Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,091

USD/JPY: USD remains under pressure 28.07.2021

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

Current trend

USD demonstrates flat trading dynamics against JPY in trading in Asia, consolidating after a significant decline the day before, which, among other things, was due to the publication of disappointing macroeconomic statistics from the US, which significantly reduced expectations that the US Fed will take a tougher position on the curtailment of existing economic incentives.

Today the market's attention is focused on the publication of the minutes of the two-day meeting of the Fed. The tension is very high, so even a hint of a possible reduction in the quantitative easing program will be enough for USD to renew a number of local highs. The neutral position of the regulator, in turn, is unlikely to provoke a new wave of sales, but there are enough reasons for negativity without it. In particular, traders are watching an increase in the incidence in the US, which is updating spring highs, despite a fairly active vaccination campaign. However, the most active increase in the number of cases of infection occurs in the southern and eastern states, where the percentage of the vaccinated population is the lowest.

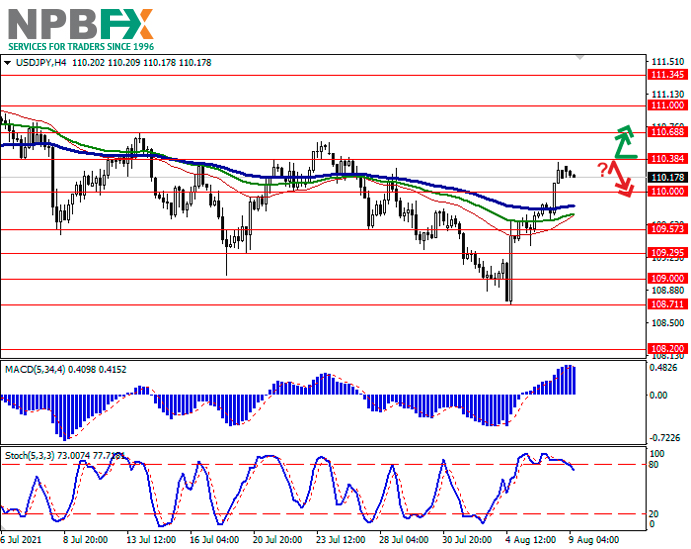

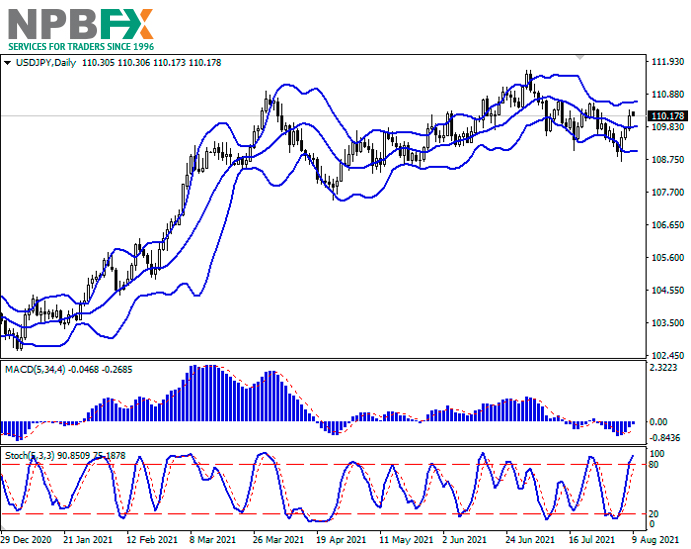

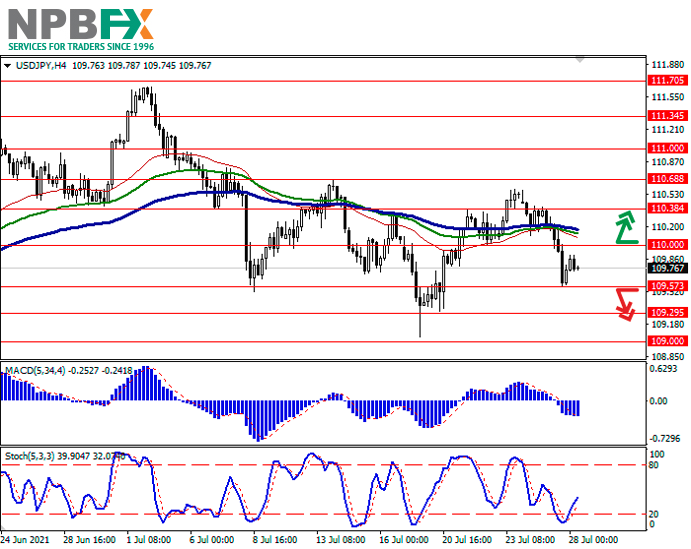

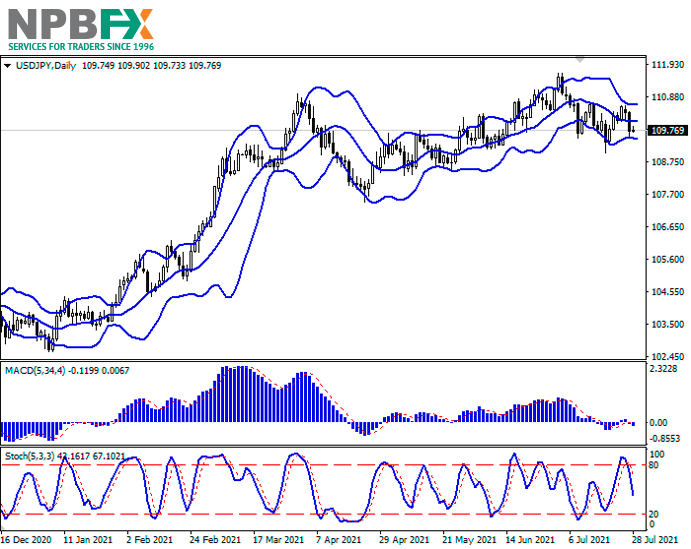

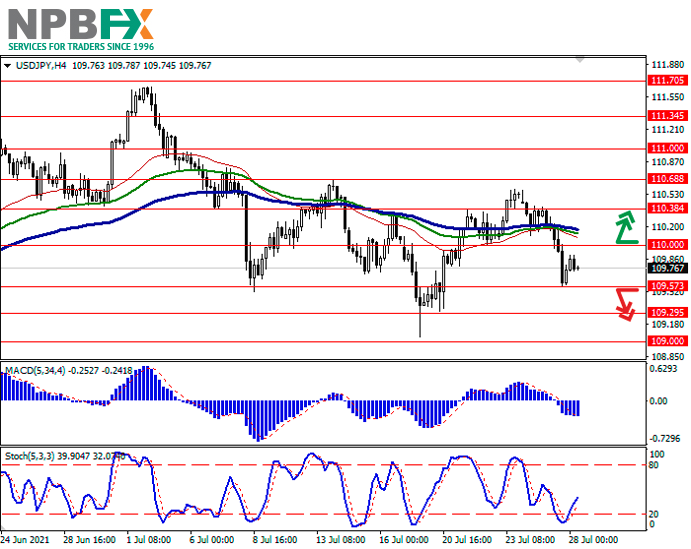

Support and resistance

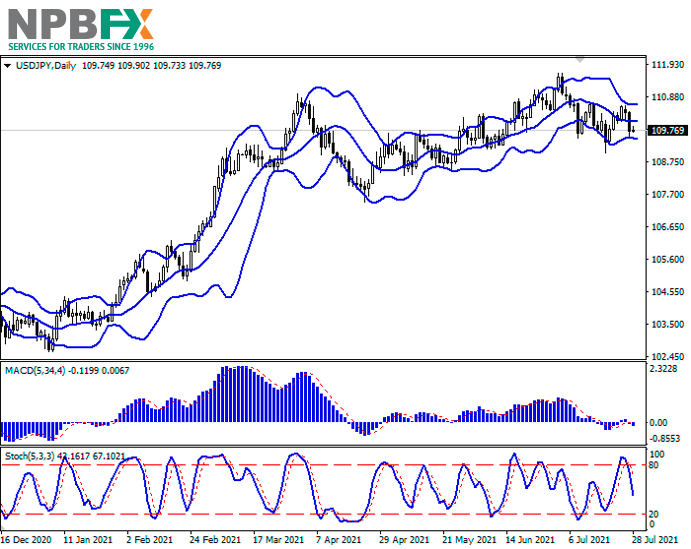

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic shows a more confident decline and signals in favor of further development of "bearish" dynamics in the ultra-short/short term.

Resistance levels: 110.00, 110.38, 110.68, 111.00.

Support levels: 109.57, 109.29, 109.00.

Trading tips

The breakdown of 109.57 may serve as a signal to new sales with target at 109.00. Stop-loss – 109.80. Implementation time: 1-2 days.

To open long positions, one can rely on the breakout of 110.00. Take-profit – 110.68. Stop-loss – 109.70.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on USD/JPY for a better understanding of the current market situation and more efficient trading.

Current trend

USD demonstrates flat trading dynamics against JPY in trading in Asia, consolidating after a significant decline the day before, which, among other things, was due to the publication of disappointing macroeconomic statistics from the US, which significantly reduced expectations that the US Fed will take a tougher position on the curtailment of existing economic incentives.

Today the market's attention is focused on the publication of the minutes of the two-day meeting of the Fed. The tension is very high, so even a hint of a possible reduction in the quantitative easing program will be enough for USD to renew a number of local highs. The neutral position of the regulator, in turn, is unlikely to provoke a new wave of sales, but there are enough reasons for negativity without it. In particular, traders are watching an increase in the incidence in the US, which is updating spring highs, despite a fairly active vaccination campaign. However, the most active increase in the number of cases of infection occurs in the southern and eastern states, where the percentage of the vaccinated population is the lowest.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is declining keeping a weak sell signal (located below the signal line). The indicator is trying to consolidate below the zero level. Stochastic shows a more confident decline and signals in favor of further development of "bearish" dynamics in the ultra-short/short term.

Resistance levels: 110.00, 110.38, 110.68, 111.00.

Support levels: 109.57, 109.29, 109.00.

Trading tips

The breakdown of 109.57 may serve as a signal to new sales with target at 109.00. Stop-loss – 109.80. Implementation time: 1-2 days.

To open long positions, one can rely on the breakout of 110.00. Take-profit – 110.68. Stop-loss – 109.70.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.