Sive Morten

Special Consultant to the FPA

- Messages

- 18,648

Fundamentals

This week gold mostly was coiling around the achieved top. There are as technical reasons as relatively quiet week, when we've got only Retail Sales which was positive and mostly dollar supportive. Common view, explaining positive performance of the gold market is rising inflation and gentle central banks' policy across the Globe. But we suspect that this is just the half of the story. Definitely pure economical factors are highly important but we also should not discount geopolitics. This week we also see the official change of the sentiment that now is reflected in COT report and Precious metals ETF performance. It suggests that gold still has potential to go higher within few months.

Market overview

President Joe Biden signed into law a $1 trillion infrastructure bill at a White House ceremony on Monday that drew Democrats and Republicans who pushed the legislation through a deeply divided U.S. Congress. The measure is designed to create jobs across the country by dispersing billions of dollars to state and local governments to fix crumbling bridges and roads and by expanding broadband internet access to millions of Americans.

President Joe Biden's $1.75 trillion bill to bolster the social safety net and fight climate change passed the U.S. House of Representatives on Friday and headed to the Senate, where divided moderates and liberals still need to reach agreement.

Senate Democrats hope to reach agreement by the end of December with centrist Democrats Joe Manchin and Kyrsten Sinema, who have raised concerns about the bill's size and some of its provisions.

The legislation follows the infrastructure investment bill that Biden signed into law this week - two key pillars of the Democratic president's domestic agenda - and a separate $1.9 trillion COVID-19 relief package that passed in March.

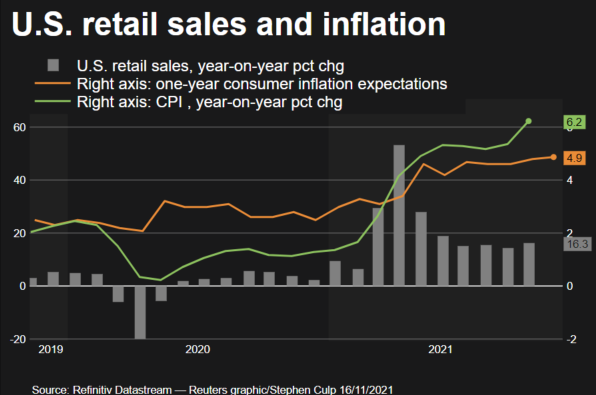

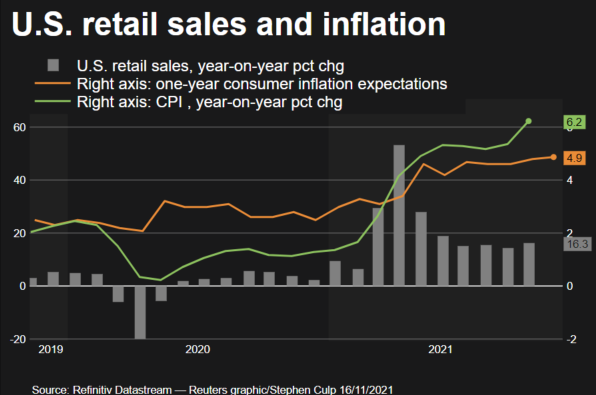

U.S. retail sales surged in October as Americans eagerly started their holiday shopping early to avoid empty shelves amid shortages of some goods because of the ongoing pandemic, giving the economy a lift at the start of the fourth quarter.

The solid report from the Commerce Department on Tuesday suggested high inflation was not yet dampening spending, even as worries about the rising cost of living sent consumer sentiment tumbling to a 10-year low in early November. Rising household wealth, thanks to a strong stock market and house prices, as well as massive savings and wage gains appear to be cushioning consumers against the highest annual inflation in three decades.

Retail sales jumped 1.7% last month, the largest gain since March, after rising 0.8% in September. It was the third straight monthly advance and topped economists' expectations for a 1.4% increase. Sales soared 16.3% year-on-year in October and are 21.4% above their pre-pandemic level.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity rose at a tepid 1.7% rate last quarter. Economists at JPMorgan boosted their fourth-quarter GDP growth estimate to a 5% rate from a 4% pace. Goldman Sachs raised its estimate by 0.5 percentage point to a 5.0% rate. The economy grew at a 2% rate in the third quarter.

The economic picture was further brightened by a separate report from the Federal Reserve on Tuesday showing manufacturing output surged 1.2% last month to its highest level since March 2019, after falling 0.7% in September.

Businesses are also making steady progress replenishing depleted inventories, which should help to keep factories humming and support the economy. Business inventories increased 0.7% in September, a third report from the Commerce Department showed.

The dollar index has rallied since U.S. inflation data last week showed annualized consumer prices jumping surged to their highest since 1990, fueling speculation that the Federal Reserve may raise interest rates sooner than expected.

The Fed should "tack in a more hawkish direction" to prepare in case inflation does not begin to ease, St. Louis Federal Reserve bank president James Bullard said.

Treasury yields also moved up on Tuesday's developments. Benchmark 10-year notes were last at 1.63%, up from 1.61% before the data was released.

The retail data added to a more buoyant mood after U.S. President Joe Biden and Chinese leader Xi Jinping held more than three hours of virtual talks Monday.

The conversation between the leaders of the world's biggest economies appeared to yield no immediate outcome but is widely seen as a joint effort to improve icy relations and avoid direct confrontation.

Yields on benchmark U.S. 10-year Treasury notes were last at 1.58%. They have jumped from a low of 1.415% last week and are holding below five-month highs of 1.705% reached on Oct. 21.

Bond moves may stay choppy, however, as the market deals with reduced liquidity that is likely to worsen during the end- of-year holiday season.

Gold prices slipped on Thursday as encouraging weekly U.S. jobless claims data strengthened bets for an earlier-than-expected rate hike by the Federal Reserve following recent strong inflation data out of the United States. Despite the drop in prices, bullion was holding near its highest level in five months touched on Tuesday.

The number of Americans filing new claims for unemployment benefits fell close to pre-pandemic levels last week, data showed on Thursday. Any signs of a recovering economy reduces demand for the safe-haven metal.

Gold prices were flat on Friday, as traders were caught between concerns over broadening inflationary risks and the prospects of quicker interest rate hikes, which challenged bullion's appeal as an inflation hedge. Gold scaled its highest level in more than five months earlier this week as an acceleration in U.S. consumer prices last month heightened concerns that inflation could stay uncomfortably high well into 2022.

Investors are keeping a close tab on U.S. President Joe Biden's nominee as the next chair of the Fed, with analysts expecting a potential appointment of Lael Brainard, considered to be more dovish than Jerome Powell, to trigger further gains in gold.

Waller said the U.S. central bank should increase the pace of its reduction in bond purchases to give more leeway to raise interest rates from their near zero level

COT DATA and Sentiment analysis

Data for commodity funds showed precious metal funds drew a net $817 million after seven straight weekly outflows as gold prices rallied to a five-month peak this week.

Recent CFTC data shows the big boost of net long position that actually has happened last week, but is reflected only in the last report. Open interest has jumped for almost 10%, 1/3 of this volume stands for long speculative positions. Hedgers also have increased hedge against gold growth, but their positions are more balanced.

SPDR Fund reserves also turn up slowly and now we see a kind of hidden bullish divergence between reserves and gold price:

Source: SPDR Fund, FPA

As a result, the net long position has broken long standing range:

Source: cftc.gov, charting by Investing.com

To be continued ...

This week gold mostly was coiling around the achieved top. There are as technical reasons as relatively quiet week, when we've got only Retail Sales which was positive and mostly dollar supportive. Common view, explaining positive performance of the gold market is rising inflation and gentle central banks' policy across the Globe. But we suspect that this is just the half of the story. Definitely pure economical factors are highly important but we also should not discount geopolitics. This week we also see the official change of the sentiment that now is reflected in COT report and Precious metals ETF performance. It suggests that gold still has potential to go higher within few months.

Market overview

President Joe Biden signed into law a $1 trillion infrastructure bill at a White House ceremony on Monday that drew Democrats and Republicans who pushed the legislation through a deeply divided U.S. Congress. The measure is designed to create jobs across the country by dispersing billions of dollars to state and local governments to fix crumbling bridges and roads and by expanding broadband internet access to millions of Americans.

President Joe Biden's $1.75 trillion bill to bolster the social safety net and fight climate change passed the U.S. House of Representatives on Friday and headed to the Senate, where divided moderates and liberals still need to reach agreement.

"Now, the Build Back Better Act goes to the United States Senate, where I look forward to it passing as soon as possible so I can sign it into law," Biden said in a statement following the vote.

Senate Democrats hope to reach agreement by the end of December with centrist Democrats Joe Manchin and Kyrsten Sinema, who have raised concerns about the bill's size and some of its provisions.

The legislation follows the infrastructure investment bill that Biden signed into law this week - two key pillars of the Democratic president's domestic agenda - and a separate $1.9 trillion COVID-19 relief package that passed in March.

U.S. retail sales surged in October as Americans eagerly started their holiday shopping early to avoid empty shelves amid shortages of some goods because of the ongoing pandemic, giving the economy a lift at the start of the fourth quarter.

The solid report from the Commerce Department on Tuesday suggested high inflation was not yet dampening spending, even as worries about the rising cost of living sent consumer sentiment tumbling to a 10-year low in early November. Rising household wealth, thanks to a strong stock market and house prices, as well as massive savings and wage gains appear to be cushioning consumers against the highest annual inflation in three decades.

"It's more important to look at what consumers do than what they say," said Gus Faucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. "They are concerned about higher inflation, but they are still in good shape and are continuing to spend."

Retail sales jumped 1.7% last month, the largest gain since March, after rising 0.8% in September. It was the third straight monthly advance and topped economists' expectations for a 1.4% increase. Sales soared 16.3% year-on-year in October and are 21.4% above their pre-pandemic level.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity rose at a tepid 1.7% rate last quarter. Economists at JPMorgan boosted their fourth-quarter GDP growth estimate to a 5% rate from a 4% pace. Goldman Sachs raised its estimate by 0.5 percentage point to a 5.0% rate. The economy grew at a 2% rate in the third quarter.

The economic picture was further brightened by a separate report from the Federal Reserve on Tuesday showing manufacturing output surged 1.2% last month to its highest level since March 2019, after falling 0.7% in September.

"The economy has thrown off whatever lethargy it might have had in the summer, and it is growing quite strongly," said Joel Naroff, chief economist at Naroff Economics in Holland, Pennsylvania.

Businesses are also making steady progress replenishing depleted inventories, which should help to keep factories humming and support the economy. Business inventories increased 0.7% in September, a third report from the Commerce Department showed.

"If the U.S. economy is going to recover, it's going to be partly through consumption, which is still about 70% of the economy," said Marc Chandler, chief market strategist at Bannockburn Global Forex. "Today's retail sales number supports that."

The dollar index has rallied since U.S. inflation data last week showed annualized consumer prices jumping surged to their highest since 1990, fueling speculation that the Federal Reserve may raise interest rates sooner than expected.

The Fed should "tack in a more hawkish direction" to prepare in case inflation does not begin to ease, St. Louis Federal Reserve bank president James Bullard said.

Treasury yields also moved up on Tuesday's developments. Benchmark 10-year notes were last at 1.63%, up from 1.61% before the data was released.

The retail data added to a more buoyant mood after U.S. President Joe Biden and Chinese leader Xi Jinping held more than three hours of virtual talks Monday.

The conversation between the leaders of the world's biggest economies appeared to yield no immediate outcome but is widely seen as a joint effort to improve icy relations and avoid direct confrontation.

The Biden-Xi summit "had the potential to do damage but seems not to have done so," said Rob Carnell, head of research for Asia Pacific at ING.

"Ultimately we're in a place where it looks like growth is still pretty strong," said Mike Bell, global market strategist at J.P. Morgan Asset Management. "The Fed is going to taper before they put rates up, and I think that's supporting dollar."

Yields on benchmark U.S. 10-year Treasury notes were last at 1.58%. They have jumped from a low of 1.415% last week and are holding below five-month highs of 1.705% reached on Oct. 21.

Bond moves may stay choppy, however, as the market deals with reduced liquidity that is likely to worsen during the end- of-year holiday season.

"There has been a pretty notable decline in market liquidity, which I think has been contributing to some of the outsized moves," said Jonathan Cohn, head of rates trading strategy at Credit Suisse in New York. The fact that we’ve already experienced some diminished liquidity suggests that this choppiness that we’ve seen can persist."

Gold prices slipped on Thursday as encouraging weekly U.S. jobless claims data strengthened bets for an earlier-than-expected rate hike by the Federal Reserve following recent strong inflation data out of the United States. Despite the drop in prices, bullion was holding near its highest level in five months touched on Tuesday.

"One of the major reasons for this spike in gold was that rates fell off pretty hard. But then, they came bouncing back, so that's keeping the upside limited in gold," said Daniel Pavilonis, a senior market strategist at RJO Futures. "It just correlates with a higher probability of the Fed actually having to raise rates," Pavilonis said.

The number of Americans filing new claims for unemployment benefits fell close to pre-pandemic levels last week, data showed on Thursday. Any signs of a recovering economy reduces demand for the safe-haven metal.

"At the moment, it's difficult for gold to find direction because of the uncertainty related to the dollar's performance, and the likely response of the Fed and other central banks to inflation," said ActivTrades senior analyst Ricardo Evangelista.

Gold prices were flat on Friday, as traders were caught between concerns over broadening inflationary risks and the prospects of quicker interest rate hikes, which challenged bullion's appeal as an inflation hedge. Gold scaled its highest level in more than five months earlier this week as an acceleration in U.S. consumer prices last month heightened concerns that inflation could stay uncomfortably high well into 2022.

"While elevated inflation has enticed strong buying interest in gold, expectations of policy normalization by the U.S. Fed and other major central banks amid a sharp recovery in growth remains the key headwind for the metal," said Sugandha Sachdeva, vice president of commodity & currency research at Religare Broking.

"Gold prices are likely to consolidate in a range between $1,835 and $1,880 in the short-term. But in the long term, the metal is likely to witness buying interest at lower levels and if prices nudge past $1,880, it could surge to $1,920."

"The focus on rate hikes and their impact on inflation makes gold's near-term price action very sensitive to economic data like next week's personal consumption expenditures (PCE)," DailyFX currency strategist Ilya Spivak said.

"The Fed announcing a rate hike at some point next year is gold negative, (but) there is still a lot of uncertainty, a lot of inflation concern to help gold stay supported in this environment," said UBS analyst Giovanni Staunovo. The potential for inflation to keep moving even higher could propel gold to move above $1,900 an ounce, Staunovo added.

Investors are keeping a close tab on U.S. President Joe Biden's nominee as the next chair of the Fed, with analysts expecting a potential appointment of Lael Brainard, considered to be more dovish than Jerome Powell, to trigger further gains in gold.

"Gold prices are declining after some hawkish Fed speak about accelerated tapering boosted the dollar," said Edward Moya, senior market analyst at brokerage OANDA. "Inflation and Fed speak are the primary catalyst for gold and right now traders will need to see what happens over the next couple of weeks before having strong conviction on assessing what the Fed will do regarding interest rates."

Waller said the U.S. central bank should increase the pace of its reduction in bond purchases to give more leeway to raise interest rates from their near zero level

Saxo Bank analyst Ole Hansen said in a note that lockdowns in Europe have helped provide the yellow metal a fresh boost. "The recent white-hot inflation prints, especially the 6.2% recorded in the U.S., will likely continue to support gold in its defence against the stronger dollar," Hansen added.

COT DATA and Sentiment analysis

Data for commodity funds showed precious metal funds drew a net $817 million after seven straight weekly outflows as gold prices rallied to a five-month peak this week.

"10-year U.S. real rates now -4.6% , a level in the past 200 years that has been associated with panics, inflations, wars & depression, and a level today increasingly responsible for froth in crypto, commodities, and U.S. stocks," said Michael Hartnett at BofA.

Recent CFTC data shows the big boost of net long position that actually has happened last week, but is reflected only in the last report. Open interest has jumped for almost 10%, 1/3 of this volume stands for long speculative positions. Hedgers also have increased hedge against gold growth, but their positions are more balanced.

SPDR Fund reserves also turn up slowly and now we see a kind of hidden bullish divergence between reserves and gold price:

Source: SPDR Fund, FPA

As a result, the net long position has broken long standing range:

Source: cftc.gov, charting by Investing.com

To be continued ...

Last edited: