hollywood1111

Recruit

- Messages

- 10

Thank you Sive, and please continue this work. I managed to get some pips today. Since I follow your trading plans, I only had winnings.

Good morning,

Today is Friday, today is NFP, so be careful.

Our weekly momentum trade comes to an end. Yesterday market has exceeded 1.45 area and didn't reach 1.4560 for some pips. As you understand 30-40 pips in terms of weekly time frame is nothing.

So, if you trade with our trading plan - think about tightening stops or even take profit. Do not risk profit that you already have lightly. Because trading during NFP release is slice and dice game. Be wise...

Still, if you want to trade - today we could do it I suppose. Our target will be 1.4560 area - daily Overbought, 5/8 weekly Fib resistance, 4-hour Crab target and hourly AB=CD target.

Since market not at overbought yet - it should not show deep retracement before achievement significant target. That's why I like to look at 1.4440 area for potential itraday scalp buy. This is hourly Confluence support.

Stop could be placed below 1.4390 - mothly pivot, previous consolidation and 0.618 support at hourly chart.

Market should not break all these stuff before hitting 1.4560 area. Still - today NFP, be aware of fake outs and splashes that could lead to stop grabbing. You know all this stuff, it's even needless to say here...

Hi Sive, i would like to know your opinion about yesterday market behaviour at the release of US NFP.

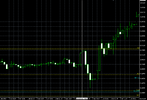

As we know numbers released were worse than expected. So, i thought that EUR should had gone up with an "instant" move (a spike). But the market reacted in a very different way. The EUR dropped (about 80 pips in 15 minutes. We can say he stopped the down move near the hourlyconfluence support, agreement with the ABC top pattern and the daily pivot point). After that market finally bounced up. Why market acted in such way? I mean, i found the initial down move really unexpected and "illogical" (for me, but not for all other market participants). (BTW, the successive up move might be related also with the greece debt situation progress).

I've attached two graphs, H1 and M5.

I would appreciate very much any comment/clarification.

Thank you in advance

View attachment 3380

View attachment 3381

Hi Papao,

It could be positions covering by those who do not want to take risk of uncertainty during release.

But I'm not a big expert of data trading. Personally I prefer to not have a possition during release time.

Greetings Sive, thanks once again for ur incisive analysis. pls i just stumbled upon DiNapoli indicator on my platform, would want to know the settings u recommend for me and their time frames. thanks once again for ur understanding.