Sive Morten

Special Consultant to the FPA

- Messages

- 18,664

Unflinching Ben

So, yesterday Ben Bernanke has spoken in Jackson Hole. I’ve watched his speech with expert comentaries on Bloomberg TV yesterday, later I’ve read some comments and vast opinion of different analysts is that Fed Governor has not said anything new. Still, we have to make some conclusions even from flat sense of Bernanke speach, particularly in relation to EUR/USD pair.

Here are just my thoughts and some conlcusion that I’ve made personally for myself. It goes without saying that you may not agree with me, so feel free to discuss it. Since, I expect that this will be important in nearest 6 month. Let’s start with it:

One thought that seems to me important, that Bernanke said is QE I, QEII and Operation twist have given positive results. They led to GDP 3% growth, hold rates at lowest levels and gave 2 mln new jobs. The other side of those programs is uncertainty of a bit farer perspectives. First of all, Fed has injected approximately 2.3 Trln USD in economy by buybacking bonds from the market. How this influence on inflation? Now even lazy person talks that sooner or later it will lead to inflation, but how fast it will be, will Fed have significant tools to bridle it? That’s the risk that Bernanke has sounded himself on some previous speeches and in Jackson Hole as well. He said that Fed has no traditional tools any more that is Fed Interest rate, so Fed has to apply some untraditional, such as QE’s. The problem though that if applying traditional tools Fed knows how they impact economy, since it has passed through its application many times, while QE feature was just initiated and nobody dares now to predict how it will impact economy when cycles will start to change. Second risk, that also was spoken by some FOMC members – Fed has expected a bit stronger impact on unemployment reducing, credits growing and GDP. Hence – it is not as smooth as it was expected. Other words, major fear of the Fed is that they definitely bring inflation by 2.3 Trln injection but will they get equal positive effect that they expect and in what way it will come – this is still yet to be seen.

Taking this stuff in consideration I have decided for myself that Fed still feels some lack of data, they need a bit more statistic about labor, production, sales loans and other. It is too small time has passed. That’s why I think that till New Year Fed will not take any radical steps and on September meeting there will be nothing tremendous. Since some positive effect has come, it is safer to just hold rates low and get a bit longer period with slow recovery, rather than take QE III with hope that positive effect will become greater but with absolutely unknown risks. Also we should not forget about elections on Nov 6, and probable US debt ceil fight in Congress in December. So, you can imagine how hot it will be right after elections. But what about EUR/USD?

On next week will be ECB meeting. Draghi surely knows effect of QE on US economy, as we’ve stated above. Since ECB sees that inflation risks still blur but it shows effect as jobs growth and GDP, I think that ECB will follow Fed. They probably will announce starting buyback of national debt of EU countries, mostly Spain and Italy. It is prefferably for bulls, that ECB will hold rate. Mostly negative scenario if ECB will decrease interest rate simulteniously with silence about bonds buyback. But anyway, I expect that sooner rather than later ECB will start its own QE. This could lead to EUR appreciation to next area around 1.30. Based on our monthly analysis this still will not break the overall bearish long term trend.

Monthly

Monthly trend holds bearish. Price continues to force significant support area 1.19-1.23 that held EUR twice from collapse – first time in 2008 when sub-prime crisis has started and second – in 2010 at beginning of Greece turmoil.

Currently August continues to be an inside month to July, but market has shown strong close. This is not a surprise, if we recall what the level it is. This is 50% support of major EUR rally of all times 2000-2008 year. Although this level was penetrated previously in 2010, but looks like it is still valid. This is most powerful Fib support inside of 1.18-1.23 area.

Still, long-term bearish context still holds and target still is 1.16-1.17 area, based on analysis of quarterly chart of Dollar Index that we’ve made in Nov 2011. Index has 95% correlation with EUR/USD. Also this is AB=CD target of most recent pattern on current chart. Take a look – this is significant support of 2005 as well – marked by yellow rectangle.

By current bounce market has reached nearest Fib resistance at 1.2590 area, but will this level hold market? If ECB will give investors what they expect to hear, then probably EUR could proceed higher. As we said above current bearish context can hold move even to monthly K-resistance at 1.2950-1.3150 area.

So, major conclusion for us here is that market bounces from strong support and if it will pass though 1.26 – next area of monthly resistance is 1.30-1.31

Weekly

On previous week price appreciation was stopped by 1.2593 Fib resistance and Monthly+Weekly Resistance 1 around 1.2640. Also this is upward border of the channel. Next resistance is 1.2790 that includes MPR1 and previous swing high. Around 1.2935-1.3150 stands Confluence resistance that is also weekly overbought. This probably the destination, if ECB will suport EUR by bullish decisions. But for that purpose we need to see upward channel breakout first. Since we have new monthly pivot at 1.2450, some retracement is possible. One thing that could give us significant bullish confirmation is if current swing up will exceed previous swing low. This is very often becomes first sign of potential reversal or deep retracement.

Daily

Trend holds bullish here, but now we have potentially reversal pattern 1.27 Butterfly “Sell” at weekly resistance. In current circumstances it is logical to expect pullback, especially because MPP has not been touched yet. But it seems that most will depend on ECB. Strong speech could lead to further EUR appreciation. Technically it probably will express in Butterfly failure. The point is that butterflies are such kind of patterns that fail miserably. So, if market accelerates above 1.618 of butterfly “Sell” it very often lead to much further move up. WPP that now stands at 1.2560 also could help us with that, since it is very useful at the beginning of new week. Move below will suggest deeper retracement, while price holding above it increase probability of upward continuation. So, if you have bearish view you may trade butterfly with stop above its 1.618 target, while if you’re bullish watch for two levels – butterfly failure or retracement to 1.24-1.2450 area – daily Confluence support and MPP.

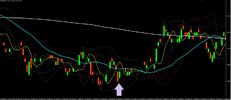

60-min

On intraday charts currently I do not see much information that could make significant impact on analysis that already made. Still, on Monday we can monitor price action around triangle that we’ve discussed in update on Friday. Probably if market will return into triangle’s body this will lead to further downward retracement and tell that buttefly has started to work. If this will not happen, then market could proceed higher. But again, ECB meeting could turn all stuff from top to bottom.

Conclusion:

Long-term bearish sentiment is still in play. Pullback that now in progress on monthly chart should not surprise us, if we take into consideration the level importance where this bounce has started. From long-term perspective, even move to 1.30 will not erase bearish context.

Currently we can say that market is entering in new financial year after summer. Now is such a situation when fundamental, political events and statistics should extremely important for market behavior. A lot of “if, if, if…” is appearing.

Short-term context still holds bullish, although suggests some retracement, but most will depend on ECB speech.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

So, yesterday Ben Bernanke has spoken in Jackson Hole. I’ve watched his speech with expert comentaries on Bloomberg TV yesterday, later I’ve read some comments and vast opinion of different analysts is that Fed Governor has not said anything new. Still, we have to make some conclusions even from flat sense of Bernanke speach, particularly in relation to EUR/USD pair.

Here are just my thoughts and some conlcusion that I’ve made personally for myself. It goes without saying that you may not agree with me, so feel free to discuss it. Since, I expect that this will be important in nearest 6 month. Let’s start with it:

One thought that seems to me important, that Bernanke said is QE I, QEII and Operation twist have given positive results. They led to GDP 3% growth, hold rates at lowest levels and gave 2 mln new jobs. The other side of those programs is uncertainty of a bit farer perspectives. First of all, Fed has injected approximately 2.3 Trln USD in economy by buybacking bonds from the market. How this influence on inflation? Now even lazy person talks that sooner or later it will lead to inflation, but how fast it will be, will Fed have significant tools to bridle it? That’s the risk that Bernanke has sounded himself on some previous speeches and in Jackson Hole as well. He said that Fed has no traditional tools any more that is Fed Interest rate, so Fed has to apply some untraditional, such as QE’s. The problem though that if applying traditional tools Fed knows how they impact economy, since it has passed through its application many times, while QE feature was just initiated and nobody dares now to predict how it will impact economy when cycles will start to change. Second risk, that also was spoken by some FOMC members – Fed has expected a bit stronger impact on unemployment reducing, credits growing and GDP. Hence – it is not as smooth as it was expected. Other words, major fear of the Fed is that they definitely bring inflation by 2.3 Trln injection but will they get equal positive effect that they expect and in what way it will come – this is still yet to be seen.

Taking this stuff in consideration I have decided for myself that Fed still feels some lack of data, they need a bit more statistic about labor, production, sales loans and other. It is too small time has passed. That’s why I think that till New Year Fed will not take any radical steps and on September meeting there will be nothing tremendous. Since some positive effect has come, it is safer to just hold rates low and get a bit longer period with slow recovery, rather than take QE III with hope that positive effect will become greater but with absolutely unknown risks. Also we should not forget about elections on Nov 6, and probable US debt ceil fight in Congress in December. So, you can imagine how hot it will be right after elections. But what about EUR/USD?

On next week will be ECB meeting. Draghi surely knows effect of QE on US economy, as we’ve stated above. Since ECB sees that inflation risks still blur but it shows effect as jobs growth and GDP, I think that ECB will follow Fed. They probably will announce starting buyback of national debt of EU countries, mostly Spain and Italy. It is prefferably for bulls, that ECB will hold rate. Mostly negative scenario if ECB will decrease interest rate simulteniously with silence about bonds buyback. But anyway, I expect that sooner rather than later ECB will start its own QE. This could lead to EUR appreciation to next area around 1.30. Based on our monthly analysis this still will not break the overall bearish long term trend.

Monthly

Monthly trend holds bearish. Price continues to force significant support area 1.19-1.23 that held EUR twice from collapse – first time in 2008 when sub-prime crisis has started and second – in 2010 at beginning of Greece turmoil.

Currently August continues to be an inside month to July, but market has shown strong close. This is not a surprise, if we recall what the level it is. This is 50% support of major EUR rally of all times 2000-2008 year. Although this level was penetrated previously in 2010, but looks like it is still valid. This is most powerful Fib support inside of 1.18-1.23 area.

Still, long-term bearish context still holds and target still is 1.16-1.17 area, based on analysis of quarterly chart of Dollar Index that we’ve made in Nov 2011. Index has 95% correlation with EUR/USD. Also this is AB=CD target of most recent pattern on current chart. Take a look – this is significant support of 2005 as well – marked by yellow rectangle.

By current bounce market has reached nearest Fib resistance at 1.2590 area, but will this level hold market? If ECB will give investors what they expect to hear, then probably EUR could proceed higher. As we said above current bearish context can hold move even to monthly K-resistance at 1.2950-1.3150 area.

So, major conclusion for us here is that market bounces from strong support and if it will pass though 1.26 – next area of monthly resistance is 1.30-1.31

Weekly

On previous week price appreciation was stopped by 1.2593 Fib resistance and Monthly+Weekly Resistance 1 around 1.2640. Also this is upward border of the channel. Next resistance is 1.2790 that includes MPR1 and previous swing high. Around 1.2935-1.3150 stands Confluence resistance that is also weekly overbought. This probably the destination, if ECB will suport EUR by bullish decisions. But for that purpose we need to see upward channel breakout first. Since we have new monthly pivot at 1.2450, some retracement is possible. One thing that could give us significant bullish confirmation is if current swing up will exceed previous swing low. This is very often becomes first sign of potential reversal or deep retracement.

Daily

Trend holds bullish here, but now we have potentially reversal pattern 1.27 Butterfly “Sell” at weekly resistance. In current circumstances it is logical to expect pullback, especially because MPP has not been touched yet. But it seems that most will depend on ECB. Strong speech could lead to further EUR appreciation. Technically it probably will express in Butterfly failure. The point is that butterflies are such kind of patterns that fail miserably. So, if market accelerates above 1.618 of butterfly “Sell” it very often lead to much further move up. WPP that now stands at 1.2560 also could help us with that, since it is very useful at the beginning of new week. Move below will suggest deeper retracement, while price holding above it increase probability of upward continuation. So, if you have bearish view you may trade butterfly with stop above its 1.618 target, while if you’re bullish watch for two levels – butterfly failure or retracement to 1.24-1.2450 area – daily Confluence support and MPP.

60-min

On intraday charts currently I do not see much information that could make significant impact on analysis that already made. Still, on Monday we can monitor price action around triangle that we’ve discussed in update on Friday. Probably if market will return into triangle’s body this will lead to further downward retracement and tell that buttefly has started to work. If this will not happen, then market could proceed higher. But again, ECB meeting could turn all stuff from top to bottom.

Conclusion:

Long-term bearish sentiment is still in play. Pullback that now in progress on monthly chart should not surprise us, if we take into consideration the level importance where this bounce has started. From long-term perspective, even move to 1.30 will not erase bearish context.

Currently we can say that market is entering in new financial year after summer. Now is such a situation when fundamental, political events and statistics should extremely important for market behavior. A lot of “if, if, if…” is appearing.

Short-term context still holds bullish, although suggests some retracement, but most will depend on ECB speech.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.