Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,091

AUD/USD: multidirectional trend 23.04.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

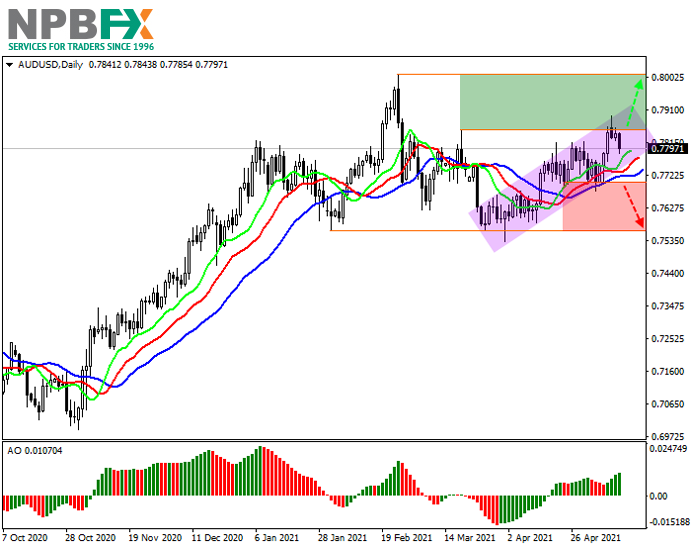

Current trend

AUD has strengthened significantly against USD during today's Asian session, recovering from a strong decline the day before, when USD gained momentum after the publication of strong data on jobless claims. The number of initial jobless claims decreased from 586K to 547K, which was the lowest level since the beginning of the COVID-19 epidemic.

In turn, the instrument is supported by upbeat statistics from Australia on Friday. Commonwealth Bank Services PMI in April rose from 55.5 to 58.6 points. Commonwealth Bank Manufacturing PMI for the same period rose from 56.8 to 59.6 points. Commonwealth Bank Composite PMI in April reached 58.8 points against 55.5 points in March.

With the opening of the American session, the markets are awaiting the release of statistics on business activity in the US, which should also demonstrate positive growth rates.

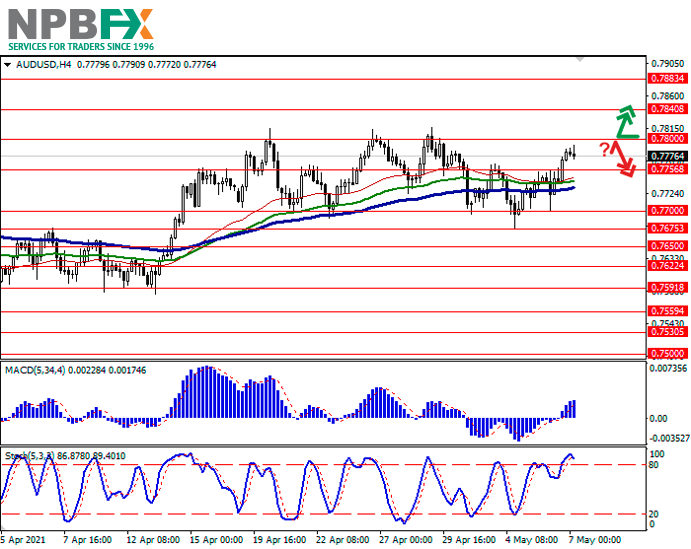

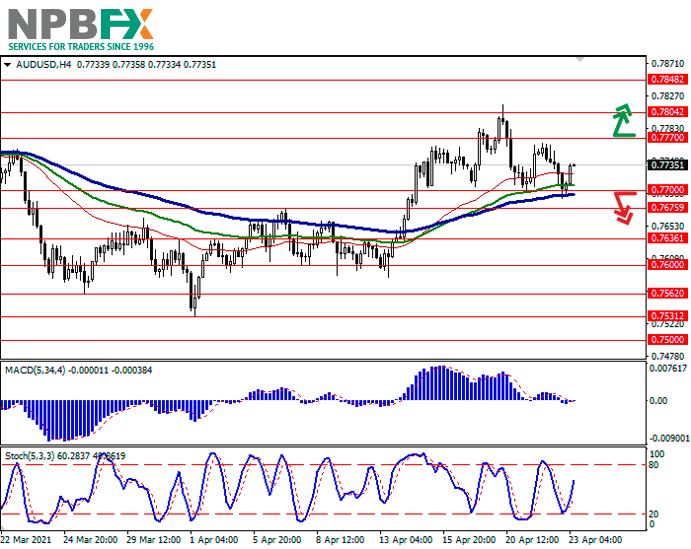

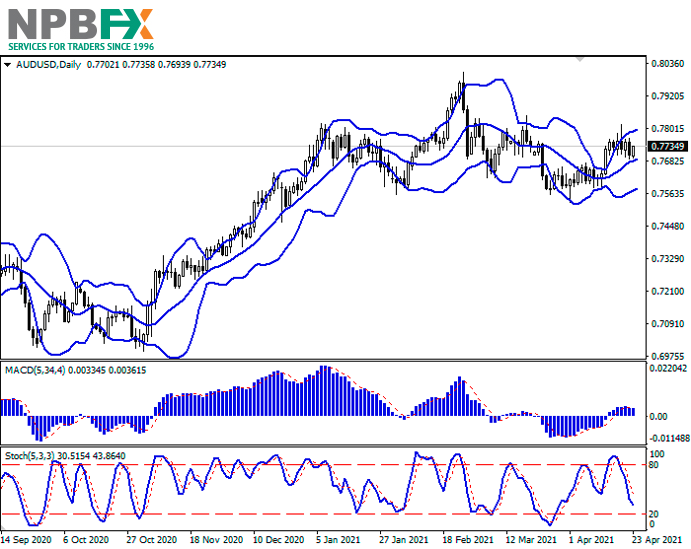

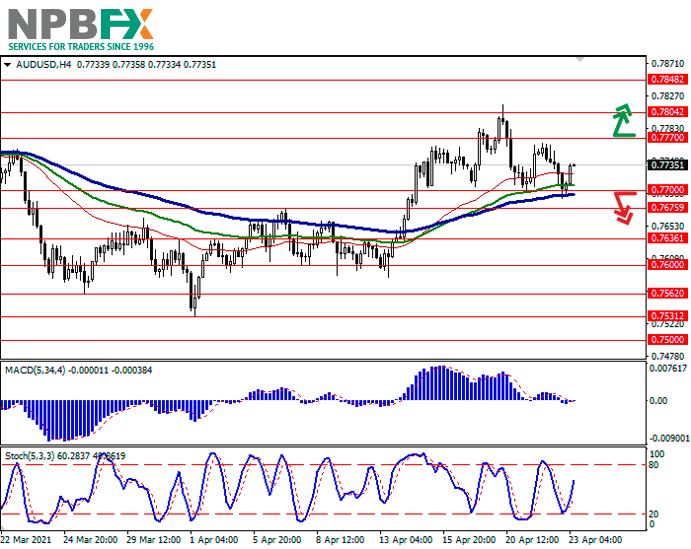

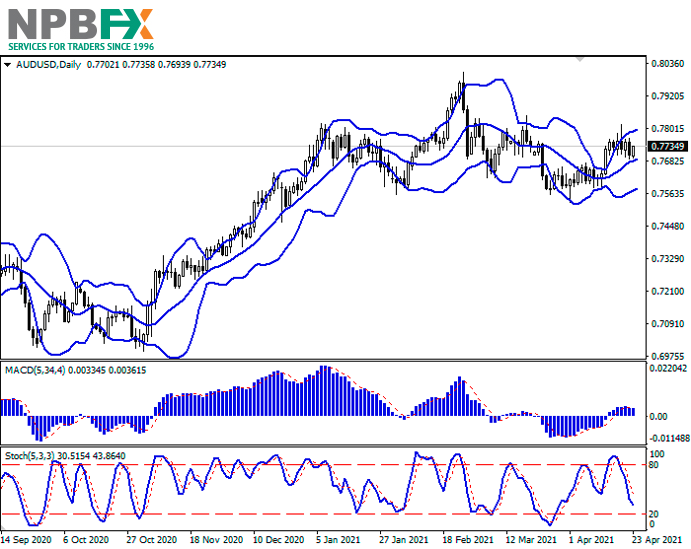

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is almost unchanged, but it follows the price upwards, freeing the way to new local highs for the "bulls". MACD reversed downwards having formed a weak sell signal (located below the signal line). Stochastic is declining much more actively and is currently approaching the level of "20", indicating the risks of oversold AUD in the ultra-short term.

To open new trading positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 0.7770, 0.7804, 0.7848, 0.7900.

Support levels: 0.7700, 0.7675, 0.7636, 0.7600.

Trading tips

To open long positions, one can rely on the breakout of 0.7770. Take-profit – 0.7848. Stop-loss – 0.7735. Implementation time: 1-2 days.

The return of "bearish" trend with the breakdown of 0.7700 may become a signal for new sales with the targets at 0.7636–0.7600. Stop-loss – 0.7740.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

AUD has strengthened significantly against USD during today's Asian session, recovering from a strong decline the day before, when USD gained momentum after the publication of strong data on jobless claims. The number of initial jobless claims decreased from 586K to 547K, which was the lowest level since the beginning of the COVID-19 epidemic.

In turn, the instrument is supported by upbeat statistics from Australia on Friday. Commonwealth Bank Services PMI in April rose from 55.5 to 58.6 points. Commonwealth Bank Manufacturing PMI for the same period rose from 56.8 to 59.6 points. Commonwealth Bank Composite PMI in April reached 58.8 points against 55.5 points in March.

With the opening of the American session, the markets are awaiting the release of statistics on business activity in the US, which should also demonstrate positive growth rates.

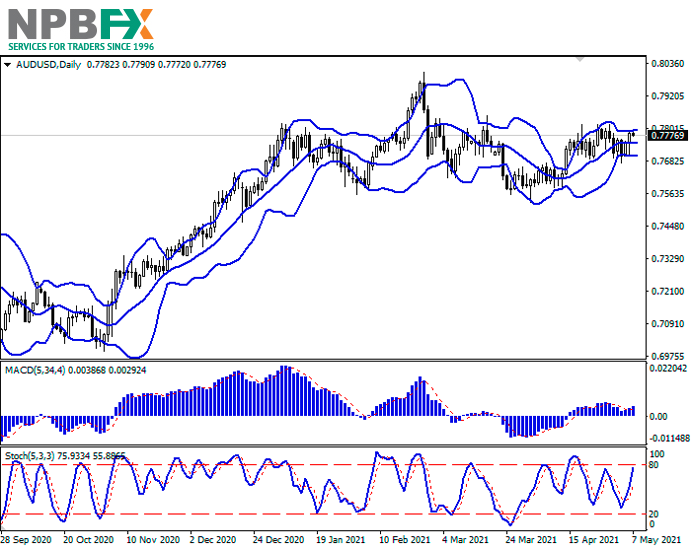

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is almost unchanged, but it follows the price upwards, freeing the way to new local highs for the "bulls". MACD reversed downwards having formed a weak sell signal (located below the signal line). Stochastic is declining much more actively and is currently approaching the level of "20", indicating the risks of oversold AUD in the ultra-short term.

To open new trading positions, it is necessary to wait for the signals from technical indicators to be clarified.

Resistance levels: 0.7770, 0.7804, 0.7848, 0.7900.

Support levels: 0.7700, 0.7675, 0.7636, 0.7600.

Trading tips

To open long positions, one can rely on the breakout of 0.7770. Take-profit – 0.7848. Stop-loss – 0.7735. Implementation time: 1-2 days.

The return of "bearish" trend with the breakdown of 0.7700 may become a signal for new sales with the targets at 0.7636–0.7600. Stop-loss – 0.7740.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.