Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

This was relatively quiet week, with just few news that have global meaning for the markets.As storm of Brexit breakout and new Fed policy was starting to calm down - investors turn to US/China negotiations progress. Also we've got first press conference of C. Lagarde, BoE meeting and some statistics through the week.

The euro edged down on Monday as investors awaited Christine Lagarde’s first speech as European Central Bank president, but hopes that the United States may choose not to impose tariffs on auto imports kept it near its highest level in weeks.

Lagarde gives her first speech on Monday as ECB chief, and markets are assuming she will stick with the easy policy script of her predecessor, Mario Draghi.

U.S. Commerce Secretary Wilbur Ross said in an interview published on Sunday that Washington may not need to impose tariffs on imported vehicles later this month after holding “good conversations” with automakers in the European Union, Japan and Korea.

The tariffs have already been delayed once by six months, and trade experts say that could happen again.

“That could lift the cloud over German manufacturing,” said Kenneth Broux, corporate forex strategist at Societe Generale.

“It could help to lift sentiment a lot” in the euro area, he said, adding that he was “not convinced that we’ll hear a lot of policy direction substance” from Lagarde on Monday.

The dollar held the upper hand against its rivals on Wednesday, particularly versus traditional safe-haven currencies, on rising hopes for a U.S.-China trade deal and a string of solid U.S. economic data.

Hopes that the Trump administration could roll back some of the tariffs it imposed on goods from China as part of a “phase one” U.S.-China trade deal boosted risk sentiment in financial markets.

A survey on the vast U.S. service sector published on Tuesday showed that business sentiment had improved in October from a three-year low in September.

The ISM non-manufacturing sector index rose to 54.7 from 52.6 in September, beating market expectations.

The rebound is a welcome sign for dollar bulls as a fall in the index would have suggested that malaise in trade war-hit manufacturers was infecting the service sector, too.

The data came after strong a U.S. employment report on Friday.

“On top of Sino-U.S. trade issues, the market is reacting to signs of U.S. economic strength at the moment,” said Kyosuke Suzuki, director of foreign exchange at Societe Generale.

The dollar was caught off-guard on Wednesday after a senior official in U.S. President Donald Trump’s administration told Reuters the signing of a so-called “phase one” trade deal could be delayed until December.

Trump had previously indicated an agreement could be signed this month.

Many investors remain nervous about the risks to the global outlook given the Sino-U.S. trade war and Brexit show no signs of a quick resolution.

“The dollar is looking for direction,” said Takuya Kanda, general manager of the research department at Gaitame.com Research Institute in Tokyo.

“The main catalyst for dollar buying was expectations that a U.S.-China trade deal is signed this month. If that is delayed by one month, that is not such a disappointment, but we need to see what the Chinese government has to say.”

Two Bank of England officials unexpectedly voted to lower interest rates on Thursday to ward off an economic slowdown, and others including Governor Mark Carney said they would consider a cut if global and Brexit headwinds do not ease.

Economists polled by Reuters had expected the BoE to vote unanimously to keep Bank Rate at 0.75%, and the announcement of the 7-2 split pushed sterling to a two-week low as market odds on a cut next year rose as high as 80%.

To date, the BoE has resisted following the U.S. Federal Reserve and the European Central Bank in cutting its main interest rate, but Thursday’s Monetary Policy Report positions the BoE for a change in stance.

Carney said the BoE’s central scenario was that a slowdown in global growth would stabilize and that Prime Minister Boris Johnson’s Brexit deal — which parliament has yet to approve — pointed the way to a reduction in Brexit uncertainty.

If this scenario unfolds, the BoE would still be able to stick to its long-standing message about limited and gradual rate hikes.

But if the outlook deteriorates, the BoE said a rate cut would become more likely.

“These are pretty big tectonic forces operating right now,” Carney told reporters. “If global growth fails to stabilize or if Brexit uncertainties remain entrenched, monetary policy may need to reinforce the expected recovery in UK GDP growth.”

For Monetary Policy Committee members Michael Saunders and Jonathan Haskel, it was already time to act — they cast the first votes for a rate cut since shortly after the 2016 Brexit referendum.

“In the short term at least, it seems the MPC is more concerned about the downside risks to growth and is prepared to pull the trigger on a rate cut if and when these risks materialize,” PwC economist John Hawksworth said.

The BoE is also grappling with uncertainty about an election which Johnson has called for Dec. 12, in a bid to get a majority to pass his Brexit deal before a new deadline of Jan. 31.

The two main political parties are promising to end years of austerity and spend billions on infrastructure — aided by record-low interest rates — to try to fuel growth.

JOB MARKET WORRIES

Saunders and Haskel noted reduced job vacancies that suggested Britain’s hitherto strong labor market was weakening as well as risks from the world economy and Brexit.

Other MPC members showed a new openness to cutting rates if things soured. They also softened their language on the need for limited and gradual rate hikes in the medium term, saying they “might” rather than “would” be necessary.

But economists at HSBC said a rate cut was not a certainty, as some policymakers looked concerned about rising labor costs.

“As we think may be the case for other central banks, uncertainties and divisions may mean the ultimate outcome is to stay on hold,” HSBC’s Simon Wells and Chris Hare wrote.

The BoE as a whole painted a darker picture for Britain’s economy over the next three years, predicting it will grow 1% less over the period than it had forecast in August, mostly due to a weaker global economy and a recently stronger pound.

But part of the growth downgrade reflected Johnson’s Brexit plans.

The BoE now assumes Britain will strike a trade deal that leads to new customs checks and puts up barriers to exports of financial and legal services.

The growth forecast would have been weaker still without higher spending announced by the government in September which the BoE said would add 0.4% to the economy.

Inflation, currently 1.7%, is forecast to drop to 1.2% in the middle of next year due to lower oil prices and regulatory caps on electricity and water bills.

But over the next couple of years, the BoE sees economic growth picking up from 1.4% in 2019 to 2.0% in 2022. The 2022 growth rate is above Britain’s long-term trend and would push inflation back above the BoE’s 2% goal, the central bank said.

The Chinese commerce ministry said that China and the U.S. must simultaneously cancel some existing tariffs on each other’s goods for both sides to reach a “phase one” trade deal.

The proportion of tariffs cancelled must be the same, and how many tariffs should be cancelled can be negotiated, said the spokesman.

The dollar jumped up to near three-month highs versus the yen, retracing its 0.3% losses from earlier in the session, as investors interpreted the comments as positive news, reducing demand for safe-haven currencies.

Adam Cole, chief currency strategist at RBC Capital Markets said the Chinese comments improved market sentiment around the trade negotiations.

“I think the best people hoped for was that we would avoid the next tranche of tariffs kicking in, whereas momentum seems to be moving in the direction of existing tariffs rolling back,” he said.

Hopes for a trade deal had been waning after a senior official of the Trump administration told Reuters on Wednesday that a meeting to sign the deal could be delayed until December and that a venue had not yet been agreed.

“Expectations were depressed and it’s not hard to beat expectations when they’re that low,” he added.

The dollar rallied to a three-week high on Friday, getting some safe-haven bids, as risk appetite for higher-yielding currencies waned with renewed uncertainty about the rollback of existing tariffs, a major component of a preliminary U.S.-China trade deal.

U.S. President Donald Trump on Friday further magnified the uncertainty, saying he had not agreed to roll back tariffs.

His comments came a day after U.S. and Chinese officials reportedly agreed to roll back tariffs on each others’ goods in a “phase one” trade deal if it is completed.

But a report also on Thursday seemed to contradict that news, with multiple sources saying the rollback faces fierce internal opposition at the White House and from outside advisers. The idea of a tariff rollback was not part of the original October “handshake” deal between Chinese Vice Premier Liu He and Trump, these sources said.

“What really has been driving the market is this underlying uncertainty over whether or not we will get that rollback,” said Brian Daingerfield, head of G10 FX strategy, at Natwest Markets in Stamford, Connecticut.

Overall, though, sentiment is likely to remain supportive for risky assets, as efforts are being made to do a trade deal, which would remove a huge risk to the global economic outlook.

“The fact that there is some discussion of moving existing tariffs leans more positive,” Daingerfield said.

White House spokeswoman Stephanie Grisham told Fox Business Network in an interview on Friday that tariffs could be lifted on Chinese goods if an agreement is reached, but she gave no further details.

Jonas Goltermann, senior markets economist at Capital Economics in London, believes as trade tensions persist, the dollar is likely to stay strong.

“While we don’t expect relative interest rates to boost the dollar much further in the near term, we think that continued trade tensions and a slowing global economy mean that the greenback will rise a bit further in 2020 despite the fact that on a trade-weighted basis it is already near its highest level since the early 2000s,” Goltermann said.

Sterling edged lower on Friday and is poised for a weekly loss as investors await political developments ahead of Britain’s Dec. 12 election.

The pound briefly dipped below $1.28 against the dollar earlier, ignoring news that Scottish First Minister Nicola Sturgeon would seek to form a “progressive alliance” to keep the Conservatives out in the event of a hung parliament.

Sturgeon said the Scottish National Party would seek to stop Brexit by supporting a second referendum.

The Bank of England meeting’s surprisingly dovish outcome did not make a lasting impression on the pound, Commerzbank FX strategist Thu Lan Nguyen said. “It just shows that the market is largely concentrated on politics at the moment, and not on fundamentals and monetary policy,” she said.

Labour market data showed that British employers’ demand for staff grew in October at the slowest rate in almost eight years. Nguyen said the weaker labour data fits into a deteriorating economic picture - along with Brexit uncertainty and weak global growth - which could make the BoE more dovish.

“This should at least limit the appreciation potential of the pound over the medium to long term, but still the general direction of pound exchange rate will be determined by the general election,” she said.

However, some investors were turning more bullish. Gregory Perdon, co-chief investment officer at Arbuthnot Latham, said that he was more optimistic on UK assets.

“It is true no one knows the Brexit outcome but it does not feel like 50/50 anymore,” he said, adding that Arbuthnot Latham had increased pound positions.

“This way, if the UK markets snap back to the upside, we will participate in the rally,” Perdon said.

CFTC data shows that net short position has increased again on EUR. It means that short position is growing three weeks in a row:

Finally here is interesting update on perspective of EU economy from Fathom consulting:

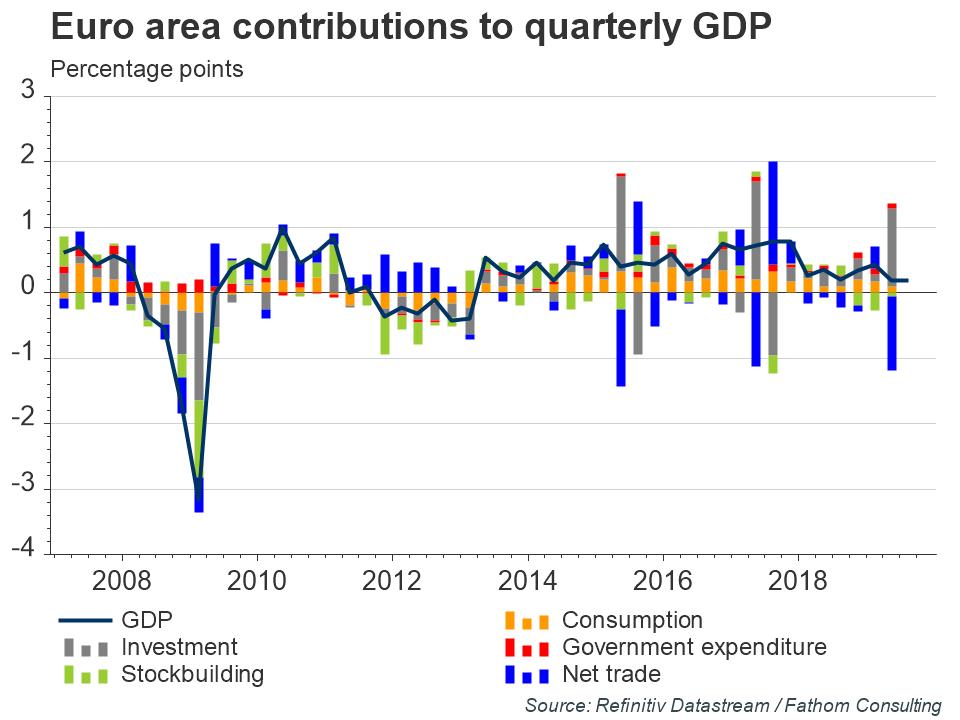

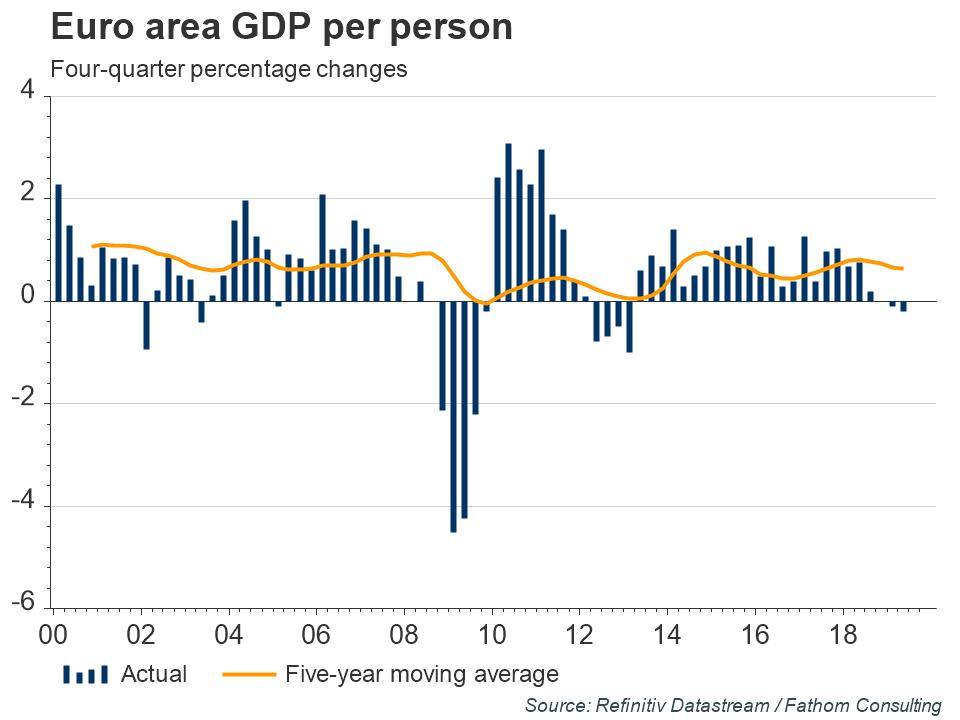

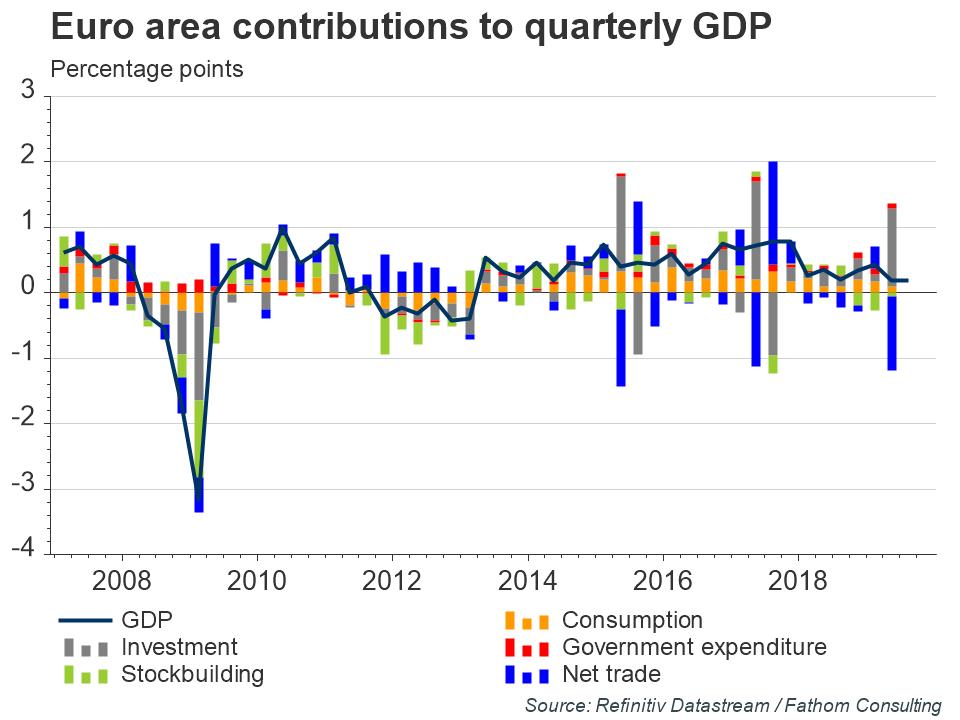

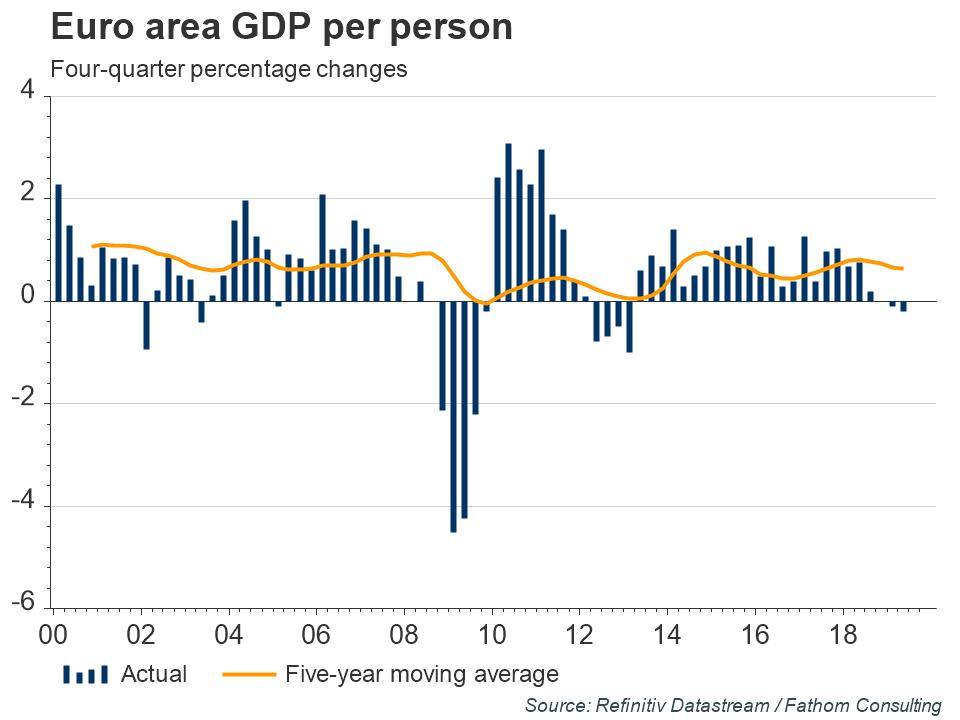

Data released on Thursday showed that the euro area economy expanded by 0.2% in the third quarter of this year, in line with the predictions of Fathom’s Nowcast model. The reading, which was unchanged from the previous quarter and marginally above the average forecast of the Reuters Poll (0.1%), reflected small upside growth surprises in both France and Italy.

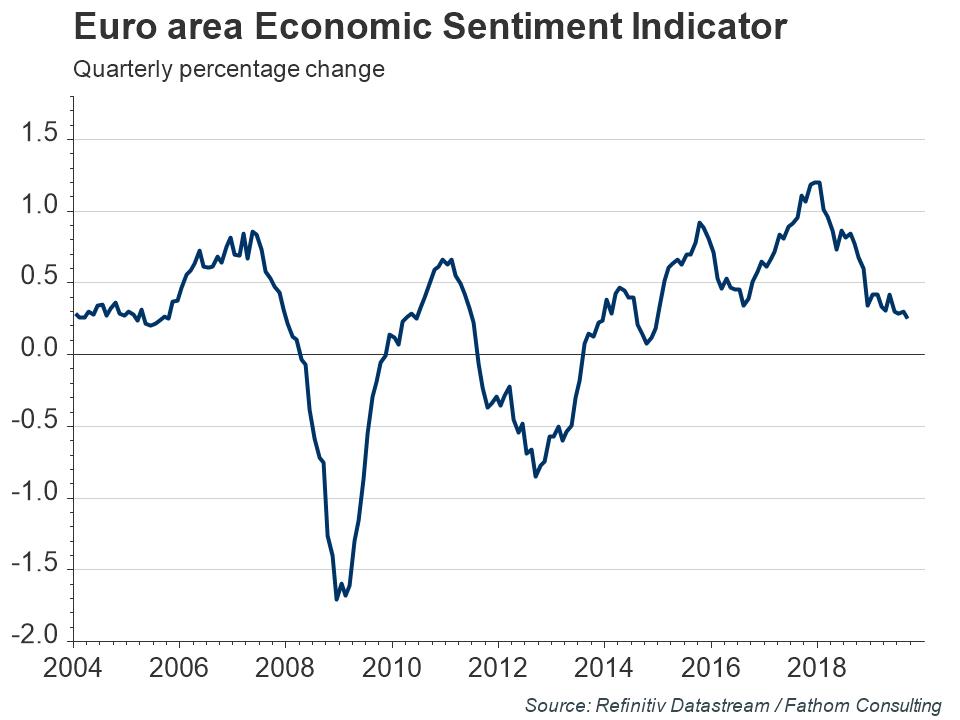

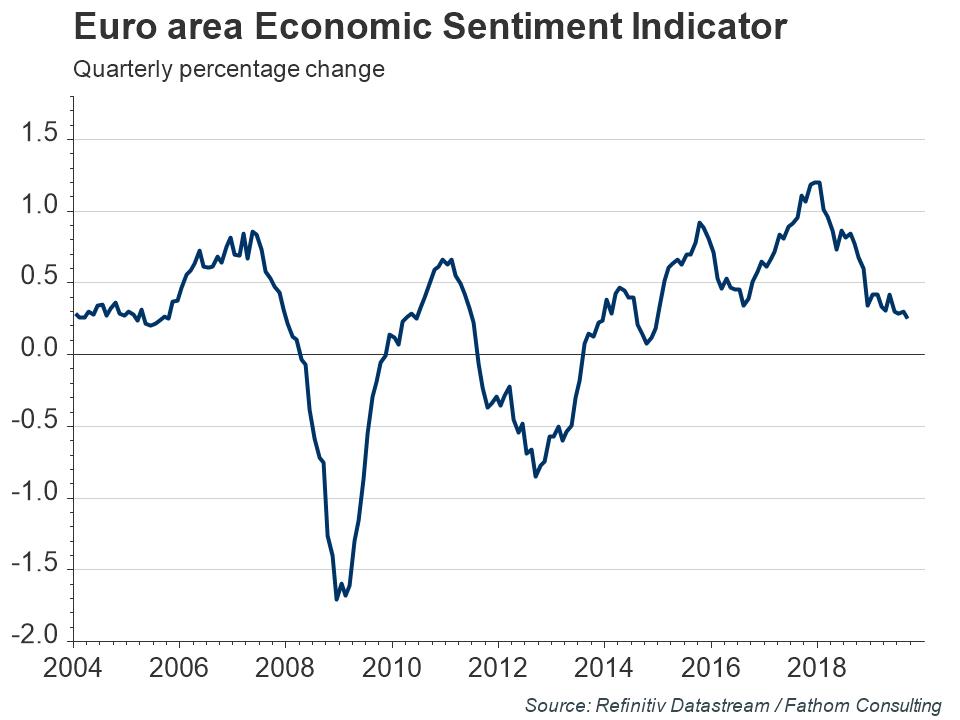

Fathom’s euro area Economic Sentiment Indicator — which distils the information from numerous measures of consumer and business confidence into a single composite measure — has fallen substantially since the start of 2018, driven by a fall in manufacturing sentiment. Although the ESI has shown signs of stabilisation in recent months, it did tick down again at the end of the third quarter. Its current level of 0.2% suggests that growth is unlikely to pick up any time soon. Although a recession in the euro area is not our central case, the natural volatility in GDP growth and a weak underlying trend implies that the odds of a quarterly contraction are high.

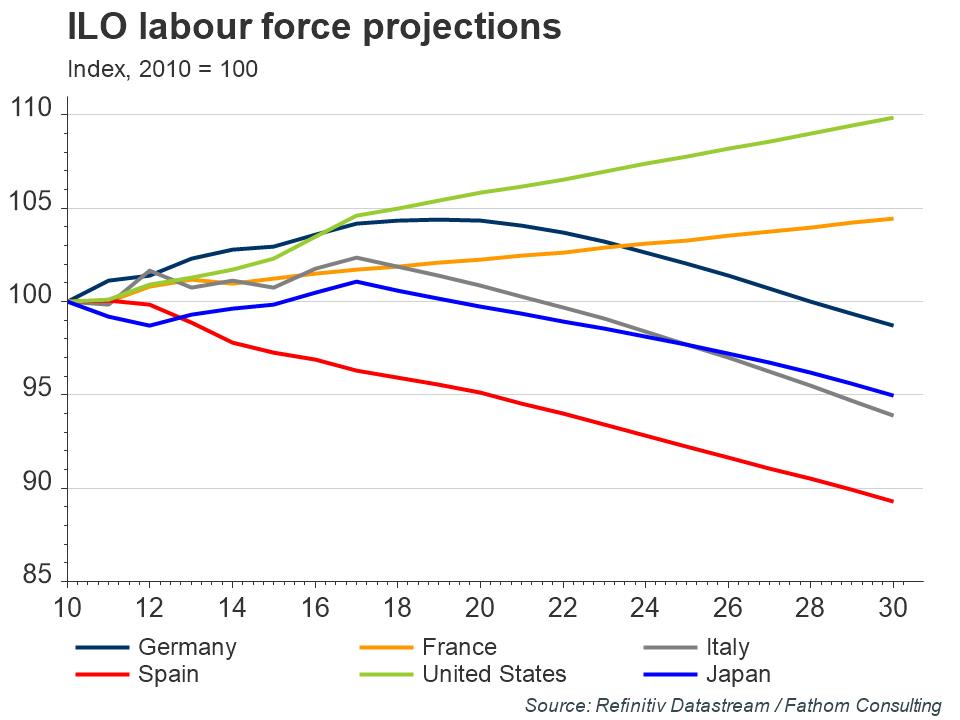

While euro area policymakers may view a growth rate of 0.2% as somewhat of a disappointment, it is broadly in line with Fathom’s estimate of the currency bloc’s trend rate of growth. According to economic theory, in the medium term an economy’s trend growth rate ultimately depends upon increases in underlying productivity and growth in the labour force. On both counts, the outlook for the euro area is far from bright.

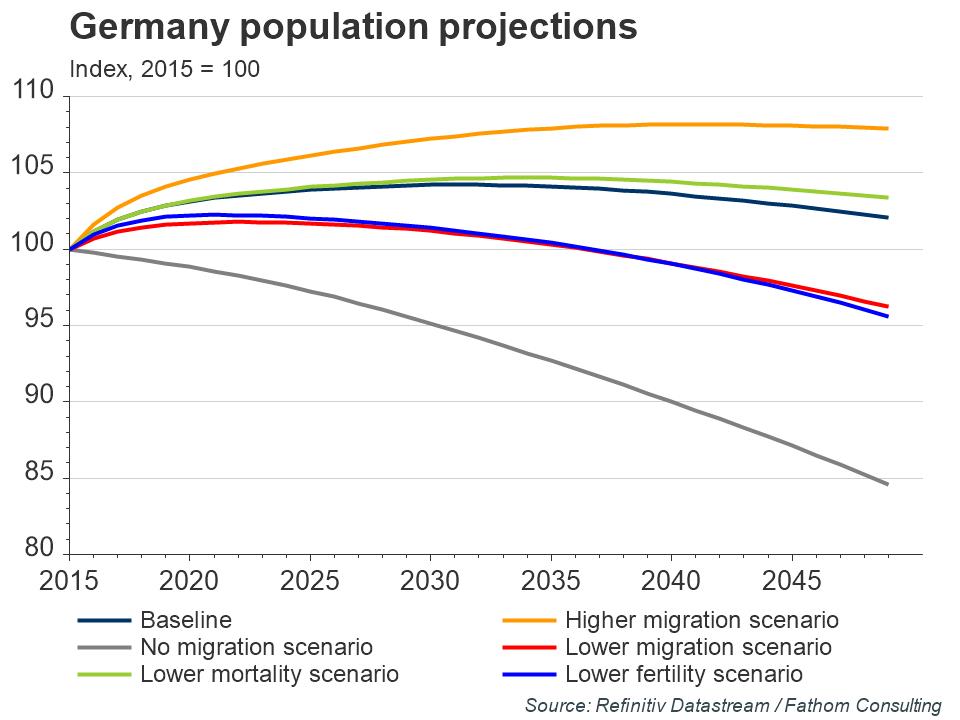

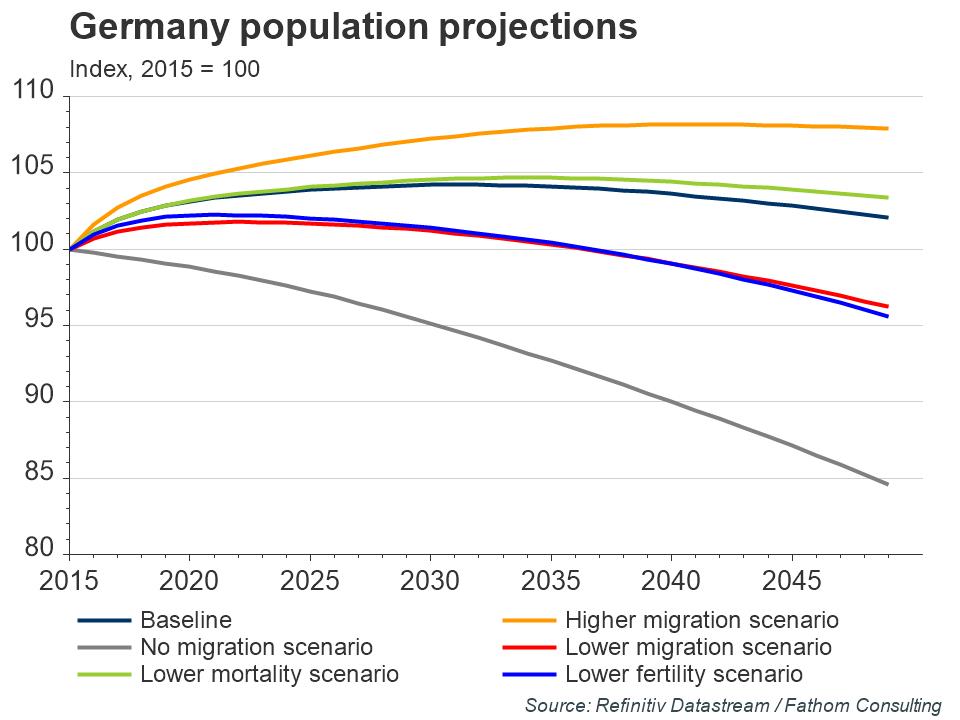

On the population front, Eurostat provides projections under a range of assumptions out to 2100. Under the central projection, the population growth rate is expected to slow substantially and even turn negative in the coming years. This is of particular concern for countries such as Germany and Italy, whose populations are projected to have started shrinking by 2049.

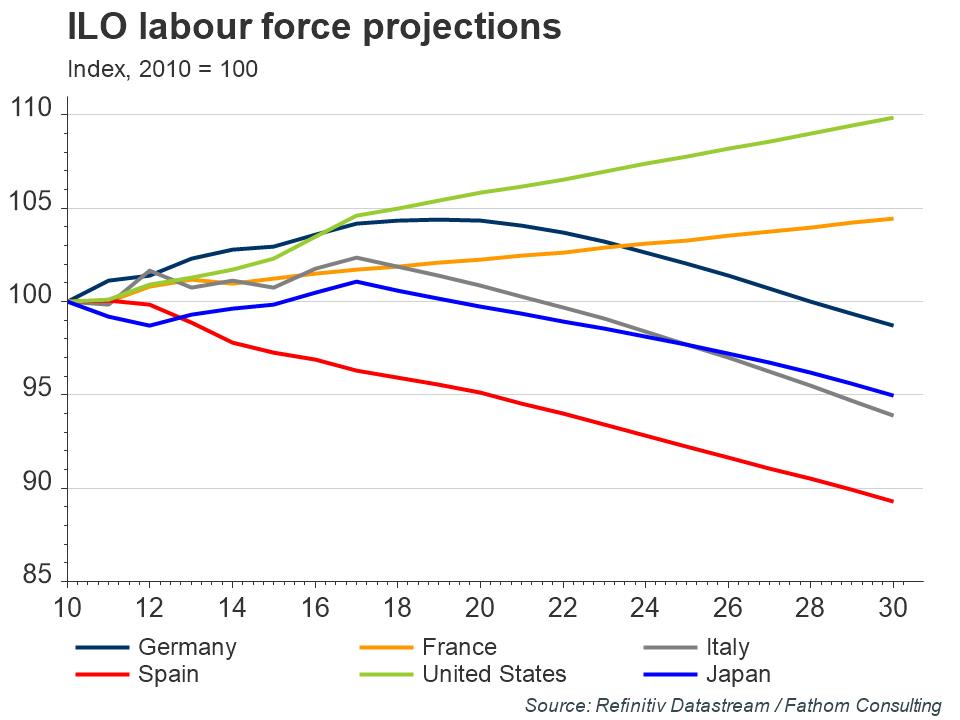

From an economic perspective, it is the fraction of the population available to work — i.e. the labour force — that determines long-run outcomes. Broadly speaking, these are individuals aged 15–64. In the medium term, lower fertility rates and the natural ageing of the population will affect this age group significantly, with the International Labour Organization (ILO) predicting that, for many euro area member states, the labour force will have shrunk substantially by 2030.

Aggregate output can of course still rise in such a world, but only if the growth rate of productivity outpaces declines in the labour force. Fortunately, while the annual growth rate of euro area labour productivity has turned negative in recent quarters, the underlying trend is still positive, even if it has slowed since the financial crisis. With limited ability to affect population growth in the short run, policymakers’ attention is likely to eventually shift towards boosting productivity as a means to improving growth. Whether this can be achieved, and whether it will be sufficient to offset declining populations, remains to be seen.

Thus, EUR action this week totally matches to changing in sentiment and reflects two driving factors. First is, investors anticipate US/Sino agreement signing, which shifts uncertainty to EU side as there is long hanging hazard of US tariffs against auto producers. This combination presses on EU value. Tariffs war easing should make positive impact on US and China economies (at least on paper), but EU will stand aside of this success. This leads to EUR creeping lower.

Within 3-4 weeks there are two major events will make the shape of the market - agreement signing and its details and any news on UK December elections.

Technicals

Monthly

As we said, we've got reversal month by October's close. November stands inside one by far, showing retracement back in October's body. In general this is not something uncommon and absolutely natural process. At the same time, taking broader view - forming of reversal bar doesn't make any impact on major tendency by far, as EUR still keeps LH-LL trend. Reversal bar will be valid if it will lead to breaking of this tendency.

In general recent changes were in favor of EUR due poor US statistics and more dovish Fed policy. But this week data has improved (ISM, NFP) and new achievement of US/China negotiations stands on horizon. It stops for awhile EUR appreciation. Now we need to keep close eye on key technical levels that are vital for longer-term tendency. Market should not erase October rally as it was in June. Otherwise EUR continues to drift lower to 1.03 area.

Now we come closer to the end of the year and second issue that might be interesting on EUR is YPS1. If EUR, by the end of the year will be able to hold above YPS1 - 2019 action could be treated as retracement of 2016 - 2017 rally. And EUR will keep chances on extension in 2020.

That's being said the major intrigue stands around fundamental background now - it is changing. It is interesting whether its change will be strong enough to make impact on monthly chart and long lasting tendency here. As economy in EU hardly will improve soon - the major driving factor depends on US - how better/worse situation will be there.

Weekly

If nothing outstanding will happen, it seems that we should forget about bullish tendency, at least for a few weeks. Weekly chart brings worrying picture. It stands out of long-term price shape inside the channel. Never before we see the same price action. Downside reversal is sharp and engulfs three previous weeks (almost month), so I mark it with "R" letter.

This let's call it reversal, happens in the middle of the range and not at some resistance area, which looks even more bearish.

Thus, currently we have to be extra careful with any long positions on daily/intraday charts. This miserable plunge on weekly chart promises nothing good to bulls on next week.

Daily

Trend stands bearish on daily chart. Here is major test is coming for EUR ambitions. Above we've talked about "vital" levels and here is the first one - major 5/8 Fib support and Agreement with XOP + daily Osold area.

Potentially, here we will get "222" Buy" pattern, which should trigger 30% upside bounce, at least. It means that if you keep shorts since last week - you have to manage stops and think about profit booking, at least partially. Second - no new shorts could be taken right now on daily chart, because market is too close to support. And, finally - scalp traders could keep an eye on fast&short-term upside trades, as soon as bullish reversal patterns will be formed on intraday charts:

Intraday

On intraday charts we do not have yet any hints on upside pullback, because EUR has not reached yet XOP and support area. Additionally, we have 1.618 extension support @ 1.10 of recent upside swing. Based on Fib levels, once major target of 1.0990-1.10 will be reached - 70+ pips retracement becomes very probable, somewhere to 3/8 Fib resistance. At least, this is theoretically suggested by '222" pattern that we have.

Anyway, before taking any scalp long position - try to get clear bullish pattern first. Do not "buy" just because of support reaching.

Conclusion:

On coming 1-2 weeks market probably will be under impact of US/China agreement anticipation and UK elections. Since tariff agreement is treated as positive sign - it's anticipation will press on EUR in short-term.

Based on weekly technical picture, we can't exclude scenario when October rally will be reversed, especially if agreement's details appear to be better than expected.

This was relatively quiet week, with just few news that have global meaning for the markets.As storm of Brexit breakout and new Fed policy was starting to calm down - investors turn to US/China negotiations progress. Also we've got first press conference of C. Lagarde, BoE meeting and some statistics through the week.

The euro edged down on Monday as investors awaited Christine Lagarde’s first speech as European Central Bank president, but hopes that the United States may choose not to impose tariffs on auto imports kept it near its highest level in weeks.

Lagarde gives her first speech on Monday as ECB chief, and markets are assuming she will stick with the easy policy script of her predecessor, Mario Draghi.

U.S. Commerce Secretary Wilbur Ross said in an interview published on Sunday that Washington may not need to impose tariffs on imported vehicles later this month after holding “good conversations” with automakers in the European Union, Japan and Korea.

The tariffs have already been delayed once by six months, and trade experts say that could happen again.

“That could lift the cloud over German manufacturing,” said Kenneth Broux, corporate forex strategist at Societe Generale.

“It could help to lift sentiment a lot” in the euro area, he said, adding that he was “not convinced that we’ll hear a lot of policy direction substance” from Lagarde on Monday.

The dollar held the upper hand against its rivals on Wednesday, particularly versus traditional safe-haven currencies, on rising hopes for a U.S.-China trade deal and a string of solid U.S. economic data.

Hopes that the Trump administration could roll back some of the tariffs it imposed on goods from China as part of a “phase one” U.S.-China trade deal boosted risk sentiment in financial markets.

A survey on the vast U.S. service sector published on Tuesday showed that business sentiment had improved in October from a three-year low in September.

The ISM non-manufacturing sector index rose to 54.7 from 52.6 in September, beating market expectations.

The rebound is a welcome sign for dollar bulls as a fall in the index would have suggested that malaise in trade war-hit manufacturers was infecting the service sector, too.

The data came after strong a U.S. employment report on Friday.

“On top of Sino-U.S. trade issues, the market is reacting to signs of U.S. economic strength at the moment,” said Kyosuke Suzuki, director of foreign exchange at Societe Generale.

The dollar was caught off-guard on Wednesday after a senior official in U.S. President Donald Trump’s administration told Reuters the signing of a so-called “phase one” trade deal could be delayed until December.

Trump had previously indicated an agreement could be signed this month.

Many investors remain nervous about the risks to the global outlook given the Sino-U.S. trade war and Brexit show no signs of a quick resolution.

“The dollar is looking for direction,” said Takuya Kanda, general manager of the research department at Gaitame.com Research Institute in Tokyo.

“The main catalyst for dollar buying was expectations that a U.S.-China trade deal is signed this month. If that is delayed by one month, that is not such a disappointment, but we need to see what the Chinese government has to say.”

Two Bank of England officials unexpectedly voted to lower interest rates on Thursday to ward off an economic slowdown, and others including Governor Mark Carney said they would consider a cut if global and Brexit headwinds do not ease.

Economists polled by Reuters had expected the BoE to vote unanimously to keep Bank Rate at 0.75%, and the announcement of the 7-2 split pushed sterling to a two-week low as market odds on a cut next year rose as high as 80%.

To date, the BoE has resisted following the U.S. Federal Reserve and the European Central Bank in cutting its main interest rate, but Thursday’s Monetary Policy Report positions the BoE for a change in stance.

Carney said the BoE’s central scenario was that a slowdown in global growth would stabilize and that Prime Minister Boris Johnson’s Brexit deal — which parliament has yet to approve — pointed the way to a reduction in Brexit uncertainty.

If this scenario unfolds, the BoE would still be able to stick to its long-standing message about limited and gradual rate hikes.

But if the outlook deteriorates, the BoE said a rate cut would become more likely.

“These are pretty big tectonic forces operating right now,” Carney told reporters. “If global growth fails to stabilize or if Brexit uncertainties remain entrenched, monetary policy may need to reinforce the expected recovery in UK GDP growth.”

For Monetary Policy Committee members Michael Saunders and Jonathan Haskel, it was already time to act — they cast the first votes for a rate cut since shortly after the 2016 Brexit referendum.

“In the short term at least, it seems the MPC is more concerned about the downside risks to growth and is prepared to pull the trigger on a rate cut if and when these risks materialize,” PwC economist John Hawksworth said.

The BoE is also grappling with uncertainty about an election which Johnson has called for Dec. 12, in a bid to get a majority to pass his Brexit deal before a new deadline of Jan. 31.

The two main political parties are promising to end years of austerity and spend billions on infrastructure — aided by record-low interest rates — to try to fuel growth.

JOB MARKET WORRIES

Saunders and Haskel noted reduced job vacancies that suggested Britain’s hitherto strong labor market was weakening as well as risks from the world economy and Brexit.

Other MPC members showed a new openness to cutting rates if things soured. They also softened their language on the need for limited and gradual rate hikes in the medium term, saying they “might” rather than “would” be necessary.

But economists at HSBC said a rate cut was not a certainty, as some policymakers looked concerned about rising labor costs.

“As we think may be the case for other central banks, uncertainties and divisions may mean the ultimate outcome is to stay on hold,” HSBC’s Simon Wells and Chris Hare wrote.

The BoE as a whole painted a darker picture for Britain’s economy over the next three years, predicting it will grow 1% less over the period than it had forecast in August, mostly due to a weaker global economy and a recently stronger pound.

But part of the growth downgrade reflected Johnson’s Brexit plans.

The BoE now assumes Britain will strike a trade deal that leads to new customs checks and puts up barriers to exports of financial and legal services.

The growth forecast would have been weaker still without higher spending announced by the government in September which the BoE said would add 0.4% to the economy.

Inflation, currently 1.7%, is forecast to drop to 1.2% in the middle of next year due to lower oil prices and regulatory caps on electricity and water bills.

But over the next couple of years, the BoE sees economic growth picking up from 1.4% in 2019 to 2.0% in 2022. The 2022 growth rate is above Britain’s long-term trend and would push inflation back above the BoE’s 2% goal, the central bank said.

The Chinese commerce ministry said that China and the U.S. must simultaneously cancel some existing tariffs on each other’s goods for both sides to reach a “phase one” trade deal.

The proportion of tariffs cancelled must be the same, and how many tariffs should be cancelled can be negotiated, said the spokesman.

The dollar jumped up to near three-month highs versus the yen, retracing its 0.3% losses from earlier in the session, as investors interpreted the comments as positive news, reducing demand for safe-haven currencies.

Adam Cole, chief currency strategist at RBC Capital Markets said the Chinese comments improved market sentiment around the trade negotiations.

“I think the best people hoped for was that we would avoid the next tranche of tariffs kicking in, whereas momentum seems to be moving in the direction of existing tariffs rolling back,” he said.

Hopes for a trade deal had been waning after a senior official of the Trump administration told Reuters on Wednesday that a meeting to sign the deal could be delayed until December and that a venue had not yet been agreed.

“Expectations were depressed and it’s not hard to beat expectations when they’re that low,” he added.

The dollar rallied to a three-week high on Friday, getting some safe-haven bids, as risk appetite for higher-yielding currencies waned with renewed uncertainty about the rollback of existing tariffs, a major component of a preliminary U.S.-China trade deal.

U.S. President Donald Trump on Friday further magnified the uncertainty, saying he had not agreed to roll back tariffs.

His comments came a day after U.S. and Chinese officials reportedly agreed to roll back tariffs on each others’ goods in a “phase one” trade deal if it is completed.

But a report also on Thursday seemed to contradict that news, with multiple sources saying the rollback faces fierce internal opposition at the White House and from outside advisers. The idea of a tariff rollback was not part of the original October “handshake” deal between Chinese Vice Premier Liu He and Trump, these sources said.

“What really has been driving the market is this underlying uncertainty over whether or not we will get that rollback,” said Brian Daingerfield, head of G10 FX strategy, at Natwest Markets in Stamford, Connecticut.

Overall, though, sentiment is likely to remain supportive for risky assets, as efforts are being made to do a trade deal, which would remove a huge risk to the global economic outlook.

“The fact that there is some discussion of moving existing tariffs leans more positive,” Daingerfield said.

White House spokeswoman Stephanie Grisham told Fox Business Network in an interview on Friday that tariffs could be lifted on Chinese goods if an agreement is reached, but she gave no further details.

Jonas Goltermann, senior markets economist at Capital Economics in London, believes as trade tensions persist, the dollar is likely to stay strong.

“While we don’t expect relative interest rates to boost the dollar much further in the near term, we think that continued trade tensions and a slowing global economy mean that the greenback will rise a bit further in 2020 despite the fact that on a trade-weighted basis it is already near its highest level since the early 2000s,” Goltermann said.

Sterling edged lower on Friday and is poised for a weekly loss as investors await political developments ahead of Britain’s Dec. 12 election.

The pound briefly dipped below $1.28 against the dollar earlier, ignoring news that Scottish First Minister Nicola Sturgeon would seek to form a “progressive alliance” to keep the Conservatives out in the event of a hung parliament.

Sturgeon said the Scottish National Party would seek to stop Brexit by supporting a second referendum.

The Bank of England meeting’s surprisingly dovish outcome did not make a lasting impression on the pound, Commerzbank FX strategist Thu Lan Nguyen said. “It just shows that the market is largely concentrated on politics at the moment, and not on fundamentals and monetary policy,” she said.

Labour market data showed that British employers’ demand for staff grew in October at the slowest rate in almost eight years. Nguyen said the weaker labour data fits into a deteriorating economic picture - along with Brexit uncertainty and weak global growth - which could make the BoE more dovish.

“This should at least limit the appreciation potential of the pound over the medium to long term, but still the general direction of pound exchange rate will be determined by the general election,” she said.

However, some investors were turning more bullish. Gregory Perdon, co-chief investment officer at Arbuthnot Latham, said that he was more optimistic on UK assets.

“It is true no one knows the Brexit outcome but it does not feel like 50/50 anymore,” he said, adding that Arbuthnot Latham had increased pound positions.

“This way, if the UK markets snap back to the upside, we will participate in the rally,” Perdon said.

CFTC data shows that net short position has increased again on EUR. It means that short position is growing three weeks in a row:

Finally here is interesting update on perspective of EU economy from Fathom consulting:

Data released on Thursday showed that the euro area economy expanded by 0.2% in the third quarter of this year, in line with the predictions of Fathom’s Nowcast model. The reading, which was unchanged from the previous quarter and marginally above the average forecast of the Reuters Poll (0.1%), reflected small upside growth surprises in both France and Italy.

Fathom’s euro area Economic Sentiment Indicator — which distils the information from numerous measures of consumer and business confidence into a single composite measure — has fallen substantially since the start of 2018, driven by a fall in manufacturing sentiment. Although the ESI has shown signs of stabilisation in recent months, it did tick down again at the end of the third quarter. Its current level of 0.2% suggests that growth is unlikely to pick up any time soon. Although a recession in the euro area is not our central case, the natural volatility in GDP growth and a weak underlying trend implies that the odds of a quarterly contraction are high.

While euro area policymakers may view a growth rate of 0.2% as somewhat of a disappointment, it is broadly in line with Fathom’s estimate of the currency bloc’s trend rate of growth. According to economic theory, in the medium term an economy’s trend growth rate ultimately depends upon increases in underlying productivity and growth in the labour force. On both counts, the outlook for the euro area is far from bright.

On the population front, Eurostat provides projections under a range of assumptions out to 2100. Under the central projection, the population growth rate is expected to slow substantially and even turn negative in the coming years. This is of particular concern for countries such as Germany and Italy, whose populations are projected to have started shrinking by 2049.

From an economic perspective, it is the fraction of the population available to work — i.e. the labour force — that determines long-run outcomes. Broadly speaking, these are individuals aged 15–64. In the medium term, lower fertility rates and the natural ageing of the population will affect this age group significantly, with the International Labour Organization (ILO) predicting that, for many euro area member states, the labour force will have shrunk substantially by 2030.

Aggregate output can of course still rise in such a world, but only if the growth rate of productivity outpaces declines in the labour force. Fortunately, while the annual growth rate of euro area labour productivity has turned negative in recent quarters, the underlying trend is still positive, even if it has slowed since the financial crisis. With limited ability to affect population growth in the short run, policymakers’ attention is likely to eventually shift towards boosting productivity as a means to improving growth. Whether this can be achieved, and whether it will be sufficient to offset declining populations, remains to be seen.

Thus, EUR action this week totally matches to changing in sentiment and reflects two driving factors. First is, investors anticipate US/Sino agreement signing, which shifts uncertainty to EU side as there is long hanging hazard of US tariffs against auto producers. This combination presses on EU value. Tariffs war easing should make positive impact on US and China economies (at least on paper), but EU will stand aside of this success. This leads to EUR creeping lower.

Within 3-4 weeks there are two major events will make the shape of the market - agreement signing and its details and any news on UK December elections.

Technicals

Monthly

As we said, we've got reversal month by October's close. November stands inside one by far, showing retracement back in October's body. In general this is not something uncommon and absolutely natural process. At the same time, taking broader view - forming of reversal bar doesn't make any impact on major tendency by far, as EUR still keeps LH-LL trend. Reversal bar will be valid if it will lead to breaking of this tendency.

In general recent changes were in favor of EUR due poor US statistics and more dovish Fed policy. But this week data has improved (ISM, NFP) and new achievement of US/China negotiations stands on horizon. It stops for awhile EUR appreciation. Now we need to keep close eye on key technical levels that are vital for longer-term tendency. Market should not erase October rally as it was in June. Otherwise EUR continues to drift lower to 1.03 area.

Now we come closer to the end of the year and second issue that might be interesting on EUR is YPS1. If EUR, by the end of the year will be able to hold above YPS1 - 2019 action could be treated as retracement of 2016 - 2017 rally. And EUR will keep chances on extension in 2020.

That's being said the major intrigue stands around fundamental background now - it is changing. It is interesting whether its change will be strong enough to make impact on monthly chart and long lasting tendency here. As economy in EU hardly will improve soon - the major driving factor depends on US - how better/worse situation will be there.

Weekly

If nothing outstanding will happen, it seems that we should forget about bullish tendency, at least for a few weeks. Weekly chart brings worrying picture. It stands out of long-term price shape inside the channel. Never before we see the same price action. Downside reversal is sharp and engulfs three previous weeks (almost month), so I mark it with "R" letter.

This let's call it reversal, happens in the middle of the range and not at some resistance area, which looks even more bearish.

Thus, currently we have to be extra careful with any long positions on daily/intraday charts. This miserable plunge on weekly chart promises nothing good to bulls on next week.

Daily

Trend stands bearish on daily chart. Here is major test is coming for EUR ambitions. Above we've talked about "vital" levels and here is the first one - major 5/8 Fib support and Agreement with XOP + daily Osold area.

Potentially, here we will get "222" Buy" pattern, which should trigger 30% upside bounce, at least. It means that if you keep shorts since last week - you have to manage stops and think about profit booking, at least partially. Second - no new shorts could be taken right now on daily chart, because market is too close to support. And, finally - scalp traders could keep an eye on fast&short-term upside trades, as soon as bullish reversal patterns will be formed on intraday charts:

Intraday

On intraday charts we do not have yet any hints on upside pullback, because EUR has not reached yet XOP and support area. Additionally, we have 1.618 extension support @ 1.10 of recent upside swing. Based on Fib levels, once major target of 1.0990-1.10 will be reached - 70+ pips retracement becomes very probable, somewhere to 3/8 Fib resistance. At least, this is theoretically suggested by '222" pattern that we have.

Anyway, before taking any scalp long position - try to get clear bullish pattern first. Do not "buy" just because of support reaching.

Conclusion:

On coming 1-2 weeks market probably will be under impact of US/China agreement anticipation and UK elections. Since tariff agreement is treated as positive sign - it's anticipation will press on EUR in short-term.

Based on weekly technical picture, we can't exclude scenario when October rally will be reversed, especially if agreement's details appear to be better than expected.