Response that had the broker:

-====================--

Dear Client,

Order execution technology on Cent NDD account type is Market Execution, which implies an execution by market. Order execution performs on contragent side, meanwhile the MetaTrader 4 platform is a data flow retranslator.

Please note, if pending order activation price was set on the level which took place between the market close price and market opening price, then order will be executed by the first available market price on the market opening.

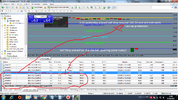

According to the records from the log file of the trading server, orders were opened by the first available tick on the market opening:

2016.04.27 15:30:01.157: activation price #98564876 sell 0.50 #AAPL for '3203150' corrected from 103.90000 to 95.98000

2016.04.27 15:30:01.157: last ticks for #98564876: 104.22000/104.26000 104.24000/104.25000 104.24000/104.26000 104.26000/104.29000 95.98000/96.01000

2016.04.27 15:30:01.159 '3203150': order #98564876, sell 0.50 #AAPL is opened at 95.98000

2016.04.27 15:30:01.160: activation price #98565141 sell 0.50 #AAPL for '3203150' corrected from 103.80000 to 95.98000

2016.04.27 15:30:01.160: last ticks for #98565141: 104.22000/104.26000 104.24000/104.25000 104.24000/104.26000 104.26000/104.29000 95.98000/96.01000

2016.04.27 15:30:01.161 '3203150': order #98565141, sell 0.50 #AAPL is opened at 95.98000

2016.04.27 15:30:01.154: activation price #98563439 sell 1.00 #AAPL for '3203150' corrected from 103.40000 to 95.98000

2016.04.27 15:30:01.155: last ticks for #98563439: 104.22000/104.26000 104.24000/104.25000 104.24000/104.26000 104.26000/104.29000 95.98000/96.01000

2016.04.27 15:30:01.156 '3203150': order #98563439, sell 1.00 #AAPL is opened at 95.98000

2016.04.27 15:30:01.152': activation price #98562971 sell 0.50 #AAPL for '3203150' corrected from 103.50000 to 95.98000

2016.04.27 15:30:01.152: last ticks for #98562971: 104.22000/104.26000 104.24000/104.25000 104.24000/104.26000 104.26000/104.29000 95.98000/96.01000

2016.04.27 15:30:01.154 '3203150': order #98562971, sell 0.50 #AAPL is opened at 95.98000

We did not found any technical issues within the execution process.

Best regards,

Forex4you Dealing Department

-====================--