Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,092

XAU/USD: gold prices are going down 14.10.2020

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on XAU/USD for a better understanding of the current market situation and more efficient trading.

Current trend

Gold prices are relatively stable during today's Asian trading session and are consolidating at 1900.00. The day before, the instrument showed a confident decline, which was caused by the growth of USD in response to the general deterioration in market sentiment.

Investors are still discussing the topic of stimulus measures for the US economy, but more and more analysts are in favor of the fact that the new package of measures will be adopted after the US presidential elections on November 3. Additional support for gold is also provided by the fact that Joe Biden is leading in the presidential race, since if he wins the election, the presidential administration may increase spending at first. Finally, the difficult situation with the coronavirus in the world contributes to the growth in demand for safe assets. WHO records the strongest increase in daily incidence since spring, while no state has completed clinical trials of the vaccine yet. Johnson & Johnson is suspending trials of its vaccine because one of the volunteers had adverse reactions.

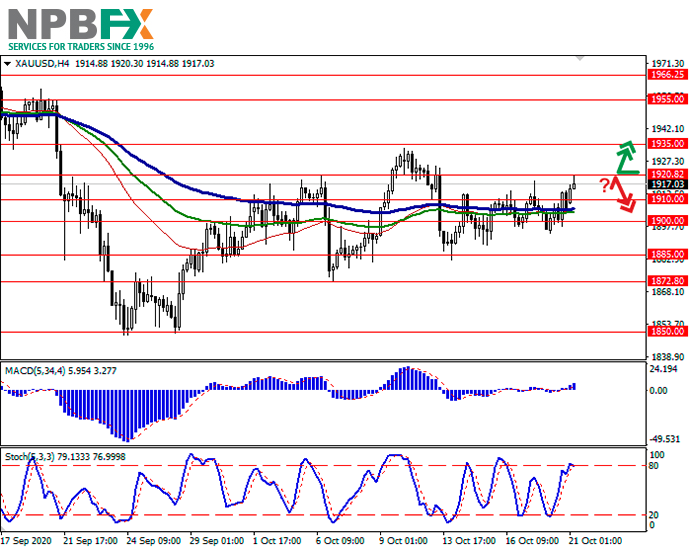

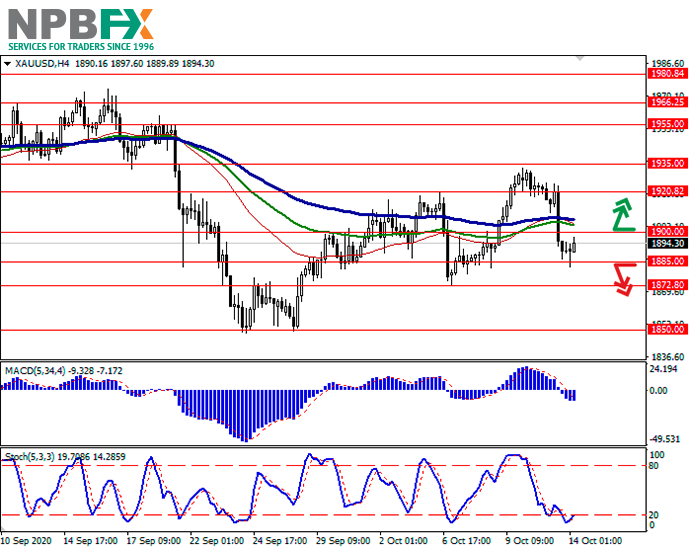

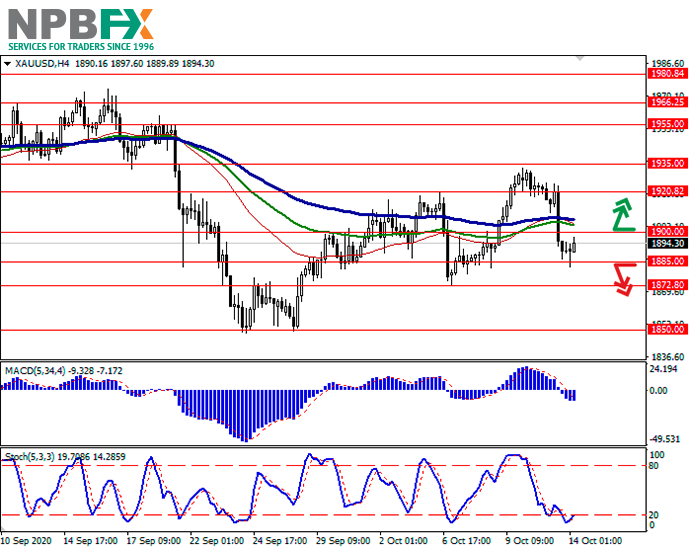

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing, reflecting the multidirectional dynamics appearance in the short term. MACD reversed downwards having formed a new weak sell signal (located below the signal line). Stochastic is showing slightly more stable decline and is located in the middle of its area.

Resistance levels: 1900.00, 1920.82, 1935.00, 1955.00.

Support levels: 1885.00, 1872.80, 1850.00.

Trading tips

To open long positions, one can rely on the breakout of 1900.00. Take-profit – 1920.82–1935.00. Stop-loss – 1885.00. Implementation time: 2-3 days.

The development of "bearish" trend with the breakdown of 1885.00 may become a signal for further sales with target at 1850.00. Stop-loss – 1900.00.

Use more opportunities of the NPBFX analytical portal: trading signals for commodities

How can a trader determine if it’s worth buying or selling XAU/USD now or better waiting for a more favorable period? Use trading signals for commodities from the top 10 technical indicators on the NPBFX portal and make the right decisions! All registered users have free and unlimited access to the minutely updated trading signals (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) for Gold, Silver, Brent and WTI Crude oil.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on XAU/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on XAU/USD for a better understanding of the current market situation and more efficient trading.

Current trend

Gold prices are relatively stable during today's Asian trading session and are consolidating at 1900.00. The day before, the instrument showed a confident decline, which was caused by the growth of USD in response to the general deterioration in market sentiment.

Investors are still discussing the topic of stimulus measures for the US economy, but more and more analysts are in favor of the fact that the new package of measures will be adopted after the US presidential elections on November 3. Additional support for gold is also provided by the fact that Joe Biden is leading in the presidential race, since if he wins the election, the presidential administration may increase spending at first. Finally, the difficult situation with the coronavirus in the world contributes to the growth in demand for safe assets. WHO records the strongest increase in daily incidence since spring, while no state has completed clinical trials of the vaccine yet. Johnson & Johnson is suspending trials of its vaccine because one of the volunteers had adverse reactions.

Support and resistance

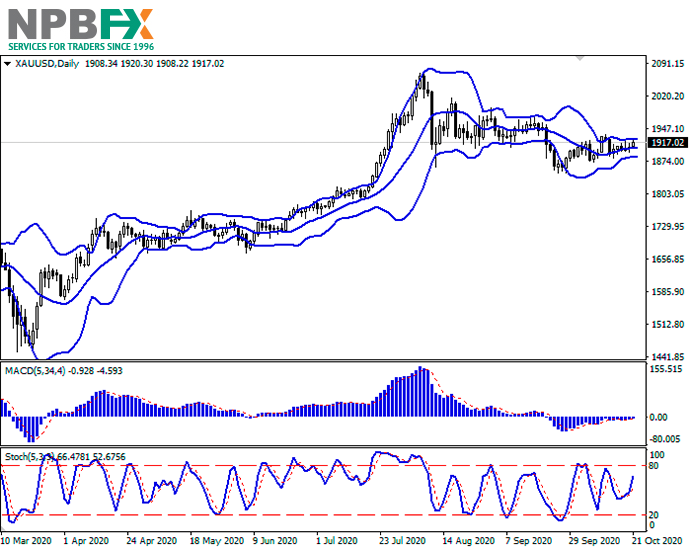

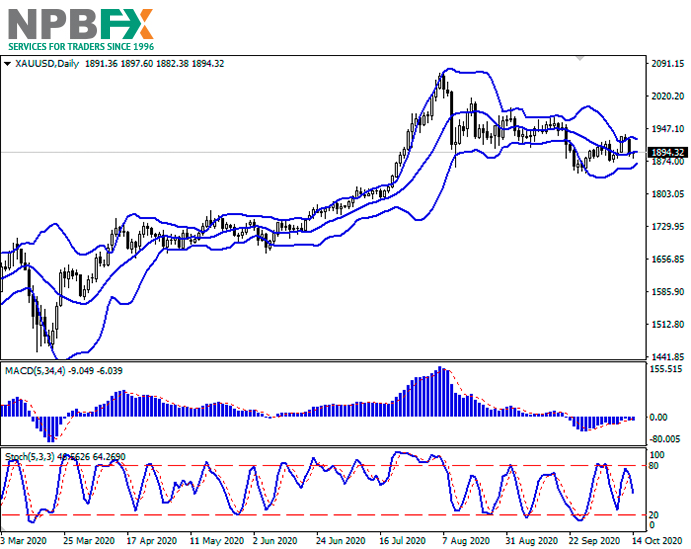

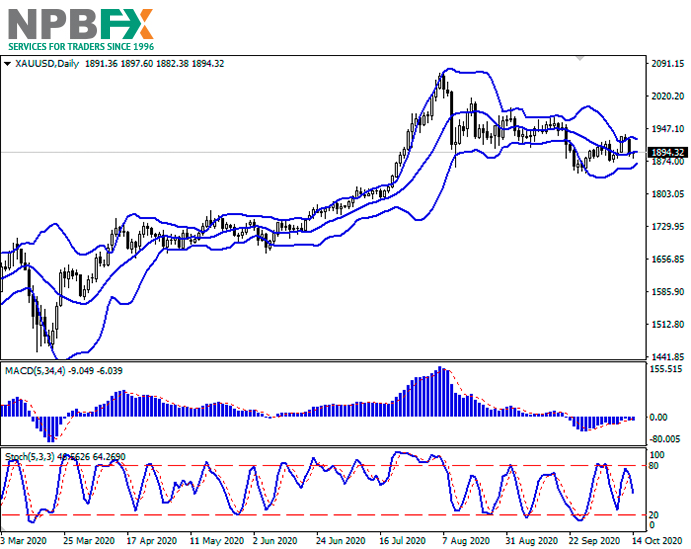

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is narrowing, reflecting the multidirectional dynamics appearance in the short term. MACD reversed downwards having formed a new weak sell signal (located below the signal line). Stochastic is showing slightly more stable decline and is located in the middle of its area.

Resistance levels: 1900.00, 1920.82, 1935.00, 1955.00.

Support levels: 1885.00, 1872.80, 1850.00.

Trading tips

To open long positions, one can rely on the breakout of 1900.00. Take-profit – 1920.82–1935.00. Stop-loss – 1885.00. Implementation time: 2-3 days.

The development of "bearish" trend with the breakdown of 1885.00 may become a signal for further sales with target at 1850.00. Stop-loss – 1900.00.

Use more opportunities of the NPBFX analytical portal: trading signals for commodities

How can a trader determine if it’s worth buying or selling XAU/USD now or better waiting for a more favorable period? Use trading signals for commodities from the top 10 technical indicators on the NPBFX portal and make the right decisions! All registered users have free and unlimited access to the minutely updated trading signals (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) for Gold, Silver, Brent and WTI Crude oil.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on XAU/USD and trade efficiently with NPBFX.