Sive Morten

Special Consultant to the FPA

- Messages

- 18,624

Fundamentals

If we take a look at gold performance this week, it could seem that nothing was going on around. Price action was in tight range without any sharp moves. In reality a lot of things have happened, but investors are too busy with gambling on next Fed step and repeat "last rate hike" and "turns to cut" like mantras don't signing anything round. Yesterday I suppose our analysis of the US Banking crisis and anticipated Fed policy was detailed enough. No doubts, it will make impact on gold market as well, but this impact mostly will be the same as on EUR. Today we focus on some other things, that are balanced between economy and politics and wil be vital for gold market in perspective of few months.

Market overview

Gold firmed on Monday, helped by a weaker dollar, although prices were stuck in a tight range as traders turned their attention to this week's economic data that may influence the U.S. Federal Reserve's next policy decision. Prices turned positive after the Dallas Fed's report showed manufacturing activity in Texas contracted in April, highlighting the economic toll of the Fed's rate tightening cycle.

Gold dropped below $2,000 last week on Fed officials' hawkish remarks and after surveys showed the U.S. and euro zone business activity gathered pace in April.

Markets now expect a 91% chance of a 25-basis-point Fed hike at its May 2 to 3 policy meeting, according to the CME FedWatch tool.

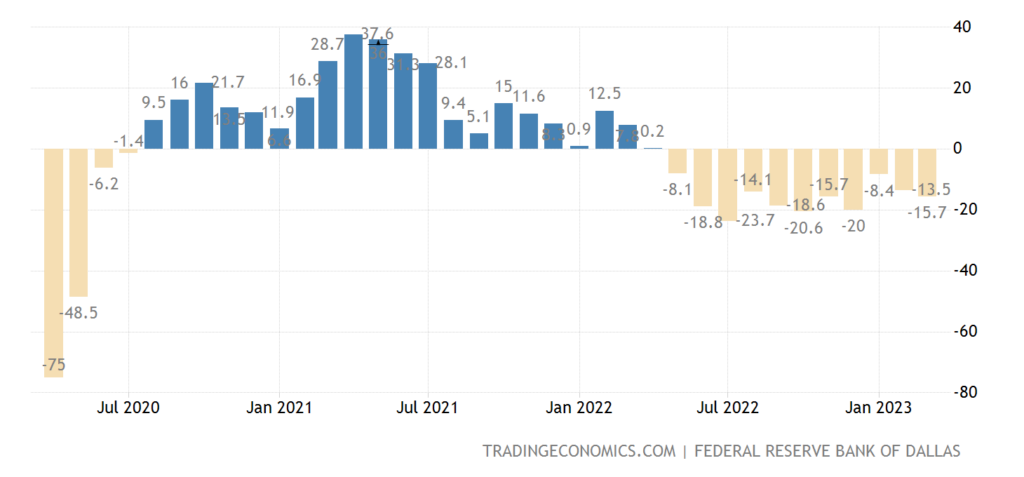

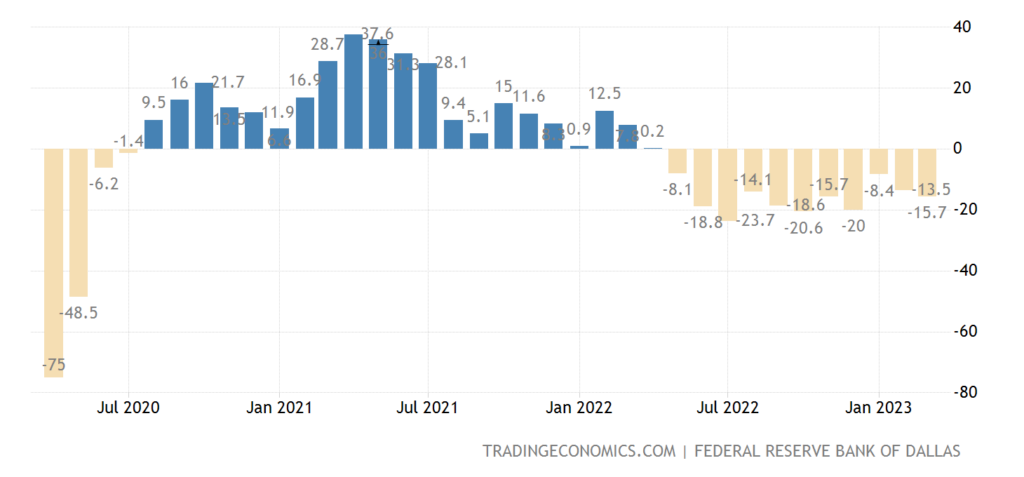

A weak U.S. consumer confidence report and lacklustre manufacturing data fanned fears of economic slowdown, lowering the bets for a rate hike next week. A weak U.S. consumer confidence report and lacklustre manufacturing data fanned fears of economic slowdown, lowering the bets for a rate hike next week. Yesterday we've talked mostly about PCE and GDP numbers but there was a lot of other interesting stuff, although it is not as popular. Just take a look at these numbers below:

Regional manufacturing and service indexes shows stable decrease, which explains drop of GDP and inventories. It confirms our suggestion that GDP is artificially overvalued and it should be lower than 1.1% while inflation is undervalued and it has to be higher. Taking in consideration that 70% of GDP is concentrated in service sector which now generates the highest inflation, GDP has to be "-6-8%" at least, while inflation should be closer to 9-10%. Still the absolute numbers could be "adjusted" but relative performance you can't hide, that's what we see on charts above.

On Wed First Republic Bank's shares hit a record low after a report said the U.S. government was unwilling to intervene in the rescue process for the troubled lender.

Gold reversed course and dropped on Thursday, as the dollar gained after weaker U.S. economic readings failed to upend expectations of another interest rate hike by the Federal Reserve next week amid stubborn inflation. Data showed the U.S. gross domestic product grew slower-than-expected last quarter, but markets focused on the above-forecast inflation number.

Also on the radar were deliberations surrounding the U.S. debt ceiling, lifting Treasury yields. Although higher interest rates work against gold as it does not provide any yield, they can work in bullion's favour because they raise the chance of another banking crisis, said independent analyst Ross Norman.

Gold bounced back on Friday on a dip in yields and renewed concerns over the U.S. banking turmoil, putting the safe haven on course for its second monthly rise even as steady U.S. inflation reinforced bets for an interest rate hike next week. The Federal Reserve issued a detailed and scathing assessment of its failure to identify problems and push for fixes at Silicon Valley Bank before the lender's collapse, promising tougher supervision and stricter rules. Benchmark yields fell after data showed the pace of overall inflation slowed in March and consumer spending was steady. But the data also indicated that the underlying price pressures remained strong, prompting traders to add to bets for a rate hike next week.

Elevated rates dull zero-yielding bullion's appeal.

In addition to the previous section, the Turkish state has started selling gold. Things are not very good in the Turkish economy, it is already clear that tying the Turkish economy to the EU economy does not lead to success anymore. And what to do in such a situation? Theoretically, to step up work on inclusion in the Eurasian Economic Union, but for this, Erdogan must first win the elections.

There are rumors that Saudi Arabia sells oil for yuan, which it converts into gold on the Shanghai International Gold Exchange (SGEI). This development would make sense as large parts of the world want de-dollarization, but the yuan is not suitable for use as a reserve currency. China has a closed capital account. ️Abandoning the dollar could be done by using the yuan as a trading currency and converting yuan earnings into gold on the SGEI. If the rumors turn out to be true, Saudi Arabia is buying 1kg bars as 12.5kg bars barely trade on the SGEI.

So the picture remains stable, the structural crisis continues, there are no deviations from the theoretical picture. Every week there are new negative data, and for the most part in new sectors. Accordingly, you can show those of them in which there was a deterioration a few weeks ago and say: "Well, look, the deterioration is over!" But this is the feature of the structural crisis that manifests itself in new places all the time!

J. BIDEN 2nd TERM RUN

At first glance - this is purely political event, what relation to gold market is has, or, actually to any market at all? Indeed, mostly it is political, but when any candidate starts the Presidents run, it has some program that has to assure voters that he is the best candidate. But what programme J. Biden has now? We would say that J. Biden's announcement that he is going to take part in President's run for the 2nd term is a major news of this week.

The point here is - for the first time, not just an abstract character (who may simply not be noticed during the election campaign), but the current president (that is, in fact, one of the leaders of the election race) does not have any economic action program. Well, that is, none at all.

Biden does not agree with the concept of "industrialization of AUKUS+" and this is understandable, since he represents the interests of multinational bankers, for whom this concept is unacceptable. Because it does not imply for them the "place under the Sun". But he does not offer any alternative concept, we have already written about this. Accordingly, there is no reason to prefer the policy of tighter interest rates policy to the one of lowering them or, say, the policy of "non-interference in the affairs of the economy."

Moreover, there is not even an understanding on what basis to negotiate with the Republicans in the House of Representatives in terms of overcoming the upper threshold of the national debt. Accordingly, there are no negotiations, there are only demands from the Biden administration that the ceil has to be raised. But Republicans will definitely not do this, as a result, expectations of default in the market are becoming more confident:

So, in the US, as we can see, the economic downturn continues and it is supported by the monetary authorities (the Fed and the Treasury) by reducing the money supply. That is, the fight against inflation continues. But Biden is entering the election campaign, and it is curious to stimulate a recession as a background of the one. Biden's rating is already shown an absolute minimum of 37%. In general, proceeding from this and realizing that there is no strategy anyway, we can count on the fact that by the summer the monetary authorities will begin to stimulate the economy a little ... with an increase in inflation, of course. However, this is not for sure, with the economic (as well as other) logic today, the US authorities are not doing very well.

Well, in conclusion of the American data, we note that the preliminary numbers of the GDP deflator for the first quarter was released. It turned out to be 4.9% with expectations of 4.7%, however, given that this is only the first estimate, it is too early to draw far-reaching conclusions here. Although, of course, 4.9% is certainly not,a 3.5% …

As you could see - politics shows tight relation to economy. As J. Biden soon will have to show something to the voters, all authorities should have to do maximum efforts to show something positive. They can't run into President's race on a back of crisis and high inflation. Most simple thing that they could do, and maybe the only thing that they could - is just give money to the people, which disguise all problems for awhile, at least until Nov 5, 2024. If this indeed will happen (it is not too long to wait, ~4-5 months), it will be great boost to Gold.

Global world fragmentation continues

Now we're talking not about speeches of leaders of opposite camps but on pure economical moments. If we take a look at global US Treasuries market fragmentation then we will see that the US has lost all foreign investors except EU.

China's share is steadily decreasing in the structure of foreign holders of treasuries – by half in 10-11 years with a decrease in the share from 26 to 13%. A more rapid and steady decline in China's share in treasuries began in 2018 at the time of the resumption of the trade war between China and the United States (then the United States began to "bring down" China's technological flagships, where Huawei got the most).

The next phase of accelerating China's isolation from American securities began in mid–2021 and continues to this day - the presence decreased by 3.7 p.p. Japan's participation in the structure of foreign holders of treasuries is decreasing from 22-23% in 2012 to 17% by January 2023.

The difference between Japan and China is that the decline in China's interest in American securities is due to political motives, while in Japan there are economic reasons due to the depletion of the current account surplus as the main resource for external investment. So, Japan will should gradually return back as soon as they resolve their inner economical problems.

Who replaces the two main holders of treasuries (China and Japan)? Key allies of the United States. The United Kingdom participated in the rescue operation of treasuries, which increased its presence from 2 to almost 9% and by 3 percentage points over the past 1.5 years, replacing Japan.

Australia and Canada have increased their share from 1.3 to 4.3% over 10 years and by 2.3 percentage points over the past 1.5 years, almost completely replacing other developing countries that are leaving the treasury.

The presence of the Eurozone has increased in 10 years from 10 to 18%, Which is very surprising, because just from Q3 2021, the Eurozone's trade balance collapsed into a deficit. even with the exhaustion of the resource of external investment, the Eurozone managed to concentrate everything possible to save the treasuries.

The eurozone and the Anglo–Saxon world have been the main actors in the operation to save treasuries over the past 10 years and especially over the past 1.5 years on the trajectory of a more stable separation of the world into spheres of influence – "World with the USA" and "World outside the USA".

The long-term trend of the dollar's decline in international reserves is undeniable, just like the dollar's decline in international trade settlements. Due to the development of alternative trade unions and clusters of the world economy, the importance of alternative currencies, primarily the yuan, will grow. It is necessary to understand and recognize the existing trends as irreversible, and the decline in the US share as inevitable.

But this does not mean the weakness of the United States, at least immediately, or even a decrease in the turnover of dollars in absolute values. In relative terms, yes, but the influence of the United States can and will remain significant within the formed clusters.

The share of key US allies in the structure of foreign holders of treasuries has grown from 52 to 66% over the past 10 years, with all the main growth occurring in the period from March 2018 to June 2022, when it increased from 55 to 66%.

There is a highly intensive and quite successful substitution of China, Russia, Turkey, and OPEC countries (a decrease in the share from 3.8 to 2.7% over 5 years due to the loss of Saudi Arabia's interest in treasuries). Brazil's share is decreasing from 5.6% to 3.3%. The geopolitical bitterness of the United States, which has entered a new round since 2018, is rather a meaningful strategy, where the American establishment understands the impossibility of controlling everyone at once.

If so, it is much more rational to fragment the global geopolitical landscape and prevent the assembly of a new geopolitical and economic structure led by China from being realized. There is an understanding that the United States is quite comfortable in its own eco-system of key allies, where high-strength technological, political, economic and financial cooperation takes place.

The United States does not rely on the control of Russia, Iran, Saudi Arabia and China and other obstinate countries, as it did 10-15 years ago, but concentrates on retaining key allies. It makes no sense anymore to maintain "warm" political relations outside your system. So you could "cut from the shoulder and shoot from the hip". But in your own eco-system there is quite harmonious and effective cooperation and development.

With this background - we see the US "AUKUS" project is becoming more evident. Now the idea of AUKUS and soon confrontation with China (suggested in ~ 2027) gradually is spreading in the US public media. The US is focusing on confrontation with China, loosing interest to Ukraine, as Zelensky campaign mostly is considered as lost.

The administration of US President Joe Biden is paying more and more attention to the potential conflict with China, forgetting about Ukraine, said American journalist, presenter of the Redacted News program Clayton Morris. So he commented on an article in Politico, according to which the White House fears the consequences of the failure of the spring counter-offensive of the Armed Forces of Ukraine, as it may "not meet the expectations" of its allies.

Morris expressed the opinion that the shift of Washington's interests towards confrontation with China is indicated, in particular, by the exercises of American troops held in the Philippines (we have talked about this last week) — the largest maneuvers aimed at simulating a clash with Beijing. With some irony, the columnist mentioned that members of the House of Representatives and experts conducted a kind of card game simulating military operations in the Taiwan region as part of a strategic study. He also noted that a potential conflict is planned by American officials for 2027.

Here is nothing to comment. Tensions are rising in global politics, and new ones appear every day. With such a periods, gold always finds its buyer.

Instead of conclusion today guys, I put article by Ruchir Sharma, chair of Rockefeller International (!) - What strong gold says about the weak dollar. It is small to read but he focus on major things, showing new picture of the world. If you pay attention to who is he, it becomes important, as this opinion is expressed at some political elite level.

With all these stuff above, it is difficult to suggest any more or less feasible gold plunge any time soon. Our strategy of accumulation continues.

Technicals

Monthly

Obviously this week we have no changes on monthly and weekly charts, as gold was showing almost no activity. Technical performance here is absolutely reasonable - price is limited by monthly overbought and YPR1, and gold needs some relief, that we see now. Major trend remains bullish. April is closed, and we've got some kind of "shooting star" on top, that keeps door open for moderate downside retracement. But until gold holds above YPP - bullish context remains intact:

Weekly

The same stuff on weekly - once overbought and COP target have been touched, the pullback has started. But, it is very limited, price is mostly coiling near the top that confirms bullish sentiment. This is how it should be, when market hits just COP target. With the environment that we have now inside the US and on global political arena - it is difficult to relax and let gold to fall.

Daily

Even on the daily chart we have no changes at all. Market stands in a tight range and as we've said on Friday - keep both doors open. Sideways action with bearish MACD could be interpreted as bullish dynamic pressure, while inability to start upside action is a point in favor of the bears. Still, taking in consideration the monthy picture, downside continuation has more chances. Weekly and monthly overbought suggest deeper reaction, so, it is too early to cancel scenario with possible action to 1950$ support area:

Intraday

Besides, our butterfly pattern is still valid and on Friday we even have got small grabber. So if you have bearish position with this butterfly pattern - it is possible to keep it. For new long positions is not time yet, as we need to get clear bullish signs and butterfly erasing action.

If we take a look at gold performance this week, it could seem that nothing was going on around. Price action was in tight range without any sharp moves. In reality a lot of things have happened, but investors are too busy with gambling on next Fed step and repeat "last rate hike" and "turns to cut" like mantras don't signing anything round. Yesterday I suppose our analysis of the US Banking crisis and anticipated Fed policy was detailed enough. No doubts, it will make impact on gold market as well, but this impact mostly will be the same as on EUR. Today we focus on some other things, that are balanced between economy and politics and wil be vital for gold market in perspective of few months.

Market overview

Gold firmed on Monday, helped by a weaker dollar, although prices were stuck in a tight range as traders turned their attention to this week's economic data that may influence the U.S. Federal Reserve's next policy decision. Prices turned positive after the Dallas Fed's report showed manufacturing activity in Texas contracted in April, highlighting the economic toll of the Fed's rate tightening cycle.

Gold dropped below $2,000 last week on Fed officials' hawkish remarks and after surveys showed the U.S. and euro zone business activity gathered pace in April.

Markets now expect a 91% chance of a 25-basis-point Fed hike at its May 2 to 3 policy meeting, according to the CME FedWatch tool.

"While it will take a fresh catalyst to see the price return above $2,000 an ounce, gold is unlikely to fall below $1,950 any time soon," Kinesis Money analyst Rupert Rowling wrote in a note.

A weak U.S. consumer confidence report and lacklustre manufacturing data fanned fears of economic slowdown, lowering the bets for a rate hike next week. A weak U.S. consumer confidence report and lacklustre manufacturing data fanned fears of economic slowdown, lowering the bets for a rate hike next week. Yesterday we've talked mostly about PCE and GDP numbers but there was a lot of other interesting stuff, although it is not as popular. Just take a look at these numbers below:

Regional manufacturing and service indexes shows stable decrease, which explains drop of GDP and inventories. It confirms our suggestion that GDP is artificially overvalued and it should be lower than 1.1% while inflation is undervalued and it has to be higher. Taking in consideration that 70% of GDP is concentrated in service sector which now generates the highest inflation, GDP has to be "-6-8%" at least, while inflation should be closer to 9-10%. Still the absolute numbers could be "adjusted" but relative performance you can't hide, that's what we see on charts above.

"The Fed would do its best to try and hold rates higher in order to quell inflation but that likely means that it might be a constraint on the economy growing as quickly," said Everett Millman, chief market analyst at Gainesville Coins. No matter what decision they have to make, it's probably going to result in some type of stress, and that looming uncertainty is certainly what gold is going to be sensitive to."

On Wed First Republic Bank's shares hit a record low after a report said the U.S. government was unwilling to intervene in the rescue process for the troubled lender.

"That was the catalyst for gold prices to revisit slightly higher levels," said Daniel Ghali, commodity strategist at TD Securities. But overall, trend-following algorithms have effectively reached their maximum long positions, Ghali added. Resurgent fears that there's always more than one cockroach when it comes to the U.S. regional banking crisis," Ghalli said.

"Retail, discretionary traders and the like remain very underexposed, a source of dry powder, especially if the market ramps up rate cut expectations," said Paul Wong, market strategist at Sprott Asset Management.

Gold reversed course and dropped on Thursday, as the dollar gained after weaker U.S. economic readings failed to upend expectations of another interest rate hike by the Federal Reserve next week amid stubborn inflation. Data showed the U.S. gross domestic product grew slower-than-expected last quarter, but markets focused on the above-forecast inflation number.

Also on the radar were deliberations surrounding the U.S. debt ceiling, lifting Treasury yields. Although higher interest rates work against gold as it does not provide any yield, they can work in bullion's favour because they raise the chance of another banking crisis, said independent analyst Ross Norman.

Gold bounced back on Friday on a dip in yields and renewed concerns over the U.S. banking turmoil, putting the safe haven on course for its second monthly rise even as steady U.S. inflation reinforced bets for an interest rate hike next week. The Federal Reserve issued a detailed and scathing assessment of its failure to identify problems and push for fixes at Silicon Valley Bank before the lender's collapse, promising tougher supervision and stricter rules. Benchmark yields fell after data showed the pace of overall inflation slowed in March and consumer spending was steady. But the data also indicated that the underlying price pressures remained strong, prompting traders to add to bets for a rate hike next week.

The Fed's report culminated around the same time as a decline in 10-year Treasury yields, turning gold positive, "but everything hinges on what (Fed Chair Jerome) Powell's going to say next week", said Daniel Pavilonis, senior market strategist at RJO Futures.

Elevated rates dull zero-yielding bullion's appeal.

"Gold seems likely to remain in its tight recent range for now, though a weekly close under $1,965 could trigger further losses, while bulls would welcome a push back above $2,000," said Tai Wong, an independent metals trader based in New York, adding it remains in question whether the Fed would signal a pause.

In addition to the previous section, the Turkish state has started selling gold. Things are not very good in the Turkish economy, it is already clear that tying the Turkish economy to the EU economy does not lead to success anymore. And what to do in such a situation? Theoretically, to step up work on inclusion in the Eurasian Economic Union, but for this, Erdogan must first win the elections.

There are rumors that Saudi Arabia sells oil for yuan, which it converts into gold on the Shanghai International Gold Exchange (SGEI). This development would make sense as large parts of the world want de-dollarization, but the yuan is not suitable for use as a reserve currency. China has a closed capital account. ️Abandoning the dollar could be done by using the yuan as a trading currency and converting yuan earnings into gold on the SGEI. If the rumors turn out to be true, Saudi Arabia is buying 1kg bars as 12.5kg bars barely trade on the SGEI.

So the picture remains stable, the structural crisis continues, there are no deviations from the theoretical picture. Every week there are new negative data, and for the most part in new sectors. Accordingly, you can show those of them in which there was a deterioration a few weeks ago and say: "Well, look, the deterioration is over!" But this is the feature of the structural crisis that manifests itself in new places all the time!

J. BIDEN 2nd TERM RUN

At first glance - this is purely political event, what relation to gold market is has, or, actually to any market at all? Indeed, mostly it is political, but when any candidate starts the Presidents run, it has some program that has to assure voters that he is the best candidate. But what programme J. Biden has now? We would say that J. Biden's announcement that he is going to take part in President's run for the 2nd term is a major news of this week.

The point here is - for the first time, not just an abstract character (who may simply not be noticed during the election campaign), but the current president (that is, in fact, one of the leaders of the election race) does not have any economic action program. Well, that is, none at all.

Biden does not agree with the concept of "industrialization of AUKUS+" and this is understandable, since he represents the interests of multinational bankers, for whom this concept is unacceptable. Because it does not imply for them the "place under the Sun". But he does not offer any alternative concept, we have already written about this. Accordingly, there is no reason to prefer the policy of tighter interest rates policy to the one of lowering them or, say, the policy of "non-interference in the affairs of the economy."

Moreover, there is not even an understanding on what basis to negotiate with the Republicans in the House of Representatives in terms of overcoming the upper threshold of the national debt. Accordingly, there are no negotiations, there are only demands from the Biden administration that the ceil has to be raised. But Republicans will definitely not do this, as a result, expectations of default in the market are becoming more confident:

So, in the US, as we can see, the economic downturn continues and it is supported by the monetary authorities (the Fed and the Treasury) by reducing the money supply. That is, the fight against inflation continues. But Biden is entering the election campaign, and it is curious to stimulate a recession as a background of the one. Biden's rating is already shown an absolute minimum of 37%. In general, proceeding from this and realizing that there is no strategy anyway, we can count on the fact that by the summer the monetary authorities will begin to stimulate the economy a little ... with an increase in inflation, of course. However, this is not for sure, with the economic (as well as other) logic today, the US authorities are not doing very well.

Well, in conclusion of the American data, we note that the preliminary numbers of the GDP deflator for the first quarter was released. It turned out to be 4.9% with expectations of 4.7%, however, given that this is only the first estimate, it is too early to draw far-reaching conclusions here. Although, of course, 4.9% is certainly not,a 3.5% …

As you could see - politics shows tight relation to economy. As J. Biden soon will have to show something to the voters, all authorities should have to do maximum efforts to show something positive. They can't run into President's race on a back of crisis and high inflation. Most simple thing that they could do, and maybe the only thing that they could - is just give money to the people, which disguise all problems for awhile, at least until Nov 5, 2024. If this indeed will happen (it is not too long to wait, ~4-5 months), it will be great boost to Gold.

Global world fragmentation continues

Now we're talking not about speeches of leaders of opposite camps but on pure economical moments. If we take a look at global US Treasuries market fragmentation then we will see that the US has lost all foreign investors except EU.

China's share is steadily decreasing in the structure of foreign holders of treasuries – by half in 10-11 years with a decrease in the share from 26 to 13%. A more rapid and steady decline in China's share in treasuries began in 2018 at the time of the resumption of the trade war between China and the United States (then the United States began to "bring down" China's technological flagships, where Huawei got the most).

The next phase of accelerating China's isolation from American securities began in mid–2021 and continues to this day - the presence decreased by 3.7 p.p. Japan's participation in the structure of foreign holders of treasuries is decreasing from 22-23% in 2012 to 17% by January 2023.

The difference between Japan and China is that the decline in China's interest in American securities is due to political motives, while in Japan there are economic reasons due to the depletion of the current account surplus as the main resource for external investment. So, Japan will should gradually return back as soon as they resolve their inner economical problems.

Who replaces the two main holders of treasuries (China and Japan)? Key allies of the United States. The United Kingdom participated in the rescue operation of treasuries, which increased its presence from 2 to almost 9% and by 3 percentage points over the past 1.5 years, replacing Japan.

Australia and Canada have increased their share from 1.3 to 4.3% over 10 years and by 2.3 percentage points over the past 1.5 years, almost completely replacing other developing countries that are leaving the treasury.

The presence of the Eurozone has increased in 10 years from 10 to 18%, Which is very surprising, because just from Q3 2021, the Eurozone's trade balance collapsed into a deficit. even with the exhaustion of the resource of external investment, the Eurozone managed to concentrate everything possible to save the treasuries.

The eurozone and the Anglo–Saxon world have been the main actors in the operation to save treasuries over the past 10 years and especially over the past 1.5 years on the trajectory of a more stable separation of the world into spheres of influence – "World with the USA" and "World outside the USA".

The long-term trend of the dollar's decline in international reserves is undeniable, just like the dollar's decline in international trade settlements. Due to the development of alternative trade unions and clusters of the world economy, the importance of alternative currencies, primarily the yuan, will grow. It is necessary to understand and recognize the existing trends as irreversible, and the decline in the US share as inevitable.

But this does not mean the weakness of the United States, at least immediately, or even a decrease in the turnover of dollars in absolute values. In relative terms, yes, but the influence of the United States can and will remain significant within the formed clusters.

The share of key US allies in the structure of foreign holders of treasuries has grown from 52 to 66% over the past 10 years, with all the main growth occurring in the period from March 2018 to June 2022, when it increased from 55 to 66%.

There is a highly intensive and quite successful substitution of China, Russia, Turkey, and OPEC countries (a decrease in the share from 3.8 to 2.7% over 5 years due to the loss of Saudi Arabia's interest in treasuries). Brazil's share is decreasing from 5.6% to 3.3%. The geopolitical bitterness of the United States, which has entered a new round since 2018, is rather a meaningful strategy, where the American establishment understands the impossibility of controlling everyone at once.

If so, it is much more rational to fragment the global geopolitical landscape and prevent the assembly of a new geopolitical and economic structure led by China from being realized. There is an understanding that the United States is quite comfortable in its own eco-system of key allies, where high-strength technological, political, economic and financial cooperation takes place.

The United States does not rely on the control of Russia, Iran, Saudi Arabia and China and other obstinate countries, as it did 10-15 years ago, but concentrates on retaining key allies. It makes no sense anymore to maintain "warm" political relations outside your system. So you could "cut from the shoulder and shoot from the hip". But in your own eco-system there is quite harmonious and effective cooperation and development.

With this background - we see the US "AUKUS" project is becoming more evident. Now the idea of AUKUS and soon confrontation with China (suggested in ~ 2027) gradually is spreading in the US public media. The US is focusing on confrontation with China, loosing interest to Ukraine, as Zelensky campaign mostly is considered as lost.

The administration of US President Joe Biden is paying more and more attention to the potential conflict with China, forgetting about Ukraine, said American journalist, presenter of the Redacted News program Clayton Morris. So he commented on an article in Politico, according to which the White House fears the consequences of the failure of the spring counter-offensive of the Armed Forces of Ukraine, as it may "not meet the expectations" of its allies.

"We (Americans. — Ed.) finished here. Zelensky is everything. We're starting a new page and focusing on China — that's the message," Morris said.

Morris expressed the opinion that the shift of Washington's interests towards confrontation with China is indicated, in particular, by the exercises of American troops held in the Philippines (we have talked about this last week) — the largest maneuvers aimed at simulating a clash with Beijing. With some irony, the columnist mentioned that members of the House of Representatives and experts conducted a kind of card game simulating military operations in the Taiwan region as part of a strategic study. He also noted that a potential conflict is planned by American officials for 2027.

Here is nothing to comment. Tensions are rising in global politics, and new ones appear every day. With such a periods, gold always finds its buyer.

Instead of conclusion today guys, I put article by Ruchir Sharma, chair of Rockefeller International (!) - What strong gold says about the weak dollar. It is small to read but he focus on major things, showing new picture of the world. If you pay attention to who is he, it becomes important, as this opinion is expressed at some political elite level.

With all these stuff above, it is difficult to suggest any more or less feasible gold plunge any time soon. Our strategy of accumulation continues.

Technicals

Monthly

Obviously this week we have no changes on monthly and weekly charts, as gold was showing almost no activity. Technical performance here is absolutely reasonable - price is limited by monthly overbought and YPR1, and gold needs some relief, that we see now. Major trend remains bullish. April is closed, and we've got some kind of "shooting star" on top, that keeps door open for moderate downside retracement. But until gold holds above YPP - bullish context remains intact:

Weekly

The same stuff on weekly - once overbought and COP target have been touched, the pullback has started. But, it is very limited, price is mostly coiling near the top that confirms bullish sentiment. This is how it should be, when market hits just COP target. With the environment that we have now inside the US and on global political arena - it is difficult to relax and let gold to fall.

Daily

Even on the daily chart we have no changes at all. Market stands in a tight range and as we've said on Friday - keep both doors open. Sideways action with bearish MACD could be interpreted as bullish dynamic pressure, while inability to start upside action is a point in favor of the bears. Still, taking in consideration the monthy picture, downside continuation has more chances. Weekly and monthly overbought suggest deeper reaction, so, it is too early to cancel scenario with possible action to 1950$ support area:

Intraday

Besides, our butterfly pattern is still valid and on Friday we even have got small grabber. So if you have bearish position with this butterfly pattern - it is possible to keep it. For new long positions is not time yet, as we need to get clear bullish signs and butterfly erasing action.