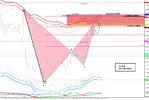

The Euro has turned lower from just above the idealized target for wave c at 1.2412 where it traveled 2.000 times wave a. We have a comlpete ABC seuence up to this level where prices also has reached the upper boundary of our green retracement zone (78% retracement).

A dip below 1.2384 will offer the first piece of evidence that the Euro might have peaked at 1.2412. Breaching 1.2345 and taking out the lower boundary of our green channel will confirm circle b has peaked.

Keep an eye on 1.2384 and lower as long as 1.2412 holds as working resistance.

View attachment 36699