IvanGlobalPrime

Company Representative

- Messages

- 36

Find my latest market thoughts

USD Suppressed As Data Keeps Disappointing

POSTED ON: 27 MAY, 2019

The story making the headlines in the currency market is the follow-through weakness in the US Dollar, exacerbated by yet another round of poor US economic data, this time the goods orders series was the culprit behind the sell-off last Friday.

The Daily Edge is authored by Ivan Delgado, Market Insights Commentator at Global Prime. The purpose of this content is to provide an assessment of the market conditions. The report takes an in-depth look of market dynamics, factoring in fundamentals, technicals, inter-market in order to determine daily biases and assist one’s decisions on a regular basis. Feel free to follow Ivan on Twitter & Youtube.

Quick Take

The story making the headlines in the currency market is the follow-through weakness in the US Dollar, exacerbated by yet another round of poor US economic data, this time the goods orders series was the culprit behind the sell-off last Friday. Movements in the Forex market are expected to come to a halt for most of the day with the two financial centers injecting the most currency vol closed due to public holidays this Monday. The rest of the currencies, with the exception of the Sterling, attracted tepid flows. Remember, most of the gains seen in majors is a function of the USD weakness we are seeing across the board vs fundamentally-backed bullish moves outside the USD.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

Source: Forexfactory

RORO (Risk On, Risk Off Conditions)

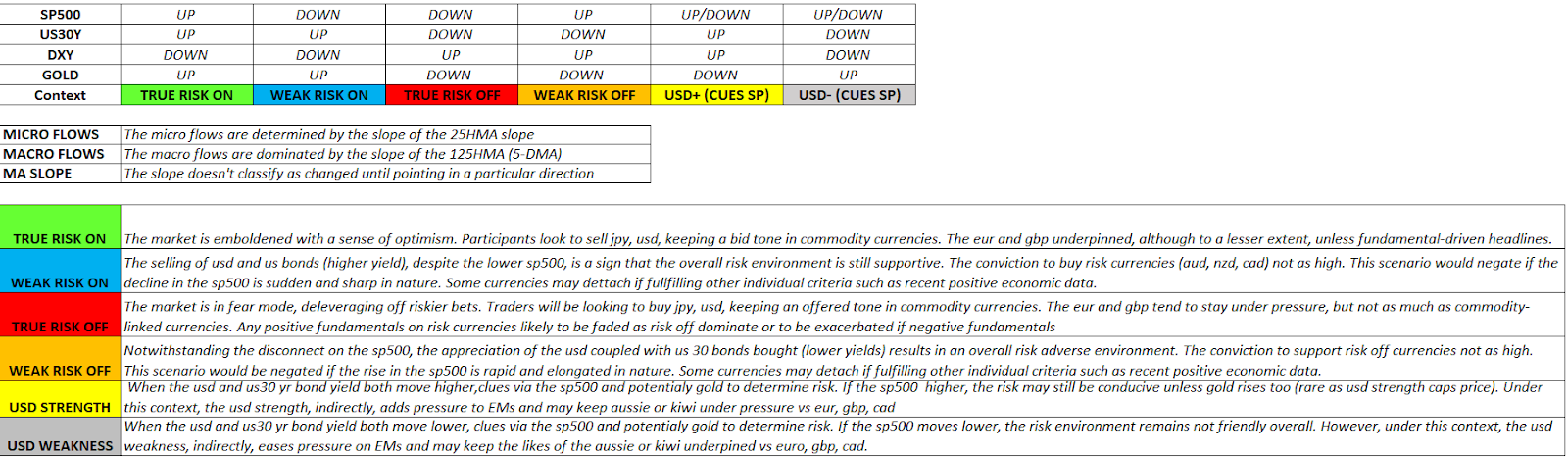

A short-lived spell of buy-side action hit the S&P 500 after Trump tried to talk up equities, which still look quite grim from an hourly structural view as well as judging by the macro trend (125HMA slope). The reversal of the micro trend based on the 25HMA slope is the one consolidation that buyers can lean on to face this week’s trading with a tad more optimism but far from bullish. When it comes to the other heavyweight to evaluate risk dynamics, the US 30y bond yield stays suppressed circa 2.75% as the market discounts a more dire outlook for global growth, with tentative evidence that it is starting to feed through sectors of the US economy after the soft data in manuf & goods orders. Remember, it’s Memorial Day in the US, so no cues will be obtained from stocks, bonds.

In the currency front, the consolidation near trend highs in the Japanese Yen, especially when cross-checked against a sharply bearish trend momentum in the USD, offers 2 takeaways. Firstly, we remain in a highly uncertain period where the deleveraging dynamics remain dominant based on the lofty pricing of the Yen vs G10 FX. Secondly, the major performance disparity between the JPY and the USD indicates that the market is assigning significantly higher chances of a slowdown in the US economy, as reflected by the slide in US yields and the DXY in tandem (USD weakness across the board). Don’t be misled by the retracement in the USD/CNH, as that’s a function of USD fragility vs RMB strength. If you assess the RMB vs G10 FX, flows still communicate no bets on an eventual US-China trade deal.

Overall, even if the desirability of Trump is to see an increase in equity valuations, his attempts are starting to be quite futile to revert the dominant risk-averse mood in the market. Unless there is some genuine progress for the market to latch on, looks like the risk-off dynamics are prevalent.

Latest Key Developments In FX (Technicals, Fundamentals, Intermarket)

EUR/USD: Volume Profile Stays Bullish

GBP/USD: Acceptance At Highs, Range Resolution Found

USD/JPY: Sellers Keep Making Further Headway

AUD/USD: First Upside Target Met, No USD Demand

Important Footnotes

USD Suppressed As Data Keeps Disappointing

POSTED ON: 27 MAY, 2019

The story making the headlines in the currency market is the follow-through weakness in the US Dollar, exacerbated by yet another round of poor US economic data, this time the goods orders series was the culprit behind the sell-off last Friday.

The Daily Edge is authored by Ivan Delgado, Market Insights Commentator at Global Prime. The purpose of this content is to provide an assessment of the market conditions. The report takes an in-depth look of market dynamics, factoring in fundamentals, technicals, inter-market in order to determine daily biases and assist one’s decisions on a regular basis. Feel free to follow Ivan on Twitter & Youtube.

Quick Take

The story making the headlines in the currency market is the follow-through weakness in the US Dollar, exacerbated by yet another round of poor US economic data, this time the goods orders series was the culprit behind the sell-off last Friday. Movements in the Forex market are expected to come to a halt for most of the day with the two financial centers injecting the most currency vol closed due to public holidays this Monday. The rest of the currencies, with the exception of the Sterling, attracted tepid flows. Remember, most of the gains seen in majors is a function of the USD weakness we are seeing across the board vs fundamentally-backed bullish moves outside the USD.

Narratives In Financial Markets

* The Information is gathered after scanning top publications including the FT, WSJ, Reuters, Bloomberg, ForexLive, Institutional Bank Research reports.

- US durable goods orders worsened the outlook for the US economy last Friday, adding to the lingering pessimism after Thursday’s US PMI data.

- US President Trump suggested a trade deal with China is still possible, even if at this stage, the statement is clearly aimed at boosting falling stocks rather than being realistic in nature. Especially when Trump said that even Huawei could be included as part of the deal. Go figure.

- Trump said that there is a “good possibility that the negotiations with Beijing could get "back on track” and that he is set to meet President Xi at the G20 meeting in Osaka.

- Meanwhile, in China, the Xinhua news agency says the US demands are an ‘invasion’ on its economic sovereignty, ramping up even further the trade rhetoric.

- The US commerce department is proposing a rule against countries that undervalue their currencies in order to increase trade competitiveness relative to the USD.

- UK’s Theresa May announced her resignation as Prime Minister effective on June 10th, pledging to stay in power until a successor takes the batton. All the options are on the table at this stage, from a 2nd Brexit referendum to a general election.

- The EU election has had a minor impact on the pricing of the Euro or the Sterling even if further fragmentation was confirmed. There was a strong voting for anti-establishment and eurosceptic groups parties such as Nigel Farage’s party or Le Pen’s far right.

- A very light day on the economic calendar, with public holidays both in the UK and the US.

Source: Forexfactory

RORO (Risk On, Risk Off Conditions)

A short-lived spell of buy-side action hit the S&P 500 after Trump tried to talk up equities, which still look quite grim from an hourly structural view as well as judging by the macro trend (125HMA slope). The reversal of the micro trend based on the 25HMA slope is the one consolidation that buyers can lean on to face this week’s trading with a tad more optimism but far from bullish. When it comes to the other heavyweight to evaluate risk dynamics, the US 30y bond yield stays suppressed circa 2.75% as the market discounts a more dire outlook for global growth, with tentative evidence that it is starting to feed through sectors of the US economy after the soft data in manuf & goods orders. Remember, it’s Memorial Day in the US, so no cues will be obtained from stocks, bonds.

In the currency front, the consolidation near trend highs in the Japanese Yen, especially when cross-checked against a sharply bearish trend momentum in the USD, offers 2 takeaways. Firstly, we remain in a highly uncertain period where the deleveraging dynamics remain dominant based on the lofty pricing of the Yen vs G10 FX. Secondly, the major performance disparity between the JPY and the USD indicates that the market is assigning significantly higher chances of a slowdown in the US economy, as reflected by the slide in US yields and the DXY in tandem (USD weakness across the board). Don’t be misled by the retracement in the USD/CNH, as that’s a function of USD fragility vs RMB strength. If you assess the RMB vs G10 FX, flows still communicate no bets on an eventual US-China trade deal.

Overall, even if the desirability of Trump is to see an increase in equity valuations, his attempts are starting to be quite futile to revert the dominant risk-averse mood in the market. Unless there is some genuine progress for the market to latch on, looks like the risk-off dynamics are prevalent.

Latest Key Developments In FX (Technicals, Fundamentals, Intermarket)

EUR/USD: Volume Profile Stays Bullish

GBP/USD: Acceptance At Highs, Range Resolution Found

USD/JPY: Sellers Keep Making Further Headway

AUD/USD: First Upside Target Met, No USD Demand

Important Footnotes

- Risk model: The fact that financial markets have become so intertwined and dynamic makes it essential to stay constantly in tune with market conditions and adapt to new environments. This prop model will assist you to gauge the context that you are trading so that you can significantly reduce the downside risks. To understand the principles applied in the assessment of this model, refer to the tutorial How to Unpack Risk Sentiment Profiles

- Cycles: Markets evolve in cycles followed by a period of distribution and/or accumulation. The weekly cycles are highlighted in red, blue refers to the daily, while the black lines represent the hourly cycles. To understand the principles applied in the assessment of cycles, refer to the tutorial How To Read Market Structures In Forex

- POC: It refers to the point of control. It represents the areas of most interest by trading volume and should act as walls of bids/offers that may result in price reversals. The volume profile analysis tracks trading activity over a specified time period at specified price levels. The study reveals the constant evolution of the market auction process. If you wish to find out more about the importance of the POC, refer to the tutorial How to Read Volume Profile Structures

- Tick Volume: Price updates activity provides great insights into the actual buy or sell-side commitment to be engaged into a specific directional movement. Studies validate that price updates (tick volume) are highly correlated to actual traded volume, with the correlation being very high, when looking at hourly data. If you wish to find out more about the importance tick volume, refer to the tutorial on Why Is Tick Volume Important To Monitor?

- Horizontal Support/Resistance: Unlike levels of dynamic support or resistance or more subjective measurements such as fibonacci retracements, pivot points, trendlines, or other forms of reactive areas, the horizontal lines of support and resistance are universal concepts used by the majority of market participants. It, therefore, makes the areas the most widely followed and relevant to monitor. The Ultimate Guide To Identify Areas Of High Interest In Any Market

- Trendlines: Besides the horizontal lines, trendlines are helpful as a visual representation of the trend. The trendlines are drawn respecting a series of rules that determine the validation of a new cycle being created. Therefore, these trendline drawn in the chart hinge to a certain interpretation of market structures.

- Correlations: Each forex pair has a series of highly correlated assets to assess valuations. This type of study is called inter-market analysis and it involves scoping out anomalies in the ever-evolving global interconnectivity between equities, bonds, currencies, and commodities. If you would like to understand more about this concept, refer to the tutorial How Divergence In Correlated Assets Can Help You Add An Edge.

- Fundamentals: It’s important to highlight that the daily market outlook provided in this report is subject to the impact of the fundamental news. Any unexpected news may cause the price to behave erratically in the short term.

- Projection Targets: The usefulness of the 100% projection resides in the symmetry and harmonic relationships of market cycles. By drawing a 100% projection, you can anticipate the area in the chart where some type of pause and potential reversals in price is likely to occur, due to 1. The side in control of the cycle takes profits 2. Counter-trend positions are added by contrarian players 3. These are price points where limit orders are set by market-makers. You can find out more by reading the tutorial on The Magical 100% Fibonacci Projection