Sive Morten

Special Consultant to the FPA

- Messages

- 18,659

Good morning,

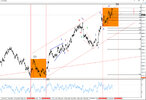

Gold keeps long term bullish trend but seems a bit overbought tactically. We consider downside pullback now, based on intraday H&S pattern and watch for 1955$ area as potential target within 1-2 weeks:

Gold keeps long term bullish trend but seems a bit overbought tactically. We consider downside pullback now, based on intraday H&S pattern and watch for 1955$ area as potential target within 1-2 weeks: