Sive Morten

Special Consultant to the FPA

- Messages

- 18,667

Fundamentals

So, just we've finished building theoretical background for our new vision of financial situation in the US - this theoretical background has come up with us in reality. Once we said that Fed will pray for inflation to stay stable - it jumps in October. As we've said inflation now is cornerstone of any significant market swing and fiscal policy of central bank. It is extremely dominant right now. Fed definitely feels uncomfortable now. They need to play for time, keep conditions for economy and employment recovery, but inflation doesn't let them to do it now. We've only got soft statements from all central banks last week that could make sentiment less tensioned, but this achievement has been hurt strongly by CPI report this week.

Market overview

U.S. consumer prices increased more than expected in October as the cost of gasoline and food surged, leading to the biggest annual gain since 1990, further signs that inflation could remain uncomfortably high well into next year amid snarled global supply chains.

The consumer price index rose 0.9% last month after gaining 0.4% in September, the Labor Department said on Wednesday. In the 12 months through October, the CPI accelerated 6.2%. That was the largest year-on-year advance since November 1990 and followed a 5.4% jump in September.

The dollar index jumped sharply on Wednesday, hitting its highest level since July 2020, after U.S. consumer prices surged to their highest rate since 1990, fueling speculation that the Federal Reserve may raise interest rates sooner than expected.

While the Fed last week restated its belief that the current inflation surge would be short-lived, many investors were suggesting stickier than expected inflation may force the Fed to increase interest rates.

Then greenback got a further boost after following a weak 30-year bond auction that pushed U.S. treasury yields higher.

Meanwhile sterling fell to its lowest level since December 23 while Britain and the European Union looked far from finding a post-Brexit agreement over Northern Ireland, adding to pressure from the U.S. inflation data. For the year before Brexit happened, we said that this situation has no golden way to be decided. Either Ireland will be split, which might become the source of instability again or Ireland see border splits the UK economy space in parts. Now we see that Ireland problem comes on surface....

The rates moves, especially at the short end, suggest traders believe the Federal Reserve will step in to hike interest rates if prices keep running higher, said National Australia Bank's head of FX strategy, Ray Attrill.

The U.S. data showed price rises extending into rents, which could drive pressure on wages, both lengthening and broadening the pandemic's inflationary pulse.

While the U.S. bond market was closed for the Veterans Day holiday, the dollar index still looked set for its second straight day of gains so far touching its highest level since July 23 2020. It was last up 0.19% at $95.003.

The dollar turned red a bit on Friday morning after the University of Michigan survey showed a plunge in U.S. consumer sentiment in early November to its lowest level in a decade as surging inflation cut into households’ living standards, with few believing policymakers are doing enough to mitigate the issue.

With short-dated U.S. Treasury yields edging higher -- five-year bond yields rose to a February 2020 high -- investors were ramping up bets this week that the Federal Reserve will have to raise interest rates sooner than expected.

But while Friday’s survey raised some eyebrows, strategists were bullish on the dollar, which was boasting its biggest weekly percentage gain since the week ending Aug. 22.

The renewed strength in the dollar earlier during the week injected fresh life into the moribund currency volatility markets, as traders have scrambled to buy options to protect themselves against further dollar strength. A currency volatility index hit a fresh six-month high on Friday.

Markets were pricing a first rate increase by July and a high likelihood of another by November. CME data is assigning a 50% probability of a rate hike by then, compared with less than 30% a month earlier.

Investors have become increasingly bearish on the outlook for the single currency as the European Central Bank appears unlikely to change its extremely dovish policy settings in the near term against the backdrop of a slowing economy.

Euro zone industrial production dipped by less than expected in September, data showed on Friday, leaving it higher than anticipated year-on-year due to a surge in output of non-durable consumer goods. The European Union's statistics office Eurostat said industrial production in the 19 countries sharing the euro fell 0.2% month-on-month in September for a 5.2% year-on-year increase.

Economists polled by Reuters had forecast a 0.5% decline month-on-month and a 4.1% increase year-on-year in September.

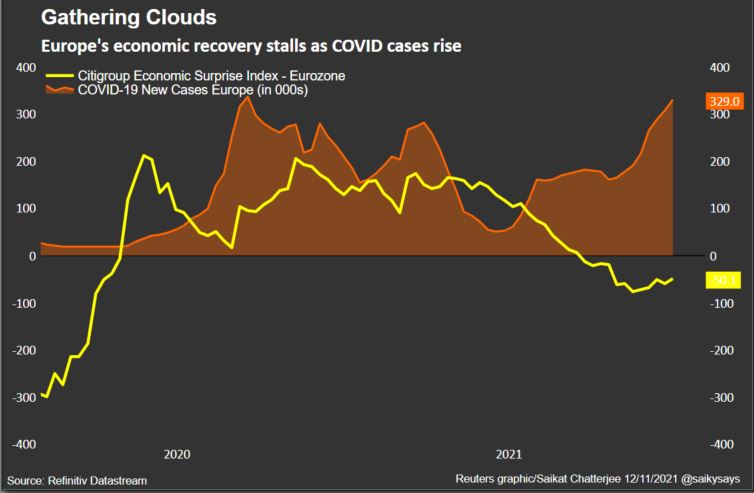

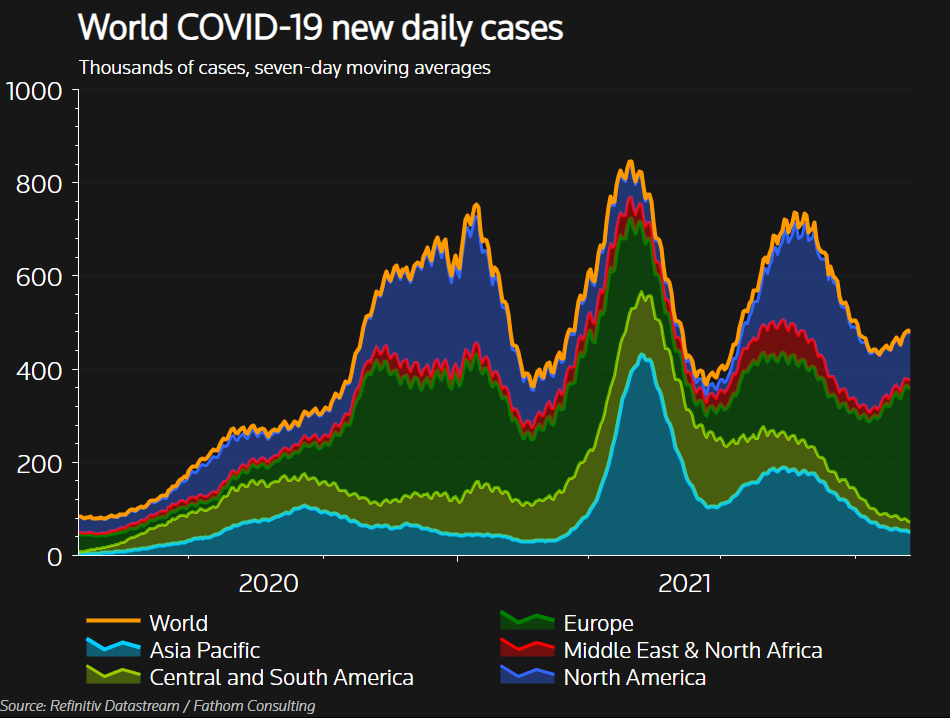

Europe has become the epicenter of the pandemic again, prompting some governments to consider re-imposing unpopular lockdowns in the run-up to Christmas and stirring debate over whether vaccines alone are enough to tame COVID-19. Europe accounts for more than half of the average 7-day infections globally and about half of latest deaths, according to a Reuters tally, the highest levels since April last year when the virus was at its initial peak in Italy.

Governments and companies are worried the prolonged pandemic will derail a fragile economic recovery. Countries including the Netherlands, Germany, Austria and the Czech Republic are taking or planning measures to curb the spread.

Germany, France and the Netherlands are also experiencing a surge in infections, showing the challenge even for governments with high acceptance rates.

The World Health Organization's report for the week to Nov. 7 showed that Europe, including Russia, was the only region to record a rise in cases, up 7%, while other areas reported declines or stable trends. Similarly, it reported a 10% increase in deaths, while other regions reported declines.

The war against COVID-19 is not over. Germany is battling record-high new cases, New Zealand is fighting off the highly infectious Delta variant and the Netherlands could soon impose a partial lockdown. However, the United States feels confident enough to ease travel restrictions. Japan on Nov. 7 recorded no daily COVID deaths for the first time in over a year. Developed countries are already lining up to secure a new antiviral pill that shows promising efficacy in some trials. Economists compiling 2022 economic forecasts will be watching closely.

NEXT WEEK TO WATCH - UK Inflation and Retail Sales

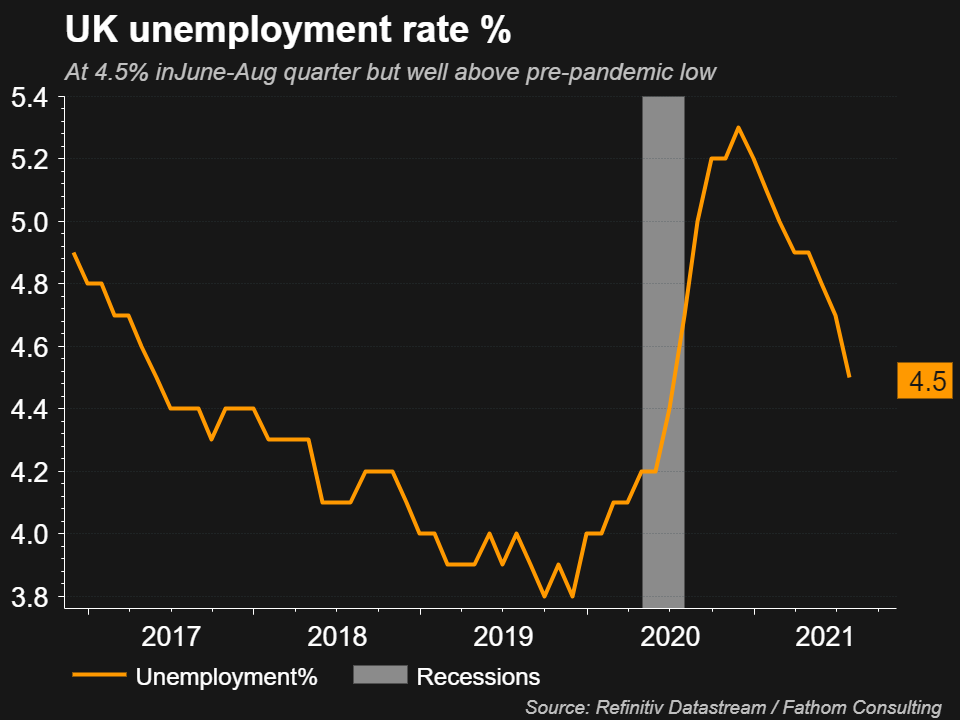

After stunning markets on Nov. 4 by not delivering a widely anticipated rate rise, the Bank of England said it wanted more evidence of labour market improvement. Two sets of data are due before its next meeting, the first on Tuesday. Following good numbers for September, October jobs data will show if unemployment rose after the Sept. 30 expiry of a pandemic-time wage subsidy scheme that one million people were estimated to be on.

Inflation and retail sales data are out Wednesday and Friday respectively. A big inflation print alongside another retail sales decline will force the BoE to choose whether to act against inflation or nurture the fragile economy.

With an economy 0.6% smaller below pre-pandemic levels and risks growing of a damaging confrontation with the EU, a rate rise is the last thing Britain needs. But 4%-plus inflation may leave the BoE no option.

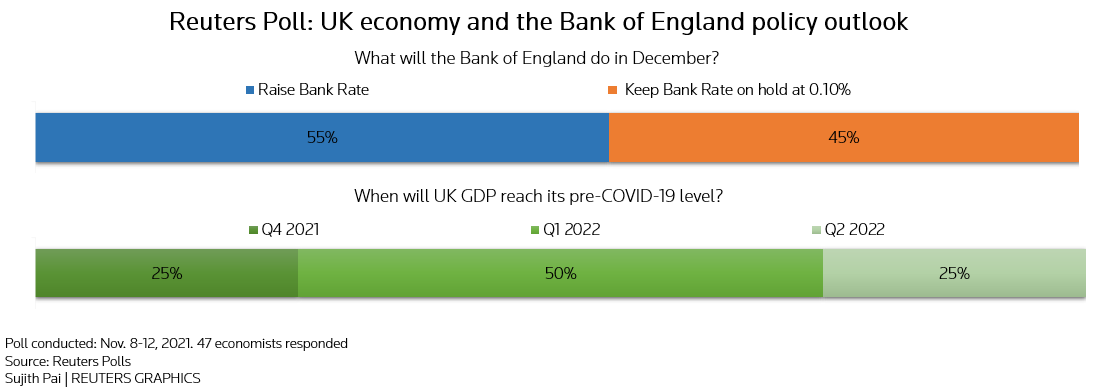

The Bank of England will be the first major central bank to raise interest rates but whether that initial increase comes as soon as next month or if it waits until early next year has divided economists polled by Reuters.

Britain’s central bank surprised markets - but not a majority of the economists Reuters surveyed in October - by leaving Bank Rate unchanged at a record low of 0.10% last week. While the median forecast in the Nov. 8-12 poll was for a 15 basis point increase on Dec. 16, just under half of those polled, 21 of 47, said the Bank would hold firm. If it does act next month it would be its first December hike since 1994.

“The meeting in December is now clearly ‘live’. Particularly important for the MPC will be the two upcoming labour market releases,” said Marchel Alexandrovich at Jefferies.

While economists’ forecasts for a December increase were on a knife edge, a rise in the first quarter of 2022 appears baked in, most likely in February when the Bank publishes its quarterly Monetary Policy Report. All but one of 44 economists are forecasting an increase by the end of March.

Following that first rise to 0.25% next month, medians showed the Bank adding another 25 basis points in the second quarter before pausing until the beginning of 2023 when it will take borrowing costs to 0.75%. In October, that third increase was penciled in for the latter half of 2023.

But while weaker growth would likely stay the BoE’s hand, inflation forecasts have increased dramatically and will remain more than double the Bank’s 2.0% target for a longer period.

Inflation will average 4.1% this quarter, 4.2% next and 4.2% in the second quarter of 2022. Last month the respective forecasts were for 3.9%, 4.0% and 3.5%. The average for 2022 was now seen at 3.2%, up from October’s 2.8% forecast.

BoE Governor Andrew Bailey said last week the Bank would act if it sees expectations of higher inflation pushing up wages, having previously said it would have to act to contain inflation expectations.

Unemployment levels were seen pretty stable, peaking early next year at 5.0% before drifting down to 4.6%, giving some comfort to policymakers who are debating whether or not to raise rates.

As a bottom line

This week we've got witness for ourselves the dominance of inflation level for all. Currently the task stands simple. Action from the Fed pushed dollar higher, no action should keep it flat (or to send lower). While the Fed policy supposedly will be determined by new inflation data releases, such as PCE, CPI, PPI and hourly earnings in Dec NFP report. Investors across the board, as we see from the comments above, expect stronger inflation in coming months. Finally I bring here the PIMCO economist opinion:

That's the answer. With such an expectations across the board and Dollar Index above 95 for now - it is difficult to make bets and build the plans on dollar weakness. We're not fans of epoch-making forecasts and prefer to focus on practical and pragmatic scenarios. Our focus right now at nearest 1.12-1.13 target, while we do not deny possible deeper downside action in medium-term perspective as well. Currently we just have no reasons to consider bullish scenarios on EUR.

Technicals

Monthly

Today we take a bit broader view on EUR performance that could give us some clue to understanding of longer term background. In general, currently trend stands bearish. Once market hits all-time OP around 1.06 area it turns to consolidation that now is taking the shape of extended triangle. Last week we've considered upside scenario based on potential change in long-term sentiment of major Central Banks, but now, in the light of recent events, we leave this scenario for now. As price breaks minor pennant, forming bearish reversal action in September, and dropping below YPP - the nearest target stands around 1.10-1.12 area. Here is we have monthly COP, YPS1 and trend line support, while on weekly and daily time frames some other objects exist in this area.

For now, the reaching of this area seems probable as it is not big distance till this level.

Weekly

Here is next area stands at Agreement of XOP 1.1220 target and major 1.1290 Fib support. Trend stands bearish, market is not at oversold. Downside breakout of K-area now shows no doubts.

Daily

Still, we're currently interested with some moderate bounce for our own trading purposes. Here we could find minor Fib levels that could provide short-term support to price action. For example, 1.1535 level and trend line support. Taking in consideration previous pullbacks, we could suggest the retracement at least to 1.1535-1.1540 area here, if it starts next week:

Intraday

Friday's performance was quiet, despite ISM numbers and picture mostly remains the same. EUR stands at local OP. We're mostly watching for the thrust products - potential B&B or DRPO patterns here. Whatever will be formed - pullback could reach 1.1532-1.1540 K-resistance area and re-test broken lows. This level perfectly agrees with harmonic minimal extension on daily chart:

So, just we've finished building theoretical background for our new vision of financial situation in the US - this theoretical background has come up with us in reality. Once we said that Fed will pray for inflation to stay stable - it jumps in October. As we've said inflation now is cornerstone of any significant market swing and fiscal policy of central bank. It is extremely dominant right now. Fed definitely feels uncomfortable now. They need to play for time, keep conditions for economy and employment recovery, but inflation doesn't let them to do it now. We've only got soft statements from all central banks last week that could make sentiment less tensioned, but this achievement has been hurt strongly by CPI report this week.

Market overview

U.S. consumer prices increased more than expected in October as the cost of gasoline and food surged, leading to the biggest annual gain since 1990, further signs that inflation could remain uncomfortably high well into next year amid snarled global supply chains.

The consumer price index rose 0.9% last month after gaining 0.4% in September, the Labor Department said on Wednesday. In the 12 months through October, the CPI accelerated 6.2%. That was the largest year-on-year advance since November 1990 and followed a 5.4% jump in September.

“We haven't seen as big of an increase in CPI as we have in PPI, which tells me that corporations have been absorbing a portion of that additional cost themselves which impacts their margins and profitability. But eventually, that has to be passed on if PPI numbers keep rising. So the fact that we've had high PPI numbers gave us some insight into the fact that we were going to get higher CPI, and there's still a lot of room there, which tells me we’ll have higher inflation again next month as well. These numbers have brought the probability of a rate hike in June up a little bit, but it won't bring it any closer than June,” said Randy Frederick from Charles Schwab.

“The most meaningful trend I think is the flattening of the curve, as the market is kind of assuming a more aggressive normalization path from the Fed. What we heard from Powell at his press conference last week seems to suggest that for the time being they’re still crediting the upside in inflation to more supply-side issues, and so they are opting to remain patient until some of those supply-side concerns start to work themselves out in the middle of next year. At this point the flatter curve seems to be pointing to more aggressive Fed action, so I think that’s going to be the primary story probably over the next several months or even the next quarter or two, said Ben Jefferely from BMO Capital, NY.

The dollar index jumped sharply on Wednesday, hitting its highest level since July 2020, after U.S. consumer prices surged to their highest rate since 1990, fueling speculation that the Federal Reserve may raise interest rates sooner than expected.

While the Fed last week restated its belief that the current inflation surge would be short-lived, many investors were suggesting stickier than expected inflation may force the Fed to increase interest rates.

"An inflationary looking print gets investors speculating about an earlier rate hike than the Fed would like to do," said Erik Bregar, an independent FX analyst. The dollar added to its gains as the session wore on with help from the easing of a rally in gold prices and the expiration of euro/dollar options, according to Bregar.

Then greenback got a further boost after following a weak 30-year bond auction that pushed U.S. treasury yields higher.

Meanwhile sterling fell to its lowest level since December 23 while Britain and the European Union looked far from finding a post-Brexit agreement over Northern Ireland, adding to pressure from the U.S. inflation data. For the year before Brexit happened, we said that this situation has no golden way to be decided. Either Ireland will be split, which might become the source of instability again or Ireland see border splits the UK economy space in parts. Now we see that Ireland problem comes on surface....

While the Federal Reserve is already tapering its bond buying, Nancy Davis, founder of Quadratic Capital Management in Greenwich, Connecticut said "rate hikes might not be enough to reverse inflation" because the Fed doesn't control supply chain bottlenecks and fiscal spending. If inflation doesn't subside, the Federal Reserve may need to taper at a more substantial rate and hike interest rates, which could hurt stocks and bonds,” said Davis.

Greg Anderson, global head of foreign exchange strategy at BMO Capital Markets in New York said the "pretty shocking" inflation data including sharp housing price increases suggest that high consumer prices are "not likely to prove transitory."

The rates moves, especially at the short end, suggest traders believe the Federal Reserve will step in to hike interest rates if prices keep running higher, said National Australia Bank's head of FX strategy, Ray Attrill.

"The market is still conferring a degree of credibility on the Fed, that they are not going to allow very high inflation to persist indefinitely," he said. If the dollar index moves higher than 95, investors might start to get out of the way, he said. It's quite a big level technically and if we can break up through that then there will be more people throwing in the towel." The index has climbed as far as 94.905.

The U.S. data showed price rises extending into rents, which could drive pressure on wages, both lengthening and broadening the pandemic's inflationary pulse.

While the U.S. bond market was closed for the Veterans Day holiday, the dollar index still looked set for its second straight day of gains so far touching its highest level since July 23 2020. It was last up 0.19% at $95.003.

"It feels like we're still trading the repercussions of the CPI," said Vassili Serebriakov, FX strategist at UBS in New York. The path of least resistance in the short term appears to be dollar higher .. Stronger inflation weakens the transitory narrative which means the Fed might need to tighten sooner."

"The hawkish repricing of Fed policy expectations has reinforced the U.S. dollar's upward momentum from the previous week in which it had already benefited from the other G10 central banks pushing back against rate hike expectations outside of the U.S," said Lee Hardman, currencies analyst at MUFG.

The dollar turned red a bit on Friday morning after the University of Michigan survey showed a plunge in U.S. consumer sentiment in early November to its lowest level in a decade as surging inflation cut into households’ living standards, with few believing policymakers are doing enough to mitigate the issue.

With short-dated U.S. Treasury yields edging higher -- five-year bond yields rose to a February 2020 high -- investors were ramping up bets this week that the Federal Reserve will have to raise interest rates sooner than expected.

“Consumers are clearly more worried about real income growth as inflation outpaces wages for now, and that is weighing on sentiment,” said Erik Nelson, macro strategist at Wells Fargo. That is feeding into growth worries for the dollar and pushing it lower against most currencies, especially the Japanese yen as U.S. yields decline here.”

But while Friday’s survey raised some eyebrows, strategists were bullish on the dollar, which was boasting its biggest weekly percentage gain since the week ending Aug. 22.

The renewed strength in the dollar earlier during the week injected fresh life into the moribund currency volatility markets, as traders have scrambled to buy options to protect themselves against further dollar strength. A currency volatility index hit a fresh six-month high on Friday.

Markets were pricing a first rate increase by July and a high likelihood of another by November. CME data is assigning a 50% probability of a rate hike by then, compared with less than 30% a month earlier.

Investors have become increasingly bearish on the outlook for the single currency as the European Central Bank appears unlikely to change its extremely dovish policy settings in the near term against the backdrop of a slowing economy.

Euro zone industrial production dipped by less than expected in September, data showed on Friday, leaving it higher than anticipated year-on-year due to a surge in output of non-durable consumer goods. The European Union's statistics office Eurostat said industrial production in the 19 countries sharing the euro fell 0.2% month-on-month in September for a 5.2% year-on-year increase.

Economists polled by Reuters had forecast a 0.5% decline month-on-month and a 4.1% increase year-on-year in September.

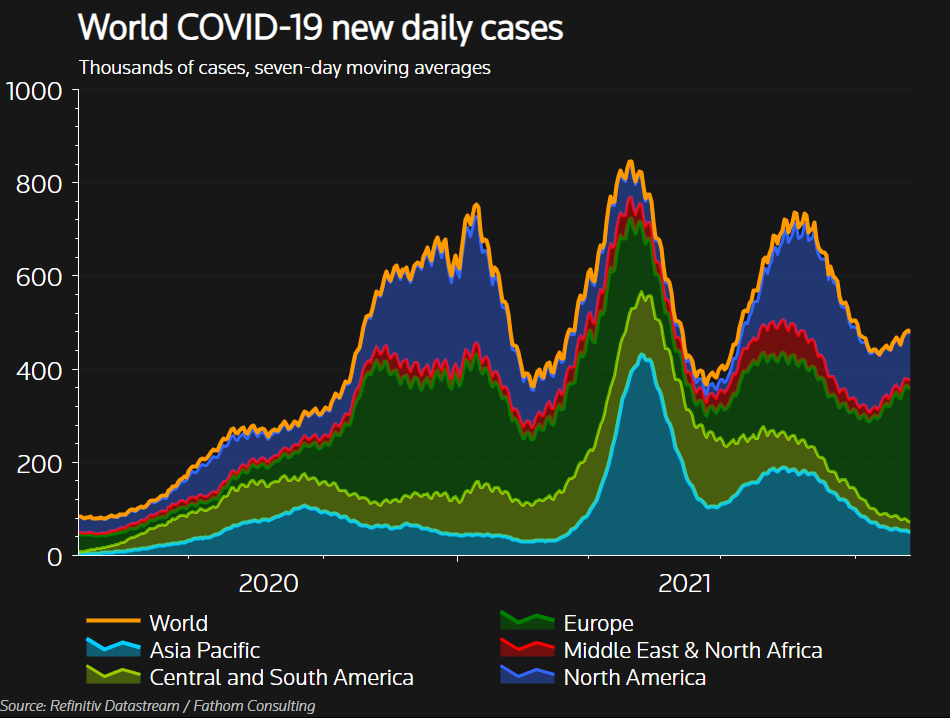

Europe has become the epicenter of the pandemic again, prompting some governments to consider re-imposing unpopular lockdowns in the run-up to Christmas and stirring debate over whether vaccines alone are enough to tame COVID-19. Europe accounts for more than half of the average 7-day infections globally and about half of latest deaths, according to a Reuters tally, the highest levels since April last year when the virus was at its initial peak in Italy.

Governments and companies are worried the prolonged pandemic will derail a fragile economic recovery. Countries including the Netherlands, Germany, Austria and the Czech Republic are taking or planning measures to curb the spread.

Germany, France and the Netherlands are also experiencing a surge in infections, showing the challenge even for governments with high acceptance rates.

The World Health Organization's report for the week to Nov. 7 showed that Europe, including Russia, was the only region to record a rise in cases, up 7%, while other areas reported declines or stable trends. Similarly, it reported a 10% increase in deaths, while other regions reported declines.

The war against COVID-19 is not over. Germany is battling record-high new cases, New Zealand is fighting off the highly infectious Delta variant and the Netherlands could soon impose a partial lockdown. However, the United States feels confident enough to ease travel restrictions. Japan on Nov. 7 recorded no daily COVID deaths for the first time in over a year. Developed countries are already lining up to secure a new antiviral pill that shows promising efficacy in some trials. Economists compiling 2022 economic forecasts will be watching closely.

NEXT WEEK TO WATCH - UK Inflation and Retail Sales

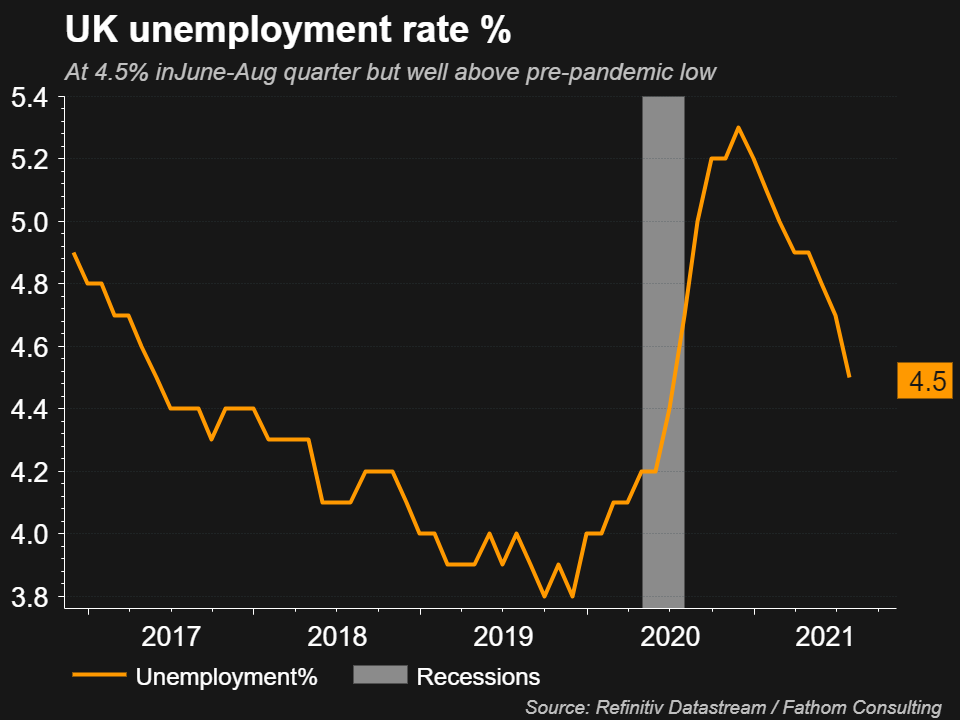

After stunning markets on Nov. 4 by not delivering a widely anticipated rate rise, the Bank of England said it wanted more evidence of labour market improvement. Two sets of data are due before its next meeting, the first on Tuesday. Following good numbers for September, October jobs data will show if unemployment rose after the Sept. 30 expiry of a pandemic-time wage subsidy scheme that one million people were estimated to be on.

Inflation and retail sales data are out Wednesday and Friday respectively. A big inflation print alongside another retail sales decline will force the BoE to choose whether to act against inflation or nurture the fragile economy.

With an economy 0.6% smaller below pre-pandemic levels and risks growing of a damaging confrontation with the EU, a rate rise is the last thing Britain needs. But 4%-plus inflation may leave the BoE no option.

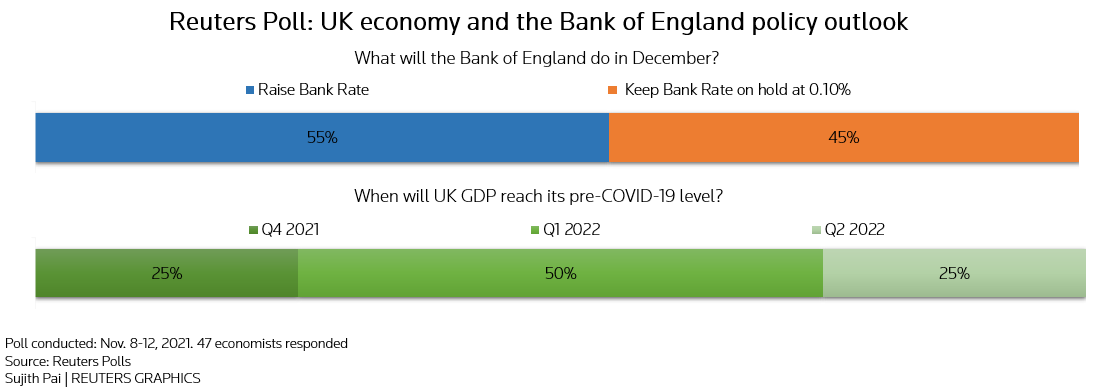

The Bank of England will be the first major central bank to raise interest rates but whether that initial increase comes as soon as next month or if it waits until early next year has divided economists polled by Reuters.

Britain’s central bank surprised markets - but not a majority of the economists Reuters surveyed in October - by leaving Bank Rate unchanged at a record low of 0.10% last week. While the median forecast in the Nov. 8-12 poll was for a 15 basis point increase on Dec. 16, just under half of those polled, 21 of 47, said the Bank would hold firm. If it does act next month it would be its first December hike since 1994.

“The meeting in December is now clearly ‘live’. Particularly important for the MPC will be the two upcoming labour market releases,” said Marchel Alexandrovich at Jefferies.

“If both are decent, the majority of the MPC could well be minded to increase Bank Rate by 15 basis points in December. However, if the December report is on the soft side, then it would clearly be more prudent for the decision on rates to be delayed until February.”

While economists’ forecasts for a December increase were on a knife edge, a rise in the first quarter of 2022 appears baked in, most likely in February when the Bank publishes its quarterly Monetary Policy Report. All but one of 44 economists are forecasting an increase by the end of March.

Following that first rise to 0.25% next month, medians showed the Bank adding another 25 basis points in the second quarter before pausing until the beginning of 2023 when it will take borrowing costs to 0.75%. In October, that third increase was penciled in for the latter half of 2023.

But while weaker growth would likely stay the BoE’s hand, inflation forecasts have increased dramatically and will remain more than double the Bank’s 2.0% target for a longer period.

Inflation will average 4.1% this quarter, 4.2% next and 4.2% in the second quarter of 2022. Last month the respective forecasts were for 3.9%, 4.0% and 3.5%. The average for 2022 was now seen at 3.2%, up from October’s 2.8% forecast.

BoE Governor Andrew Bailey said last week the Bank would act if it sees expectations of higher inflation pushing up wages, having previously said it would have to act to contain inflation expectations.

Unemployment levels were seen pretty stable, peaking early next year at 5.0% before drifting down to 4.6%, giving some comfort to policymakers who are debating whether or not to raise rates.

“I think they should. The labour data are quite strong,” said Brian Hilliard at Societe Generale, who expects a December increase.

As a bottom line

This week we've got witness for ourselves the dominance of inflation level for all. Currently the task stands simple. Action from the Fed pushed dollar higher, no action should keep it flat (or to send lower). While the Fed policy supposedly will be determined by new inflation data releases, such as PCE, CPI, PPI and hourly earnings in Dec NFP report. Investors across the board, as we see from the comments above, expect stronger inflation in coming months. Finally I bring here the PIMCO economist opinion:

"Overall, the October U.S. CPI report reaffirms that the Fed is in an uncomfortable place. While we expected that the next several months would be challenging for the Fed to navigate, the stronger-than-expected price gains in October, especially in the stickier shelter categories, all but confirm that Fed officials will once again revise their inflation and rate path forecasts in the December 2021 summary of economic projections (SEP). We expect the revised median Fed forecast will imply two rate hikes in 2022 (and another three to four hikes in 2023), which suggests the Fed is likely to begin hiking soon after the bond purchases end.

For now, we expect the pace of tapering of asset purchases to continue at $10 billion per month for U.S. Treasuries and $5 billion per month for agency mortgage-backed securities (MBS). However, we wouldn’t be surprised to see more calls for Fed officials to speed up the taper in January, when they will need to announce the ongoing pace."

That's the answer. With such an expectations across the board and Dollar Index above 95 for now - it is difficult to make bets and build the plans on dollar weakness. We're not fans of epoch-making forecasts and prefer to focus on practical and pragmatic scenarios. Our focus right now at nearest 1.12-1.13 target, while we do not deny possible deeper downside action in medium-term perspective as well. Currently we just have no reasons to consider bullish scenarios on EUR.

Technicals

Monthly

Today we take a bit broader view on EUR performance that could give us some clue to understanding of longer term background. In general, currently trend stands bearish. Once market hits all-time OP around 1.06 area it turns to consolidation that now is taking the shape of extended triangle. Last week we've considered upside scenario based on potential change in long-term sentiment of major Central Banks, but now, in the light of recent events, we leave this scenario for now. As price breaks minor pennant, forming bearish reversal action in September, and dropping below YPP - the nearest target stands around 1.10-1.12 area. Here is we have monthly COP, YPS1 and trend line support, while on weekly and daily time frames some other objects exist in this area.

For now, the reaching of this area seems probable as it is not big distance till this level.

Weekly

Here is next area stands at Agreement of XOP 1.1220 target and major 1.1290 Fib support. Trend stands bearish, market is not at oversold. Downside breakout of K-area now shows no doubts.

Daily

Still, we're currently interested with some moderate bounce for our own trading purposes. Here we could find minor Fib levels that could provide short-term support to price action. For example, 1.1535 level and trend line support. Taking in consideration previous pullbacks, we could suggest the retracement at least to 1.1535-1.1540 area here, if it starts next week:

Intraday

Friday's performance was quiet, despite ISM numbers and picture mostly remains the same. EUR stands at local OP. We're mostly watching for the thrust products - potential B&B or DRPO patterns here. Whatever will be formed - pullback could reach 1.1532-1.1540 K-resistance area and re-test broken lows. This level perfectly agrees with harmonic minimal extension on daily chart: