Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Fundamentals

Just few days ago we thought that CPI should become primary information this week, but banking crisis, although it has started last Friday but mostly was developing this week overshadows all other events. Probably we get lack of space here if we would try to discuss and describe all crisis details, but in fact, it is not needed. Thus, today we try to consider only major points and make some preliminary conclusions. For perfectionist we acknowledge that it is impossible to see now real depth of the crisis iceberg. I would suggest that even Fed doesn't know all nuances in the depth of banking system and what particular place will be come thin in nearest 2-3 weeks. Thus, we also do not dare to say that we know where crisis will lead us and what will be in the end. We do not know. Now it seems that Fed makes good driving of the crisis, managing its well, and could try to nip it in the bud, but it is too complicated process and surprises could come from you're not expected. Besides, we suggest that here we have the political background as well.

Before we start digging in banking crisis, let's take a look at recent statistics across the Globe. Although now it takes the backseat, but it is temporal, and very soon everybody will turn back and start to catch new released numbers. Based on recent data we could say that structural crisis stands underway and brings now surprises - everything goes as it should to. Industrial production, GDP, manufacturing, retail sales, real estate market are slowing down, while inflation either stands stubborn or rising. This week there are few charts, still that are especially interesting. First is - collapse of foreign investments in China, which has more political background of US-China confrontation. Also pay attention to US regional data - it clearly shows difficult times.

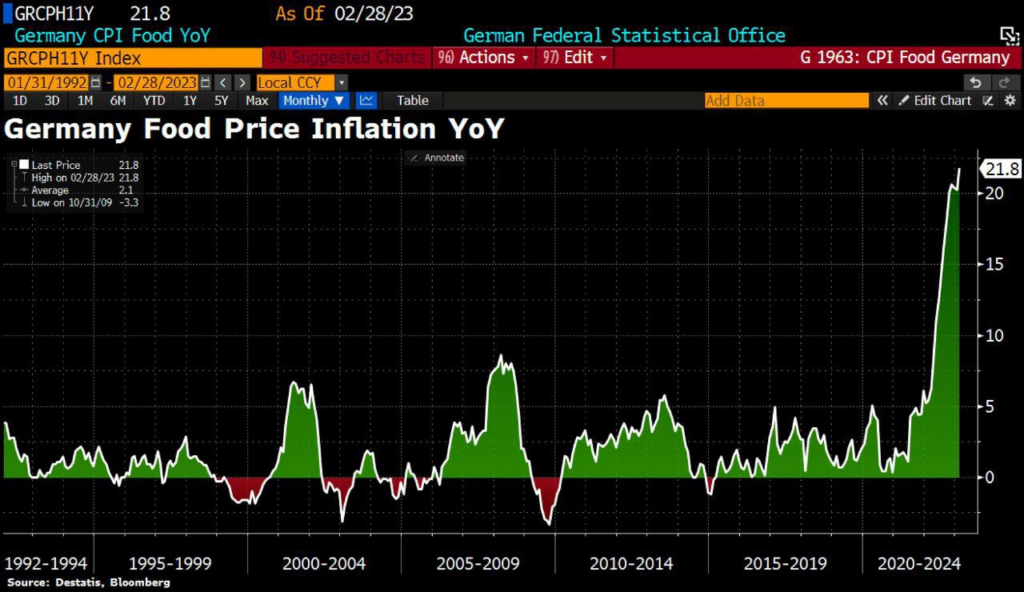

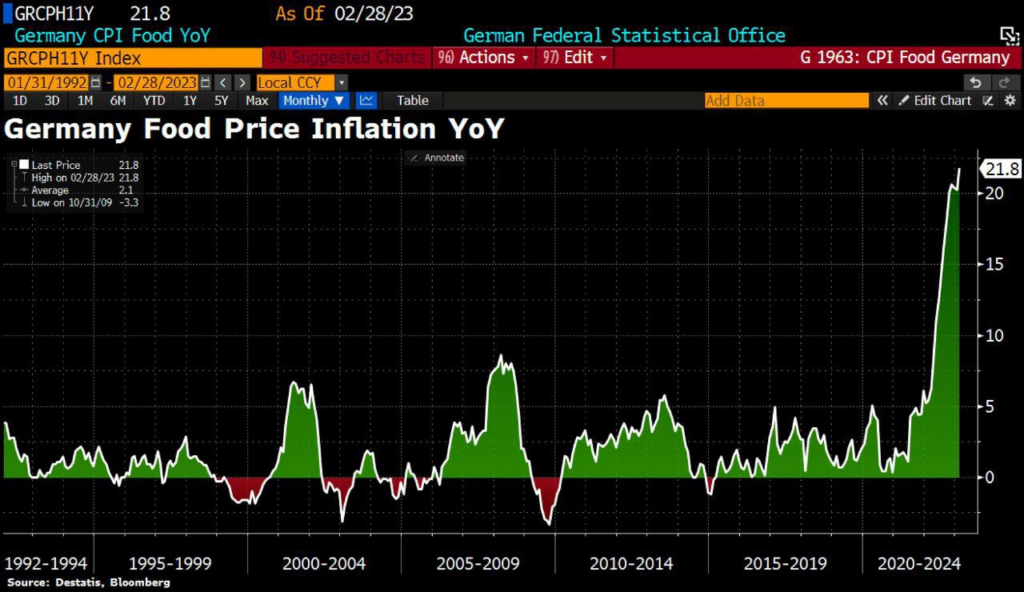

Core Inflation in EU remains high for all history of observations, while Retail Sales remains vulnerable and unstable. Here is also two charts that I would like to show you, because they are specific. First is the food inflation in Germany:

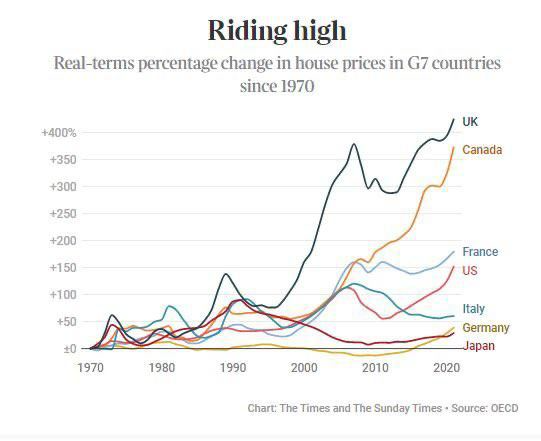

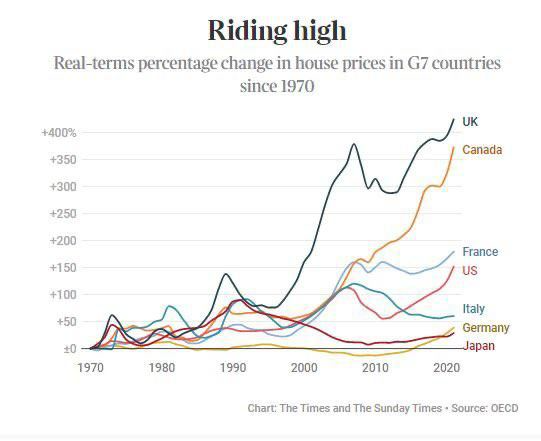

THe Real Estate prices across the Globe:

And most important - take a look at US PPI all Commodity index. This is our favorite index to watch that reflects inflation processes in production by all commodities while popular PPI has some weights on different components. So, our PPI shows strong deflationary process:

And there is an opinion that there may already be degradation mechanisms associated with the decline of industry, aggregate demand and aggregate sales.

Because if it would be the opposite - we should get opposite other numbers as well - growth of GDP, Retail Sales, PMI, ISM etc., that we do not see now. So, everything goes as it should, no drastic changes in major crisis trend by far.

THE US BANKING CRISIS

First is, let us to recommend you interesting article by Arthur Hayes. It is rather big, but it brings a lot of details on crisis and recent events. Also he makes forecasts. He is a big fan of crypto, so all his conclusions lead to idea - "spend fiat, by crypto". We have different opinion, Fed has initiated the crisis not to make crypto market happy. But this is off top and stands behind the scope of this report.

If we leave noise behind, here is what has happened this week:

Meanwhile, the "regional banking infection" has reached out to all sorts of dirty funds on derivatives.

Levinson's macro hedge fund Graticule will close after losses: this year the fund fell by more than 25%, most of the losses occurred after the collapse of the American SVB. Its rates tied to short-term bonds collapsed and erased multi-year profits, the people said, asking not to be named because the details are confidential. Why did this happen? It is enough to look at the chart of volatility of treasuries. The second largest jump in the bond market in the last 30+.

The term of BTFP is 1 year - Advances will be made available to eligible borrowers for a term of up to one year and can be requested under the Program until at least March 11, 2024. But with high degree of certainty it will be extended.

Just to give you some clarity on the value of BTFP (if banks put all available bonds in collateral) - Potentially, the Fed would print $4.189 trillion in response COVID. Right off the bat, the Fed implicitly printed $4.4 trillion with the implementation of BTFP. JPMorgan expects that $2 trillion worth of securities will be brought to the Fed (at face value), which in general is not at all excluded. US Treasury also has provided funds, but in less volume. Now its account in the Fed has dropped to 277 Bln:

The result of all these efforts is a big liquidity boost of all US banking system. Banks have got 400+ Bln and deposits returned back to ~ 3.5 Trln level. In total, the banks together with the reverse repo again have $5.87 trillion - the last time they had so much at the end of 2021... in a week, we disposed of all the QT for more than a year.

Fed will use BTFP at full throttle. It was worth a couple of banks to fall and the Fed is here again with fresh dollars ... "toughens it up." Let's see how J. will comment on all this stuff on next week. As WSJ writes - in a new study, economists said they found 186 banks that may be prone to similar SVB risks. For now we could say that Fed's initial 300 Bln "pump" is successful. Nothing personal - just business, great deal for the banks. You give the Fed securities at face value, which are traded actually with 20-30% loss, and you get a 4.3-4.5% cash for a year – then it's a matter of imagination and courage. It is a double deuce - your balance is cleared from unrealized loss and you get a profit from provided cash...Nice.

The unrealized loss on bonds that were issued in the dollar system amounts to $4.8 trillion based on the Fed's data in the Z1 report. This is the difference between the nominal value to maturity and the market value at the time of the cutoff. This is the first assessment of a hole in the financial system in the mass media. The difference between the market valuation of bonds in Q4 2020 and Q4 2022 is almost $ 7.6 trillion – this is a record negative change in the entire history of the debt market.

It is a question of time, when other G7 central banks will follow the Fed. ECB tries to resist by far, while BoJ was making no pause and keep QE for two years now. It is not surprising that total Balance sheet of three major banks is growing. Why you would have to think about anti-crisis plans, saving banking sector, cutting expenses etc. - print,dump pump and be happy. This is new slogan.

CRISIS WAS LAUNCHED INTENTIONALLY. MAJOR FED TARGETS ARE ACHIEVED

First of all, we have to recognize that in the US there are two sides of political elite - Industrial and Financial. The Fed reserve had ability to choose, whom it would like to join and recent events cleary shows that the Fed is a darling of Financial group fo elite. But maybe be they always were and now just becomes offensive, showing its side. Because, Fed was always gravitating to dovish policy. QT speed constantly was lagging behind planned size:

We suggest that the crisis was intentionally planned by US financial authorities - Fed, US Treasury and FDIC with involving of "top five" banks (JPM, Citi, GS, BoFA, Wells Fargo) and totally managed to desirable targets (see below). The actual closure of SVB bank was announced in the middle of the working day (!!!). Which, as it is clear, significantly spun the panic. In addition, many sources have become clearly hysterical, having, by and large, no objective grounds for panic. Well, on Sunday, everything became clear, since the Fed received the "go-ahead" from the political authorities to resume the money printing.

In fact, today we can safely say that there was no threat to the US financial system, and the panic was deliberately inflated in order to stop the tightening of monetary policy. As soon as the permission was received on Sunday, the panic was quickly closed. However, there are still some problems, the main of which is budgetary. Especially given the need to raise the debt limit, without which there is very little money left in the Treasury accounts.

As for the EU, the situation there is absolutely similar. The fact that Credit Suisse, Credit Lyon, and Deutsche Bank have been breathing hard has been known for a long time, this is not a surprise to anyone. But under the well-pitched panic, the Swiss Bank was allowed to allocate more than 50 billion francs to support Credit Suisse, similar decisions will be made for other banks.

Taking into account the fact that there was a meeting of the ECB last week, which raised the rate by 0.5%, it can be assumed that the EU monetary authorities decided to continue their policy, in which the rate rises, but they give money to banks. As for the real sector, it seems that he is recommended to move to other regions …

It should be noted that with SVB bankruptcy there were a lot of projects related to big pharma and green energy have also been written off. By the way, the bank's management, which has been withdrawing its own money from it for several months, is likely to end up in probe (and jail), which is also useful for easing social tensions. Still, major US banks also could have problems. But — not today, probably.

So, the US financial elite group, via the Fed, US Treasury and FDIC activity has reached following targets:

Should EUR rise in long term on the background of new US QE? Not necessary. EU has bigger banks' problem, higher inflation and lower rate (at least for now). They will start printing in the same manner as the Fed. Industrial sector leaves EU in favor of the US and other regions. Why EUR should start rising? Rock hard Fed guarantees could trigger demand for safe haven assets, making USD investments attractive again, and in conditions of global crisis exacerbating, hardly EUR will take the lead...

Just few days ago we thought that CPI should become primary information this week, but banking crisis, although it has started last Friday but mostly was developing this week overshadows all other events. Probably we get lack of space here if we would try to discuss and describe all crisis details, but in fact, it is not needed. Thus, today we try to consider only major points and make some preliminary conclusions. For perfectionist we acknowledge that it is impossible to see now real depth of the crisis iceberg. I would suggest that even Fed doesn't know all nuances in the depth of banking system and what particular place will be come thin in nearest 2-3 weeks. Thus, we also do not dare to say that we know where crisis will lead us and what will be in the end. We do not know. Now it seems that Fed makes good driving of the crisis, managing its well, and could try to nip it in the bud, but it is too complicated process and surprises could come from you're not expected. Besides, we suggest that here we have the political background as well.

Before we start digging in banking crisis, let's take a look at recent statistics across the Globe. Although now it takes the backseat, but it is temporal, and very soon everybody will turn back and start to catch new released numbers. Based on recent data we could say that structural crisis stands underway and brings now surprises - everything goes as it should to. Industrial production, GDP, manufacturing, retail sales, real estate market are slowing down, while inflation either stands stubborn or rising. This week there are few charts, still that are especially interesting. First is - collapse of foreign investments in China, which has more political background of US-China confrontation. Also pay attention to US regional data - it clearly shows difficult times.

Core Inflation in EU remains high for all history of observations, while Retail Sales remains vulnerable and unstable. Here is also two charts that I would like to show you, because they are specific. First is the food inflation in Germany:

THe Real Estate prices across the Globe:

And most important - take a look at US PPI all Commodity index. This is our favorite index to watch that reflects inflation processes in production by all commodities while popular PPI has some weights on different components. So, our PPI shows strong deflationary process:

And there is an opinion that there may already be degradation mechanisms associated with the decline of industry, aggregate demand and aggregate sales.

Because if it would be the opposite - we should get opposite other numbers as well - growth of GDP, Retail Sales, PMI, ISM etc., that we do not see now. So, everything goes as it should, no drastic changes in major crisis trend by far.

THE US BANKING CRISIS

First is, let us to recommend you interesting article by Arthur Hayes. It is rather big, but it brings a lot of details on crisis and recent events. Also he makes forecasts. He is a big fan of crypto, so all his conclusions lead to idea - "spend fiat, by crypto". We have different opinion, Fed has initiated the crisis not to make crypto market happy. But this is off top and stands behind the scope of this report.

If we leave noise behind, here is what has happened this week:

- The Fed put $300 billion on the balance sheet in less than a week. Most of it went to soft loans to banks ($164.8 billion).The rest was sent to close the hole on the deposits of two bankrupts.

Meanwhile, the "regional banking infection" has reached out to all sorts of dirty funds on derivatives.

Levinson's macro hedge fund Graticule will close after losses: this year the fund fell by more than 25%, most of the losses occurred after the collapse of the American SVB. Its rates tied to short-term bonds collapsed and erased multi-year profits, the people said, asking not to be named because the details are confidential. Why did this happen? It is enough to look at the chart of volatility of treasuries. The second largest jump in the bond market in the last 30+.

- Janet Yellen calms down while banks are fleeing:

- And the "High spot" of the show - Bank Term Funding Program (BTFP), aka Bailout.

The term of BTFP is 1 year - Advances will be made available to eligible borrowers for a term of up to one year and can be requested under the Program until at least March 11, 2024. But with high degree of certainty it will be extended.

Just to give you some clarity on the value of BTFP (if banks put all available bonds in collateral) - Potentially, the Fed would print $4.189 trillion in response COVID. Right off the bat, the Fed implicitly printed $4.4 trillion with the implementation of BTFP. JPMorgan expects that $2 trillion worth of securities will be brought to the Fed (at face value), which in general is not at all excluded. US Treasury also has provided funds, but in less volume. Now its account in the Fed has dropped to 277 Bln:

- And the last but not least - QT is lost now. The US Treasury is drying liquidity, providing cash to stressed banks. The Fed's balance sheet jumped $297 billion, the biggest weekly gain since the pandemic. The United States is becoming more and more like China, where the Communist Party does not hesitate to periodically inject trillions of yuan (hundreds of billions of dollars) to support and even save a wide range of industries - from the banking system to raw materials and developers. Money, and not restructuring and complex reforms, is now flooding all the problems.

The result of all these efforts is a big liquidity boost of all US banking system. Banks have got 400+ Bln and deposits returned back to ~ 3.5 Trln level. In total, the banks together with the reverse repo again have $5.87 trillion - the last time they had so much at the end of 2021... in a week, we disposed of all the QT for more than a year.

Fed will use BTFP at full throttle. It was worth a couple of banks to fall and the Fed is here again with fresh dollars ... "toughens it up." Let's see how J. will comment on all this stuff on next week. As WSJ writes - in a new study, economists said they found 186 banks that may be prone to similar SVB risks. For now we could say that Fed's initial 300 Bln "pump" is successful. Nothing personal - just business, great deal for the banks. You give the Fed securities at face value, which are traded actually with 20-30% loss, and you get a 4.3-4.5% cash for a year – then it's a matter of imagination and courage. It is a double deuce - your balance is cleared from unrealized loss and you get a profit from provided cash...Nice.

The unrealized loss on bonds that were issued in the dollar system amounts to $4.8 trillion based on the Fed's data in the Z1 report. This is the difference between the nominal value to maturity and the market value at the time of the cutoff. This is the first assessment of a hole in the financial system in the mass media. The difference between the market valuation of bonds in Q4 2020 and Q4 2022 is almost $ 7.6 trillion – this is a record negative change in the entire history of the debt market.

It is a question of time, when other G7 central banks will follow the Fed. ECB tries to resist by far, while BoJ was making no pause and keep QE for two years now. It is not surprising that total Balance sheet of three major banks is growing. Why you would have to think about anti-crisis plans, saving banking sector, cutting expenses etc. - print,

CRISIS WAS LAUNCHED INTENTIONALLY. MAJOR FED TARGETS ARE ACHIEVED

First of all, we have to recognize that in the US there are two sides of political elite - Industrial and Financial. The Fed reserve had ability to choose, whom it would like to join and recent events cleary shows that the Fed is a darling of Financial group fo elite. But maybe be they always were and now just becomes offensive, showing its side. Because, Fed was always gravitating to dovish policy. QT speed constantly was lagging behind planned size:

We suggest that the crisis was intentionally planned by US financial authorities - Fed, US Treasury and FDIC with involving of "top five" banks (JPM, Citi, GS, BoFA, Wells Fargo) and totally managed to desirable targets (see below). The actual closure of SVB bank was announced in the middle of the working day (!!!). Which, as it is clear, significantly spun the panic. In addition, many sources have become clearly hysterical, having, by and large, no objective grounds for panic. Well, on Sunday, everything became clear, since the Fed received the "go-ahead" from the political authorities to resume the money printing.

In fact, today we can safely say that there was no threat to the US financial system, and the panic was deliberately inflated in order to stop the tightening of monetary policy. As soon as the permission was received on Sunday, the panic was quickly closed. However, there are still some problems, the main of which is budgetary. Especially given the need to raise the debt limit, without which there is very little money left in the Treasury accounts.

As for the EU, the situation there is absolutely similar. The fact that Credit Suisse, Credit Lyon, and Deutsche Bank have been breathing hard has been known for a long time, this is not a surprise to anyone. But under the well-pitched panic, the Swiss Bank was allowed to allocate more than 50 billion francs to support Credit Suisse, similar decisions will be made for other banks.

Taking into account the fact that there was a meeting of the ECB last week, which raised the rate by 0.5%, it can be assumed that the EU monetary authorities decided to continue their policy, in which the rate rises, but they give money to banks. As for the real sector, it seems that he is recommended to move to other regions …

It should be noted that with SVB bankruptcy there were a lot of projects related to big pharma and green energy have also been written off. By the way, the bank's management, which has been withdrawing its own money from it for several months, is likely to end up in probe (and jail), which is also useful for easing social tensions. Still, major US banks also could have problems. But — not today, probably.

So, the US financial elite group, via the Fed, US Treasury and FDIC activity has reached following targets:

- In less than two weeks before the Fed meeting, create a market shock of sufficient force to, on the one hand, not destroy the system (a problematic regional bank was chosen for this), on the other hand, create room for the Fed to maneuver with the ability to deftly steer out of the previously announced rigid trajectory of the policy. In other words, to keep the trust and reputation of the Fed with a sharp change in the direction of monetary policy.

- To restore debt refinancing through increased demand for bonds while disorienting investors and avoiding risk. The main problem in 2022, which in the conditions of negative real rates made it difficult to place corporate and government bonds.️

- As a bonus. Create a redistribution of liquidity from small and medium-sized banks to large ones.

Should EUR rise in long term on the background of new US QE? Not necessary. EU has bigger banks' problem, higher inflation and lower rate (at least for now). They will start printing in the same manner as the Fed. Industrial sector leaves EU in favor of the US and other regions. Why EUR should start rising? Rock hard Fed guarantees could trigger demand for safe haven assets, making USD investments attractive again, and in conditions of global crisis exacerbating, hardly EUR will take the lead...