aariapoor

Recruit

- Messages

- 2

At 14th Apr. 2017 FXTM stopped me out with nearly 100% margin level (1 min before) when market was moving in my favor, I contact them several times but they were just repeating you become stopped out because your margin level reached to 20% (as if I don't know when stop-out happens  ), so I wrote the following letter and explained in details and repeated my question that "Why my margin level has to drop 80% in 1 minutes?".

), so I wrote the following letter and explained in details and repeated my question that "Why my margin level has to drop 80% in 1 minutes?".

They replied "... account may suffer losses and cause margin level to fall due to rollover costs, exchange rate fluctuations or widening spreads. Such losses may trigger a Margin Call and a Stop Out..."

My email to them:

1- Markets moves in my favor but I become stop-out!!!

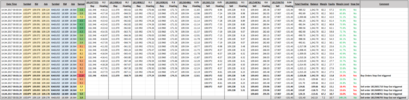

Please check the image below and you will see where and when my position were closed:

As you can see, first position closed at 109.059 and 00:01:16, while market was moving in my favor -my BUY positions were 0.65 and my SELL position were 0.75 lots and it means bear movement in the market was actually increasing my margin level.

After closing my buy positions and removing the hedge of course, market moves 6 pips and my sell positions also closed at 109.178 and 109.170 in the same time at 00:01:29!!! (I don’t know how price can be in 2 different place in same time). But more important thing is this is the price that candle wick even has not reached, and it seems the spread would be 59.

2- Bigger movement did not make me stop-out

In the image below you can see a bigger movement (100) just 10 minutes before (the average price is also higher than the mentioned candle’s high), which did not cause me stop-out (I saw that my margin level is about 95%). How is it possible that 6 pip movement 10 minutes later drops my margin level about 75%?

3- Differences in FXTM chart comparing other brokers

In the time mentioned, FXTM’s candle size and color is not matches with other brokers or TradingView charts (which is the traders’ most reliable source).

Please compare your first 5M candle at April 14th with 2 other brokers (I can provide more if needed) and TradingView here:

Trading View 5M

IC Market 1M

FXTM 30M

Plus500 30M

As you can see only FXTM has printed a Bull candle.

4- Wider spread than weekend and ever

At the time of writing this letter (Sunday, April 24, 2017) and other weekends, USDJPY spread is about 39 but as I calculated based on my closing position price, during transition time from Thursday session to Friday session spread was 59. (The spread that I have not seen in 1 year working with FXTM even during major news events. Let alone 14th and 13th of April was only normal weekdays)

Base on this link (http://www.forextime.com/forex-trading/contract-specifications/USDJPY) USDJPY typical spread, on FXTM Standard account should be 2.2 but we witnessed 2.7 times or 168% widening/increasing in NY close / Sydney open.

I believe that they stopped me out just before the big move that was reaching my take profit level and I could double my account

Please check what happened exactly after I lost my account:

They replied "... account may suffer losses and cause margin level to fall due to rollover costs, exchange rate fluctuations or widening spreads. Such losses may trigger a Margin Call and a Stop Out..."

My email to them:

1- Markets moves in my favor but I become stop-out!!!

Please check the image below and you will see where and when my position were closed:

As you can see, first position closed at 109.059 and 00:01:16, while market was moving in my favor -my BUY positions were 0.65 and my SELL position were 0.75 lots and it means bear movement in the market was actually increasing my margin level.

After closing my buy positions and removing the hedge of course, market moves 6 pips and my sell positions also closed at 109.178 and 109.170 in the same time at 00:01:29!!! (I don’t know how price can be in 2 different place in same time). But more important thing is this is the price that candle wick even has not reached, and it seems the spread would be 59.

2- Bigger movement did not make me stop-out

In the image below you can see a bigger movement (100) just 10 minutes before (the average price is also higher than the mentioned candle’s high), which did not cause me stop-out (I saw that my margin level is about 95%). How is it possible that 6 pip movement 10 minutes later drops my margin level about 75%?

3- Differences in FXTM chart comparing other brokers

In the time mentioned, FXTM’s candle size and color is not matches with other brokers or TradingView charts (which is the traders’ most reliable source).

Please compare your first 5M candle at April 14th with 2 other brokers (I can provide more if needed) and TradingView here:

Trading View 5M

IC Market 1M

FXTM 30M

Plus500 30M

As you can see only FXTM has printed a Bull candle.

4- Wider spread than weekend and ever

At the time of writing this letter (Sunday, April 24, 2017) and other weekends, USDJPY spread is about 39 but as I calculated based on my closing position price, during transition time from Thursday session to Friday session spread was 59. (The spread that I have not seen in 1 year working with FXTM even during major news events. Let alone 14th and 13th of April was only normal weekdays)

Base on this link (http://www.forextime.com/forex-trading/contract-specifications/USDJPY) USDJPY typical spread, on FXTM Standard account should be 2.2 but we witnessed 2.7 times or 168% widening/increasing in NY close / Sydney open.

I believe that they stopped me out just before the big move that was reaching my take profit level and I could double my account

Please check what happened exactly after I lost my account: