Sive Morten

Special Consultant to the FPA

- Messages

- 18,664

Fundamentals

Gold market mostly was driven by the same factors through the week, but due to specific of yellow metal, its special safe-haven feature, it reacts differently, compares to FX market and stocks. Yesterday, in our FX report we mostly were focused on recent Fed statement and come to conclusion that the Fed and J. Powell now stand at the edge, as they have reached the limit of their mandate on decision making. Any other step, either dovish or hawkish have to be agreed in White House. Because whatever next step will be done by the Fed - it will trigger serious structural shifts in the US economy, or maybe even in a whole western economy. So we've explained why this view has reasons to exist.

Today we focus on other issues - briefly consider the way of structural crisis, and take a look at the debt ceil issue. You can't read it in public big media resources, but banking crisis and debt ceil saga might be two sides of the same medal. To understand it we have to climb on higher level - from narrow purely inner US vision of the problem to global financial system area. And a lot of new ideas immediately appear. Of course, this is too thin substance to talk about it because we know too little. But, we do not exclude scenario when banking crisis is the preparation to controlled default that could help US to re-start its economy and throw away the debt burden that it has. How? You'll see below.

STRUCTURAL CRISIS

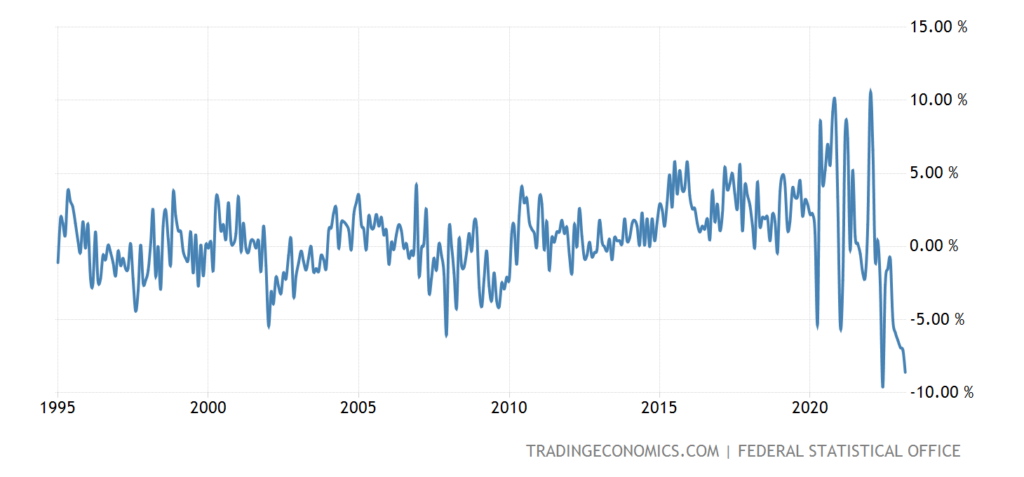

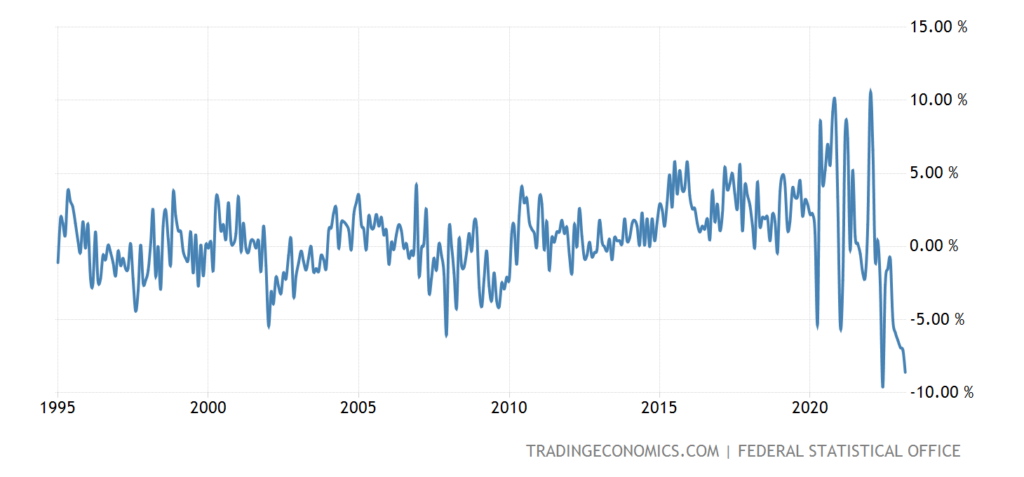

To keep it short we will not start showing you again the same charts, showing decreasing of major data in different countries. Here is enough to mention few "fresh" statistics and acknowledge that mostly it goes smooth as it should. Because the feature of the structural crisis is gradual and slow progress. Usually it is not accompanied with big drop of any kind in major statistics, but shows slow but direct decrease. Still, in some data we have strong outbreaks, that are needed to be explained. For example - German manufacturing orders have fallen by the most since the pandemic, as the manufacturing sector continues to perform worse than other parts of Europe's largest economy, the risk of a recession rises. ️March orders fell 10.7%, while economists had expected a fall of 2.3% - 5 times difference, is it too much? On annual basis orders has fell for 11% and are falling 13th month in a row.

The same is with Germany Retail Sales - they are even worse than on average in EU. Bottom since 1994, -10.3% YoY.

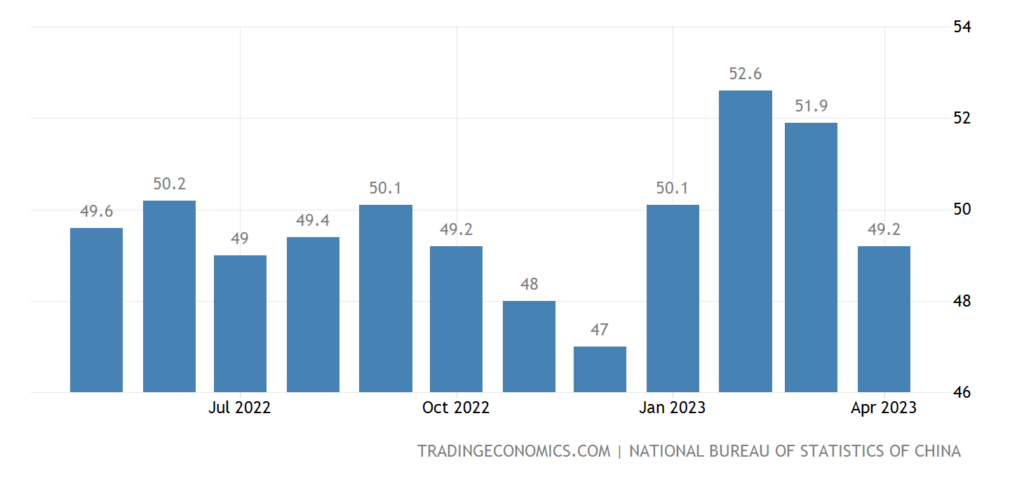

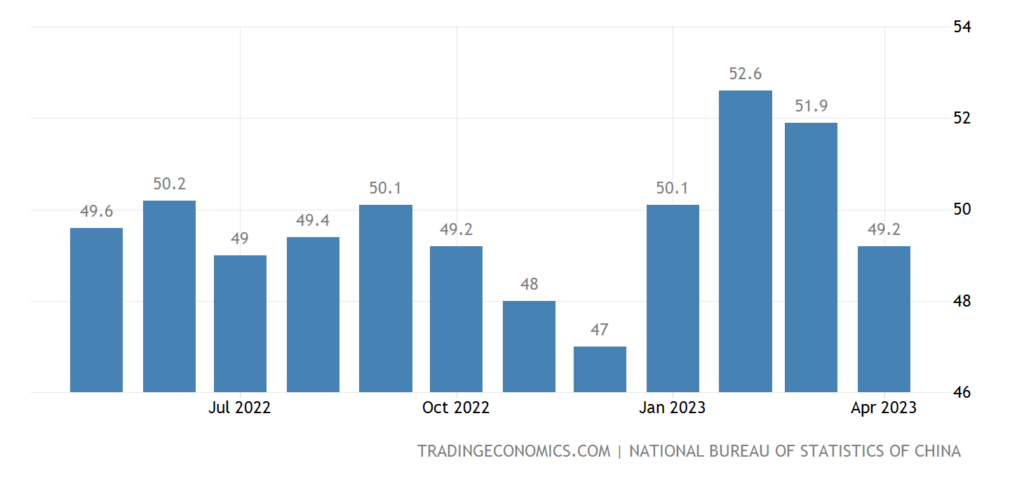

China NBS Manufacturing PMI has returned to the recession zone (49.2), it has been at the bottom for 4 months. It was big hopes for rebound after Covid limitations, but it seems that not everything is good. Next week a raft of Chinese data will likely offer a reality check on March's upside surprises. April trade figures on Tuesday are likely to show a cooling of March's export surge. The services component of the price data can gauge demand, but consumer and producer price data broadly paint a picture of deflation. April inflation data is out Thursday.

The United Nations food agency's world price index rose in April for the first time in a year. The Food and Agriculture Organization's (FAO) price index, which tracks the most globally traded food commodities, averaged 127.2 points last month against 126.5 for March, the agency said on Friday. The March reading was originally given as 126.9. The sugar price index surged 17.6% from March, hitting its highest level since October 2011.

South Korea's exports fell for a seventh straight month in April for their longest losing streak in three years, driven by an extended slump in sales to China and suggesting persistent pressure on the economy from frail global demand. The downturn comes despite the reopening of the Chinese economy - a major market for South Korean goods and especially for chips - in December, and raises the challenge for policymakers as they push for a robust post-COVID revival. Overseas sales by Asia's fourth-largest economy fell 14.2% year-on-year. It was the worst decline in three months, and reinforced the recent signs of a domestic economy struggling to fire on all cylinders in the wake of slowing global growth.

In US economy gives the signs of loosing momentum across the board - PMI's, Manufacturing, consumption of electricity and diesel etc. US factory orders show first annual decline since December 2020.

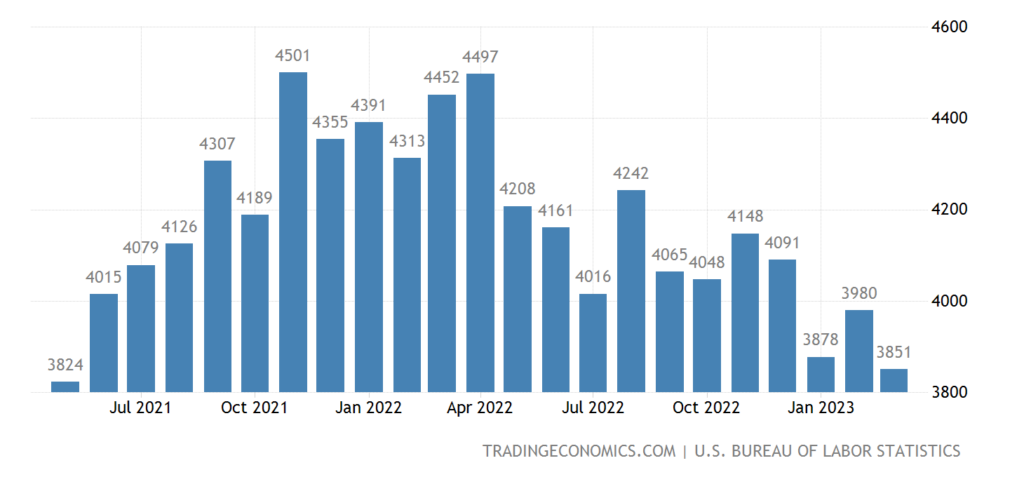

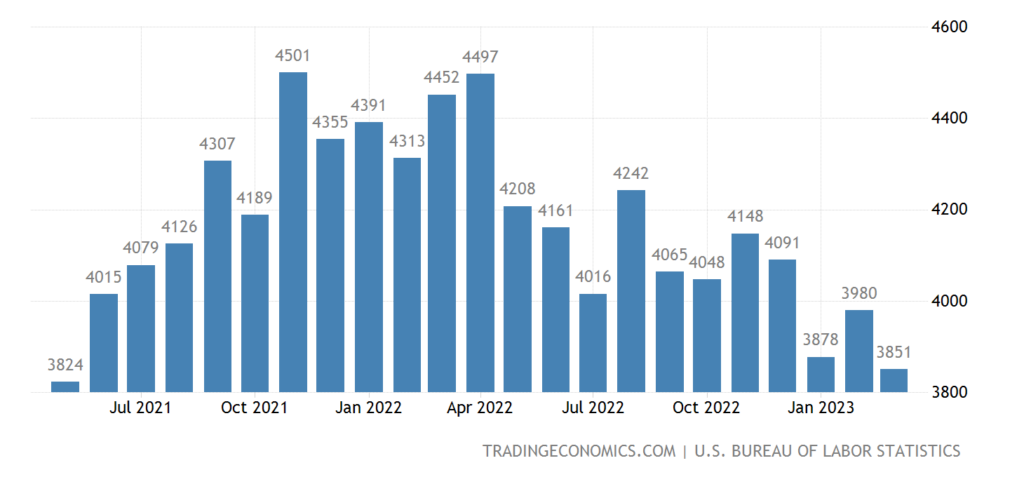

Job market finally start showing reaction on economy slowdown. Everything has started from JOLTS Report, showing that vacancies have dropped around 200K in March. And followed by inflation data, as of GDP deflator and Labour cost. Even recent NFP data shows growth of hourly earnings above expectations.

Vacancies:

Maersk, a leader in global container shipping, reports a 56% fall in Q1 2023 profit due to a slowdown in global trade - the company's volumes decreased by 9.4%. The company is signaling weaker results through the end of 2023 as global traffic volumes could fall by 2.5% through the year as demand wanes and freight rates fall.

Together with the rising interest rates, it could trigger the chain reaction. Perhaps one of the quite obvious from the point of view of common sense, but for some "unexpected" consequences of the growth of rates will be the collapse of planned unprofitable activities. For example, if Amazon earns on cloud services, and e-commerce brings nothing, then it is reduced. Because at zero rates, it was possible to play it, but with a cost of capital of 5-10%, it somehow doesn’t feel like it.

The same will be true for other segments: "sharing economy", meme companies, stupid ESG activity, remaining unicorns, "subsidy kings", etc.

A year and a half ago, it was said that the economy would not be able to sustain the Fed's 3% rate. Actually, this is true, but it was necessary to clarify what kind of economy. The unicorns are really dead. Now weak banks and parties with zero margins are dying. Somewhere close to the collapse in real estate - maybe the Fed's rate of 6-7% for them milestone. This, in turn, triggers another spiral of economy contraction.

In general, it is possible to make a diagnosis, the industry of the whole world is in a steady decline. If we also take into account that industry experts usually tend to look at the situation in their industry from an optimistic side, the picture becomes even more sad. Judging by the figures, the decline in the industrial sector in the global economy has accelerated. This somewhat contradicts the structural crisis model (as we've said above), but perhaps it's not about the economy at all. If the monetary authorities in the main Western countries (and their policy was agreed through the IMF and other Bretton Woods institutions) believed that the deterioration was temporary, then they could deliberately overstate the indicators so as not to frighten ordinary people and entrepreneurs. But as the discrepancies accumulate, they have to be recognized, which requires showing slightly worse figures. Therefore, it will not be argued that the situation is rapidly deteriorating. We will check this in nearest few months. If smooth deterioration continues - then we're right on our suggestion.

DEBT CEIL

In general, if you know nothing about this issue, you'd better start with Fathom consulting article, showing major well-known points around it - spread of the bond yields before and after X-day, Credit Default Spread, MOVE volatility etc. But we focus on few new issues and other moments that are not widely covered in big media. Everything has started from J. Yellen speech that the US could default by June 1:

Now discussion gradually shifts from "if" default happens to "when" it could happen. US Treasury is loosing safety margin fast. And with any new bank crash they have to add more. For the truth sake, the tax revenues have increased in recent week, but anyway, major consensus stands that X-day is around June-mid July. They could apply emergency tools and temporal debt ceil by president J. Biden initiative ( Invoke the 14th Amendment to the U.S. Constitution to ensure the United States can continue to pay its bills.) but anyway they could last until September at max. And that would almost certainly lead to prolonged legal wrangling, which could unsettle financial markets. White House already has released the scenario of debt default.

Then everything was going even more interesting. Now we need to take a look at US Bonds auctions results. Usually they come weekly or bi-weekly depending on maturity. Auction on 04/27, before Yellen said about default on 1 June, maturing on 05/30 and we see a yield of 3.905%. Auction for Treasuries maturing 06/06 (5 days after possible default) yields 5.964% and is 0.714% higher than the Fed rate.

Finally, and is most interesting - auction for Treasuries maturing 05.07 (one month and 4 days after the default) yield 5.547%. Apparently, the probability is not very high that they will be settled in a month, since the yield is still higher than for the placement, which took place on 27.04. The auctions of longer ones simply did not take place (!!!). You can see for yourself - they were announced, but there are no results on them. It means that US Treasury primary dealers (big banks) suggest that debt ceil crisis will not be resolved in 1-2 weeks after X-day. It will last for some time. Second - they have uncertainty about the term, suggesting that it could be even for few months. Otherwise how we could explain failure of auctions for long-term bonds?

My suspicion that the core is not in confrontation of political elites inside the US, or at least it is not the major background. The bets are significantly higher. Survival of global domination and strategical control over global economy, i.e. world. Here is few facts that we could consider.

As we've said yesterday, the major impact of high rates and potential debt default takes financial sector, not the real economy that high rates are yet to reach.

The real sector did not feel this until the rates rose for it, and this is happening quite slowly.

We often talk about the United States, but there is a eurozone where the situation is even worse because of internal imbalances between countries. And they have similar problems. Only inflation is higher and they cannot raise the rate so quickly, which destroys the demand for debt in the economy. Why did they blow up the Northern Streams? To raise energy prices, weaken European industry and disperse the energy component of inflation? For what? Note that this has affected not only Europe, but also Japan, and the whole world because of the jump in energy prices.

But, why, instead of issuing licenses for oil production in the United States, they drain the PSR, realizing that it is finite and it will need to be replenished? If we postulate that the goal is to weaken or de-expose competitors and this goal is successfully implemented, then we need to make sure that the competitor has problems for a long time. The Great European Depression. And this can only be done by destroying its superstructure in the form of the financial sector. So maybe that's the goal? Supposedly the vital point is the Eurodollar system. It can be destroyed by a liquidity crisis. The background is prepared with a high rate. How many commercial mortgages in the United States need to be refinanced in the next three years? 5 trillion? The eurodollar system is many times larger than the American one and the debt there is more diverse. Now a lot of talks about ECB tries outhawk the Fed, but in reality this is the same system, controlled in Washington.

Second, as we've said, debt crisis might be the tool in the hands of political elites to return strategical control over the global system that now starts slipping through the US fingers. But, to achieve this, this event has to be the scale of 09/11. Otherwise, nobody runs "back into USD quality". And here is the question: can a managed default, with all the possible consequences attached to it, become such an occasion? And the second one - who could voice this idea of a global default and convey it to the right circles so that it becomes a reality?

There are not so many such people left in world politics. But this, two possible candidates for a similar role met in Berlin. I mean Barack Obama and Angela Merkel. We could make assumptions, that among other things, Merkel could be offered the role of a person who is able to prevent the world miserable. Four hours of negotiation over a small piece of fish just because they haven't seen each other for a long time? Of course not. Undoubtedly, the issue of global default and a way out of today's impasse was discussed. Controlled default could resolve all US problems - in one moment you can write off debts, support the falling American system of power, re-emphasize and continue this line, which is familiar to them and even to make money on it. Another confirmation of Obama person for this mission is recent J. Biden interview, where he urged Not To Let Obama Win Election

But the scenario could be, and how the US will coupe the problem of global domination loss with managed default? Hm, let's say it like that. Don't treat it as the only possible way, and take it with some healthy part of humor, but, behind every joke there's some truth. Before we start I would say, that although our scenario seems incredible, but technically it is possible.

The Fed as a central bank has some profit. Or a loss, depending on the year. By law, he must transfer profits to the state budget. But his loss should also be compensated from the state budget. Let's imagine for a moment that the default did happen. And not for a day, but such a serious one, for a month. The prices of treasuries have gone down, the discounts are huge.

And then J. Powell comes out on stage. All in white.

And he says: "The country's leadership, of course, are complete idiots, but we are ready to support the markets. US Banks already could get loans from us backed by US Treasuries at face value (that is, without a discount). And for the rest of the market (i.e. world that should pay for default LOL), we offer a unique offer (ha-ha x3) - we take everything with a 50% discount. Don't thank me.". And they buy up all debt. Anyone who wants to sell. From foreign individuals, companies, foreign holders, states, etc.

Let's assume that they will buy 2/3 in this way. That is, by $20 trillion. With a 50% discount. And they will get a profit of $10 trillion. And then - they will pay the state $ 10 trillion in profits, of which this very state will pay off half of the debt repurchased by the Fed.

What will happen to the financial system? Well, it will be very bad, of course. But surely you can come up with something so that there are fewer victims inside, and foreigners can be shod. For example, limit the withdrawal of funds from money market funds at times of strong movements, so that physicists do not dig in. Oh, so this rule has already been adopted (!!) in April of this year.

Bla-bla-bla, we understand, reputation, everything, they will never do that, shoot themselves in the foot. But there is already one assumption that "never" is a default, so the second one automatically becomes improbable. But technically, this can be done. They could even force US commercial banks to participate with 100% guarantees from the Federal government. Cash position of JP Morgan, Citi, GS and other whales could cover $5-7 Trln of national debt buyback. And they could be motivated by the same discount - is it bad to get 50% margin on this operation?

The major reason why all this stuff is possible because of concentration of real economy sector and self-sufficiency of western economy. They have everything in place - plants, factories, technologies, qualified labor force, logistics, legal background, consumption - everything. G7 together is too big to ignore, so, as they were functioning, they will keep functioning. And other countries, despite the default will keep make deals with them, no doubts. Because there is no alternatives. West just need to cut off some lines in expenses sheet - the national debt. Which is mostly paper operation - "We forgive to everybody whom we owe to". In a moment it will be painful, mostly for foreign countries and EU in particular, but strategically, it makes sense.

It might be curious, but, in a moment of default, I wouldn't surprise too much if dollar jumps to new highs. If Debt ceil will be increased - US Treasury immediately will come with huge borrowings, drying liquidity even more and rising US Dollar value. With this scenario, we could get big drop on a gold market. That's why be extra careful with long gold position, starting from June 1st, especially if you hold them through the night or weekend. It would be better to not do this.

Gold market mostly was driven by the same factors through the week, but due to specific of yellow metal, its special safe-haven feature, it reacts differently, compares to FX market and stocks. Yesterday, in our FX report we mostly were focused on recent Fed statement and come to conclusion that the Fed and J. Powell now stand at the edge, as they have reached the limit of their mandate on decision making. Any other step, either dovish or hawkish have to be agreed in White House. Because whatever next step will be done by the Fed - it will trigger serious structural shifts in the US economy, or maybe even in a whole western economy. So we've explained why this view has reasons to exist.

Today we focus on other issues - briefly consider the way of structural crisis, and take a look at the debt ceil issue. You can't read it in public big media resources, but banking crisis and debt ceil saga might be two sides of the same medal. To understand it we have to climb on higher level - from narrow purely inner US vision of the problem to global financial system area. And a lot of new ideas immediately appear. Of course, this is too thin substance to talk about it because we know too little. But, we do not exclude scenario when banking crisis is the preparation to controlled default that could help US to re-start its economy and throw away the debt burden that it has. How? You'll see below.

STRUCTURAL CRISIS

To keep it short we will not start showing you again the same charts, showing decreasing of major data in different countries. Here is enough to mention few "fresh" statistics and acknowledge that mostly it goes smooth as it should. Because the feature of the structural crisis is gradual and slow progress. Usually it is not accompanied with big drop of any kind in major statistics, but shows slow but direct decrease. Still, in some data we have strong outbreaks, that are needed to be explained. For example - German manufacturing orders have fallen by the most since the pandemic, as the manufacturing sector continues to perform worse than other parts of Europe's largest economy, the risk of a recession rises. ️March orders fell 10.7%, while economists had expected a fall of 2.3% - 5 times difference, is it too much? On annual basis orders has fell for 11% and are falling 13th month in a row.

The same is with Germany Retail Sales - they are even worse than on average in EU. Bottom since 1994, -10.3% YoY.

China NBS Manufacturing PMI has returned to the recession zone (49.2), it has been at the bottom for 4 months. It was big hopes for rebound after Covid limitations, but it seems that not everything is good. Next week a raft of Chinese data will likely offer a reality check on March's upside surprises. April trade figures on Tuesday are likely to show a cooling of March's export surge. The services component of the price data can gauge demand, but consumer and producer price data broadly paint a picture of deflation. April inflation data is out Thursday.

The United Nations food agency's world price index rose in April for the first time in a year. The Food and Agriculture Organization's (FAO) price index, which tracks the most globally traded food commodities, averaged 127.2 points last month against 126.5 for March, the agency said on Friday. The March reading was originally given as 126.9. The sugar price index surged 17.6% from March, hitting its highest level since October 2011.

South Korea's exports fell for a seventh straight month in April for their longest losing streak in three years, driven by an extended slump in sales to China and suggesting persistent pressure on the economy from frail global demand. The downturn comes despite the reopening of the Chinese economy - a major market for South Korean goods and especially for chips - in December, and raises the challenge for policymakers as they push for a robust post-COVID revival. Overseas sales by Asia's fourth-largest economy fell 14.2% year-on-year. It was the worst decline in three months, and reinforced the recent signs of a domestic economy struggling to fire on all cylinders in the wake of slowing global growth.

In US economy gives the signs of loosing momentum across the board - PMI's, Manufacturing, consumption of electricity and diesel etc. US factory orders show first annual decline since December 2020.

Job market finally start showing reaction on economy slowdown. Everything has started from JOLTS Report, showing that vacancies have dropped around 200K in March. And followed by inflation data, as of GDP deflator and Labour cost. Even recent NFP data shows growth of hourly earnings above expectations.

Vacancies:

Maersk, a leader in global container shipping, reports a 56% fall in Q1 2023 profit due to a slowdown in global trade - the company's volumes decreased by 9.4%. The company is signaling weaker results through the end of 2023 as global traffic volumes could fall by 2.5% through the year as demand wanes and freight rates fall.

Together with the rising interest rates, it could trigger the chain reaction. Perhaps one of the quite obvious from the point of view of common sense, but for some "unexpected" consequences of the growth of rates will be the collapse of planned unprofitable activities. For example, if Amazon earns on cloud services, and e-commerce brings nothing, then it is reduced. Because at zero rates, it was possible to play it, but with a cost of capital of 5-10%, it somehow doesn’t feel like it.

The same will be true for other segments: "sharing economy", meme companies, stupid ESG activity, remaining unicorns, "subsidy kings", etc.

A year and a half ago, it was said that the economy would not be able to sustain the Fed's 3% rate. Actually, this is true, but it was necessary to clarify what kind of economy. The unicorns are really dead. Now weak banks and parties with zero margins are dying. Somewhere close to the collapse in real estate - maybe the Fed's rate of 6-7% for them milestone. This, in turn, triggers another spiral of economy contraction.

In general, it is possible to make a diagnosis, the industry of the whole world is in a steady decline. If we also take into account that industry experts usually tend to look at the situation in their industry from an optimistic side, the picture becomes even more sad. Judging by the figures, the decline in the industrial sector in the global economy has accelerated. This somewhat contradicts the structural crisis model (as we've said above), but perhaps it's not about the economy at all. If the monetary authorities in the main Western countries (and their policy was agreed through the IMF and other Bretton Woods institutions) believed that the deterioration was temporary, then they could deliberately overstate the indicators so as not to frighten ordinary people and entrepreneurs. But as the discrepancies accumulate, they have to be recognized, which requires showing slightly worse figures. Therefore, it will not be argued that the situation is rapidly deteriorating. We will check this in nearest few months. If smooth deterioration continues - then we're right on our suggestion.

DEBT CEIL

In general, if you know nothing about this issue, you'd better start with Fathom consulting article, showing major well-known points around it - spread of the bond yields before and after X-day, Credit Default Spread, MOVE volatility etc. But we focus on few new issues and other moments that are not widely covered in big media. Everything has started from J. Yellen speech that the US could default by June 1:

"By our best estimates, we will not be able to continue to meet all government obligations by early June, and potentially as early as June 1.Given the current outlook, it is critical that Congress act as soon as possible to increase or suspend the debt limit in a manner that provides long-term confidence that the government will continue to make its payments."

Now discussion gradually shifts from "if" default happens to "when" it could happen. US Treasury is loosing safety margin fast. And with any new bank crash they have to add more. For the truth sake, the tax revenues have increased in recent week, but anyway, major consensus stands that X-day is around June-mid July. They could apply emergency tools and temporal debt ceil by president J. Biden initiative ( Invoke the 14th Amendment to the U.S. Constitution to ensure the United States can continue to pay its bills.) but anyway they could last until September at max. And that would almost certainly lead to prolonged legal wrangling, which could unsettle financial markets. White House already has released the scenario of debt default.

Then everything was going even more interesting. Now we need to take a look at US Bonds auctions results. Usually they come weekly or bi-weekly depending on maturity. Auction on 04/27, before Yellen said about default on 1 June, maturing on 05/30 and we see a yield of 3.905%. Auction for Treasuries maturing 06/06 (5 days after possible default) yields 5.964% and is 0.714% higher than the Fed rate.

Finally, and is most interesting - auction for Treasuries maturing 05.07 (one month and 4 days after the default) yield 5.547%. Apparently, the probability is not very high that they will be settled in a month, since the yield is still higher than for the placement, which took place on 27.04. The auctions of longer ones simply did not take place (!!!). You can see for yourself - they were announced, but there are no results on them. It means that US Treasury primary dealers (big banks) suggest that debt ceil crisis will not be resolved in 1-2 weeks after X-day. It will last for some time. Second - they have uncertainty about the term, suggesting that it could be even for few months. Otherwise how we could explain failure of auctions for long-term bonds?

My suspicion that the core is not in confrontation of political elites inside the US, or at least it is not the major background. The bets are significantly higher. Survival of global domination and strategical control over global economy, i.e. world. Here is few facts that we could consider.

As we've said yesterday, the major impact of high rates and potential debt default takes financial sector, not the real economy that high rates are yet to reach.

The real sector did not feel this until the rates rose for it, and this is happening quite slowly.

We often talk about the United States, but there is a eurozone where the situation is even worse because of internal imbalances between countries. And they have similar problems. Only inflation is higher and they cannot raise the rate so quickly, which destroys the demand for debt in the economy. Why did they blow up the Northern Streams? To raise energy prices, weaken European industry and disperse the energy component of inflation? For what? Note that this has affected not only Europe, but also Japan, and the whole world because of the jump in energy prices.

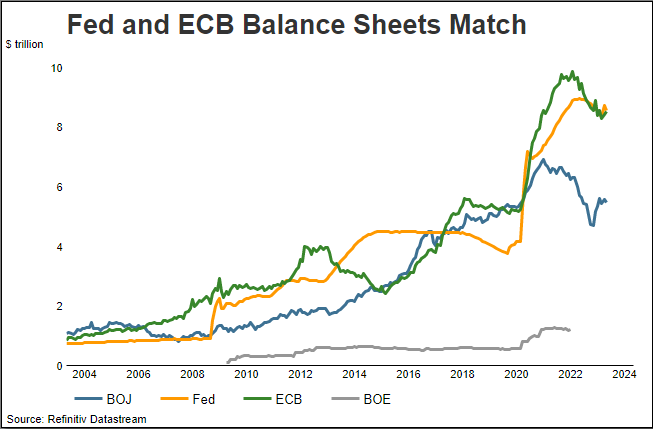

But, why, instead of issuing licenses for oil production in the United States, they drain the PSR, realizing that it is finite and it will need to be replenished? If we postulate that the goal is to weaken or de-expose competitors and this goal is successfully implemented, then we need to make sure that the competitor has problems for a long time. The Great European Depression. And this can only be done by destroying its superstructure in the form of the financial sector. So maybe that's the goal? Supposedly the vital point is the Eurodollar system. It can be destroyed by a liquidity crisis. The background is prepared with a high rate. How many commercial mortgages in the United States need to be refinanced in the next three years? 5 trillion? The eurodollar system is many times larger than the American one and the debt there is more diverse. Now a lot of talks about ECB tries outhawk the Fed, but in reality this is the same system, controlled in Washington.

Second, as we've said, debt crisis might be the tool in the hands of political elites to return strategical control over the global system that now starts slipping through the US fingers. But, to achieve this, this event has to be the scale of 09/11. Otherwise, nobody runs "back into USD quality". And here is the question: can a managed default, with all the possible consequences attached to it, become such an occasion? And the second one - who could voice this idea of a global default and convey it to the right circles so that it becomes a reality?

There are not so many such people left in world politics. But this, two possible candidates for a similar role met in Berlin. I mean Barack Obama and Angela Merkel. We could make assumptions, that among other things, Merkel could be offered the role of a person who is able to prevent the world miserable. Four hours of negotiation over a small piece of fish just because they haven't seen each other for a long time? Of course not. Undoubtedly, the issue of global default and a way out of today's impasse was discussed. Controlled default could resolve all US problems - in one moment you can write off debts, support the falling American system of power, re-emphasize and continue this line, which is familiar to them and even to make money on it. Another confirmation of Obama person for this mission is recent J. Biden interview, where he urged Not To Let Obama Win Election

But the scenario could be, and how the US will coupe the problem of global domination loss with managed default? Hm, let's say it like that. Don't treat it as the only possible way, and take it with some healthy part of humor, but, behind every joke there's some truth. Before we start I would say, that although our scenario seems incredible, but technically it is possible.

The Fed as a central bank has some profit. Or a loss, depending on the year. By law, he must transfer profits to the state budget. But his loss should also be compensated from the state budget. Let's imagine for a moment that the default did happen. And not for a day, but such a serious one, for a month. The prices of treasuries have gone down, the discounts are huge.

And then J. Powell comes out on stage. All in white.

And he says: "The country's leadership, of course, are complete idiots, but we are ready to support the markets. US Banks already could get loans from us backed by US Treasuries at face value (that is, without a discount). And for the rest of the market (i.e. world that should pay for default LOL), we offer a unique offer (ha-ha x3) - we take everything with a 50% discount. Don't thank me.". And they buy up all debt. Anyone who wants to sell. From foreign individuals, companies, foreign holders, states, etc.

Let's assume that they will buy 2/3 in this way. That is, by $20 trillion. With a 50% discount. And they will get a profit of $10 trillion. And then - they will pay the state $ 10 trillion in profits, of which this very state will pay off half of the debt repurchased by the Fed.

What will happen to the financial system? Well, it will be very bad, of course. But surely you can come up with something so that there are fewer victims inside, and foreigners can be shod. For example, limit the withdrawal of funds from money market funds at times of strong movements, so that physicists do not dig in. Oh, so this rule has already been adopted (!!) in April of this year.

Bla-bla-bla, we understand, reputation, everything, they will never do that, shoot themselves in the foot. But there is already one assumption that "never" is a default, so the second one automatically becomes improbable. But technically, this can be done. They could even force US commercial banks to participate with 100% guarantees from the Federal government. Cash position of JP Morgan, Citi, GS and other whales could cover $5-7 Trln of national debt buyback. And they could be motivated by the same discount - is it bad to get 50% margin on this operation?

The major reason why all this stuff is possible because of concentration of real economy sector and self-sufficiency of western economy. They have everything in place - plants, factories, technologies, qualified labor force, logistics, legal background, consumption - everything. G7 together is too big to ignore, so, as they were functioning, they will keep functioning. And other countries, despite the default will keep make deals with them, no doubts. Because there is no alternatives. West just need to cut off some lines in expenses sheet - the national debt. Which is mostly paper operation - "We forgive to everybody whom we owe to". In a moment it will be painful, mostly for foreign countries and EU in particular, but strategically, it makes sense.

It might be curious, but, in a moment of default, I wouldn't surprise too much if dollar jumps to new highs. If Debt ceil will be increased - US Treasury immediately will come with huge borrowings, drying liquidity even more and rising US Dollar value. With this scenario, we could get big drop on a gold market. That's why be extra careful with long gold position, starting from June 1st, especially if you hold them through the night or weekend. It would be better to not do this.