Sive Morten

Special Consultant to the FPA

- Messages

- 18,621

Fundamentals

Once again, gold shows different action compares to FX rivals. While currencies mostly have shown extreme intraday volatility without any direction - gold has shown solid upside performance. Yesterday we've tried to understand how correct recent market's view is, and come to conclusion that as two weeks ago as now the majority undervalue the Fed's commitment to go right up to the end, in terms of inflation. Despite big Fed impact, the US economy shows surprisingly good resistance, providing not as bad data as we would suggest. Due to this moment, it seems that J. Powell will do everything to become a new Paul Volker and new saver of the US economy. He doesn't want to become the one who ruined the US. It will be great temptation to him to press a bit more and more as victory over inflation seems to be near and economy looks not bad still. But this is the road with the only final point. It seems that J. Powell still doesn't believe that inflation can't be defeated just by rate raising. And that is what will lead him to disaster. This is the reason why, in nearest term, we are not too inspired with recent gold rally, suggesting that it is probably short-term... At the same time, we keep our long-term bullish view on gold market, suggesting that it should show best performance in perspective of 2-3 years.

Market overview

Gold prices gained this week as strong Chinese economic data dented the dollar and drove some bets for better physical demand from the top bullion consumer, although the risk of rising U.S. interest rates capped gains.

With strong data out of China and some countries looking to continue with rate hikes, the dollar was weakening against other currencies, providing some support to the gold market, said David Meger, director of metals trading at High Ridge Futures. The dollar hit a one-week low earlier today after China's yuan gained as the country's manufacturing activity expanded at its fastest pace since April 2012.

The day's gains in prices come after bullion posted its worst month since June 2021 in February after strong U.S. data pointed to a resilient economy, suggesting that the Federal Reserve could deliver more rate hikes to curb inflation. Higher interest rates to rein in consumer prices dim the appetite for bullion since it pays no interest against bond yields. U.S. employment and consumer prices reports in the next two weeks would help investors to gauge the path of interest rates.

In general, according to World Gold Council, another month of increasing COMEX futures net longs to 250t or 16% of open interest, helped drive the price . While European gold ETFs continue to see outflows in a more sanguine regional economic and inflation environment, US funds have been dipping their toes due, in our view, to a good tactical case for gold.

A good portion of January’s performance can be attributed to the weaker US dollar, followed by a sizeable 37bps drop in the US 10-year Treasury yield in January. The strong December return for gold was a small drag in January as gold returns tend to experience some mean reversion, a feature that reflects its low volatility relative to other assets.

At the same time, currently we see that as dynamic of ETF as no decrease in short positions tells that investors suggest better conditions for gold purchase ahead. Just compare performance of ETF at the eve of strong gold rally in the past and current performance. There has been no apparent participation from global gold ETFs so far. Even in recent weeks, aggregate flows have been negative. But when we strip out flows out of European funds, US funds have now experienced cumulative inflows since December. It means that gold keeps some investors' interest but accumulation still stands low.

The same you could see on the pace of contraction of short positions - their drop is much slower than at the eve of the rallies in the past. On the short side, the reduction in positions has been more muted than previously. This might suggest that some scepticism remains and there are shorts still to capitulate. Let's keep in mind these two charts, as we will need them in next section of report.

Among major political events of this week is worthy to mention failed conclusion of the G20 ministerial meeting. Yes, formally, it was not an economic meeting, but a meeting of foreign ministers, but the G20 was created in 2009 as an anti-crisis association. Today, everyone has forgotten about it, only politics is being discussed, and in an extremely narrow aspect, who will condemn Russia and who will not.

Moreover, China's "12 theses" peace plan on the situation in Ukraine are an obvious claim to enter world politics at the level of a "great power", which is why the United States is so excited. But the point here is that the "unipolar world", in reality, is the world of the Bretton Woods system, a world in which the economy is determined within the framework of the dollar system. If the United States cannot answer either Putin or China, this in reality means that they do not see the future of this system.

Moreover, the only alternative plan for the United States legalized in the political field of this country today is the industrialization of AUKUS. But any industrialization within the framework of the Bretton Woods system is impossible, since the immanent property of this system is a higher profitability of the financial sector compared to the industrial one. Consequence: in order to implement this plan (and there is no other one by far), it is necessary to destroy the B.-W. system.

We have already partially discussed some of the consequences of this scenario, in particular, the destruction of the system of legitimization of property (expropriation of national reserves, personal and companies' assets in a way of sanctions) . And we have no desire to frighten anyone — we are just evaluating the obvious conclusions from the current situation. Theoretically, you can try to save the B.-W. system (although it is not very clear how), you can try to come up with an alternative plan instead of AUKUS industrialization. But so far, such options are not seen on horizon, even from theoretical point of view.

Today we do not consider a lot of statistics (because everything we've considered yesterday ), but, just take a look at this chart. The dynamics of world trade in physical volumes (Units) decreased by 2.98% compared to the same month a year ago, the worst decrease it was worst decrease over the past 15 years after the crash in 2008 and the lockdown in 2020. And it's funny that in monetary terms (Money based volume) it continues to grow: +3.22%. (hello, inflation, hello!);

), but, just take a look at this chart. The dynamics of world trade in physical volumes (Units) decreased by 2.98% compared to the same month a year ago, the worst decrease it was worst decrease over the past 15 years after the crash in 2008 and the lockdown in 2020. And it's funny that in monetary terms (Money based volume) it continues to grow: +3.22%. (hello, inflation, hello!);

- the dynamics of global production somehow stayed in the plus zone, but only by a measly 0.17% - again, in last 15 years worse was only after the crash in 2008 and the lockdown in 2020;

So, shortly speaking, G7 countries has lost 1/8-1/4 of its industrial production, since peaks of 2017. US industrial production increased by puny 2.37% since 2007 (stagnation on a long horizon). Of course, this is not a "re-industrialization" (AUKUS?). Germany has lost 12.34% since 2017 peak (i.e. 1/8), Italy - 20.99% (1/5 drop since 2007 peak), France has -14.24% of the 2008 peak (1/7) and Japan has -23.45% ( almost 1/4 since Feb 2008 peak).

And now - let's use just a common sense. Chart clearly shows the real state of things in the world economy. I especially would like to point the graph of the physical volume of world trade: bearing in mind that the world's population has grown by as much as 2 billion (or 33%) from 1999 to 2022. It means that since 2007/2008, the real consumption of goods in terms of per capita has only decreased. At the same time, according to the IMF, GDP has grown by about 50% during this time, of course - due to services and all sorts ofmanipulations accruals. The correctness of the calculations of all this is already tired of being ironic.

From theory to practice - what performance we expect.

So, why investors are so passive by far in gold accumulation? It seems everything stands around Fed plans. Of course, nobody would share with this information publicly and in the media. Currently we see some scenario where Fed is trying to put as much many as they could out from the stock market and follow everybody to buy US Bonds. The signs of this campagne we see in multiple recommendations of big banks to move out of the stocks. And this recommendations are started somewhere in January, where it was become more evident that inflation is not defeated. Still, the plan is based on two points - to assure public that stocks are overbought, and second inflation is temporal. Concerning first point, we see very often comments like JP Morgan has given in January:

Second, any "inflation defeat" episode is getting high resonance. Markets usually show big moves, while market society starts remaining the boiling pot where investors start dreaming on deflation times. Because the idea of transitory inflation still stands on the surface. Fundstrat research points that from the 50-year history the inflation of 2021-2022 certainly looks transitory. In fact, it looks more like a short-term episode of inflation, as in 2008, in contrast to the structural inflation of the 1970s and 1980s. Therefore, what kind of inflation war should the Fed wage? The bond market argues that the Fed should end the inflation war soon.

And actually Fed from time to time warms up this idea, telling about "deflationary signs", "some progress in inflation struggle" etc. Our followers clearly understand that inflationary quite not transitory. But why both these things are done by the Fed and its big banks dealers? There is only single reason - send all possible cash into bonds to finance deficit and reduce US Treasury burden. Here is the logic.

Americans still have a lot of money on their hands. They are invested everywhere but not always where they need to, that is, in US Treasuries. In particular, deposits and stocks are of concern. As we have discussed in our previous reports, due to domestic interest rates imbalances, banks mostly provide loans to the real sector by public deposits, and rates there are growing slower than the Fed rate due excessive liquidity. Moreover, over the past year, the US budget has provided government guarantees to "system state important enterprises", which has largely replaced classical commercial loans. This is not bad for banks, but if the guarantee works, then the budget has an additional burden.

That's why the intensity of US Treasuries purchase is not sufficient and should be strengthened. To do this, it is necessary to actively sell shares. It was decided to sacrifice them because there is simply nothing else left. Therefore, Fed follows to "the carrot and the stick" way, and stock analytics comes into play as have mentioned above.

As a result - it will be absolutely no matter what Fed do next - lower the rate, raise it or do nothing at all. Because everyone are in bonds, ,the debt is financed, the problem is solved for a while. It will end anyway, it's a matter of QE, but it will already be someone who needs QE and who needs to buy assets. As a result: JP Morgan is probably right about the shares, but it's definitely not the time to buy treasuries yet.

Now we stands somewhere in a half way. If you conduct rate policy according to the rules, then sooner or later the "Taylor rule" awaits you Assuming a rate of 9% with inflation of 6-7%, and respectively 15% with an inflation rate of 10-12%. Will they risk raising the bid so high?

On the one hand, hardly , but on the other - they can try. Because in the fight against inflation, a bright and quick success is needed, and if there is no such success, then there is no point in taking any risks. And it could be just a "shock without therapy". It all depends on the willingness of the Fed directors to implement these (Taylor) rules. It seems that the reason which stops them is mainly the fear that the rule might not actually work.

Taking it all together, we're inclined to think that the Fed will "wait" for inflation above 10%, make sure that everyone who needs to be are sit in US Treasuries already. inflation has not decreased, and then when there is nowhere to go, they will pull sharply up.

This explains why gold investors are so inactive by far. So we need to do the same. Gold is super attractive on a long run, but in nearest 3-6 months, it would be better to wait as we should get good entry levels. The psychological preparation of markets for higher rates is started already. It seems that it is not only our view. Bloomberg uses different reasons and their regression real interest rate model, but also suggest that gold could return back to 1600:

This is the reason why current rally looks not very reliable for short-term perspective. Actually our technical analysis tells the same. In a longer term view investors gradually are daylighting of ongoing global processes. Take a look what Switzerland (!!!) analyst wrote (full interview is here) :

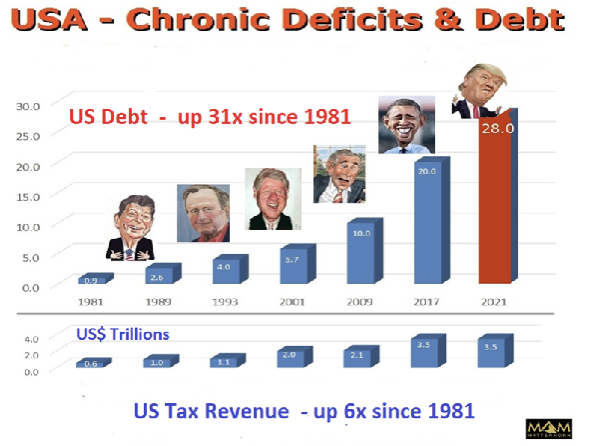

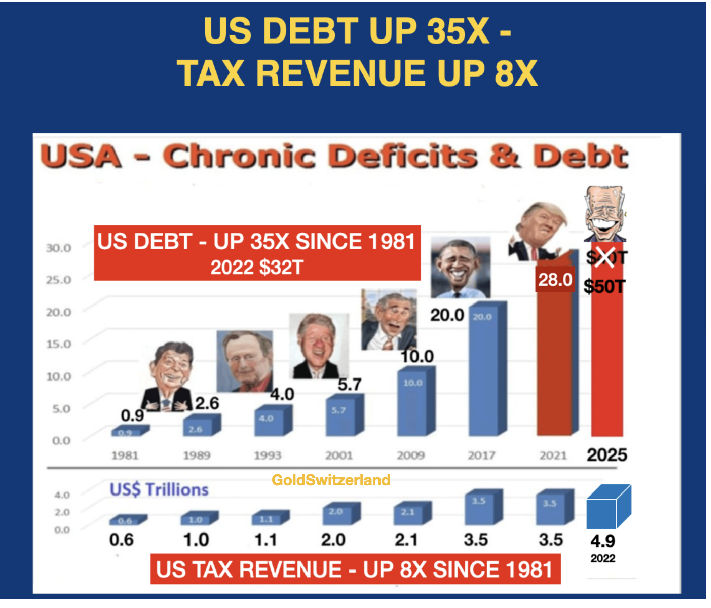

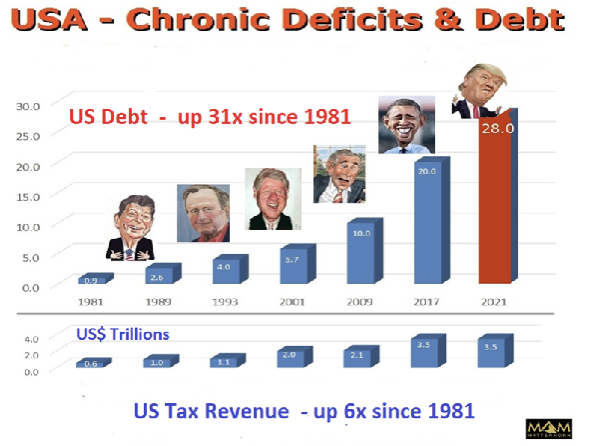

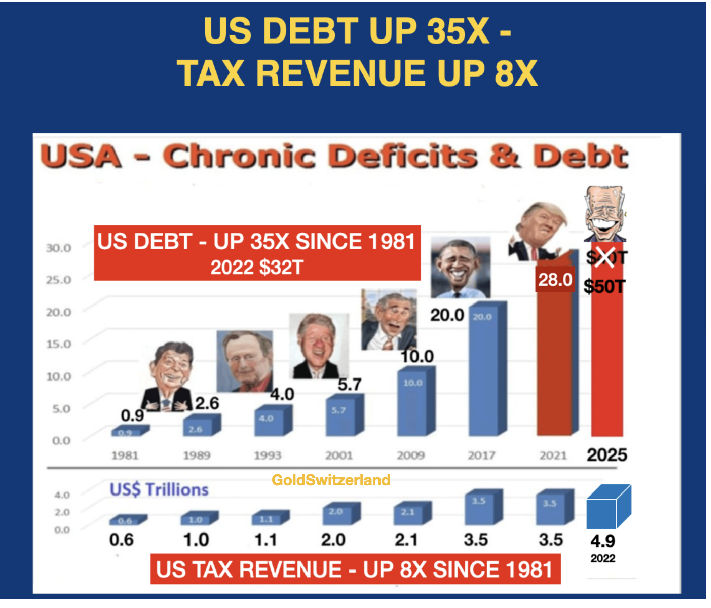

Pay attention, guys, this was said by Switzerland analyst. If you're interested, here is a great article but it is too large to post here even partially. Now, by taking a look at US Budget Deficit - debts and deficits will increase exponentially. I (Egon von Greyerz) have for many years shown the growth in US debt which on average has doubled every 8 years since Reagan became president in 1981.

I projected then in 2016 that when Trump would reach the end of his first term in January 2021, US debt would be $28 trillion on the way to $40 trillion four years later in 2025. Interestingly, the debt was $28T in Jan. 2021. It doesn’t require a genius to project this figure as it is a straight extrapolation of the trend dating back 40 years (just a simple maths as we've mentioned last time).

So how is the US going to go from $32T to $50T in 3 years. Well, in the same way as bankrupt countries collapse with tax revenue falling precipitously and expenditure exploding. So, colleagues are right - the deficit has reached covid levels and if he stays there, then we will get a deficit of $3-3.5 trillion for the fiscal year. By the way, every $0.5 trillion. deficits add 2-2.3 percentage points to inflation, depending on how this deficit is financed (basically, of course, it will be the Fed, other players simply do not have free money in such a volume right now). In short, dollar inflation should be expected in 2023 at the level of 10-12%, and with a 3 trillion deficit closer to the upper limit.

Just four months into fiscal 2023 and the US federal budget deficit is already approaching half a trillion dollars. This is a big problem for the Federal Reserve that few people seem to be talking about. The total deficit for the fiscal year is up to $460.19 billion. That’s up 9% over the same period last year and on a trajectory to blow past the $1.38 trillion fiscal 2022 deficit.

So, with this analysis everything finally comes on right place. Our position now is to expect stronger drop on gold market in nearest 3-6 months, which should create great chances for investing in long-term. Maybe, according to Bloomberg, we will see again 1600 area. Thus, right now, any rally should be considered with caution and be careful with bullish positions by far.

Once again, gold shows different action compares to FX rivals. While currencies mostly have shown extreme intraday volatility without any direction - gold has shown solid upside performance. Yesterday we've tried to understand how correct recent market's view is, and come to conclusion that as two weeks ago as now the majority undervalue the Fed's commitment to go right up to the end, in terms of inflation. Despite big Fed impact, the US economy shows surprisingly good resistance, providing not as bad data as we would suggest. Due to this moment, it seems that J. Powell will do everything to become a new Paul Volker and new saver of the US economy. He doesn't want to become the one who ruined the US. It will be great temptation to him to press a bit more and more as victory over inflation seems to be near and economy looks not bad still. But this is the road with the only final point. It seems that J. Powell still doesn't believe that inflation can't be defeated just by rate raising. And that is what will lead him to disaster. This is the reason why, in nearest term, we are not too inspired with recent gold rally, suggesting that it is probably short-term... At the same time, we keep our long-term bullish view on gold market, suggesting that it should show best performance in perspective of 2-3 years.

Market overview

Gold prices gained this week as strong Chinese economic data dented the dollar and drove some bets for better physical demand from the top bullion consumer, although the risk of rising U.S. interest rates capped gains.

With strong data out of China and some countries looking to continue with rate hikes, the dollar was weakening against other currencies, providing some support to the gold market, said David Meger, director of metals trading at High Ridge Futures. The dollar hit a one-week low earlier today after China's yuan gained as the country's manufacturing activity expanded at its fastest pace since April 2012.

The day's gains in prices come after bullion posted its worst month since June 2021 in February after strong U.S. data pointed to a resilient economy, suggesting that the Federal Reserve could deliver more rate hikes to curb inflation. Higher interest rates to rein in consumer prices dim the appetite for bullion since it pays no interest against bond yields. U.S. employment and consumer prices reports in the next two weeks would help investors to gauge the path of interest rates.

"We're vacillating between an expected increased demand coming from China, along with the concerns of recessionary fears here in the U.S. and elsewhere," Meger said on the recent volatility in platinum and palladium markets.

In general, according to World Gold Council, another month of increasing COMEX futures net longs to 250t or 16% of open interest, helped drive the price . While European gold ETFs continue to see outflows in a more sanguine regional economic and inflation environment, US funds have been dipping their toes due, in our view, to a good tactical case for gold.

A good portion of January’s performance can be attributed to the weaker US dollar, followed by a sizeable 37bps drop in the US 10-year Treasury yield in January. The strong December return for gold was a small drag in January as gold returns tend to experience some mean reversion, a feature that reflects its low volatility relative to other assets.

At the same time, currently we see that as dynamic of ETF as no decrease in short positions tells that investors suggest better conditions for gold purchase ahead. Just compare performance of ETF at the eve of strong gold rally in the past and current performance. There has been no apparent participation from global gold ETFs so far. Even in recent weeks, aggregate flows have been negative. But when we strip out flows out of European funds, US funds have now experienced cumulative inflows since December. It means that gold keeps some investors' interest but accumulation still stands low.

The same you could see on the pace of contraction of short positions - their drop is much slower than at the eve of the rallies in the past. On the short side, the reduction in positions has been more muted than previously. This might suggest that some scepticism remains and there are shorts still to capitulate. Let's keep in mind these two charts, as we will need them in next section of report.

Among major political events of this week is worthy to mention failed conclusion of the G20 ministerial meeting. Yes, formally, it was not an economic meeting, but a meeting of foreign ministers, but the G20 was created in 2009 as an anti-crisis association. Today, everyone has forgotten about it, only politics is being discussed, and in an extremely narrow aspect, who will condemn Russia and who will not.

Moreover, China's "12 theses" peace plan on the situation in Ukraine are an obvious claim to enter world politics at the level of a "great power", which is why the United States is so excited. But the point here is that the "unipolar world", in reality, is the world of the Bretton Woods system, a world in which the economy is determined within the framework of the dollar system. If the United States cannot answer either Putin or China, this in reality means that they do not see the future of this system.

Moreover, the only alternative plan for the United States legalized in the political field of this country today is the industrialization of AUKUS. But any industrialization within the framework of the Bretton Woods system is impossible, since the immanent property of this system is a higher profitability of the financial sector compared to the industrial one. Consequence: in order to implement this plan (and there is no other one by far), it is necessary to destroy the B.-W. system.

We have already partially discussed some of the consequences of this scenario, in particular, the destruction of the system of legitimization of property (expropriation of national reserves, personal and companies' assets in a way of sanctions) . And we have no desire to frighten anyone — we are just evaluating the obvious conclusions from the current situation. Theoretically, you can try to save the B.-W. system (although it is not very clear how), you can try to come up with an alternative plan instead of AUKUS industrialization. But so far, such options are not seen on horizon, even from theoretical point of view.

Today we do not consider a lot of statistics (because everything we've considered yesterday

- the dynamics of global production somehow stayed in the plus zone, but only by a measly 0.17% - again, in last 15 years worse was only after the crash in 2008 and the lockdown in 2020;

So, shortly speaking, G7 countries has lost 1/8-1/4 of its industrial production, since peaks of 2017. US industrial production increased by puny 2.37% since 2007 (stagnation on a long horizon). Of course, this is not a "re-industrialization" (AUKUS?). Germany has lost 12.34% since 2017 peak (i.e. 1/8), Italy - 20.99% (1/5 drop since 2007 peak), France has -14.24% of the 2008 peak (1/7) and Japan has -23.45% ( almost 1/4 since Feb 2008 peak).

And now - let's use just a common sense. Chart clearly shows the real state of things in the world economy. I especially would like to point the graph of the physical volume of world trade: bearing in mind that the world's population has grown by as much as 2 billion (or 33%) from 1999 to 2022. It means that since 2007/2008, the real consumption of goods in terms of per capita has only decreased. At the same time, according to the IMF, GDP has grown by about 50% during this time, of course - due to services and all sorts of

From theory to practice - what performance we expect.

So, why investors are so passive by far in gold accumulation? It seems everything stands around Fed plans. Of course, nobody would share with this information publicly and in the media. Currently we see some scenario where Fed is trying to put as much many as they could out from the stock market and follow everybody to buy US Bonds. The signs of this campagne we see in multiple recommendations of big banks to move out of the stocks. And this recommendations are started somewhere in January, where it was become more evident that inflation is not defeated. Still, the plan is based on two points - to assure public that stocks are overbought, and second inflation is temporal. Concerning first point, we see very often comments like JP Morgan has given in January:

And many similar comments we're hearing around. Even yesterday we've talked about BofA statistics that investors are running into cash and leaving stock funds. That S&P risk premium has dropped to the level of US Treasury Bills and have no advantage over them any more, so stocks currently keep unreasonable risk, etc. And many other comments on this kind.JPMorgan advised investors to get rid of American stocks. Investors should sell shares and lock in profits, according to JPMorgan. The risks of recession and excessive tightening of the Fed's policy remain high, so the US stock market is waiting for a fall, the bank warned. JPMorgan analysts expect the US stock market to fall in the short term, but believe that in the long term, the potential for growth remains. The target price for the end of the year for the S&P 500 index is 4,200 points.

Second, any "inflation defeat" episode is getting high resonance. Markets usually show big moves, while market society starts remaining the boiling pot where investors start dreaming on deflation times. Because the idea of transitory inflation still stands on the surface. Fundstrat research points that from the 50-year history the inflation of 2021-2022 certainly looks transitory. In fact, it looks more like a short-term episode of inflation, as in 2008, in contrast to the structural inflation of the 1970s and 1980s. Therefore, what kind of inflation war should the Fed wage? The bond market argues that the Fed should end the inflation war soon.

And actually Fed from time to time warms up this idea, telling about "deflationary signs", "some progress in inflation struggle" etc. Our followers clearly understand that inflationary quite not transitory. But why both these things are done by the Fed and its big banks dealers? There is only single reason - send all possible cash into bonds to finance deficit and reduce US Treasury burden. Here is the logic.

Americans still have a lot of money on their hands. They are invested everywhere but not always where they need to, that is, in US Treasuries. In particular, deposits and stocks are of concern. As we have discussed in our previous reports, due to domestic interest rates imbalances, banks mostly provide loans to the real sector by public deposits, and rates there are growing slower than the Fed rate due excessive liquidity. Moreover, over the past year, the US budget has provided government guarantees to "system state important enterprises", which has largely replaced classical commercial loans. This is not bad for banks, but if the guarantee works, then the budget has an additional burden.

That's why the intensity of US Treasuries purchase is not sufficient and should be strengthened. To do this, it is necessary to actively sell shares. It was decided to sacrifice them because there is simply nothing else left. Therefore, Fed follows to "the carrot and the stick" way, and stock analytics comes into play as have mentioned above.

- The carrot - it is strictly recommended for everyone to fix profits on stock market and out;

- The stick - the second season of the series "inflation is temporary" has been launched. Additionally media supports rumors that the Fed will definitely lower rates, although the Fed denies everything.

As a result - it will be absolutely no matter what Fed do next - lower the rate, raise it or do nothing at all. Because everyone are in bonds, ,the debt is financed, the problem is solved for a while. It will end anyway, it's a matter of QE, but it will already be someone who needs QE and who needs to buy assets. As a result: JP Morgan is probably right about the shares, but it's definitely not the time to buy treasuries yet.

Now we stands somewhere in a half way. If you conduct rate policy according to the rules, then sooner or later the "Taylor rule" awaits you Assuming a rate of 9% with inflation of 6-7%, and respectively 15% with an inflation rate of 10-12%. Will they risk raising the bid so high?

On the one hand, hardly , but on the other - they can try. Because in the fight against inflation, a bright and quick success is needed, and if there is no such success, then there is no point in taking any risks. And it could be just a "shock without therapy". It all depends on the willingness of the Fed directors to implement these (Taylor) rules. It seems that the reason which stops them is mainly the fear that the rule might not actually work.

Taking it all together, we're inclined to think that the Fed will "wait" for inflation above 10%, make sure that everyone who needs to be are sit in US Treasuries already. inflation has not decreased, and then when there is nowhere to go, they will pull sharply up.

This explains why gold investors are so inactive by far. So we need to do the same. Gold is super attractive on a long run, but in nearest 3-6 months, it would be better to wait as we should get good entry levels. The psychological preparation of markets for higher rates is started already. It seems that it is not only our view. Bloomberg uses different reasons and their regression real interest rate model, but also suggest that gold could return back to 1600:

This is the reason why current rally looks not very reliable for short-term perspective. Actually our technical analysis tells the same. In a longer term view investors gradually are daylighting of ongoing global processes. Take a look what Switzerland (!!!) analyst wrote (full interview is here) :

Matterhorn Asset Management (MAM) founder, Egon von Greyerz, addresses a global financial system sitting on the knife’s edge while underscoring the proper and essential ownership of physical precious metals. The under-funded and ultimately insolvent Western retirement plans whose only “assets” are bubble assets moving toward massive devaluation. The process von Greyerz foresees is a gradual shift away from Western and USD hegemony toward a rise in the East where national and currency wealth will be measured by real assets and superior balance sheets as opposed to the West’s debt-based models and increasingly worthless paper money.

The foregoing shift will likely begin more in the openly more fractured European Community and increasingly weaker euro (!!). Despite the USD’s relative strength at the moment, however, the end-game for the USD will be no different as debt ($300T global debt and quadrillion-level derivative debt) always destroys sovereign strength and currencies from within. The rise of CBDCs, as von Greyerz warns, is no solution but merely a totalitarian tool of greater control.

As to the headline topic of war, von Greyerz evidences extreme concern. He views the war in the Ukraine as nothing more than another US proxy war. American fear of an economically resurging Russia ($75T in natural resources) as opposed to freedom for Ukraine is the real motive here, and the US is making no effort at peace. As for hyped-fears of Russian expansion in the EU, von Greyerz is very clear that such concerns are distorted.

Pay attention, guys, this was said by Switzerland analyst. If you're interested, here is a great article but it is too large to post here even partially. Now, by taking a look at US Budget Deficit - debts and deficits will increase exponentially. I (Egon von Greyerz) have for many years shown the growth in US debt which on average has doubled every 8 years since Reagan became president in 1981.

I projected then in 2016 that when Trump would reach the end of his first term in January 2021, US debt would be $28 trillion on the way to $40 trillion four years later in 2025. Interestingly, the debt was $28T in Jan. 2021. It doesn’t require a genius to project this figure as it is a straight extrapolation of the trend dating back 40 years (just a simple maths as we've mentioned last time).

So how is the US going to go from $32T to $50T in 3 years. Well, in the same way as bankrupt countries collapse with tax revenue falling precipitously and expenditure exploding. So, colleagues are right - the deficit has reached covid levels and if he stays there, then we will get a deficit of $3-3.5 trillion for the fiscal year. By the way, every $0.5 trillion. deficits add 2-2.3 percentage points to inflation, depending on how this deficit is financed (basically, of course, it will be the Fed, other players simply do not have free money in such a volume right now). In short, dollar inflation should be expected in 2023 at the level of 10-12%, and with a 3 trillion deficit closer to the upper limit.

Just four months into fiscal 2023 and the US federal budget deficit is already approaching half a trillion dollars. This is a big problem for the Federal Reserve that few people seem to be talking about. The total deficit for the fiscal year is up to $460.19 billion. That’s up 9% over the same period last year and on a trajectory to blow past the $1.38 trillion fiscal 2022 deficit.

So, with this analysis everything finally comes on right place. Our position now is to expect stronger drop on gold market in nearest 3-6 months, which should create great chances for investing in long-term. Maybe, according to Bloomberg, we will see again 1600 area. Thus, right now, any rally should be considered with caution and be careful with bullish positions by far.