Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,091

USD/JPY: USD is strengthening 02.12.2020

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

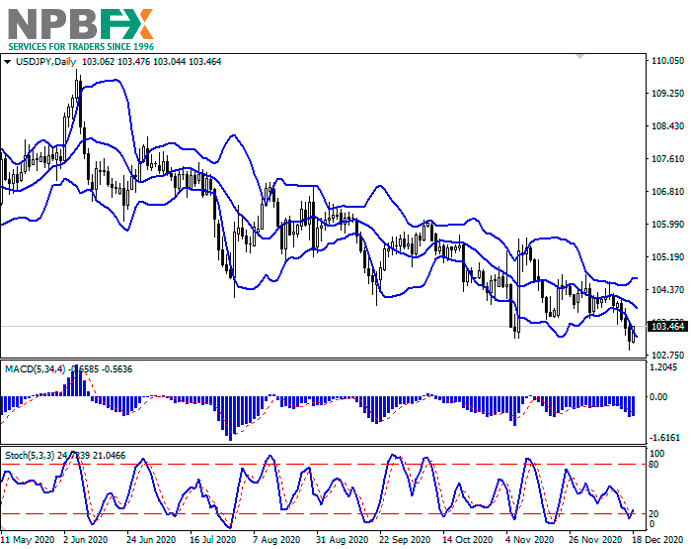

Current trend

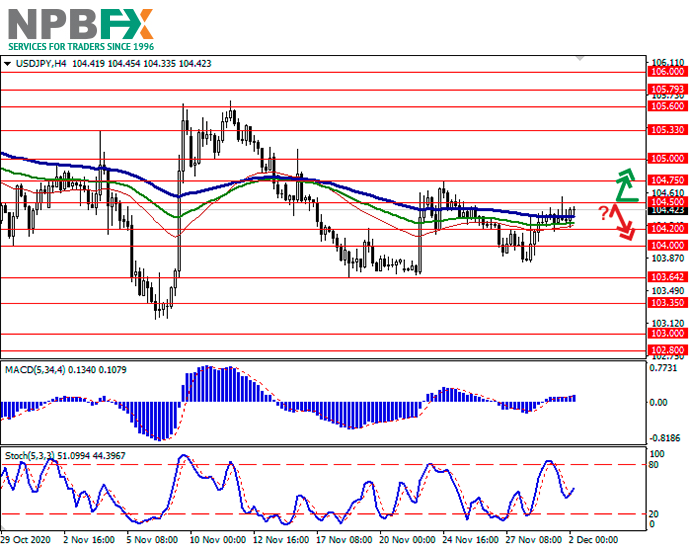

USD is showing moderate gains against JPY during today's morning trading session, building on an uncertain "bullish" momentum formed earlier this week. The instrument adds about 0.13% and is about to test the level of 104.50 for a breakout.

The macroeconomic statistics from the US published yesterday did not provide almost any support to USD. ISM Manufacturing PMI in November showed a decrease from 59.3 to 57.5 points, which was worse than the forecasts of a fall to 58 points. At the same time, ISM Manufacturing Employment Index for the same period fell below the psychological level of 50 points to 48.4 points.

Wednesday's macroeconomic statistics provide moderate support to JPY. Investors reacted positively to the growth of the Consumer Confidence Index in November from 33.6 to 33.7 points, while the forecasts assumed its decline to 29 points.

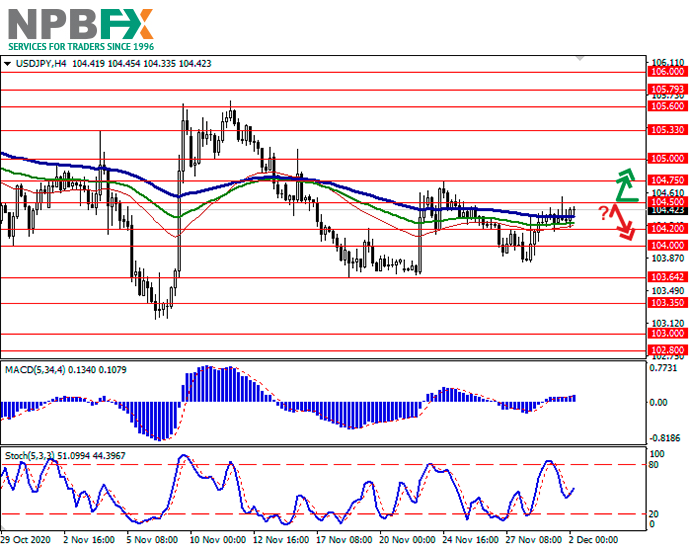

Support and resistance

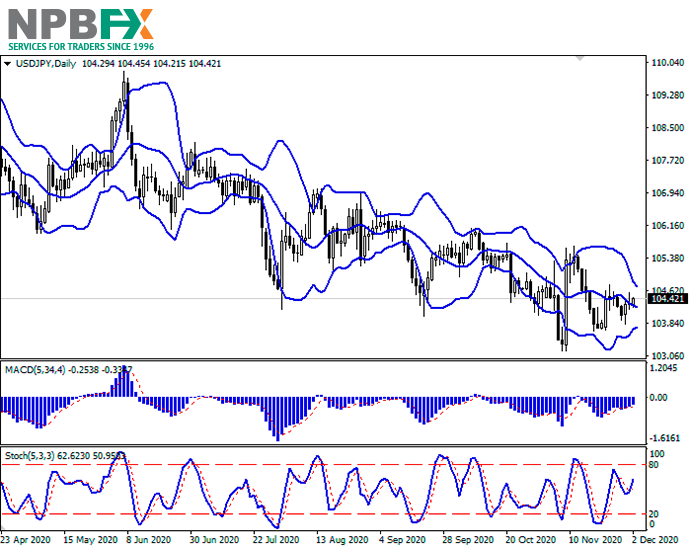

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is narrowing, reflecting flat nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic has reversed upwards again after a moderate decline at the end of last week, signaling in favor of a recovery in USD in the ultra-short term.

Current indications do not contradict further growth of the instrument in the near future.

Resistance levels: 104.50, 104.75, 105.00, 105.33.

Support levels: 104.20, 104.00, 103.64, 103.35.

Trading tips

To open long positions, one can rely on the breakout of 104.50. Take-profit – 105.00. Stop-loss – 104.20. Implementation time: 1-2 days.

A rebound from 104.50 as from resistance followed by a breakdown of 104.20 may become a signal for new sales with the target at 103.64. Stop-loss – 104.50.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

Current trend

USD is showing moderate gains against JPY during today's morning trading session, building on an uncertain "bullish" momentum formed earlier this week. The instrument adds about 0.13% and is about to test the level of 104.50 for a breakout.

The macroeconomic statistics from the US published yesterday did not provide almost any support to USD. ISM Manufacturing PMI in November showed a decrease from 59.3 to 57.5 points, which was worse than the forecasts of a fall to 58 points. At the same time, ISM Manufacturing Employment Index for the same period fell below the psychological level of 50 points to 48.4 points.

Wednesday's macroeconomic statistics provide moderate support to JPY. Investors reacted positively to the growth of the Consumer Confidence Index in November from 33.6 to 33.7 points, while the forecasts assumed its decline to 29 points.

Support and resistance

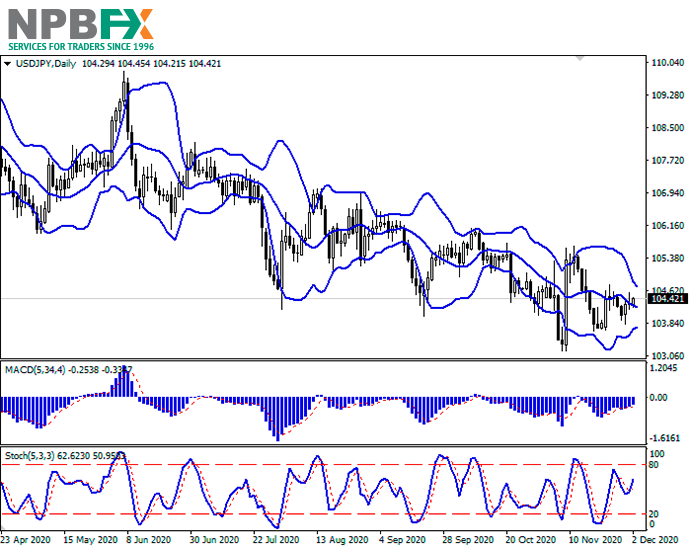

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is narrowing, reflecting flat nature of trading in the short term. MACD indicator is growing preserving a weak buy signal (located above the signal line). Stochastic has reversed upwards again after a moderate decline at the end of last week, signaling in favor of a recovery in USD in the ultra-short term.

Current indications do not contradict further growth of the instrument in the near future.

Resistance levels: 104.50, 104.75, 105.00, 105.33.

Support levels: 104.20, 104.00, 103.64, 103.35.

Trading tips

To open long positions, one can rely on the breakout of 104.50. Take-profit – 105.00. Stop-loss – 104.20. Implementation time: 1-2 days.

A rebound from 104.50 as from resistance followed by a breakdown of 104.20 may become a signal for new sales with the target at 103.64. Stop-loss – 104.50.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.