Sive Morten

Special Consultant to the FPA

- Messages

- 18,639

Fundamentals

Yesterday we've considered financial background, which explains recent gold performance. Starting of new QE that is backed by high inflation and obvious problems in banking sector across the board just obviously have to trigger gold rally. Today we keep talking about few economical moments as well, but as you will see below, the political background for now is even more interesting, and I would say even better guarantee strong demand for the gold.

Market overview

Rally is started right on Monday, when the gold bulls were running again, hoping that a short-term boost from the collapse of Silicon Valley Bank can be translated into a longer-term rally for the precious metal. The rally was driven by investors buying into gold Exchange Traded Funds (ETFs), with the largest such vehicle, the SPDR Gold Trust reporting that its holdings rose 1.31% on Monday to 913.27 tonnes from 901.42 tonnes on March 10. Recall our recent discussion of price-to-holding divergence. Now it seems that it is resolving in favor of the former - holding are start rising.

The broader question for the gold market is whether worries of a wider contagion in U.S. financial markets will persist, or whether the actions of the Federal Reserve and the move by President Joe Biden to assuage fears will prevent the spread. Even if the market is reassured that the problem is limited to the two collapsed banks, there may be implications that are positive for the price of gold.

Any suggestion that the Federal Reserve will pare back its current tightening of monetary policy is likely to be a longer-term positive for gold, especially if this occurs before the market is confident that high inflation is tamed. So far it appears that gold is once again fulfilling its traditional role as a safe haven against volatility and risk, but it's probably too early to say that the current buying will persist.

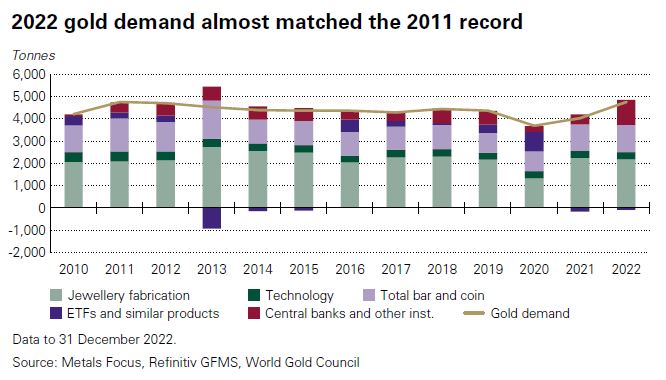

Nonetheless, the likely ramifications of the bank collapse are positive for gold, which was already being supported by other bullish factors. China and India play an outsize role in the physical gold jewellery market, accounting for about two-thirds of the global total in 2022, with the next biggest country being the United States, which had jewellery demand of 143.7 tonnes last year.

Central bank buying is the wildcard for gold, having risen a strong 152% in 2022 to 1,135.7 tonnes.

Overall, the risks for gold are skewed to the upside assuming that investors are drawn back to gold as a hedge against risk and inflation, China and India boost their physical demand, and central bank buying also holds up.

Gold prices climbed over 1% to their highest since early February on Wednesday as a fresh crisis in the banking sector turned investors away from seemingly riskier assets and drove them to the safety of bullion.

Gold prices in sterling hit a record high while bullion in euros also spiked towards all-time peaks hit last year. Gold rose despite a sharp jump in the dollar, which is also 100% indicator of safe-haven demand, that usually comes on some big shakes and/or rising geopolitical risks. Overall focus was still on the Federal Reserve's next move on interest rates as it assesses data showing elevated inflation in February against the backdrop of the collapse of two regional banks.

Ignoring financial market chaos and calls by investors to dial back policy tightening at least until markets stabilise, the European Central Bank raised interest rates by 50 basis points on Thursday.

The near-term outlook for gold looks bullish, but if the Fed decides to rate hikes by 50 bps next week, then it will pressure bullion, said Daniel Pavilonis, senior market strategist at RJO Futures. Meanwhile, the number of Americans filing new claims for unemployment benefits fell more than expected last week, pointing to continued labor market strength.

Gold prices surged more than 2% on Friday as a wave of banking crises shook global markets and put bullion on track for its biggest weekly rise in three years, while bets solidified for a less aggressive Federal Reserve in its fight against inflation.

The Fed will raise interest rates by 25 basis points on March 22 despite the recent banking sector turmoil, according to a majority of economists polled by Reuters.

Nouriel Roubini, chairman and CEO at Roubini Macro Associates, says long-term Treasuries aren't the safe haven investors should pursue as a hedge against risk. "Last year you lost 20% on your safe bonds -- the solution is going to be short-term Treasuries, TIPS, gold and other precious metals," he says on “Bloomberg Surveillance."

Speaking about couple of moments in relation to the Fed's BTFP programme - we do not expect that inflation starts rising immediately, at least until overall liquidity pumping stands under $1Trln. Mostly because these funds will be widely distributed, concentrated on banks accounts and financial sector and hardly will reach industrial and manufacturing sector, as well as households. Besides, programme (at least theoretically) is planned for just 1 year. Supposedly Fed suggests that they should get a chance on rate cut and unrealized loss on bond portfolio will start decreasing, which, in turn, could let them to return back to the banks, getting cash back. But - this is only theoretically. In practice it could get different - recall well-known truth "it is nothing more infinite than temporal plans". Thus, we suggest that BTFP is inflationary initiative by nature, but its effect might be lagging significantly and come only if it size will be $2-$4 Trln, i.e. if banks will use it at full capacity.

But, there are other bullish sources for Gold market. First is - this cash, that banks will get from the Fed will not reach the real industrial sector. So, the normal funding of manufacturing and production will be broken. Because with 5-6 % short-term rates banks can't provide 5-10 year loans for 3%, and they can't pay 2-3% on public cash deposits, they have to rise rate. It means that most probable that all cash that they get will be invested in US short-term bonds. This is actually what Fed wants to achieve. You could see on the chart the difference between 10 year and 1 year US Treasury yields. It is negative.

This in turn means, that the real sector of economy will be underfunded. As a result, we get recession events in the economy - decrease of GDP, employment, wage growth, industrial production and manufacturing, other words everything that we call as "recession". Inflation could even drop because of lack of demand. In fact, we already see deflationary processes as we've mentioned yesterday - All commodity PPI is near zero level. But this is not because of inflation defeated, but due to degradation mechanisms associated with the decline of industry, aggregate demand and aggregate sales.

This, in turn, leads to deeper negative real rates, which should support the Gold. J. Yellen actually talked about it recently:

Second thrilling moment is US debt ceil. Yes, everybody forgets about it, stunned by banking crisis, but time is ticking, and US default spread is rising. Annual credit default swaps on US government debt continue to grow slowly, already 80+, i.е. for insurance against default, you have to pay 0.8% per annum. Why they are bought is clear - just technically, the risk policies of individual holders may imply the need to buy. But on the side of insurance sellers, there seem to be supply problems ... so we are crawling to new records:

As you could see - now it is doesn't matter what next CPI we get or what J. Powell will tell on next meeting and how far Fed will rise the rate. When you pump in $300+Bln liquidity just in a single week - all other things do not matter. The powers that be insist this is not a bailout. But it is absolutely a bailout. Well, if it looks like a bailout, walks like a bailout, and talks like a bailout, it’s probably a bailout.

Speaking about inflation, CPI in particular - investors are just inspired that it is decreasing 8 months in a row. Despite falling over the last eight months, CPI is still closer to its summer peak than it is to the Fed’s mythical 2% target.

The ugly truth is the US economy is addicted to easy money. It is addicted to artificially low interest rates and quantitative easing. You can’t take an addict’s drug away without sending him into withdrawal. The economy can only limp along so long with tighter monetary policy. We saw the first crack in the dam last week. The Fed and US Treasury managed to stick a finger in the hole. But there are more cracks to come, and eventually, the dam will break.

There is also the issue of federal government spending. Even the Fed has conceded it can’t slay inflation with monetary policy alone. US government fiscal policy contributes to inflationary pressure and makes it impossible for the Fed to do its job.

It’s easy to get caught up in the weekly data releases, but it’s important to keep your focus on the fundamentals and the bigger economic picture. The fact is, the Fed pumped trillions of dollars into the economy starting after the 2008 financial crisis and then doubling down during the pandemic. The price inflation we’re experiencing today is a symptom of that monetary malfeasance. The Fed can’t fix this problem with some rate hikes and a modest decrease to its balance sheet. It needs to pull trillions of dollars in liquidity out of the economy.

And it can’t. But the tightening it has already done is enough to pop the bubbles and cause an economic earthquake. We’re already feeling the first tremors.

POLITICAL BACKGROUND OF THE US BANKING CRISIS

To give you fully detailed picture, we should to consider not only banking crisis per se, but also recent information about D. Trump coming arrest next week and what is more important - The International Criminal Court (“ICC”) issued warrants of arrest Mr Putin. We will return to this topic later, so let's start from the beginning.

To understand what is going on, you should consider crisis in sphere of the US domestic political struggle between "Industrial" elite blog and "financial" elite blog. The latter are represented by liberal financial elite, bankers who are managers and controllers of Bretton Wood system. Controlling the credit and global money emission they control the world. The "Industrial" elite represents AUKUS strategy - not as military and political block, but as economical strategy. On a foundation of the US, UK, Australia, Canada, New Zealand and Japan (most probable) they would like to build most industrialized economy block, concentrating all high tech and most top heavy industry. With creating separate currency zone.

From this standpoint - the major rivals to AUKUS are the most industrialized regions, which are EU and China. With EU it is more or less clear. Since EU is not independent politically, it is controlled over Brussels, which in turn is a tool of control in the hands of the US. And EU heavy and high tech industry sector most probably will migrate to the US and its satellites. So, EU ability to make economical struggle with the US is tending to zero. So, only China rests. But this is on foreign arena.

Inside the US, the liberal "financial" elite block resists to AUKUS initiative. Because they contradict to each other. If AUKUS will be realized - it will turn all capital flows out of the markets and banking sector into real economy, production and manufacturing. With current system, AUKUS plan is impossible to realize, because banks will absorb all capital investments and start parasite over them, twisting and turning on financial markets. To make loans to real sector it is risky, long-term and not as profitable as to trade derivatives. So, AUKUS elite have to crash first the liberal Neo Cons, that are sit upon Bretton Wood system.

The banking crisis that you see now is Liberal response, the kind of strike back on AUKUS plan. AUKUS followers, have made the first strike, trying to control and tied liberals by tight interest rate policy, cut the financial appetites and redistribute cash flows out from banking and financial sector. They have tried to start reformation of the US national economy in favor of real economy sector. But liberals strike back, starting banking crisis. The Fed for some time was on a crossroads, starting QT, but still gravitating to Liberal elite, keeping QT below the planned value. Now, the Fed has made its choice, joining Liberal "old" banking elite.

In fact, according to the results of the last working week, we can confidently say that the US financial elite (well, in the EU, too, but there is no industry opposing it) took a powerful revenge for attempts to limit it through tightening monetary policy. Taking into account the growth of speculative assets, we can safely say that any industrialization programs will not pass now either in the USA or on the scale of AUKUS. Actually, we have written a lot about this, but today it has become clear to everyone, for industrialization it is necessary to destroy the Bretton Woods system and the national and world elites associated with it (transnational bankers). This the major point that you have to know - all other stuff is just a wrap.

Second Liberal strike on AUKUS elite is announcing of D. Trump arrest on next week. D. Trump is already confirmed that. So, the tough stage of domestic political struggle is still ahead. Liberals are loosing positions but still strong enough and they will find up to the end.

Actually, the support of the global dollar system costs the United States (and its closest allies) is very expensive and this price is a decrease in their share in the global economy. It is becoming like a baggage without a handle - it is difficult to carry but it is regretted to throw away.

Meantime, on foreign political arena we have not less interesting events. As we've said above, China is a major US rival on foreign arena now. Despite all its power (I mean China), previously it never has played top role in international policy. Yes, it is a member of Security Council, but it never made decisive steps on top political events. Now it has happened. As Reuters reports-

The US always wants to put Iran in a limits of so-called "Nuclear deal". While S. Arabia always was US puppet, or at least, followed in the US political stream. But recent demarche, represented by China, Iran and especially S. Arabia clearly has shown to Global political society and establishment that now nobody is interested with opinion offormer "Hegemon". Here is another nuance exists - the deal was only represented as "brokered by China", but in reality all negotiations were under Russia management and brokerage. That's why Mr. Xi flies to Moscow and will meet V. Putin on 21st of March, in acknowledgment of Russian effort. With this precedent China joins the Global political elite and becomes one of the top political power.

Knowing that, the US revenge to Russia was in ICC act, mentioned above. I would ask you - who in clear mind will start legal claim against the member of Security Council and one of the creators of UN? It seems like some intellectual impairment. What is it? So, they would like to say that when V. Putin (or any his follower) flies to some international meeting, he will be arrested? The real sense stands in different moment. In fact, ICC structure is the same product of the global world order (major rules, how World will be managed and functioned), formed after WW II on Yalta conference, by Roosevelt, Churchill and Stalin. As well as UN, Security Council and, yes, B-W system. The ICC act tells that "Yalta" order is not working anymore and has to be replaced by the new order. And will be replaced. In fact, ICC, which actually the part of "Yalta" system, now makes a decision against this system.

With this ICC act West shows that it doesn't treat Russia as independent sovereign country in supposed "new" Global order that they are trying to build. It is needless to tell that situation will be similar to any other member of Security Council or any other country by simple West decision. Such kind of decision could be made only in a moment of absolute despair, because it is no return until new "Yalta" will be adopted. And it is rather dangerous.

ICC decision just shows that B-W system is breathing hard and world is coming to multi currency zones and spheres of power and interests. Top political powers have to struggle for them because nobody will share with you for free. And China soon will go to war for its own sphere of interest in Asia Pacific region. The AUKUS task is to prevent it. Otherwise it will loose the global domination in industry and manufacturing sector. China will start struggle against AUKUS, and hot stage is not excluded. With new global order coming the US not give Taiwan to China at no cost. AUKUS will have to resolve two problems - isolate China from global markets and control China export to the world. The way how they wil try to do this is isolate China access to world ocean by creating of Asia Pacific outpost by the line of S. Korea, Japan, Taiwan, Burma and Laos (to control access to Cambodia and Indian ocean) where recently color revolutions and coups have been initiated). China "arguable" islands in South China sea probably will become starting point of conflict. AUKUS vitally needs they to be destroyed.

This is the 2nd reason why Xi is coming to Moscow - China role is changing. Now it is not the " wise monkey on a tree" anymore who is watching how "Two tigers" fight. Now, China is becoming one of the Tigers instead of Russia. Ukrainian conflict soon will be over, because its "damage-to-Russia" resource is exhausting, while the eye of the Sauron turns East. This process will accelerate if AUKUS will take revanche inside the US over Liberals. China, in turn, has no experience of big war conflicts and it needs to get reliable background, represented by Russia. China has to play with the 1st number, but it is not ready. Mr. Xi has got the domestic support as it was re-elected on 3rd term in a row.

So, we stand at the edge of fighting for areas of interest among major players. ICC is a baby of the Monocentric world model where the US could make a decision to arrest and national leader. Obviously it doesn't fit to many countries. It means that this monocentric model that has borne ICC should be destroyed, with coming of a new global rules and order, the "New Yalta". Now it is absolutely can't be avoided.

With all these thoughts in mind, just imagine gold coming performance. This will the only real asset. Don't be upset that it seems it is too expensive due to rally last week. It is still cheap and rally is just started. Of course, those who have followed us last year and bought around 1600-1700$ are well done, but it is the reason to be upset. For investing purposes - gold is still cheap. The major demand is just appeared.

Yesterday we've considered financial background, which explains recent gold performance. Starting of new QE that is backed by high inflation and obvious problems in banking sector across the board just obviously have to trigger gold rally. Today we keep talking about few economical moments as well, but as you will see below, the political background for now is even more interesting, and I would say even better guarantee strong demand for the gold.

Market overview

Rally is started right on Monday, when the gold bulls were running again, hoping that a short-term boost from the collapse of Silicon Valley Bank can be translated into a longer-term rally for the precious metal. The rally was driven by investors buying into gold Exchange Traded Funds (ETFs), with the largest such vehicle, the SPDR Gold Trust reporting that its holdings rose 1.31% on Monday to 913.27 tonnes from 901.42 tonnes on March 10. Recall our recent discussion of price-to-holding divergence. Now it seems that it is resolving in favor of the former - holding are start rising.

The broader question for the gold market is whether worries of a wider contagion in U.S. financial markets will persist, or whether the actions of the Federal Reserve and the move by President Joe Biden to assuage fears will prevent the spread. Even if the market is reassured that the problem is limited to the two collapsed banks, there may be implications that are positive for the price of gold.

Any suggestion that the Federal Reserve will pare back its current tightening of monetary policy is likely to be a longer-term positive for gold, especially if this occurs before the market is confident that high inflation is tamed. So far it appears that gold is once again fulfilling its traditional role as a safe haven against volatility and risk, but it's probably too early to say that the current buying will persist.

Nonetheless, the likely ramifications of the bank collapse are positive for gold, which was already being supported by other bullish factors. China and India play an outsize role in the physical gold jewellery market, accounting for about two-thirds of the global total in 2022, with the next biggest country being the United States, which had jewellery demand of 143.7 tonnes last year.

Central bank buying is the wildcard for gold, having risen a strong 152% in 2022 to 1,135.7 tonnes.

Overall, the risks for gold are skewed to the upside assuming that investors are drawn back to gold as a hedge against risk and inflation, China and India boost their physical demand, and central bank buying also holds up.

Gold prices climbed over 1% to their highest since early February on Wednesday as a fresh crisis in the banking sector turned investors away from seemingly riskier assets and drove them to the safety of bullion.

"It's a total safe-haven trade. There's a lot of concern about Credit Suisse and now European banks are really coming under quite a bit of pressure. So it's a complete flight to safety," said Phillip Streible, chief market strategist at Blue Line Futures in Chicago. "People are going to the U.S. Treasuries, gold, silver, and the dollar. They're exiting riskier assets like U.S. equities and economically-sensitive metals like copper, platinum and palladium," Streible said.

Gold prices in sterling hit a record high while bullion in euros also spiked towards all-time peaks hit last year. Gold rose despite a sharp jump in the dollar, which is also 100% indicator of safe-haven demand, that usually comes on some big shakes and/or rising geopolitical risks. Overall focus was still on the Federal Reserve's next move on interest rates as it assesses data showing elevated inflation in February against the backdrop of the collapse of two regional banks.

Ignoring financial market chaos and calls by investors to dial back policy tightening at least until markets stabilise, the European Central Bank raised interest rates by 50 basis points on Thursday.

"The ECB did surprise the market with a 50 basis point (bp) hike, it is a little unsettling because the reason banks are in trouble is because of rates rising too fast," said Jim Wycoff, senior analyst at Kitco Metals. We are seeing continued safe-haven demand for gold with elevated anxiety in the marketplace over this banking crisis."

The near-term outlook for gold looks bullish, but if the Fed decides to rate hikes by 50 bps next week, then it will pressure bullion, said Daniel Pavilonis, senior market strategist at RJO Futures. Meanwhile, the number of Americans filing new claims for unemployment benefits fell more than expected last week, pointing to continued labor market strength.

Gold prices surged more than 2% on Friday as a wave of banking crises shook global markets and put bullion on track for its biggest weekly rise in three years, while bets solidified for a less aggressive Federal Reserve in its fight against inflation.

"Gold is surging on fears that more bad banking news could appear over the weekend and hopes that the Fed will pause its rate hikes next week," said Tai Wong, an independent metals trader based in New York. "The sudden tightening in financial conditions won't help palladium, whose usage is largely industrial though it is technically in the precious complex," Wong said, adding that platinum "has just been a chronic underperformer and is struggling to shake its reputation".

"Gold is likely to shine through the chaos as investors adopt a guarded stance," said Lukman Otunuga, senior research analyst at FXTM.

The Fed will raise interest rates by 25 basis points on March 22 despite the recent banking sector turmoil, according to a majority of economists polled by Reuters.

Nouriel Roubini, chairman and CEO at Roubini Macro Associates, says long-term Treasuries aren't the safe haven investors should pursue as a hedge against risk. "Last year you lost 20% on your safe bonds -- the solution is going to be short-term Treasuries, TIPS, gold and other precious metals," he says on “Bloomberg Surveillance."

Speaking about couple of moments in relation to the Fed's BTFP programme - we do not expect that inflation starts rising immediately, at least until overall liquidity pumping stands under $1Trln. Mostly because these funds will be widely distributed, concentrated on banks accounts and financial sector and hardly will reach industrial and manufacturing sector, as well as households. Besides, programme (at least theoretically) is planned for just 1 year. Supposedly Fed suggests that they should get a chance on rate cut and unrealized loss on bond portfolio will start decreasing, which, in turn, could let them to return back to the banks, getting cash back. But - this is only theoretically. In practice it could get different - recall well-known truth "it is nothing more infinite than temporal plans". Thus, we suggest that BTFP is inflationary initiative by nature, but its effect might be lagging significantly and come only if it size will be $2-$4 Trln, i.e. if banks will use it at full capacity.

But, there are other bullish sources for Gold market. First is - this cash, that banks will get from the Fed will not reach the real industrial sector. So, the normal funding of manufacturing and production will be broken. Because with 5-6 % short-term rates banks can't provide 5-10 year loans for 3%, and they can't pay 2-3% on public cash deposits, they have to rise rate. It means that most probable that all cash that they get will be invested in US short-term bonds. This is actually what Fed wants to achieve. You could see on the chart the difference between 10 year and 1 year US Treasury yields. It is negative.

This in turn means, that the real sector of economy will be underfunded. As a result, we get recession events in the economy - decrease of GDP, employment, wage growth, industrial production and manufacturing, other words everything that we call as "recession". Inflation could even drop because of lack of demand. In fact, we already see deflationary processes as we've mentioned yesterday - All commodity PPI is near zero level. But this is not because of inflation defeated, but due to degradation mechanisms associated with the decline of industry, aggregate demand and aggregate sales.

This, in turn, leads to deeper negative real rates, which should support the Gold. J. Yellen actually talked about it recently:

Treasury Secretary Yellen: I'm looking at stress indicators in the banking system, I want to make sure that the problems of failed banks do not spread to others. I'm concerned that if banks get stressed, they will tighten lending. Tighter lending conditions can be a significant source of economic risk reduction.

Second thrilling moment is US debt ceil. Yes, everybody forgets about it, stunned by banking crisis, but time is ticking, and US default spread is rising. Annual credit default swaps on US government debt continue to grow slowly, already 80+, i.е. for insurance against default, you have to pay 0.8% per annum. Why they are bought is clear - just technically, the risk policies of individual holders may imply the need to buy. But on the side of insurance sellers, there seem to be supply problems ... so we are crawling to new records:

As you could see - now it is doesn't matter what next CPI we get or what J. Powell will tell on next meeting and how far Fed will rise the rate. When you pump in $300+Bln liquidity just in a single week - all other things do not matter. The powers that be insist this is not a bailout. But it is absolutely a bailout. Well, if it looks like a bailout, walks like a bailout, and talks like a bailout, it’s probably a bailout.

Speaking about inflation, CPI in particular - investors are just inspired that it is decreasing 8 months in a row. Despite falling over the last eight months, CPI is still closer to its summer peak than it is to the Fed’s mythical 2% target.

The ugly truth is the US economy is addicted to easy money. It is addicted to artificially low interest rates and quantitative easing. You can’t take an addict’s drug away without sending him into withdrawal. The economy can only limp along so long with tighter monetary policy. We saw the first crack in the dam last week. The Fed and US Treasury managed to stick a finger in the hole. But there are more cracks to come, and eventually, the dam will break.

There is also the issue of federal government spending. Even the Fed has conceded it can’t slay inflation with monetary policy alone. US government fiscal policy contributes to inflationary pressure and makes it impossible for the Fed to do its job.

It’s easy to get caught up in the weekly data releases, but it’s important to keep your focus on the fundamentals and the bigger economic picture. The fact is, the Fed pumped trillions of dollars into the economy starting after the 2008 financial crisis and then doubling down during the pandemic. The price inflation we’re experiencing today is a symptom of that monetary malfeasance. The Fed can’t fix this problem with some rate hikes and a modest decrease to its balance sheet. It needs to pull trillions of dollars in liquidity out of the economy.

And it can’t. But the tightening it has already done is enough to pop the bubbles and cause an economic earthquake. We’re already feeling the first tremors.

POLITICAL BACKGROUND OF THE US BANKING CRISIS

To give you fully detailed picture, we should to consider not only banking crisis per se, but also recent information about D. Trump coming arrest next week and what is more important - The International Criminal Court (“ICC”) issued warrants of arrest Mr Putin. We will return to this topic later, so let's start from the beginning.

To understand what is going on, you should consider crisis in sphere of the US domestic political struggle between "Industrial" elite blog and "financial" elite blog. The latter are represented by liberal financial elite, bankers who are managers and controllers of Bretton Wood system. Controlling the credit and global money emission they control the world. The "Industrial" elite represents AUKUS strategy - not as military and political block, but as economical strategy. On a foundation of the US, UK, Australia, Canada, New Zealand and Japan (most probable) they would like to build most industrialized economy block, concentrating all high tech and most top heavy industry. With creating separate currency zone.

From this standpoint - the major rivals to AUKUS are the most industrialized regions, which are EU and China. With EU it is more or less clear. Since EU is not independent politically, it is controlled over Brussels, which in turn is a tool of control in the hands of the US. And EU heavy and high tech industry sector most probably will migrate to the US and its satellites. So, EU ability to make economical struggle with the US is tending to zero. So, only China rests. But this is on foreign arena.

Inside the US, the liberal "financial" elite block resists to AUKUS initiative. Because they contradict to each other. If AUKUS will be realized - it will turn all capital flows out of the markets and banking sector into real economy, production and manufacturing. With current system, AUKUS plan is impossible to realize, because banks will absorb all capital investments and start parasite over them, twisting and turning on financial markets. To make loans to real sector it is risky, long-term and not as profitable as to trade derivatives. So, AUKUS elite have to crash first the liberal Neo Cons, that are sit upon Bretton Wood system.

The banking crisis that you see now is Liberal response, the kind of strike back on AUKUS plan. AUKUS followers, have made the first strike, trying to control and tied liberals by tight interest rate policy, cut the financial appetites and redistribute cash flows out from banking and financial sector. They have tried to start reformation of the US national economy in favor of real economy sector. But liberals strike back, starting banking crisis. The Fed for some time was on a crossroads, starting QT, but still gravitating to Liberal elite, keeping QT below the planned value. Now, the Fed has made its choice, joining Liberal "old" banking elite.

In fact, according to the results of the last working week, we can confidently say that the US financial elite (well, in the EU, too, but there is no industry opposing it) took a powerful revenge for attempts to limit it through tightening monetary policy. Taking into account the growth of speculative assets, we can safely say that any industrialization programs will not pass now either in the USA or on the scale of AUKUS. Actually, we have written a lot about this, but today it has become clear to everyone, for industrialization it is necessary to destroy the Bretton Woods system and the national and world elites associated with it (transnational bankers). This the major point that you have to know - all other stuff is just a wrap.

Second Liberal strike on AUKUS elite is announcing of D. Trump arrest on next week. D. Trump is already confirmed that. So, the tough stage of domestic political struggle is still ahead. Liberals are loosing positions but still strong enough and they will find up to the end.

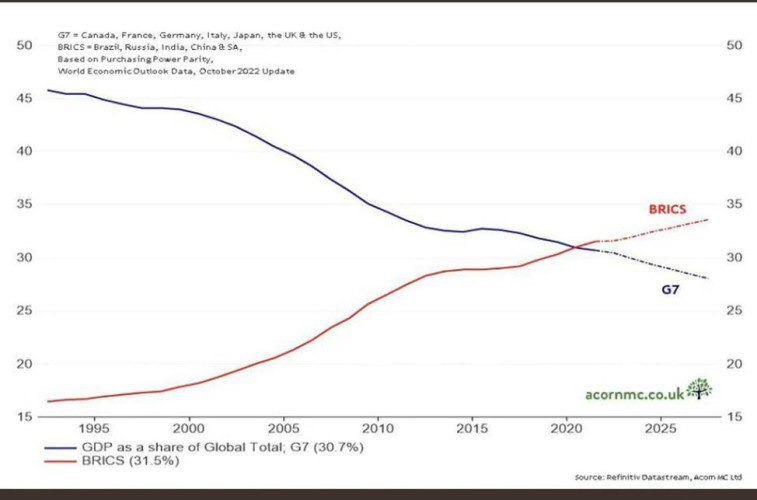

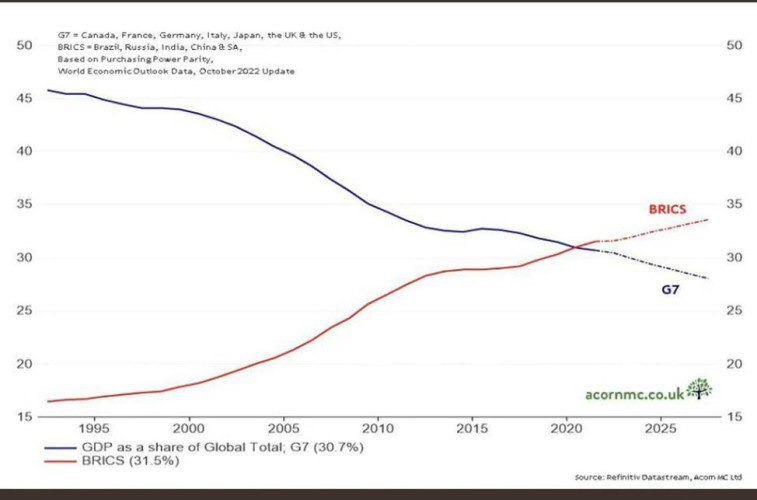

Actually, the support of the global dollar system costs the United States (and its closest allies) is very expensive and this price is a decrease in their share in the global economy. It is becoming like a baggage without a handle - it is difficult to carry but it is regretted to throw away.

Meantime, on foreign political arena we have not less interesting events. As we've said above, China is a major US rival on foreign arena now. Despite all its power (I mean China), previously it never has played top role in international policy. Yes, it is a member of Security Council, but it never made decisive steps on top political events. Now it has happened. As Reuters reports-

Iran and Saudi Arabia agreed on Friday (March 11) to re-establish relations after years of hostility that had threatened stability and security in the Gulf and helped fuel conflicts in the Middle East from Yemen to Syria. The deal, brokered by China, was announced after four days of previously undisclosed talks in Beijing between top security officials from the two rival Middle East powers.

The US always wants to put Iran in a limits of so-called "Nuclear deal". While S. Arabia always was US puppet, or at least, followed in the US political stream. But recent demarche, represented by China, Iran and especially S. Arabia clearly has shown to Global political society and establishment that now nobody is interested with opinion of

Knowing that, the US revenge to Russia was in ICC act, mentioned above. I would ask you - who in clear mind will start legal claim against the member of Security Council and one of the creators of UN? It seems like some intellectual impairment. What is it? So, they would like to say that when V. Putin (or any his follower) flies to some international meeting, he will be arrested? The real sense stands in different moment. In fact, ICC structure is the same product of the global world order (major rules, how World will be managed and functioned), formed after WW II on Yalta conference, by Roosevelt, Churchill and Stalin. As well as UN, Security Council and, yes, B-W system. The ICC act tells that "Yalta" order is not working anymore and has to be replaced by the new order. And will be replaced. In fact, ICC, which actually the part of "Yalta" system, now makes a decision against this system.

With this ICC act West shows that it doesn't treat Russia as independent sovereign country in supposed "new" Global order that they are trying to build. It is needless to tell that situation will be similar to any other member of Security Council or any other country by simple West decision. Such kind of decision could be made only in a moment of absolute despair, because it is no return until new "Yalta" will be adopted. And it is rather dangerous.

ICC decision just shows that B-W system is breathing hard and world is coming to multi currency zones and spheres of power and interests. Top political powers have to struggle for them because nobody will share with you for free. And China soon will go to war for its own sphere of interest in Asia Pacific region. The AUKUS task is to prevent it. Otherwise it will loose the global domination in industry and manufacturing sector. China will start struggle against AUKUS, and hot stage is not excluded. With new global order coming the US not give Taiwan to China at no cost. AUKUS will have to resolve two problems - isolate China from global markets and control China export to the world. The way how they wil try to do this is isolate China access to world ocean by creating of Asia Pacific outpost by the line of S. Korea, Japan, Taiwan, Burma and Laos (to control access to Cambodia and Indian ocean) where recently color revolutions and coups have been initiated). China "arguable" islands in South China sea probably will become starting point of conflict. AUKUS vitally needs they to be destroyed.

This is the 2nd reason why Xi is coming to Moscow - China role is changing. Now it is not the " wise monkey on a tree" anymore who is watching how "Two tigers" fight. Now, China is becoming one of the Tigers instead of Russia. Ukrainian conflict soon will be over, because its "damage-to-Russia" resource is exhausting, while the eye of the Sauron turns East. This process will accelerate if AUKUS will take revanche inside the US over Liberals. China, in turn, has no experience of big war conflicts and it needs to get reliable background, represented by Russia. China has to play with the 1st number, but it is not ready. Mr. Xi has got the domestic support as it was re-elected on 3rd term in a row.

So, we stand at the edge of fighting for areas of interest among major players. ICC is a baby of the Monocentric world model where the US could make a decision to arrest and national leader. Obviously it doesn't fit to many countries. It means that this monocentric model that has borne ICC should be destroyed, with coming of a new global rules and order, the "New Yalta". Now it is absolutely can't be avoided.

With all these thoughts in mind, just imagine gold coming performance. This will the only real asset. Don't be upset that it seems it is too expensive due to rally last week. It is still cheap and rally is just started. Of course, those who have followed us last year and bought around 1600-1700$ are well done, but it is the reason to be upset. For investing purposes - gold is still cheap. The major demand is just appeared.

Last edited: