cjforex

Recruit

- Messages

- 9

Most people think they have good internet, and it rarely goes down, so it’s fine for trading. Well, the real truth can cost you.

First there are two key components for trading:

Latency – The Hidden Killer

Basically latency adds slippage. It adds slippage twice! The first component of latency is the delay in the quote price from your brokerage’s trade server to send the price quote to your computer trading platform. Noisy latency causes delays in a couple ways.

The Hidden Requote

The Internet sends data in packets. It breaks information up into a bunch of little packets and then sends them to be reassembled at your computer. When your latency is noisy, it means that you are losing packets. When a packet is dropped, your computer send a signal to resend the information. This means that the first time a quote is sent, you didn’t get it, and you had to ask for it again. Chances are the the price may have moved by then, or is close to moving at any moment.

The Hidden ReTrade

It’s the same thing when you place a trade. If you have noisy latency, your trade order will not be received, and the server will ask for it again because of lost packets.

The Ordinary Delay

The basic delay is latency time. A latency of 100ms (milliseconds) means 0.1 seconds. Doesn’t seem like a lot, but it adds up. It’s a basic delay for you getting the quote, and then another delay you sending the order. This isn’t as troublesome as ReQuotes and ReTrades (unless you are a High Frequency Trader).

How To Tell What You Have?

It’s important to know what kind of Internet quality you have. First consider that it changes all day long. Most people use a shared Internet such as Cable Internet. It’s shared with all your neighbors in the town you live. So when your neighbors kid starts torrenting music, your internet is going to suffer. So you need to know what the Internet quality is when you are trading. So watch it during key times for your trading style.

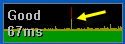

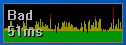

A tool I use on all my machines is NetMon. It’s a tiny program that puts a small chart on your desktop showing the quality. Here is an example of the output.

Here is an example from my home computer. (I don’t trade from my home computer.)

The left “Good” example is an example of a relatively good, clean connection. The “Bad” example shows a clearly noisy connection. Note even in the “Good” example there is a dropped packet that would have triggered a ReQuote or a ReTrade (Yellow Arrow).

NetMon (the tool I use) is free. For download links (no links allowed) so google Nullsoft Netmon. Make sure its free!

~CJForex~

First there are two key components for trading:

- Latency

This is the stuff High Frequency Traders talk about, and it’s critical for any trader. Basically it is how long it takes to send a signal from your computer to the trade server of your brokerage. This delays your quotes, and delays the execution of your orders. - Reliability

Most people think their Internet doesn’t go down that often. I will talk about this in another post.

Latency – The Hidden Killer

Basically latency adds slippage. It adds slippage twice! The first component of latency is the delay in the quote price from your brokerage’s trade server to send the price quote to your computer trading platform. Noisy latency causes delays in a couple ways.

The Hidden Requote

The Internet sends data in packets. It breaks information up into a bunch of little packets and then sends them to be reassembled at your computer. When your latency is noisy, it means that you are losing packets. When a packet is dropped, your computer send a signal to resend the information. This means that the first time a quote is sent, you didn’t get it, and you had to ask for it again. Chances are the the price may have moved by then, or is close to moving at any moment.

The Hidden ReTrade

It’s the same thing when you place a trade. If you have noisy latency, your trade order will not be received, and the server will ask for it again because of lost packets.

The Ordinary Delay

The basic delay is latency time. A latency of 100ms (milliseconds) means 0.1 seconds. Doesn’t seem like a lot, but it adds up. It’s a basic delay for you getting the quote, and then another delay you sending the order. This isn’t as troublesome as ReQuotes and ReTrades (unless you are a High Frequency Trader).

How To Tell What You Have?

It’s important to know what kind of Internet quality you have. First consider that it changes all day long. Most people use a shared Internet such as Cable Internet. It’s shared with all your neighbors in the town you live. So when your neighbors kid starts torrenting music, your internet is going to suffer. So you need to know what the Internet quality is when you are trading. So watch it during key times for your trading style.

A tool I use on all my machines is NetMon. It’s a tiny program that puts a small chart on your desktop showing the quality. Here is an example of the output.

Here is an example from my home computer. (I don’t trade from my home computer.)

The left “Good” example is an example of a relatively good, clean connection. The “Bad” example shows a clearly noisy connection. Note even in the “Good” example there is a dropped packet that would have triggered a ReQuote or a ReTrade (Yellow Arrow).

NetMon (the tool I use) is free. For download links (no links allowed) so google Nullsoft Netmon. Make sure its free!

~CJForex~