Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Fundamentals

This week, folks, we've got few important factors that mostly are long-term and should make long lasting effect on the markets. Currently world stands in difficult times and some news that could be decisive just recently - now are totally ignored as market and investors watch only for global events. For example, this week GBP shows good PMI numbers and US reports on positive real estate statistics. But all these numbers barely were signed when they were released. Now world have more important problems - virus spreading, political tensions, central banks action and major decisions of world leaders. This week is not an exception - new records of virus spreading, historical EU summit decision and difficult political situation are among those that make impact the most on the markets this week. Gold this week also shines but we talk about it tomorrow in our special Gold report.

COVID situation

We probably should start with virus situation as now it is obvious that news agencies start to prepare world to relapse and 2nd wave of panemic. People day by day hear about worsen situation in US and Latin America, especially Brazil. But now new signals come from the Europe - Austria and France tight migration and virus controlling, in Spain additional measures of limitations applied to restaurants and public entertainment places. The dry statistics shows worrying picture:

Almost 40 countries have reported record single-day increases in coronavirus infections over the past week, around double the number that did so the previous week, according to a Reuters tally showing a pick-up in the pandemic in every region of the world. The rate of cases has been increasing not only in countries like the United States, Brazil and India, which have dominated global headlines with large outbreaks, but in Australia, Japan, Hong Kong, Bolivia, Sudan, Ethiopia, Bulgaria, Belgium, Uzbekistan and Israel, among others.

Many countries, especially those where officials eased earlier social distancing lockdowns, are experiencing a second peak more than a month after recording their first.

“We will not be going back to the ‘old normal’. The pandemic has already changed the way we live our lives,” World Health Organization (WHO) Director-General Tedros Adhanom Ghebreyesus said this week. “We’re asking everyone to treat the decisions about where they go, what they do and who they meet with as life-and-death decisions – because they are.”

The number of new global COVID-19 cases continues to rise, driven by the countries highlighted in the second chart below. Combined, these ten countries account for almost 80% of new daily infections, which were up by 231,000 per day on average over the last week. The US continues to account for the bulk of these, with Florida, Texas and California all reporting over 9000 new infections yesterday, prompting Donald Trump to state that it will “get worse before it gets better”.

The Reuters data, compiled from official reports, shows a steady rise in the number of countries reporting record daily increases in the virus that causes COVID-19 over the past month. At least seven countries recorded such increases three weeks ago, rising to at least 13 countries two weeks ago to at least 20 countries last week and to 37 countries this week. The true numbers of both cases and deaths are almost certainly underreported, particularly in countries with poorer health care systems, health experts and officials say. For this report, the Reuters data was restricted to countries that provide regular daily numbers.

A surge in cases usually precedes a rise in deaths by a couple of weeks.

The United States remains at the top of the case list, this week passing more than 4 million cases and recording more than 1,000 deaths for four consecutive days. Brazil and India - which epidemiologists say is still likely months from hitting its peak - have also exceeded 1 million cases.

The data reveals a growing number of resurgent cases in countries across all regions.

In Australia, officials enforced a six-week partial lockdown and made face masks mandatory for residents in the country’s second-largest city, Melbourne, after a fresh outbreak. Australia and Japan, which also posted a daily case record this week, both warned of a rise in infections among young people, many of whom celebrated the end of social restrictions at bars and parties.

In Mexico, which also posted a daily record this week and has the fourth-highest death toll of any country, officials warned that a downward trend in case numbers that began in mid-June - about the time the city began relaxing social distancing measures - could reverse.Based on the rate of hospital admissions over the past week, Mexico City Mayor Claudia Sheinbaum said, hospitalisation levels by October could exceed those registered in June, the height of the pandemic.

“It is important to recognise that if we do not change the trend, there could be exponential growth,” she said.

In Europe, where the summer vacation season is in full swing, a new daily record figure in Spain is likely to deter tourists from visiting one of the continent’s most popular destinations.

In Africa, Kenya recorded a record high daily case number less than two weeks after reopening activity, including domestic passenger flights. President Uhuru Kenyatta, who had announced international flights would resume on Aug. 1, has summoned officials to an emergency meeting on Monday to discuss the surge in cases.

In the Middle East, Oman imposed new restrictions that begin on Saturday in addition to a two-week lockdown that will overlap the Islamic feast of Eid al-Adha after reporting a record number of cases.

EU Summit historical decision

The euro on Tuesday scaled to its highest against the U.S. dollar since January 2019, after European Union countries reached an accord on a massive stimulus plan to revive their economies that have been mired in a coronvirus-induced slump.

The EU deal - a compromise on concerns that states considered to be frugal such as the Netherlands, Austria and Sweden, had about aid for more their more profligate neighbors - was hailed as an important signal of unity by Europe’s leaders and a foundation for economic recovery but also revealed potential fractures that could inhibit any future deals.

“It’s an important fact they finally got around to doing it, they got everybody on board with it. It’s less than I certainly thought they would do so its effect on the euro is going to be limited,” said Joseph Trevisani, senior analyst at FXStreet.com.

ING analysts said they are looking for “more gains to $1.20 later this year” as dollar weakness kicks in because the recovery fund agreement is significant enough “not to prompt investors to exit their long euro positions,” particularly against the dollar, where the outlook has darkened for the rest of the year.

Political tensions

China’s foreign ministry told the U.S. embassy early on Friday to close its consulate in the city of Chengdu, after Washington ordered the closure of the Chinese consulate in Houston, which U.S. officials called on Friday “one of the worst offenders in terms of Chinese espionage in the United States.”

“Typically when we would be entering into more of a risk- averse posture, the dollar would strengthen,” said Shannon Saccocia, CIO at Boston Private Wealth. But because the United States has managed the coronavirus pandemic worse than Europe or China, “it seems like there is more promise outside of the United States.

“I think we’re going to continue to see pressure on the dollar” as expectations of a steadier return to growth diverge between the United States and the rest of the world, Saccocia said.

Sino-U.S. ties have deteriorated over issues ranging from the COVD-19 pandemic, which began in China, to Beijing trade and business practices, its territorial claims in the South China Sea and its clamp-down on Hong Kong.

Markets have been relieved that so far China and the United State have not abandoned their trade deal, but they are beginning to view that as a real risk.

The dollar posted its biggest weekly decline in almost four months against a basket of currencies and also saw its largest weekly percentage loss against a surging euro since late March.

“The first key thing is the Fed has knocked real rates down into negative territory, you have economic growth differentials turning against the U.S., so essentially the second wave of coronavirus infections is lowering activity across the states and is weighing on the likelihood of a rebound,” said Karl Schamotta, chief market strategist at Cambridge Global Payments. “At the same time you have relatively positive signs elsewhere in the global economy.

Senate Majority Leader Mitch McConnell said on Thursday that U.S. Senate Republicans will unveil their proposal next week for a new round of coronavirus aid, including more direct payments to Americans and a partial extension of enhanced unemployment benefits. He added that the administration has requested additional time to review the fine details of the proposal.

U.S. unemployment benefits expire next week and without the extension of those benefits, millions of unemployed Americans would struggle massively. U.S. House Speaker Nancy Pelosi said on Friday she was not considering a temporary extension to enhanced unemployment benefits.

CFTC Data

EUR net position stands positive, shows good dynamic according to recent COT report, showing growth as in net position as in open interest. This confirms existing of positive sentiment on EUR. As overall position is still far from top level here we do not see any source of resistance for the market. Now position hits 125K contracts while the historical top stands around 150K. Open interest jumps this week for 40K+ contracts, indicating strong interest to EUR. Speculators in general added 17K contracts by adding new longs and closing shorts at one time.

The bottom line

Analysts mostly keep valid "V" shape recovery scenario as statistics indeed confirms improvements in global economy and developed countries in particular, despite difficult situation in US with virus spreading. Thus, Fathom tells -

Our central scenario remains, by a narrow margin, a broadly V-shaped recovery for the world as a whole, with global output returning to pre-COVID levels around the middle of next year. Recovery paths will, of course, vary substantially across countries. The level of fiscal support will be important, but so too will the degree of confidence among individuals that it is safe to return to familiar, yet potentially risky activities, such as eating out.

Still, as we're mostly interested in specific currencies but not the things "in common", we should take careful look at EUR/USD. Speaking on EUR - recent summit decision is very positive and should keep effect for a few weeks or even months probably, depending what will happen in US. But now we think that it is crucial that ECB has to follow in the footsteps of EU leaders. As they have made efforts and come to historical agreement as ECB has to make an effort an announce strong supportive measures to EU economy. If ECB fails to provide this, EU decision effect starts to fade.

Besides, next week we get Fed meeting and a lot of questions stand on the table, especially concerning providing of new stimulus and prolongation of existed ones, especially in job sphere. Aggressive Fed steps and anemic ECB behavior could become the headwind for EUR/USD. We still keep our view that EU has to act aggressively in the sphere of global finance, significantly increasing the EUR role in global economy. Now they have very good time moment for that as US is stuck with their domestic problems including President run, social unrest and worse virus situation.

Finally, it seems that at some degree but we meet the relapse of pandemic. It is clear that news agencies starts to zombify the population again. More and more time takes by COVID news. We treat it as gradual preparation to announcing of 2nd wave of panemic and limitations across the board. Gold rally is additional confirmation of that.

What to watch on next week

The euro suddenly looks unstoppable, hitting 21-month highs above $1.16 after the European Union set aside differences and agreed a COVID-19 recovery fund. This signal of solidarity, combined with monetary and budget stimulus, could propel the currency to $1.20, some predict.

The optimism should take the sting out of upcoming German and euro zone second-quarter gross domestic product data, expected to show steep contractions amid the coronavirus hit. In nominal trade-weighted terms, the euro is now above 2018 peaks. If exports take a hit, euro strength won’t sit well with policymakers.

#2

U.S. diplomats are clearing out of the Chengdu consulate after their Chinese counterparts were ordered to quit Texas in the latest round of tensions. Markets sold the moves, but not too much because nobody’s mentioned tariffs.Yet caution is warranted. This represents a big push towards de-coupling with Mike Pompeo saying the “old paradigm of blind engagement” is done. Currency markets are advising care; the yuan had its steepest three-day selloff since late March and the U.S. dollar is tanking for the fourth straight week.

#3

After slashing interest rates to near zero and engaging in huge asset buying, the U.S. Federal Reserve will probably sit on its hands at the July 28-29 meeting.

Markets are seeking clues on its next move. The Fed doesn’t seem keen on yield curve control or negative interest rates. But if it wants to rely on asset purchases and forward guidance only, it might eventually need to expand QE, Fedwatchers reckon. Also, this QE programme has spread purchases of Treasuries pretty evenly across the curve, while the last two rounds focused on the long end. Many predict the Fed will opt to up purchases in the 20- to 30-year bracket; that will keep in check the term premium - the extra return earned from holding long-term bonds.

Yet Fed Governor Lael Brainard recently mentioned the "thick fog of uncertainty" surrounding the U.S. economy. So for now, the Fed might just wait for that fog to dissipate.

Technicals

Monthly

As we've said last week - "Technical picture on monthly chart suggests positive result of EU summit on rescue fund approvement". And that has happened. We suggest that this factor, in addition to other ones could provide long lasting effect on EUR. Even rough approximation suggests that market could reach 1.20-1.23 area. The same was mentioned above by other analysts as well. Besides, large grabber ultimately suggests action above 1.26 in long-term perspective, although now it seems unbelievable. I'm not an expert in EW, and lets professionals correct me, but it looks like 3rd wave up has started which should become the major swing in upside tendency. Theoretically it should be significantly in excess of "B" point"

Now market shows good bullish signs - the doji range is broken up and price stands above YPR1 that indicates new upside trend but not retracement to existing bearish tendency. Monthly overbought area stands far from here and provides room for more upside action.

Weekly

Weekly chart shows over-extension to the upside as EUR hits overbought level. Besides current swing up is a first one after long-term downside tendency, which means that we have reversal swing. On a way up next resistance is 1.1875, but it is too far to this level now. Technical picture tells about strong bullish context but at the same time suggests technical retracement due mentioned reasons.

Broken K-area and previous top could become excellent levels to watch for position taking. If, of course, EUR will reach it.

Daily

Here EUR has passed through our targets around 1.1590 area and keep moving forward. Thus we have to appoint new potential destinations. Here we follow to classic rules to not draw butterfly at the bottom and use on extensions of big drop. As you can see, 1.27 extension stands around 1.2728, while 1.618 matches monthly COP target at 1.20.

Weekly overbought is not a strict price level and lets market to fluctuate around. Thus, EUR could reach 1.2730. Then supposedly some retracement should start here. I prefer to see price able to stay above 1.1450 area - broken weekly K-support and previous EUR top. Besides, here we could use the value of harmonic swing retracement that EUR keeps well in recent action. I would suggest that it should be 0.5-1 of harmonic swing pullback. Hardly it will be X 1.5 because now we stand not after strong sell-off and not in the beginning of upside action, but on the run already.

Intraday

Here is, I think, we could focus on these support levels. Now it seems that they do not match to harmonic swings as they point on deeper retracement. But do not forget that EUR could climb slightly higher before retracement will start. In this case they perfectly will match to broken weekly levels. Even now they more or less agrees with intraday levels. There we consider long entry as soon as retracement will happen.

This week, folks, we've got few important factors that mostly are long-term and should make long lasting effect on the markets. Currently world stands in difficult times and some news that could be decisive just recently - now are totally ignored as market and investors watch only for global events. For example, this week GBP shows good PMI numbers and US reports on positive real estate statistics. But all these numbers barely were signed when they were released. Now world have more important problems - virus spreading, political tensions, central banks action and major decisions of world leaders. This week is not an exception - new records of virus spreading, historical EU summit decision and difficult political situation are among those that make impact the most on the markets this week. Gold this week also shines but we talk about it tomorrow in our special Gold report.

COVID situation

We probably should start with virus situation as now it is obvious that news agencies start to prepare world to relapse and 2nd wave of panemic. People day by day hear about worsen situation in US and Latin America, especially Brazil. But now new signals come from the Europe - Austria and France tight migration and virus controlling, in Spain additional measures of limitations applied to restaurants and public entertainment places. The dry statistics shows worrying picture:

Almost 40 countries have reported record single-day increases in coronavirus infections over the past week, around double the number that did so the previous week, according to a Reuters tally showing a pick-up in the pandemic in every region of the world. The rate of cases has been increasing not only in countries like the United States, Brazil and India, which have dominated global headlines with large outbreaks, but in Australia, Japan, Hong Kong, Bolivia, Sudan, Ethiopia, Bulgaria, Belgium, Uzbekistan and Israel, among others.

Many countries, especially those where officials eased earlier social distancing lockdowns, are experiencing a second peak more than a month after recording their first.

“We will not be going back to the ‘old normal’. The pandemic has already changed the way we live our lives,” World Health Organization (WHO) Director-General Tedros Adhanom Ghebreyesus said this week. “We’re asking everyone to treat the decisions about where they go, what they do and who they meet with as life-and-death decisions – because they are.”

The number of new global COVID-19 cases continues to rise, driven by the countries highlighted in the second chart below. Combined, these ten countries account for almost 80% of new daily infections, which were up by 231,000 per day on average over the last week. The US continues to account for the bulk of these, with Florida, Texas and California all reporting over 9000 new infections yesterday, prompting Donald Trump to state that it will “get worse before it gets better”.

The Reuters data, compiled from official reports, shows a steady rise in the number of countries reporting record daily increases in the virus that causes COVID-19 over the past month. At least seven countries recorded such increases three weeks ago, rising to at least 13 countries two weeks ago to at least 20 countries last week and to 37 countries this week. The true numbers of both cases and deaths are almost certainly underreported, particularly in countries with poorer health care systems, health experts and officials say. For this report, the Reuters data was restricted to countries that provide regular daily numbers.

A surge in cases usually precedes a rise in deaths by a couple of weeks.

The United States remains at the top of the case list, this week passing more than 4 million cases and recording more than 1,000 deaths for four consecutive days. Brazil and India - which epidemiologists say is still likely months from hitting its peak - have also exceeded 1 million cases.

The data reveals a growing number of resurgent cases in countries across all regions.

In Australia, officials enforced a six-week partial lockdown and made face masks mandatory for residents in the country’s second-largest city, Melbourne, after a fresh outbreak. Australia and Japan, which also posted a daily case record this week, both warned of a rise in infections among young people, many of whom celebrated the end of social restrictions at bars and parties.

In Mexico, which also posted a daily record this week and has the fourth-highest death toll of any country, officials warned that a downward trend in case numbers that began in mid-June - about the time the city began relaxing social distancing measures - could reverse.Based on the rate of hospital admissions over the past week, Mexico City Mayor Claudia Sheinbaum said, hospitalisation levels by October could exceed those registered in June, the height of the pandemic.

“It is important to recognise that if we do not change the trend, there could be exponential growth,” she said.

In Europe, where the summer vacation season is in full swing, a new daily record figure in Spain is likely to deter tourists from visiting one of the continent’s most popular destinations.

In Africa, Kenya recorded a record high daily case number less than two weeks after reopening activity, including domestic passenger flights. President Uhuru Kenyatta, who had announced international flights would resume on Aug. 1, has summoned officials to an emergency meeting on Monday to discuss the surge in cases.

In the Middle East, Oman imposed new restrictions that begin on Saturday in addition to a two-week lockdown that will overlap the Islamic feast of Eid al-Adha after reporting a record number of cases.

EU Summit historical decision

The euro on Tuesday scaled to its highest against the U.S. dollar since January 2019, after European Union countries reached an accord on a massive stimulus plan to revive their economies that have been mired in a coronvirus-induced slump.

The EU deal - a compromise on concerns that states considered to be frugal such as the Netherlands, Austria and Sweden, had about aid for more their more profligate neighbors - was hailed as an important signal of unity by Europe’s leaders and a foundation for economic recovery but also revealed potential fractures that could inhibit any future deals.

“It’s an important fact they finally got around to doing it, they got everybody on board with it. It’s less than I certainly thought they would do so its effect on the euro is going to be limited,” said Joseph Trevisani, senior analyst at FXStreet.com.

ING analysts said they are looking for “more gains to $1.20 later this year” as dollar weakness kicks in because the recovery fund agreement is significant enough “not to prompt investors to exit their long euro positions,” particularly against the dollar, where the outlook has darkened for the rest of the year.

Political tensions

China’s foreign ministry told the U.S. embassy early on Friday to close its consulate in the city of Chengdu, after Washington ordered the closure of the Chinese consulate in Houston, which U.S. officials called on Friday “one of the worst offenders in terms of Chinese espionage in the United States.”

“Typically when we would be entering into more of a risk- averse posture, the dollar would strengthen,” said Shannon Saccocia, CIO at Boston Private Wealth. But because the United States has managed the coronavirus pandemic worse than Europe or China, “it seems like there is more promise outside of the United States.

“I think we’re going to continue to see pressure on the dollar” as expectations of a steadier return to growth diverge between the United States and the rest of the world, Saccocia said.

Sino-U.S. ties have deteriorated over issues ranging from the COVD-19 pandemic, which began in China, to Beijing trade and business practices, its territorial claims in the South China Sea and its clamp-down on Hong Kong.

Markets have been relieved that so far China and the United State have not abandoned their trade deal, but they are beginning to view that as a real risk.

The dollar posted its biggest weekly decline in almost four months against a basket of currencies and also saw its largest weekly percentage loss against a surging euro since late March.

“The first key thing is the Fed has knocked real rates down into negative territory, you have economic growth differentials turning against the U.S., so essentially the second wave of coronavirus infections is lowering activity across the states and is weighing on the likelihood of a rebound,” said Karl Schamotta, chief market strategist at Cambridge Global Payments. “At the same time you have relatively positive signs elsewhere in the global economy.

Senate Majority Leader Mitch McConnell said on Thursday that U.S. Senate Republicans will unveil their proposal next week for a new round of coronavirus aid, including more direct payments to Americans and a partial extension of enhanced unemployment benefits. He added that the administration has requested additional time to review the fine details of the proposal.

U.S. unemployment benefits expire next week and without the extension of those benefits, millions of unemployed Americans would struggle massively. U.S. House Speaker Nancy Pelosi said on Friday she was not considering a temporary extension to enhanced unemployment benefits.

CFTC Data

EUR net position stands positive, shows good dynamic according to recent COT report, showing growth as in net position as in open interest. This confirms existing of positive sentiment on EUR. As overall position is still far from top level here we do not see any source of resistance for the market. Now position hits 125K contracts while the historical top stands around 150K. Open interest jumps this week for 40K+ contracts, indicating strong interest to EUR. Speculators in general added 17K contracts by adding new longs and closing shorts at one time.

The bottom line

Analysts mostly keep valid "V" shape recovery scenario as statistics indeed confirms improvements in global economy and developed countries in particular, despite difficult situation in US with virus spreading. Thus, Fathom tells -

Our central scenario remains, by a narrow margin, a broadly V-shaped recovery for the world as a whole, with global output returning to pre-COVID levels around the middle of next year. Recovery paths will, of course, vary substantially across countries. The level of fiscal support will be important, but so too will the degree of confidence among individuals that it is safe to return to familiar, yet potentially risky activities, such as eating out.

Still, as we're mostly interested in specific currencies but not the things "in common", we should take careful look at EUR/USD. Speaking on EUR - recent summit decision is very positive and should keep effect for a few weeks or even months probably, depending what will happen in US. But now we think that it is crucial that ECB has to follow in the footsteps of EU leaders. As they have made efforts and come to historical agreement as ECB has to make an effort an announce strong supportive measures to EU economy. If ECB fails to provide this, EU decision effect starts to fade.

Besides, next week we get Fed meeting and a lot of questions stand on the table, especially concerning providing of new stimulus and prolongation of existed ones, especially in job sphere. Aggressive Fed steps and anemic ECB behavior could become the headwind for EUR/USD. We still keep our view that EU has to act aggressively in the sphere of global finance, significantly increasing the EUR role in global economy. Now they have very good time moment for that as US is stuck with their domestic problems including President run, social unrest and worse virus situation.

Finally, it seems that at some degree but we meet the relapse of pandemic. It is clear that news agencies starts to zombify the population again. More and more time takes by COVID news. We treat it as gradual preparation to announcing of 2nd wave of panemic and limitations across the board. Gold rally is additional confirmation of that.

What to watch on next week

The euro suddenly looks unstoppable, hitting 21-month highs above $1.16 after the European Union set aside differences and agreed a COVID-19 recovery fund. This signal of solidarity, combined with monetary and budget stimulus, could propel the currency to $1.20, some predict.

The optimism should take the sting out of upcoming German and euro zone second-quarter gross domestic product data, expected to show steep contractions amid the coronavirus hit. In nominal trade-weighted terms, the euro is now above 2018 peaks. If exports take a hit, euro strength won’t sit well with policymakers.

#2

U.S. diplomats are clearing out of the Chengdu consulate after their Chinese counterparts were ordered to quit Texas in the latest round of tensions. Markets sold the moves, but not too much because nobody’s mentioned tariffs.Yet caution is warranted. This represents a big push towards de-coupling with Mike Pompeo saying the “old paradigm of blind engagement” is done. Currency markets are advising care; the yuan had its steepest three-day selloff since late March and the U.S. dollar is tanking for the fourth straight week.

#3

After slashing interest rates to near zero and engaging in huge asset buying, the U.S. Federal Reserve will probably sit on its hands at the July 28-29 meeting.

Markets are seeking clues on its next move. The Fed doesn’t seem keen on yield curve control or negative interest rates. But if it wants to rely on asset purchases and forward guidance only, it might eventually need to expand QE, Fedwatchers reckon. Also, this QE programme has spread purchases of Treasuries pretty evenly across the curve, while the last two rounds focused on the long end. Many predict the Fed will opt to up purchases in the 20- to 30-year bracket; that will keep in check the term premium - the extra return earned from holding long-term bonds.

Yet Fed Governor Lael Brainard recently mentioned the "thick fog of uncertainty" surrounding the U.S. economy. So for now, the Fed might just wait for that fog to dissipate.

Technicals

Monthly

As we've said last week - "Technical picture on monthly chart suggests positive result of EU summit on rescue fund approvement". And that has happened. We suggest that this factor, in addition to other ones could provide long lasting effect on EUR. Even rough approximation suggests that market could reach 1.20-1.23 area. The same was mentioned above by other analysts as well. Besides, large grabber ultimately suggests action above 1.26 in long-term perspective, although now it seems unbelievable. I'm not an expert in EW, and lets professionals correct me, but it looks like 3rd wave up has started which should become the major swing in upside tendency. Theoretically it should be significantly in excess of "B" point"

Now market shows good bullish signs - the doji range is broken up and price stands above YPR1 that indicates new upside trend but not retracement to existing bearish tendency. Monthly overbought area stands far from here and provides room for more upside action.

Weekly

Weekly chart shows over-extension to the upside as EUR hits overbought level. Besides current swing up is a first one after long-term downside tendency, which means that we have reversal swing. On a way up next resistance is 1.1875, but it is too far to this level now. Technical picture tells about strong bullish context but at the same time suggests technical retracement due mentioned reasons.

Broken K-area and previous top could become excellent levels to watch for position taking. If, of course, EUR will reach it.

Daily

Here EUR has passed through our targets around 1.1590 area and keep moving forward. Thus we have to appoint new potential destinations. Here we follow to classic rules to not draw butterfly at the bottom and use on extensions of big drop. As you can see, 1.27 extension stands around 1.2728, while 1.618 matches monthly COP target at 1.20.

Weekly overbought is not a strict price level and lets market to fluctuate around. Thus, EUR could reach 1.2730. Then supposedly some retracement should start here. I prefer to see price able to stay above 1.1450 area - broken weekly K-support and previous EUR top. Besides, here we could use the value of harmonic swing retracement that EUR keeps well in recent action. I would suggest that it should be 0.5-1 of harmonic swing pullback. Hardly it will be X 1.5 because now we stand not after strong sell-off and not in the beginning of upside action, but on the run already.

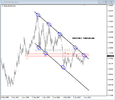

Intraday

Here is, I think, we could focus on these support levels. Now it seems that they do not match to harmonic swings as they point on deeper retracement. But do not forget that EUR could climb slightly higher before retracement will start. In this case they perfectly will match to broken weekly levels. Even now they more or less agrees with intraday levels. There we consider long entry as soon as retracement will happen.