Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,091

WTI Crude Oil: oil prices are falling 14.11.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the WTI Crude Oil for a better understanding of the current market situation and more efficient trading.

Current trend

Yesterday, oil prices renewed the year’s lows. The commodity markets have been declining for the 6th week in a row due to the sharp increase in oil production, despite the current OPEC agreement. The published report of the cartel reflected an increase in forecasts for 2018 and 2019, as well as a sharp increase in the current level of production in October against September.

US "black gold" production increases significantly, too. Earlier this month, the Department of Energy announced that the country reached peak volumes of 11.346 million barrels per day. In this case, according to President Donald Trump, prices on the market should be much lower. Based on these considerations, Trump criticized Saudi Arabia’s intention to cut production and try to stabilize the market situation in the coming month.

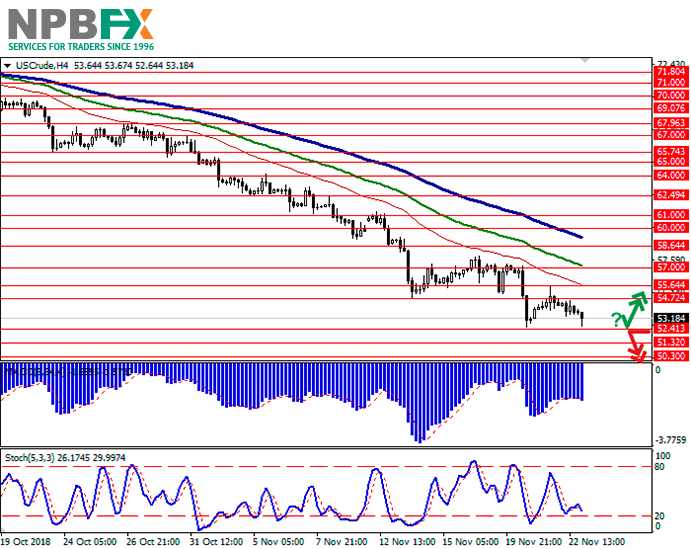

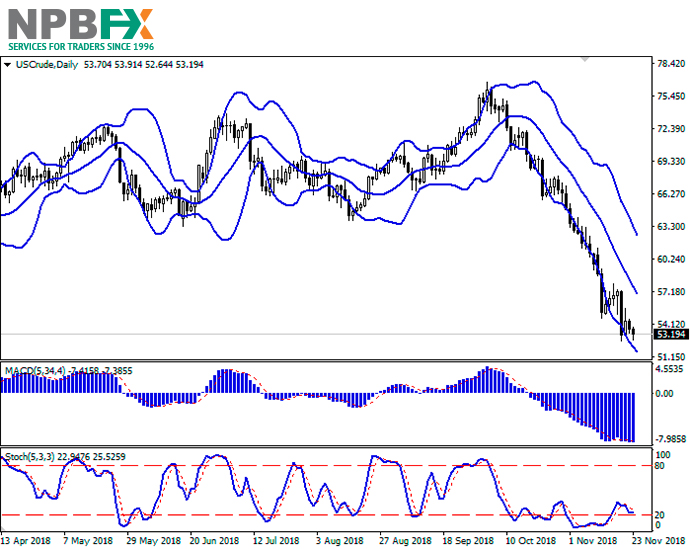

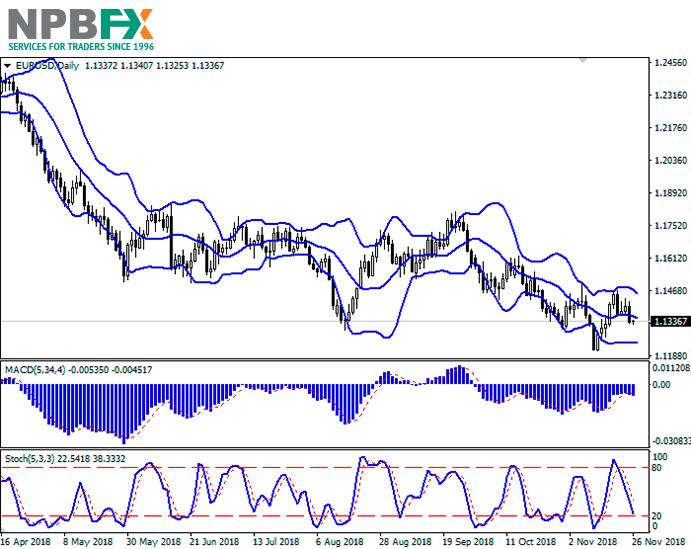

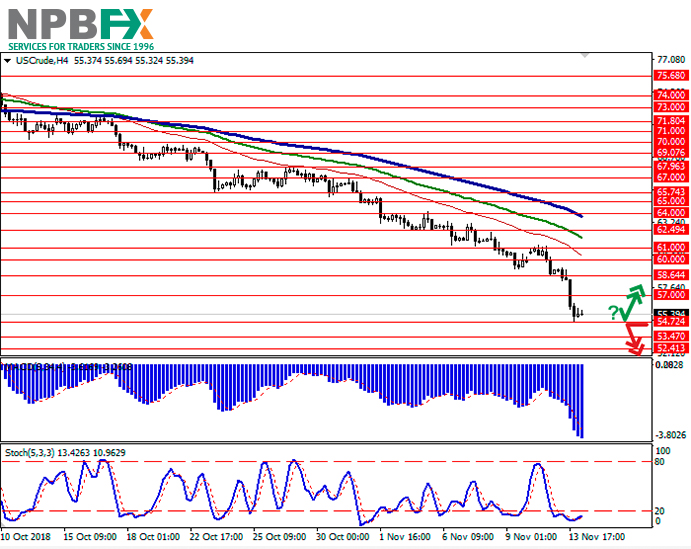

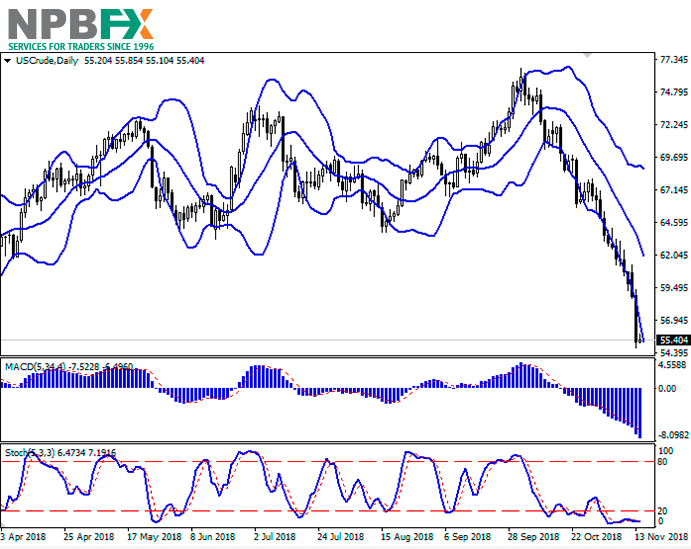

Support and resistance

On the daily chart, Bollinger bands are steadily declining. The price range is widening but not as fast as the “bearish” moods are developing. MACD is falling, keeping a strong sell signal (the histogram is below the signal line). Stochastic has been close to its lows for several weeks, reflecting that the instrument is strongly oversold in the short and super short term.

A correction impulse formation is possible at the end of the current trading week.

Resistance levels: 57.00, 58.64, 60.00, 61.00.

Support levels: 54.72, 53.47, 52.41.

Trading tips

Long positions can be opened after a rebound from the level of 54.72 and a breakout of the level of 57.00 with the target at 60.00 or 61.00. Stop loss is 55.50. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 54.72 with the targets at 52.41–52.00. Stop loss is 56.00. Implementation period: 1–2 days.

Use more opportunities of the NPBFX analytical portal: glossary. Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on WTI Crude Oil and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the WTI Crude Oil for a better understanding of the current market situation and more efficient trading.

Current trend

Yesterday, oil prices renewed the year’s lows. The commodity markets have been declining for the 6th week in a row due to the sharp increase in oil production, despite the current OPEC agreement. The published report of the cartel reflected an increase in forecasts for 2018 and 2019, as well as a sharp increase in the current level of production in October against September.

US "black gold" production increases significantly, too. Earlier this month, the Department of Energy announced that the country reached peak volumes of 11.346 million barrels per day. In this case, according to President Donald Trump, prices on the market should be much lower. Based on these considerations, Trump criticized Saudi Arabia’s intention to cut production and try to stabilize the market situation in the coming month.

Support and resistance

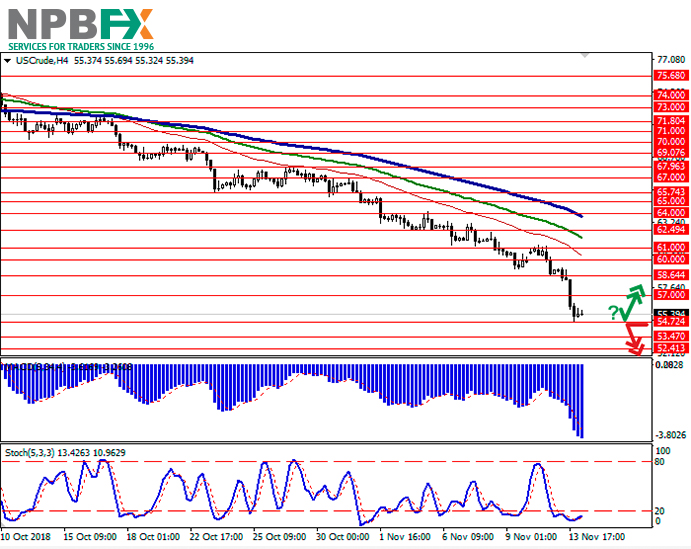

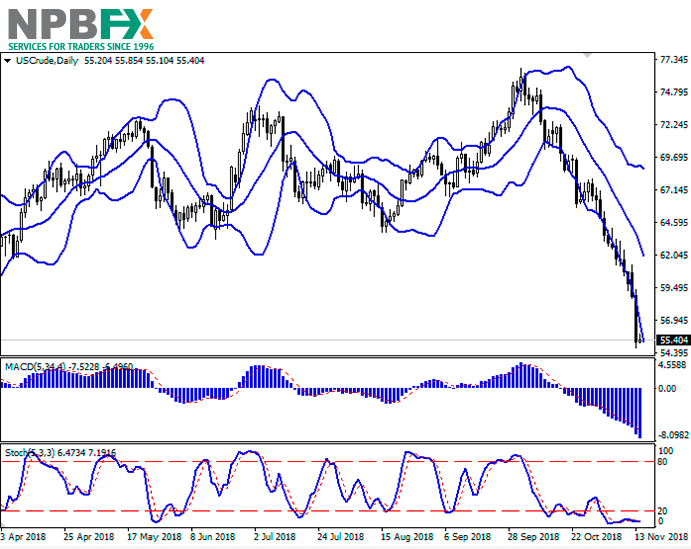

On the daily chart, Bollinger bands are steadily declining. The price range is widening but not as fast as the “bearish” moods are developing. MACD is falling, keeping a strong sell signal (the histogram is below the signal line). Stochastic has been close to its lows for several weeks, reflecting that the instrument is strongly oversold in the short and super short term.

A correction impulse formation is possible at the end of the current trading week.

Resistance levels: 57.00, 58.64, 60.00, 61.00.

Support levels: 54.72, 53.47, 52.41.

Trading tips

Long positions can be opened after a rebound from the level of 54.72 and a breakout of the level of 57.00 with the target at 60.00 or 61.00. Stop loss is 55.50. Implementation period: 2–3 days.

Short positions can be opened after the breakdown of the level of 54.72 with the targets at 52.41–52.00. Stop loss is 56.00. Implementation period: 1–2 days.

Use more opportunities of the NPBFX analytical portal: glossary. Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on WTI Crude Oil and trade efficiently with NPBFX.