Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

So, the miracle has happened - preliminary agreement on debt ceil raising is achieved. Now it should become breathing easier. But is it last point in the saga, or nothing is done yet? And what the consequences for the gold market?

Market overview

A team of JPMorgan strategists led by Kolanovic trimmed its allocation to stocks and corporate bonds while boosting its stake in cash by 2%. Within the commodities portfolio, the firm also rotated out of energy and into gold on haven demand and as a debt-ceiling hedge — another move intended to strengthen the JPMorgan’s defensive posture.

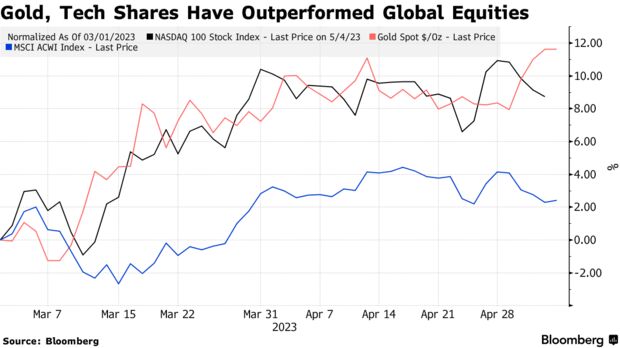

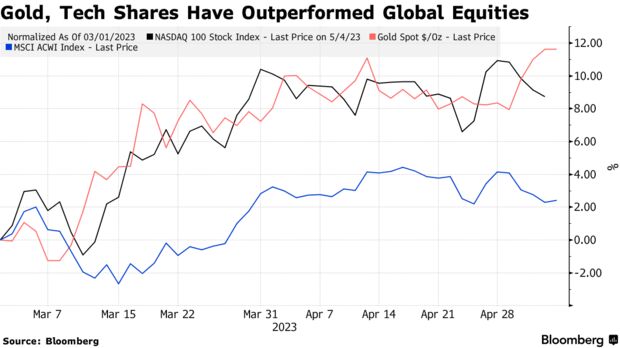

Investors are likely to favor gold and technology stocks as those bets are expected to provide a buffer against the possibility of a US recession this year, according to strategists at JPMorgan Chase & Co. The trade defined as “long duration” is expressed by being overweight on gold, growth stocks such as technology companies and currencies (short USD), strategists including Nikolaos Panigirtzoglou and Mika Inkinen wrote in a note, adding the bet is far from crowded in rates due to the highly inverted yield curve.

JPMorgan notes that the long duration theme seems to have become a consensus in recent months. Such a trade looks “relatively attractive” as it would have limited downside in a mild US recession scenario, but plenty of upside in a deeper recession. Institutional investors flocked into gold, but it appears retail investors boosted exposure to Bitcoin.

Prior the weekend, gold slid to its lowest in two months on Thursday as optimism around the U.S. debt ceiling talks lowered safe-haven demand for bullion and robust economic data fueled bets of another rate hike by the Federal Reserve.

Gold extended losses after official data showed new U.S. jobless claims rose moderately last week, indicating persistent labor market strength, and revised up the estimated GDP growth last quarter, as well as PCE data and GDP revision this week (this subject we've considered yesterday). Now Fed watch tool shows chances for rate hike in June is about 64.2%. Recall from what level we've started in the beginning of May - around 20%. So, our forecast for 25 points hike in June that we've made a month ago, it seems, should be executed.

Take a look that July chances for another rate hike (550-575 column) stands only 27.1%. How do you think now - whether this means something? Nope, of course. June example shows that statistics is stubborn thing, despite what markets expect and what Fed tells. Recent data, as we've said, shows economy resilience together with jump in inflation - healthy background for tighter policy. And I'm sure for 70% that another rate hike will be in July, before August break in meetings. Hardly something will change in a month.

Is it debt ceil saga over?

After tough negotiations to reach a tentative deal with the White House on the U.S. borrowing limit, the next challenge for House Speaker Kevin McCarthy is pushing it through the House, where it may be opposed by both hardline Republicans and progressive Democrats. A failure by Congress to deal with its self-imposed debt ceiling before June 5 could trigger a default that would shake financial markets and send the United States into a deep recession.

Republicans control the House by 222-213, while Democrats control the Senate by 51-49. These margins mean that moderates from both sides will have to support the bill, as any compromise will almost definitely lose the support of the far left and far right wings of each party. To win the speaker's gavel, McCarthy agreed to enable any single member to call for a vote to unseat him, which could lead to his ouster if he seeks to work with Democrats.

Hours before the deal was announced, some hardline Republicans balked at McCarthy cooperating with the White House.

The deal does just that, sources briefed on it say: it suspends the debt ceiling until January 2025, after the November 2024 presidential election, in exchange for caps on spending and cuts in government programs. Bishop and other hardline Republicans were sharply critical of early deal details that suggest Biden has pushed back successfully on several cost-cutting demands on Saturday, signaling McCarthy may have an issue getting votes.

Progressive Democrats in both chambers have said they would not support any deal that has additional work requirements. This deal does, sources say, adding work requirements to food aid for people aged 50 to 54. The deal would boost spending on the military and veterans' care, and cap it for many discretionary domestic programs, according to sources familiar with the talks. But Republicans and Democrats will need to battle over which ones in the months to come, as the deal doesn't specify them.

It is not necessary to talk that a lot of rumors stand behind this agreement, including those that suspect McCarthy "sold" national interests to Democrats. It seems a really big political game that takes less and less relation to national interests and national debt and more relates to undercover political struggle where everybody, starting from big persons down to congressmen and senators are trying to get its own piece of pie. And you have to satisfy all of them to get the agreement passed both House and Senate. Everybody now will start shouting the odds. In such an environment, despite the "deal", whatever it is, we should know on Monday, has small chances to be pushed through Congress.

As democrats and republicans are throwing hot cinder to each other, watching in which hands it will stuck - those will be accused in default. And the booing is already started. Rep. Ralph Norman -

By January 2025, less than two years from now, debt will increase from $31.4 trillion to $36 trillion. And for this there is no spending reform and some symbolic cuts of $50 billion? They returned some of the unspent money for Covid. Waste of time.

So, I'm not sure that we should speak about the end of the debt ceil saga at all. It seems that everything is just going to start. But this doesn’t solve the problem. In fact, raising the debt ceiling will exacerbate it. The fundamental problem isn’t that the US government can’t borrow enough money. The fundamental problem is the US government spends too much money. In reality, raising the debt ceiling is enabling destructive behavior. It’s like handing a heroin addict a $100 bill.

The Biden administration has been spending at around a half a trillion dollar per month clip. In April, the US government blew through $426.34 billion. Thanks to all of that spending, coupled with declining tax receipts, the fiscal 2023 budget deficit already stands at just under $1 trillion.

Moreover, a budget deficit of 10% of GDP and more cannot be financed otherwise than by emission. Especially in conditions when you quarreled with almost half of international creditors. So, regardless of whether they decide something with a default this time or not , on the horizon of 2 years there is no alternative to super-QE and hyper in general, as we've said.

There is no way the government can raise enough tax revenue to cover the spending without levying significant tax increases on the middle class, something nobody in DC is willing to do. It’s much easier to just keep borrowing money. So, it has to raise the debt ceiling. It’s not just about a default. That’s just a talking point. The real issue is the federal government can’t maintain its current trajectory without borrowing more. And there is virtually nobody in Washington D.C. who is really willing to do what it takes to change that trajectory.

So, borrowing it is. The problem is that isn’t sustainable either. And that’s why the real trouble starts once Congress hikes the borrowing limit.

According to analysis by Goldman Sachs, the US Treasury may have to sell $700 billion in T-bills within six to eight weeks of a debt ceiling deal just to replenish cash reserves spent down while the government was up against the borrowing limit. On a net basis, the Treasury will likely have to sell more than $1 trillion in Treasuries this year.

Who is going to buy all of those bonds? The market may be able to absorb all of that paper, but it will almost certainly cause interest rates to rise even more as the sale drains liquidity out of the market. In effect, as the Treasury floods the market with new debt, bond prices will likely fall in order to create enough demand for all of those Treasuries.

A Bank of America note projects that the anticipated post-debt ceiling bond sale would have an impact equivalent to another 25 basis point Federal Reserve rate hike. The liquidity crunch will spill over into the private bond market. The price of non-government debt instruments will have to fall as well in order to compete with Treasury bonds. That means the cost of borrowing will go up for everybody.

Rate hikes have already precipitated a financial crisis. The government and the Federal Reserve managed to paper over the problem with a bailout. But it’s only a matter of time before something else breaks in the economy. This bubble economy is built on easy money and debt. Take that away and the house of cards collapses.

The only other option is for the Federal Reserve to go back to quantitative easing. In fact, even if it doesn’t happen immediately, QE is in the future. Much of this debt will ultimately have to be monetized. There is no other way for the market to absorb all of the debt the Treasury will have to issue to support the borrowing and spending.

In order to prop up the bond market and keep prices higher than they otherwise would be (and interest rates lower), the Fed will ultimately have to buy bonds to boost demand. It will buy those Treasuries with money created out of thin air. That’s inflation.

In other words, you’re going to pay for all of this government spending through the inflation tax. This is one of the reasons the Fed can’t win the inflation fight. The bottom line is that raising the debt ceiling doesn’t fix anything. It just kicks the can down the road. The only way to address the problem is for the government to significantly slash spending and bring it into line with tax receipts. You can decide for yourself how likely that is.

We dare to suggest that looking at this show, a lot of investors, in principle, did not want to keep US Treasuries. This behavior of the issuer is normal for junk bond market, but there are other risks and investors have other limits. In general, the problems in the US debt market will not go away, but rather take other forms. China and other Asian holders will continue to sell securities and they will need to be replaced by someone. And this is about $2-2.5 trillion.

It seems that "debt ceil" franchise is endured for another couple of years, LOL.

Conclusion:

Although, final agreement is not signed yet, let's suggest that it will be done. What the consequences we have for the gold market? I would split it in two parts or better to say terms. The Longer term details we keep for the next report, just to not overload this one with details that we do not need yet. In shorter-term perspective, gold probably will have difficult days or even weeks. And pressure comes from multiple sides.

First is, those who were buying gold only as insurance from potential default or just intended to do it - will reverse their transactions. In general, if you take a look at recent performance of SPDR fund, despite the default hazard, we do not see any explosive demand for the Gold. Take a look how different it is, compares with the beginning of 2022 and 2020 years. This shows some fragile background in short-term.

Second hit comes from the Fed. We already have considered the background and our reasons of rate hike in June. Market only partially has priced in this step. July rate hike is not priced-in at all. Here is might be solid hopes' crash for those who expect early Fed easing. Interest rates rising, especially unexpected, will be negative factor for the gold, as inflation is stubborn, but loosing momentum (at least now, in short-term. Long term story is different).

Finally is third - US Treasury activity. It vitally needs a lot of cash. Its deposit is empty, US government wouldn't think about stop spending money and US bond issues that are coming to maturity needs to be refinanced. The total value is impressive. As we've mentioned above Goldman expects 700 Bln in nearest 5-6 months and around $1 Trln until the end of the year. But we suggest that this number will be at least 1.5-2 times greater. Only interest debt payments are coming to $1 Trln level. All markets will have hard time - stocks, cryptos, bonds, and gold is not an exception. Because everybody start hunting for US Dollars - somebody to rise margin on collateral, or to compensate assets value drawdown, while others to invest them at high yield level. 5.75%-6.0% seems as a Fed pivot, because US economy hardly could care burden of higher interest rates. So, let's be patient and not hurry to buy gold by far.

But since every rule has exception... still, keep in mind that announcement of agreement is not the agreement itself. Risk is still high that this initiative wil stuck in Congress or Senate, McCarthy will be relegated, etc. What if agreement of announcement is an intended step, provocation, to make market fill relaxed?

Technicals

Monthly

Technical picture mostly confirms our suspicions on short-term gold performance. Despite that MACD trend still stands bullish, monthly chart shows that May candle is getting reversal feature, turning to bearish reversal month out from the YPR1 - gold was not able to break it at first touch. It seems that upside gold's journey is not an easy way and will be bumpy... Despite that pullback might be solid, we suggest that it should be good chance for buying, as our long-term view looks positive.

Weekly

Weekly trend already stands bearish. Despite how scaring monthly picture looks - current action has not reached even 3/8 Fib support area and totally fits to idea of just minor retracement, normal reaction on COP target. First destination point here is 1901-1908 K-support and weekly oversold:

Daily

Daily chart shows nothing important, just gradual downside action - no divergence, trend stands bearish and no oversold. Market still stands at hidden 5/8 DiNapoli level of gap reaction point. Using last upside swing extension gives us additional support areas of 1940 (where market stands now) and $1902

Intraday

It seems that market has foreseen something on Friday, formed two side by side bearish grabbers on 4H chart. Monday is a holiday, so gold market will be closed. And particular on Monday the agreement text should be released. Let's focus on nearest XOP of 1922$ area, but I'm afraid that it could be hit right at gap open on Tue. Anyway, let's see. If you hold bearish positions that we've discussed through the week - it might be lucky time for you.

I don't think it makes sense to discuss 1H chart now, because everything 100% will be different on Tue open. Besides, we do not have something interesting there...

So, the miracle has happened - preliminary agreement on debt ceil raising is achieved. Now it should become breathing easier. But is it last point in the saga, or nothing is done yet? And what the consequences for the gold market?

Market overview

A team of JPMorgan strategists led by Kolanovic trimmed its allocation to stocks and corporate bonds while boosting its stake in cash by 2%. Within the commodities portfolio, the firm also rotated out of energy and into gold on haven demand and as a debt-ceiling hedge — another move intended to strengthen the JPMorgan’s defensive posture.

“Hopes of a swift resolution to the US debt ceiling have somewhat bolstered market sentiment,” Kolanovic wrote in a note to clients. “Despite last week’s rebound, risk assets are failing to break out of this year’s ranges and if anything credit and commodities are trading at the lower end of this year’s ranges. With equities trading close to this year’s highs, our model portfolio produced another loss last month, the third loss in four months.”

Investors are likely to favor gold and technology stocks as those bets are expected to provide a buffer against the possibility of a US recession this year, according to strategists at JPMorgan Chase & Co. The trade defined as “long duration” is expressed by being overweight on gold, growth stocks such as technology companies and currencies (short USD), strategists including Nikolaos Panigirtzoglou and Mika Inkinen wrote in a note, adding the bet is far from crowded in rates due to the highly inverted yield curve.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’” they wrote.

JPMorgan notes that the long duration theme seems to have become a consensus in recent months. Such a trade looks “relatively attractive” as it would have limited downside in a mild US recession scenario, but plenty of upside in a deeper recession. Institutional investors flocked into gold, but it appears retail investors boosted exposure to Bitcoin.

Prior the weekend, gold slid to its lowest in two months on Thursday as optimism around the U.S. debt ceiling talks lowered safe-haven demand for bullion and robust economic data fueled bets of another rate hike by the Federal Reserve.

"It's a one-two punch for gold ... if a deal is done over the weekend, then that will remove the biggest risk off the table," said Edward Moya, senior market analyst at OANDA. "A rather impressive round of economic data suggests this economy is still showing so much resilience ... the argument for possibly delivering another rate hike is gaining steam here," Moya added.

Gold extended losses after official data showed new U.S. jobless claims rose moderately last week, indicating persistent labor market strength, and revised up the estimated GDP growth last quarter, as well as PCE data and GDP revision this week (this subject we've considered yesterday). Now Fed watch tool shows chances for rate hike in June is about 64.2%. Recall from what level we've started in the beginning of May - around 20%. So, our forecast for 25 points hike in June that we've made a month ago, it seems, should be executed.

Take a look that July chances for another rate hike (550-575 column) stands only 27.1%. How do you think now - whether this means something? Nope, of course. June example shows that statistics is stubborn thing, despite what markets expect and what Fed tells. Recent data, as we've said, shows economy resilience together with jump in inflation - healthy background for tighter policy. And I'm sure for 70% that another rate hike will be in July, before August break in meetings. Hardly something will change in a month.

Gold was "really viewing things through the lens of the dollar," said independent analyst Ross Norman.

Is it debt ceil saga over?

After tough negotiations to reach a tentative deal with the White House on the U.S. borrowing limit, the next challenge for House Speaker Kevin McCarthy is pushing it through the House, where it may be opposed by both hardline Republicans and progressive Democrats. A failure by Congress to deal with its self-imposed debt ceiling before June 5 could trigger a default that would shake financial markets and send the United States into a deep recession.

Republicans control the House by 222-213, while Democrats control the Senate by 51-49. These margins mean that moderates from both sides will have to support the bill, as any compromise will almost definitely lose the support of the far left and far right wings of each party. To win the speaker's gavel, McCarthy agreed to enable any single member to call for a vote to unseat him, which could lead to his ouster if he seeks to work with Democrats.

Hours before the deal was announced, some hardline Republicans balked at McCarthy cooperating with the White House.

"If Speaker's negotiators bring back in substance a clean debt limit increase ... one so large that it even protects Biden from the issue in the presidential ..., it's war," Representative Dan Bishop, a Freedom Caucus member, tweeted.

The deal does just that, sources briefed on it say: it suspends the debt ceiling until January 2025, after the November 2024 presidential election, in exchange for caps on spending and cuts in government programs. Bishop and other hardline Republicans were sharply critical of early deal details that suggest Biden has pushed back successfully on several cost-cutting demands on Saturday, signaling McCarthy may have an issue getting votes.

"Utter capitulation in progress. By the side holding the cards," Bishop said.

Progressive Democrats in both chambers have said they would not support any deal that has additional work requirements. This deal does, sources say, adding work requirements to food aid for people aged 50 to 54. The deal would boost spending on the military and veterans' care, and cap it for many discretionary domestic programs, according to sources familiar with the talks. But Republicans and Democrats will need to battle over which ones in the months to come, as the deal doesn't specify them.

It is not necessary to talk that a lot of rumors stand behind this agreement, including those that suspect McCarthy "sold" national interests to Democrats. It seems a really big political game that takes less and less relation to national interests and national debt and more relates to undercover political struggle where everybody, starting from big persons down to congressmen and senators are trying to get its own piece of pie. And you have to satisfy all of them to get the agreement passed both House and Senate. Everybody now will start shouting the odds. In such an environment, despite the "deal", whatever it is, we should know on Monday, has small chances to be pushed through Congress.

As democrats and republicans are throwing hot cinder to each other, watching in which hands it will stuck - those will be accused in default. And the booing is already started. Rep. Ralph Norman -

This "deal" is crazy. Raising the debt ceiling by $4 trillion with virtually no cuts is not what we agreed to. I will not vote for the bankruptcy of our country. The American people deserve better.

By January 2025, less than two years from now, debt will increase from $31.4 trillion to $36 trillion. And for this there is no spending reform and some symbolic cuts of $50 billion? They returned some of the unspent money for Covid. Waste of time.

So, I'm not sure that we should speak about the end of the debt ceil saga at all. It seems that everything is just going to start. But this doesn’t solve the problem. In fact, raising the debt ceiling will exacerbate it. The fundamental problem isn’t that the US government can’t borrow enough money. The fundamental problem is the US government spends too much money. In reality, raising the debt ceiling is enabling destructive behavior. It’s like handing a heroin addict a $100 bill.

The Biden administration has been spending at around a half a trillion dollar per month clip. In April, the US government blew through $426.34 billion. Thanks to all of that spending, coupled with declining tax receipts, the fiscal 2023 budget deficit already stands at just under $1 trillion.

Moreover, a budget deficit of 10% of GDP and more cannot be financed otherwise than by emission. Especially in conditions when you quarreled with almost half of international creditors. So, regardless of whether they decide something with a default this time or not , on the horizon of 2 years there is no alternative to super-QE and hyper in general, as we've said.

There is no way the government can raise enough tax revenue to cover the spending without levying significant tax increases on the middle class, something nobody in DC is willing to do. It’s much easier to just keep borrowing money. So, it has to raise the debt ceiling. It’s not just about a default. That’s just a talking point. The real issue is the federal government can’t maintain its current trajectory without borrowing more. And there is virtually nobody in Washington D.C. who is really willing to do what it takes to change that trajectory.

So, borrowing it is. The problem is that isn’t sustainable either. And that’s why the real trouble starts once Congress hikes the borrowing limit.

According to analysis by Goldman Sachs, the US Treasury may have to sell $700 billion in T-bills within six to eight weeks of a debt ceiling deal just to replenish cash reserves spent down while the government was up against the borrowing limit. On a net basis, the Treasury will likely have to sell more than $1 trillion in Treasuries this year.

Who is going to buy all of those bonds? The market may be able to absorb all of that paper, but it will almost certainly cause interest rates to rise even more as the sale drains liquidity out of the market. In effect, as the Treasury floods the market with new debt, bond prices will likely fall in order to create enough demand for all of those Treasuries.

A Bank of America note projects that the anticipated post-debt ceiling bond sale would have an impact equivalent to another 25 basis point Federal Reserve rate hike. The liquidity crunch will spill over into the private bond market. The price of non-government debt instruments will have to fall as well in order to compete with Treasury bonds. That means the cost of borrowing will go up for everybody.

Rate hikes have already precipitated a financial crisis. The government and the Federal Reserve managed to paper over the problem with a bailout. But it’s only a matter of time before something else breaks in the economy. This bubble economy is built on easy money and debt. Take that away and the house of cards collapses.

The only other option is for the Federal Reserve to go back to quantitative easing. In fact, even if it doesn’t happen immediately, QE is in the future. Much of this debt will ultimately have to be monetized. There is no other way for the market to absorb all of the debt the Treasury will have to issue to support the borrowing and spending.

In order to prop up the bond market and keep prices higher than they otherwise would be (and interest rates lower), the Fed will ultimately have to buy bonds to boost demand. It will buy those Treasuries with money created out of thin air. That’s inflation.

In other words, you’re going to pay for all of this government spending through the inflation tax. This is one of the reasons the Fed can’t win the inflation fight. The bottom line is that raising the debt ceiling doesn’t fix anything. It just kicks the can down the road. The only way to address the problem is for the government to significantly slash spending and bring it into line with tax receipts. You can decide for yourself how likely that is.

We dare to suggest that looking at this show, a lot of investors, in principle, did not want to keep US Treasuries. This behavior of the issuer is normal for junk bond market, but there are other risks and investors have other limits. In general, the problems in the US debt market will not go away, but rather take other forms. China and other Asian holders will continue to sell securities and they will need to be replaced by someone. And this is about $2-2.5 trillion.

It seems that "debt ceil" franchise is endured for another couple of years, LOL.

Conclusion:

Although, final agreement is not signed yet, let's suggest that it will be done. What the consequences we have for the gold market? I would split it in two parts or better to say terms. The Longer term details we keep for the next report, just to not overload this one with details that we do not need yet. In shorter-term perspective, gold probably will have difficult days or even weeks. And pressure comes from multiple sides.

First is, those who were buying gold only as insurance from potential default or just intended to do it - will reverse their transactions. In general, if you take a look at recent performance of SPDR fund, despite the default hazard, we do not see any explosive demand for the Gold. Take a look how different it is, compares with the beginning of 2022 and 2020 years. This shows some fragile background in short-term.

Second hit comes from the Fed. We already have considered the background and our reasons of rate hike in June. Market only partially has priced in this step. July rate hike is not priced-in at all. Here is might be solid hopes' crash for those who expect early Fed easing. Interest rates rising, especially unexpected, will be negative factor for the gold, as inflation is stubborn, but loosing momentum (at least now, in short-term. Long term story is different).

Finally is third - US Treasury activity. It vitally needs a lot of cash. Its deposit is empty, US government wouldn't think about stop spending money and US bond issues that are coming to maturity needs to be refinanced. The total value is impressive. As we've mentioned above Goldman expects 700 Bln in nearest 5-6 months and around $1 Trln until the end of the year. But we suggest that this number will be at least 1.5-2 times greater. Only interest debt payments are coming to $1 Trln level. All markets will have hard time - stocks, cryptos, bonds, and gold is not an exception. Because everybody start hunting for US Dollars - somebody to rise margin on collateral, or to compensate assets value drawdown, while others to invest them at high yield level. 5.75%-6.0% seems as a Fed pivot, because US economy hardly could care burden of higher interest rates. So, let's be patient and not hurry to buy gold by far.

But since every rule has exception... still, keep in mind that announcement of agreement is not the agreement itself. Risk is still high that this initiative wil stuck in Congress or Senate, McCarthy will be relegated, etc. What if agreement of announcement is an intended step, provocation, to make market fill relaxed?

Technicals

Monthly

Technical picture mostly confirms our suspicions on short-term gold performance. Despite that MACD trend still stands bullish, monthly chart shows that May candle is getting reversal feature, turning to bearish reversal month out from the YPR1 - gold was not able to break it at first touch. It seems that upside gold's journey is not an easy way and will be bumpy... Despite that pullback might be solid, we suggest that it should be good chance for buying, as our long-term view looks positive.

Weekly

Weekly trend already stands bearish. Despite how scaring monthly picture looks - current action has not reached even 3/8 Fib support area and totally fits to idea of just minor retracement, normal reaction on COP target. First destination point here is 1901-1908 K-support and weekly oversold:

Daily

Daily chart shows nothing important, just gradual downside action - no divergence, trend stands bearish and no oversold. Market still stands at hidden 5/8 DiNapoli level of gap reaction point. Using last upside swing extension gives us additional support areas of 1940 (where market stands now) and $1902

Intraday

It seems that market has foreseen something on Friday, formed two side by side bearish grabbers on 4H chart. Monday is a holiday, so gold market will be closed. And particular on Monday the agreement text should be released. Let's focus on nearest XOP of 1922$ area, but I'm afraid that it could be hit right at gap open on Tue. Anyway, let's see. If you hold bearish positions that we've discussed through the week - it might be lucky time for you.

I don't think it makes sense to discuss 1H chart now, because everything 100% will be different on Tue open. Besides, we do not have something interesting there...