Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

Gold market this week shows better resistance to bearish factors compares to FX and stock markets. Although downside action has happened as well, but once Gold has reached 1810-1815$ support area, it stands stubborn around despite that EUR, and especially GBP were keeping downside action. As we've mentioned, gold is a specific asset which could be driven a bit differently by similar factors.

Yesterday we have considered new economical background in very detailed report. The new environment in two words could be described as "markets were wrong with early easing expectations. Fed is going up further". It is no needed to say that it totally agrees with our fundamental view and actually agrees with the US statistics that we see. Inflation is not defeated, real estate market in terrible situation, while some tricky revisions and "seasonal adjustments" of all other indicators, such as NFP, Retail Sales, CPI by the way, hurt investors' faith in numbers and statistics agencies:

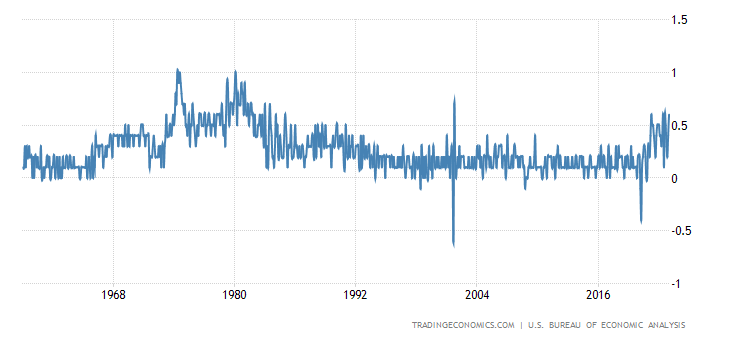

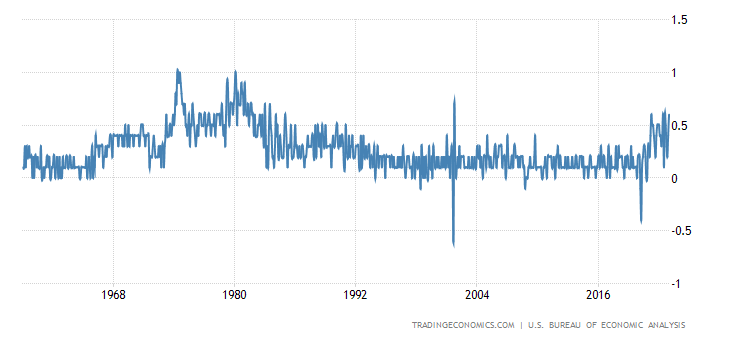

Finally, recent PCE numbers also shows that inflation is back - numbers around 2001 terrorists attack levels. Higher numbers were only during inflation spiral in 1980s:

Currently we're not stated that inflation definitely is back and keep going higher - we still need to check it with 1-2 months of fresh data, but it is highly likely and supported by idea of structural crisis.

Meantime, short term under 1 year Treasury bills suggest rate around 5.45-5.5%. With recent jump in inflation, real interest rates once again become negative. Although we see 30-year TIPs (Treasury Inflation-Protected Bonds) yield around 1.55%, it is a bit tricky number, because it is based on forward long-term inflationary expectations. Which, in turn, are based on futures markets quotes on future interest rates. Expectations now stand low but who said that fact yields will match them?

For example, just a week ago, they were lower.

By taking a look at long-term 10-year bonds chart we suggest that yields will go higher, and maybe much higher. Now market is overbought and at resistance of 4.11% level, but technical picture suggests action somewhere to 5.05%, at least. US Treasuries enter new trading range of 4-5%. And even higher yield is possible, but the question is - whether it will be due Fed policy only, or, rising of default spread as well? It seems that the US bond market with possible default on horizon (although low probability), rising budget deficit, fever real estate market and its Fed policy is entering some kind of chaotic performance.

Keeping this stuff in mind, we see that Central Banks are preparing for something. Ruined Turkey gold import from Switzerland rose to the highest since at least 2012 in January as the country’s soaring inflation spurred demand for the precious metal. More than 58 tons of the precious metal was shipped to Turkey, according to Swiss Customs, the biggest monthly figure in data going back to January 2012. The eye-watering figure — accounting for 42% of total Swiss gold exports — comes after bullion buying surged as Turkish consumer inflation accelerated to as high as 85% last year.

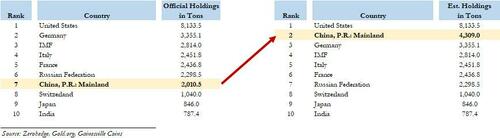

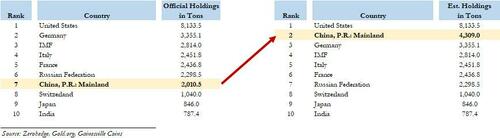

Some experts suggest that China in reality has twice larger gold volume than officially disclosed:

Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right? But a lot of people are ignoring a key question: how are people paying for this shopping spree? As it turns out, they’re putting a lot of this spending on credit cards.

Even with a big 1.8% decline in retail sales in December, revolving credit, primarily reflecting credit card debt, grew by another $7.2 billion that month, a 7.3% increase.

To put the numbers into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that Americans are still heavily relying on credit cards to make ends meet.

Meanwhile, household debt rose by $394 billion in the fourth quarter of 2022. It was the largest quarter-on-quarter increase in household debt in two decades. Debt balances have risen $2.7 higher than they were at the beginning of the pandemic.

Clearly, this isn’t a sign of a healthy economy. Americans are spending more on everything thanks to rampant price inflation that doesn’t appear to be waning, and they’re relying on credit cards to do it. Saving has plunged. This isn’t a sound economic foundation, and it isn’t even sustainable. Credit cards have a nasty thing called a limit. And with credit card interest rates at record-high levels, people will reach those limits pretty quickly.

American consumers continue to “support the economy” by spending money today despite rising prices. But they’re borrowing to do it. Tomorrow is fast approaching. And with it depleted savings, higher interest rates, and looming credit card limits. This is simply not a sustainable trajectory, no matter how the mainstream press tries to spin it.

Circa 2008 our central bankers in general, and the U.S. Fed in particular, had the insanely bad idea that central banks could use fiat money created out of thin air to save bad banks, defeat recessions, manage inflation, monetize debt, win a Nobel Prize and ensure total employment with a “Pickett’s charge” of mouse-click money.

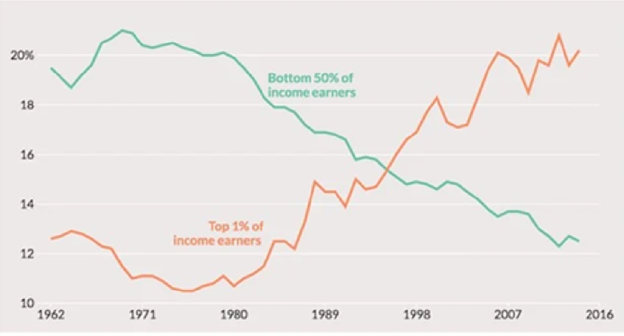

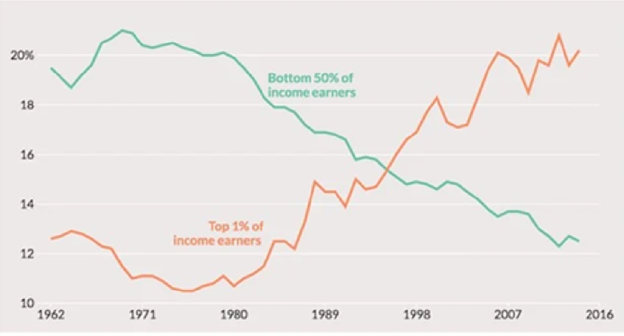

Unfortunately, those early and mouse-clicked victories ignored the longer-term realities/casualties, namely: historically unprecedented wealth inequality, grotesque currency debasement, the death of free-market price discovery and the birth of what amounts to little more than Wall Street socialism and market feudalism masquerading today as MMT “capitalism.” Such short-term “glory” at the expense of longer-term ruin is a pattern all too familiar for those paying attention…

Powell, for example, thinks he can “win the war against inflation,” but like Napoleon, Lee and von Paulus, he is still unable to admit to himself (or us lieutenants) that his grand vision is doomed either way. And so, he continues to desperately fight a losing cause at the expense of countless currencies and investors (casualties) around the world. How can we know this? As we've said in our previous reports - the math speaks for itself. Global debt levels are past their “point of no return" —there are no easy victories left once we start dealing in the quadrillions…

Whether Powell continues with QT or pivots to more QE, retail foot-soldiers here and abroad face either economic recession/depression or extreme inflation. But it could come with both in a way of stagflation. So, the big question today is this: Will the USD get stronger or weaker in 2023 and beyond? There are two camps in this strategic debate, and two consequences depending on which camp is right. Neither are “victorious.”

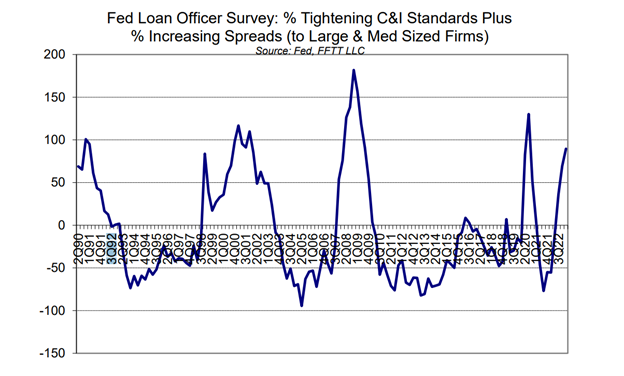

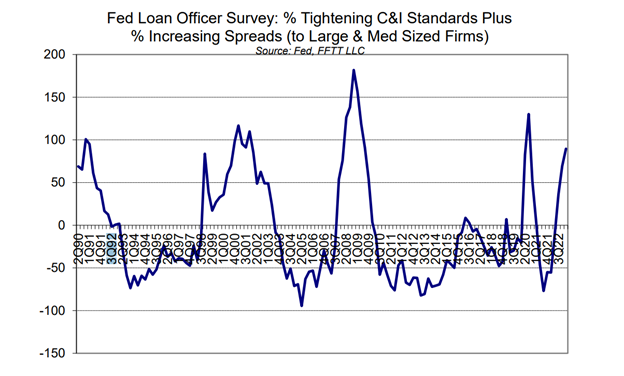

If the USD gets stronger, it kills just about every asset class but the USD. Already, we are seeing this open carnage in credit markets as rising rates and General Powell’s strong-Dollar policies cripple lending and borrowing norms of the past. Loan officers are confirming a tightening of credit availability (and a widening of bank lending spreads, above) at levels only seen in prior recessions:

A strengthening USD (with high Fed rate) will send bond yields higher, which will be deflationary as debt-soaked America gets poorer and foreigners are forced to sell more USTs alongside a tightening Fed which is doing exactly the same thing—namely: Bond dumping and yield-spiking.

However, if the USD gets weaker, the inflation we are already feeling will only get worse as $2T+ deficits make their steady climb North toward $3T, $4T or even $5T+ for 2023. So, once again: Will the USD get stronger or weaker? The answer lies in what signals (or desperate generals) you track or trust: Powell’s Fed or the UST market?

So, the courageous meme that “rising rates kills inflation.” Well… yes, but at what cost?

If Powell wins the headline battle against inflation, he loses the war for global credit markets, economies and political credibility, which loss will be immediately blamed on a virus and/or Russian "bad guy" (Russian did it) but never on the "mad Fed generals" who pushed us over the debt cliff.

If we look only at what the Fed says, and it tightens, which, for now seems like the plan for Q1 and Q2, the USD will strengthen, yields and rates (5.25% to 5.50%) will rise further and the UST market will see such a wave a selling (foreign and QT Fed-driven), that a fourth “uh-oh” moment in the sovereign bond market will be inevitable, and likely enough to not only “crack the ice” of global bond markets, but drown everyone skating above it.

Given these realities and risks in the UST market, risks which even a fork-tongued and totally cornered Jerome Powell understands, I see no realistic way forward other than a weaker USD and thus a move from QT to QE. Unless Powell weakens the USD and injects more QE liquidity sometime in 2023, his victory over inflation will be at the expense of America’s life-blood—namely the UST market.

A weaker USD will buy time (and USTs) until ultimately the developed economies of the world, which in fact have the balance sheets of banana republics, finally realize that there’s still nothing left to save them but a great big “reset”. Recall our last week discussion of US debt default, that sounds awful but in reality is not the worse scenario to withdraw huge debt, especially if suddenly US gets some 3rd side part who could be blamed in all fails.

The need for this “re-set” will, of course, be conveniently blamed on Putin and Covid rather than the central bankers (failed generals) who caused this horrific war on real money, sustainable debt and sound fiscal spending years ago.

In short term, dollar could rise more and gold could remain under pressure for a while, as 2-4 rate hikes are still possible. Powell, who desperately wishes to be remembered as a Napoleonic Paul Volcker rather than a comical Arthur Burns, is no exception to such human-all-too-human small-mindedness. Unwilling to accept a Gettysburg moment that originated with Colonel Greenspan, followed by Benny "Helicopter" Bernanke, General J. Powell could indeed push too far and too long with rising rates, a stronger USD and tanking bonds until inflation and everything else is destroyed. We can only wait and see.

But, in a longer term, regardless of what Powell says today, the real play is 3 to 4 moves ahead, which all point toward an inevitably weaker USD and thus an inevitably rising gold price. Powell, DC and the creative math and fiction writers at the BLS will continue to do what all politicians (or losing armies) do when things are going against them: Lie.

Thus, the DC creative writers will continue to fudge, distort and “tweak” the CPI (and other) data to mis-report true inflation as nearly “beating expectations,” thereby allowing Powell to save face in a losing “war against inflation” while Lieutenant Yellen quietly pushes a weaker USD narrative to save the UST market (i.e., prevent more foreign UST dumping). This face-saving policy will then allow the US to do what it does best: Borrow, spend and go deeper into inflationary debt spirals. Recall our 10-year UST chart in the beginning...

Physical gold, of course, loves chaos and offers far greater loyalty to those who put their trust in this natural metal rather than flimsy paper money and the even flimsier promises from on high. Thus, now we treat any downside action as very attractive moment for more long-term gold investing, additionally to our first step-in recommendation around 1600-1650$. The journey is just beginning. Besides, we have few geopolitical issues that can't be ignored -

Geopolitical component

As we've mentioned yesterday, the monetary authorities of the United States do not want to soften monetary policy, while industry in developed countries is declining, the construction sector in the United States is in deep decline, there is clearly a trend towards higher prices, and aggregate private demand is declining (especially if we take into account the real inflation rate).

These negative processes will inevitably continue, unless monetary policy easing begins. At least in the form of supporting household demand.

The trouble is that even such support, (not to mention a rate decrease) or an increase in the monetary base, will cause a sharp increase in inflation. Despite the fact that even now, after a year and a half of raising the US rate (and at a record pace in history), it is three times more than the US monetary authorities would like. So Biden's silence is largely caused by objective reasons.

Another thing is that the political situation strongly demanded (and continues to demand) from Biden to decide on economic policy. This was not done, which means a serious demotion of the "Biden team" within the framework of political processes in the United States.

This week we've heard speeches by the leaders of two of the three main countries in the world today: Putin and Biden and the unveiling of a peace plan around Ukraine by China.

Why is this so important? The fact is that the inadequacy of the "old" Bretton Woods model is already clear to almost everyone and the only question is: who will be the first to offer some alternative and take the initiative in its implementation. In the USA, an alternative model has been proposed ("industrialization of AUKUS+"), but it has not yet been recognized in official policy. The process is underway. Accordingly, there were considerations that Biden might say something on this topic - at least in response to Putin.

Putin (who started first) started talking quite directly about leaving the dollar zone, redistributing the main logistics areas, and, in fact, Russia's leaving of the Bretton Woods system of humanitarian standards (for example, in education). At the same time, he did not say anything about Eurasian integration, the post-crisis currency system and other relevant topics related to the division of the dollar system into currency zones.

In fact, this means that he has moved away from declaring a direct economic confrontation with the Bretton Woods elites and will expect further weakening of the relevant institutions in the course of the crisis. At the same time, it can be assumed, based, among other things, on his previous speeches, that he proceeds precisely from the option of the collapse of the single dollar system into several currency zones.

In response to this, Biden should, theoretically, either offer his own version of the collapse of the Bretton Woods system (note that the AUKUS is just within the framework of Putin's approach - the dollar currency zone) or explain how the United States will stop the crisis processes. Neither one nor the other option was proposed, from which it can be concluded with high probability that the current US leadership has no idea how to stop the crisis and what to do in the process of strengthening it.

Theoretically, this was already evident from the message to Congress two weeks earlier, but then it was still possible to assume that Biden and his team simply did not consider the economic crisis a serious enough topic for discussion. According to Biden, inflation has almost been overcome, the monetary authorities will soon cope with the fall in aggregate demand, employment is at record high levels — what more can you wish for. In reality, everything is not as good at all (just read our reports) and the whole world was waiting for what the answer to Putin would be in essence in the financial and economic sphere. As already mentioned, there was no response.

China talked more about diplomacy. He also practically refused to give an answer to Putin (to support or refute his theses), but the fact that Biden evaded the answer in the framework of a potential economic discussion was not emphasized. Since it is impossible to assume that China's leaders do not understand the complexity of the economic situation, it can be concluded that it is not yet ready to act as a leader in the economic sphere. This means that all negative processes in the global economy and finance will continue unhindered.

With such a situation and rising conflict areas in the world like mushrooms after the rain, gold seems the only asset for long term investing by far.

Gold market this week shows better resistance to bearish factors compares to FX and stock markets. Although downside action has happened as well, but once Gold has reached 1810-1815$ support area, it stands stubborn around despite that EUR, and especially GBP were keeping downside action. As we've mentioned, gold is a specific asset which could be driven a bit differently by similar factors.

Yesterday we have considered new economical background in very detailed report. The new environment in two words could be described as "markets were wrong with early easing expectations. Fed is going up further". It is no needed to say that it totally agrees with our fundamental view and actually agrees with the US statistics that we see. Inflation is not defeated, real estate market in terrible situation, while some tricky revisions and "seasonal adjustments" of all other indicators, such as NFP, Retail Sales, CPI by the way, hurt investors' faith in numbers and statistics agencies:

Finally, recent PCE numbers also shows that inflation is back - numbers around 2001 terrorists attack levels. Higher numbers were only during inflation spiral in 1980s:

Currently we're not stated that inflation definitely is back and keep going higher - we still need to check it with 1-2 months of fresh data, but it is highly likely and supported by idea of structural crisis.

Meantime, short term under 1 year Treasury bills suggest rate around 5.45-5.5%. With recent jump in inflation, real interest rates once again become negative. Although we see 30-year TIPs (Treasury Inflation-Protected Bonds) yield around 1.55%, it is a bit tricky number, because it is based on forward long-term inflationary expectations. Which, in turn, are based on futures markets quotes on future interest rates. Expectations now stand low but who said that fact yields will match them?

For example, just a week ago, they were lower.

By taking a look at long-term 10-year bonds chart we suggest that yields will go higher, and maybe much higher. Now market is overbought and at resistance of 4.11% level, but technical picture suggests action somewhere to 5.05%, at least. US Treasuries enter new trading range of 4-5%. And even higher yield is possible, but the question is - whether it will be due Fed policy only, or, rising of default spread as well? It seems that the US bond market with possible default on horizon (although low probability), rising budget deficit, fever real estate market and its Fed policy is entering some kind of chaotic performance.

Keeping this stuff in mind, we see that Central Banks are preparing for something. Ruined Turkey gold import from Switzerland rose to the highest since at least 2012 in January as the country’s soaring inflation spurred demand for the precious metal. More than 58 tons of the precious metal was shipped to Turkey, according to Swiss Customs, the biggest monthly figure in data going back to January 2012. The eye-watering figure — accounting for 42% of total Swiss gold exports — comes after bullion buying surged as Turkish consumer inflation accelerated to as high as 85% last year.

Some experts suggest that China in reality has twice larger gold volume than officially disclosed:

Retail sales surged in January, creating the impression that the economy is humming along nicely. After all, there can’t be a problem if consumers are out there consuming, right? But a lot of people are ignoring a key question: how are people paying for this shopping spree? As it turns out, they’re putting a lot of this spending on credit cards.

Even with a big 1.8% decline in retail sales in December, revolving credit, primarily reflecting credit card debt, grew by another $7.2 billion that month, a 7.3% increase.

To put the numbers into perspective, the annual increase in 2019, prior to the pandemic, was 3.6%. It’s pretty clear that Americans are still heavily relying on credit cards to make ends meet.

Meanwhile, household debt rose by $394 billion in the fourth quarter of 2022. It was the largest quarter-on-quarter increase in household debt in two decades. Debt balances have risen $2.7 higher than they were at the beginning of the pandemic.

Clearly, this isn’t a sign of a healthy economy. Americans are spending more on everything thanks to rampant price inflation that doesn’t appear to be waning, and they’re relying on credit cards to do it. Saving has plunged. This isn’t a sound economic foundation, and it isn’t even sustainable. Credit cards have a nasty thing called a limit. And with credit card interest rates at record-high levels, people will reach those limits pretty quickly.

American consumers continue to “support the economy” by spending money today despite rising prices. But they’re borrowing to do it. Tomorrow is fast approaching. And with it depleted savings, higher interest rates, and looming credit card limits. This is simply not a sustainable trajectory, no matter how the mainstream press tries to spin it.

Circa 2008 our central bankers in general, and the U.S. Fed in particular, had the insanely bad idea that central banks could use fiat money created out of thin air to save bad banks, defeat recessions, manage inflation, monetize debt, win a Nobel Prize and ensure total employment with a “Pickett’s charge” of mouse-click money.

Unfortunately, those early and mouse-clicked victories ignored the longer-term realities/casualties, namely: historically unprecedented wealth inequality, grotesque currency debasement, the death of free-market price discovery and the birth of what amounts to little more than Wall Street socialism and market feudalism masquerading today as MMT “capitalism.” Such short-term “glory” at the expense of longer-term ruin is a pattern all too familiar for those paying attention…

Powell, for example, thinks he can “win the war against inflation,” but like Napoleon, Lee and von Paulus, he is still unable to admit to himself (or us lieutenants) that his grand vision is doomed either way. And so, he continues to desperately fight a losing cause at the expense of countless currencies and investors (casualties) around the world. How can we know this? As we've said in our previous reports - the math speaks for itself. Global debt levels are past their “point of no return" —there are no easy victories left once we start dealing in the quadrillions…

Whether Powell continues with QT or pivots to more QE, retail foot-soldiers here and abroad face either economic recession/depression or extreme inflation. But it could come with both in a way of stagflation. So, the big question today is this: Will the USD get stronger or weaker in 2023 and beyond? There are two camps in this strategic debate, and two consequences depending on which camp is right. Neither are “victorious.”

If the USD gets stronger, it kills just about every asset class but the USD. Already, we are seeing this open carnage in credit markets as rising rates and General Powell’s strong-Dollar policies cripple lending and borrowing norms of the past. Loan officers are confirming a tightening of credit availability (and a widening of bank lending spreads, above) at levels only seen in prior recessions:

A strengthening USD (with high Fed rate) will send bond yields higher, which will be deflationary as debt-soaked America gets poorer and foreigners are forced to sell more USTs alongside a tightening Fed which is doing exactly the same thing—namely: Bond dumping and yield-spiking.

However, if the USD gets weaker, the inflation we are already feeling will only get worse as $2T+ deficits make their steady climb North toward $3T, $4T or even $5T+ for 2023. So, once again: Will the USD get stronger or weaker? The answer lies in what signals (or desperate generals) you track or trust: Powell’s Fed or the UST market?

So, the courageous meme that “rising rates kills inflation.” Well… yes, but at what cost?

If Powell wins the headline battle against inflation, he loses the war for global credit markets, economies and political credibility, which loss will be immediately blamed on a virus and/or Russian "bad guy" (Russian did it) but never on the "mad Fed generals" who pushed us over the debt cliff.

If we look only at what the Fed says, and it tightens, which, for now seems like the plan for Q1 and Q2, the USD will strengthen, yields and rates (5.25% to 5.50%) will rise further and the UST market will see such a wave a selling (foreign and QT Fed-driven), that a fourth “uh-oh” moment in the sovereign bond market will be inevitable, and likely enough to not only “crack the ice” of global bond markets, but drown everyone skating above it.

Given these realities and risks in the UST market, risks which even a fork-tongued and totally cornered Jerome Powell understands, I see no realistic way forward other than a weaker USD and thus a move from QT to QE. Unless Powell weakens the USD and injects more QE liquidity sometime in 2023, his victory over inflation will be at the expense of America’s life-blood—namely the UST market.

A weaker USD will buy time (and USTs) until ultimately the developed economies of the world, which in fact have the balance sheets of banana republics, finally realize that there’s still nothing left to save them but a great big “reset”. Recall our last week discussion of US debt default, that sounds awful but in reality is not the worse scenario to withdraw huge debt, especially if suddenly US gets some 3rd side part who could be blamed in all fails.

The need for this “re-set” will, of course, be conveniently blamed on Putin and Covid rather than the central bankers (failed generals) who caused this horrific war on real money, sustainable debt and sound fiscal spending years ago.

In short term, dollar could rise more and gold could remain under pressure for a while, as 2-4 rate hikes are still possible. Powell, who desperately wishes to be remembered as a Napoleonic Paul Volcker rather than a comical Arthur Burns, is no exception to such human-all-too-human small-mindedness. Unwilling to accept a Gettysburg moment that originated with Colonel Greenspan, followed by Benny "Helicopter" Bernanke, General J. Powell could indeed push too far and too long with rising rates, a stronger USD and tanking bonds until inflation and everything else is destroyed. We can only wait and see.

But, in a longer term, regardless of what Powell says today, the real play is 3 to 4 moves ahead, which all point toward an inevitably weaker USD and thus an inevitably rising gold price. Powell, DC and the creative math and fiction writers at the BLS will continue to do what all politicians (or losing armies) do when things are going against them: Lie.

Thus, the DC creative writers will continue to fudge, distort and “tweak” the CPI (and other) data to mis-report true inflation as nearly “beating expectations,” thereby allowing Powell to save face in a losing “war against inflation” while Lieutenant Yellen quietly pushes a weaker USD narrative to save the UST market (i.e., prevent more foreign UST dumping). This face-saving policy will then allow the US to do what it does best: Borrow, spend and go deeper into inflationary debt spirals. Recall our 10-year UST chart in the beginning...

Physical gold, of course, loves chaos and offers far greater loyalty to those who put their trust in this natural metal rather than flimsy paper money and the even flimsier promises from on high. Thus, now we treat any downside action as very attractive moment for more long-term gold investing, additionally to our first step-in recommendation around 1600-1650$. The journey is just beginning. Besides, we have few geopolitical issues that can't be ignored -

Geopolitical component

As we've mentioned yesterday, the monetary authorities of the United States do not want to soften monetary policy, while industry in developed countries is declining, the construction sector in the United States is in deep decline, there is clearly a trend towards higher prices, and aggregate private demand is declining (especially if we take into account the real inflation rate).

These negative processes will inevitably continue, unless monetary policy easing begins. At least in the form of supporting household demand.

The trouble is that even such support, (not to mention a rate decrease) or an increase in the monetary base, will cause a sharp increase in inflation. Despite the fact that even now, after a year and a half of raising the US rate (and at a record pace in history), it is three times more than the US monetary authorities would like. So Biden's silence is largely caused by objective reasons.

Another thing is that the political situation strongly demanded (and continues to demand) from Biden to decide on economic policy. This was not done, which means a serious demotion of the "Biden team" within the framework of political processes in the United States.

This week we've heard speeches by the leaders of two of the three main countries in the world today: Putin and Biden and the unveiling of a peace plan around Ukraine by China.

Why is this so important? The fact is that the inadequacy of the "old" Bretton Woods model is already clear to almost everyone and the only question is: who will be the first to offer some alternative and take the initiative in its implementation. In the USA, an alternative model has been proposed ("industrialization of AUKUS+"), but it has not yet been recognized in official policy. The process is underway. Accordingly, there were considerations that Biden might say something on this topic - at least in response to Putin.

Putin (who started first) started talking quite directly about leaving the dollar zone, redistributing the main logistics areas, and, in fact, Russia's leaving of the Bretton Woods system of humanitarian standards (for example, in education). At the same time, he did not say anything about Eurasian integration, the post-crisis currency system and other relevant topics related to the division of the dollar system into currency zones.

In fact, this means that he has moved away from declaring a direct economic confrontation with the Bretton Woods elites and will expect further weakening of the relevant institutions in the course of the crisis. At the same time, it can be assumed, based, among other things, on his previous speeches, that he proceeds precisely from the option of the collapse of the single dollar system into several currency zones.

In response to this, Biden should, theoretically, either offer his own version of the collapse of the Bretton Woods system (note that the AUKUS is just within the framework of Putin's approach - the dollar currency zone) or explain how the United States will stop the crisis processes. Neither one nor the other option was proposed, from which it can be concluded with high probability that the current US leadership has no idea how to stop the crisis and what to do in the process of strengthening it.

Theoretically, this was already evident from the message to Congress two weeks earlier, but then it was still possible to assume that Biden and his team simply did not consider the economic crisis a serious enough topic for discussion. According to Biden, inflation has almost been overcome, the monetary authorities will soon cope with the fall in aggregate demand, employment is at record high levels — what more can you wish for. In reality, everything is not as good at all (just read our reports) and the whole world was waiting for what the answer to Putin would be in essence in the financial and economic sphere. As already mentioned, there was no response.

China talked more about diplomacy. He also practically refused to give an answer to Putin (to support or refute his theses), but the fact that Biden evaded the answer in the framework of a potential economic discussion was not emphasized. Since it is impossible to assume that China's leaders do not understand the complexity of the economic situation, it can be concluded that it is not yet ready to act as a leader in the economic sphere. This means that all negative processes in the global economy and finance will continue unhindered.

With such a situation and rising conflict areas in the world like mushrooms after the rain, gold seems the only asset for long term investing by far.