hiked rates by a widely expected 25 basis points, said he is not fully sure where the central bank will stop with its increases to borrowing costs as it presses forward with its efforts to cool inflation.

He also noted progress on disinflation, which he said is in its early stages, and said the Fed will continue to make decisions on a meeting-by-meeting basis.

"The markets are pretty much intent that (Powell) sees inflation coming down, and it seems like he's pretty confident that it's going to continue," said Edward Moya, senior market analyst at OANDA in New York. They have two more inflation reports going into the March meeting, and if we see pricing pressures continue to ease then they might fall short of their dot plots and only have to deliver one more rate hike," Moya added. "This is good news for risky assets, good news for the euro and it's taking the dollar to some of the lowest levels we've seen in several months."

The ADP National Employment report on Wednesday showed that U.S. private payrolls rose by 106,000 jobs last month, far less than expected in January, hinting at some cooling in the labor market. But NFP on Friday was absolutely stunning. The dollar jumped on Friday after data showed that U.S. employers added significantly more jobs in January than economists expected, potentially giving the Federal Reserve more leeway to keep hiking interest rates.

The Labor Department's closely watched employment report showed that nonfarm payrolls surged by 517,000 jobs last month. The department revised December data higher to show 260,000 jobs added instead of the previously reported 223,000. Average hourly earnings rose 0.3% after gaining 0.4% in December. That lowered the year-on-year increase in wages to 4.4% from 4.8% in December.

The surprisingly strong payrolls number reversed a move from Wednesday when traders raised bets that the U.S. central bank would stop hiking borrowing costs after a widely expected 25-basis-point increase in March.

"It is a "monster number," said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York. After the Fed meeting it looked like markets had the advantage - it was still pricing in a rate cut, they took interest rates down, and they took the dollar down, and now I think 48 hours later the Fed looks like they might have the upper hand again," Chandler said.

Fed officials in December said they expected to raise the central bank's benchmark overnight interest rate above 5% and they have stressed they will need to hold it in restrictive territory for a period of time in order to sustainably bring down inflation. Traders are now pricing in the Fed's policy rate to peak at 5.03% in June, up from 4.88% on Thursday afternoon.

As rate hike expectations increase, however, fears of a bigger economic downturn may also weigh on markets.

"Whenever we see these big numbers, especially with the headlines, the fear of the Fed comes back with a vengeance because people are probably afraid that the Fed is going to push things even further than what they have, running the risk of not a soft landing, but more of a car crash," said Brian Jacobsen, senior investment strategist at Allspring Global Investments in Wisconsin.

The next major U.S. economic release that may give further clues to Fed policy will be consumer price data for January due on Feb. 14.

While the Fed intention to rise rates above 5% was not a surprise and widely announced and not just once, for the markets recent NFP report has turned everything from top to bottom. Interest-rate futures traders, initially skeptical that with a disinflationary trend already underway the Fed would need more than a one further quarter point interest-rate increase in March, moved after Friday's job report to price a further increase in May.

That move would bring the policy rate to the 5%-5.25% range.

Traders also pushed out their expectations for eventual Fed rate cuts after the jobs report, pricing them to start in November versus in September previously.

Powell has said he does not expect inflation to fall fast enough to allow the Fed to cut rates at all this year.

"While the Fed welcomes any signs of easing wage pressures, the pace of growth in average hourly earnings is still too strong to help lower inflation," Oxford Economics' Ryan Sweet wrote.

And it is progress on inflation that will drive the Fed's policy decisions ahead, Daly said on Friday. By the Fed's preferred gauge, inflation registered 5% in December, a slowdown from earlier in the year. But it's too early to say that inflation has peaked, Daly warned. The direction of policy is for additional tightening and in holding that restrictive stance for some time," she said. "We really will have to be in a restrictive stance of policy until we truly understand and believe that inflation will come squarely back down to our 2% target."

So, what is in a dry residual?

Of course, we couldn't know that NFP report will be so strong, but we know other background and that's why we've said on Wed that market will regret on this rally very soon, because it absolutely doesn't correspond to the spirit of recent J.Powell speech, which was hawkish enough. What did he say? I see following major points:

- No rate cut in 2023 and few more hikes, supposedly for 0.25-0.5% to 5-5.25% area;

- Fed will not pause in raising the rate. Rates remain at high level for a long time. Main task: to reduce inflation by 2%;

- The full effect of the rapid tightening of the policy has yet to be felt;

- To achieve inflation of 2%, it is necessary to slow down the economy;

- It is important for the Fed to see clear signs of a decline in inflation in the services sector (last week we talked about it), which is the main one in the structure of consumer spending (it takes about 2/3). The Fed does not see progress in this direction and it will take time for the signals to become more explicit.

- The regulator needs a weak labor market to slow down policy tightening.

If we take a deeper look at fundamentals we could find a lot of reasons why Fed should start searching reasons to stop tightening and turning to easing, but this is only in a case of deep analysis. On a surface - US economy shows good shape. Take a look - inflation is dropping, job market is strong, GDP is rising above 2%, why not to keep tight policy for longer?

Markets do not believe to the Fed

"It's going to take some time" for disinflation to spread through the economy, Powell said in a news conference following the Fed's latest quarter-point interest rate increase. He said he expects a couple more rate hikes still to go, and, "given our outlook, I just I don't see us cutting rates this year."

Investors ignored him, keeping bets on just one more rate hike ahead and piling further into bets that rates will be lower by year's end than they are now. It's not obvious which view will prove right: neither the Fed nor markets have a great predictive record since the central bank's current round of rate hikes began last March.

Markets have repeatedly had to scrap bets for a quick pivot, pushing those expectations out farther as the central bank charged ahead with the most aggressive policy tightening in 40 years.

"The actual outcome is data dependent, and we won't have the data to confirm or deny...until we are deeper into the first half of the year," said Tim Duy, chief U.S. economist at SGH Macro Advisors. But so far, said Kroll Institute's Global Chief Economist Megan Greene, "the markets aren't buying what the Fed is peddling."

"Investors are inviting him to be Arthur Burns, and he doesn't want to accept that invitation," Dreyfus and Mellon Chief Economist Vincent Reinhart said of Powell.

It was on Fed Chair Burns' watch, in the 1970s, that the Fed repeatedly raised rates and then cut them to fight rising unemployment, only for prices to explode again and force more rate hikes. His successor Paul Volcker ended up jacking rates to almost 20% to finally quash the inflation that Burns had let get out of hand.

Financial conditions began to ease following the central bank's policy meeting last November and while Powell largely brushed off such concerns on Wednesday, the Fed can ill afford for them to ease further

"This loosening of financial conditions is undoubtedly not what the Fed was aiming for, and we expect a cacophony of Fed speeches in the coming weeks will aim to reorient the Fed's message," said Gregory Daco, chief economist at EY Parthenon.

US Government bond markets meanwhile continued to price in rate cuts by year-end as the economic cycle turns. Over in Europe, the European Central Bank delivered a hefty 50 bps hike on Thursday and promised more of the same for March and beyond. Euro zone markets also rallied.

"Markets are saying 'you can say what you want right now, we know you'll change your tune,'" said Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International.

Investors said that whatever central banks pledged now mattered less for markets already driven by a belief that inflation has peaked. Markets also anticipate the lagged effect of rate rises would slow the global economy, with both forcing rate hikes to be reversed later in the year. Traders expect the Fed to cut rates at least twice by year-end . Even as the ECB sounded hawkish, markets lowered expectations for where its key rate will end up to around 3.25% from 3.4% earlier on Thursday .

"What you're seeing here is the market saying okay, the Fed is going to hike, but ultimately, it's going to need to come back down at some point," said Jeffrey Sherman, Deputy CIO at DoubleLine Capital, which manages almost $100 billion in assets, referring to inflation easing.

"They have continued to sound quite hawkish but the market doesn't really believe them," said Sebastian Mackay, multi-asset fund manager at Invesco. In terms of the impact of (central bank) hawkishness on markets," he added, "this has significantly softened."

Markets also price a scenario where major economies cool down just enough to prompt central banks to quit hiking rates, without plunging into dreadful recessions.

Some investors believed markets are also underestimating the full impact of monetary tightening that operates with a time lag.

"This tightening was not done on planet Mars. This was done on planet Earth and somebody has to pay for this tightening," said Fidelity's Ahmed.

What the reasons are to "not believe in Fed"?

First is the Fed balance, of course - it is a big way to normalization still. Just 500 Bln was sold off the balance.

Second reason - J. Powell speech sounds a bit unconfident. Just he said that rate will not be cut any time soon, and immediately he tells that "If the data comes in the other direction, then we will certainly make decisions depending on the data (it is assumed to stop the increase or even decrease)". Thus, Powell "promised" not to cut rates this year, but immediately made a reservation that we are very flexible and will revise our plans if necessary. Markets feel that whole Powell's rhetoric was suggesting the desire to retreat. Powell actually is a natural "dovish person" through his carrier as he is the one among other creators of modern financial imbalances (including bubbles), who is trying to manipulate market expectations by portraying an aggressive hawk. It's a bluff. Markets feel it.

This circus continues until there are no visible signs of a crisis and until no one from the "too big to fall" segment cracks at the seams from overload. The measure of the Fed's aggressiveness is directly proportional to the degree of stability of the financial system. Any, even the most insignificant disruption – the rhetoric will change at lightning speed. In the hierarchy of priorities, the stability of the financial system is much higher than any attempt to combat inflation.

Potential capital flow out from the dollar means a decrease in the value of the dollar, i.e. a purely inflationary process. Inflation is the other side of the measure of confidence in the Fed's policy, as the monetary aspect of inflation. To reduce market nervousness and stabilize inflation expectations from about June last year to December, Powell portrayed an aggressive hawk.

In principle, a good double game. So far, it has been successful, the work is very difficult, but now another process has begun, more complex and structural – the transfer of high interest rates expenses to the economy. I wonder what is the margin of safety of an economy that has existed for 15 years in the illusion of endless and free money? No, the game is not over, everything is just beginning! The focus is on the transfer of interest costs to the economy. Who will be the first to stagger?

But definitely, there should be some more practical background beyond just psychology and suspicions. They are actually exist. Some economists suggest that calculation methods of major statistician indicators are built so to underestimate negative factors. Simple comparison of average indicator, such as CPI of GDP deflator with industry private indicators clearly show this.

There is a serious crisis in the USA. It's coming. It is structural in nature, it has nothing to do with the recession. In fact, the decline in US GDP in 2022 alone amounted to ~6-8% (see below). And since this decline anyway appears in the income of households, politicians must do something.

Both the main inflation indices, PPI and CPI, are currently more than 6% according to official data, in reality they are seriously underestimated. In terms of the current situation, it turned out about 3%. That is, only due to this parameter, it is necessary to increase the inflation figures to 9%, and the US GDP, respectively, to reduce by 3%.

And there are other indicators (for example, in recent years, only the methodology for calculating GDP has changed at least twice, and each time it increased GDP). In particular, the GDP began to include the growth of capitalization of various kinds of financial assets. It is not surprising that the real disposable incomes of households have become increasingly detached from the expenditures necessary for the formation of GDP.

The same is with EU's GDP deflator:

"It is known that inflation in Europe has been breaking all records, at least for the last 40 years, but does Eurostat transfer this inflation into the calculation of GDP? That's what it's worth checking out. Comparing the deflator on consumer spending and the CPI across the Eurozone, you can definitely notice a correlation (it can't be otherwise), since mid-2021, Eurostat has really started to translate price growth into a deflator, but it turns out that the conversion of price growth into a deflator is insufficient if estimated by the CPI.

For Q3 2022, the CPI increased by 9.3% YoY, and the deflator of consumer spending by only 7.4%, i.e. a gap of almost 2% in favor of prices, respectively, real consumer spending is highly likely to be overstated by 1.8-2.1%.

Is the error accumulating in the calculations of Eurostat? The accumulated CPI price growth from December 2019 to September 2022 was 12%, and the deflator price growth by 10%, i.e. this means that the 2% gap is not formed every year, but is spread over three years.

If we average the period 2009-2019, the CPI is usually higher than the deflator with a discrepancy of about 0.2 percentage points per year, and now 2% per year at once, i.e. they have clearly under-twisted about 1.7-1.8%, but the effect of imports is possible."

Since the methods, in general, are about the same, it can be assumed that in the United States, an underestimation of the deflator relative to the PPI and CPI indices also gives about 2%. Since these two understatements act independently, we can already talk about 5%. And if we add that hedonistic indices are far from exhausting ways to underestimate inflation, it turns out already somewhere 6-7%.

We do not know the exact indicators of various intra-industry indices and parameters, and therefore we cannot give accurate estimates. But these calculations show the scale of distortions, and it is safe to say that there are other factors that underestimate inflation. And any assessment of the economic situation should take this into account.

In other words, it is safe to say that the US GDP in 2022 fell by at least 2%, and with a high probability that this decline is approaching 6%. Of course the Fed knows this. Whether do other market participants know this? I'm not sure. Big whales do probably. This explains different comments and reaction. While individual investors are trying to catch up the market -

While big banks warn about durable high inflation time. We discussed this last week. Besides, the bulk of recent data, especially private PMI indexes and US regions data clearly show that "something is wrong in Dutch Kingdom." Last week we've mentioned Richmond and this week we've got data from Texas FRB and Chicago. As well as some other data:

Finally, Fed could meet technical problems to provide liquidity closer to the summer time. We already talked about it many times and keep an eye on US Treasury deposit. Now it stands around 500 Bln. But, with delay in debt ceil agreement, and knowing that February-March are the heaviest months in terms of budget deficit. (Last year in these months the deficit was 409 billion, from 2017 to 2020 an average of 380 billion.)

We could suggest that in February-March, the system will receive more from the Fed/US Treasury (350-450 billion) than it will withdraw (190 billion). But by June, the cache will exhaust and they will have to borrow actively – this will become a problem.

Conclusion:

Events of recent week shows us that everybody should be driven by own analysis and keep head in cold, not to succumb to panic/euphoria and use common sense, believe in numbers but not in emotions. That is what recent week teaches us. Currently it is very difficult to predict the perspective of dollar strength. Probably it lasts for some time, because EU policy is known until March - another 0.5% rate change and totally priced-in, while Fed policy is still unclear. Recent Fed comments together with strong data are powerful reasons to review market strategy in favor of stronger USD. But longer-term perspective is blur and hardly somebody could tell something definite, including the Fed probably. Particular speaking - everything depends on "signs of weakness", mentioned above. Until they come Fed should keep rates high. The same could happen in EU as well. They have slightly less interest rate now, but their economy looks weaker either. This is a kind of "war of attrition", depending who could keep tight policy longer. That's why we intend to go with our trading plan - moderate pullback in near term, but with some circumstances, dollar could rise significantly, so our 0.9 target is not cancelled yet totally.