Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Hi Sive,

Do you remember, last week I asked you a few naive questions about acronyms you use (WPP, WPR1, etc.). You've pointed me out the FPA Forex Military School. So, I went to the School and have done my homework. I've read only two chapters (10 and 15) and I'm amazed how much they explained to me. You can believe or not, but before you have posted this analysis I 've drawn "my own" MPP, MPR1, MPS1, WPP, WPR1 and WPS1 and I've planned my trade for next week. The plan is:

1) Don't trade in Monday according to Greece elections,

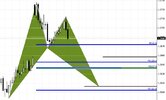

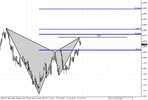

2) Wait for retracement to WPP (1.2582),

3) Put BUY STOP order at 1.2615 with SL@1.2580 and TP@1.2715 (just bellow WPR1=1.2722).

You Can't even imagine how proud of myself I was reading your analysis

Thank you for FPA Forex Military School. It's really big deal. It's the most comprehensible material concerning FX I've ever read. Even that english isn't my mother tongue. I've add FPA Forex Military School to my Favorities and I gona read it throughout.

I'd be really grateful for any comments to my plan.

Hi Marky,

This is great that FPA work appears useful to you. In general your plan is correct, but better do not do it blindly. We still need one more puzzle part - price action on Monday morning. When we will see it, it will become clear - is our plan is still valid or not.