Monthly

Here we see further acceleration to the upside after hitting of 0.618 support and 0.618 Fib extension target. Usually after reaching of just 0.618 AB=CD extension market shows not deep retracement. While may be 1.3271 seems too shallow – reaching of Monthly K-resistance 1.3505-1.3669 seems logical. I see some advantage of combination of so kind – achievement of 0.618 target and K-resistance above. If long-term sentiment is still bearish, market should not break this area. If market breaks K-resistance after just reaching of 0.618 AB-CD extension – this is more bullish sign.

Still trend is bearish. In medium term perspective we have to watch for two contrary scenarios – either downward reversal patterns on weekly time frame inside of 1.35-1.3650 area or breakout of K-resistance area. These scenarios lead to absolutely different directions of trades. That is what about long-term trading.

In shorter term trading we do not care much about monthly trend direction itself, but mostly by Fib levels.

So, as a result on monthly chart we might say that market is underway to deeper upward retracement. Still it seems logical and natural, until it will break 1.35-1.3650 K-resistance area. If this will happen - it will be bullish sign.

Weekly

Analysis of this time frame does not look complex on current week. Trend holds bullish, market is not at overbought condition. Right above the market 1.3505-1.3625 K-resistance area and Agreement with AB-CD target 1.3687. Also pay attention that previous swing low stands at the same area – this will add resistance to it.

Speaking about trend line – I’ve drawn it in this way. You probably will draw it a bit different if apply just two most recent points. In this case it will be slightly steeper. Nevertheless it also stands in the same area and also will be resistance.

In general, weekly analysis tells us to be careful on daily time frame, when market will step above 1.35. This is resistance zone and some reversal patterns and retracements could appear on daily time frame.

And the last one here – although I do not have monthly pivot R1 on this chart, market now stands above it. This points on the fact, that although overall bearish trend has not been broken yet, still market could show at least deeper retracement up.

There is also another Agreement exists at 1.4050-1.4120 area, but it stands beyond overbought level that’s why not important for us currently. But if switch on imagination – reaching of it could lead to reverse H&S pattern…

Daily

Trend is strongly bullish, market is approaching to weekly K-resistance area. Level of overbought for Monday stands at 1.3570. Also we can see 1.3550 is 1.618 extension of previous retracement down. Since market stands very close to resistance area, this is not very good idea to enter long right here – in the middle of upward move and near resistance. Although probably market will proceed higher, it’s better to buy deep to enter Long.

At the same time, since all trends are bullish, and market not at oversold, this retracement should not be too deep. I prefer to see support at 1.3292-1.3325 area – nearest daily Fib support and previous high. Also, this is very close to pivot point - 1.3377. Next target after retracement probably will be 1.3670 – daily AB=CD target.

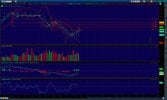

4-hour

Trend is bullish. Market shows nice thrust up, that will be perfect for DRPO or B&B pattern, if they will appear of cause. The odds exist that they will, because right above the market stand: 1.3505 Fib resistance, 1.3541 1.618 extension of daily retracement, 13570 weekly pivot R1 and overbought. May be market will continue move up a bit, but logically market should start retracement sooner rather than later and somehow respect this strong area. If you trade intraday you may use this respect and enter short, if you trade on daily time frame – use it to enter long.

On hourly chart I do not see any significant moments that allow us to make valuable add-on.

Conclusion:

Combination of monthly bearish trend and bullish sentiment on lower time frames points on deeper upward retracement to 1.35-1.37 area. At the same time this area is significant beacon, because bearish sentiment does not suggest it’s break, since market just has reached 0.618 AB-CD target on monthly. If it will happen this will be quite another tune.

On daily time frame trend is strongly bullish, but market is approaching to solid resistance level, so may be it will be better idea to buy some deep when it will appear. Since market is not at overbought at weekly, 1.33 area looks suitable for that purpose.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.