- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FOREX PRO Weekly June 17-21, 2013

- Thread starter Sive Morten

- Start date

Triantus Shango

Sergeant Major

- Messages

- 1,371

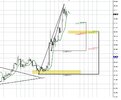

i wouldn't be so sure. we only have 100 pips or so to go on daily to get a gartley SELL at 78.6%, initially since of course it could turn into a butterfly or bat or whatever the f$*k you wanna call it. RSST R2 is in the vicinity of that level as well where also the gartley's AB=CD structure 127.2% projection (XOP) is.

so even though on my daily chart everything is signaling we are entering extreme OB territory , that is not the case on the weekly, H1, and H4 charts. so i believe it is quite possible market will push up and complete this gartley and only then reverse seeing as there is still plenty of room to the upside.

watch what happens between 3428 and 3515, R1 and R2 pivots respectively. they coincide with key fib retracement and extension/projection level and also mark a potential gartley like structure completion zone.

and of course, above 3515 until 3680 or so, we have a K-area on weekly.

my advice, take it or leave it, and of course i could be TOTALLY WRONG, is to drop down to the M3 chart, look for BUY signals for a quick scalp towards those end points mentioned above. then if that turns out not to be a trend continuation, but exhaustion, get out, and look for SELL opportunities at around the key levels.

but, i don't know, there is a weird feeling to this structure on daily. the uptrend that followed the smaller embedded gartley BUY on daily is hitting all the terminal points or getting closer to them. but on M3 and M5, we seem poised for some more upside movement. my indicators are not flat or mid-range at all, but in the lower end of an extreme from where they usually bounce to the other upper-end.

let's check the economic calendar. i vaguely remember something important is supposed to be released. f*#K! draghi is speaking at 6.00 GMT. that's in 2 1/2 hours. after that, the ZEW index and the US releases. oh i see. tomorrow WED is the big day. everyone is waiting i guess. mmhh... perhaps better to sit on one's hands after all.

so even though on my daily chart everything is signaling we are entering extreme OB territory , that is not the case on the weekly, H1, and H4 charts. so i believe it is quite possible market will push up and complete this gartley and only then reverse seeing as there is still plenty of room to the upside.

watch what happens between 3428 and 3515, R1 and R2 pivots respectively. they coincide with key fib retracement and extension/projection level and also mark a potential gartley like structure completion zone.

and of course, above 3515 until 3680 or so, we have a K-area on weekly.

my advice, take it or leave it, and of course i could be TOTALLY WRONG, is to drop down to the M3 chart, look for BUY signals for a quick scalp towards those end points mentioned above. then if that turns out not to be a trend continuation, but exhaustion, get out, and look for SELL opportunities at around the key levels.

but, i don't know, there is a weird feeling to this structure on daily. the uptrend that followed the smaller embedded gartley BUY on daily is hitting all the terminal points or getting closer to them. but on M3 and M5, we seem poised for some more upside movement. my indicators are not flat or mid-range at all, but in the lower end of an extreme from where they usually bounce to the other upper-end.

let's check the economic calendar. i vaguely remember something important is supposed to be released. f*#K! draghi is speaking at 6.00 GMT. that's in 2 1/2 hours. after that, the ZEW index and the US releases. oh i see. tomorrow WED is the big day. everyone is waiting i guess. mmhh... perhaps better to sit on one's hands after all.

maybe tomorrow we can get a breakout (probably to the downside). Let's see what's going to happen.

Last edited:

Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Hey Sive,

Just wanted to give you a huge thanks for informing us about B&B pattern on USD/JPY. I honestly usually just focus on EUR/USD so I rarely see other patterns on other pairs.

Thanks for informing us.

Take care.

Best,

Brandon

No problem, Brandon, you're welcome. That's, in fact, my job here. It very often makes sense, since you may find excellent setups on different majors.

From the other side - it's better to be focused on 3-4 pairs as maximum, at least initially. Otherwise it could take a long time to catch the breath of each pair.

Thanks for this and for all your hard work. I think this format is great as there are some interesting moments in different pairs like USDJPY EURUSD or even AUDUSD. In my humble opinion works better to find good opportunities in whatever pairs than having to wait for something to happen in one specific pair...cause sometimes the wait can be very long while there is a lot of stuff going on elsewhere. This has got to do with the psychological side of trading as well because waiting too long might make ppl do more mistakes like not trading only the high probability setups and settling for something less than that.

Thanks again and have a great day.

Thanks again and have a great day.

S.chakrabortty2011

Private, 1st Class

- Messages

- 60

Lolly Tripathy

Sergeant Major

- Messages

- 515

Similar threads

- Replies

- 7

- Views

- 237

- Replies

- 11

- Views

- 259

- Replies

- 14

- Views

- 292

- Replies

- 5

- Views

- 216

- Replies

- 17

- Views

- 304

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video