Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Fundamentals

Sometimes happens when week is bore and nothing to talk about. This week was rather active and we have too many events for discussion - going banking crisis, Xi visit to Moscow and Fed meeting. Today we try to put together Fed meeting results with crisis as they are related topics. Xi's visit also has economical background, but mostly relates to macro economy and Bretton Woods system.

FED MEETING RESULTS

The dollar slid after the U.S. Federal Reserve raised its key rate by a quarter of a percentage point, as widely expected, and pointed to just one more rate hike this year. The Fed projected at least one additional interest rate increase of 25 basis points by the end of 2023, but suggested that could represent at least an initial stopping point for the rate hikes.

In a key shift driven by the sudden failures this month of Silicon Valley Bank (SVB) and Signature Bank, the Fed's latest policy statement no longer says that "ongoing increases" in rates will likely be appropriate. That language had been in every policy statement since the March 16, 2022 decision to start the rate-hiking cycle. Markets had projected a quarter-point rise in U.S. rates, but investors were also paying close attention to Fed Chair Jerome Powell's comments about the crisis that has rattled global banks this month.

So, here are major points of JPow speech:

In addition, in the answers to the questions, Powell said:

First - Powell admitted that there is a crisis in the banking sector (initially, after achieving the desired goal, resolving the issue in favor of banks, there was a desire to quickly cover up the topic).

Second - he acknowledged what we have already written about in several reviews — that inflation began to rise again, and even before the beginning of the banking crisis.

Third - he constantly repeats that the situation is under control and the 2% inflation target has not gone away.

The latter is important, since the head of the Treasury (US Treasury Department) and Powell's predecessor as head of the Fed, Yellen, said in her press conference that there would be no guarantees for all deposits in the US. An exception was made for the Silicone Valley Bank — but it will remain an exception. But the most important point in Powell's speeches is an attempt to maintain a high level of confidence in the Fed. Because if the confidence of the markets is lost, it will definitely be impossible to resist the crisis.

But there are problems with this. Even taking into account the fact that most observers do not have an understanding of macroeconomic patterns, they understand that inflation has started to rise (and with the new issue it will still grow), and the Fed has no desire to raise the rate. Because even its current value has a serious negative impact on the banking system around the world.

That is, Powell was trying to "talk inflation problem around", including the threat of a rate hike, but almost no one has confidence that he will decide to raise the rate seriously. Just take a look at new market expectations on Fed rate, this is quite different to what JP has promised -

And the desired indicator of 2% is still very, very far away, moreover, this distance has begun to grow again. And if we also take into account Powell's hints that in order to reduce the pressure on inflation, it is necessary to lower the standard of living of the population …

What to do in such a situation? We already talked about it many times. The only solution is restructuring of the US economy (that's why crisis is called as "structural") it suggests obliged reduction in the standard of living of the population until a uniform state is reached between household incomes and expenditures. The trouble is that the fall in GDP and living standards will be too big (more than 50% of the real GDP of the United States and 2/3 of the nominal one) to say it publicly and loud and even start acting in this direction immediately. But the truth stands so that this scenario inevitable will be achieved and the longer the US authorities resist, the more terrible the crisis will be.

How realistic Fed/US Treasury plans are?

Fed and US Treasury have not become the first on a way of loosing confidence to banking system. Credit Suisse takeover by UBS has become most impressive starting point. Shortly speaking banks decide to write off the so-called CoCos CS bonds, which are included in the Tier 1 capital, in the amount of $17 billion, which is about 6% of the total global market of such bonds worth $275 billion.

Who has already reliably lost money on CS bonds:

- PIMCO $870 million.

- Invesco $370 million

- Blackrock $113 million

- Lazard $1.5 billion.

- GAM $1.2 billion.

- a bunch of rich Asians from Hong Kong and Singapore

- CS top managers - yes, yes, they were also paid part of their salaries with these bonds

It is also worth mentioning the Arabs, who owned more than 20% of the bank's shares, and lost over $4 billion. after less than 6 months of ownership.

Conclusion: the consequences of such decisions by bankers and regulators are dramatic for everyone. Undermining mass confidence in the system, all this rolls back development (both financial and economic) far back, indicating that not a single lesson has been learned from 2008, and investors' reliance on fundamental indicators, reporting, comments from managers, and so on is all nonsense, it costs nothing

Postscript: in parallel, when you are still reading the news now that JPMorgan bought bags of stones worth $1.3 million instead of nickel metal, you are once again convinced that "sitting there" are completely stupid people with the absence of any risk management who are besotted with business class flights and life in 5-star hotels hotels, thanks to a decade of zero rates.

Besides, here we should mention that Credit Suisse AG and UBS are under scrutiny in a U.S. Department of Justice (DOJ) probe into whether financial professionals helped Russian oligarchs evade sanctions, Bloomberg News reported on Thursday. With all this mess around - who will put money in the banks?

Western mainstream economists/analysts still rub in that the world economy is in the stage of "rebalancing and new financing", where the interest rate is important for "fighting inflation", but we have long passed the point of no return. The dollar system has stuck its head into a debt refinancing loop, which is rapidly tightening — flooding the fire with liquidity will not help. The essence of the problem is that the global dollar system depends on the constant prolongation or refinancing of debt. For decades, the rates only decreased, and eventually became zero or negative, so the system worked on constant refinancing by issuing "reserve currencies".

Prerequisites for debt prolongation are:

1. Sufficient liquidity/bank reserves. The Fed can inject liquidity into the system using a printing press: quantitative easing (debt repurchase), preferential lending programs for banks/BTFP and swap lines (loans for the issuance of other currencies) for the rest of the Central Bank.

2. Risk-free collateral. Businesses use U.S. Treasury bonds as collateral to obtain a loan, as they are a direct obligation of the U.S. government, which "will never default."

3. Normalized yield curve. For the system to work, there must be a normal (ascending) yield curve when short-term rates are lower than long-term ones. The principle of the banking system is simple - we take short loans and issue long loans. If the rates at the far end of the curve are higher than at the near end, then it is simply unprofitable to lend.

As a result normally we should get: banks take liquidity (1), issue it under "risk-free collateral" (2), if the economy has a normal situation with the yield curve, when they benefit (3). What is the problem? Vicious and terrible inflation.

In order to suppress price growth (monetary and structural, which is already unrealistic), the Fed sharply raised rates at the near end of the curve, which is why short-term interest rates begin to exceed long-term ones. This event breaks the banking system (3), causing an inversion of the yield curve.

It is important that the Fed ensures holding of the lower limit of interest rates, via Repurchase Agreement tool (so called Repo ). The US Treasuries are transferred from the Fed's balance sheet to the banking system with the obligation to redeem them in a few days. In fact, banks are draining the newly printed liquidity back to the Federal Reserve, now receiving risk-free returns from the state government, which is very generous.

Actually, there is no real liquidity (1) for the real sector, since everything merges into Repo. Plus, within the dollar system, risk-free collateral (2) is sometimes "re-mortgaged" X times of its face value - very convenient, but leads to a shortage of collateral: long-term rates grow even slower due to demand, increasing inversion (3). The system cannot afford treasury bond yields above 4-5%, sitting on billions of unrealized losses on "risk-free collateral". And instead of conservative hedging to reduce risks, many craftsmen also used leverage for speculative purchases of stocks and cryptocurrencies.

Sovereign debt crisis = inability to finance/prolong debts

To prevent the collapse of the system, instead of a Quantitative Chaos, the Fed will have to pour in a sea of liquidity on the one hand, and on the other reduce interest rates, normalizing the curve against the background of depression in the economy (trying to cut the gap between short-term and long-term rates). In fact, with emission Fed de-facto is financing the rate difference. This of course means a serious build-up of the national debt. In fact, the only way to survive is debt monetization = devaluation of one's own currency and exit from the "reserve" status (the notorious Triffin paradox). But how they will do it in current situation?

Where Fed and Treasury will get the funds?

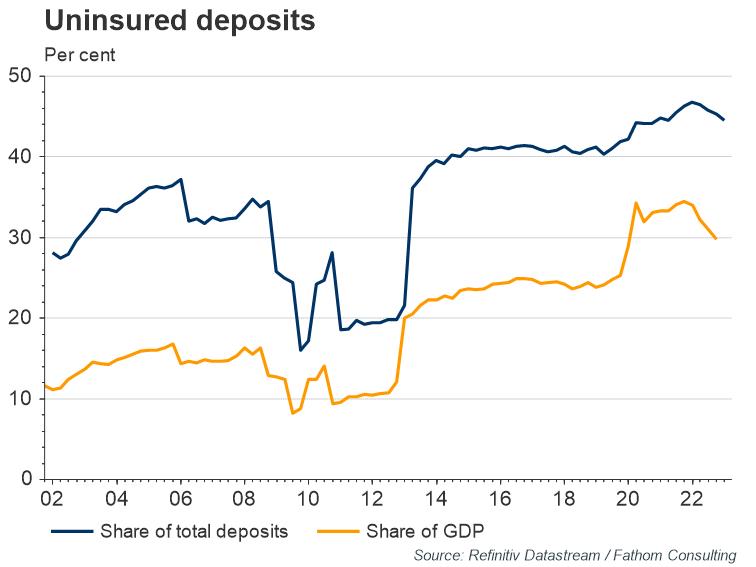

Here are just few dry numbers - so we could see that the Fed and US Treasury just have no money to pull off the deal. First is, full insurance coverage of all bank deposits costs $17.7 trillion. This not just a "powerful injection", it is more than 85% of M1 and about 80% of M2. This is a very strong move, which in terms of inflation will easily surpass the results of the Turkish rate policy and will fall just short of Argentina. But still, it is unlikely to print 17-18 trillion at once. 5-6, I think it will be enough under the most unfavorable scenarios, although hardly it could be treated as relief.

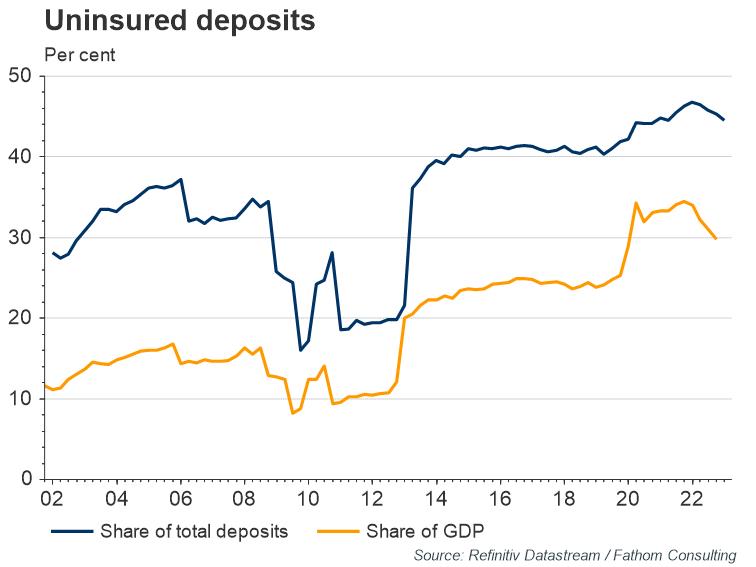

The problem is that most american deposits are above 250K that are not covered by FDIC insurance. FDIC funds for now are totally exhausted (it was just $128 Bln) - all money were spent just on single SNV, and even Treasury have had to add a bit. So, with spreading of the crisis around and due to promises of JP and J.Yellen, mentioned above - US Treasury will have to find funds somewhere. But where? And there are more bailouts coming...

Another 50 American banks may go bankrupt before the White House solves the structural problem, former vice president of Lehman Brothers Financial Corporation Lawrence McDonald.

Jeffrey Gundlach, the CEO of DoubleLine, echoed Gross' grim prediction in his own Thursday tweet. He pointed to the narrowing inversion in the yields from 2-year and 10-year Treasuries, noting the gap between them has shrunk from 107 basis points to 40 in recent weeks.

Small Banks have debts on commercial real estate of about 2.3 trillion dollars. Commercial mortgages worth $270 billion held by banks expire this year. It is noteworthy that this is the highest indicator in the entire history of observations. The banks that own most of these loans have assets of less than $250 billion.

In short, all that we need to know about the Fed expenses are pictured on below charts - total interest expenses and daily interest expenses on Repo trades- $700 million per day in interest including reserve repo.

In general, according to Bloomberg - US banks are facing $1.7 trillion in unrealized losses. Thus the nearest size of new QE should be around $1.7 - 5 Trln at least. For the first time in 3 years, more than $100 billion went into US money market funds in a week:

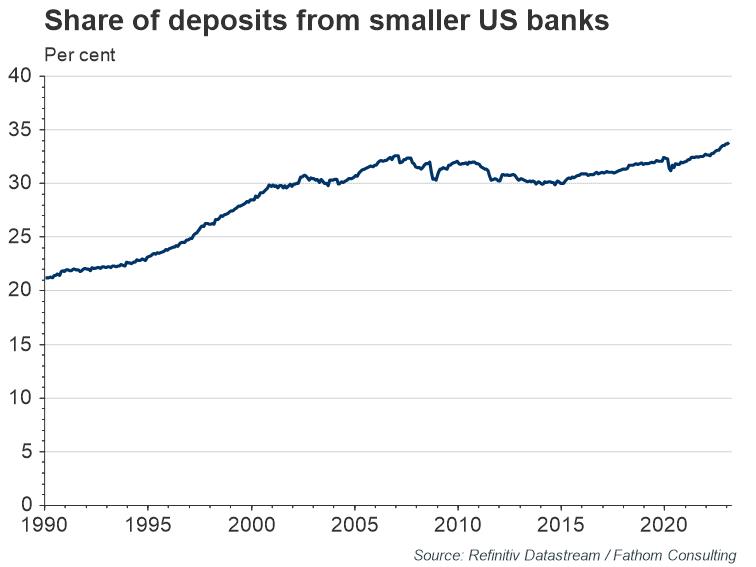

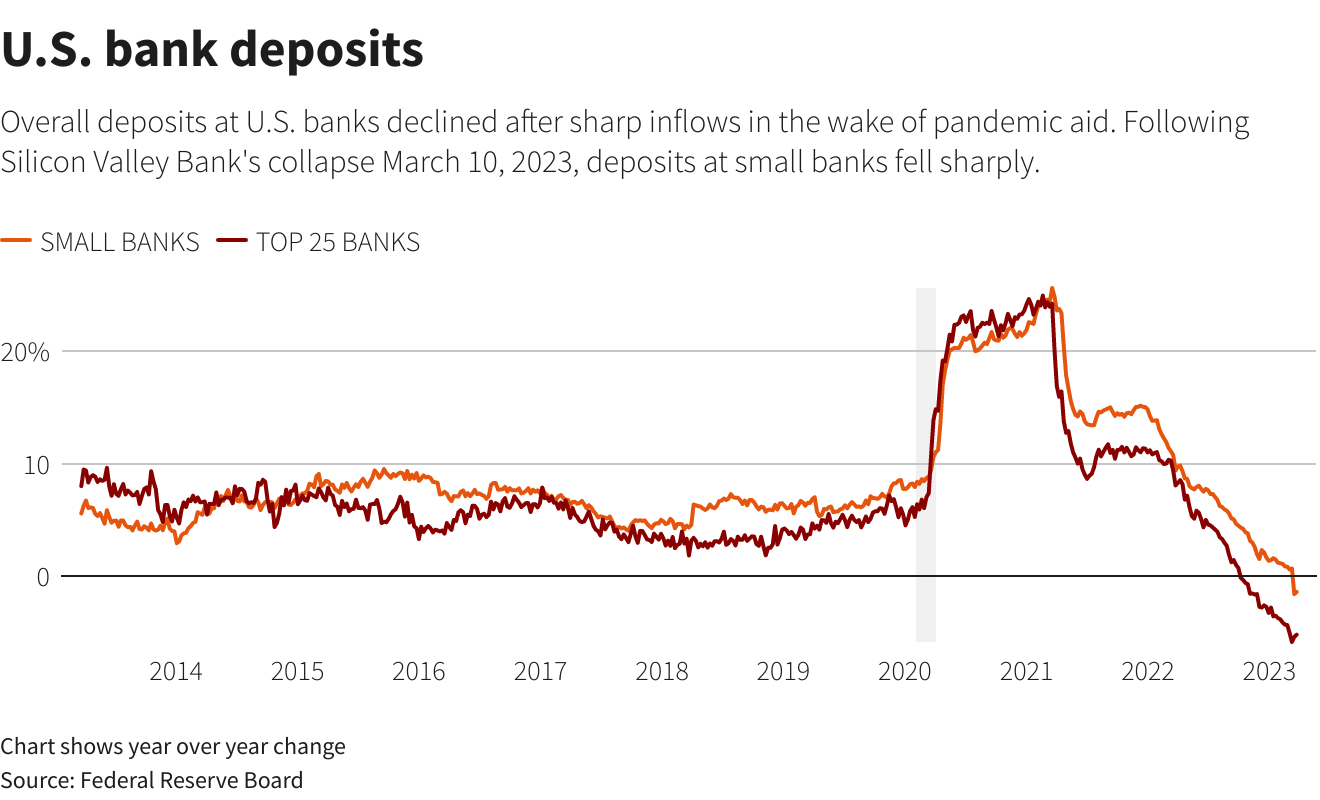

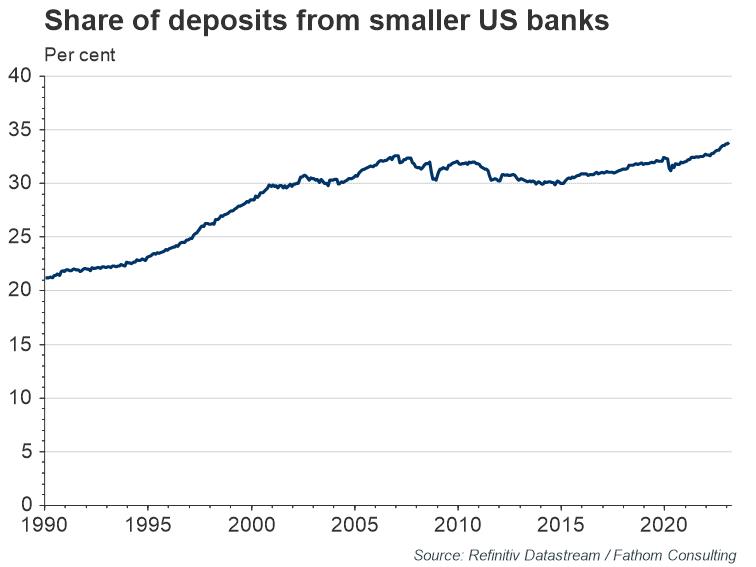

As we've mentioned, it is a huge money, around 5.3 Trln is accumulated in cash funds. There are two additional issues that have developed since 2008 that may be cause for concern. Smaller US banks are now holding a higher share of deposits than at the onset of the previous banking crisis, yet are not subject to the same regulatory safeguards as the largest US financial institutions.

Additionally, a higher share of the deposits are not insured than was the case in 2008, and this could make a potential run on the banks both more likely and more painful.

It is worth remembering that the reason that the Fed and other central banks have been tightening monetary policy is to cool the economy. Admittedly, you might expect to see the impact of higher rates emerge in the real economy before the banks, but the fact that tightening is causing some economic pain should be expected. With the ECB hiking 50 basis-points last week, and the Fed hike of 25 basis-points on Wednesday, there is likely more pain to come, with Fathom’s central scenario still being that developed economies enter a recession later this year.

EU SITUATION IS NOT BETTER

Somehow recent attention stands upon the US problems and at first glance it seems that EU has much better situation (ex. Switzerland LOL). But, in reality it is not necessary so. If even we suggest that Deutsche Bank will survive (if not, it will be very bad), it seems that there is no reason to collapse, except for naked panic (although in some cases it is enough, alas, that's why they singled it out as possible candidates for distribution earlier).

But for some other European banks, the problems, it seems, are more tangible. Here, probably, there can be an aftershock of the PIIG Euro-crisis of 2010-11:

For example, Italian banks (+ Greek, Spanish). They have a high concentration of Italian government bonds in assets, under 10% (see the histogram). The ECB raises rates, while the price of peripheral bonds falls, and they are on the balance sheets of banks (the same problem, by the way, in the UK). A spiral is possible here - banks will need to recapitalize at the expense of budget money, that is, an additional issue of government bonds, while the price of government bonds will fall even more, which will require even more additional capital, etc. This is an extremely negative scenario, not necessary it will materialize, but there are certain risks.

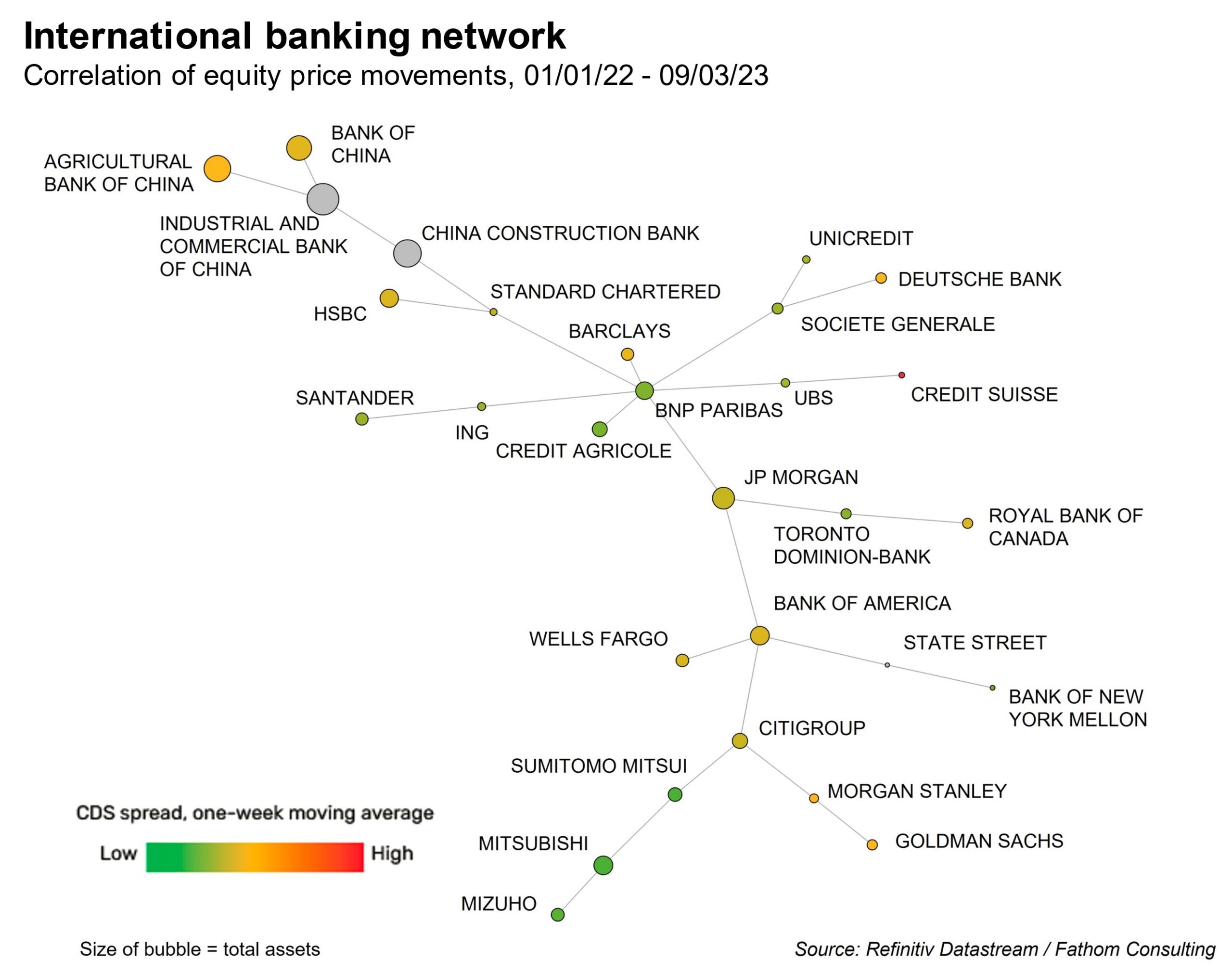

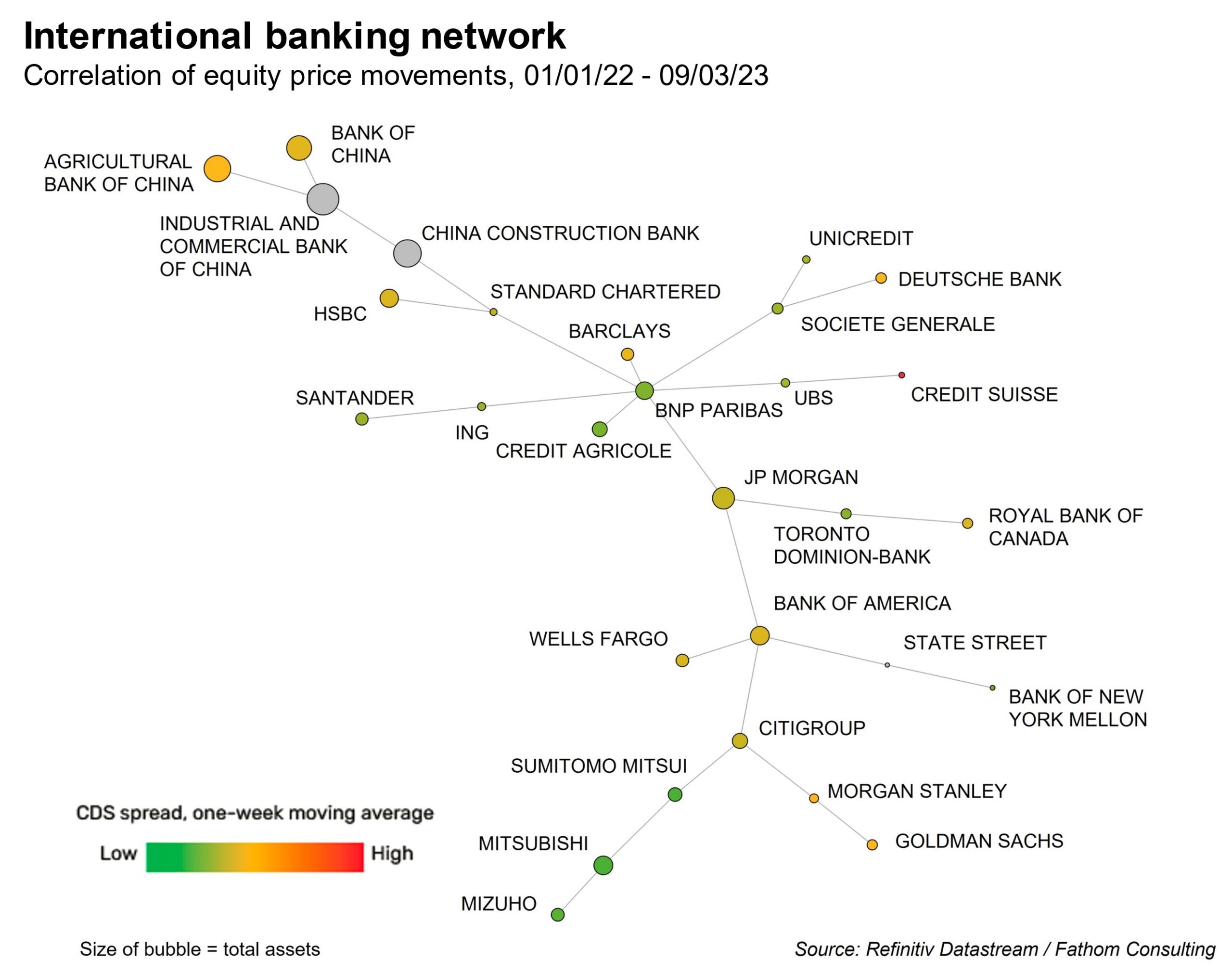

Now let's take a look at the structure of world major banks. Deutsche Bank directly relates to BNP Paribas, as well as UBS by the way. Both have visible problems.

Somehow now mostly clients' raid is excluded. But, just think what you're going to do in this case? Every person with just common sense thinks that "yes, maybe JPow and Lagarde are right, they look confident and hopefully everything will be OK, but... who knows. I would better withdraw and sit on the cash or buy crypto for some time - that would be safer". That's it. And I'm sure the majority of people think in this way. Besides, with modern client-bank mobile apps it is very easy to do.

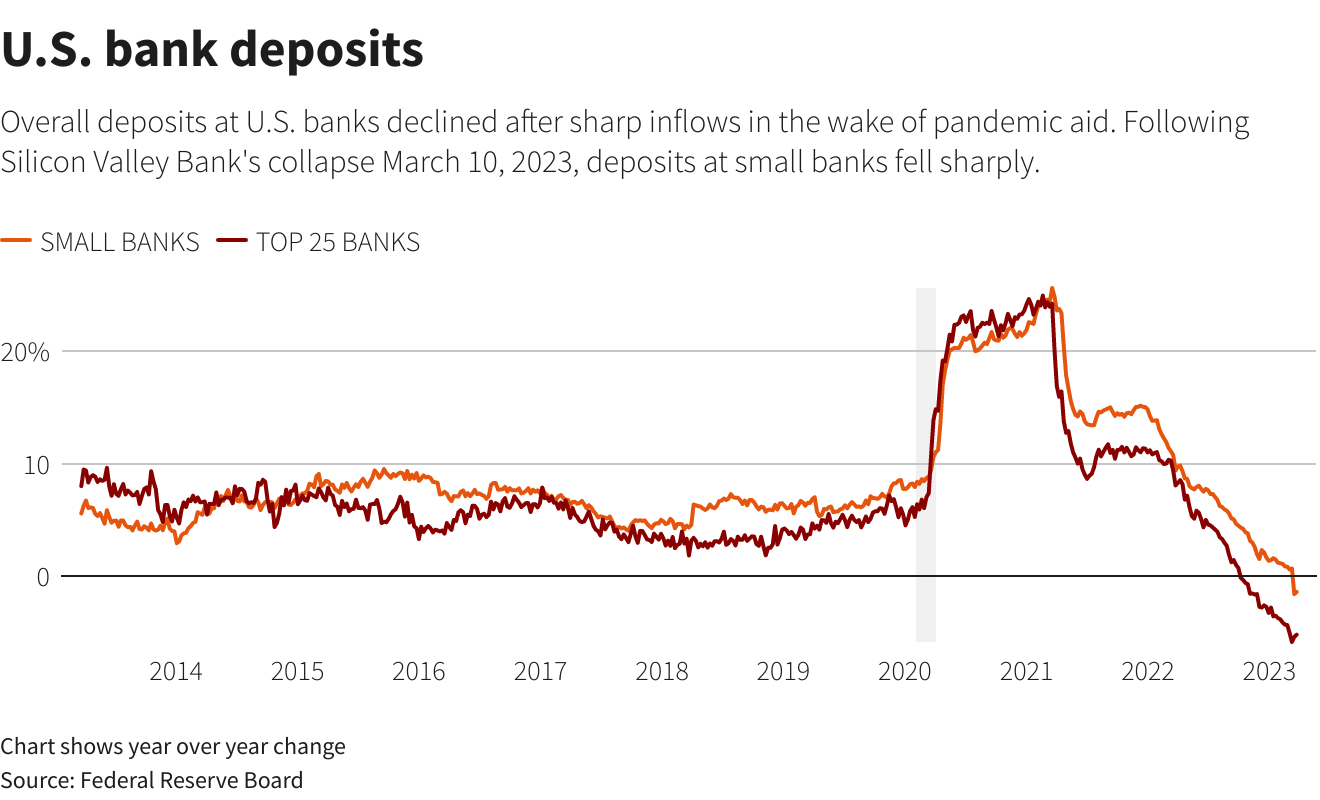

Deposits at small U.S. banks dropped by a record amount following the collapse of Silicon Valley Bank on March 10, data released on Friday by the Federal Reserve showed. Deposits at small banks fell $119 billion to $5.46 trillion in the week ended March 15. That was more than twice the previous record drop and the biggest decline as a percent of overall deposits since the week ended March 16, 2007.

So we will be watching how the situation in the European Union will develop, in particular, whether Deutsche Bank, which, in reality, is more of an all-American bank rather than a German one, will be able to keep from bankruptcy. But the main threat, of course, is the position of the US monetary authorities, who have demonstrated their complete helplessness in terms of real control over the situation.

However, taking into account the time lag between the issue and the growth of inflation (which reaches 2-3 months), it is practically safe to say that there will be no collapse of markets in the US (this does not apply to the EU) before the beginning of summer....

Sometimes happens when week is bore and nothing to talk about. This week was rather active and we have too many events for discussion - going banking crisis, Xi visit to Moscow and Fed meeting. Today we try to put together Fed meeting results with crisis as they are related topics. Xi's visit also has economical background, but mostly relates to macro economy and Bretton Woods system.

FED MEETING RESULTS

The dollar slid after the U.S. Federal Reserve raised its key rate by a quarter of a percentage point, as widely expected, and pointed to just one more rate hike this year. The Fed projected at least one additional interest rate increase of 25 basis points by the end of 2023, but suggested that could represent at least an initial stopping point for the rate hikes.

In a key shift driven by the sudden failures this month of Silicon Valley Bank (SVB) and Signature Bank, the Fed's latest policy statement no longer says that "ongoing increases" in rates will likely be appropriate. That language had been in every policy statement since the March 16, 2022 decision to start the rate-hiking cycle. Markets had projected a quarter-point rise in U.S. rates, but investors were also paying close attention to Fed Chair Jerome Powell's comments about the crisis that has rattled global banks this month.

"Our banking system is sound and resilient with strong capital and liquidity. We will continue to closely monitor conditions of the banking system and are prepared to use all of our tools as needed to keep it safe and sound," Powell said at the news conference following the Fed's rate hike announcement.

So, here are major points of JPow speech:

- Isolated banking problems, if not solved, can threaten the banking system;

- all depositors' savings are safe (???);

- The Fed, Treasury and FDIC took decisive action earlier;

- we remain firmly committed to bring inflation to 2%;

- inflation remains too high;

- higher rates, slower growth put pressure on business;

- we are ready to use all the tools to ensure the security of the banking system;

- the labor market is still very "tight";

- inflation has decreased slightly, but the strength of the latest data indicates inflationary pressure;

- we are continuing the process of significantly reducing our balance sheet (???);

- the process of restoring inflation is a long way;

- we will closely monitor incoming data, as well as the actual and expected consequences of credit conditions. We use this as a basis for solutions;

- it's too early (??) to talk about how we should respond to the banking crisis

In addition, in the answers to the questions, Powell said:

- it is possible to consider banking tension as the equivalent of raising rates;

- The Fed took into account all events in the banking segment in its forecasts for the rate ceiling for 2023-2024;

- disinflation is in force! (this is happening here and now);

- there is still no progress in the service sector (???);

- there should be a softening of demand through the future balance in the labor market;

- there are no serious holes in the banking system (???);

- the purpose of the SVB supervisory investigation is to find out what went wrong;

- US banking crisis — the consequences are not yet known(!!!);

- a reduction in rates in 2023 is not our main expectation! The collapse of the SVB bank cannot be 100% the reason for the Fed's reversal;

- changes are needed in the US banking system — I understood it right away;

- the recent provision of liquidity to banks has increased our balance sheet, Yes;

- but this does not change the Fed's position on the main goal — to reduce inflation in the US by 2%;(???)

- we have tools to protect depositors when there is a threat to the economy, and we are ready to use them;

- it's too early to say whether the recent consequences change the chances of a soft landing;

- there is a path to a soft landing of the US economy;

- depositors' deposits are safe.

First - Powell admitted that there is a crisis in the banking sector (initially, after achieving the desired goal, resolving the issue in favor of banks, there was a desire to quickly cover up the topic).

Second - he acknowledged what we have already written about in several reviews — that inflation began to rise again, and even before the beginning of the banking crisis.

Third - he constantly repeats that the situation is under control and the 2% inflation target has not gone away.

The latter is important, since the head of the Treasury (US Treasury Department) and Powell's predecessor as head of the Fed, Yellen, said in her press conference that there would be no guarantees for all deposits in the US. An exception was made for the Silicone Valley Bank — but it will remain an exception. But the most important point in Powell's speeches is an attempt to maintain a high level of confidence in the Fed. Because if the confidence of the markets is lost, it will definitely be impossible to resist the crisis.

But there are problems with this. Even taking into account the fact that most observers do not have an understanding of macroeconomic patterns, they understand that inflation has started to rise (and with the new issue it will still grow), and the Fed has no desire to raise the rate. Because even its current value has a serious negative impact on the banking system around the world.

That is, Powell was trying to "talk inflation problem around", including the threat of a rate hike, but almost no one has confidence that he will decide to raise the rate seriously. Just take a look at new market expectations on Fed rate, this is quite different to what JP has promised -

And the desired indicator of 2% is still very, very far away, moreover, this distance has begun to grow again. And if we also take into account Powell's hints that in order to reduce the pressure on inflation, it is necessary to lower the standard of living of the population …

What to do in such a situation? We already talked about it many times. The only solution is restructuring of the US economy (that's why crisis is called as "structural") it suggests obliged reduction in the standard of living of the population until a uniform state is reached between household incomes and expenditures. The trouble is that the fall in GDP and living standards will be too big (more than 50% of the real GDP of the United States and 2/3 of the nominal one) to say it publicly and loud and even start acting in this direction immediately. But the truth stands so that this scenario inevitable will be achieved and the longer the US authorities resist, the more terrible the crisis will be.

How realistic Fed/US Treasury plans are?

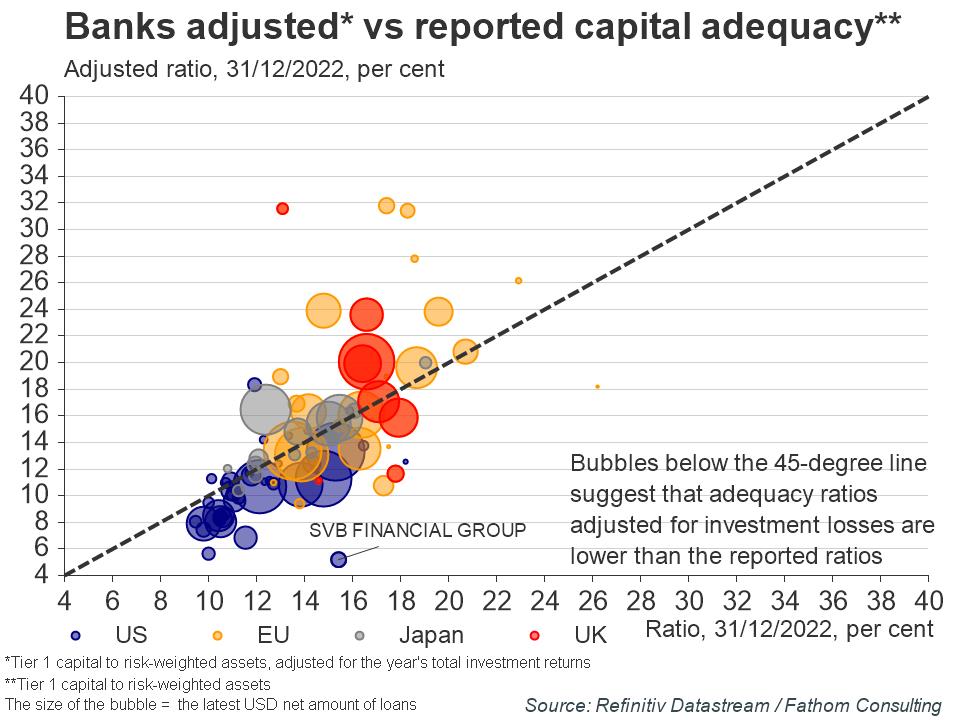

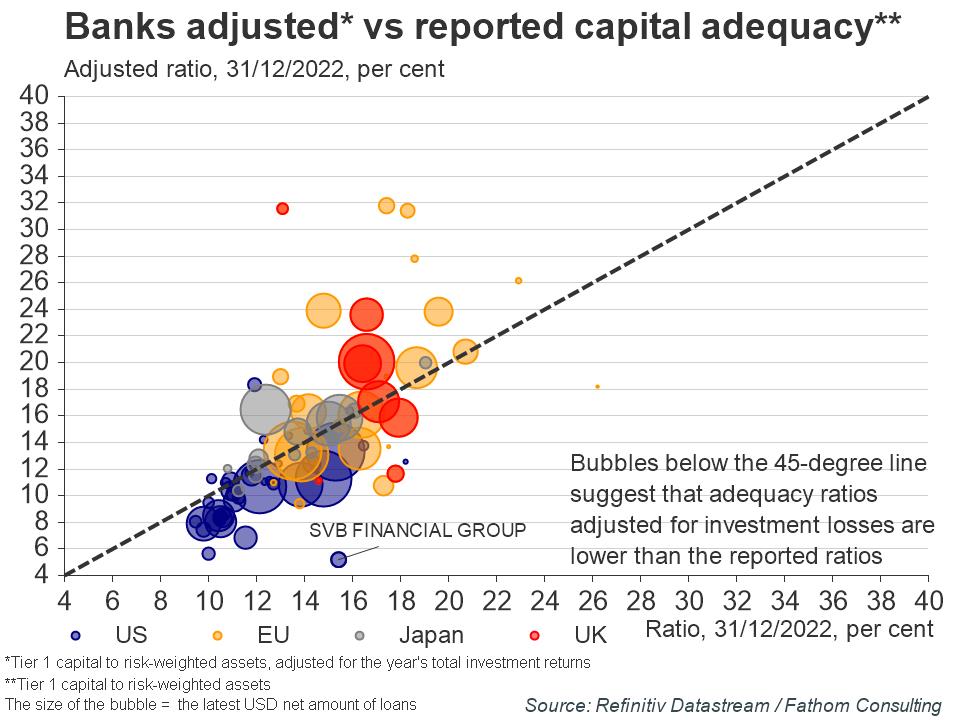

Fed and US Treasury have not become the first on a way of loosing confidence to banking system. Credit Suisse takeover by UBS has become most impressive starting point. Shortly speaking banks decide to write off the so-called CoCos CS bonds, which are included in the Tier 1 capital, in the amount of $17 billion, which is about 6% of the total global market of such bonds worth $275 billion.

Who has already reliably lost money on CS bonds:

- PIMCO $870 million.

- Invesco $370 million

- Blackrock $113 million

- Lazard $1.5 billion.

- GAM $1.2 billion.

- a bunch of rich Asians from Hong Kong and Singapore

- CS top managers - yes, yes, they were also paid part of their salaries with these bonds

It is also worth mentioning the Arabs, who owned more than 20% of the bank's shares, and lost over $4 billion. after less than 6 months of ownership.

Conclusion: the consequences of such decisions by bankers and regulators are dramatic for everyone. Undermining mass confidence in the system, all this rolls back development (both financial and economic) far back, indicating that not a single lesson has been learned from 2008, and investors' reliance on fundamental indicators, reporting, comments from managers, and so on is all nonsense, it costs nothing

Postscript: in parallel, when you are still reading the news now that JPMorgan bought bags of stones worth $1.3 million instead of nickel metal, you are once again convinced that "sitting there" are completely stupid people with the absence of any risk management who are besotted with business class flights and life in 5-star hotels hotels, thanks to a decade of zero rates.

Besides, here we should mention that Credit Suisse AG and UBS are under scrutiny in a U.S. Department of Justice (DOJ) probe into whether financial professionals helped Russian oligarchs evade sanctions, Bloomberg News reported on Thursday. With all this mess around - who will put money in the banks?

Western mainstream economists/analysts still rub in that the world economy is in the stage of "rebalancing and new financing", where the interest rate is important for "fighting inflation", but we have long passed the point of no return. The dollar system has stuck its head into a debt refinancing loop, which is rapidly tightening — flooding the fire with liquidity will not help. The essence of the problem is that the global dollar system depends on the constant prolongation or refinancing of debt. For decades, the rates only decreased, and eventually became zero or negative, so the system worked on constant refinancing by issuing "reserve currencies".

Prerequisites for debt prolongation are:

1. Sufficient liquidity/bank reserves. The Fed can inject liquidity into the system using a printing press: quantitative easing (debt repurchase), preferential lending programs for banks/BTFP and swap lines (loans for the issuance of other currencies) for the rest of the Central Bank.

2. Risk-free collateral. Businesses use U.S. Treasury bonds as collateral to obtain a loan, as they are a direct obligation of the U.S. government, which "will never default."

3. Normalized yield curve. For the system to work, there must be a normal (ascending) yield curve when short-term rates are lower than long-term ones. The principle of the banking system is simple - we take short loans and issue long loans. If the rates at the far end of the curve are higher than at the near end, then it is simply unprofitable to lend.

As a result normally we should get: banks take liquidity (1), issue it under "risk-free collateral" (2), if the economy has a normal situation with the yield curve, when they benefit (3). What is the problem? Vicious and terrible inflation.

In order to suppress price growth (monetary and structural, which is already unrealistic), the Fed sharply raised rates at the near end of the curve, which is why short-term interest rates begin to exceed long-term ones. This event breaks the banking system (3), causing an inversion of the yield curve.

It is important that the Fed ensures holding of the lower limit of interest rates, via Repurchase Agreement tool (so called Repo ). The US Treasuries are transferred from the Fed's balance sheet to the banking system with the obligation to redeem them in a few days. In fact, banks are draining the newly printed liquidity back to the Federal Reserve, now receiving risk-free returns from the state government, which is very generous.

Actually, there is no real liquidity (1) for the real sector, since everything merges into Repo. Plus, within the dollar system, risk-free collateral (2) is sometimes "re-mortgaged" X times of its face value - very convenient, but leads to a shortage of collateral: long-term rates grow even slower due to demand, increasing inversion (3). The system cannot afford treasury bond yields above 4-5%, sitting on billions of unrealized losses on "risk-free collateral". And instead of conservative hedging to reduce risks, many craftsmen also used leverage for speculative purchases of stocks and cryptocurrencies.

Sovereign debt crisis = inability to finance/prolong debts

To prevent the collapse of the system, instead of a Quantitative Chaos, the Fed will have to pour in a sea of liquidity on the one hand, and on the other reduce interest rates, normalizing the curve against the background of depression in the economy (trying to cut the gap between short-term and long-term rates). In fact, with emission Fed de-facto is financing the rate difference. This of course means a serious build-up of the national debt. In fact, the only way to survive is debt monetization = devaluation of one's own currency and exit from the "reserve" status (the notorious Triffin paradox). But how they will do it in current situation?

Where Fed and Treasury will get the funds?

Here are just few dry numbers - so we could see that the Fed and US Treasury just have no money to pull off the deal. First is, full insurance coverage of all bank deposits costs $17.7 trillion. This not just a "powerful injection", it is more than 85% of M1 and about 80% of M2. This is a very strong move, which in terms of inflation will easily surpass the results of the Turkish rate policy and will fall just short of Argentina. But still, it is unlikely to print 17-18 trillion at once. 5-6, I think it will be enough under the most unfavorable scenarios, although hardly it could be treated as relief.

The problem is that most american deposits are above 250K that are not covered by FDIC insurance. FDIC funds for now are totally exhausted (it was just $128 Bln) - all money were spent just on single SNV, and even Treasury have had to add a bit. So, with spreading of the crisis around and due to promises of JP and J.Yellen, mentioned above - US Treasury will have to find funds somewhere. But where? And there are more bailouts coming...

Another 50 American banks may go bankrupt before the White House solves the structural problem, former vice president of Lehman Brothers Financial Corporation Lawrence McDonald.

"Another 50 banks may collapse until they solve the structural problem. Politicians are likely to be forced to somehow introduce a much greater withholding (outflow of deposits from bank accounts. — Editor's note), significantly exceeding deposits of 250 thousand dollars," he said.

"The banking turmoil sparked by the collapse of Silicon Valley Bank is not yet over, and a significant number of banks will fail within two years, the CEO of hedge fund Man Group. I think we will have significantly more banks that don't exist in 12-24 months," Ellis said, adding that he thought smaller and regional banks in the United States and challenger banks in Britain could be at risk.

Brace for an imminent recession as higher interest rates strangle the US economy, two billionaire investors both known as the "Bond King" have warned. "Be cautious. Recession to come soon," Bill Gross, Pimco's cofounder and the former chief of its flagship Total Return fund, tweeted on Thursday. "A year ago I argued in this space that 4.5% FF was the limit and it appears it was," Gross added, referring to the federal funds rate. The Federal Reserve lifted its benchmark interest rate to upwards of 4.75% on Wednesday.

Jeffrey Gundlach, the CEO of DoubleLine, echoed Gross' grim prediction in his own Thursday tweet. He pointed to the narrowing inversion in the yields from 2-year and 10-year Treasuries, noting the gap between them has shrunk from 107 basis points to 40 in recent weeks.

Small Banks have debts on commercial real estate of about 2.3 trillion dollars. Commercial mortgages worth $270 billion held by banks expire this year. It is noteworthy that this is the highest indicator in the entire history of observations. The banks that own most of these loans have assets of less than $250 billion.

In short, all that we need to know about the Fed expenses are pictured on below charts - total interest expenses and daily interest expenses on Repo trades- $700 million per day in interest including reserve repo.

In general, according to Bloomberg - US banks are facing $1.7 trillion in unrealized losses. Thus the nearest size of new QE should be around $1.7 - 5 Trln at least. For the first time in 3 years, more than $100 billion went into US money market funds in a week:

As we've mentioned, it is a huge money, around 5.3 Trln is accumulated in cash funds. There are two additional issues that have developed since 2008 that may be cause for concern. Smaller US banks are now holding a higher share of deposits than at the onset of the previous banking crisis, yet are not subject to the same regulatory safeguards as the largest US financial institutions.

Additionally, a higher share of the deposits are not insured than was the case in 2008, and this could make a potential run on the banks both more likely and more painful.

It is worth remembering that the reason that the Fed and other central banks have been tightening monetary policy is to cool the economy. Admittedly, you might expect to see the impact of higher rates emerge in the real economy before the banks, but the fact that tightening is causing some economic pain should be expected. With the ECB hiking 50 basis-points last week, and the Fed hike of 25 basis-points on Wednesday, there is likely more pain to come, with Fathom’s central scenario still being that developed economies enter a recession later this year.

EU SITUATION IS NOT BETTER

Somehow recent attention stands upon the US problems and at first glance it seems that EU has much better situation (ex. Switzerland LOL). But, in reality it is not necessary so. If even we suggest that Deutsche Bank will survive (if not, it will be very bad), it seems that there is no reason to collapse, except for naked panic (although in some cases it is enough, alas, that's why they singled it out as possible candidates for distribution earlier).

But for some other European banks, the problems, it seems, are more tangible. Here, probably, there can be an aftershock of the PIIG Euro-crisis of 2010-11:

For example, Italian banks (+ Greek, Spanish). They have a high concentration of Italian government bonds in assets, under 10% (see the histogram). The ECB raises rates, while the price of peripheral bonds falls, and they are on the balance sheets of banks (the same problem, by the way, in the UK). A spiral is possible here - banks will need to recapitalize at the expense of budget money, that is, an additional issue of government bonds, while the price of government bonds will fall even more, which will require even more additional capital, etc. This is an extremely negative scenario, not necessary it will materialize, but there are certain risks.

Now let's take a look at the structure of world major banks. Deutsche Bank directly relates to BNP Paribas, as well as UBS by the way. Both have visible problems.

Somehow now mostly clients' raid is excluded. But, just think what you're going to do in this case? Every person with just common sense thinks that "yes, maybe JPow and Lagarde are right, they look confident and hopefully everything will be OK, but... who knows. I would better withdraw and sit on the cash or buy crypto for some time - that would be safer". That's it. And I'm sure the majority of people think in this way. Besides, with modern client-bank mobile apps it is very easy to do.

Deposits at small U.S. banks dropped by a record amount following the collapse of Silicon Valley Bank on March 10, data released on Friday by the Federal Reserve showed. Deposits at small banks fell $119 billion to $5.46 trillion in the week ended March 15. That was more than twice the previous record drop and the biggest decline as a percent of overall deposits since the week ended March 16, 2007.

So we will be watching how the situation in the European Union will develop, in particular, whether Deutsche Bank, which, in reality, is more of an all-American bank rather than a German one, will be able to keep from bankruptcy. But the main threat, of course, is the position of the US monetary authorities, who have demonstrated their complete helplessness in terms of real control over the situation.

However, taking into account the time lag between the issue and the growth of inflation (which reaches 2-3 months), it is practically safe to say that there will be no collapse of markets in the US (this does not apply to the EU) before the beginning of summer....