Jason Rogers

FXCM Representative

- Messages

- 517

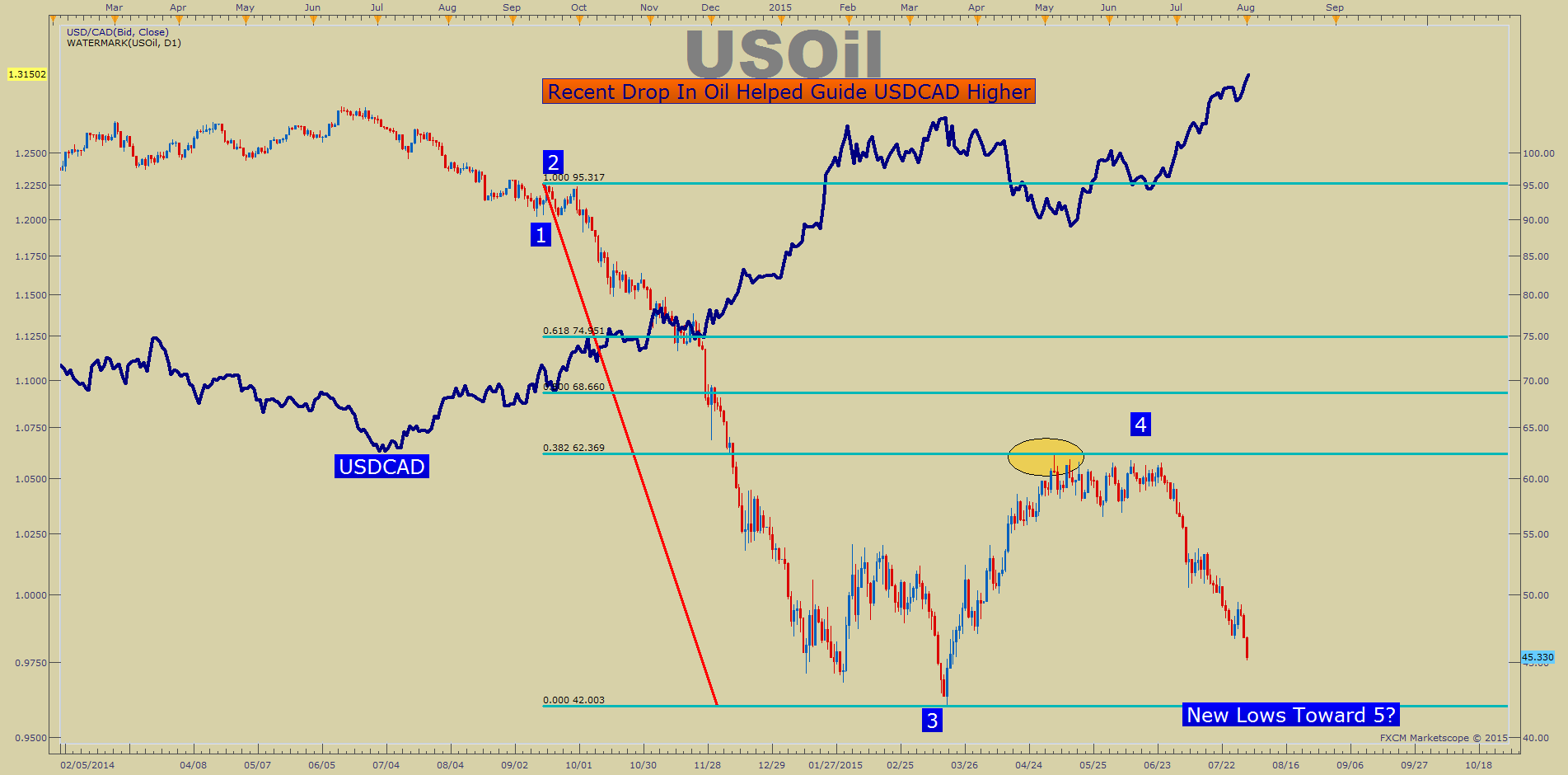

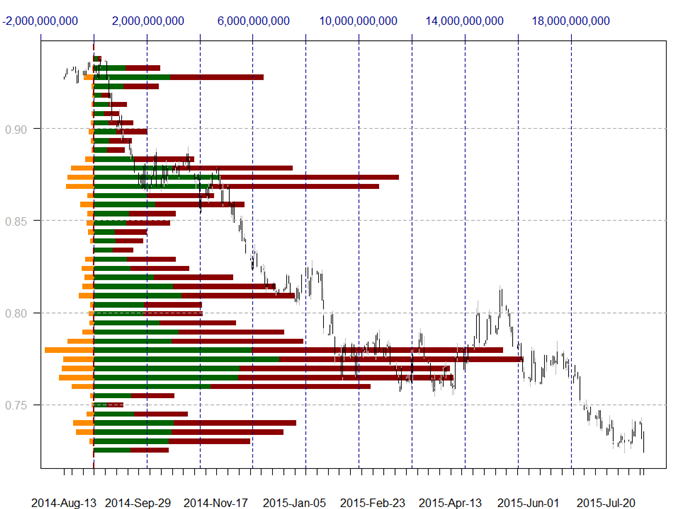

I think Crude is playing a part in CAD weakness..

That's right, AliKhan

Below is a chart showing the inverse correlation between USD/CAD and USOil.

I think Crude is playing a part in CAD weakness..

Jason,

I think something has gone wrong with your images. Please use Preview Post when posting and you'll be able to see if everything worked or not.