Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

This week we've got a lot of data, including two central banks meeting and job statistics on Friday. If it is more or less clear with the job report, J. Powell speech raises many questions. Even not about the content of speech but about possible confidence loss in what he is doing. The most repeatable phrase was " we do not have information". It seems that Fed stands at the edge, when its technical economical decisions come very close to become political but it seems that J. Powell has no permition to accept this responsibility and, actually do not want it. This is not good sign for strategic management.

Market overview

The dollar rose on Thursday against the euro after the European Central Bank eased its pace of rate hikes, a day after the Federal Reserve hiked rates by 25 basis points and indicated that it may pause further increases. The ECB’s 25-basis-point increase was the smallest since it started lifting them last summer, but the bank also signalled that more tightening would be needed to tame inflation. The Fed on Wednesday dropped from its policy statement language saying that it "anticipates" further rate increases would be needed.

Market reaction was relatively subdued, however, with the euro and yen failing to break out of recent ranges against the greenback. The single currency has gained against the dollar in recent months as investors bet the dollar’s interest rate advantage over the single currency would continue to decline. But analysts said that much of that expected move may already be priced in, with the next focus likely to be when the U.S. central bank will start cutting rates.

Fed funds futures traders are now pricing in a roughly 62% chance the Fed will begin cutting rates by July, according to the CME Group’s FedWatch. Adding to the argument that the Fed will soon begin easing monetary conditions were lingering fears of banking sector turmoil.

The greenback got a brief boost on Thursday after data showed that U.S. Unit labor costs - the price of labor per single unit of output - surged at a 6.3% rate in the first quarter, after increasing at a 3.3% pace in the fourth quarter. It is interesting that Labour productivity simultaneously dropped by 2.7% in 1Q.

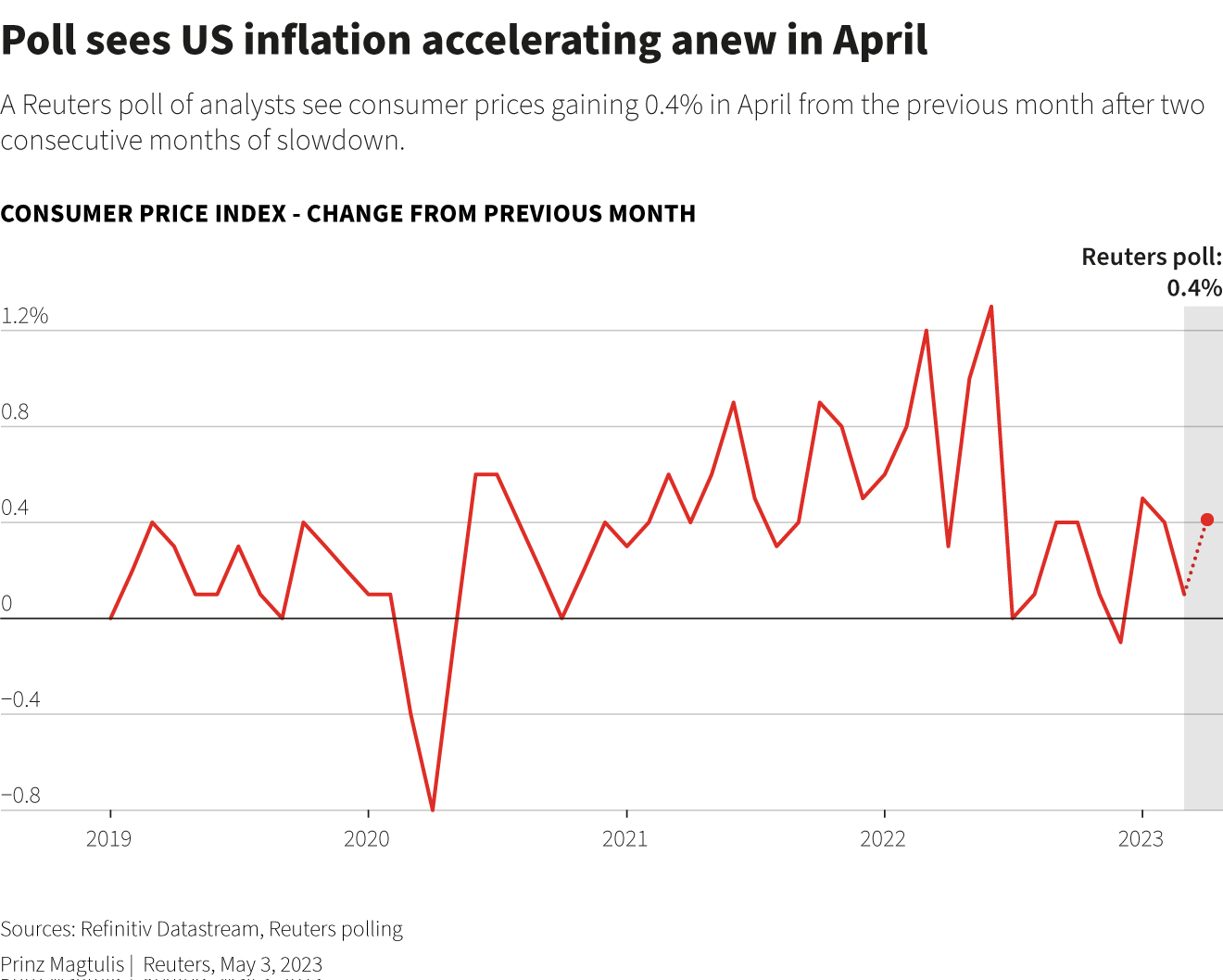

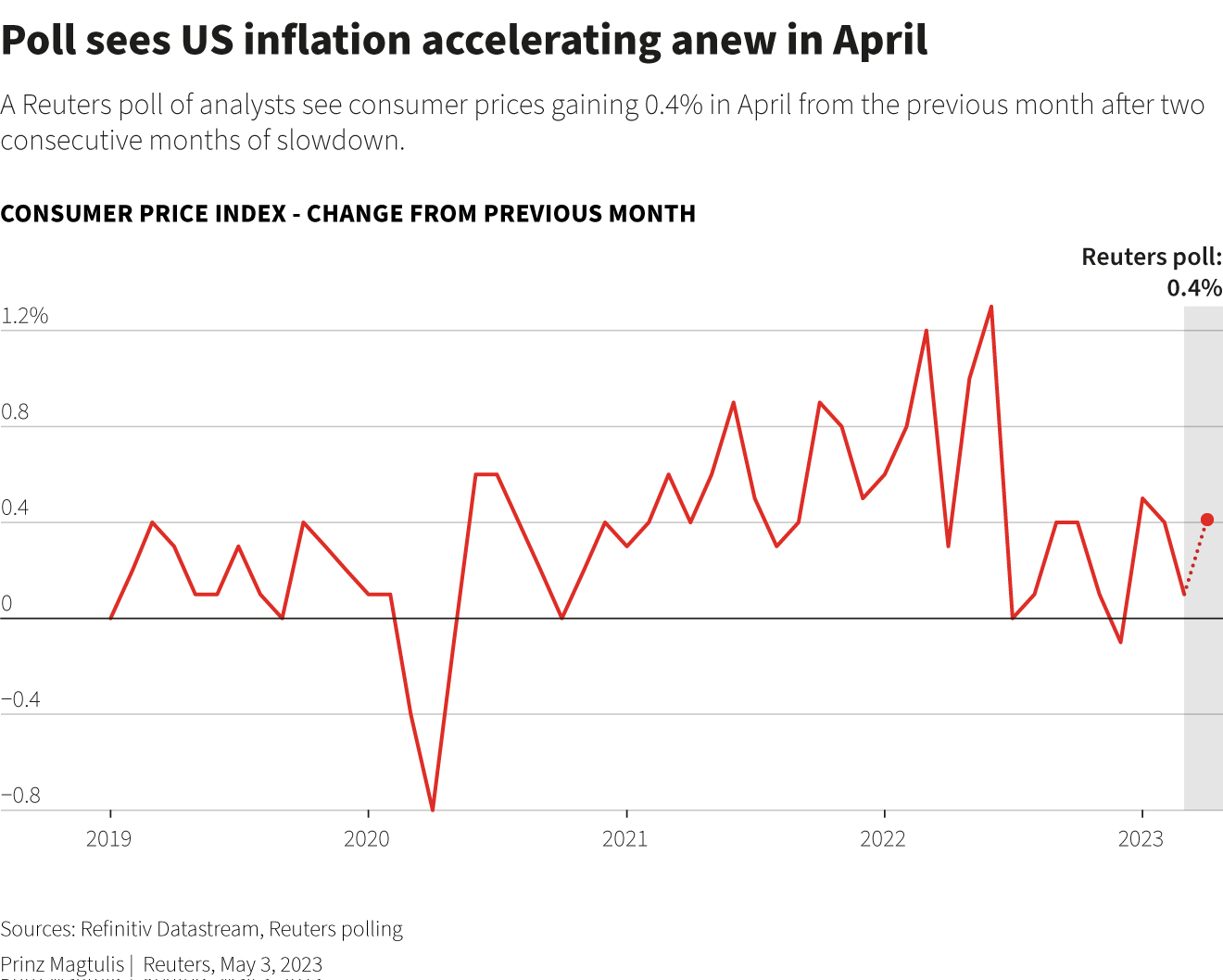

Economists polled by Reuters expect a 0.4% rise in consumer prices. A sharper-than-expected slowdown could vindicate those betting on rate cuts later this year, giving a further tailwind to risk assets - including an equity rally that has seen the S&P 500 gain 5.8% year-to-date. A strong reading, on the other hand, would support the case for the Fed to keep rates higher for longer and feed into market fears over stagflation - a mix of high inflation and low growth that is detrimental to risk assets.

Another highly waited statistics is consumer price data for April, due on Wednesday, May 10, that could offer a clearer picture of whether the Fed’s interest rate increases are cooling inflation. A strong number could weigh on a rally that has lifted the S&P 500 nearly 8% this year. April’s survey of global fund managers from BoFA Global Research showed stagflation expectations near historical highs, with 86% saying it will be part of the macroeconomic backdrop in 2024.

The U.S. dollar will remain resilient against most major currencies over the coming months despite expectations of narrowing interest rate differentials, a Reuters poll of foreign exchange strategists predicted. The dollar was forecast to trade around current levels against most major currencies over the next six months, according to the April 28-May 3 Reuters poll of 75 strategists.

Still, Over the next 12 months, the dollar is expected to fall 2.7% and 2.4% against the euro and pound, respectively.

Easing concerns about the health of the banking system following the orderly failure of three U.S. mid-sized lenders since mid-March suggests inflation remains the key worry given the economy is holding up reasonably well. Most of the optimism around the dollar stems from the view that irrespective of whether the Fed is done with its tightening cycle on Wednesday, it is unlikely to start cutting rates any time soon as some in financial markets are betting.

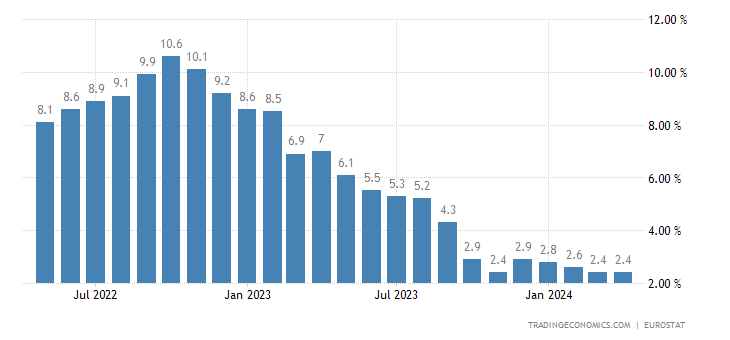

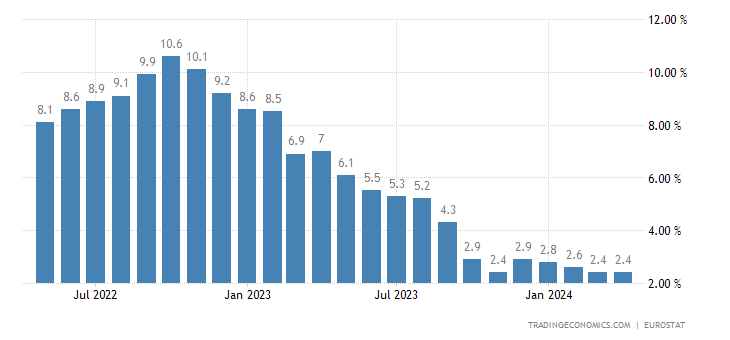

Euro zone inflation accelerated last month but underlying price growth eased unexpectedly. Overall price growth in the 20 nations sharing the euro currency picked up to 7.0% in April from 6.9% a month earlier, Eurostat said on Tuesday, in line with expectations in a Reuters poll of economists. Excluding volatile food and fuel prices, core inflation slowed to 7.3% from 7.5%.

The central bank's latest poll of 61 large euro zone companies from outside the financial sector may give it some comfort, with companies reporting slower price growth, albeit with differences among sectors. Labour costs were rising, with wages expected to rise by 5% this year -- unchanged from the previous survey round in February. This meant that service providers, which are particularly sensitive to labour costs, continued to anticipate strong price hikes.

Nearly all 26 members of the Governing Council appear to agree that more policy tightening is required after a record 350 basis points of rate increases since July. A key worry is that wage growth is now accelerating above expectations and this will drive up the cost of services, the single largest item in the consumer price basket. Investors see the ECB's 3% deposit rate rising to around 3.75% by the end of the summer.

Economists at UBS expect the benchmark interest rate in the eurozone to peak at 3.75%, while Societe Generale sees it at 4% after the European Central Bank (ECB) signalled more tightening ahead. However, UBS expects a pause after July as it sees inflation declining slowly over the summer.

Goldman Sachs and Bank of America also expect the rate to peak at 3.75%, although BofA sees a "significantly" higher chance of rates hitting 4%. Societe Generale expects three more hikes as it sees the eurozone's core inflation staying elevated without showing convincing signs of weakening until September.

The ECB euro short-term rate (ESTR) September 2023 forward was around 3.6%, implying an ECB deposit rate peak of 3.7% by this summer.

The European Central Bank will stop reinvesting cash from maturing bonds bought under its 3.2 trillion Asset Purchase Programme from July, it said on Thursday, taking another small step towards shrinking its oversized balance sheet. Redemptions fluctuate, but about 148 billion euros' worth of debt held under the APP expires in the second half of the year. That means a halt to reinvestment would see an extra 58 billion euros' worth of maturities on top of the currently scheduled 15 billion euros per month.

At 7.7 trillion euros, the ECB's balance sheet is already more than a trillion euros below its peak size but remains well above its historical average. Thursday's decision does not affect reinvestments in the smaller, 1.7 trillion euro Pandemic Emergency Purchase Programme, which are set to continue until the end of 2024.

On Friday, NFP showed that employers added 253,000 jobs, beating economists' forecasts for a 180,000 gain. But data for March was also revised lower to show 165,000 jobs added instead of 236,000 as previously reported.

The unexpected rise in US employment and wages last month increases the chances that the Fed will keep rates high longer and possibly keep the door open for the 11th straight rate hike in June. U.S. average hourly earnings rose at an annual rate of 4.4%, above expectations for a 4.2% increase.

US BANKING CRISIS

Speaking shortly - it is not resolved and still underway, despite that the Fed, US Treasury together with big banks coup problem banks fast. To be honest guys, by looking at Fed, Treasury reactions, by looking on how fast big banks participate and takeover problem banks, I start to think that this is controlled and well-managed process. Because failed banks are not small at all. They are among top-20. And I start suspecting that it also could have a relation to inner political confrontation, becoming a tool for it.

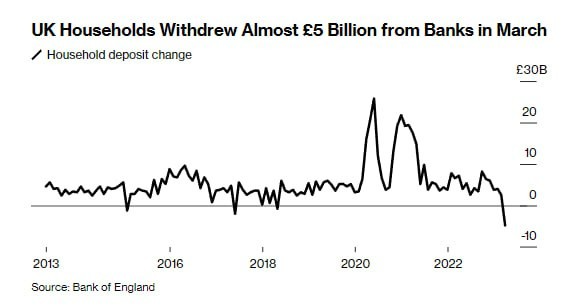

Recent data shows, that deposits outflows continues. Deposits on a non-seasonally adjusted basis fell in the week ended April 26 to about $17.1 trillion, a drop of about $120 billion from the week earlier. That was the lowest level since June 2021, with deposits now having declined by more than $500 billion from the week before collapsed in March. Meanwhile, total banking system credit has yet to show the contraction many economists and policymakers anticipate to develop after the recent banking system turmoil and aggressive interest rate increases by the Federal Reserve over the past year. We mentioned few more banks that under investors' scrutiny for to fall next, such as WestPac and some others. Run into money market funds continues:

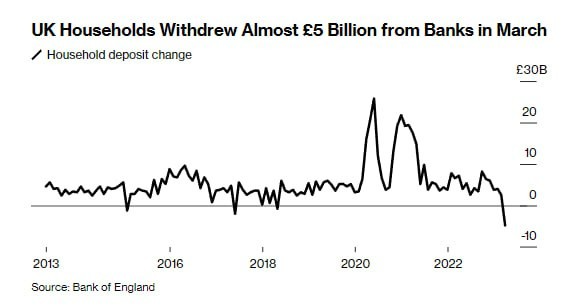

And actually, this is not unique for the US, but the same tendency starts in Europe. In Germany, Bundesbank data showed households' deposits dropped nearly 8% from a year earlier.

So, the reason why I think that this is controlled process is an example of JP Morgan deal on FRB takeover. Take a look, The FDIC is ready to take on $13 billion in potential losses. JPMorgan has $900 billion in cash position (that is, free money), so they can buy up half of the banks altogether. We remember that the assets of the banking sector in the US are about 20 trillion. dollars, and the capital is about 10%. And that's for reporting purposes. Unrealized losses there are approx. equal to capital. So JPM can buy all this for zero, and use the cash to add liquidity to them and make them a little healthier. The losses will be borne by the state. Very convenient, right? And we also have GS, Citi, Morgan Stanley, WS etc that could also "participate".

In fact, if there is a bank with a good loan portfolio, which can agree with the regulator to take over other banks on good risk-free conditions, this opens up completely different perspectives. Especially when he conditionally has an unlimited resource in the Fed.

In fact, such a bank can even pick up not only depreciated financial assets in these banks, such as loans or bonds, but also real assets. And do it with free money. Let me remind you that the same JPMorgan deposit rates are still near zero and depositors carry their money to them, escaping problems in small and medium-sized banks. And commercial real estate, even regardless of the decrease in occupancy, fell in price only because of the increase in rates by tens of percent. Why is it bad to pick it up now, if you understand that sooner or later the rate will drop to zero again and only due to inflation this property will add interest per year?

So, I would start talking about the US banking system controlled&managed "centralization" rather than uncontrolled chaotic banking crisis where Fed and US Treasury are trying to fight the fire and plug holes. In latter case, everything was going to be not as smooth as it has happened.

Second is, on a back of this crisis, could stand the priority of narrow-group interests over public ones (trying to tear off a bigger slice while there is an opportunity). While other market participants, and politicians, too, simply refuse to believe in such primitive cannibalism and try to find either a cunning plan or a subtle calculation in the actions of the Fed. It is easy - raise rates, provoke crisis and start banking sanitation.

Finally, banking crisis could have relation to strategic plan. More and more economists start speaking about controlled US Default. This is necessary to take back the strategical control that is lost now. But to do this, they need really big event, something of 09/11 scale. Thus, consolidation of banking system might be the preparation step. But, what is more probable - this is combination of all reasons mentioned here. And there are few political events that indirectly hint on this verse. We consider them in our Gold report tomorrow.

Of course, it can't pass unsigned for real economy sector. Small businesses are struggling to get loans and tightening conditions, and that usually means lower bank lending over the next 12 months. This chart also confirms our view that the US economy is already in recession since the last year, at least:

Bank failures, by and large, is not a tragedy, but they are an important indicator that the real sector can't carry the burden of higher rates, because banks cannot fully put these rates on them. Loans have the appropriate deadlines, and the rate increase is going too fast. All these bank rescues take place inside the financial system and do not affect M1 and M2. People simply transfer money from a small bank to a large bank or to money market.

The fight against inflation is not real. Over the year, QT M1 and M2 decreased, but only on savings accounts of non-financial companies. An indicator of a decrease in demand would be a decrease, first of all, in current accounts. Don't you spend "cash" first and only then sell assets if you need money?

Therefore, It seems that the main part of the blow falls on the financial sector, and the global one. The real sector did not feel this until the rates rose for it, and this is happening quite slowly. Thus, the major goal is to weaken or expose oversea competitors and this goal is being successfully implemented, then it is necessary to make sure that the competitor has problems for a long time. The Great European Depression. And this can only be done by destroying its superstructure in the form of the financial sector. So maybe that's the goal?

There core is the Eurodollar system. It can be destroyed by a liquidity crisis. The background is prepared with a high rate. How many commercial mortgages in the United States need to be refinanced in the next three years? 5 trillion? The eurodollar system is many times larger than the American one and the debt there is more diverse.

So - keep an eye on the process of banking crisis, but take a wider look at reasons and consequences. It might be just a tool, the disguise of big political tricks.

To be continued...

This week we've got a lot of data, including two central banks meeting and job statistics on Friday. If it is more or less clear with the job report, J. Powell speech raises many questions. Even not about the content of speech but about possible confidence loss in what he is doing. The most repeatable phrase was " we do not have information". It seems that Fed stands at the edge, when its technical economical decisions come very close to become political but it seems that J. Powell has no permition to accept this responsibility and, actually do not want it. This is not good sign for strategic management.

Market overview

The dollar rose on Thursday against the euro after the European Central Bank eased its pace of rate hikes, a day after the Federal Reserve hiked rates by 25 basis points and indicated that it may pause further increases. The ECB’s 25-basis-point increase was the smallest since it started lifting them last summer, but the bank also signalled that more tightening would be needed to tame inflation. The Fed on Wednesday dropped from its policy statement language saying that it "anticipates" further rate increases would be needed.

Market reaction was relatively subdued, however, with the euro and yen failing to break out of recent ranges against the greenback. The single currency has gained against the dollar in recent months as investors bet the dollar’s interest rate advantage over the single currency would continue to decline. But analysts said that much of that expected move may already be priced in, with the next focus likely to be when the U.S. central bank will start cutting rates.

“The monetary policy dynamics are more or less fully priced in here at this point in terms of the tightening cycle, now it’s going to be a focus on the bets on when the Fed starts to ease, how much it eases and how that relates to what (other) central banks are doing,” said Shaun Osborne, chief FX strategist at Scotiabank in Toronto.

Fed funds futures traders are now pricing in a roughly 62% chance the Fed will begin cutting rates by July, according to the CME Group’s FedWatch. Adding to the argument that the Fed will soon begin easing monetary conditions were lingering fears of banking sector turmoil.

Analysts at Morgan Stanley said that "we think the Fed is done hiking rates. But we expect the US dollar to gain," noting that "falling Treasury yields may herald a risk-off trading environment, implying US dollar strength to come." Shorter-dated rates are likely to fall on growing concern about the U.S. banking sector, the analysts said in a report, as money market fund assets continue to grow and banks see more deposit outflows.

The greenback got a brief boost on Thursday after data showed that U.S. Unit labor costs - the price of labor per single unit of output - surged at a 6.3% rate in the first quarter, after increasing at a 3.3% pace in the fourth quarter. It is interesting that Labour productivity simultaneously dropped by 2.7% in 1Q.

"That gave the dollar a bit of a push up because it came in quite a bit higher than expected and it’s not really commensurate with the Fed on hold story," said Osborne.

Economists polled by Reuters expect a 0.4% rise in consumer prices. A sharper-than-expected slowdown could vindicate those betting on rate cuts later this year, giving a further tailwind to risk assets - including an equity rally that has seen the S&P 500 gain 5.8% year-to-date. A strong reading, on the other hand, would support the case for the Fed to keep rates higher for longer and feed into market fears over stagflation - a mix of high inflation and low growth that is detrimental to risk assets.

Another highly waited statistics is consumer price data for April, due on Wednesday, May 10, that could offer a clearer picture of whether the Fed’s interest rate increases are cooling inflation. A strong number could weigh on a rally that has lifted the S&P 500 nearly 8% this year. April’s survey of global fund managers from BoFA Global Research showed stagflation expectations near historical highs, with 86% saying it will be part of the macroeconomic backdrop in 2024.

The U.S. dollar will remain resilient against most major currencies over the coming months despite expectations of narrowing interest rate differentials, a Reuters poll of foreign exchange strategists predicted. The dollar was forecast to trade around current levels against most major currencies over the next six months, according to the April 28-May 3 Reuters poll of 75 strategists.

Still, Over the next 12 months, the dollar is expected to fall 2.7% and 2.4% against the euro and pound, respectively.

"If short rate expectations are going to drive currency trends, we'll go on seeing the ECB's hawkish stance dominate and there's more upside to EUR/USD...to come," said Kit Juckes, chief FX strategist at Societe Generale.

Easing concerns about the health of the banking system following the orderly failure of three U.S. mid-sized lenders since mid-March suggests inflation remains the key worry given the economy is holding up reasonably well. Most of the optimism around the dollar stems from the view that irrespective of whether the Fed is done with its tightening cycle on Wednesday, it is unlikely to start cutting rates any time soon as some in financial markets are betting.

"It is our view, that these cuts will be priced out in the coming months as the Fed, like many other G10 central banks, struggles to push services inflation lower," said Jane Foley, head of FX strategy at Rabobank. "We also expect the dollar will see further bouts of support in the months ahead from safe-haven demand."

Euro zone inflation accelerated last month but underlying price growth eased unexpectedly. Overall price growth in the 20 nations sharing the euro currency picked up to 7.0% in April from 6.9% a month earlier, Eurostat said on Tuesday, in line with expectations in a Reuters poll of economists. Excluding volatile food and fuel prices, core inflation slowed to 7.3% from 7.5%.

The central bank's latest poll of 61 large euro zone companies from outside the financial sector may give it some comfort, with companies reporting slower price growth, albeit with differences among sectors. Labour costs were rising, with wages expected to rise by 5% this year -- unchanged from the previous survey round in February. This meant that service providers, which are particularly sensitive to labour costs, continued to anticipate strong price hikes.

Nearly all 26 members of the Governing Council appear to agree that more policy tightening is required after a record 350 basis points of rate increases since July. A key worry is that wage growth is now accelerating above expectations and this will drive up the cost of services, the single largest item in the consumer price basket. Investors see the ECB's 3% deposit rate rising to around 3.75% by the end of the summer.

Economists at UBS expect the benchmark interest rate in the eurozone to peak at 3.75%, while Societe Generale sees it at 4% after the European Central Bank (ECB) signalled more tightening ahead. However, UBS expects a pause after July as it sees inflation declining slowly over the summer.

Goldman Sachs and Bank of America also expect the rate to peak at 3.75%, although BofA sees a "significantly" higher chance of rates hitting 4%. Societe Generale expects three more hikes as it sees the eurozone's core inflation staying elevated without showing convincing signs of weakening until September.

The ECB euro short-term rate (ESTR) September 2023 forward was around 3.6%, implying an ECB deposit rate peak of 3.7% by this summer.

The European Central Bank will stop reinvesting cash from maturing bonds bought under its 3.2 trillion Asset Purchase Programme from July, it said on Thursday, taking another small step towards shrinking its oversized balance sheet. Redemptions fluctuate, but about 148 billion euros' worth of debt held under the APP expires in the second half of the year. That means a halt to reinvestment would see an extra 58 billion euros' worth of maturities on top of the currently scheduled 15 billion euros per month.

At 7.7 trillion euros, the ECB's balance sheet is already more than a trillion euros below its peak size but remains well above its historical average. Thursday's decision does not affect reinvestments in the smaller, 1.7 trillion euro Pandemic Emergency Purchase Programme, which are set to continue until the end of 2024.

On Friday, NFP showed that employers added 253,000 jobs, beating economists' forecasts for a 180,000 gain. But data for March was also revised lower to show 165,000 jobs added instead of 236,000 as previously reported.

The unexpected rise in US employment and wages last month increases the chances that the Fed will keep rates high longer and possibly keep the door open for the 11th straight rate hike in June. U.S. average hourly earnings rose at an annual rate of 4.4%, above expectations for a 4.2% increase.

Technical analysts at JPMorgan including Jason Hunter noted on Friday that there are bearish divergences on the daily EUR/USD chart and that the single currency's gains have stalled, but the rally is "not decisively over." The bank said that if the euro sees sustained weakness below the $1.0909 and $1.0831 levels, it would confirm a short-term trend reversal, while a drop below $1.0762 "would imply a more significant trend reversal is in the making."

US BANKING CRISIS

Speaking shortly - it is not resolved and still underway, despite that the Fed, US Treasury together with big banks coup problem banks fast. To be honest guys, by looking at Fed, Treasury reactions, by looking on how fast big banks participate and takeover problem banks, I start to think that this is controlled and well-managed process. Because failed banks are not small at all. They are among top-20. And I start suspecting that it also could have a relation to inner political confrontation, becoming a tool for it.

Recent data shows, that deposits outflows continues. Deposits on a non-seasonally adjusted basis fell in the week ended April 26 to about $17.1 trillion, a drop of about $120 billion from the week earlier. That was the lowest level since June 2021, with deposits now having declined by more than $500 billion from the week before collapsed in March. Meanwhile, total banking system credit has yet to show the contraction many economists and policymakers anticipate to develop after the recent banking system turmoil and aggressive interest rate increases by the Federal Reserve over the past year. We mentioned few more banks that under investors' scrutiny for to fall next, such as WestPac and some others. Run into money market funds continues:

And actually, this is not unique for the US, but the same tendency starts in Europe. In Germany, Bundesbank data showed households' deposits dropped nearly 8% from a year earlier.

So, the reason why I think that this is controlled process is an example of JP Morgan deal on FRB takeover. Take a look, The FDIC is ready to take on $13 billion in potential losses. JPMorgan has $900 billion in cash position (that is, free money), so they can buy up half of the banks altogether. We remember that the assets of the banking sector in the US are about 20 trillion. dollars, and the capital is about 10%. And that's for reporting purposes. Unrealized losses there are approx. equal to capital. So JPM can buy all this for zero, and use the cash to add liquidity to them and make them a little healthier. The losses will be borne by the state. Very convenient, right? And we also have GS, Citi, Morgan Stanley, WS etc that could also "participate".

In fact, if there is a bank with a good loan portfolio, which can agree with the regulator to take over other banks on good risk-free conditions, this opens up completely different perspectives. Especially when he conditionally has an unlimited resource in the Fed.

In fact, such a bank can even pick up not only depreciated financial assets in these banks, such as loans or bonds, but also real assets. And do it with free money. Let me remind you that the same JPMorgan deposit rates are still near zero and depositors carry their money to them, escaping problems in small and medium-sized banks. And commercial real estate, even regardless of the decrease in occupancy, fell in price only because of the increase in rates by tens of percent. Why is it bad to pick it up now, if you understand that sooner or later the rate will drop to zero again and only due to inflation this property will add interest per year?

So, I would start talking about the US banking system controlled&managed "centralization" rather than uncontrolled chaotic banking crisis where Fed and US Treasury are trying to fight the fire and plug holes. In latter case, everything was going to be not as smooth as it has happened.

Second is, on a back of this crisis, could stand the priority of narrow-group interests over public ones (trying to tear off a bigger slice while there is an opportunity). While other market participants, and politicians, too, simply refuse to believe in such primitive cannibalism and try to find either a cunning plan or a subtle calculation in the actions of the Fed. It is easy - raise rates, provoke crisis and start banking sanitation.

Finally, banking crisis could have relation to strategic plan. More and more economists start speaking about controlled US Default. This is necessary to take back the strategical control that is lost now. But to do this, they need really big event, something of 09/11 scale. Thus, consolidation of banking system might be the preparation step. But, what is more probable - this is combination of all reasons mentioned here. And there are few political events that indirectly hint on this verse. We consider them in our Gold report tomorrow.

Of course, it can't pass unsigned for real economy sector. Small businesses are struggling to get loans and tightening conditions, and that usually means lower bank lending over the next 12 months. This chart also confirms our view that the US economy is already in recession since the last year, at least:

Bank failures, by and large, is not a tragedy, but they are an important indicator that the real sector can't carry the burden of higher rates, because banks cannot fully put these rates on them. Loans have the appropriate deadlines, and the rate increase is going too fast. All these bank rescues take place inside the financial system and do not affect M1 and M2. People simply transfer money from a small bank to a large bank or to money market.

The fight against inflation is not real. Over the year, QT M1 and M2 decreased, but only on savings accounts of non-financial companies. An indicator of a decrease in demand would be a decrease, first of all, in current accounts. Don't you spend "cash" first and only then sell assets if you need money?

Therefore, It seems that the main part of the blow falls on the financial sector, and the global one. The real sector did not feel this until the rates rose for it, and this is happening quite slowly. Thus, the major goal is to weaken or expose oversea competitors and this goal is being successfully implemented, then it is necessary to make sure that the competitor has problems for a long time. The Great European Depression. And this can only be done by destroying its superstructure in the form of the financial sector. So maybe that's the goal?

There core is the Eurodollar system. It can be destroyed by a liquidity crisis. The background is prepared with a high rate. How many commercial mortgages in the United States need to be refinanced in the next three years? 5 trillion? The eurodollar system is many times larger than the American one and the debt there is more diverse.

So - keep an eye on the process of banking crisis, but take a wider look at reasons and consequences. It might be just a tool, the disguise of big political tricks.

To be continued...