Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,093

USD/CHF: the dollar is strengthening 30.08.2019

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CHF for a better understanding of the current market situation and more efficient trading.

Current trend

Yesterday, the USD/CHF pair rose steadily, coming close to local highs of August 23, due to the news about the possible resumption of trade negotiations between the US and China in September. In addition, investors reacted negatively to poor macroeconomic statistics from Germany, which could push the ECB to further active measures to support the European economy. In particular, in addition to a further reduction in interest rates, the European regulator is expected to start new rounds of quantitative easing.

Thursday’s US statistics did not affect the instrument significantly since it came close to its forecasts. Thus, Q2 US GDP, according to preliminary estimates, slowed down from +2.1% YoY to +2.0% YoY. Q2 GDP Price Index kept the previous dynamics of +2.5% YoY, which turned out to be slightly better than forecasts of +2.4% YoY.

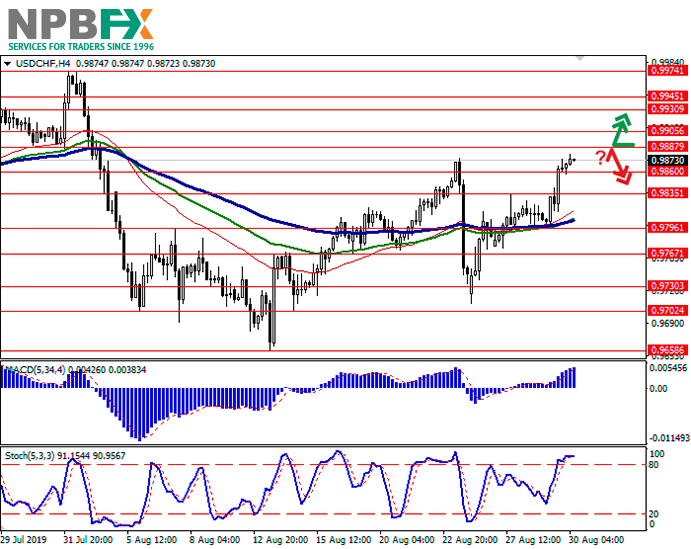

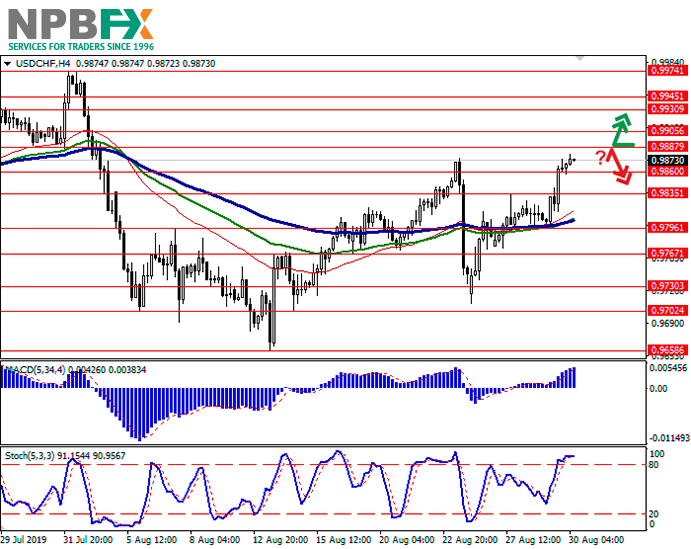

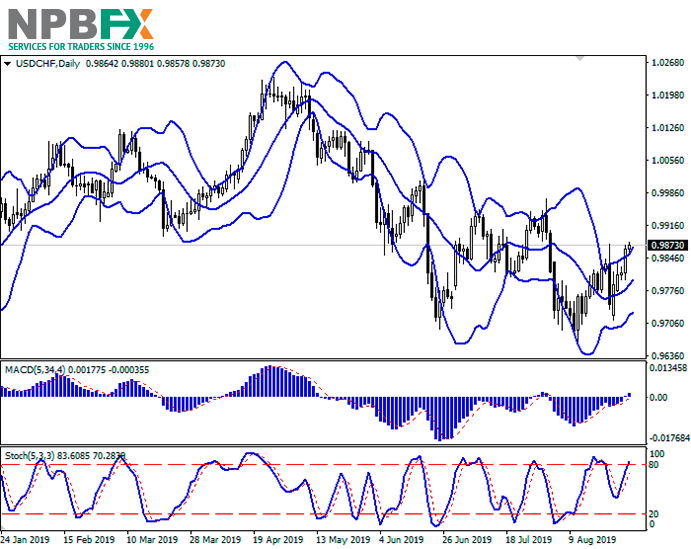

Support and resistance

On the daily chart, Bollinger bands actively grow. The price range expands but not as fast as the “bullish” dynamics develop. MACD grows, keeping a moderate buy signal (the histogram is above the signal line), and is trying to consolidate above the zero line. Stochastic is directed upwards but is close to its highs, which reflects that USD may become overbought in the ultra-short term.

It is better to keep current long positions until the situation becomes clear.

Resistance levels: 0.9887, 0.9905, 0.9930, 0.9945.

Support levels: 0.9860, 0.9835, 0.9796, 0.9767.

Trading tips

Long positions can be opened after the breakout of 0.9887 or 0.9905 with the target at 0.9974 or 1.0000. Stop loss – 0.9860.

Short positions can be opened after a rebound from 0.9887 and the breakdown of 0.9860 with the targets at 0.9767–0.9750. Stop loss is no further than 0.9900.

Implementation period: 2–3 days.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/CHF for a better understanding of the current market situation and more efficient trading.

Current trend

Yesterday, the USD/CHF pair rose steadily, coming close to local highs of August 23, due to the news about the possible resumption of trade negotiations between the US and China in September. In addition, investors reacted negatively to poor macroeconomic statistics from Germany, which could push the ECB to further active measures to support the European economy. In particular, in addition to a further reduction in interest rates, the European regulator is expected to start new rounds of quantitative easing.

Thursday’s US statistics did not affect the instrument significantly since it came close to its forecasts. Thus, Q2 US GDP, according to preliminary estimates, slowed down from +2.1% YoY to +2.0% YoY. Q2 GDP Price Index kept the previous dynamics of +2.5% YoY, which turned out to be slightly better than forecasts of +2.4% YoY.

Support and resistance

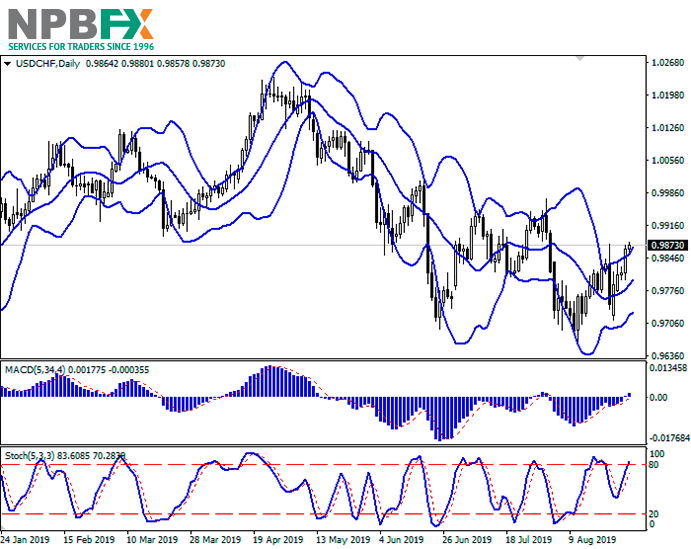

On the daily chart, Bollinger bands actively grow. The price range expands but not as fast as the “bullish” dynamics develop. MACD grows, keeping a moderate buy signal (the histogram is above the signal line), and is trying to consolidate above the zero line. Stochastic is directed upwards but is close to its highs, which reflects that USD may become overbought in the ultra-short term.

It is better to keep current long positions until the situation becomes clear.

Resistance levels: 0.9887, 0.9905, 0.9930, 0.9945.

Support levels: 0.9860, 0.9835, 0.9796, 0.9767.

Trading tips

Long positions can be opened after the breakout of 0.9887 or 0.9905 with the target at 0.9974 or 1.0000. Stop loss – 0.9860.

Short positions can be opened after a rebound from 0.9887 and the breakdown of 0.9860 with the targets at 0.9767–0.9750. Stop loss is no further than 0.9900.

Implementation period: 2–3 days.

Use more opportunities of the NPBFX analytical portal: economic calendar

Be ready for any market changes through global events using the economic calendar on the NPBFX portal. The calendar contains all the most important events of the world economy and prognoses for them. In order to get free and unlimited access to the economic calendar and other useful instruments on the portal, you need to pass a one-time registration on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.