BulletProof_Traders

Recruit

- Messages

- 1

Neckline Trading

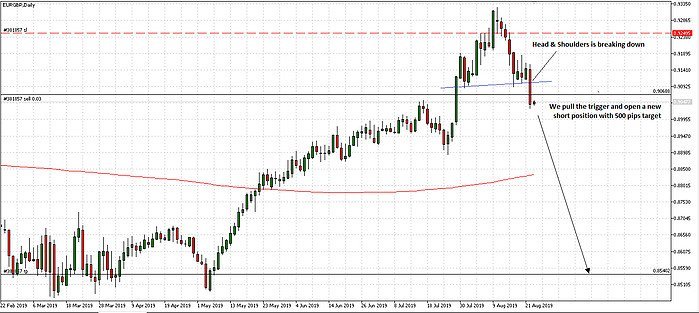

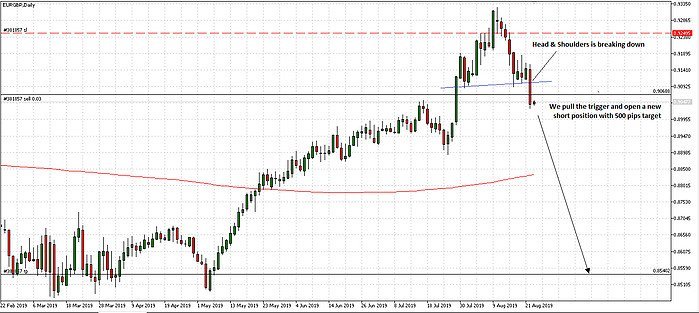

There are very few trading setups that excites us as much as the Neckline – Double Top setup. This trading technique is a derivative of the Head & Shoulders pattern. The setup itself is not too abundant and will only appear every now and then. However, when it does appear, it’s a gold mine. It carries one of the highest success rate scores amongst all the advanced setups that we normally apply in our day to day trading.

After countless of neckline trading events, we can estimate the success rate of this trading technique at around 85%. We assume that the main reason for this high success rate score is the powerful relationship between the neckline of an established Head & Shoulders pattern and a simple Double Top Pattern that interacts with that neckline from below.

Effectively speaking, on the second touch, the neckline is being confirmed by price action which by now, is officially a solid-strong resistance level, and its probably going to hold its ground. This means that with unusually high probability level, price is going to bounce off that resisting neckline into a full-fledged downside move, continuing the natural flow of the original Head & Shoulders breakout.

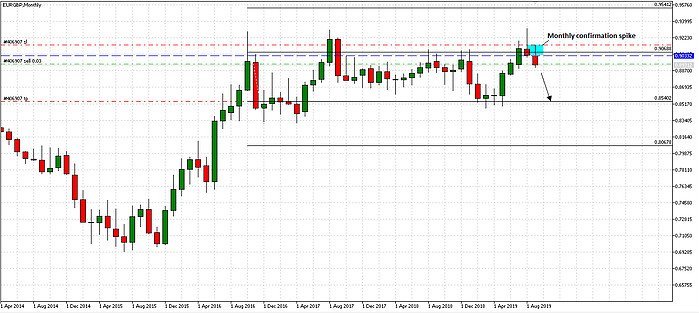

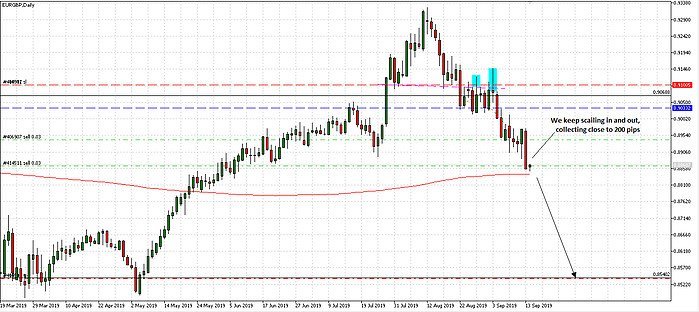

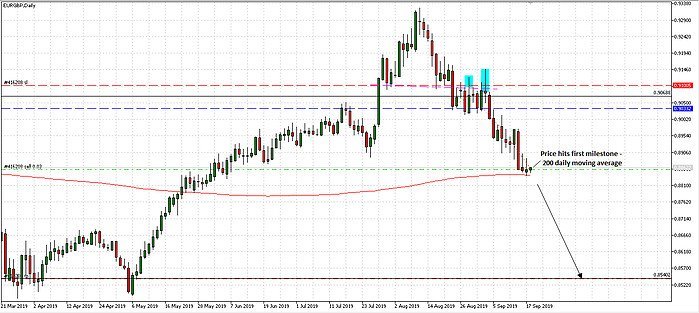

The complimentary confirmation spikes (from the Weekly and Monthly charts) off the major resistance key level of 0.9068 created a particularly high probability situation and re-enforced our bearish conviction. This in turn, helped us to build a big size position sliding downwards.

The second bounce off the neckline completes the setup and triggers our full commitment to push more trades and increase our short position. Even though we have a long way to go till our primary price target at 0.8540, we are going to utilize the relatively close by 200 Daily moving average as a secondary price target for partial profit taking.

Bulletproof Traders