Forex Forecast and Cryptocurrencies Forecast for August 27-31, 2018

First, a review of last week’s forecast:

- EUR/USD. As expected, the US-China talks did not bring clarity: the only information came from the PRC Ministry of Commerce, which reported that the talks were frank and useful. Such a wording can be considered as the absence of specific results. Speech by Fed Chairman Jerome Powell was not revolutionary either and dropped the dollar by just 30 points.

In general, over the week, the euro rose by almost 200 points, which, in the first place, was caused by serious problems around the US president and his surrounding, which could turn into prison terms for his assistants and the criminal prosecution of Trump himself. The US decision to postpone the question of raising duties on cars from the EU played in favor of the euro as well. As a result, the pair completed the week session where 45% of experts had expected - at 1.1622, close to resistance 1.1630;

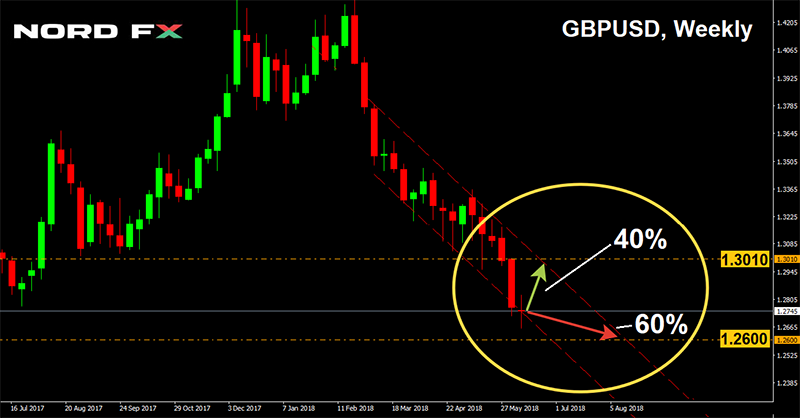

- GBP/USD. Following the euro, the British pound grew against the dollar, reaching the middle of the medium-term downtrend, which began back in spring. The pair reached the marks of the beginning of August and met the end of the five-day period at 1.2845;

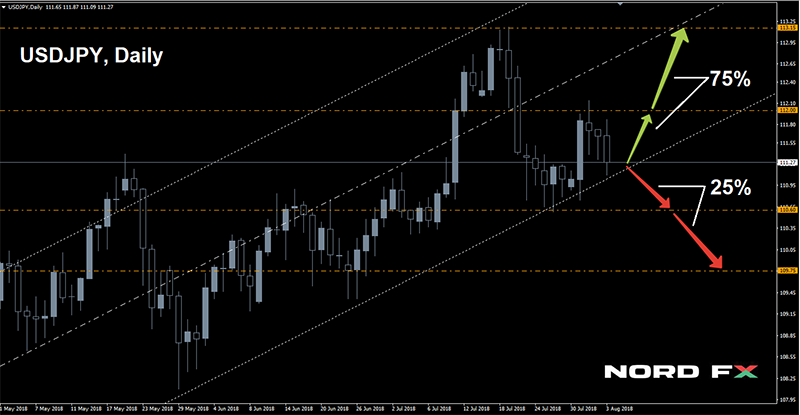

- USD/JPY. Recall that 75% of analysts expected the pair to fall into the 109.00 zone, and 25% voted for its return to the levels of 111.00-112.00. The pair, according to the expectations of the majority, really went down and on Tuesday, August 21, it dropped to the level of 109.75. However, the drop ceased, and then the forecast of the remaining 25% of the experts was implemented: the pair rose to the area of 111.00-112.00, reaching the height of 111.50.The final chord sounded a little lower - at around 111.25;

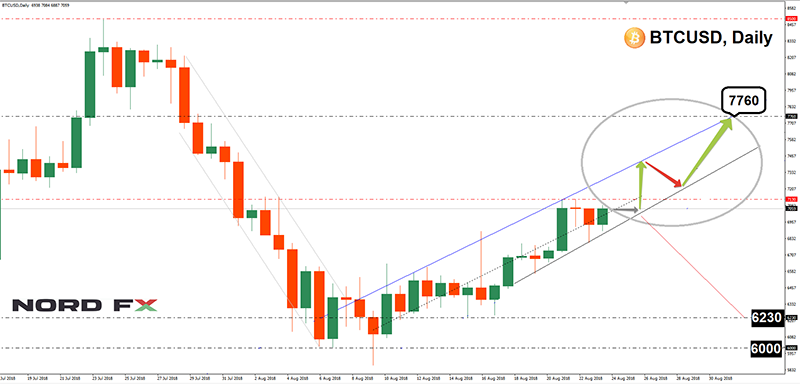

- Cryptocurrencies. The main bad news of the week is that the US Securities and Exchange Commission (SEC) has rejected five more (nine in total) applications to launch Bitcoin -oriented investment funds (Bitcoin-ETF). The main reason for the rejection is the same - the problems of crypto-exchanges with fraud and price manipulation. The good news is that the SEC can still reconsider its decision. The bulls were also pleased with the news that the world's first blockchain-based bonds issued by Bank of Australia, are actively bought by investors.

As for the crypto market capitalization, it has grown slightly and amounted to just over $210 billion.

In this situation, the pair BTC/USD continued to move almost all the time in a rather narrow range of $6,230-6,65 0. As we assumed, it was difficult enough for bitcoin to gain a foothold above the resistance of $6,830. The attempt on August 22 failed: reaching $6,885, the pair quickly turned around and returned to the weekly range. The next attempt occurred on Friday night, when the thin market becomes even thinner.

The breakdown of support $6,230 is hampered by the fact that it is already now that most miners are working on the verge of payback. And if there is a fall below the $6,000-6,100 zone, mining becomes almost unprofitable.

Litecoin (LTH), ripple (XRP) and many other top coins, have followed the bitcoin into a flat state. But the Ethereum (ETH) has once again demonstrated negative dynamics, having lost about 15% during the week.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

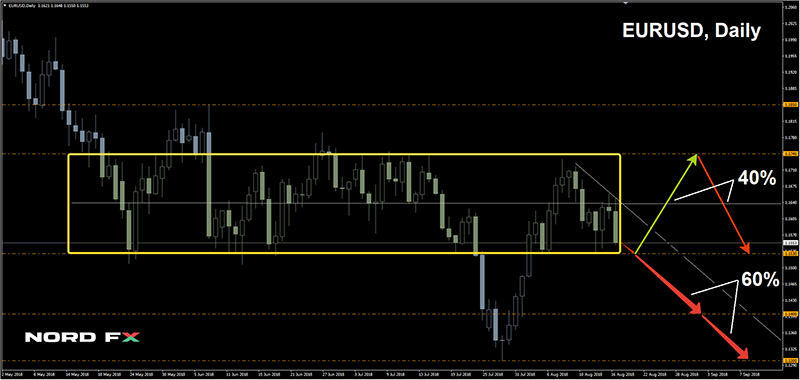

- EUR/USD. No results in the US-China talks, possible impeachment of President Trump. One can also add the attacks of the US president towards the head of the Federal Reserve. The latter fell out of favor with Trump because of an excessively tight financial policy and an increase in lending rates. All this still creates uncertainty in the market, as a result of which the opinions of experts are divided as follows:

- 45% of them, supported by most oscillators and graphical analysis for H4, are in favor of further weakening of the dollar and the pair's transition to the zone 1.1630 -1.1750. The next resistance is 1.1840;

- 30% of analysts still believe in the dollar and are waiting for the pair to return to the mid-August low. The nearest support is 1.1430, the target is 1.1300. Graphical analysis on D1 and 15% of oscillators, signaling that the American currency is overbought, side with these analysts;

- and, finally, the remaining 25% of experts simply could not make a decision in this situation.

If we move to longer-term forecasts, more than 60% of experts give preference to the dollar. Thus, for example, while the EU is deciding whether to continue or not stimulating monetary policy, JP Morgan analysts forecast the euro/dollar rate at the level of 1.1000-1.1200 by the end of the year. The reasons are the same: Brexit, Italy and Turkey, along with other countries on the perimeter of the European Union. However, JP Morgan analysts do not exclude the rise of the European currency to the level of 1.1900 afterwards, but this will not happen until spring 2019;

- GBP/USD. According to the graphical analysis, the future of this pair looks as follows: first growth to the upper boundary of the descending channel (zone 1.3000-1.3080), then rebound and fall first to support 1.2660, and then even lower, to the level of 1.2585. As for the indicators, there is a complete confusion among them. Some signal that the pair is overbought, some say it is oversold, some are painted red, others are green or neutral gray. A similar confusion can be seen among the experts as well. However, when we look at forecasts for autumn, the picture becomes more clear - here it is already more than 65% of analysts who talk about the growth of the pair. The targets, however, are still rather vague - from 1.3100 to 1.3500;

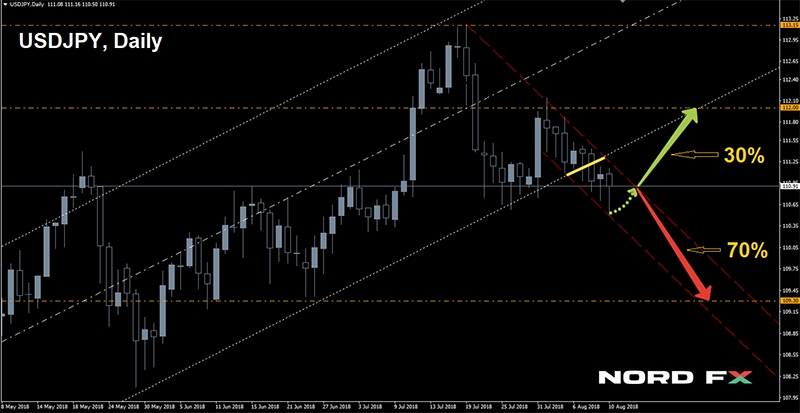

- USD/JPY. The yen continues to be pressured by low inflation, which speaks of weak demand and hinders the GDP growth. The head of the Central Bank of Japan Haruhiko Kuroda has once even promised to commit hara-kiri if inflation does not reach the target of 2%. But the price increase is still extremely weak and has not even reached 1%. However, let's hope that Mr. Kuroda will not rush to fulfill his deadly promises.

Meanwhile, the regulator continues the stimulating policy of negative rates and large-scale buying up of assets. Against this background, even despite the US-China trade wars and other US problems, the dollar may continue its growth. At least that's what 65% of experts think, indicating 112.00, 113.50 and 114.70 as targets.

An alternative point of view is represented by 35% of analysts, graphical analysis on D1 and 20% of oscillators giving signals that the pair is overbought. If this bearish scenario gets a continuation, the pair is expected to go down to the area of 109.75-110.10. The nearest support is 110.75;

- Cryptocurrencies. Both bitcoin and major altcoins are close to their lows, and the crisis of confidence in the sector and the lack of positive news impedes the development of a strong bullish impulse. Although, as we noted earlier, such news most often does not entail any serious economic consequences and are only a reason for the next speculation.

The targets for the BTC/USD are the same. The target for the bulls is taking the height of $6,850, and then $7,760, for the bears it is to break the support of $6,230, then $6,000 and to go down to a low of $5,760. A fall below this mark may become a strong signal for a massive sell-off of cryptocurrencies and lead to a complete market collapse. And this is against the interests of all its participants, even those who are currently playing on the decline. Therefore, if the breakdown occurs, it is likely to be short-lived, and the pair will again return to the zone above $6,000. Although some analysts predict a drop to the level of $4,700.

And now, here is news for super-optimists and long-term investors, who are prepared to keep bitcoin until complete victory. The Telegram Channel What's on Crypto noted that after each halving of the mining award, the bitcoin price increased by dozen times. At the first reduction of fees on November 28, 2012, the pair BTC/USD traded at $12.With the second reduction on July 9, 2016, the rate was about $657. The third decline (from 12.5 BTC to 6.25 per block) should occur in the middle of 2020 and, if the forecast goes right, by 2023 the rate of this cryptocurrency can reach $10 million per coin. Whether it is true or not, we will learn "soon" - it's "only" about five years to wait.

Roman Butko, NordFX

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #usdchf #forex #forex_example #signals #forex #cryptocurrencies #bitcoin

https://nordfx.com/

https://nordfx.io/