Henry Liu

Former FPA Special Consultant

- Messages

- 473

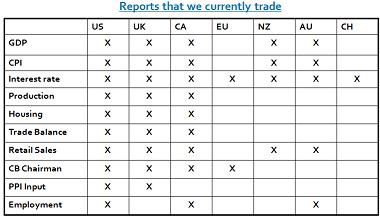

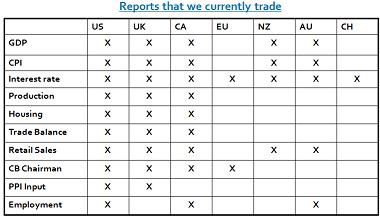

What Kind Of News Do We Trade?

There is literally hundreds of financial news released around the clock from all over the world. The key is to concentrate on news releases that have an immediate impact on the market. There are about 5 to 10 important news from U.S., and about 3~5 each from UK, EURO Zone, Australia, Canada, and New Zealand. These news releases are usually scheduled monthly or quarterly; they will repeat every month around the same day of the week or day of the month.

We only trade news releases that are currently considered as “hot”, meaning that the market is particularly interested in it. For example, a few years ago during the real estate boom, U.S. Housing Start, Existing Home Sales, and New Home Sales were constantly ignored and no one was paying attention to it. Why? Because at the time economy was doing good, home sales were always better than expected, and market just assumed the best and basically ignored the numbers. Look at the same news releases today, Housing news releases were particularly important because the economy is suffering, any signs of rebound from the housing sector signals improvement in the economy, as many market analysts pointed out; therefore, housing data is currently “hot”. Similarly, the weekly Jobless Claims is also “hot” recently because of former Fed. Chairman Greenspan talked about it in his book…

Other news releases such as consumer confidence, current account, and even the TIC Net Long-Term Securities are currently being ignored. But they will eventually become hot again, as many of these news releases and market focus work in cycles, just as the fashion industry.

The key to trading economic news successfully is to be selective with news releases to trade. As stated before, with hundreds of news released monthly, why risk with less important news releases and gamble your hard earned money when you can trade with news that have a higher probability of success? Therefore, I have compiled a list of news releases that have a high probability of success (at least 70%) backed by solid track record.

We'll be looking at all of these releases together and I'll be posting my analyses about 24 hours ahead of their scheduled release times right in the Current Forex Trading Signals section, make sure to check back often...

Basic Trading Concept

Let’s start by defining few important terms:

Forecasted (Consensus or Expected) Figure: This is usually derived from a survey done by financial news organizations such as Bloomberg, Reuters, etc… Usually they get a number of economists, anywhere from 20 to 240, and ask them what number they think it will be. After getting all of the numbers, the highest and the lowest are taken out with the rest averaged out to a single “averaged” figure. That is why with different news organizations will have a slightly different consensus number.

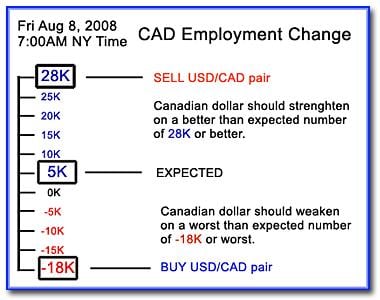

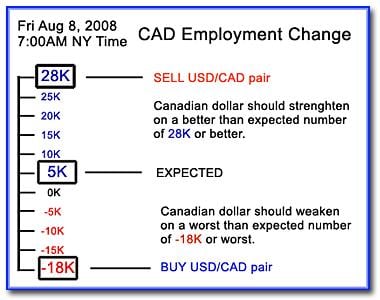

Deviation: is the difference between the actual release number and the forecasted number. Let’s say that CPI is expected to be 3.0% and the actual number came out as 3.3%; the deviation is then 0.3%.

Actual Figure: This is the actual release figure from the official source of the information.

Revision: This is the revised change done for previous release figure, usually the month before. It could sometime impact the market greatly if the revision is huge. Usually if we have a good deviation with a good revision number, the market will react even more.

Fundamental Trading In a Nutshell: Every major news release has a forecasted or consensus figure determined by economists beforehand. If the actual release figure is different from the consensus or forecasted (or expected) figure, the market is surprised and will react to the release immediately. The bigger the surprise, or deviation, will produce bigger reaction. Based on historical data, we can predict that a particular deviation will trigger a minimum amount of pips movement. If a news release consistently moves over 40 pips with a particular deviation, we expect that a similar deviation in the future will likely to cause the market to move 40 pips.

Although we have to be flexible in our trading, news trading requires that a specific plan to be followed with specific set of rules to protect our investment. It is particularly important that we only take a trade when our expected deviation is hit, not we get a close enough deviation.

For example, if you have promised your teenage son a car on his 18th birthday on the condition that he gets straight A’s in school this semester, and he came home with a couple of B’s, you wouldn’t have to give him a car. We must regard news trading with the same kind of discipline because sometimes almost still means no.

To further drive this point, consider that since the forecasted number is an average, many fund managers or banks might be expecting a slightly different number than you and I, and if we take a close enough deviation to trade, we might just be going in the opposite direction against some of these big fund managers.

For example, if the upcoming ISM Manufacturing Index has a forecasted number of 52.5, and our standard deviation is 3.0. The actual release came out as 50.3… what is our course of action? The actual deviation is 2.2, about 0.8 points away from our tradable deviation, but it’s close enough… so you enter a short trade. But Mr. Big Shot at ABC Hedge Fund may also be looking at release of 50.3, which still means expansion in the sector (above 50 means expansion, below 50 means contraction), and decided to go on a long trade. This could be devastating for your account. Remember, the deviations that we trade are “safe” deviations, they have been proven to work in the past and that is why we trade them.

It’s time to lay down some ground rules before getting into the actual trading methods. Remember that the following are extremely important and you should always keep in mind when trading the news, no matter what kind of news releases or how huge the deviations are.

Ok, it’s time to talk about the actual fundamental news trading methods. Remember to always prepare a plan by writing them down on a piece of paper; do not get into the market unprepared.

Fundamental Trading Methods

TRADE THE SPIKE

This type of trading requires a fast reaction, a good broker that allows you to trade the news and gives you a good fill with minimum slippage.

TRADE THE RETRACEMENT

This type of trading is much easier than trading the spike, but sometimes we might not get a retracement at all or big enough and miss this trade altogether.

Here's a video demonstrating the Trade The Retracement method.

<object width="480" height="385"><param name="movie" value="http://www.youtube.com/v/ccPsFS3US_A&hl=en_US&fs=1?rel=0"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/ccPsFS3US_A&hl=en_US&fs=1?rel=0" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="480" height="385"></embed></object>

Thanks!

There is literally hundreds of financial news released around the clock from all over the world. The key is to concentrate on news releases that have an immediate impact on the market. There are about 5 to 10 important news from U.S., and about 3~5 each from UK, EURO Zone, Australia, Canada, and New Zealand. These news releases are usually scheduled monthly or quarterly; they will repeat every month around the same day of the week or day of the month.

We only trade news releases that are currently considered as “hot”, meaning that the market is particularly interested in it. For example, a few years ago during the real estate boom, U.S. Housing Start, Existing Home Sales, and New Home Sales were constantly ignored and no one was paying attention to it. Why? Because at the time economy was doing good, home sales were always better than expected, and market just assumed the best and basically ignored the numbers. Look at the same news releases today, Housing news releases were particularly important because the economy is suffering, any signs of rebound from the housing sector signals improvement in the economy, as many market analysts pointed out; therefore, housing data is currently “hot”. Similarly, the weekly Jobless Claims is also “hot” recently because of former Fed. Chairman Greenspan talked about it in his book…

Other news releases such as consumer confidence, current account, and even the TIC Net Long-Term Securities are currently being ignored. But they will eventually become hot again, as many of these news releases and market focus work in cycles, just as the fashion industry.

The key to trading economic news successfully is to be selective with news releases to trade. As stated before, with hundreds of news released monthly, why risk with less important news releases and gamble your hard earned money when you can trade with news that have a higher probability of success? Therefore, I have compiled a list of news releases that have a high probability of success (at least 70%) backed by solid track record.

We'll be looking at all of these releases together and I'll be posting my analyses about 24 hours ahead of their scheduled release times right in the Current Forex Trading Signals section, make sure to check back often...

Basic Trading Concept

Let’s start by defining few important terms:

Forecasted (Consensus or Expected) Figure: This is usually derived from a survey done by financial news organizations such as Bloomberg, Reuters, etc… Usually they get a number of economists, anywhere from 20 to 240, and ask them what number they think it will be. After getting all of the numbers, the highest and the lowest are taken out with the rest averaged out to a single “averaged” figure. That is why with different news organizations will have a slightly different consensus number.

Deviation: is the difference between the actual release number and the forecasted number. Let’s say that CPI is expected to be 3.0% and the actual number came out as 3.3%; the deviation is then 0.3%.

Actual Figure: This is the actual release figure from the official source of the information.

Revision: This is the revised change done for previous release figure, usually the month before. It could sometime impact the market greatly if the revision is huge. Usually if we have a good deviation with a good revision number, the market will react even more.

Fundamental Trading In a Nutshell: Every major news release has a forecasted or consensus figure determined by economists beforehand. If the actual release figure is different from the consensus or forecasted (or expected) figure, the market is surprised and will react to the release immediately. The bigger the surprise, or deviation, will produce bigger reaction. Based on historical data, we can predict that a particular deviation will trigger a minimum amount of pips movement. If a news release consistently moves over 40 pips with a particular deviation, we expect that a similar deviation in the future will likely to cause the market to move 40 pips.

Although we have to be flexible in our trading, news trading requires that a specific plan to be followed with specific set of rules to protect our investment. It is particularly important that we only take a trade when our expected deviation is hit, not we get a close enough deviation.

For example, if you have promised your teenage son a car on his 18th birthday on the condition that he gets straight A’s in school this semester, and he came home with a couple of B’s, you wouldn’t have to give him a car. We must regard news trading with the same kind of discipline because sometimes almost still means no.

To further drive this point, consider that since the forecasted number is an average, many fund managers or banks might be expecting a slightly different number than you and I, and if we take a close enough deviation to trade, we might just be going in the opposite direction against some of these big fund managers.

For example, if the upcoming ISM Manufacturing Index has a forecasted number of 52.5, and our standard deviation is 3.0. The actual release came out as 50.3… what is our course of action? The actual deviation is 2.2, about 0.8 points away from our tradable deviation, but it’s close enough… so you enter a short trade. But Mr. Big Shot at ABC Hedge Fund may also be looking at release of 50.3, which still means expansion in the sector (above 50 means expansion, below 50 means contraction), and decided to go on a long trade. This could be devastating for your account. Remember, the deviations that we trade are “safe” deviations, they have been proven to work in the past and that is why we trade them.

It’s time to lay down some ground rules before getting into the actual trading methods. Remember that the following are extremely important and you should always keep in mind when trading the news, no matter what kind of news releases or how huge the deviations are.

- It doesn’t matter whether or not the market reacts the way you expect it to react. You have to remember that nothing is absolute in trading, especially with Forex.

- We do not form an opinion before the news release; we will wait for news release to come out, and then trade according to plan.

- We are only looking for the probability of the combined reaction of the market in the short term, within the first 30 minutes up to 2 hours immediately after the news release.

- We must be flexible in trading. If market sentiment, technical analysis, and the news release numbers all point to one direction but the market still react in a completely opposite direction, we must also act accordingly. It is most likely that we’ve missed some underlying reason to this reaction, and we must respect the market.

- We only concentrate on the news that has most impact to the market with most predictable reaction.

- We always assume that the market will overreact to the news.

- Study the reaction of the market after news release. You will see the “underlying market” sentiment.

Ok, it’s time to talk about the actual fundamental news trading methods. Remember to always prepare a plan by writing them down on a piece of paper; do not get into the market unprepared.

Fundamental Trading Methods

TRADE THE SPIKE

- We wait for the news release to come out. Based on the release number we will enter the market immediately if our expected deviation is hit.

- We will try to catch the initial spike move, whole or part of the move, and get out of the trade at top of the expected movement range (40-50 pips.)

- A stop/loss will be placed 15 pips from the pre-release price. This is the price level just before the news release. Our take profit order will be once again the top of the expected movement range.

This type of trading requires a fast reaction, a good broker that allows you to trade the news and gives you a good fill with minimum slippage.

TRADE THE RETRACEMENT

- We wait for the news release to come out. Based on the release number we will determine “where” to get into the market if our expected deviation is hit.

- We will wait for the market to retrace back within 10~15 pips of the pre-release price level. Sometimes when we have a huge deviation, we can enter the market at 20~30 pips from the pre-release level, but it would be based on discretion. Market will usually retrace within the first 5~30 minutes, if a retracement is to take place. A lot of times it is important to take consideration of the context of the news when trading.

- A stop/loss will be placed 20~25 pips from the entry price. Therefore, it is very important to wait for the market to come back because if we enter too soon, we might get stopped out.

This type of trading is much easier than trading the spike, but sometimes we might not get a retracement at all or big enough and miss this trade altogether.

Here's a video demonstrating the Trade The Retracement method.

<object width="480" height="385"><param name="movie" value="http://www.youtube.com/v/ccPsFS3US_A&hl=en_US&fs=1?rel=0"></param><param name="allowFullScreen" value="true"></param><param name="allowscriptaccess" value="always"></param><embed src="http://www.youtube.com/v/ccPsFS3US_A&hl=en_US&fs=1?rel=0" type="application/x-shockwave-flash" allowscriptaccess="always" allowfullscreen="true" width="480" height="385"></embed></object>

Thanks!

Last edited: