Stan NordFX

NordFX Representative

- Messages

- 712

CryptoNews

- One of the US venture capital pioneers, Tim Draper, has once again reaffirmed his commitment to bitcoin. According to the financier, now is the time to invest in the main cryptocurrency, as it looks relatively stable against other assets. Even the dollar cannot compete with bitcoin on a number of parameters. Investing in altcoins will also definitely bear fruit, but the risk in this case is slightly increased. The financier did not rule out that even large banks, starting first just to work with cryptocurrencies, will then make them their main tool. And then the exchange rate of the dollar and the rest of the fiat will sink significantly.

“The effectiveness of each investment tool needs to be evaluated in times of crisis. If an asset sinks along with the entire market, the same can happen to it at any time. When a financial instrument shows relative stability, you need to use it for your own purposes. I'm sure bitcoin is the optimal asset to invest right now. The cryptocurrency market has a real support, so a serious drawdown is unlikely for it. In addition, digital assets are not associated with risky industries like the oil and the dollar. The cryptocurrency is almost unaffected by the geopolitical situation, which makes it stronger than any fiat asset,” Draper argued.

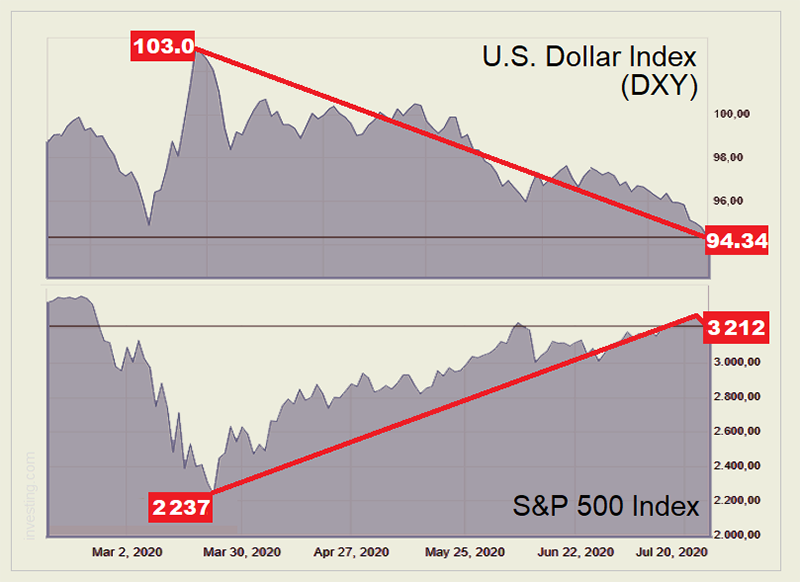

- According to the analytical portal Skew, the correlation between bitcoin and the S&P500 index has reached a historical high. The current rate is approximately 66.2 per cent. There has been an increase in correlation over the past few months, but now the value has reached its peak. If at the beginning of the year the correlation was traced only at serious collapses or spikes, now it takes place even at the lowest volatility. “Some people compare bitcoin with gold, but even if it is connected with the stock markets, it remains a risky asset,” experts say.

- The Binance-supported blockchain hotel reservation service Travala has announced a partnership with Expedia, an American tour operator. Thanks to this, it will be possible to pay for rooms in 700,000 hotels from the company's catalogue using BTC and another 30 digital currencies. Expedia previously accepted payments in bitcoins but abandoned this method in 2018 as it did not fit with their traditional financial model. And now a second attempt follows, apparently related to the general crisis in the tourism industry.

- The experts of The Tokenist information platform, having polled 4852 people aged 18 to 65 years from 17 countries, analysed how the attitude towards bitcoin has changed over the past three years. Since 2017, the number of people who prefer BTC to traditional assets has grown significantly. More than 45% of respondents would prefer to have this cryptocurrency instead of stocks, real estate and gold, which is 13% more than three years ago. Moreover, among millennials, their share is 92% against 68% earlier.

The number of people familiar with Bitcoin increased from 30% to 61%, with the number of respondents owning or having owned it rising from 2% to 6%. Among millennials, the number of people familiar with bitcoin rose from 42% to 78%, and cryptocurrency owners rose from 4% to 14%. Note that 44% of millennials claim that they will buy BTC within the next five years.

There is an increase аrom 18% to 47% in the number of people trusting bitcoin more than large banks. Among millennials surveyed, there are 51 percent of them, among older people, only 7 percent of them. It is noteworthy that the number of people over 65 who are familiar with cryptocurrencies has grown by 51%! The authors of the study believe that this is due to the growing mention of bitcoin in the media and the growing support for coins from the side of trade.

- A team of researchers from Bloomberg Agency published a report forecasting the rapid resumption of the rally of the leading cryptocurrency. According to analysts, the market has the most comfortable environment for the flow of capital into the crypto industry. Among the factors contributing to the strengthening of BTC, experts highlighted the weakening position of central banks, as well as the growth of investment in gold, the digital counterpart of which is bitcoin. The low volatility that we have observed over the past weeks also contributes to the flow of funds from the stock market to BTC. The result of the new bitcoin race should be a rise to $12,000. Recall that among Bloomberg analysts, Mike McGlone is an ardent supporter of the largest cryptocurrency. He said back in June that a BTC jerk was imminent, with the result by the end of the year being to overcome the psychological milestone of $20,000. In shaping his forecast, McGlone relied on statistics on the growth of active addresses in the BTC network.

- Anthony Trenchev, Managing Partner of Nexo Credit Platform, gave an even more optimistic forecast. In his opinion, the value of bitcoin may exceed $50,000 in a few months. During an interview at the Block Down conference, Anthony Trenchev said that the Nexo platform is growing tens of percent every month, new customers are constantly registering, both retail and institutional investors. And it is the increased participation of institutionals that can be the driver of growth.

Trenchev believes that from the point of view of fundamental factors, bitcoin is now stronger than ever. It looks particularly strong against the backdrop of quantitative easing policies pursued by central banks. “I think it's good for gold and especially for bitcoin. So, I'm sticking to my $50,000 forecast by the end of the year. I admit, this is a bold statement, but fundamental factors and a change in attitude towards cryptocurrency make it real,” Anthony Trenchev concluded.

- A popular crypto analyst under the nickname PlanB conducted a survey among Twitter users to find out what the price of BTC will be by December 2021. The survey involved 26,639 people. Most respondents believe that the largest cryptocurrency will not be able to break above $55,000. Nearly 30% of respondents named the $100,000 mark. And 17% do not exclude the option in which BTC will approach $ 300,000.

- Developer and founder of startup Zap Inc. Jack Mullers announced the launch of the Strike product into the open beta stage. Strike will allow transfers in BTC via direct bank deposits, similar to how it works with dollars. 2Also, in order to enter the market in the most efficient way, the startup is preparing to release its own card in the Visa system.

This year, Visa accepted the Fold cryptocurrency cashback distribution program into Fast Track. There is also a debit card that allows you to pay with cryptocurrency. It is not yet known what option will be offered to Zap card holders.

- The chief organizer and principal perpetrator of the Olalekan crime scheme, Jacob Ponle, better known as Woodbery, has been extradited from the UAE and will be tried in the United States in a case of money laundering, fraud a particularly large scale and a number of crimes. The cybercriminal faces up to 20 years in prison. According to the FBI, about 2 million people and organizations have become victims of fraud over the past few years. The group included at least 11 people who were engaged in hacker attacks on computers and servers of large American companies, having stolen about $168 million.

- The ZUBR crypto derivatives exchange published a study according to which the daily mining of bitcoin by the end of this decade will be significantly lower than the demand for it from buyers. Based on the performance of Chainalysis, ZUBR estimates that by the time of the next halving in 2024, small investors will already absorb more than 50% of the supply. And if everything continues at this rate, the demand for bitcoins will significantly exceed the supply by 2028, which will entail a significant increase in the price of this cryptocurrency.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #forex #cryptocurrencies #bitcoin #stock_market

https://nordfx.com/

- One of the US venture capital pioneers, Tim Draper, has once again reaffirmed his commitment to bitcoin. According to the financier, now is the time to invest in the main cryptocurrency, as it looks relatively stable against other assets. Even the dollar cannot compete with bitcoin on a number of parameters. Investing in altcoins will also definitely bear fruit, but the risk in this case is slightly increased. The financier did not rule out that even large banks, starting first just to work with cryptocurrencies, will then make them their main tool. And then the exchange rate of the dollar and the rest of the fiat will sink significantly.

“The effectiveness of each investment tool needs to be evaluated in times of crisis. If an asset sinks along with the entire market, the same can happen to it at any time. When a financial instrument shows relative stability, you need to use it for your own purposes. I'm sure bitcoin is the optimal asset to invest right now. The cryptocurrency market has a real support, so a serious drawdown is unlikely for it. In addition, digital assets are not associated with risky industries like the oil and the dollar. The cryptocurrency is almost unaffected by the geopolitical situation, which makes it stronger than any fiat asset,” Draper argued.

- According to the analytical portal Skew, the correlation between bitcoin and the S&P500 index has reached a historical high. The current rate is approximately 66.2 per cent. There has been an increase in correlation over the past few months, but now the value has reached its peak. If at the beginning of the year the correlation was traced only at serious collapses or spikes, now it takes place even at the lowest volatility. “Some people compare bitcoin with gold, but even if it is connected with the stock markets, it remains a risky asset,” experts say.

- The Binance-supported blockchain hotel reservation service Travala has announced a partnership with Expedia, an American tour operator. Thanks to this, it will be possible to pay for rooms in 700,000 hotels from the company's catalogue using BTC and another 30 digital currencies. Expedia previously accepted payments in bitcoins but abandoned this method in 2018 as it did not fit with their traditional financial model. And now a second attempt follows, apparently related to the general crisis in the tourism industry.

- The experts of The Tokenist information platform, having polled 4852 people aged 18 to 65 years from 17 countries, analysed how the attitude towards bitcoin has changed over the past three years. Since 2017, the number of people who prefer BTC to traditional assets has grown significantly. More than 45% of respondents would prefer to have this cryptocurrency instead of stocks, real estate and gold, which is 13% more than three years ago. Moreover, among millennials, their share is 92% against 68% earlier.

The number of people familiar with Bitcoin increased from 30% to 61%, with the number of respondents owning or having owned it rising from 2% to 6%. Among millennials, the number of people familiar with bitcoin rose from 42% to 78%, and cryptocurrency owners rose from 4% to 14%. Note that 44% of millennials claim that they will buy BTC within the next five years.

There is an increase аrom 18% to 47% in the number of people trusting bitcoin more than large banks. Among millennials surveyed, there are 51 percent of them, among older people, only 7 percent of them. It is noteworthy that the number of people over 65 who are familiar with cryptocurrencies has grown by 51%! The authors of the study believe that this is due to the growing mention of bitcoin in the media and the growing support for coins from the side of trade.

- A team of researchers from Bloomberg Agency published a report forecasting the rapid resumption of the rally of the leading cryptocurrency. According to analysts, the market has the most comfortable environment for the flow of capital into the crypto industry. Among the factors contributing to the strengthening of BTC, experts highlighted the weakening position of central banks, as well as the growth of investment in gold, the digital counterpart of which is bitcoin. The low volatility that we have observed over the past weeks also contributes to the flow of funds from the stock market to BTC. The result of the new bitcoin race should be a rise to $12,000. Recall that among Bloomberg analysts, Mike McGlone is an ardent supporter of the largest cryptocurrency. He said back in June that a BTC jerk was imminent, with the result by the end of the year being to overcome the psychological milestone of $20,000. In shaping his forecast, McGlone relied on statistics on the growth of active addresses in the BTC network.

- Anthony Trenchev, Managing Partner of Nexo Credit Platform, gave an even more optimistic forecast. In his opinion, the value of bitcoin may exceed $50,000 in a few months. During an interview at the Block Down conference, Anthony Trenchev said that the Nexo platform is growing tens of percent every month, new customers are constantly registering, both retail and institutional investors. And it is the increased participation of institutionals that can be the driver of growth.

Trenchev believes that from the point of view of fundamental factors, bitcoin is now stronger than ever. It looks particularly strong against the backdrop of quantitative easing policies pursued by central banks. “I think it's good for gold and especially for bitcoin. So, I'm sticking to my $50,000 forecast by the end of the year. I admit, this is a bold statement, but fundamental factors and a change in attitude towards cryptocurrency make it real,” Anthony Trenchev concluded.

- A popular crypto analyst under the nickname PlanB conducted a survey among Twitter users to find out what the price of BTC will be by December 2021. The survey involved 26,639 people. Most respondents believe that the largest cryptocurrency will not be able to break above $55,000. Nearly 30% of respondents named the $100,000 mark. And 17% do not exclude the option in which BTC will approach $ 300,000.

- Developer and founder of startup Zap Inc. Jack Mullers announced the launch of the Strike product into the open beta stage. Strike will allow transfers in BTC via direct bank deposits, similar to how it works with dollars. 2Also, in order to enter the market in the most efficient way, the startup is preparing to release its own card in the Visa system.

This year, Visa accepted the Fold cryptocurrency cashback distribution program into Fast Track. There is also a debit card that allows you to pay with cryptocurrency. It is not yet known what option will be offered to Zap card holders.

- The chief organizer and principal perpetrator of the Olalekan crime scheme, Jacob Ponle, better known as Woodbery, has been extradited from the UAE and will be tried in the United States in a case of money laundering, fraud a particularly large scale and a number of crimes. The cybercriminal faces up to 20 years in prison. According to the FBI, about 2 million people and organizations have become victims of fraud over the past few years. The group included at least 11 people who were engaged in hacker attacks on computers and servers of large American companies, having stolen about $168 million.

- The ZUBR crypto derivatives exchange published a study according to which the daily mining of bitcoin by the end of this decade will be significantly lower than the demand for it from buyers. Based on the performance of Chainalysis, ZUBR estimates that by the time of the next halving in 2024, small investors will already absorb more than 50% of the supply. And if everything continues at this rate, the demand for bitcoins will significantly exceed the supply by 2028, which will entail a significant increase in the price of this cryptocurrency.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #forex #cryptocurrencies #bitcoin #stock_market

https://nordfx.com/