Sive Morten

Special Consultant to the FPA

- Messages

- 18,654

Fundamentals

This time, guys, we try to not bore you with sophisticated charts, statistics and indicators. Global situation is changing fast and we try to take a look at gold place in modern history. But also with some hindsight on historical events, trying to understand what vector the US could try to follow. Obviously, all these stuff around Ukraine, and other multiple conflicts around the Globe, including Taiwan, political and economical confrontation with China and other countries - is pure greed. Some countries just what to keep sitting on the back of the world, keep consuming everything for free as they did for decades, just printing "obligations" but somehow these countries raise against this surprisingly and do not want to be exploited any more. This situation start shaking the fragile balance in economy, because developed world obligations has reached so large scale that even minor shake could break the whole card house. In fact, it has no difference with middle centuries colonization where so called developed countries evidently were robing Latin America, Middle East, Africa and China. In modern world they have tried to present this in some civilized view, forming it like "obligations" that nobody of course intend to pay out. And now this system is gradually coming to the boiling point.

Obviously it is all about the US national Debt. If it somehow miracly disappeared - they would be absolutely happy and keep existent system for another century. It means that all the US efforts right now in all spheres is just an attempt to withdraw this debt and hold existent Global financial system. But now the servicing of the debt is a direct hazard to the US economy. With the new rate around 5.5% rising interest expenses seriously contract ability to consume, as a lot of budget income is utilized to pay interest. So they have to find the way to withdraw the debt by any acceptable way.

US debt default

There are no many ways to to withdraw the debt. It could be destruction of the major debt holders (which seems like preferable scenario), say, by big war in Europe, destruction of financial system and major holders of US debt, involving China in some way and imposing sanctions on it (freeze assets etc., sound familiar, right?). This could help to withdraw big bulk of debt. Second way is worse - destruction of the US in some way. For example, if the US will fall apart, with appearing of independent states, so that global debt appear to belong to nobody and should be withdrawn. This is like when USSR has fallen, this was a free Russia decision to accept USSR debt, but it could be easily withdrawn as USSR doesn't exist anymore. And third way is... right - default. But somehow this wold scares people. In reality it is not as impossible as seems at first glance and is not as horrible. With all negative consequences, it is much better than US split in parts.

First of all - although it is few people who know this but the US was in default four times. Here we bring historical data just briefly. If you're interested - you could find more detailed information. So -

1838 – the first US default

Rather, it was the default of the popular municipal bonds of eight southern US states (Arkansas, Indiana, Illinois, Louisiana, Maryland, Michigan, Mississippi and Pennsylvania), as well as the state of Florida, which did not yet have rights at that time. The justification for the default was "dislike of foreigners and fear of foreign influence." The British actively bought these bonds, despite the fact that only a couple of decades ago they were at war with the United States (1812-14). Therefore, for Americans there were obvious sociological and psychological "reasons to stiff" their former colonizers. The economic reasons for the default are active borrowings of the southern states, the repayment and payment of interest of which were refinanced by subsequent borrowings.

1893-95 – the second default of the USA

Although it did not come to the actual default, the US Treasury managed to avoid it only by paying financiers a huge amount. At the end of the 19th century, "the United States was still a debtor country that owed foreigners more than it earned from them." In August 1894, "the federal budget deficit (the first deficit recorded after the Civil War) reached $ 60 million." The situation was saved only by a banking syndicate led by Pierpont Morgan and Auguste Belmont (a representative of the Rothschild banking house in the United States), who placed in England for a very decent reward U.S. Treasury bonds in the amount of $ 65 million.USD. "As a result of this operation, the Treasury's reserves increased and it was saved from the shameful bankruptcy and default of the United States." The banking syndicate earned about $6 million or more than 9% of the placement amount on this transaction. In the future, the US Government made simpler and cheaper decisions, not defaulting on government obligations, but devaluing the US dollar.

1933 – the third default of the United States

"When the inauguration of President Franklin D. Roosevelt was approaching in 1933, the financial system of the United States was in serious danger. The fear that Roosevelt would devalue money forced speculators to exchange dollars for gold, which caused the Treasury to lose gold reserves at a tremendous rate." On March 5, the day of the inauguration, Roosevelt issued a decree in which he stopped exchanging dollars for gold and ordered US citizens to hand over their gold bars and coins.

At the same time, the gold content of the US dollar was reduced: the price of gold pegged to the dollar was raised from $ 20.67 per troy ounce to $ 35, i.e. a simultaneous devaluation of the dollar was made by more than 69%.

In 1935 The US Supreme Court, which by a majority of votes "upheld the gold law. He concluded that the government's rejection of the gold equivalent of its own bonds was generally illegal, but stressed that nothing could be done about it. The court stated that the US Congress had the right to change the bond contracts." In fact, it was announced that, despite the violation of the law and the US Constitution, the President, the Government and Congress had the right to change the terms of their obligations, citing the poor state of the country's economy and the threat of mass bank failures, and after it, enterprises. After four years of the Great Depression, public opinion did not resist this offense of top US officials, tacitly sanctioning the redistribution of wealth.

1971 – the fourth US default

On Monday, August 15, 1971, "President Nixon announced that from now on, the United States will stop converting dollars in circulation abroad into gold, thereby making a unilateral revision of the international monetary system that has existed for 25 years. Sounds awful, but in reality the US have got great advantages:

The result of the devaluation – by the end of the 70s of the XX century, the dollar lost half its value against the German mark and a third against the Japanese yen. Gold has risen in price 9 times since 1971 (from $35 per ounce to 325) with a 4.4-fold increase in prices. Thus, the net devaluation of the gold content of the dollar from 1971 to the present (summer 2002) amounted to 111%, i.e. for $ 100 in 1971, you can buy gold twice as much as in dollars in 2002. By the way, the broad money supply of M3 increased more than 10 times from August 1971 to summer 2002. And if gold at that time was undervalued by about two times, then now, in relation to the mass of dollars in circulation, it is undervalued – by about the same two times.

This measure, combined with the restriction of wage and price growth, tax cuts and the federal budget, allowed:

— to reduce unemployment from 6.1% in August 1971, the highest level in the previous 10 years, to 4.6% in October 1973;

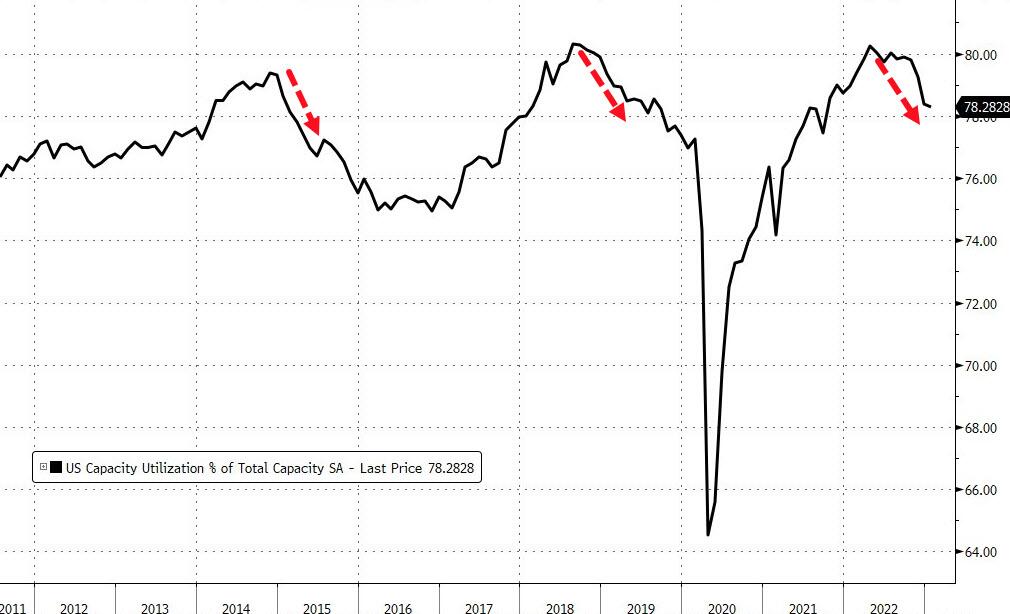

— to improve the situation in industry — capacity utilization rose above the key level of 80, supporting growth of industrial production;

— over the next year and a half, US GDP growth averaged 7%.

So we can say that the Americans have fulfilled their task – by reducing the burden on the dollar, played into the hands of exports, supporting industry. At the same time, financial markets were shaken – interest rates jumped to 10% in 1973, simultaneously bringing down the balance of payments to a deficit of 0.43% of GDP (due to capital flight from the United States). Note that subsequently the devaluation of the dollar led to the oil shock of 1973. But that was later, and in the short term, the United States definitely won. And again at the expense of foreign investors, together with holders of gold reserves.

So, despite that "default" sounds bad and scaring - it could bring big benefits to economy, especially if it withdraws so huge burden like $31 Trln off the balance. Despite the default - industrial powers remain untouched with solid foreign demand, overseas plants are still belong to US giants and keep working. Effect of default might be similar to 1971, boosting US export due to cheap value of the dollar. US is mostly self-sufficient country in terms of energy, basic metals, food and other critical sources. Besides it has allies such as Australia and Canada who will provide everything that they need.

Let's take a look at how "Operation Default" could be realized in modern world. First of all - nobody will use word "default". It will be something like "reset" or "restructuring". States almost always in such a difficult situation choose default and / or restructure. There are two main reasons. Firstly, this is a long-standing beautiful custom - almost all of the empires of the new time were in default, and some of them not just once . Perhaps only Austria-Hungary and the Russian Empire escaped this fate, but only because they collapsed in 1917-1918. The United States has been in default 4 times, as we've said. By the way - recent freeze of the dollar gold reserves of Iran, Russia and Venezuela is also a default. Inability to fulfill selective obligations, and who cares about reasons...

Second, when a government has a choice between defaulting or continuing to service its debt, very often the decision is made by the group or narrowly understood political reasons. It is not public or population decision. Sometimes it seems that it is easier to find a scapegoat, dump all the negativity, and keep running in the same way. All the talk about decade plans and strategic projects is certainly good, but a specific politician in a high position rarely has a planning horizon of 5-10 years longer. It is necessary tosteal earn money and, as a result, do not be jailed.

Once thesacral victim scapegoat found, he/she is appointed on Finance Minister post (or some other) to declare the default. And, what is typical, already in 2-3 years it is possible, to start building financial pyramids again. Therefore, returning to the current situation with the US, the temptation of a "small controlled default" is huge, although in the case of the US it is not very rational. There might be another solution here:

In this case, for some time, the problem of the growth of budget interest expenses is removed. And the problem is quite real now - if everything will keep going as it goes now - the United States will allocate the same share in budget spending on debt service by 2032 as Ukraine does today - about 20%. And if you suddenly pay 0.1% instead of 5-6% on the main part of the debt, then this completely changes the situation and allows you to continue the previous policy as if nothing had happened further. At least you can try If somebody will disagree, you could frightened them using common US practice. And I have big doubts that US Treasury, the Fed, J. Yellen together with J. Powell do not think about this... Scenario looks too temptative to ignore it. Knowing the power of the US propaganda machine, it will be easy to do and even accuse some third country, in a same way as it was done about US inflation, energy prices and other stuff -"Putin did it etc.".

If somebody will disagree, you could frightened them using common US practice. And I have big doubts that US Treasury, the Fed, J. Yellen together with J. Powell do not think about this... Scenario looks too temptative to ignore it. Knowing the power of the US propaganda machine, it will be easy to do and even accuse some third country, in a same way as it was done about US inflation, energy prices and other stuff -"Putin did it etc.".

Meantime in the US economy

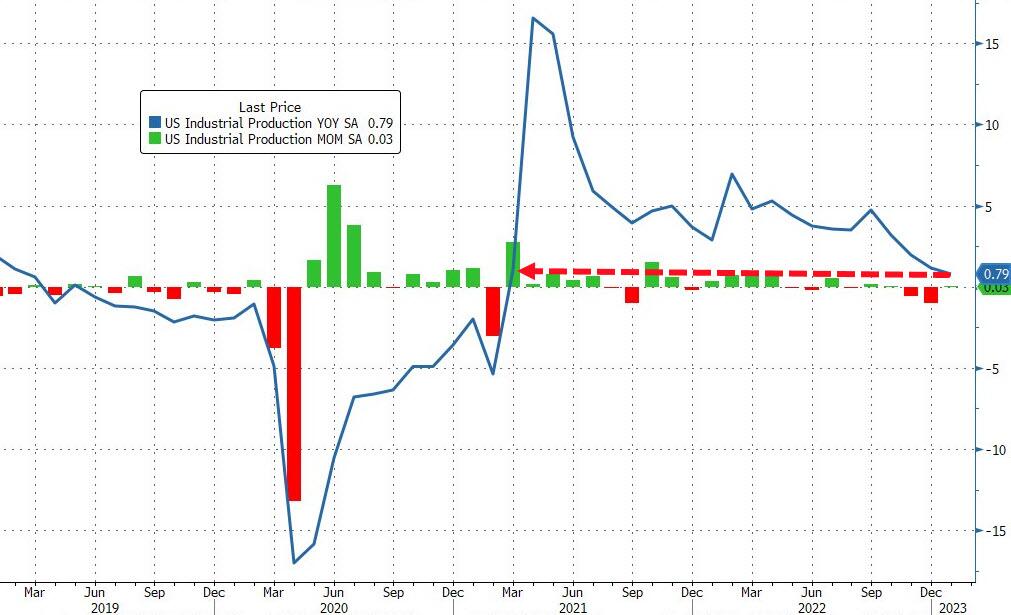

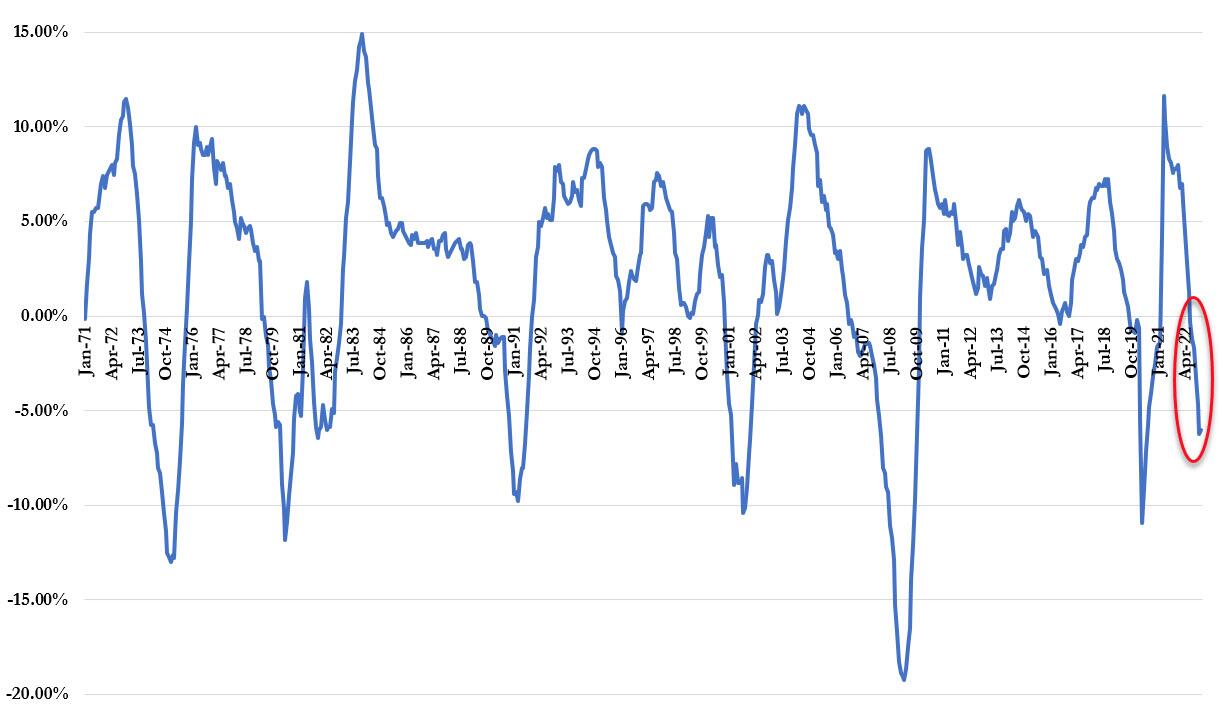

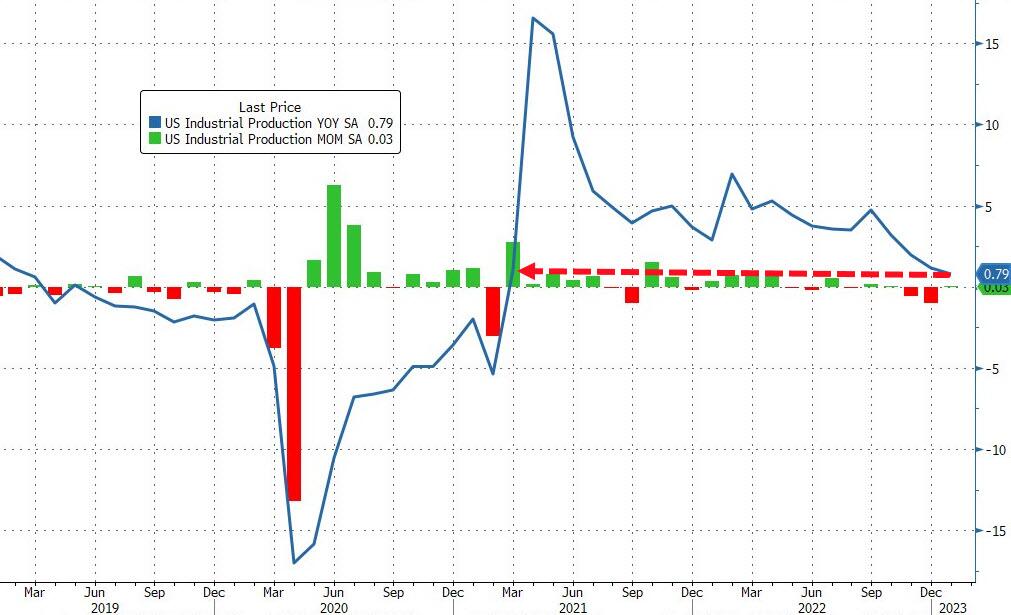

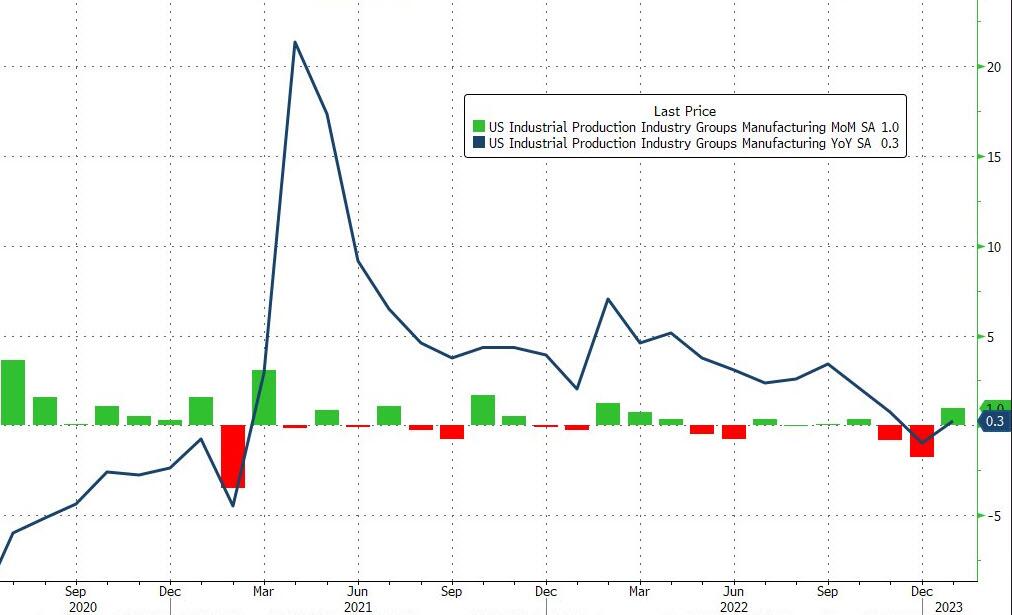

There are two major moments right now. First is, rising stock market as never before. In our FX report we've said that it is curious to see rising stock market with negative personal spending and no liquidity injections. We come to conclusion that money are distributed out of industrial production and manufacturing sector due to drop in consumer demand, so CAPEX are counterproductive now and send into financial markets. Indeed, Industrial production in the US stands in pitty condition - up just 0.79% YoY - the weakest since Feb 2021...

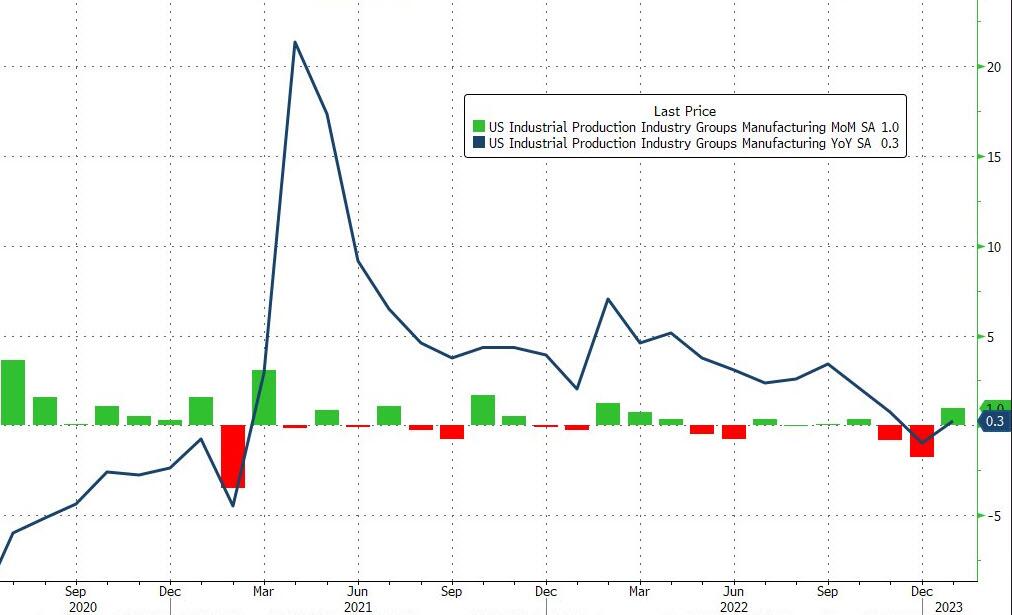

Manufacturing as well - output actually rose 1.0% MoM, better than the +0.8% expected, and its best print since Feb 2022. That dragged the YoY move back into the green...barely.

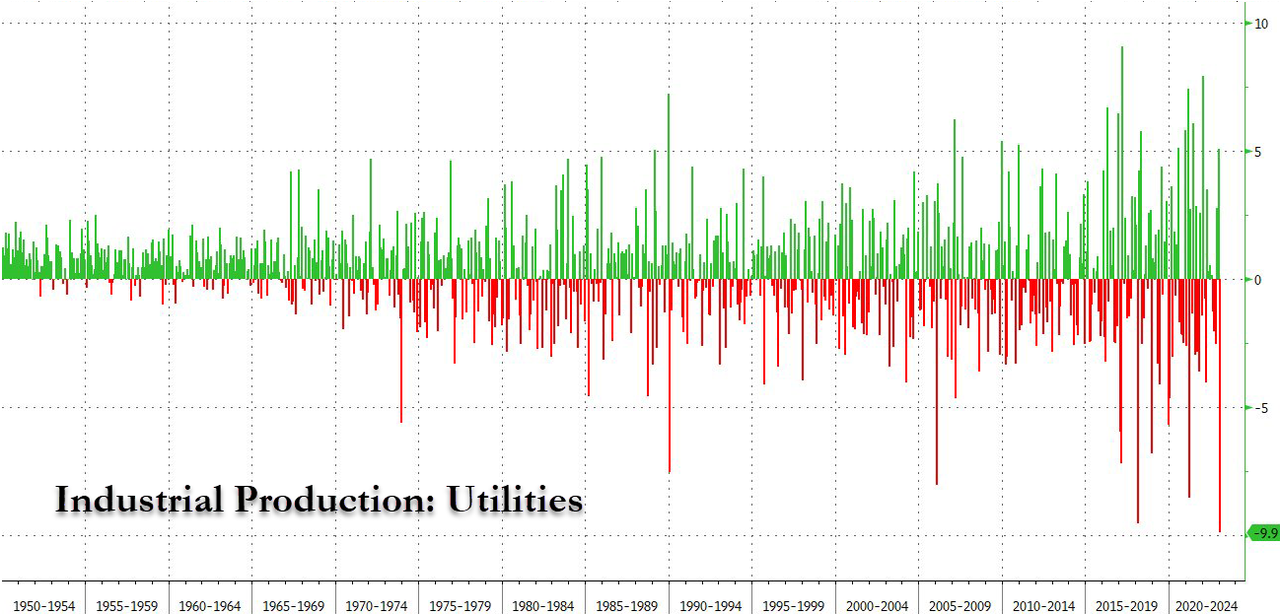

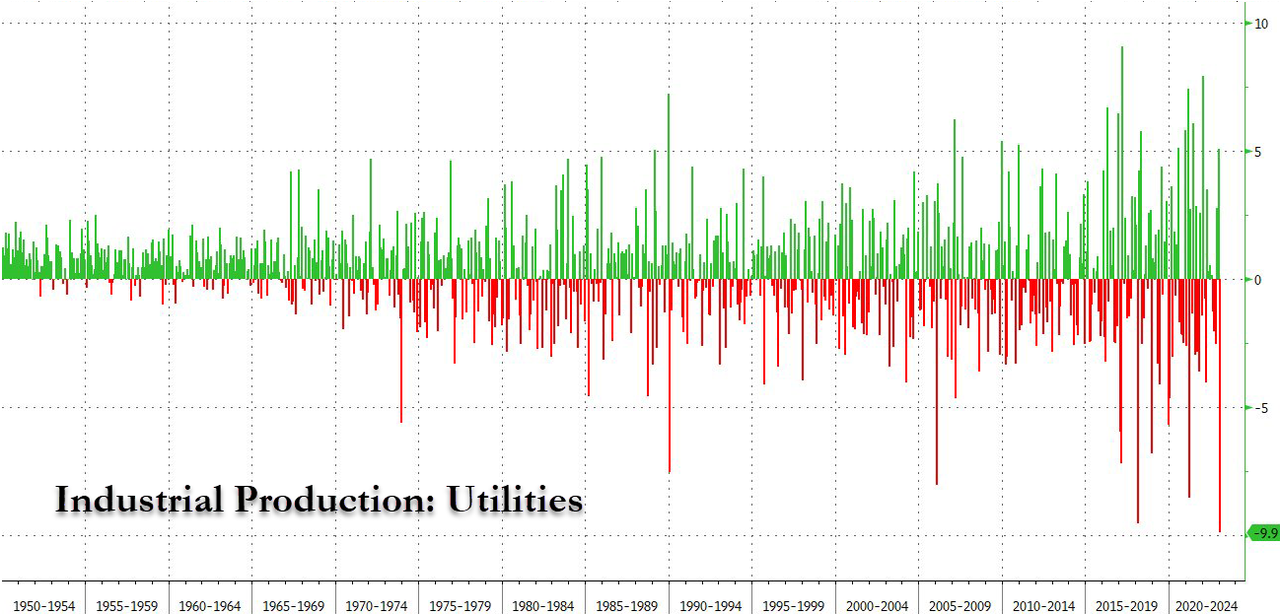

The biggest headline from the report is the record 9.9% collapse in Utilities...

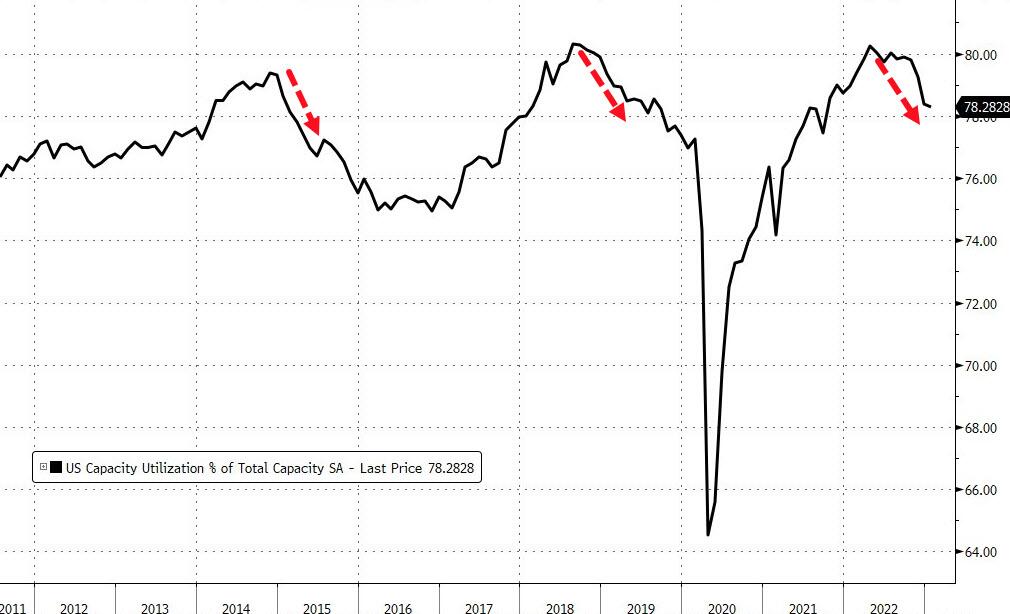

Capacity Utilization slid to 78.3% - the lowest since Oct 2021. So it is difficult to call economy "Strong as hell"...

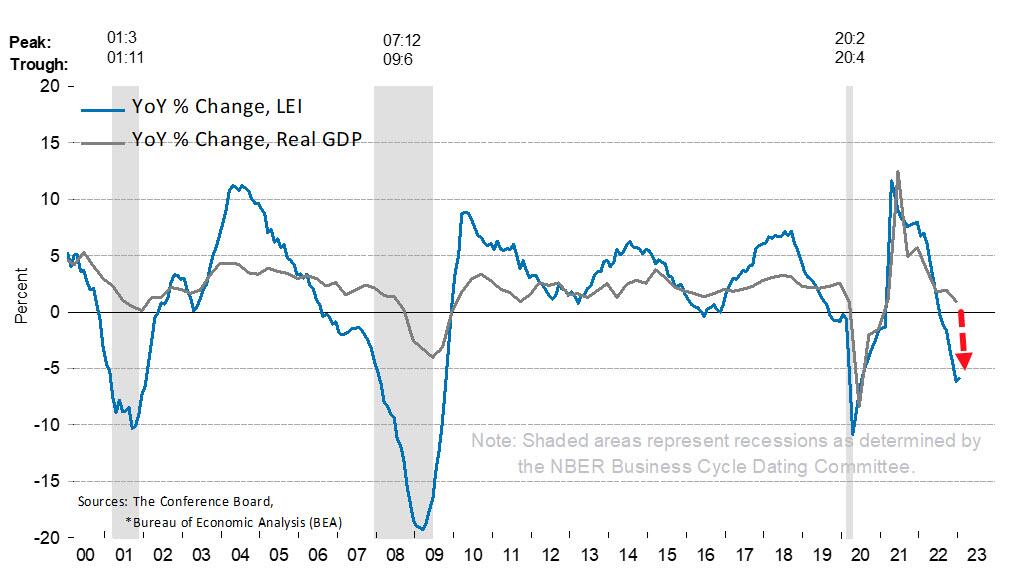

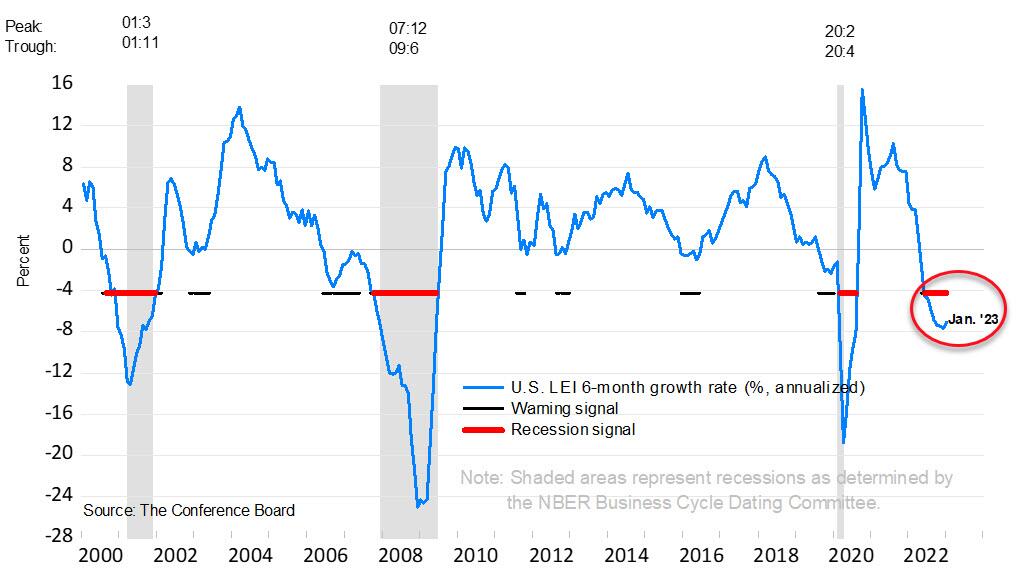

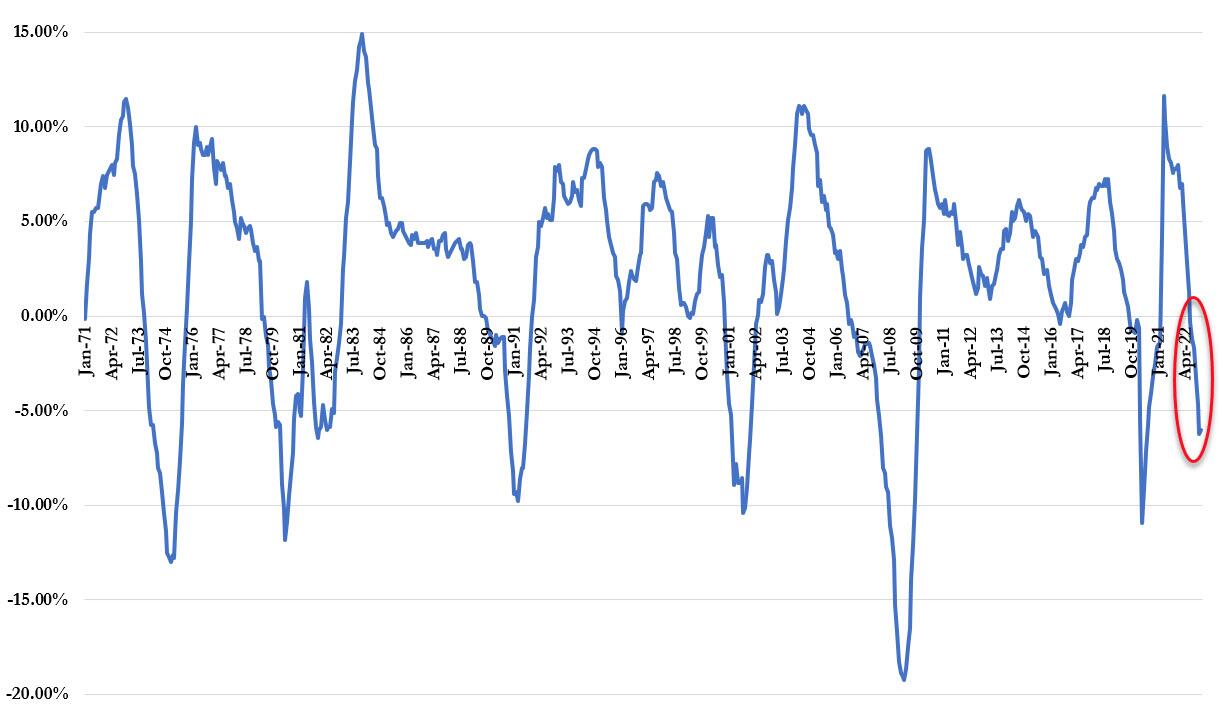

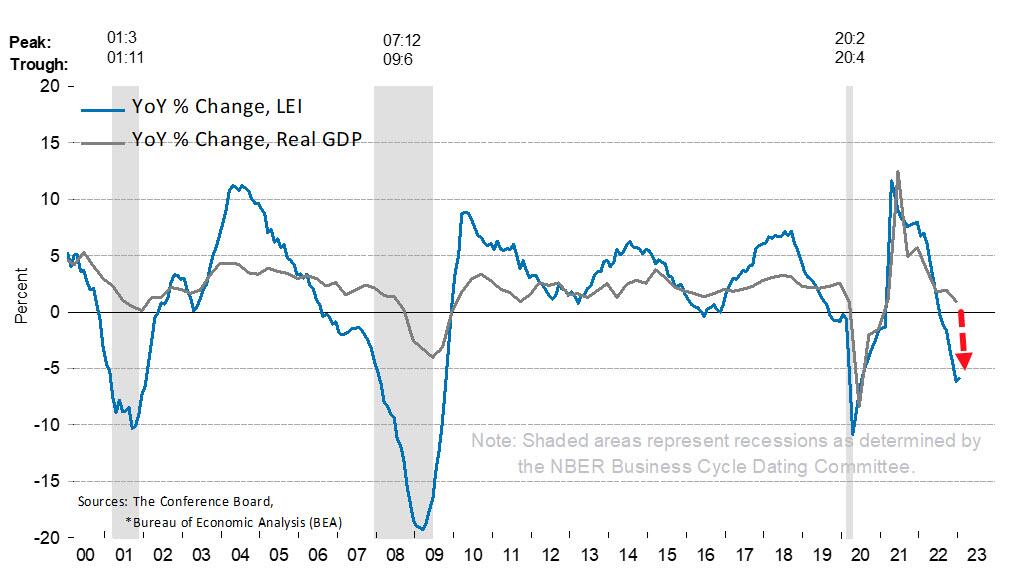

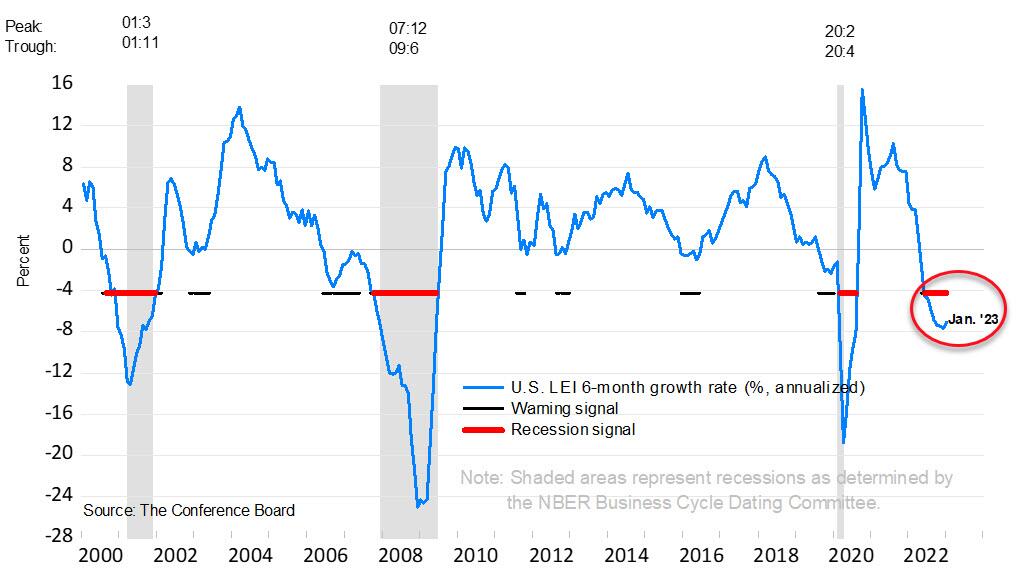

The Conference Board's Leading Economic Indicators (LEI) continued its decline in January, dropping 0.3% MoM (vs -0.3% exp).

And on a year-over-year basis, the LEI is down 6.03% (a slightly better than the revised 6.22% decline in Dec) - but still close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse...

Not a good sign for GDP:

The trajectory of the US LEI continues to signal a recession over the next 12 months

Thus, If it is vital to compare something with 1929, then take the stock markets. Whatever happens in the real sector, they are always recognizable. Now we are seeing a frenzy of speculation out of the blue simply because there is nowhere to park savings. Investors "take the risk", "prink but keep eating the cactus" almost as violently as they did in 1929, but there are big differences in terms of motivation. Because they do it today, most likely, not from the excessive optimism of the "roaring 20s", but quite the opposite.

It is a similar story of 2014-2015 crisis. People were fired or are about to be cut, loans are dragging to the bottom, something needs to be done . So they are taken for speculation in the hope of winning money and unraveling the financial tangle. Many, by the way, are well aware that this is a lottery and a huge risk, but they rely on chance, because they see no other hope.And now it's the same on a global scale. Intergalactic franchise.

The most interesting thing is that the Fed and other global central banks could support this madness by injecting some fresh money into the system. But they seem to have different plans this time. As we've mentioned in Telegram - households again will become a victim...as usual. While institutional investors leaving equity funds and market, households keep buying with 1.5 Bln/week tempo. So it seems that households are being urgently put into stocks under the talk that "the Fed is about to turn around with monetary policy", and the crypto is also trying to not lag behind.

The Fed, of course, will not deploy anything, but will continue to raise the rate, and then act with a clear conscience in the role of " I always told you".

Conclusion

Theoretically we could provide different scenarios on how long Fed rate remains high and how average cost of the US debt will change and for how long this debt burden will not become a hot problem for global financial system, but some things are becoming evident right now. On economical stage:

There will be no immediate increase in the cost of borrowing, as the average term of the US government debt is 5-6 years. But even if rates are lowered, interest on debt will be the biggest expense in a few years. And if prices continue to rise in the United States, about 20% of the budget may be spent on interest in 10 years.

️It is very likely that in a few years the topic of the US national debt will become very nervous for the whole world.

️Powell needs to fight inflation quickly. He now raises the rate so quickly that he could lower it as soon as possible. It remains to be hoped that he succeeds. What if not?

Well, it is the most interesting: And what are the US going to do? After all, they perfectly understand everything. There are a lot of options for the development of events:

Today we see that "nullification", "default", "restructuring" or "reset" doesn't look as awful as it sounds, if you put it in beautiful wrapper. Mass media, no doubts, could do this. Whatever scenario will be chosen right now, it is gradates from "bad" to "very bad". Geopolitical situation also changes very fast, involving more and more countries. War "in Ukraine" gradually turns to war "around Ukraine", when the latter is becoming just the territory where conflict stands. In the same way as it was Vietnam and then Afghanistan in 1980s.

Good US statistics let Fed to be stubborn on high rate for longer, which should make additional pressure on gold market in short term. Whatever price drop will happen, we consider it as good gift for more investments into gold market. Although gold rally could be postponed but no single scenario, even most positive one, doesn't suggest denying of gold rally. Big activity of the US political establishment and domestic political struggle makes me think that "long-term solutions' are hardly possible . The US slowly but stubbornly is taking course on AUKUS+ establishment, suggesting boost of domestic industrial production with direct investments and sweeping off the banking system out of investments' control. It means struggle against liberal US political elite. But to start AUKUS (MAGA) project, the US have to deny the Bretton-Wood system, which is based on dominant role of the bankers. The problem is that banks absorb all investments, use them for own needs and do not let them to come into real industry/manufacturing sector due to bureaucracy, corruption and nepotism at the top level of government. Together with external political factors, it should accelerate process in economy as well. We suggest that effect should be visible as soon as in the 2nd half of 2023.

This time, guys, we try to not bore you with sophisticated charts, statistics and indicators. Global situation is changing fast and we try to take a look at gold place in modern history. But also with some hindsight on historical events, trying to understand what vector the US could try to follow. Obviously, all these stuff around Ukraine, and other multiple conflicts around the Globe, including Taiwan, political and economical confrontation with China and other countries - is pure greed. Some countries just what to keep sitting on the back of the world, keep consuming everything for free as they did for decades, just printing "obligations" but somehow these countries raise against this surprisingly and do not want to be exploited any more. This situation start shaking the fragile balance in economy, because developed world obligations has reached so large scale that even minor shake could break the whole card house. In fact, it has no difference with middle centuries colonization where so called developed countries evidently were robing Latin America, Middle East, Africa and China. In modern world they have tried to present this in some civilized view, forming it like "obligations" that nobody of course intend to pay out. And now this system is gradually coming to the boiling point.

Obviously it is all about the US national Debt. If it somehow miracly disappeared - they would be absolutely happy and keep existent system for another century. It means that all the US efforts right now in all spheres is just an attempt to withdraw this debt and hold existent Global financial system. But now the servicing of the debt is a direct hazard to the US economy. With the new rate around 5.5% rising interest expenses seriously contract ability to consume, as a lot of budget income is utilized to pay interest. So they have to find the way to withdraw the debt by any acceptable way.

US debt default

There are no many ways to to withdraw the debt. It could be destruction of the major debt holders (which seems like preferable scenario), say, by big war in Europe, destruction of financial system and major holders of US debt, involving China in some way and imposing sanctions on it (freeze assets etc., sound familiar, right?). This could help to withdraw big bulk of debt. Second way is worse - destruction of the US in some way. For example, if the US will fall apart, with appearing of independent states, so that global debt appear to belong to nobody and should be withdrawn. This is like when USSR has fallen, this was a free Russia decision to accept USSR debt, but it could be easily withdrawn as USSR doesn't exist anymore. And third way is... right - default. But somehow this wold scares people. In reality it is not as impossible as seems at first glance and is not as horrible. With all negative consequences, it is much better than US split in parts.

First of all - although it is few people who know this but the US was in default four times. Here we bring historical data just briefly. If you're interested - you could find more detailed information. So -

1838 – the first US default

Rather, it was the default of the popular municipal bonds of eight southern US states (Arkansas, Indiana, Illinois, Louisiana, Maryland, Michigan, Mississippi and Pennsylvania), as well as the state of Florida, which did not yet have rights at that time. The justification for the default was "dislike of foreigners and fear of foreign influence." The British actively bought these bonds, despite the fact that only a couple of decades ago they were at war with the United States (1812-14). Therefore, for Americans there were obvious sociological and psychological "reasons to stiff" their former colonizers. The economic reasons for the default are active borrowings of the southern states, the repayment and payment of interest of which were refinanced by subsequent borrowings.

1893-95 – the second default of the USA

Although it did not come to the actual default, the US Treasury managed to avoid it only by paying financiers a huge amount. At the end of the 19th century, "the United States was still a debtor country that owed foreigners more than it earned from them." In August 1894, "the federal budget deficit (the first deficit recorded after the Civil War) reached $ 60 million." The situation was saved only by a banking syndicate led by Pierpont Morgan and Auguste Belmont (a representative of the Rothschild banking house in the United States), who placed in England for a very decent reward U.S. Treasury bonds in the amount of $ 65 million.USD. "As a result of this operation, the Treasury's reserves increased and it was saved from the shameful bankruptcy and default of the United States." The banking syndicate earned about $6 million or more than 9% of the placement amount on this transaction. In the future, the US Government made simpler and cheaper decisions, not defaulting on government obligations, but devaluing the US dollar.

1933 – the third default of the United States

"When the inauguration of President Franklin D. Roosevelt was approaching in 1933, the financial system of the United States was in serious danger. The fear that Roosevelt would devalue money forced speculators to exchange dollars for gold, which caused the Treasury to lose gold reserves at a tremendous rate." On March 5, the day of the inauguration, Roosevelt issued a decree in which he stopped exchanging dollars for gold and ordered US citizens to hand over their gold bars and coins.

At the same time, the gold content of the US dollar was reduced: the price of gold pegged to the dollar was raised from $ 20.67 per troy ounce to $ 35, i.e. a simultaneous devaluation of the dollar was made by more than 69%.

In 1935 The US Supreme Court, which by a majority of votes "upheld the gold law. He concluded that the government's rejection of the gold equivalent of its own bonds was generally illegal, but stressed that nothing could be done about it. The court stated that the US Congress had the right to change the bond contracts." In fact, it was announced that, despite the violation of the law and the US Constitution, the President, the Government and Congress had the right to change the terms of their obligations, citing the poor state of the country's economy and the threat of mass bank failures, and after it, enterprises. After four years of the Great Depression, public opinion did not resist this offense of top US officials, tacitly sanctioning the redistribution of wealth.

1971 – the fourth US default

On Monday, August 15, 1971, "President Nixon announced that from now on, the United States will stop converting dollars in circulation abroad into gold, thereby making a unilateral revision of the international monetary system that has existed for 25 years. Sounds awful, but in reality the US have got great advantages:

The result of the devaluation – by the end of the 70s of the XX century, the dollar lost half its value against the German mark and a third against the Japanese yen. Gold has risen in price 9 times since 1971 (from $35 per ounce to 325) with a 4.4-fold increase in prices. Thus, the net devaluation of the gold content of the dollar from 1971 to the present (summer 2002) amounted to 111%, i.e. for $ 100 in 1971, you can buy gold twice as much as in dollars in 2002. By the way, the broad money supply of M3 increased more than 10 times from August 1971 to summer 2002. And if gold at that time was undervalued by about two times, then now, in relation to the mass of dollars in circulation, it is undervalued – by about the same two times.

This measure, combined with the restriction of wage and price growth, tax cuts and the federal budget, allowed:

— to reduce unemployment from 6.1% in August 1971, the highest level in the previous 10 years, to 4.6% in October 1973;

— to improve the situation in industry — capacity utilization rose above the key level of 80, supporting growth of industrial production;

— over the next year and a half, US GDP growth averaged 7%.

So we can say that the Americans have fulfilled their task – by reducing the burden on the dollar, played into the hands of exports, supporting industry. At the same time, financial markets were shaken – interest rates jumped to 10% in 1973, simultaneously bringing down the balance of payments to a deficit of 0.43% of GDP (due to capital flight from the United States). Note that subsequently the devaluation of the dollar led to the oil shock of 1973. But that was later, and in the short term, the United States definitely won. And again at the expense of foreign investors, together with holders of gold reserves.

So, despite that "default" sounds bad and scaring - it could bring big benefits to economy, especially if it withdraws so huge burden like $31 Trln off the balance. Despite the default - industrial powers remain untouched with solid foreign demand, overseas plants are still belong to US giants and keep working. Effect of default might be similar to 1971, boosting US export due to cheap value of the dollar. US is mostly self-sufficient country in terms of energy, basic metals, food and other critical sources. Besides it has allies such as Australia and Canada who will provide everything that they need.

Let's take a look at how "Operation Default" could be realized in modern world. First of all - nobody will use word "default". It will be something like "reset" or "restructuring". States almost always in such a difficult situation choose default and / or restructure. There are two main reasons. Firstly, this is a long-standing beautiful custom - almost all of the empires of the new time were in default, and some of them not just once . Perhaps only Austria-Hungary and the Russian Empire escaped this fate, but only because they collapsed in 1917-1918. The United States has been in default 4 times, as we've said. By the way - recent freeze of the dollar gold reserves of Iran, Russia and Venezuela is also a default. Inability to fulfill selective obligations, and who cares about reasons...

Second, when a government has a choice between defaulting or continuing to service its debt, very often the decision is made by the group or narrowly understood political reasons. It is not public or population decision. Sometimes it seems that it is easier to find a scapegoat, dump all the negativity, and keep running in the same way. All the talk about decade plans and strategic projects is certainly good, but a specific politician in a high position rarely has a planning horizon of 5-10 years longer. It is necessary to

Once the

- The Fed is buying up the bulk of the debt in one way or another, for example, as part of the next QE round, the resumption of which, let me remind you, we are waiting for in the second half of this year.

- further, as a sufficient number of securities is accumulated on the Fed's balance sheet, a restoring in the style of like "something is written off, something is prolonged at a rate of 0.1% for 20-30 years". And the debt pyramid can be restarted: everything looks decorous and noble. By the way, new debt can be attracted at market rates, and old debt can be restructured.

- Simultaneously hard mass media attack should be made, when the media will once again f**k the brain of the public and explain that there was nothing shameful here and in general this is some kind of ESG. Instead, not-paid investors' interest were sent to support climate and gender diversity.

In this case, for some time, the problem of the growth of budget interest expenses is removed. And the problem is quite real now - if everything will keep going as it goes now - the United States will allocate the same share in budget spending on debt service by 2032 as Ukraine does today - about 20%. And if you suddenly pay 0.1% instead of 5-6% on the main part of the debt, then this completely changes the situation and allows you to continue the previous policy as if nothing had happened further. At least you can try

Meantime in the US economy

There are two major moments right now. First is, rising stock market as never before. In our FX report we've said that it is curious to see rising stock market with negative personal spending and no liquidity injections. We come to conclusion that money are distributed out of industrial production and manufacturing sector due to drop in consumer demand, so CAPEX are counterproductive now and send into financial markets. Indeed, Industrial production in the US stands in pitty condition - up just 0.79% YoY - the weakest since Feb 2021...

Manufacturing as well - output actually rose 1.0% MoM, better than the +0.8% expected, and its best print since Feb 2022. That dragged the YoY move back into the green...barely.

The biggest headline from the report is the record 9.9% collapse in Utilities...

Capacity Utilization slid to 78.3% - the lowest since Oct 2021. So it is difficult to call economy "Strong as hell"...

The Conference Board's Leading Economic Indicators (LEI) continued its decline in January, dropping 0.3% MoM (vs -0.3% exp).

- The biggest positive contributor to the leading index was average workweek at 0.18

- The biggest negative contributor was ISM new orders at -0.28

“Among the leading indicators, deteriorating manufacturing new orders, consumers’ expectations of business conditions, and credit conditions more than offset strengths in labor markets and stock prices to drive the index lower in the month. The contribution of the yield spread component of the LEI also turned negative in the last two months, which is often a signal of recession to come. While the LEI continues to signal recession in the near term, indicators related to the labor market—including employment and personal income—remain robust so far. Nonetheless, The Conference Board still expects high inflation, rising interest rates, and contracting consumer spending to tip the US economy into recession in 2023.”

And on a year-over-year basis, the LEI is down 6.03% (a slightly better than the revised 6.22% decline in Dec) - but still close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse...

Not a good sign for GDP:

The trajectory of the US LEI continues to signal a recession over the next 12 months

Thus, If it is vital to compare something with 1929, then take the stock markets. Whatever happens in the real sector, they are always recognizable. Now we are seeing a frenzy of speculation out of the blue simply because there is nowhere to park savings. Investors "take the risk", "prink but keep eating the cactus" almost as violently as they did in 1929, but there are big differences in terms of motivation. Because they do it today, most likely, not from the excessive optimism of the "roaring 20s", but quite the opposite.

It is a similar story of 2014-2015 crisis. People were fired or are about to be cut, loans are dragging to the bottom, something needs to be done . So they are taken for speculation in the hope of winning money and unraveling the financial tangle. Many, by the way, are well aware that this is a lottery and a huge risk, but they rely on chance, because they see no other hope.And now it's the same on a global scale. Intergalactic franchise.

The most interesting thing is that the Fed and other global central banks could support this madness by injecting some fresh money into the system. But they seem to have different plans this time. As we've mentioned in Telegram - households again will become a victim...as usual. While institutional investors leaving equity funds and market, households keep buying with 1.5 Bln/week tempo. So it seems that households are being urgently put into stocks under the talk that "the Fed is about to turn around with monetary policy", and the crypto is also trying to not lag behind.

The Fed, of course, will not deploy anything, but will continue to raise the rate, and then act with a clear conscience in the role of " I always told you".

Conclusion

Theoretically we could provide different scenarios on how long Fed rate remains high and how average cost of the US debt will change and for how long this debt burden will not become a hot problem for global financial system, but some things are becoming evident right now. On economical stage:

There will be no immediate increase in the cost of borrowing, as the average term of the US government debt is 5-6 years. But even if rates are lowered, interest on debt will be the biggest expense in a few years. And if prices continue to rise in the United States, about 20% of the budget may be spent on interest in 10 years.

️It is very likely that in a few years the topic of the US national debt will become very nervous for the whole world.

️Powell needs to fight inflation quickly. He now raises the rate so quickly that he could lower it as soon as possible. It remains to be hoped that he succeeds. What if not?

Well, it is the most interesting: And what are the US going to do? After all, they perfectly understand everything. There are a lot of options for the development of events:

- Discrediting any alternatives to the US dollar. Besides… how to put it mildly. Well, let's say "systematic work with competing organizations."

- Great global shake-up. This is essentially already happening, but this is obviously only the beginning.

- A sharp increase in budget revenues? Hm... I wonder how this can be done?

- Dramatic cost reduction. Do not make me laugh.

- Transition to some new foundations and a new financial system. According to the principle - " And where are you going to go?" Essentially, it's "nullification". Something like we've discussed in "Default" section.

- And finally, the scenario of “let our children and grandchildren solve this problem”. Why should we clean the Augean stables? Look, both Japan and Greece somehow live with debts above 200% of GDP. And nothing, they live quite well. Let's "kick the bank" further. But this scenario is now coming to the dead way.

Today we see that "nullification", "default", "restructuring" or "reset" doesn't look as awful as it sounds, if you put it in beautiful wrapper. Mass media, no doubts, could do this. Whatever scenario will be chosen right now, it is gradates from "bad" to "very bad". Geopolitical situation also changes very fast, involving more and more countries. War "in Ukraine" gradually turns to war "around Ukraine", when the latter is becoming just the territory where conflict stands. In the same way as it was Vietnam and then Afghanistan in 1980s.

Good US statistics let Fed to be stubborn on high rate for longer, which should make additional pressure on gold market in short term. Whatever price drop will happen, we consider it as good gift for more investments into gold market. Although gold rally could be postponed but no single scenario, even most positive one, doesn't suggest denying of gold rally. Big activity of the US political establishment and domestic political struggle makes me think that "long-term solutions' are hardly possible . The US slowly but stubbornly is taking course on AUKUS+ establishment, suggesting boost of domestic industrial production with direct investments and sweeping off the banking system out of investments' control. It means struggle against liberal US political elite. But to start AUKUS (MAGA) project, the US have to deny the Bretton-Wood system, which is based on dominant role of the bankers. The problem is that banks absorb all investments, use them for own needs and do not let them to come into real industry/manufacturing sector due to bureaucracy, corruption and nepotism at the top level of government. Together with external political factors, it should accelerate process in economy as well. We suggest that effect should be visible as soon as in the 2nd half of 2023.