Volkov Yuriy

Recruit

- Messages

- 612

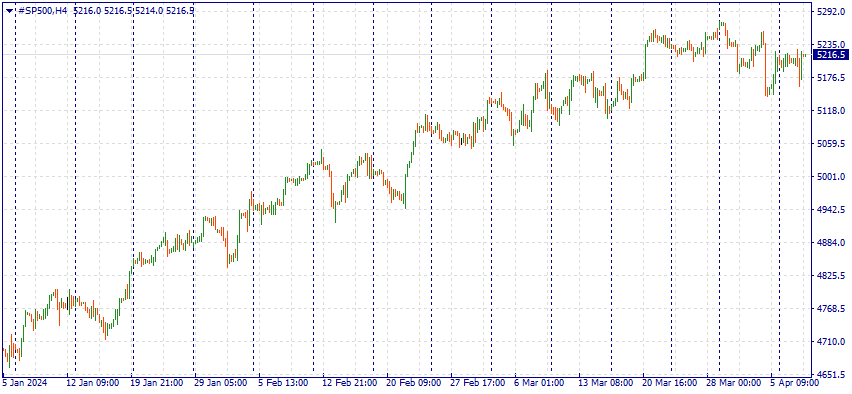

S&P 500 INDEX CONTINUES TO RISE - UP 9% SINCE THE BEGINNING OF THE YEAR!

FreshForex analysts have highlighted the following growth factors:

- Stable economic growth in the US and significant corporate earnings.

- Shares of the "Fabulous Seven" (companies strongly influencing the index such as #Apple, #Amazon, #Google, #Meta(Facebook), #Microsoft, #Nvidia, and #Tesla) are rising due to the implementation of artificial intelligence. The "Fabulous Seven" are still available for trading on our platform and represent an interesting idea for long-term investments. The Fed has again confirmed its readiness for three interest rate cuts, supporting growth in the American stock markets. Investors are eagerly awaiting new signals about the dynamics of interest rates in the US.

- Last month, analysts at HSBC and BofA Global Research forecasted that by the end of 2024, the index would reach 5400, while Oppenheimer estimated it at 5500.

- And yesterday, Wells Fargo, one of the largest financial companies in the US, forecasted that the #SP500 index will rise to 5535 points by the end of this year. This is the highest forecast among all brokerage firms on Wall Street.

Thus, investors around the world seem to be ignoring the possibility that stock valuations have risen too high against the backdrop of the overall market rally, providing even more opportunities for growth. At the same time, professionals will be monitoring whether Wall Street giants can justify the huge rise in stock prices seen over the past three months.

Trade popular stock indices with maximum benefits at FreshForex - with leverage of 1:1000 and tight spreads!

Trade indices

Trade indices