Sive Morten

Special Consultant to the FPA

- Messages

- 18,644

Fundamentals

Gold has got significant push this week, climbing above psychological level of $2000 and reaching our monthly ~2.1K target. Overall situation in the world remains difficult, a lot of political piking in US brings more fuel to the gold's rally as investors have lost horizons when finally situation could normalize, at least in US. A lot of new unrest appear in recent few weeks. Besides, situation around CV19 remains difficult. All this stuff keeps gold on positive marche.

News & comments surfing

Gold prices soared past the key $2,000 mark for the first time in history on Tuesday, as the ultra-low interest rate environment and hopes for more U.S. stimulus to safeguard the coronavirus-hit economy enhanced the safe-haven metal’s appeal.

“Safe-haven buying has propelled gold prices to breach $2,000 for the first time as the U.S. dollar tested lows last seen over two years ago, negative real rates fell to levels last seen in 2013 and expectations for further stimulus packages continue to build,” said Standard Chartered analyst Suki Cooper. “Given how quickly prices have rallied, the risk of a temporary pullback has risen,” Cooper said, adding the balance of risks still remain skewed to the upside in light of the macro backdrop remaining “exceptionally favourable.”

Prices can rally towards the $2,300 level by the year-end, according to Edward Moya, senior market analyst at broker OANDA. “The treasury market is strongly signalling that this lower interest rate environment is here to stay. In the last decade, treasuries always had the edge over gold but right now that’s not the case, we’re going to see investors’ primary focus be on gold.”

Weakness in the dollar and falling U.S. Treasury yields have encouraged investors to look for alternative store of value - boosting the appeal of gold.

“What we’re seeing at the moment with the dollar, bond yields and gold are macro trades of concern - not just about the coronavirus but also about the fiscal cliff in the U.S.,” said Seema Shah, chief strategist at Principal Global Investors in London. “There are real concerns that without a (U.S. stimulus) deal, we will be looking at a very tough fourth quarter for the U.S. economy and therefore the global economy.”

White House negotiators on Tuesday vowed to work “around the clock” with congressional Democrats to try to reach a deal on coronavirus relief by the end of this week, as the pandemic takes a heavy toll on American life. This backdrop has boosted expectations for more stimulus, with the president of the Federal Reserve Bank of San Francisco saying on Tuesday that the U.S. economy will need more support than initially thought. The five-year Treasury yield hit a record low on Tuesday and the benchmark 10-year Treasury yield fell to a five-month low at around 0.51%, holding near those levels on Wednesday.

“Significantly increased odds” of more monetary policy stimulus from the U.S. Federal Reserve is a key driver of equities although the rally has been reined in by stretched valuations, Mizuho analysts wrote in a note.

“The ongoing fall in U.S. real yields is helping to lift the price of gold and weakening the U.S. dollar,” said Lee Hardman, currency analyst at MUFG, adding that the bank had lowered its forecasts for the dollar on the assumption that the Federal Reserve will loosen policy further this year.

Investors fear economic stimulus unleashed in response to the pandemic will trigger inflation that will devalue other assets. Real returns on U.S. bonds have already fallen sharply, making non-yielding gold more attractive.

“We’re seeing an ongoing deterioration in the U.S. dollar, U.S. yield curve dropping further and an increase in inflation expectations,” said Bart Melek, head of commodity strategies at TD Securities. “This implies that for the foreseeable future, the opportunity cost of holding gold is going to get less and less.”

Inflation-adjusted U.S. 10-year bond yields fell to minus 1.06% from around 0.1% at the start of the year.

Gold has rallied so fast — leaping more than $200 in a little over two weeks — that a correction is due, said Robin Bhar, an independent analyst. Any rebound in Treasury yields and strengthening of the dollar would stall gold’s rally and push prices lower, he said.

“It’s difficult to hold anything but a constructive view (on gold),” said ING analyst Warren Patterson. “Whilst the pace of the rally may slow, there certainly does seem to further upside in the near term, and for the remainder of the year.”

Gold is likely to hover around $2,020-2,080 an ounce in the near term, with key focus on whether there is any progress on COVID-19 vaccines, said National Australia Bank economist John Sharma.

Stimulus pack is signed

“Once they agree on a stimulus it’ll be bearish for the dollar. The global economy is still very wobbly and as a result we’re going to get a lot more easy money, so all that is tailwind for gold,” said Edward Meir, analyst at ED&F Man Capital Markets.

President Donald Trump signed executive orders on Saturday partly restoring enhanced unemployment payments to the tens of millions of Americans who lost jobs in the coronavirus pandemic, as the United States marked a grim milestone of 5 million cases. Trump said the orders would provide an extra $400 per week in unemployment payments, less than the $600 per week passed earlier in the crisis. Some of the measures were likely to face legal challenges, as the U.S. Constitution gives Congress authority over federal spending.

Trump’s move to take relief measures out of the hands of Congress drew immediate criticism from some Democrats.

“Donald Trump is trying to distract from his failure to extend the $600 federal boost for 30 million unemployed workers by issuing illegal executive orders,” said Senator Ron Wyden, the top Democrat on the Senate Finance Committee. “This scheme is a classic Donald Trump con: playacting at leadership while robbing people of the support they desperately need.”

Democratic presidential candidate Joe Biden called the orders a “series of half-baked measures” and accused Trump of putting Social Security “at grave risk” by delaying the collection of payroll taxes that pay for the program.

$2000 is passed, what's next?

The speed at which gold has broken above $2,000 an ounce has left some in the market fearing a correction, but many analysts predict more gains as the coronavirus crisis spurs investors to buy into bullion’s relative safety. It has risen $500 this year, and $200 in the last two weeks alone.

Taking out the totemic $2,000 barrier means investors must change their reference points, said Frederic Panizzutti at Swiss precious metals dealers MKS. “The adjustment will be higher. We are definitely in a bull run,” he said.

A hoarding spree has fuelled the rally, with investors adding 922 tonnes of gold worth $60 billion at current prices to their stockpiles in exchange-traded funds this year, according to the World Gold Council. Investors see gold as an asset that should hold its value as the health crisis and money printing by central banks erode the value of others.

Real returns on U.S. bonds - in normal times a much more popular perceived safe asset than gold - have tumbled to minus 1.07% from 0.15% at the start of the year, making bullion look like a better bet.

The dollar, another safe-haven rival to gold and the currency in which it is priced, has slid to 2-year lows as the novel coronavirus infects more Americans.

With central banks keeping interest rates low and pumping money into markets, even an economic rebound — which would typically see money move from bullion to more productive assets — would help gold, said Commerzbank analyst Carsten Fritsch. That is because rising inflation expectations would push the real returns on bonds even lower.

“Ultimately with gold you can’t print any more of it, you can’t artificially create it. It will hold its value,” said Michael Hewson at CMC Markets.

Bank of America says prices could hit $3,000 within 18 months.

Not everyone is convinced. Demand for gold in Asia has collapsed due to lockdowns and high prices, and the rally looks overextended to many, at the very least in the short term.

“This is a market to short, not to chase higher,” said Gianclaudio Torlizzi at traders T-Commodity, adding that prices could - probably after a correction - rise to $2,300 but were unlikely to go further.

“The insurance gold provides to an investor’s portfolio has become very expensive,” said Julius Baer analyst Carsten Menke.

CFTC Data

CFTC data shows that position has been increased slightly but at significantly less level compares to the price change. Actually net long position stands lower than few weeks before. This makes risk of retracement higher.

Source: cftc.gov

Charting by Investing.com

The Bottom line

So, it seems that currently it is still nothing to worry about, at least in long-term perspective. We agree that while interest rates are low and Central banks pumping in huge amount of cash - situation should stay approximately the same. In fact this is the same that we've talked about for months, since massive liquidity "help" was announced in different countries.

Stock investors now stand at crossroad. Shares were rising too fast and too far (they have dig it too deep and too greedy (The Lord of the Rings)) that now, when they look at fair valuation of the companies - they do not know what to do. It is unreasonable to keep shares from valuation point of view, but reasonable from fiscal point of view. I do not exclude situation when we could get cross market money flow at some degree from stocks into gold within few months by those who decides to contract positions in stocks.

Tough political situation in US brings more fuel to the gold. As we stand just in 90 days till the voting day - it is absolutely doesn't matter who will win. As we mentioned this before, D. Trump victory put them in a real hell as Demoncrats will unleash holy hell on him, accusing in all possible sins. While J. Biden victory puts US on a long ways of reforms in different "Democratic-like" reality.

Still, at shorter-term perspective market shows signs of exhausting. It is too fast action an as CFTC position as price action hints on possible pullback. Besides, The comment that we've mentioned above (“This is a market to short, not to chase higher,” said Gianclaudio Torlizzi at traders T-Commodity, adding that prices could - probably after a correction - rise to $2,300 but were unlikely to go further.) on action just to 2300 area makes me a bit worry. I'm not an expert in EW, and if you do, I would be grateful, if you provide your analysis. The point is - it seems that Gold stands in 5th upside wave. This wave's top should be around the top of 3rd wave, with some truncation may be. From that standpoint, the upside potential of the gold is coming to an end in short-term perspective. Thus, I would like to be wrong...

Technicals

Monthly

Just to show you my suggestion of Elliot wave sequence - here is what I'm concerning about. If I'm correct then major rally has not significant perspective in short term and solid retracement could follow. Next rally will start significantly later and the whole action from 1 to 5 will be the new 1st wave, while now we could enter in 2nd wave of big scale. Thus, although long-term perspective of gold looks unbelievable, in short-term we could meet with solid pullback. Thus, I would be thankful for any professional view on this EW sequence, as I'm not an expert with it...

Turning back to our "normal" scale, it seems that we should not look too far from here. Yes, OP target is around 2.6K, but currently it makes no sense to discuss it. Currently gold already stands at "Big achievement", reaching the first all time COP at 2.1K area and historical Overbought level. Hardly this level will be ignored, especially when we already see some technical hints on exhausting of upside pace.

So, here on monthly chart everything looks positive, upside action has good momentum. If we will be able to deflate 5th wave hazard - I'll be absolutely happy...

Weekly

We do not see any patterns, based on recent thrust, so we could increase the scale here as well and get to extensions of big butterfly pattern. First one stands very close - 2160 area, while 1.618 is around 2460$. In general, butterfly is reversal pattern. Yes it could satisfy with just minimal 3/8 retracement target. But what if it will not? I'm again speaking about 5th wave scenario. Because butterfly could work as a pure reversal pattern and often does.

Currently combination of monthly/weekly charts clearly point that pullback should be from 2100-2160 area and at least for 30% - somewhere to 1750-1800 level, which is the weekly Oversold by the way.

Daily

Here I do not see any reasons to look at far stand support levels as all of them below daily Oversold area. Here we have just first "black" session on Friday and no clear patterns. As previously all our hopes are based on the thrust and ability to get DiNapoli direction pattern - either B&B or DRPO. But, currently we do have nothing yet.

We could get something, more or less valuable, if price drops at least to first 3/8 Fib support level around 1970.

Intraday

On intraday chart unfortunately we have nothing really interesting. Only minor setup as gold stands around support area, some pullback is possible, especially because of signing supportive measures by D. Trump in weekend. Pullback could be even more significant, as we've mentioned above - gold still could reach 2160 level, we can't exclude some chaotic action around the top as overbought pressure on the markets is a bit specific and this is not strict price level.

At the same time, guys, as my experience tells, in such moments the most valuable personal quality is patient. Just to make effort and wait a bit more, especially when you were waiting for retracement for so long time. Wait a bit more and get clear signs before the pull the trigger. By the way, market makers know that and their bread is to punish with different spikes those who try to enter too early.

Gold has got significant push this week, climbing above psychological level of $2000 and reaching our monthly ~2.1K target. Overall situation in the world remains difficult, a lot of political piking in US brings more fuel to the gold's rally as investors have lost horizons when finally situation could normalize, at least in US. A lot of new unrest appear in recent few weeks. Besides, situation around CV19 remains difficult. All this stuff keeps gold on positive marche.

News & comments surfing

Gold prices soared past the key $2,000 mark for the first time in history on Tuesday, as the ultra-low interest rate environment and hopes for more U.S. stimulus to safeguard the coronavirus-hit economy enhanced the safe-haven metal’s appeal.

“Safe-haven buying has propelled gold prices to breach $2,000 for the first time as the U.S. dollar tested lows last seen over two years ago, negative real rates fell to levels last seen in 2013 and expectations for further stimulus packages continue to build,” said Standard Chartered analyst Suki Cooper. “Given how quickly prices have rallied, the risk of a temporary pullback has risen,” Cooper said, adding the balance of risks still remain skewed to the upside in light of the macro backdrop remaining “exceptionally favourable.”

Prices can rally towards the $2,300 level by the year-end, according to Edward Moya, senior market analyst at broker OANDA. “The treasury market is strongly signalling that this lower interest rate environment is here to stay. In the last decade, treasuries always had the edge over gold but right now that’s not the case, we’re going to see investors’ primary focus be on gold.”

Weakness in the dollar and falling U.S. Treasury yields have encouraged investors to look for alternative store of value - boosting the appeal of gold.

“What we’re seeing at the moment with the dollar, bond yields and gold are macro trades of concern - not just about the coronavirus but also about the fiscal cliff in the U.S.,” said Seema Shah, chief strategist at Principal Global Investors in London. “There are real concerns that without a (U.S. stimulus) deal, we will be looking at a very tough fourth quarter for the U.S. economy and therefore the global economy.”

White House negotiators on Tuesday vowed to work “around the clock” with congressional Democrats to try to reach a deal on coronavirus relief by the end of this week, as the pandemic takes a heavy toll on American life. This backdrop has boosted expectations for more stimulus, with the president of the Federal Reserve Bank of San Francisco saying on Tuesday that the U.S. economy will need more support than initially thought. The five-year Treasury yield hit a record low on Tuesday and the benchmark 10-year Treasury yield fell to a five-month low at around 0.51%, holding near those levels on Wednesday.

“Significantly increased odds” of more monetary policy stimulus from the U.S. Federal Reserve is a key driver of equities although the rally has been reined in by stretched valuations, Mizuho analysts wrote in a note.

“The ongoing fall in U.S. real yields is helping to lift the price of gold and weakening the U.S. dollar,” said Lee Hardman, currency analyst at MUFG, adding that the bank had lowered its forecasts for the dollar on the assumption that the Federal Reserve will loosen policy further this year.

Investors fear economic stimulus unleashed in response to the pandemic will trigger inflation that will devalue other assets. Real returns on U.S. bonds have already fallen sharply, making non-yielding gold more attractive.

“We’re seeing an ongoing deterioration in the U.S. dollar, U.S. yield curve dropping further and an increase in inflation expectations,” said Bart Melek, head of commodity strategies at TD Securities. “This implies that for the foreseeable future, the opportunity cost of holding gold is going to get less and less.”

Inflation-adjusted U.S. 10-year bond yields fell to minus 1.06% from around 0.1% at the start of the year.

Gold has rallied so fast — leaping more than $200 in a little over two weeks — that a correction is due, said Robin Bhar, an independent analyst. Any rebound in Treasury yields and strengthening of the dollar would stall gold’s rally and push prices lower, he said.

“It’s difficult to hold anything but a constructive view (on gold),” said ING analyst Warren Patterson. “Whilst the pace of the rally may slow, there certainly does seem to further upside in the near term, and for the remainder of the year.”

Gold is likely to hover around $2,020-2,080 an ounce in the near term, with key focus on whether there is any progress on COVID-19 vaccines, said National Australia Bank economist John Sharma.

Stimulus pack is signed

“Once they agree on a stimulus it’ll be bearish for the dollar. The global economy is still very wobbly and as a result we’re going to get a lot more easy money, so all that is tailwind for gold,” said Edward Meir, analyst at ED&F Man Capital Markets.

President Donald Trump signed executive orders on Saturday partly restoring enhanced unemployment payments to the tens of millions of Americans who lost jobs in the coronavirus pandemic, as the United States marked a grim milestone of 5 million cases. Trump said the orders would provide an extra $400 per week in unemployment payments, less than the $600 per week passed earlier in the crisis. Some of the measures were likely to face legal challenges, as the U.S. Constitution gives Congress authority over federal spending.

Trump’s move to take relief measures out of the hands of Congress drew immediate criticism from some Democrats.

“Donald Trump is trying to distract from his failure to extend the $600 federal boost for 30 million unemployed workers by issuing illegal executive orders,” said Senator Ron Wyden, the top Democrat on the Senate Finance Committee. “This scheme is a classic Donald Trump con: playacting at leadership while robbing people of the support they desperately need.”

Democratic presidential candidate Joe Biden called the orders a “series of half-baked measures” and accused Trump of putting Social Security “at grave risk” by delaying the collection of payroll taxes that pay for the program.

$2000 is passed, what's next?

The speed at which gold has broken above $2,000 an ounce has left some in the market fearing a correction, but many analysts predict more gains as the coronavirus crisis spurs investors to buy into bullion’s relative safety. It has risen $500 this year, and $200 in the last two weeks alone.

Taking out the totemic $2,000 barrier means investors must change their reference points, said Frederic Panizzutti at Swiss precious metals dealers MKS. “The adjustment will be higher. We are definitely in a bull run,” he said.

A hoarding spree has fuelled the rally, with investors adding 922 tonnes of gold worth $60 billion at current prices to their stockpiles in exchange-traded funds this year, according to the World Gold Council. Investors see gold as an asset that should hold its value as the health crisis and money printing by central banks erode the value of others.

Real returns on U.S. bonds - in normal times a much more popular perceived safe asset than gold - have tumbled to minus 1.07% from 0.15% at the start of the year, making bullion look like a better bet.

The dollar, another safe-haven rival to gold and the currency in which it is priced, has slid to 2-year lows as the novel coronavirus infects more Americans.

With central banks keeping interest rates low and pumping money into markets, even an economic rebound — which would typically see money move from bullion to more productive assets — would help gold, said Commerzbank analyst Carsten Fritsch. That is because rising inflation expectations would push the real returns on bonds even lower.

“Ultimately with gold you can’t print any more of it, you can’t artificially create it. It will hold its value,” said Michael Hewson at CMC Markets.

Bank of America says prices could hit $3,000 within 18 months.

Not everyone is convinced. Demand for gold in Asia has collapsed due to lockdowns and high prices, and the rally looks overextended to many, at the very least in the short term.

“This is a market to short, not to chase higher,” said Gianclaudio Torlizzi at traders T-Commodity, adding that prices could - probably after a correction - rise to $2,300 but were unlikely to go further.

“The insurance gold provides to an investor’s portfolio has become very expensive,” said Julius Baer analyst Carsten Menke.

CFTC Data

CFTC data shows that position has been increased slightly but at significantly less level compares to the price change. Actually net long position stands lower than few weeks before. This makes risk of retracement higher.

Source: cftc.gov

Charting by Investing.com

The Bottom line

So, it seems that currently it is still nothing to worry about, at least in long-term perspective. We agree that while interest rates are low and Central banks pumping in huge amount of cash - situation should stay approximately the same. In fact this is the same that we've talked about for months, since massive liquidity "help" was announced in different countries.

Stock investors now stand at crossroad. Shares were rising too fast and too far (they have dig it too deep and too greedy (The Lord of the Rings)) that now, when they look at fair valuation of the companies - they do not know what to do. It is unreasonable to keep shares from valuation point of view, but reasonable from fiscal point of view. I do not exclude situation when we could get cross market money flow at some degree from stocks into gold within few months by those who decides to contract positions in stocks.

Tough political situation in US brings more fuel to the gold. As we stand just in 90 days till the voting day - it is absolutely doesn't matter who will win. As we mentioned this before, D. Trump victory put them in a real hell as Demoncrats will unleash holy hell on him, accusing in all possible sins. While J. Biden victory puts US on a long ways of reforms in different "Democratic-like" reality.

Still, at shorter-term perspective market shows signs of exhausting. It is too fast action an as CFTC position as price action hints on possible pullback. Besides, The comment that we've mentioned above (“This is a market to short, not to chase higher,” said Gianclaudio Torlizzi at traders T-Commodity, adding that prices could - probably after a correction - rise to $2,300 but were unlikely to go further.) on action just to 2300 area makes me a bit worry. I'm not an expert in EW, and if you do, I would be grateful, if you provide your analysis. The point is - it seems that Gold stands in 5th upside wave. This wave's top should be around the top of 3rd wave, with some truncation may be. From that standpoint, the upside potential of the gold is coming to an end in short-term perspective. Thus, I would like to be wrong...

Technicals

Monthly

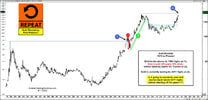

Just to show you my suggestion of Elliot wave sequence - here is what I'm concerning about. If I'm correct then major rally has not significant perspective in short term and solid retracement could follow. Next rally will start significantly later and the whole action from 1 to 5 will be the new 1st wave, while now we could enter in 2nd wave of big scale. Thus, although long-term perspective of gold looks unbelievable, in short-term we could meet with solid pullback. Thus, I would be thankful for any professional view on this EW sequence, as I'm not an expert with it...

Turning back to our "normal" scale, it seems that we should not look too far from here. Yes, OP target is around 2.6K, but currently it makes no sense to discuss it. Currently gold already stands at "Big achievement", reaching the first all time COP at 2.1K area and historical Overbought level. Hardly this level will be ignored, especially when we already see some technical hints on exhausting of upside pace.

So, here on monthly chart everything looks positive, upside action has good momentum. If we will be able to deflate 5th wave hazard - I'll be absolutely happy...

Weekly

We do not see any patterns, based on recent thrust, so we could increase the scale here as well and get to extensions of big butterfly pattern. First one stands very close - 2160 area, while 1.618 is around 2460$. In general, butterfly is reversal pattern. Yes it could satisfy with just minimal 3/8 retracement target. But what if it will not? I'm again speaking about 5th wave scenario. Because butterfly could work as a pure reversal pattern and often does.

Currently combination of monthly/weekly charts clearly point that pullback should be from 2100-2160 area and at least for 30% - somewhere to 1750-1800 level, which is the weekly Oversold by the way.

Daily

Here I do not see any reasons to look at far stand support levels as all of them below daily Oversold area. Here we have just first "black" session on Friday and no clear patterns. As previously all our hopes are based on the thrust and ability to get DiNapoli direction pattern - either B&B or DRPO. But, currently we do have nothing yet.

We could get something, more or less valuable, if price drops at least to first 3/8 Fib support level around 1970.

Intraday

On intraday chart unfortunately we have nothing really interesting. Only minor setup as gold stands around support area, some pullback is possible, especially because of signing supportive measures by D. Trump in weekend. Pullback could be even more significant, as we've mentioned above - gold still could reach 2160 level, we can't exclude some chaotic action around the top as overbought pressure on the markets is a bit specific and this is not strict price level.

At the same time, guys, as my experience tells, in such moments the most valuable personal quality is patient. Just to make effort and wait a bit more, especially when you were waiting for retracement for so long time. Wait a bit more and get clear signs before the pull the trigger. By the way, market makers know that and their bread is to punish with different spikes those who try to enter too early.