IvanGlobalPrime

Company Representative

- Messages

- 36

Find my latest market thoughts

Asian Currencies Dumped As COVID-19 Plays Out

The USD continues to have no rival in FX land, while the Canadian Dollar also rides the wave as the market fully turns its attention away from the most exposed Asian economies to the COVID-19 and into the search for yield, with the North American currencies the safest bet given the positive swaps offered. Want to know the rest of key drivers and developments, including a fresh 11-year low in the Aussie? Keep reading...

The Daily Edge is authored by Ivan Delgado, 10y Forex Trader veteran & Market Insights Commentator at Global Prime. Feel free to follow Ivan on Twitter & Youtube weekly show. You can also subscribe to the mailing list to receive Ivan’s Daily wrap. The purpose of this content is to provide an assessment of the conditions, taking an in-depth look of market dynamics - fundamentals and technicals - determine daily biases and assist one’s trading decisions.

Let’s get started…

Quick Take

Geographics are playing a greater role in the adjustment of portfolio positioning as the COVID-19 plays out, with concerns over the spread now in Beijing and outside of China. When officials in China are even weighing the possibility of a "Wuhan-Level" lockdown, you know risk is that the market may go on ‘the defensive'.

The acceleration to buying into the USD portrays a market that is starting to diversify more aggressively away from Asian-based currencies (JPY, CNY, AUD, NZD) and into the allure of the world’s reserve currency. This comes as the seeking of yield continues in a world with excess liquidity and too limited places to park this capital.

Gold’s unstoppable rise represents like no other asset this urge for capital-preservation amid the COVID-19 induced growth concerns that may lead the pool of negative yielding bonds global further into negative territory as markets anticipate Central Banks will be forced to ease further down the road.

The Canadian Dollar, the darling of G8 FX in terms of the relatively high-yield it pays, is also drawing plenty of attention, piggy backing the USD as a solid investment destination to find shelter. There is a perception that the North American economies are not as economically exposed to the headwinds by COVID-19, and in the case of the CAD, it also benefits from a flying USD.

When it comes to the European-based currencies, the Swissy, on the back of the loss in safe haven bids by the Yen, appears to be capitalizing on this diversification away from Japanese currency, which keeps playing out despite the selling of equities. The Euro, after a dramatic fall for over 2 weeks in a row at an index level, which accounts for aggregated flows, it’s seen steadier buying. Lastly, the Pound, lacking any catalyst of note, whipsawed around with no particular bias.

The indices show the performance of a particular currency vs G8 FX. An educational video on how to interpret these indices can be found in the Global Prime's Research section.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

Asian currencies on free-fall: Judging by the movements in Forex, it appears as though the exodus of capital away from Asian-based currencies (AUD, NZD, JPY, CNH) is a phenomenon gathering steam amid the rising concerns over the spread of COVID-19 in Beijing and outside of China. Officials are even weighing the possibility of a "Wuhan-Level" lockdown.

CB bazookas 'locked and loaded': Even if the total number of cases/deaths has slowed down, the market appears to be focused on the ramifications the COVID-19 will have on growth within the Asian region and more wildly. The market is acting as if the economic inactivity in China and suppressed sentiment will cause sufficient damage for Central Banks around the globe to be ‘locked and loaded’ having to step up to the plate with more easing to combat the upcoming slowdown in China and the global economy. Gold’s rally tells us this story.

South Korea’s ghost city: South Korea is a good example of the COVID-19 fears spreading into the wider Asian region as city streets were deserted amid surge in Korean COVID-19 cases. "it looks like a zombie apocalypse". As Zero Hedge reports, in Daegu, the country's fourth-largest city, with a population of 2.5 million people - roughly one-tenth of the South's total population, the most crowded streets in the city were abandoned. "It’s like someone dropped a bomb in the middle of the city. It looks like a zombie apocalypse," Kim Geun-woo, a 28-year-old resident told Reuters by telephone.

The Aussie prints 11-year low vs the USD: The fall comes as USD/CNH moved decisively above the 7.0 level to a high of 7.05. The Kiwi got dragged lower piggybacking these movements, while the Yen appears to be going through a transient paradigm shift, losing its status as a safe haven at times of selling pressure in yields and stocks. For an in-depth look at the Yen debacle and the possible culprits behind, check yesterday’s special article. I also recommend this read on “Coronavirus To Hammer Japan And The Yen.”

‘True risk-off’ settles in: US and EU equities were taken to the woodshed with tech shares the worst performers. The US yields kept falling. The S&P index fell just -0.3%, the Nasdaq lost as much as -0.67%, while the Dow fell -0.44%. These combined down movements in equities and yields are the ultimate barometers that communicate ‘risk-off’ is creeping back in.

Apple revenue miss in China 40-50%? Some news outlets I scanned this morning are suggesting headlines from China's Global Times on iPhone sales collapsing as one of the possible catalysts for the bleeding in equities. Global Times tweeted the following during the US morning time. “Due to COVID19 outbreak, Apple's iPhone sales in China may fall by at least 40-50% in February and March compared with the same period last year, and its Q1 sales are likely to be less than half of the same quarter in 2019: industry analyst.” Full story here. This follows the warning by Apple to downgrade guidance earlier this week, which already caused a selling in equities from Asian to the US.

JPY loses safe haven bids: Despite this ‘true risk off’ settling back into the market, the JPY continues to lose safe haven bids, as the technical bearish momentum is still unfavourable following the dramatic fall on Wed. By checking at the CME Daily FX Volume and Open Interest, we can see that the Yen selling carried a major spike in both volumes and open interest, a precursor for follow through, even if it’s fair to say that the currency is now too high to perceive much value to add until a deep correction.

USD the safest bet to house the excessive liquidity: At the risk of sounding like a broken record, the high uncertainty that the COVID-19 is causing on the prospects for suppressed growth this year has led to the reinforcement of a premise. That is, the USD dominance as the safest bet to house capital flows as the country is seen as relatively immune to the spillover effects that the Asian countries will comparatively go through.

US fundamentals support the USD as secondary driver: Despite it’s all about housing international capital as the key catalyst fueling the trend, as the cherry on top of the cake, the USD continues to be well supported via local economic fundamentals, with the latest Philly Fed Survey coming way above expectations. Earlier this week, housing data and inflation did also provide a cushion for the USD, which keeps outperforming G8 FX this year.

Fed rate cuts still priced in: Despite the strength in the USD, the market keeps pricing in around 40bps of Fed cuts by the end of the year. It was therefore good timing to hear what Fed Vice Chair Clarida thinks about these prospects in a CNBC interview. The policymaker said that “market pricing on rate cuts is a little tricky”, while noting that fundamentals of the US economy were strong, while sounding cautious in not making hasty projections about the potential impact of COVID-19 on the economy until more data comes in.

Aussie positive jobs disregarded: The Australian Dollar has reached a record 11 year low against the US Dollar, disregarding what was an overall solid Australian jobs report, despite a bigger than expected rise in the unemployment rate, at 5.3% vs 5.2% expected even if the blow softens up when noticing that the participation rate creeped up to 66.1% vs 66% expected. The rest of the Australian January labour market report was quite positive with the employment change at +13.5K, slightly beating expectations. The break down of full vs part time employment was also encouraging with +46.2K full time and -32.7K part time.

ECB minutes a no-event: The ECB released its account of the January policy meeting, noting that they need more data to see if tentative signs of stabilisation provide firmer ground for optimism. By reading the aggregation of headlines, I sense the ECB is in ‘wait and see’ mode as the COVID-19 impact plays out yet they still want to hold tight to their hopes of a glass half full.

What’s ahead in the calendar? Today’s calendar is heavy on PMI data as many countries (Japan, Germany, UK, Eurozone, and the US) are due to update the market with preliminary Manufacturing and services numbers for February. It’s going to be a good opportunity for the market to be updated on the COVID-19 impact to economies, even if the worst might be still to come as the sluggish Chinese activity is still feeding through and won’t be fully captured until the data releases for the next few months. Besides, Canada publishes retail sales figures for December, alongside existing home sales data in the US for the month of January.

Other events to take into account: These will include the line up of Fed officials to speak, with Dallas Fed Governor Kaplan, Governor Brainard, Vice Chairman Clarida and Cleveland Fed Mester. What’s more, the next Democratic Caucus out of Nevada takes place on Saturday, an event that will be closely watched by Mr. Market to readjust the odds for the runner up for Democrats. This time, the Caucus has 48 delegates at stake, including 12 superdelegates.

If you found this fundamental summary helpful, just click here to share it!

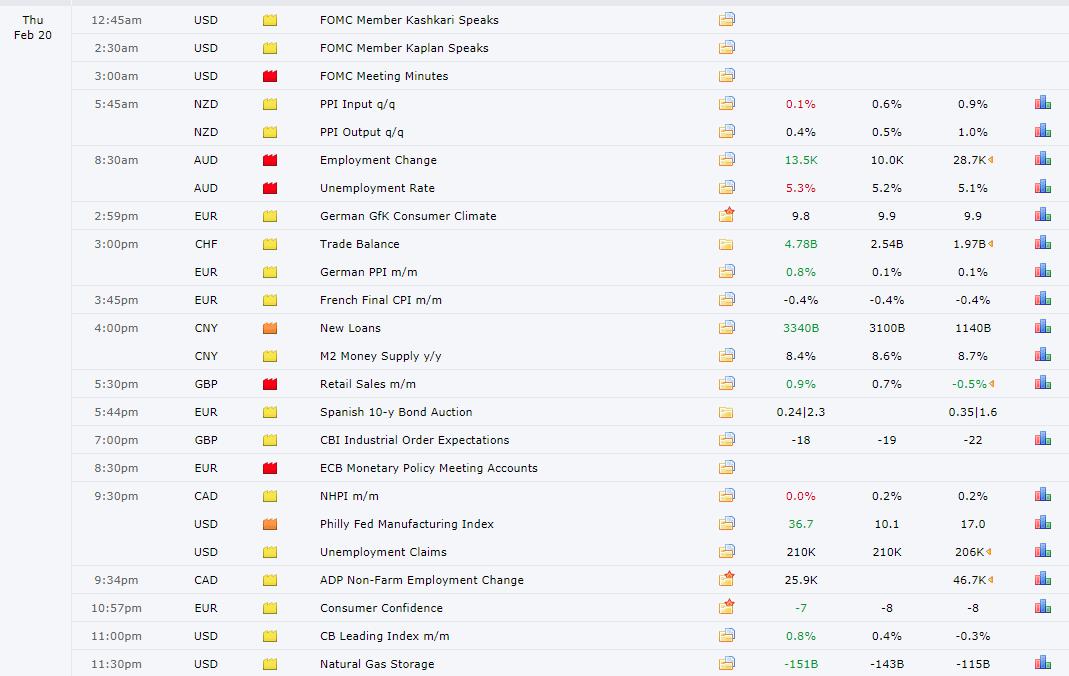

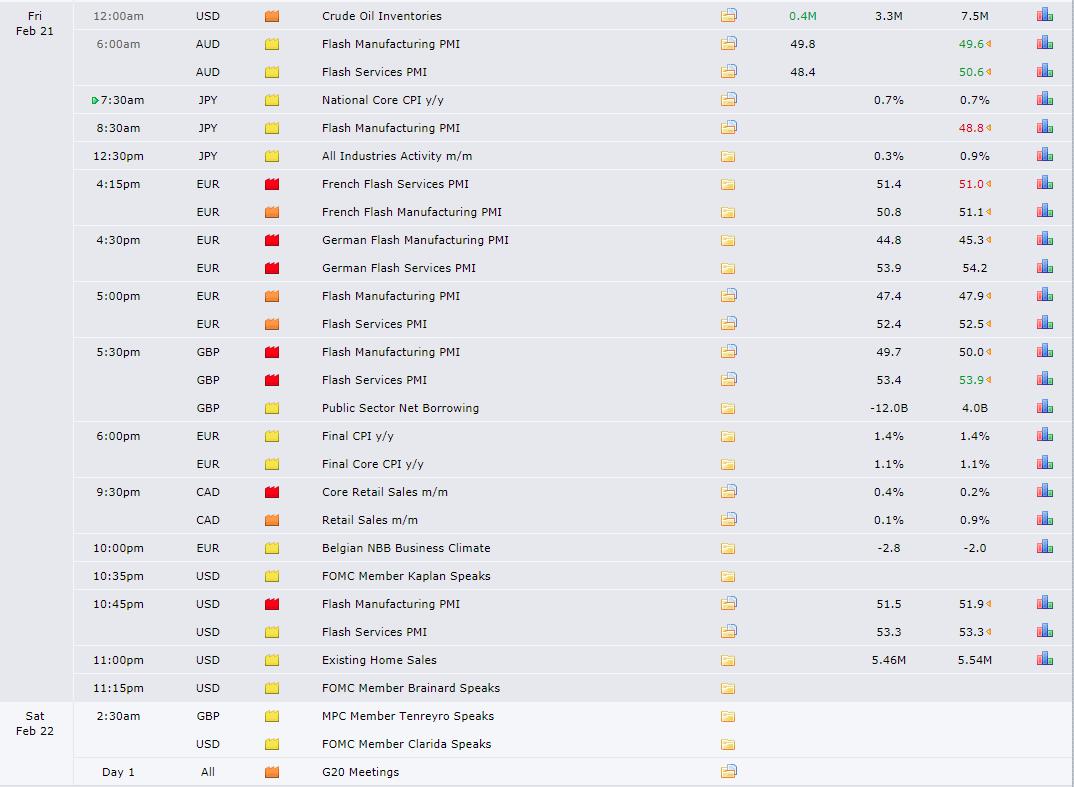

Recent Economic Indicators & Events Ahead

Source: Forexfactory

Insights Into FX Index Charts

The indices show the performance of a particular currency vs G8 FX. An educational video on how to interpret these indices can be found in the Global Prime's Research section. The idea of this analysis is to complement one’s daily bias by accounting for this holistic analysis.

If you found the content in this section valuable, give us a share by just clicking here!

The EUR index has found two days of strong buying flows to see a return back towards the back-end of its broken support now turned resistance. This represents a major technical stumbling block if you are betting for further EUR gains this Friday. Anything can happen, but trading long EUR inventory into this macro resistance does not tend to be a good idea, unless of course, you are matching off the currency against an even weaker one such as the Aussie. Besides, with the 100% proj target still to be met, there is likely more downside from here. This is a market that remains a sell on strength at regular intervals until the 100% proj target met.

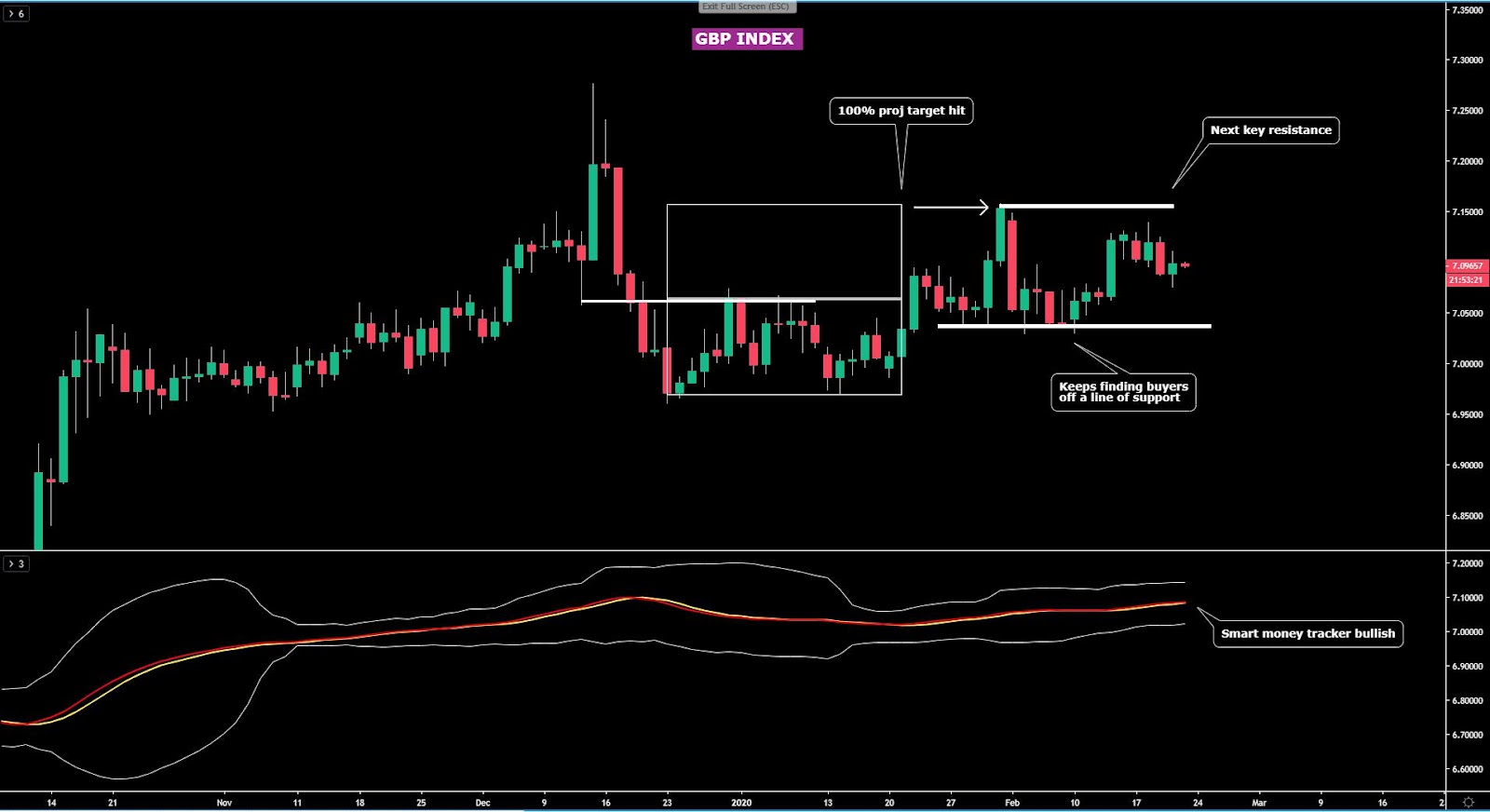

The GBP index went through a recovery after testing the origin of a daily demand imbalance, which led to marginal gains printed for the day. The price structure is still supporting the notion that this market is headed towards the previous swing high, a trade premise that for now continues to be backed up by the smart money tracker as a gauge of the short-term momentum. The aggregated flows in GBP tells me that buying on dips is still the way to go up until the next resistance, with this scenario invalidated on a break of support.

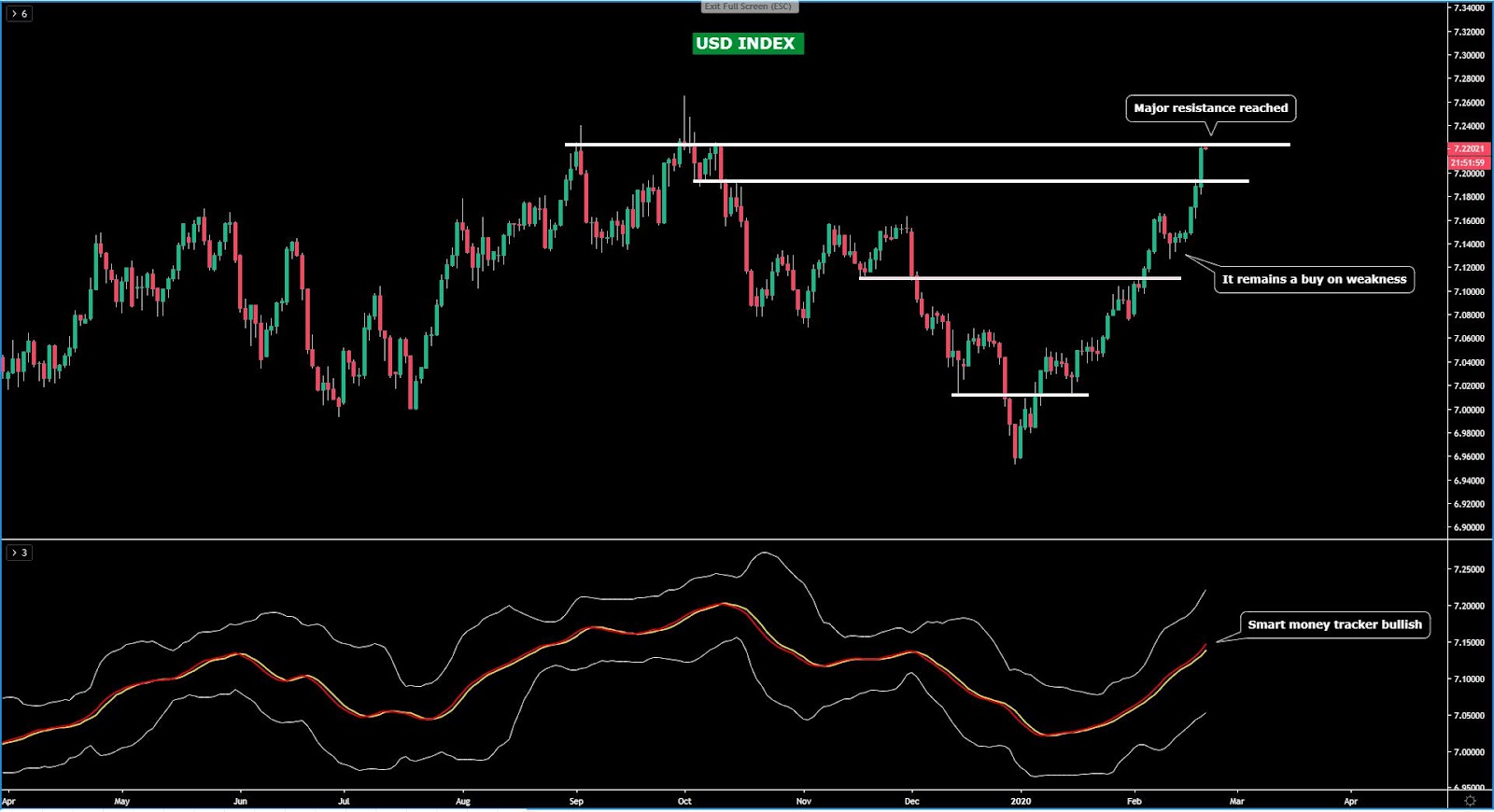

The USD index has continued to balloon to such an extent that I find it really hard to see further remaining buy-side pressure is in store unless we go through some type of shallow pullback. The daily candle printed on Thursday is the most elongated in 2020, which speaks volumes about the current narrative of the USD becoming the ultimate safe house to attract capital. On top of that, the currency has landed at a critical macro resistance rejected in three instances in Q4 2019. The USD remains the top performing currency in this new decade by a fair margin but the extension looks awfully overbought in the near-term. As I always say, unless you deploy momentum-type strategies to scalp intraday, there is no value in being long at these levels.

The CAD index is a moving train very well suited for those intraday scalpers that aim to jump in momentum plays, that’s a given. However, akin to the stance I hold in the USD, unless we see a pullback that may relax some of the overbought buying measures, being long at these highs is not fitting accounts that aim to engage at daily technical value areas. While the recent breakout of a key swing high last Friday has invigorated buyers and validated a fresh bullish cycle with the sight on last years’ double bottom, apply patience to reinstate longs. This market has ‘buy on dips’ written all over the wall up as I mentioned earlier this week, but you don’t want to get caught at these suboptimal prices to start building CAD long inventory.

The JPY index displays a break of structure to the bearish side which has now reached the 100% proj target, an area that coincides with a key support on the daily. Selling on strength remains the way to go, but be aware that it is at these extremes (projected targets) where a reversal tends to occur, especially if it aligned with an area of horizontal support. I’d be very cautious to keep adding JPY shorts at this level as it faces the imminent risk of buy-side pressure increasing. By far, the best area to re-engage in shorts comes at a retest of the broken line of support.

The AUD index appears to have finally failed at its overhead resistance, a clear line in the sand that I mentioned in previous posts that was a clear risk in disallowing further gains. The decisive selloff seen in the last 24h has now realigned the bearish structure with the smart money tracker, which sets the stage for a revisit of the previous trend low. Going short the Aussie on episodes of strength at key intraday levels of resistance is the way to go. The close at the lows by the end of NY tells us the appetite to buy the currency is null for the time being.

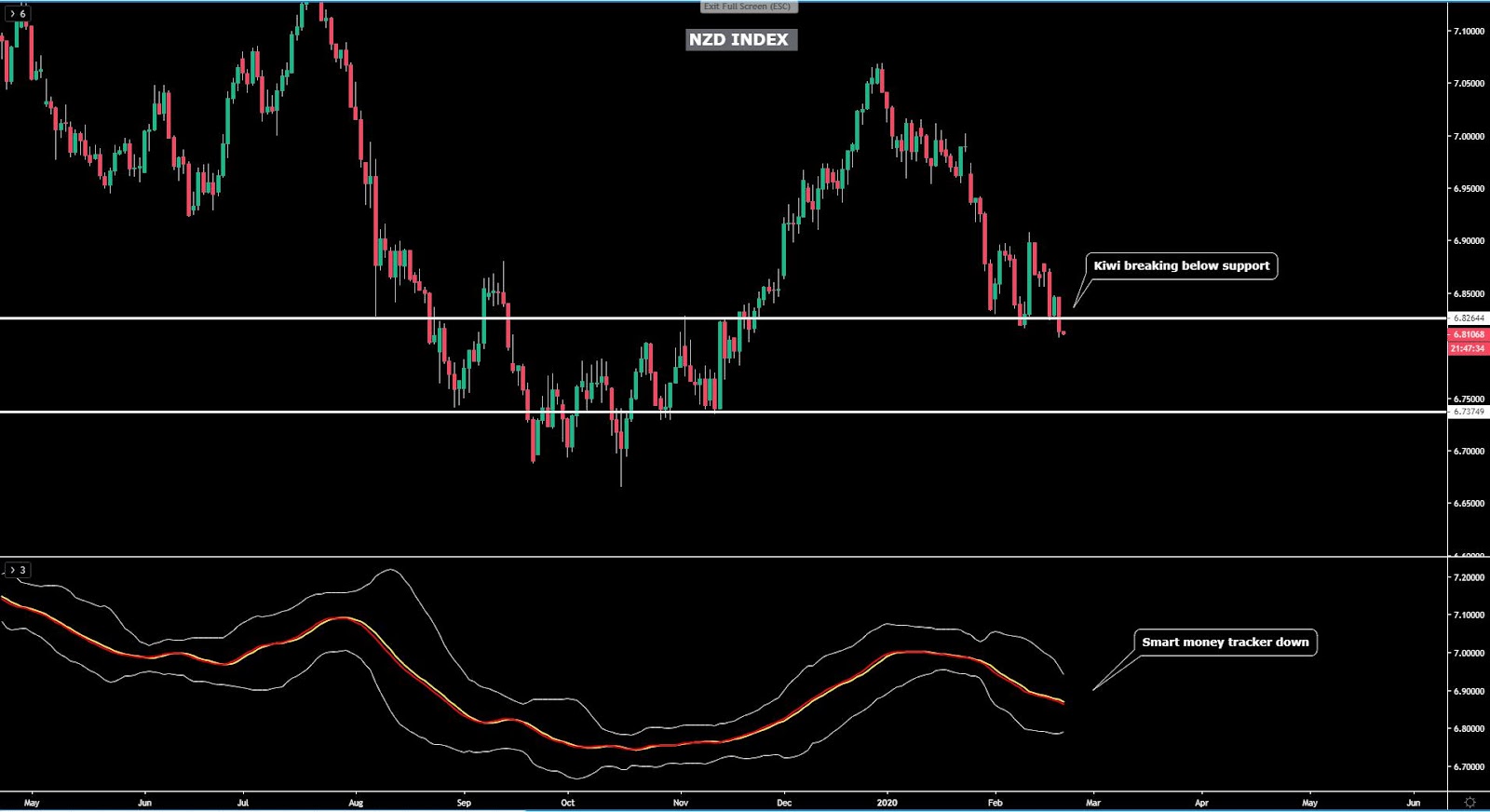

The NZD index has now confirmed a fresh bearish cycle by breaking the previous swing low, hence validating the trade premise of being a seller on strength. The currency was dragged lower by the breakout in 11-year low in the AUD/USD, while at the same time, the suppressed sentiment towards Asian currencies as a whole as COVID-19 spreads is also weighting. The fall also indicates that for now the market is looking past the neutral stance by the RBNZ, not buying into the assumption that conditions will be favorable enough to retain such bias.

The CHF index found strong buying off a key level of support in line with the more macro weekly trend. It is in these areas where building long inventory in a currency offers the most bang for your buck. The impulsiveness of the recovery off this swing low tells me the CHF is once again setting its sight towards the recent highs, even if the currency looks overbought. I won’t rule out further buying by momentum-type accounts and for other variance of reasons, but the play to get the most value is done until a correction occurs. Note, the smart money tracker has once again re-aligned to the upside, which supports the bullish bias.

Important Footnotes

Asian Currencies Dumped As COVID-19 Plays Out

The USD continues to have no rival in FX land, while the Canadian Dollar also rides the wave as the market fully turns its attention away from the most exposed Asian economies to the COVID-19 and into the search for yield, with the North American currencies the safest bet given the positive swaps offered. Want to know the rest of key drivers and developments, including a fresh 11-year low in the Aussie? Keep reading...

The Daily Edge is authored by Ivan Delgado, 10y Forex Trader veteran & Market Insights Commentator at Global Prime. Feel free to follow Ivan on Twitter & Youtube weekly show. You can also subscribe to the mailing list to receive Ivan’s Daily wrap. The purpose of this content is to provide an assessment of the conditions, taking an in-depth look of market dynamics - fundamentals and technicals - determine daily biases and assist one’s trading decisions.

Let’s get started…

- Quick Take

- Narratives in Financial Markets

- Recent Economic Indicators

- Dive Into FX Chart Insights

- Educational Material

Quick Take

Geographics are playing a greater role in the adjustment of portfolio positioning as the COVID-19 plays out, with concerns over the spread now in Beijing and outside of China. When officials in China are even weighing the possibility of a "Wuhan-Level" lockdown, you know risk is that the market may go on ‘the defensive'.

The acceleration to buying into the USD portrays a market that is starting to diversify more aggressively away from Asian-based currencies (JPY, CNY, AUD, NZD) and into the allure of the world’s reserve currency. This comes as the seeking of yield continues in a world with excess liquidity and too limited places to park this capital.

Gold’s unstoppable rise represents like no other asset this urge for capital-preservation amid the COVID-19 induced growth concerns that may lead the pool of negative yielding bonds global further into negative territory as markets anticipate Central Banks will be forced to ease further down the road.

The Canadian Dollar, the darling of G8 FX in terms of the relatively high-yield it pays, is also drawing plenty of attention, piggy backing the USD as a solid investment destination to find shelter. There is a perception that the North American economies are not as economically exposed to the headwinds by COVID-19, and in the case of the CAD, it also benefits from a flying USD.

When it comes to the European-based currencies, the Swissy, on the back of the loss in safe haven bids by the Yen, appears to be capitalizing on this diversification away from Japanese currency, which keeps playing out despite the selling of equities. The Euro, after a dramatic fall for over 2 weeks in a row at an index level, which accounts for aggregated flows, it’s seen steadier buying. Lastly, the Pound, lacking any catalyst of note, whipsawed around with no particular bias.

The indices show the performance of a particular currency vs G8 FX. An educational video on how to interpret these indices can be found in the Global Prime's Research section.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

Asian currencies on free-fall: Judging by the movements in Forex, it appears as though the exodus of capital away from Asian-based currencies (AUD, NZD, JPY, CNH) is a phenomenon gathering steam amid the rising concerns over the spread of COVID-19 in Beijing and outside of China. Officials are even weighing the possibility of a "Wuhan-Level" lockdown.

CB bazookas 'locked and loaded': Even if the total number of cases/deaths has slowed down, the market appears to be focused on the ramifications the COVID-19 will have on growth within the Asian region and more wildly. The market is acting as if the economic inactivity in China and suppressed sentiment will cause sufficient damage for Central Banks around the globe to be ‘locked and loaded’ having to step up to the plate with more easing to combat the upcoming slowdown in China and the global economy. Gold’s rally tells us this story.

South Korea’s ghost city: South Korea is a good example of the COVID-19 fears spreading into the wider Asian region as city streets were deserted amid surge in Korean COVID-19 cases. "it looks like a zombie apocalypse". As Zero Hedge reports, in Daegu, the country's fourth-largest city, with a population of 2.5 million people - roughly one-tenth of the South's total population, the most crowded streets in the city were abandoned. "It’s like someone dropped a bomb in the middle of the city. It looks like a zombie apocalypse," Kim Geun-woo, a 28-year-old resident told Reuters by telephone.

The Aussie prints 11-year low vs the USD: The fall comes as USD/CNH moved decisively above the 7.0 level to a high of 7.05. The Kiwi got dragged lower piggybacking these movements, while the Yen appears to be going through a transient paradigm shift, losing its status as a safe haven at times of selling pressure in yields and stocks. For an in-depth look at the Yen debacle and the possible culprits behind, check yesterday’s special article. I also recommend this read on “Coronavirus To Hammer Japan And The Yen.”

‘True risk-off’ settles in: US and EU equities were taken to the woodshed with tech shares the worst performers. The US yields kept falling. The S&P index fell just -0.3%, the Nasdaq lost as much as -0.67%, while the Dow fell -0.44%. These combined down movements in equities and yields are the ultimate barometers that communicate ‘risk-off’ is creeping back in.

Apple revenue miss in China 40-50%? Some news outlets I scanned this morning are suggesting headlines from China's Global Times on iPhone sales collapsing as one of the possible catalysts for the bleeding in equities. Global Times tweeted the following during the US morning time. “Due to COVID19 outbreak, Apple's iPhone sales in China may fall by at least 40-50% in February and March compared with the same period last year, and its Q1 sales are likely to be less than half of the same quarter in 2019: industry analyst.” Full story here. This follows the warning by Apple to downgrade guidance earlier this week, which already caused a selling in equities from Asian to the US.

JPY loses safe haven bids: Despite this ‘true risk off’ settling back into the market, the JPY continues to lose safe haven bids, as the technical bearish momentum is still unfavourable following the dramatic fall on Wed. By checking at the CME Daily FX Volume and Open Interest, we can see that the Yen selling carried a major spike in both volumes and open interest, a precursor for follow through, even if it’s fair to say that the currency is now too high to perceive much value to add until a deep correction.

USD the safest bet to house the excessive liquidity: At the risk of sounding like a broken record, the high uncertainty that the COVID-19 is causing on the prospects for suppressed growth this year has led to the reinforcement of a premise. That is, the USD dominance as the safest bet to house capital flows as the country is seen as relatively immune to the spillover effects that the Asian countries will comparatively go through.

US fundamentals support the USD as secondary driver: Despite it’s all about housing international capital as the key catalyst fueling the trend, as the cherry on top of the cake, the USD continues to be well supported via local economic fundamentals, with the latest Philly Fed Survey coming way above expectations. Earlier this week, housing data and inflation did also provide a cushion for the USD, which keeps outperforming G8 FX this year.

Fed rate cuts still priced in: Despite the strength in the USD, the market keeps pricing in around 40bps of Fed cuts by the end of the year. It was therefore good timing to hear what Fed Vice Chair Clarida thinks about these prospects in a CNBC interview. The policymaker said that “market pricing on rate cuts is a little tricky”, while noting that fundamentals of the US economy were strong, while sounding cautious in not making hasty projections about the potential impact of COVID-19 on the economy until more data comes in.

Aussie positive jobs disregarded: The Australian Dollar has reached a record 11 year low against the US Dollar, disregarding what was an overall solid Australian jobs report, despite a bigger than expected rise in the unemployment rate, at 5.3% vs 5.2% expected even if the blow softens up when noticing that the participation rate creeped up to 66.1% vs 66% expected. The rest of the Australian January labour market report was quite positive with the employment change at +13.5K, slightly beating expectations. The break down of full vs part time employment was also encouraging with +46.2K full time and -32.7K part time.

ECB minutes a no-event: The ECB released its account of the January policy meeting, noting that they need more data to see if tentative signs of stabilisation provide firmer ground for optimism. By reading the aggregation of headlines, I sense the ECB is in ‘wait and see’ mode as the COVID-19 impact plays out yet they still want to hold tight to their hopes of a glass half full.

What’s ahead in the calendar? Today’s calendar is heavy on PMI data as many countries (Japan, Germany, UK, Eurozone, and the US) are due to update the market with preliminary Manufacturing and services numbers for February. It’s going to be a good opportunity for the market to be updated on the COVID-19 impact to economies, even if the worst might be still to come as the sluggish Chinese activity is still feeding through and won’t be fully captured until the data releases for the next few months. Besides, Canada publishes retail sales figures for December, alongside existing home sales data in the US for the month of January.

Other events to take into account: These will include the line up of Fed officials to speak, with Dallas Fed Governor Kaplan, Governor Brainard, Vice Chairman Clarida and Cleveland Fed Mester. What’s more, the next Democratic Caucus out of Nevada takes place on Saturday, an event that will be closely watched by Mr. Market to readjust the odds for the runner up for Democrats. This time, the Caucus has 48 delegates at stake, including 12 superdelegates.

If you found this fundamental summary helpful, just click here to share it!

Recent Economic Indicators & Events Ahead

Source: Forexfactory

Insights Into FX Index Charts

The indices show the performance of a particular currency vs G8 FX. An educational video on how to interpret these indices can be found in the Global Prime's Research section. The idea of this analysis is to complement one’s daily bias by accounting for this holistic analysis.

If you found the content in this section valuable, give us a share by just clicking here!

The EUR index has found two days of strong buying flows to see a return back towards the back-end of its broken support now turned resistance. This represents a major technical stumbling block if you are betting for further EUR gains this Friday. Anything can happen, but trading long EUR inventory into this macro resistance does not tend to be a good idea, unless of course, you are matching off the currency against an even weaker one such as the Aussie. Besides, with the 100% proj target still to be met, there is likely more downside from here. This is a market that remains a sell on strength at regular intervals until the 100% proj target met.

The GBP index went through a recovery after testing the origin of a daily demand imbalance, which led to marginal gains printed for the day. The price structure is still supporting the notion that this market is headed towards the previous swing high, a trade premise that for now continues to be backed up by the smart money tracker as a gauge of the short-term momentum. The aggregated flows in GBP tells me that buying on dips is still the way to go up until the next resistance, with this scenario invalidated on a break of support.

The USD index has continued to balloon to such an extent that I find it really hard to see further remaining buy-side pressure is in store unless we go through some type of shallow pullback. The daily candle printed on Thursday is the most elongated in 2020, which speaks volumes about the current narrative of the USD becoming the ultimate safe house to attract capital. On top of that, the currency has landed at a critical macro resistance rejected in three instances in Q4 2019. The USD remains the top performing currency in this new decade by a fair margin but the extension looks awfully overbought in the near-term. As I always say, unless you deploy momentum-type strategies to scalp intraday, there is no value in being long at these levels.

The CAD index is a moving train very well suited for those intraday scalpers that aim to jump in momentum plays, that’s a given. However, akin to the stance I hold in the USD, unless we see a pullback that may relax some of the overbought buying measures, being long at these highs is not fitting accounts that aim to engage at daily technical value areas. While the recent breakout of a key swing high last Friday has invigorated buyers and validated a fresh bullish cycle with the sight on last years’ double bottom, apply patience to reinstate longs. This market has ‘buy on dips’ written all over the wall up as I mentioned earlier this week, but you don’t want to get caught at these suboptimal prices to start building CAD long inventory.

The JPY index displays a break of structure to the bearish side which has now reached the 100% proj target, an area that coincides with a key support on the daily. Selling on strength remains the way to go, but be aware that it is at these extremes (projected targets) where a reversal tends to occur, especially if it aligned with an area of horizontal support. I’d be very cautious to keep adding JPY shorts at this level as it faces the imminent risk of buy-side pressure increasing. By far, the best area to re-engage in shorts comes at a retest of the broken line of support.

The AUD index appears to have finally failed at its overhead resistance, a clear line in the sand that I mentioned in previous posts that was a clear risk in disallowing further gains. The decisive selloff seen in the last 24h has now realigned the bearish structure with the smart money tracker, which sets the stage for a revisit of the previous trend low. Going short the Aussie on episodes of strength at key intraday levels of resistance is the way to go. The close at the lows by the end of NY tells us the appetite to buy the currency is null for the time being.

The NZD index has now confirmed a fresh bearish cycle by breaking the previous swing low, hence validating the trade premise of being a seller on strength. The currency was dragged lower by the breakout in 11-year low in the AUD/USD, while at the same time, the suppressed sentiment towards Asian currencies as a whole as COVID-19 spreads is also weighting. The fall also indicates that for now the market is looking past the neutral stance by the RBNZ, not buying into the assumption that conditions will be favorable enough to retain such bias.

The CHF index found strong buying off a key level of support in line with the more macro weekly trend. It is in these areas where building long inventory in a currency offers the most bang for your buck. The impulsiveness of the recovery off this swing low tells me the CHF is once again setting its sight towards the recent highs, even if the currency looks overbought. I won’t rule out further buying by momentum-type accounts and for other variance of reasons, but the play to get the most value is done until a correction occurs. Note, the smart money tracker has once again re-aligned to the upside, which supports the bullish bias.

Important Footnotes

- Market structure: Markets evolve in cycles followed by a period of distribution and/or accumulation. To understand the principles applied in the assessment of cycles, refer to the tutorial How To Read Market Structures In Forex

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor. The Ultimate Guide To Identify Areas Of High Interest In Any Market

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers. You can find out more by reading the tutorial on The Magical 100% Fibonacci Projection.