Sive Morten

Special Consultant to the FPA

- Messages

- 18,635

Fundamentals

So, the tactical pullback that we would like to get has happened right on Friday, immediately at market's open after Thanksgiving. But it was played back rather soon. And now it is a big question what's next. Of course it is very naïve to tell that nobody knows but we do know. We could make propositions and use common sense to decide how it would be better to deal with the new environment of "Omicron" variant and, market reaction specifically. This is the big topic to consider and the first step will be to set aside emotions and take a calm view on ongoing events. As one investor said on Friday:

and he was right.

Market overview

COVID-19 has resurfaced as a worry for investors and a potential driver of big market moves after a new variant triggered alarm, long after the threat had receded in Wall Street's eyes. Worries about a new strain of the virus, named Omicron and classified by the World Health Organization as a variant of concern, slammed markets worldwide and dealt the S&P 500 its biggest one-day percentage loss in nine months.

With little known about the new variant, longer term implications for U.S. assets were unclear. At least, investors said signs that the new strain is spreading and questions over its resistance to vaccines could weigh on the so-called reopening trade that has lifted markets at various times this year. The new strain may also complicate the outlook for how aggressively the Federal Reserve normalizes monetary policy to fight inflation.

Before Friday, broader vaccine availability and advances in treatments made markets potentially less sensitive to COVID-19. The virus had dropped to a distant fifth in a list of so-called "tail risks" to the market in a recent survey of fund managers by BofA Global Research, with inflation and central bank hikes taking the top spots.

U.S. officials said Friday they would impose travel restrictions on eight southern African countries in response to the new variant found in South Africa. It has also been reported in Israel and Belgium.

Friday's swings also sent the Cboe Volatility Index, known as Wall Street's fear gauge, soaring and options investors scrambling to hedge their portfolios against further market swings.

U.S. President Joe Biden and Vice President Kamala Harris have been briefed on the latest situation regarding the new Omicron variant of COVID-19, the White House said on Saturday, as Britain, Germany and Italy reported detecting cases.

Biden, who is spending Thanksgiving with his family in Nantucket, Massachusetts, told reporters on Friday, "We don't know a lot about the variant except that it is of great concern, seems to spread rapidly."

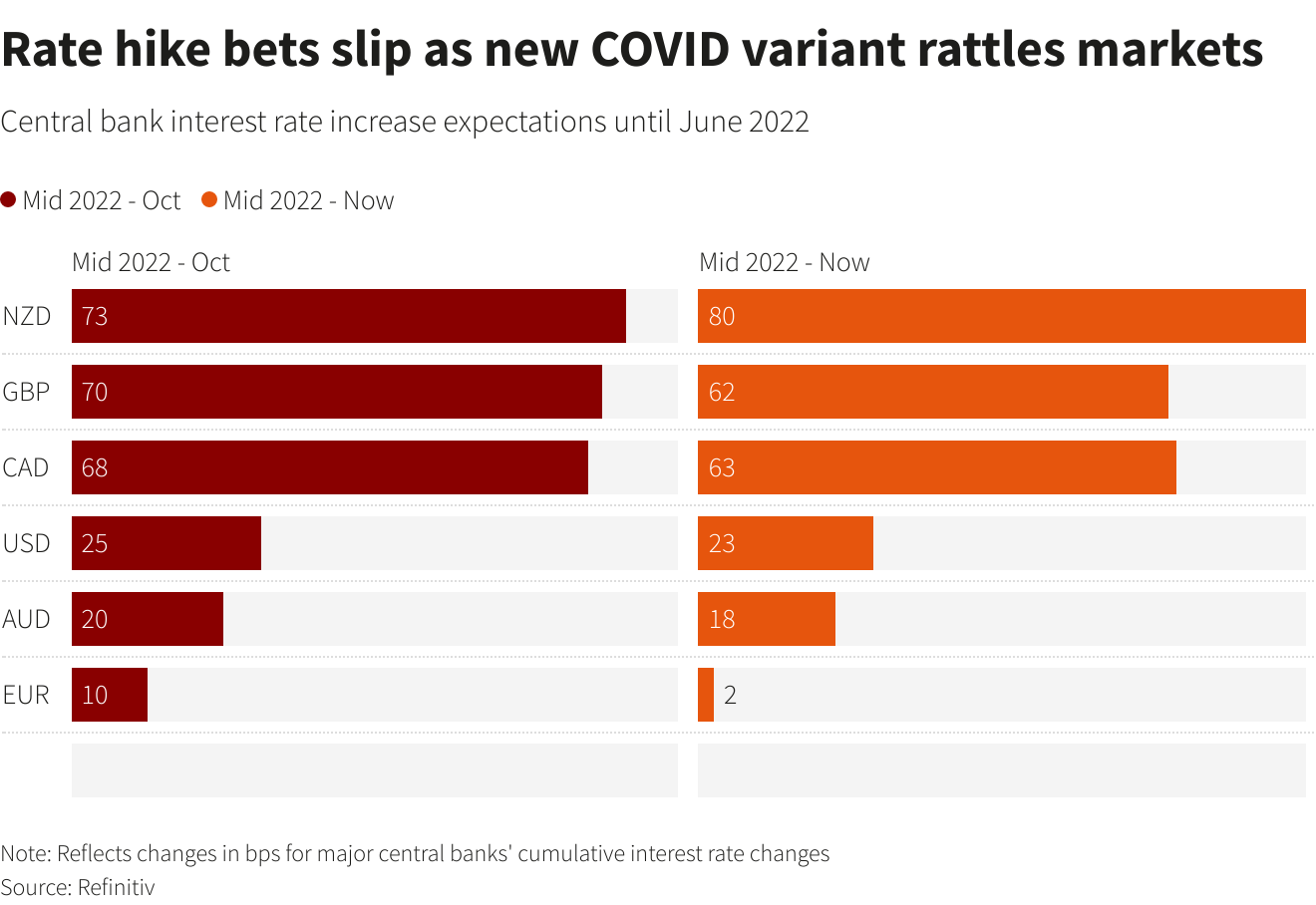

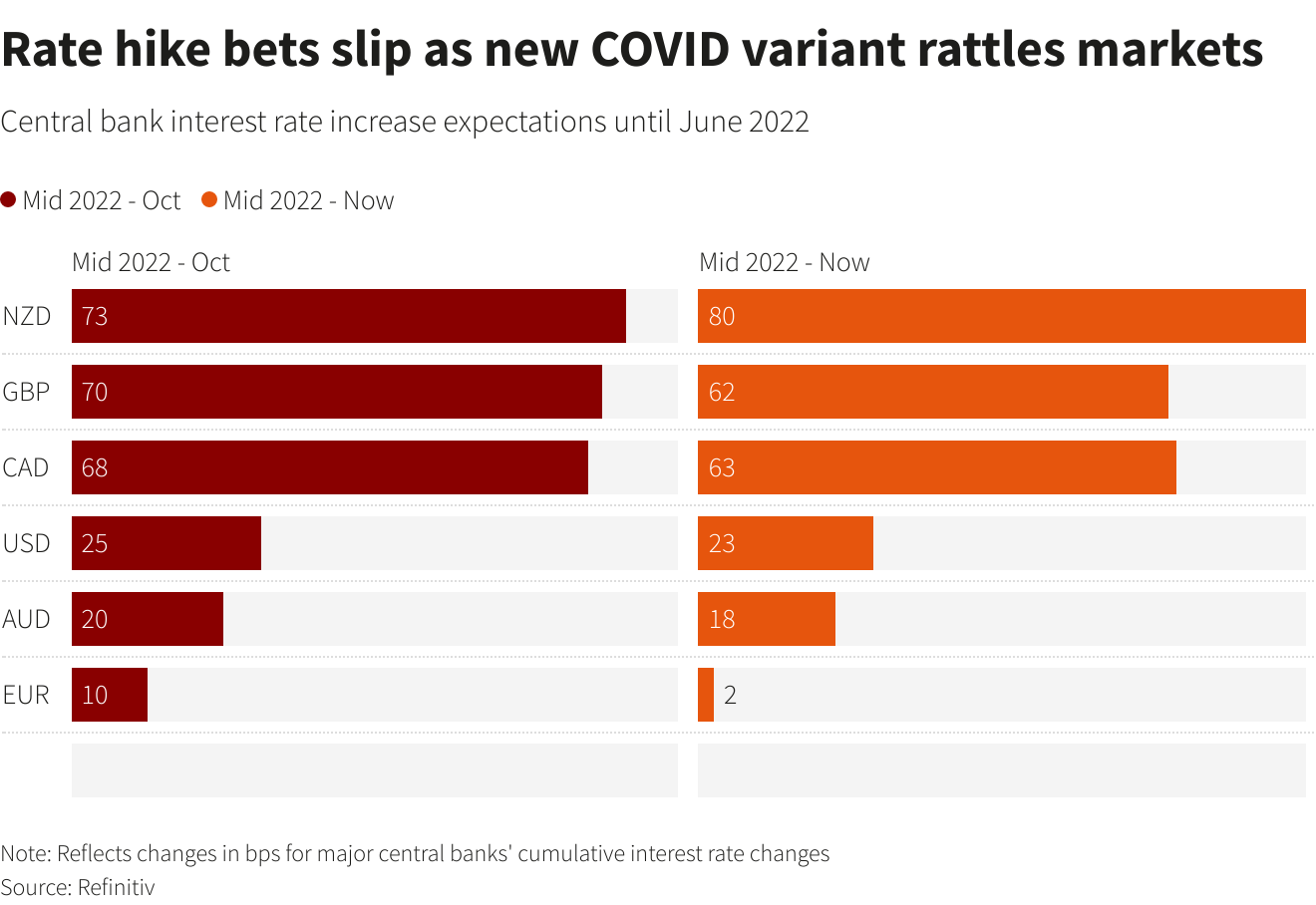

One of several wild cards is whether virus-driven economic uncertainty will slow the Federal Reserve's plans to normalize monetary policy, just as it has started unwinding its $120 billion a month bond buying program. Futures on the U.S. federal funds rate, which track short-term interest rate expectations, on Friday showed investors rolling back their view of a sooner-than-expected rate increase.

Investors will be watching Fed Chair Jerome Powell and U.S. Treasury Secretary Janet Yellen's appearance before Congress to discuss the government's COVID response on Nov. 30 as well as U.S. employment numbers, due out next Friday.

Money markets no longer fully price a 25-basis-point interest rate rise by the Federal Reserve by June 2022, nor are they positioned for a full 10-bps hike from the European Central Bank by the end of 2022, as they were just a few days ago. And the chances of the Bank of England raising rates next month are seen around 53%, from 75% on Thursday.

UBS Investment Bank chief economist Arend Kapteyn said while confidence in improving U.S. labour markets could fade if a new variant takes hold, it was still early days in terms of gauging the impact.

Physical gold demand picked up in major Asian hubs this week helped by a retreat in prices, with dealers in India prepared for a likely spurt in buying as the wedding season gathers pace. With a correction in prices during the first half of the week, "jewelers have been making purchases at lower levels as they are witnessing healthy retail demand for weddings," said a Mumbai-based bullion dealer with a private bank.

Gold has traditionally been an integral part of weddings in India, the world's second biggest bullion consumer after China. The country's monthly net gold imports via Hong Kong jumped 56% in October to the highest since June 2018.

Peter Fung, head of dealing at Wing Fung Precious Metals, said Chinese demand should remain healthy as Christmas approaches, adding a dip in global rates below $1,800 an ounce prompted a pick in purchases. "Demand has recovered a bit in Hong Kong as well, we can see more interest in jewelry," Fung added.

Gold prices fell around 1% to a near three-week low on Tuesday as the re-nomination of U.S. Federal Reserve Chair Jerome Powell fueled bets of faster interest rate hikes, bolstering the dollar and Treasury yields.

Gold prices have fallen nearly $100 since scaling a five-month peak of $1,876.90 per ounce last week.

U.S. business activity slowed moderately in November amid labour shortages and raw material delays, contributing to prices continuing to soar halfway through the fourth quarter.

Indicative of sentiment, SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, said its holdings rose 0.6% to 991.11 tonnes on Tuesday from 985 tonnes on Monday.

The World Platinum Investment Council (WPIC) expects a much larger surplus in the global platinum market this year than it previously forecast and another big oversupply in 2022.

Gold prices slipped to a three-week low on Wednesday as robust U.S. economic data lifted the dollar and Treasury yields, with jitters around a sooner-than-expected interest rate hike from the Federal Reserve adding to the downbeat mood.

Investors also took stock of a raft of U.S. data which included an upwards revision to third-quarter GDP, a fall in jobless claims to a 52-year low last week and a higher personal consumption expenditures price index reading. The number of Americans filing new claims for unemployment benefits dropped to a 52-year low last week, suggesting economic activity was accelerating as a year ravaged by shortages, high inflation and an unrelenting pandemic draws to a close.

A separate report from the Commerce Department on Wednesday showed gross domestic product rose at a 2.1% rate in the third quarter. That was a slight upward revision from the 2.0% pace estimated in October, but was still the slowest in more than a year. The economy grew at a 6.7% rate in the second quarter. But that is all in the rear-view mirror. A third report from the Commerce Department showed consumer spending, which accounts for more than two-thirds of U.S. economic activity, jumped 1.3% in October after rising 0.6% in September.

The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, increased 0.4% last month after gaining 0.2% in September. In the 12 months through October, the so-called core PCE price index accelerated 4.1%. That was the largest gain since January 1991 and followed a 3.7% year-on-year advance in September.

Gold gained on Friday, as concerns over the spread of a newly identified coronavirus variant boosted the metal's safe-haven appeal, although bullion was set for a weekly drop on bets of U.S. Federal Reserve turning more hawkish.

But after the rally due to bullion's safe-haven appeal, the overall bearish turn in commodities eventually claimed gold as well, said Jim Wyckoff, senior analyst at Kitco Metals, adding the market reaction was probably overblown.

COT Report

This week we do not have fresh CFTC data, but we have recent update from SPDR Fund that shows more inflows this week, although it is dated before Omicron news. Data shows that reserves have increased despite recent sell-off.

The bottom line

Now, with the comments above we could more or less, but understand investors' sentiment. There are big hopes that Omicron will pass in the same way as Delta, but recent virologists careful statements do not exclude that world still could return to pre-vaccine area, at some degree. But what hazard it could care for gold performance? Recall how pandemic been progressed - it was total run into quality, with real interest rates were dropping all thinkable levels, making gold more attractive for investing. Whatever degree to lockdown economy it will be - anyway this is supportive to the gold market. This is first fact.

Second is - review of the Fed tightening. Indeed, hardly they cancel the tapering, because inflation is not cancelled, actually. But tapering is not the tightening - it has minor value and could be continued without big harm to economy. But investors' sentiment change on Fed rate hike speed means a lot for gold and supports it. Developed central banks already have printed together 20 Trln - 20-25% of World GDP. With more lockdowns - more stimulus should come, which is also supportive to the gold market. So, the first conclusion that could make here is - if Omicron shows any hazard, even at minor degree, it should be supportive to the Gold market.

Now let's suppose that this was just emotional reaction and soon virologists tell that its hazard is overvalued, i.e. world returns back to its own. This situation we widely have discussed in our previous researches. Gold should get the period when it is free from interest rate change pressure, as it is set only for the middle of the next year. Until this moment gold has chances to show positive performance, if real rates will not rise too fast. With the recent data on Platinum consumption it is really could mean that inflation will be transitory. The same we could say from economists forecast of slowdown of global economy next year. The advantage for gold here exists as well - now markets and central banks will be aware of any new variant that could appear. This could stop them from drastic decisions and could slowdown the Fed interest rates activity as well.

That's being said, whatever scenario we get, it should not have strong negative impact on the gold. Although short-term volatility could rise, bringing few unwelcome surprises. Chart of real interest rates, with divergence to Gold suggests that 2nd scenario is more probable. Whatever happens, hardly world returns to total lockdowns era. More probable that people just accept this fact as the new environment where we're living now and keep moving on in the future. On Friday we've got sharp collapse of interest rates, with reversal week that should support gold and challenge the recent drop that we've got on re-appointment of J. Powell, at least in the short-term.

Technicals

Monthly

In short-term performance looks a bit poor, as market pulls back inside the flag consolidation and under YPP, showing upside spike. So, we can't totally exclude some downside continuation on lower time frames as well. At the same time, it doesn't break yet the monthly picture. The support line that makes shape of triangle here seems to be more important at current moment.

Speaking about upside target, we have very thrilling combination. Major COP is completed, but we also have all-time COP, when A point equals to ~ 40$ - fixed gold price to US dollar before the Bretton Wood. In this case all time COP agrees with YPR1 around 2165$. This is next nearest target on gold...

Once we've mentioned that overall price performance doesn't look truly bearish in long term. Market stands too close to the top, forming tight consolidation and has not reached even 3/8 major support. And potential appearing of pennant pattern just confirms this.

Weekly

Here trend stands bullish, overall action to the "blue OP" was fast and currently downside reaction doesn't contradict to the normal market behavior. The only unpleasant moment is that price drops back inside the triangle. This increases chances on some downside continuation before new signs of recovering could appear:

Daily

Daily picture reminds action on the monthly chart. The pullback and 4H DRPO pattern has worked perfect but its effect was reversed rather soon. As major K-area is broken already and price is not at oversold anymore - gold could keep dropping to the next support of 1760$, as we've suggested through the previous week.

Intraday

So, the sell-off was too strong to ignore it, and quite enough to reach at least downside COP target here. This target, by the way, perfectly agrees with daily 5/8 1758$ Fib support. DRPO "Buy" has worked nice.

Here we could discuss only the way, how market turns down. As interest rates collapsed on Friday, and recalling gold's habit to show deep retracement, we do not exclude a kind of AB-CD retracement and appearing of "222" Sell, before downside action continues. Conversely it could be direct drop as well...

It means that if you're searching chances to go short on intraday chart - you could combine two things. First is, you could use stop "Sell" order near the bottom for the case of direct breakout, and additionally Limit order around 1815$, in a case of upside AB-CD. Just avoid strong upward action.

For the buyers is nothing to do by far - we wait for the next support area.

So, the tactical pullback that we would like to get has happened right on Friday, immediately at market's open after Thanksgiving. But it was played back rather soon. And now it is a big question what's next. Of course it is very naïve to tell that nobody knows but we do know. We could make propositions and use common sense to decide how it would be better to deal with the new environment of "Omicron" variant and, market reaction specifically. This is the big topic to consider and the first step will be to set aside emotions and take a calm view on ongoing events. As one investor said on Friday:

Jack Ablin, chief investment officer at Cresset Capital Management, said - my first reaction is anything we are going to see today is overdone" .

and he was right.

Market overview

COVID-19 has resurfaced as a worry for investors and a potential driver of big market moves after a new variant triggered alarm, long after the threat had receded in Wall Street's eyes. Worries about a new strain of the virus, named Omicron and classified by the World Health Organization as a variant of concern, slammed markets worldwide and dealt the S&P 500 its biggest one-day percentage loss in nine months.

With little known about the new variant, longer term implications for U.S. assets were unclear. At least, investors said signs that the new strain is spreading and questions over its resistance to vaccines could weigh on the so-called reopening trade that has lifted markets at various times this year. The new strain may also complicate the outlook for how aggressively the Federal Reserve normalizes monetary policy to fight inflation.

"Markets were celebrating the end of the pandemic. Slam. It isn't over," said David Kotok, chairman and chief investment officer at Cumberland Advisors. "All policy issues, meaning monetary policy, business trajectories, GDP growth estimates, leisure and hospitality recovery, the list goes on, are on hold."

Before Friday, broader vaccine availability and advances in treatments made markets potentially less sensitive to COVID-19. The virus had dropped to a distant fifth in a list of so-called "tail risks" to the market in a recent survey of fund managers by BofA Global Research, with inflation and central bank hikes taking the top spots.

U.S. officials said Friday they would impose travel restrictions on eight southern African countries in response to the new variant found in South Africa. It has also been reported in Israel and Belgium.

Friday's swings also sent the Cboe Volatility Index, known as Wall Street's fear gauge, soaring and options investors scrambling to hedge their portfolios against further market swings.

U.S. President Joe Biden and Vice President Kamala Harris have been briefed on the latest situation regarding the new Omicron variant of COVID-19, the White House said on Saturday, as Britain, Germany and Italy reported detecting cases.

Biden, who is spending Thanksgiving with his family in Nantucket, Massachusetts, told reporters on Friday, "We don't know a lot about the variant except that it is of great concern, seems to spread rapidly."

One of several wild cards is whether virus-driven economic uncertainty will slow the Federal Reserve's plans to normalize monetary policy, just as it has started unwinding its $120 billion a month bond buying program. Futures on the U.S. federal funds rate, which track short-term interest rate expectations, on Friday showed investors rolling back their view of a sooner-than-expected rate increase.

Investors will be watching Fed Chair Jerome Powell and U.S. Treasury Secretary Janet Yellen's appearance before Congress to discuss the government's COVID response on Nov. 30 as well as U.S. employment numbers, due out next Friday.

Money markets no longer fully price a 25-basis-point interest rate rise by the Federal Reserve by June 2022, nor are they positioned for a full 10-bps hike from the European Central Bank by the end of 2022, as they were just a few days ago. And the chances of the Bank of England raising rates next month are seen around 53%, from 75% on Thursday.

"While central bank commentary has been focused on upside risks to inflation, this (new COVID variant) highlights that there are significant downside risks and we are in a significant phase of uncertainty for the economy," said Chris Scicluna, head of economic research at Daiwa.

UBS Investment Bank chief economist Arend Kapteyn said while confidence in improving U.S. labour markets could fade if a new variant takes hold, it was still early days in terms of gauging the impact.

But he added that "the market had gotten too far ahead of itself in terms of pricing a shortened taper window and multiple hikes next year".

While the ECB is expected to wind down its 1.85 trillion euro ($2.08 trillion) pandemic emergency stimulus scheme, Mizuho strategist Peter McCallum now sees a greater chance the programme gets extended beyond the March deadline. "They (ECB) were saying that the European situation doesn't change the PEPP outcome but if there is a new variant requiring new vaccines that surely does change the picture," said McCallum.

Physical gold demand picked up in major Asian hubs this week helped by a retreat in prices, with dealers in India prepared for a likely spurt in buying as the wedding season gathers pace. With a correction in prices during the first half of the week, "jewelers have been making purchases at lower levels as they are witnessing healthy retail demand for weddings," said a Mumbai-based bullion dealer with a private bank.

Gold has traditionally been an integral part of weddings in India, the world's second biggest bullion consumer after China. The country's monthly net gold imports via Hong Kong jumped 56% in October to the highest since June 2018.

Peter Fung, head of dealing at Wing Fung Precious Metals, said Chinese demand should remain healthy as Christmas approaches, adding a dip in global rates below $1,800 an ounce prompted a pick in purchases. "Demand has recovered a bit in Hong Kong as well, we can see more interest in jewelry," Fung added.

Gold prices fell around 1% to a near three-week low on Tuesday as the re-nomination of U.S. Federal Reserve Chair Jerome Powell fueled bets of faster interest rate hikes, bolstering the dollar and Treasury yields.

"Gold has been in a panic selloff over the last 48 hours and I would blame most of it on rising 10-year Treasury yields. As the yield curve gets steeper, gold futures do not respond kindly," said Phillip Streible, chief market strategist at Blue Line Futures in Chicago.

Gold prices have fallen nearly $100 since scaling a five-month peak of $1,876.90 per ounce last week.

However, Ross Norman, an independent analyst, said it is "too early to write off gold". Inflation still has legs to run, and there are COVID-19 restrictions in Europe once again. But the onus is on the bulls to prove their case and garner support, failing which the metal could drift lower again," Norman added.

U.S. business activity slowed moderately in November amid labour shortages and raw material delays, contributing to prices continuing to soar halfway through the fourth quarter.

Indicative of sentiment, SPDR Gold Trust , the world's largest gold-backed exchange-traded fund, said its holdings rose 0.6% to 991.11 tonnes on Tuesday from 985 tonnes on Monday.

The World Platinum Investment Council (WPIC) expects a much larger surplus in the global platinum market this year than it previously forecast and another big oversupply in 2022.

Gold prices slipped to a three-week low on Wednesday as robust U.S. economic data lifted the dollar and Treasury yields, with jitters around a sooner-than-expected interest rate hike from the Federal Reserve adding to the downbeat mood.

With inflows into gold-backed ETFs also subdued, short acquisitions by "trend followers" remain the primary contributor to flows, suggesting further downside to prices, TD Securities said in a note.

"As markets price in some monetary policy normalization, that should weigh on gold in the short term. But major central banks are unlikely to aggressively hike rates given the fiscal burden of higher interest rates and large government debt accumulated" said Hitesh Jain, lead analyst at Mumbai-based Yes Securities. This more-moderate monetary policy normalization and the potential loss of momentum in economic growth next year as the base effects of the pandemic wear off, should support gold in 2022, Jain added.

Investors also took stock of a raft of U.S. data which included an upwards revision to third-quarter GDP, a fall in jobless claims to a 52-year low last week and a higher personal consumption expenditures price index reading. The number of Americans filing new claims for unemployment benefits dropped to a 52-year low last week, suggesting economic activity was accelerating as a year ravaged by shortages, high inflation and an unrelenting pandemic draws to a close.

A separate report from the Commerce Department on Wednesday showed gross domestic product rose at a 2.1% rate in the third quarter. That was a slight upward revision from the 2.0% pace estimated in October, but was still the slowest in more than a year. The economy grew at a 6.7% rate in the second quarter. But that is all in the rear-view mirror. A third report from the Commerce Department showed consumer spending, which accounts for more than two-thirds of U.S. economic activity, jumped 1.3% in October after rising 0.6% in September.

The personal consumption expenditures (PCE) price index, excluding the volatile food and energy components, increased 0.4% last month after gaining 0.2% in September. In the 12 months through October, the so-called core PCE price index accelerated 4.1%. That was the largest gain since January 1991 and followed a 3.7% year-on-year advance in September.

"Gold still has some recovery potential on anticipation of high inflation figures. But essentially, with the Fed pursuing the ongoing tapering, that should push up real rates at a later stage, keeping prices volatile", said UBS analyst Giovanni Staunovo.

"The prevailing sentiment is that the price of gold will be facing some headwinds," and bullion could face significant resistance around the $1,800 - $1,810 levels, said Ricardo Evangelista, senior analyst at ActivTrades.

The Fed will likely double the pace of tapering its monthly bond purchases from January to $30 billion, and wind down its pandemic-era bond buying scheme by mid-March, Goldman Sachs strategists said in a daily note on Thursday.

Gold gained on Friday, as concerns over the spread of a newly identified coronavirus variant boosted the metal's safe-haven appeal, although bullion was set for a weekly drop on bets of U.S. Federal Reserve turning more hawkish.

"A rate hike cycle is generally negative for gold, but we have to keep an eye on this new COVID variant - if it spreads to the United States, that could weaken growth and I can't see the Fed hiking rates in that environment," said Stephen Innes, managing partner at SPI Asset Management.

Michael Langford, director at corporate advisory AirGuide, expects gold to decline further on higher chances of Fed's sticking to tapering timeline. The Fed is unlikely to alter its taper timeline as monetary policies are closely intertwined with the government's public sentiment that any change would be negative for their next election prospects, limiting gold's decline."

"Uncertainty about the possible consequences of the new virus variant clearly reminds the markets that this pandemic is not over yet," said Alexander Zumpfe, a precious metals dealer at Heraeus. "The gold price should remain supported in this environment and the topic of tapering should take a back seat for the time being," he said.

But after the rally due to bullion's safe-haven appeal, the overall bearish turn in commodities eventually claimed gold as well, said Jim Wyckoff, senior analyst at Kitco Metals, adding the market reaction was probably overblown.

COT Report

This week we do not have fresh CFTC data, but we have recent update from SPDR Fund that shows more inflows this week, although it is dated before Omicron news. Data shows that reserves have increased despite recent sell-off.

The bottom line

Now, with the comments above we could more or less, but understand investors' sentiment. There are big hopes that Omicron will pass in the same way as Delta, but recent virologists careful statements do not exclude that world still could return to pre-vaccine area, at some degree. But what hazard it could care for gold performance? Recall how pandemic been progressed - it was total run into quality, with real interest rates were dropping all thinkable levels, making gold more attractive for investing. Whatever degree to lockdown economy it will be - anyway this is supportive to the gold market. This is first fact.

Second is - review of the Fed tightening. Indeed, hardly they cancel the tapering, because inflation is not cancelled, actually. But tapering is not the tightening - it has minor value and could be continued without big harm to economy. But investors' sentiment change on Fed rate hike speed means a lot for gold and supports it. Developed central banks already have printed together 20 Trln - 20-25% of World GDP. With more lockdowns - more stimulus should come, which is also supportive to the gold market. So, the first conclusion that could make here is - if Omicron shows any hazard, even at minor degree, it should be supportive to the Gold market.

Now let's suppose that this was just emotional reaction and soon virologists tell that its hazard is overvalued, i.e. world returns back to its own. This situation we widely have discussed in our previous researches. Gold should get the period when it is free from interest rate change pressure, as it is set only for the middle of the next year. Until this moment gold has chances to show positive performance, if real rates will not rise too fast. With the recent data on Platinum consumption it is really could mean that inflation will be transitory. The same we could say from economists forecast of slowdown of global economy next year. The advantage for gold here exists as well - now markets and central banks will be aware of any new variant that could appear. This could stop them from drastic decisions and could slowdown the Fed interest rates activity as well.

That's being said, whatever scenario we get, it should not have strong negative impact on the gold. Although short-term volatility could rise, bringing few unwelcome surprises. Chart of real interest rates, with divergence to Gold suggests that 2nd scenario is more probable. Whatever happens, hardly world returns to total lockdowns era. More probable that people just accept this fact as the new environment where we're living now and keep moving on in the future. On Friday we've got sharp collapse of interest rates, with reversal week that should support gold and challenge the recent drop that we've got on re-appointment of J. Powell, at least in the short-term.

Technicals

Monthly

In short-term performance looks a bit poor, as market pulls back inside the flag consolidation and under YPP, showing upside spike. So, we can't totally exclude some downside continuation on lower time frames as well. At the same time, it doesn't break yet the monthly picture. The support line that makes shape of triangle here seems to be more important at current moment.

Speaking about upside target, we have very thrilling combination. Major COP is completed, but we also have all-time COP, when A point equals to ~ 40$ - fixed gold price to US dollar before the Bretton Wood. In this case all time COP agrees with YPR1 around 2165$. This is next nearest target on gold...

Once we've mentioned that overall price performance doesn't look truly bearish in long term. Market stands too close to the top, forming tight consolidation and has not reached even 3/8 major support. And potential appearing of pennant pattern just confirms this.

Weekly

Here trend stands bullish, overall action to the "blue OP" was fast and currently downside reaction doesn't contradict to the normal market behavior. The only unpleasant moment is that price drops back inside the triangle. This increases chances on some downside continuation before new signs of recovering could appear:

Daily

Daily picture reminds action on the monthly chart. The pullback and 4H DRPO pattern has worked perfect but its effect was reversed rather soon. As major K-area is broken already and price is not at oversold anymore - gold could keep dropping to the next support of 1760$, as we've suggested through the previous week.

Intraday

So, the sell-off was too strong to ignore it, and quite enough to reach at least downside COP target here. This target, by the way, perfectly agrees with daily 5/8 1758$ Fib support. DRPO "Buy" has worked nice.

Here we could discuss only the way, how market turns down. As interest rates collapsed on Friday, and recalling gold's habit to show deep retracement, we do not exclude a kind of AB-CD retracement and appearing of "222" Sell, before downside action continues. Conversely it could be direct drop as well...

It means that if you're searching chances to go short on intraday chart - you could combine two things. First is, you could use stop "Sell" order near the bottom for the case of direct breakout, and additionally Limit order around 1815$, in a case of upside AB-CD. Just avoid strong upward action.

For the buyers is nothing to do by far - we wait for the next support area.